Frequency Synthesizer Market by Type (Analog and Digital), Components (Phase Detectors, Loop Filters, Oscillators, and Mixers), Application (Telecommunications, Military & Aerospace, and Research & Measurement), and Geography - Global Forecast to 2022

[149 Pages Report] The overall frequency synthesizer market is expected to be worth at USD 1,446.3 Million by 2022 growing at a CAGR of 6.56% from 2017 and is expected to register a shipment of 1,457.0 thousand units by 2022. The demand for frequency synthesizers is expected to increase due to their requirement in the telecommunications application, which is constantly evolving and expanding to serve a wider range of consumers. The need to upgrade the military and research equipment is driving the market growth. The base year considered for the study is 2016, and the market size forecast is given for the period between 2017 and 2022.

The prime objectives of this report can be summarized in the following points.

- To define, describe, and forecast the overall frequency synthesizer market on the basis of type, application, and geography

- To describe the components of frequency synthesizers

- To forecast the market size across various segments with respect to major geographical divisions—North America, Europe, Asia-Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information and analysis of the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically profile the key players and provide comprehensive analysis of their market positions in terms of ranking and core competency along with detailed competitive landscape for the market leaders

- To study the complete value chain and allied industry segments the frequency synthesizer market

This research study involves the extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg Business, Factiva, and OneSource) to identify and collect information useful for this study. The research methodology followed in this report is explained below.

- Analysis of all the applications of frequency synthesizers worldwide

- Analysis of various frequency synthesizers sold to various end users

- Analysis of the penetration of frequency synthesizers in various applications

- Estimation of the market size in terms of value

- Estimation of the market size of the frequency synthesizers in terms of applications across various industry verticals

- Overall market size along with data triangulation with supply-side data including product developments, supply chain, and estimated sales of products using frequency synthesizer

According to the MarketsandMarkets forecast, the global frequency synthesizer market is expected to witness a consistent growth till 2022; the market is expected to register a shipment of 1,457.0 thousand units by 2022. The overall market is expected to grow at a CAGR of 6.56% from 2017 to 2022 and is expected to be worth USD 1,446.3 Million by 2022.

The frequency synthesizers have applications across a number of industry verticals such as telecommunications, research and measurement, and military and aerospace. The frequency synthesizers are used to generate a variable frequency output from a standalone device. The key features of the device are signal purity and stability, low phase noise performance, high switching speed, and output frequency range. The growth in the use of mobile phones in the telecommunications sector and the RF capable ICs and chips are major factors influencing growth in this market.

This report segments the frequency synthesizer market on the basis of application, type, and geography. The telecommunications application is expected to hold the largest share of the market while demonstrating the highest rate during the forecast period. The expected dominance of the telecommunications sector is due to widespread usage of telecommunications networks and constant technological advancements in the sector.

The analog type of frequency synthesizer accounted for the largest share of the market based on type in 2016. The market for digital frequency synthesizers is expected to grow at the highest rate during the forecast period. The high growth is expected on account of comparative ease of integration of the digital frequency synthesizers in various applications.

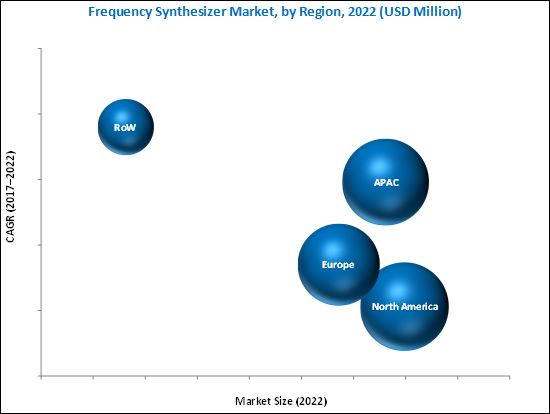

With the estimated largest share, North America is expected to dominate the frequency synthesizer market between 2017 and 2020; whereas, RoW, consisting of the Middle East and Africa, and South America, is expected to grow at the highest rate. The evolution and expansion of the telecommunications sector are expected to be the major factors fueling the growth of the market.

A major deterrent for the growth of market is the comparatively high cost of synthesizer modules utilized in the research sector. The upcoming 5G technology is expected to boost the market growth considerably during the forecast period. The major vendors in the frequency synthesizer market are Ultra Electronics (U.K.), Texas Instruments Inc. (U.S.), Analog Devices Inc. (U.S.), National Instruments (U.S.), and Qorvo, Inc. (U.S.), among others. These players adopted various strategies such as new product launches and developments, partnerships, collaborations, business expansions, and mergers to cater to the need for frequency synthesizers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data From Primary Sources

2.2 Secondary and Primary Research

2.2.1 Key Industry Insights

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.3.2 Top-Down Approach

2.3.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Global Frequency Synthesizer Market

4.2 Market, By Type

4.3 Market, By Application

4.4 Market, By Geography

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 Market, By Application

5.3.2 Market, By Type

5.3.3 Market, By Geography

5.3.4 Components in Frequency Synthesizers

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Widespread Use of Mobile Phones Across the Globe

5.4.1.2 Use in Research and Measurement, and Military and Aerospace Applications

5.4.1.3 RF Capable CIS and Chips Help in Widespread Adoption in Telecommunications Sector

5.4.2 Restraints

5.4.2.1 High Cost of Modular Frequency Synthesizers

5.4.3 Opportunities

5.4.3.1 Upcoming Technologies in the Market

5.4.3.2 Growth Opportunity Amid the Market Competition Through Inorganic Growth Strategies

5.4.4 Challenges

5.4.4.1 Improving Quality of Product Features

5.4.4.2 Developing Newer Techniques Or Architectures for Frequency Synthesis to Improve Performance and Widen Market Scope

6 Industry Trends (Page No. - 41)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Research and Development

6.2.2 Manufacturing and Assembly

6.2.3 Distribution/Marketing

6.2.4 Post-Sale Services

6.3 Key Industry Trends

6.4 Porter’s Five Forces Analysis

6.4.1 Bargaining Power of Suppliers

6.4.2 Bargaining Power of Buyers

6.4.3 Threat of New Entrants

6.4.4 Threat of Substitutes

6.4.5 Competitive Rivalry

7 Market, By Application (Page No. - 51)

7.1 Introduction

7.2 Research and Measurement

7.2.1 Microwave Synthesis

7.2.2 Calibration

7.2.3 Time and Frequency Metrology

7.3 Military and Aerospace

7.3.1 Radar

7.3.2 Signals Intelligence (Sigint)

7.3.3 Electronic Warfare (EW)

7.4 Telecommunications

7.4.1 Software-Defined Radio (SDR)

7.4.2 Wimax

7.4.3 Wlan

7.4.4 Satcom

7.4.5 Cellular

8 Market, By Type (Page No. - 65)

8.1 Introduction

8.2 Analog

8.3 Digital

9 Market, By Geography (Page No. - 74)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.1.1 New Communications Standards for Telecommunications Industry

9.2.1.2 Ever-Growing U.S. Defense Budget and Aerospace Industry

9.2.2 Canada

9.2.2.1 The Upgrade of Telecommunications Network in Canada

9.2.3 Mexico

9.2.3.1 Military Hardware Upgrade

9.2.3.2 Expansion of Telecommunications Industry in Mexico

9.3 Europe

9.3.1 Germany

9.3.2 U.K.

9.3.3 France

9.3.4 Russia

9.3.5 Rest of Europe

9.4 APAC

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 Rest of APAC

9.5 Rest of the World

9.5.1 Middle East and Africa

9.5.2 Latin America

10 Components of Frequency Synthesizers (Page No. - 106)

10.1 Introduction

10.2 Phase Detectors

10.3 Loop Filters

10.4 Oscillators

10.5 Mixers

10.6 Dividers

11 Competitive Landscape (Page No. - 109)

11.1 Introduction

11.2 Ranking of Market Players, 2016

11.3 Competitive Situations and Trends

11.3.1 New Product Launches

11.3.2 Contracts and Agreements

11.3.3 Alliances and Expansions

11.3.4 Mergers and Acquisitions

12 Company Profiles (Page No. - 115)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 Ultra Electronics (Herley CTI Division)

12.3 Texas Instruments Incorporated

12.4 Analog Devices, Inc.

12.5 National Instruments

12.6 Qorvo Inc.

12.7 Fei-Elcom Tech, Inc.

12.8 EM Research, Inc.

12.9 Programmed Test Sources Inc.

12.10 Sivers IMA AB

12.11 Micro Lambda Wireless, Inc.

12.12 Synergy Microwave Corporation

12.13 Mercury United Electronics Inc.

12.14 Key Innovators

12.14.1 Introduction

12.14.2 Signalcore, Inc.

12.14.3 L3 Narda-Miteq

12.14.4 VIDA Products, Inc.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 141)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (79 Tables)

Table 1 Frequency Synthesizer Market, By Application, 2014–2022 (USD Million)

Table 2 Frequency Synthesizer Market, By Application, 2014–2022 (Thousand Units)

Table 3 Frequency Synthesizer for Research and Measurement Application, By Region, 2014–2022 (USD Million)

Table 4 Frequency Synthesizer for Research and Measurement Application in North America, By Country, 2014–2022 (USD Million)

Table 5 Market for Research and Measurement Application in Europe, By Country, 2014–2022 (USD Million)

Table 6 Market for Research and Measurement Application in APAC, By Country, 2014–2022 (USD Million)

Table 7 Market for Research and Measurement Application in RoW, By Region, 2014–2022 (USD Million)

Table 8 Market for Military and Aerospace Application, By Region, 2014–2022 (USD Million)

Table 9 Market for Military and Aerospace Application in North America, By Country, 2014–2022 (USD Million)

Table 10 Market for Military and Aerospace Application in Europe, By Country, 2014–2022 (USD Million)

Table 11 Market for Military and Aerospace Application in APAC, By Country, 2014–2022 (USD Million)

Table 12 Frequency Synthesizer for Military and Aerospace Application in RoW, By Region, 2014–2022 (USD Million)

Table 13 Frequency Synthesizer for Telecommunications Application, By Region, 2014–2022 (USD Million)

Table 14 Market for Telecommunications Application in North America, By Country, 2014–2022 (USD Million)

Table 15 Market for Telecommunications Application in Europe, By Country, 2014–2022 (USD Million)

Table 16 Market for Telecommunications Application in APAC, By Country, 2014–2022 (USD Million)

Table 17 Market for Telecommunications Application in RoW, By Region, 2014–2022 (USD Million)

Table 18 Frequency Synthesizer Market, By Type, 2014–2022 (USD Million)

Table 19 Market for Analog Frequency Synthesizers, By Region, 2014–2022 (USD Million)

Table 20 Market for Analog Frequency Synthesizers in North America, By Country, 2014–2022 (USD Million)

Table 21 Market for Analog Frequency Synthesizers in Europe, By Country, 2014–2022 (USD Million)

Table 22 Market for Analog Frequency Synthesizers in APAC, By Country, 2014–2022 (USD Million)

Table 23 Market for Analog Frequency Synthesizers in RoW, By Country, 2014–2022 (USD Million)

Table 24 Market for Digital Frequency Synthesizers, By Region, 2014–2022 (USD Million)

Table 25 Market for Digital Frequency Synthesizers in North America, By Country, 2014–2022 (USD Million)

Table 26 Market for Digital Frequency Synthesizers in Europe, By Country, 2014–2022 (USD Million)

Table 27 Market for Digital Frequency Synthesizers in APAC, By Country, 2014–2022 (USD Million)

Table 28 Market for Digital Frequency Synthesizers in RoW, By Country, 2014–2022 (USD Million)

Table 29 Market, By Geography, 2014–2022 (USD Million)

Table 30 Frequency Synthesizer Market, By Geography, 2014–2022 (Thousand Units)

Table 31 Market in North America, By Country, 2014–2022 (USD Million)

Table 32 Market in North America, By Application, 2014–2022 (USD Million)

Table 33 Market in North America, By Application, 2014–2022 (Thousand Units)

Table 34 Market in U.S., By Application, 2014–2022 (USD Million)

Table 35 Market in Canada, By Application, 2014–2022 (USD Million)

Table 36 Market in Mexico, By Application, 2014–2022 (USD Million)

Table 37 Market in North America, By Type, 2014–2022 (USD Million)

Table 38 Market Market in U.S., By Type, 2014–2022 (USD Million)

Table 39 Market in Canada, By Type, 2014–2022 (USD Million)

Table 40 Market in Mexico, By Type, 2014–2022 (USD Million)

Table 41 Market in Europe, By Country, 2014–2022 (USD Million)

Table 42 Market in Europe, By Application, 2014–2022 (USD Million)

Table 43 Market in Europe, By Application, 2014–2022 (Thousand Units)

Table 44 Market in Germany, By Application, 2014–2022 (USD Million)

Table 45 Market in U.K., By Application, 2014–2022 (USD Million)

Table 46 Market in France, By Application, 2014–2022 (USD Million)

Table 47 Market in Russia, By Application, 2014–2022 (USD Million)

Table 48 Market in Rest of Europe, By Application, 2014–2022 (USD Million)

Table 49 Market in Europe, By Type, 2014–2022 (USD Million)

Table 50 Market in Germany, By Type, 2014–2022 (USD Million)

Table 51 Market in U.K., By Type, 2014–2022 (USD Million)

Table 52 Market in France, By Type, 2014–2022 (USD Million)

Table 53 Market in Russia, By Type, 2014–2022 (USD Million)

Table 54 Market in Rest of Europe, By Type, 2014–2022 (USD Million)

Table 55 Market in APAC, By Country, 2014–2022 (USD Million)

Table 56 Market in APAC, By Application, 2014–2022 (USD Million)

Table 57 Market in APAC, By Application, 2014–2022 (Thousand Units)

Table 58 Market in China, By Application, 2014–2022 (USD Million)

Table 59 Market in Japan, By Application, 2014–2022 (USD Million)

Table 60 Market in India, By Application, 2014–2022 (USD Million)

Table 61 Market in Rest of APAC, By Application, 2014–2022 (USD Million)

Table 62 Market in APAC, By Type, 2014–2022 (USD Million)

Table 63 Market in China, By Type, 2014–2022 (USD Million)

Table 64 Market in Japan, By Type, 2014–2022 (USD Million)

Table 65 Market in India, By Type, 2014–2022 (USD Million)

Table 66 Market in Rest of APAC, By Type, 2014–2022 (USD Million)

Table 67 Market in RoW, By Region, 2014–2022 (USD Million)

Table 68 Market in RoW, By Application, 2014–2022 (USD Million)

Table 69 Market in RoW, By Application, 2014–2022 (Thousand Units)

Table 70 Market in Middle East and Africa, By Application, 2014–2022 (USD Million)

Table 71 Market in South America, By Application, 2014–2022 (USD Million)

Table 72 Market in RoW, By Type, 2014–2022 (USD Million)

Table 73 Market in Middle East and Africa, By Type, 2014–2022 (USD Million)

Table 74 Market in South America, By Type, 2014–2022 (USD Million)

Table 75 Ranking of the Top 5 Players in the Frequency Synthesizer Market, 2016

Table 76 New Product Launches in the Frequency Synthesizer Market, 2016–2017

Table 77 Contracts and Agreements in the Frequency Synthesizer Market, 2015–2016

Table 78 Alliances and Expansions in the Frequency Synthesizer Market, 2016–2017

Table 79 Mergers and Acquisitions in the Frequency Synthesizer Market, 2015–2016

List of Figures (58 Figures)

Figure 1 Frequency Synthesizer : Segmentation

Figure 2 Frequency Synthesizer : Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Market for Telecommunications Application Expected to Grow at the Highest Rate During the Forecast Period

Figure 7 Market for Digital Frequency Synthesizers Expected to Grow at the Highest CAGR During the Forecast Period

Figure 8 North America Dominated the Frequency Synthesizers Market With the Largest Share in 2016

Figure 9 Frequency Synthesizer Market Offers Lucrative Opportunities Owing to the Rapid Rise of the New Solutions/Systems Sector

Figure 10 Analog Frequency Synthesizer Expected to Hold A Larger Size of the Market During the Forecast Period

Figure 11 Market for Telecommunications Application Expected to Grow at the Highest Rate During the Forecast Period

Figure 12 North America Expected to Hold the Largest Share of the Frequency Synthesizer Market During the Forecast Period

Figure 13 Drivers, Restraints, Opportunities and Challenges for the Frequency Synthesizer Market

Figure 14 Number of Mobile Phone Users in the World 2011–2016

Figure 15 Frequency Synthesizer Market: Value Chain Analysis

Figure 16 Greater Vertical Integration—Leading Trend Among Key Market Players

Figure 17 Porter’s Five Forces Analysis

Figure 18 Porter’s Five Forces: Impact Analysis

Figure 19 Bargaining Power of Suppliers in the Market, 2016

Figure 20 Bargaining Power of Buyers in the Market, 2016

Figure 21 Threat of New Entrants in the Market, 2016

Figure 22 Threat of Substitutes in the Market, 2016

Figure 23 Competitive Rivalry in the Market, 2016

Figure 24 Frequency Synthesizer Market, By Application

Figure 25 APAC Region to Dominate the Frequency Synthesizer for Research and Measurement Application, During the Forecast Period

Figure 26 Frequency Synthesizer Market for Research and Measurement Application in RoW, By Region, 2017–2022 (USD Million)

Figure 27 Frequency Synthesizer Market for Military and Aerospace Application in APAC, By Country, 2017–2022 (USD Million)

Figure 28 U.S. is Expected to Dominate the Frequency Synthesizer for Telecommunications Application in North America, During the Forecast Period

Figure 29 Frequency Synthesizer Market, By Type

Figure 30 MEA Expected to Hold A Larger Size in the Market for Analog Frequency Synthesizers in RoW By 2022 (USD Million)

Figure 31 U.S. Expected to Hold the Largest Size in the Market for Digital Frequency Synthesizers in North America By 2022 (USD Million)

Figure 32 MEA Expected to Hold A Larger Size of the Market for Digital Frequency Synthesizers in RoW, 2014–2022 (USD Million)

Figure 33 Frequency Synthesizer Market, By Region

Figure 34 Middle East and Africa, and India are Expected to Witness Significant Growth During the Forecast Period

Figure 35 North America: Frequency Synthesizer Snapshot

Figure 36 Telecommunications Application Likely to Dominate Frequency Synthesizer Market in the U.S. During the Forecast Period

Figure 37 Analog Frequency Synthesizers Expected to Hold Largest Market in U.S. During the Forecast Period (USD Million)

Figure 38 Europe: Frequency Synthesizer Snapshot

Figure 39 Frequency Synthesizer for Telecommunications in Rest of Europe is Expected to Witness the Fastest Growth Between 2017 and 2022 (USD Million)

Figure 40 APAC: Frequency Synthesizer Snapshot

Figure 41 Analog Frequency Synthesizer Expected to Dominate APAC During the Forecast Period (USD Million)

Figure 42 RoW: Frequency Synthesizer Snapshot

Figure 43 Telecommunications Application of Frequency Synthesizer Dominated Middle East and African Market in 2016

Figure 44 Components of Frequency Synthesizers

Figure 45 Mergers & Acquisitions Formed the Major Strategies Adopted By the Top Players in the Market

Figure 46 Market Evaluation Framework: New Products Launches Was the Major Growth Strategy Between 2014 and 2017

Figure 47 Battle for Market Share: New Product Launches Was the Key Strategy Adopted Between 2014 and 2017

Figure 48 Geographic Revenue Mix of the Major Players in the Frequency Synthesizer Market, 2016

Figure 49 Ultra Electronics: Company Snapshot

Figure 50 Ultra Electronics: SWOT Analysis

Figure 51 Texas Instruments Inc.: Company Snapshot

Figure 52 Texas Instruments: SWOT Analysis

Figure 53 Analog Devices: Company Snapshot

Figure 54 Analog Devices: SWOT Analysis

Figure 55 National Instruments: Company Snapshot

Figure 56 National Instruments: SWOT Analysis

Figure 57 Qorvo, Inc.: Company Snapshot

Figure 58 Qorvo, Inc.: SWOT Analysis

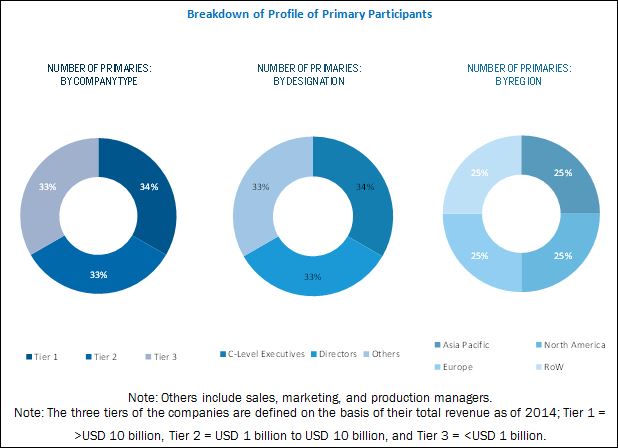

After arriving at the overall market size, the total market has been split into several segments and subsegments, which was further confirmed with the key industry experts. The figure below shows the breakdown of primaries on the basis of company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

The frequency synthesizer market ecosystem includes the manufacturers such as Ultra Electronics (U.K.), Texas Instruments Inc. (U.S.), Analog Devices Inc. (U.S.), National Instruments (U.S.), Qorvo, Inc. (U.S.), FEI-Elcom Tech Inc. (U.S.), and Sivers IMA AB (Sweden).

Scope of the Report:

|

Report Metric |

Details |

|

Base year |

2016 |

|

Forecast period |

2017–2022 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Ultra Electronics (U.K.), Texas Instruments Inc. (U.S.), Analog Devices Inc. (U.S.), National Instruments (U.S.), Qorvo, Inc. (U.S.), FEI-Elcom Tech Inc. (U.S.), and Sivers IMA AB (Sweden) |

Key Target Audience:

- Frequency synthesizer manufacturers

- Telecommunication system integrators

- Military research departments

- Telecommunications governing bodies

- Educational institutes

- Distributers

- Investors

- Research organizations

- Organizations, alliances, and associations related to telecommunication industry

Scope of the Report:

The frequency synthesizer market is segmented into following submarkets

By Application

- Research and Measurement

- Military and Aerospace

- Telecommunications

By Types

- Analog

- Digital

By Components

- Phase Detectors

- Loop Filters

- Oscillators

- Mixers

- Divider

By Region

-

North America

- U.S.

- Canada

- Mexico

-

Europe

- Germany

- U.K.

- France

- Russia

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of APAC

-

Rest of the World (RoW)

- Middle East and Africa

- South America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Company Information: Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Frequency Synthesizer Market

I am currently working on a high-speed-on-chip-Direct digital frequency synthesizer towards my PhD/research. The "Frequency Synthesizer Market" sample would be helpful for my dissertation and understanding more into the detail of prospective FS-start up.