Shape Memory Alloys Market by Type (Nitinol, Copper based, Iron-Manganese-Silicon), End-use Industry (Biomedical, Aerospace & Defense, Automotive, Consumer Electronics, and Home appliances) and Region - Global Forecast to 2026

Updated on : September 03, 2025

Shape Memory Alloys Market

The global shape memory alloys market was valued at USD 11.0 billion in 2021 and is projected to reach USD 18.8 billion by 2026, growing at 11.2% cagr from 2021 to 2026. The SMAs market growth is highly ascribed to increasing demand for SMAs in the manufacturing of biomedical devices; surgical instruments; aircraft components; automotive actuators; and consumer electronics. The major region for the SMAs market in North America, due to the tremendous demand for biomedical device manufacturing. Market growth is attributed to the growing demand for high-quality, and life-saving medical equipment with better automotive & aircraft components. The physical characteristics of SMAs are promoting their use in different end-use applications. Still, the high price of an implanted device, which is the major application of SMAs, is the key challenge to the growth of the market.

Shape Memory Alloys Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Shape Memory Alloy Market

The outbreak of the COVID-19 wrought havoc on the world economy. The world economy entered recession due to this pandemic, with the confinement of international borders and closure of economic activities across countries against the spread of COVID-19. The IMF cautioned of a total output loss of USD 9 trillion in the world economy between 2020 and 2021. The extent of economic damage still depends on how the virus spreads throughout the US, Europe, and other large economies.

Shape Memory Alloys Market Dynamics

Driver: Ever-increasing adoption, and aging population of biomedical implants to spur the demand

SMAs are extensively used in biomedical applications, especially in medical implants, due to their biological compatibility. The recovery process after implant surgery is dependent on the mechanical properties of the implant materials. Nitinol SMAs are widely accepted for medical implants due to their characteristics such as consistency of stress, kink resistance, better elasticity, and resistance to corrosion.

The rise in the aging population and the spread of chronic diseases have boosted the demand for life-saving medical implants. Reduction in fertility rate and longer life expectancy rate increase the aging population. According to the United Nations, by 2050, 1 in 6 people in the world will be over 65 years of age compared to 1 in 11 in 2019. Elderly persons are more susceptible to orthopedic, and cardiovascular conditions due to age-related physical changes. Given the fact that surgical procedures are regarded as an effective therapy option for most of these conditions, the growth in elderly patients is resulting in a higher demand for surgical procedures.

Restrain: Availability of substitutes and Rising cost of raw materials

Raw materials of SMAs are metals such as aluminum, nickel, titanium, and copper. Prices of these metals are constantly increasing. These alloys are widely used in the health care industry for biomedical implants and surgical tools. Still, for many applications in the automotive, biomedical, and consumer electronics industries, stainless steel is preferable to SMAs owing to its high prices of these and the presence of similar properties. Consequently, the increasing cost of raw materials and the availability of substitutes are curbing the growth of the SMAs market.

Challenges: Effect of a pandemic on the actuator market

The COVID-19 outbreak has triggered disturbances in the global supply chain and business processes. Major industries utilizing SMAs, such as aerospace & defense, automotive, consumer electronics & home appliances, have been crushed negatively by the COVID-19 pandemic outbreak. Apart from the biomedical sector, nearly all industries witnessed a downfall. Also, the imposition of lockdowns and quarantine regulations in India, Canada, and European countries have disturbed the normal flow of business, sales, demand for new projects, and revenue in major industries, including aviation, automotive, and oil & gas.

Opportunities: Growth of the consumer electronics industry

Consumer electronics & home appliances are one of the most rapidly growing end-use industries of SMAs. SMAs are used widely in manufacturing rice cookers, air conditioners, coffee makers, cameras, personal accessories, minidisc recorders, and cellular phones. These alloys are favored due to their better elasticity, long fatigue life, and corrosion resistance. They are mainly used as actuators and sensors in various applications in electrical equipment and household applications.

- They are used as fasteners for high-density circuit board connections

- In cameras, they are being used as a lock switch actuator

- In cellular phones, they are used in the manufacture of cellular phone antennas

- They are used for personal accessories such as Brassiere underwires, eyeglass frames, shoulder pad wires

Shape Memory Alloys Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

“Nitinol segment to drive the shape memory alloys market in 2020”

The Nitinol segment has the biggest share in the overall shape memory alloys market. The considerably growing biomedical industry, particularly for medical implants, leads the demand for nitinol SMAs. These SMAs are being used in the form of sheets, wires, rods, and ribbons.

“The biomedical end-use segment is the major segment of shape memory alloys”

The biomedical segment was the major end-use industry of SMAs, followed closely by the aerospace & defense segment. Applications of SMAs in the automotive industry will increase as the EV market is gaining momentum. SMAs are also widely dental applications for the production of orthodontic wires due to their shape memory properties, super-elasticity, high toughness, and resistance to corrosion. Still, due to the COVID-19 pandemic in 2020, and social distancing norms, only basic services remain open. Oral dentists have been impacted due to the restrictions imposed by the governments. Consequently, the requirements for the SMAs dental use declined in 2020.

“North America accounted for the major share of the shape memory alloys market during the forecast period”

North America accounted for the biggest share in the worldwide shape memory alloys market, in terms of both value and volume, from 2021 to 2026. The underlying growth of the North American market is fuelled by capacity expansion, and new product development strategies adopted by the top players in this region. Furthermore, the region leads the market for SMAs in the biomedical end-use industry due to increased demand for transplantation. The US is the major economy to dominate the market, followed up by Canada, in the region.

Shape Memory Alloys Market Players

The worldwide shape memory alloys market comprises major manufacturers such as SAES Getters (Italy), ATI Specialty Alloys & Components (US), Furukawa Electric Co., Ltd (Japan), Nippon Steel & Sumitomo Metal (Japan), and Johnson Matthey (UK). Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the shape memory alloys market.

Shape Memory Alloys Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 11.0 billion |

|

Revenue Forecast in 2026 |

USD 18.8 billion |

|

CAGR |

11.2% |

|

Market size available for years |

2019-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Type, End-Use Industry, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and Middle East & Africa |

|

Companies covered |

SAES Getters (Italy), ATI Specialty Alloys & Components (US), Furukawa Electric Co., Ltd (Japan), Nippon Steel & Sumitomo Metal (Japan), Johnson Matthey (UK), Fort Wayne Metals (US), Nippon Seisen co. ltd. (Japan), Xian Saite Metal Materials Development Company Limited (China) are the top 8 manufacturers are covered in the shape memory alloys market. |

This research report categorizes the shape memory alloys market based on type, end-use industry, and region.

Shape Memory Alloys Market, By Type

- Nickel-Titanium (Nitinol)

- Copper-based

- Fe-Mn-Si

- Others

Shape Memory Alloys Market, By End Use Industry

- Biomedical

- Aerospace & Defence

- Automotive

- Consumer Electronics & Home Appliances

- Others

Shape Memory Alloys Market, By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- In July 2018, ATI acquired the assets of Addaero Manufacturing (headquartered in Connecticut, US) for USD 10.0 million. Addaero Manufacturing is a metal alloy-based additive manufacturer for the aerospace & defense industry.

- In January 2018, ATI announced a 50–50 joint venture with a subsidiary Tsingshan Group (US) to produce 60-inch-wide stainless sheet products for sale in North America. This joint venture will increase ATI’s sustainable development in the North American market.

- In January 2018, ATI has signed two long-term agreements with General Dynamics Land Systems Inc. (US) to be a leading supplier of titanium plates for use in next-generation military vehicles.

Upcoming Changes

This new version of the report on the shape memory alloys market includes the following changes.

- Market size from 2019 to 2021, base year: 2020, forecast period: 2021–2026

- Updated financial information till 2020 (depending on the availability) for each listed company, which helps in easy analysis of the present status of the profiled companies in terms of their financial strength, profitability, key revenue-generating regions/countries, and the highest revenue-generating business segments

- Profile of 25 companies, along with additional information on winning imperatives, right to win, and key strategies adopted by them.

- The updated product portfolio of companies profiled in the report

- Recent developments that help assess market trends and growth strategies adopted by the leading players in the market

- Information related to ecosystem, technology analysis, regulatory landscape, value chain analysis, forecasting factors impacting the growth, YC & YCC shift, COVID-19 impact analysis, macroeconomic indicators, patent analysis, market size based on three scenarios—optimistic, realistic, and pessimistic, and case study analysis

- Market share of the top companies, company evaluation quadrant of the shape memory alloy manufacturing companies, and revenue analysis of top players

- Market size estimated after considering the impact of COVID-19 across the supply chain and a detailed analysis of the impact of COVID-19 on each market segment

-

New sections for a comprehensive analysis:

- Impact Analysis of Forecasting Factors and COVID-19

- YC and YCC Shift

- Patent Analysis

- Pricing Analysis

- Supply Chain Analysis

- Ecosystem Maps

- Technology Mapping

- Industry Experts’ Key Insights

- Macroeconomic Indicators

- Regulatory Landscape

- Comprehensive Analysis of Industrial Segment

- Key Players’ Market Share and Ranking

- Company Evaluation Matrix

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

TABLE 1 INCLUSIONS AND EXCLUSIONS

FIGURE 1 SHAPE MEMORY ALLOYS MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 2 SHAPE MEMORY ALLOYS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 SUPPLY-SIDE APPROACH: ASCERTAINING THE SHARE OF TOP PLAYERS IN THE GLOBAL MARKET,

FIGURE 3 APPROACH 1: SUPPLY SIDE, 2019

2.2.2 DEMAND-SIDE APPROACH: BASED ON ASSESSMENT BY TYPE AND ITS SHARE IN THE GLOBAL MARKET

FIGURE 4 APPROACH 2: BASED ON TYPE DEMAND ESTIMATE, 2019

2.2.3 RELATED MARKET APPROACH: BASED ON ASSESSMENT BY SHARE OF SHAPE MEMORY ALLOYS IN SMART MATERIAL MARKET

FIGURE 5 APPROACH 3: BASED ON THE SHARE FROM THE PARENT MARKET

2.3 DATA TRIANGULATION

FIGURE 6 SHAPE MEMORY ALLOYS MARKET: DATA TRIANGULATION

2.3.1 ASSUMPTIONS

2.3.2 LIMITATIONS

2.3.3 GROWTH RATE ASSUMPTIONS

2.4 FORECAST FACTOR IMPACTING GROWTH

FIGURE 7 FORECAST FACTOR IMPACTING GROWTH

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 8 NITINOL SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET IN 2020

FIGURE 9 PREFERENCE OF SHAPE MEMORY ALLOYS, TYPE VS. END-USE INDUSTRY

FIGURE 10 BIOMEDICAL END-USE INDUSTRY ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET IN 2020

FIGURE 11 NORTH AMERICA WAS THE LARGEST SHAPE MEMORY ALLOY MARKET IN 2020

TABLE 2 MAJOR PLAYERS PROFILED IN THIS REPORT

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 SIGNIFICANT OPPORTUNITIES IN SHAPE MEMORY ALLOYS MARKET

FIGURE 12 BIOMEDICAL AND AEROSPACE & DEFENSE INDUSTRIES TO OFFER MARKET GROWTH OPPORTUNITIES

4.2 NORTH AMERICA: SHAPE MEMORY ALLOYS MARKET, BY END-USE INDUSTRY AND COUNTRY, 2020

FIGURE 13 US AND BIOMEDICAL SEGMENT ACCOUNTED FOR THE LARGEST SHARES

4.3 SHAPE MEMORY ALLOYS MARKET, BY TYPE

FIGURE 14 NITINOL (NITI) TO DOMINATE THE OVERALL SHAPE MEMORY ALLOYS MARKET, 2021–2026

4.4 SHAPE MEMORY ALLOYS MARKET, BY END-USE INDUSTRY

FIGURE 15 BIOMEDICAL TO DOMINATE THE OVERALL SHAPE MEMORY ALLOYS MARKET, 2021–2026

4.5 SHAPE MEMORY ALLOYS MARKET, BY COUNTRY

FIGURE 16 CHINA TO BE THE FASTEST-GROWING MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SHAPE MEMORY ALLOYS MARKET

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Aging population and growing adoption of biomedical implants across the globe

TABLE 3 WORLD POPULATION AGING, 2019

5.2.1.2 Increasing investment in the aerospace & defense industry

TABLE 4 MILITARY EXPENDITURE, BY REGION, USD BILLION, 2018-2020

5.2.1.3 Increased utilization of nitinol-based SMAs in various end-use industries

5.2.1.4 Increasing penetration of SMAs in the automotive industry

5.2.2 RESTRAINTS

5.2.2.1 Rising cost of raw materials and availability of substitutes

FIGURE 18 LME NICKEL HISTORICAL PRICE (USD PER TONNE)

5.2.2.2 High cost of metal implants

5.2.3 OPPORTUNITIES

5.2.3.1 Growth of the consumer electronics industry

5.2.3.2 Rapid industrialization and growing adoption of industrial and service robots

5.2.4 CHALLENGES

5.2.4.1 Pandemic and its effect on the actuator market

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 SHAPE MEMORY ALLOYS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 INTENSITY OF COMPETITIVE RIVALRY

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 THREAT OF SUBSTITUTES

TABLE 5 SHAPE MEMORY ALLOYS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 MACROECONOMIC INDICATORS

TABLE 6 GDP GROWTH PROJECTION WORLDWIDE

TABLE 7 GLOBAL AUTOMOBILE PRODUCTION (UNITS), BY COUNTRY

TABLE 8 GLOBAL HEALTH SPENDING (USD PER CAPITA), BY COUNTRY, 2018-2020

FIGURE 20 SHARE OF GLOBAL MILITARY EXPENDITURE OF 15 COUNTRIES WITH THE HIGHEST SPENDING IN 2020

5.5 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS OF SHAPE MEMORY ALLOYS MARKET

5.5.1 DISRUPTION DUE TO COVID-19

5.6 REGULATORY LANDSCAPE

5.7 ECOSYSTEM MARKET MAP

5.8 YC, YCC SHIFT

FIGURE 22 YCC SHIFT: YOUR CLIENTS’ CLIENTS’ SHIFT IN IMPERATIVES & OUTCOMES IN BIOMEDICAL AND AEROSPACE INDUSTRY TRENDS WILL BRING IN CHANGE IN FUTURE REVENUE MIX!!

5.8.1 YC SHIFT

5.8.2 YCC SHIFT

5.9 AVERAGE PRICE ANALYSIS

FIGURE 23 WEIGHTED AVERAGE PRICING ANALYSIS (USD/KG) OF SHAPE MEMORY ALLOYS, BY REGION, 2020

5.10 SCENARIO ANALYSIS OF SHAPE MEMORY ALLOYS MARKET

FIGURE 24 SHAPE MEMORY ALLOYS MARKET, IN TERMS OF VALUE, BY SCENARIO ANALYSIS, 2019–2026 (USD MILLION)

5.11 TECHNOLOGY ANALYSIS

5.11.1 SHAPE MEMORY ALLOY PRODUCTION PROCESS

5.11.1.1 Vacuum arc melting

5.11.1.2 Vacuum Induction Melting (VIM)

5.11.2 TYPE OF SHAPE MEMORY EFFECT

5.11.2.1 One-way memory effect

5.11.2.2 Two-way memory effect

5.12 COVID-19 IMPACT

5.12.1 COVID-19 ECONOMIC ASSESSMENT

5.12.2 MAJOR ECONOMIC EFFECT OF COVID-19

5.12.3 EFFECTS ON GDP OF COUNTRIES

FIGURE 25 PRE & POST-COVID ANALYSIS OF SHAPE MEMORY ALLOY DEMAND

5.13 CASE STUDY

5.13.1 SHAPE MEMORY ALLOYS IN SPACE APPLICATIONS

5.13.2 SHAPE MEMORY ALLOYS IN MEDICAL DEVICE APPLICATIONS

5.14 PATENT ANALYSIS

5.14.1 INTRODUCTION

5.14.2 METHODOLOGY

5.14.3 DOCUMENT TYPE

FIGURE 26 NUMBER OF PATENTS IN THE LAST 10 YEARS

5.14.4 PUBLICATION TRENDS - LAST 10 YEARS

FIGURE 27 NUMBER OF PATENTS PUBLISHED YEAR-WISE

5.14.5 INSIGHTS

5.14.6 JURISDICTION ANALYSIS

FIGURE 28 PATENT ANALYSIS, BY TOP JURISDICTIONS

5.14.7 TOP COMPANIES/APPLICANTS

FIGURE 29 TOP 10 COMPANIES/APPLICANTS WITH THE HIGHEST NUMBER OF PATENTS

TABLE 9 LIST OF PATENTS BY THE BOEING COMPANY

TABLE 10 LIST OF PATENTS BY CAMBRIDGE MECHATRONICS LTD

TABLE 11 LIST OF PATENTS BY GM GLOBAL TECH OPERATIONS INC.

TABLE 12 LIST OF PATENTS BY GENERAL ELECTRIC COMPANY

TABLE 13 TOP 10 PATENT OWNERS (US) IN LAST 10 Y EARS

6 SHAPE MEMORY ALLOYS MARKET, BY TYPE (Page No. - 84)

6.1 INTRODUCTION

FIGURE 30 NITINOL TO BE THE LARGEST TYPE OF SHAPE MEMORY ALLOYS

TABLE 14 SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 15 MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

6.2 NITINOL(NITI)

6.2.1 DEMAND IS HIGH DUE TO ITS SUPER ELASTIC PROPERTY

TABLE 16 NITINOL (NITI) SHAPE MEMORY ALLOY MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 17 NITINOL (NITI) MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 COPPER BASED

6.3.1 BEING A COST-EFFECTIVE ALTERNATIVE TO NITINOL SMAS, COPPER-BASED SMAS ARE GAINING TRACTION ACROSS SEVERAL INDUSTRIES

TABLE 18 COPPER-BASED SHAPE MEMORY ALLOYS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 19 COPPER-BASED MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4 IRON-MANGANESE-SILICON (FE-MN-SI)

6.4.1 FE-MN-SI ALLOYS ARE EXPECTED TO REGISTER STEADY GROWTH THROUGHOUT THE FORECAST PERIOD

TABLE 20 IRON-MANGANESE-SILICON SHAPE MEMORY ALLOY MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 21 IRON-MANGANESE-SILICON MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.5 OTHERS

TABLE 22 OTHER SHAPE MEMORY ALLOYS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 23 OTHER MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 SHAPE MEMORY ALLOYS MARKET, BY END-USE INDUSTRY (Page No. - 90)

7.1 INTRODUCTION

TABLE 24 APPLICATIONS OF SHAPE MEMORY ALLOYS IN END-USE INDUSTRIES

FIGURE 31 BIOMEDICAL TO BE THE LARGEST END-USE INDUSTRY SEGMENT OF THE MARKET

TABLE 25 SHAPE MEMORY ALLOYS MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 26 MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

7.2 BIOMEDICAL

7.2.1 GROWING ADOPTION OF SMA-BASED SURGICAL IMPLANTS ACROSS THE GLOBE TO SUPPORT MARKET GROWTH

TABLE 27 BIOMEDICAL: SHAPE MEMORY ALLOY MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 28 BIOMEDICAL: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 AEROSPACE & DEFENSE

7.3.1 RECOVERY OF AEROSPACE INDUSTRY FROM THE REPERCUSSIONS OF COVID-19 TO BOOST THE MARKET

TABLE 29 COVID-19 IMPACT ON PASSENGER NUMBER AND PASSENGER REVENUE

7.3.1.1 Reduced global demand for Maintenance, Repair, and Overhaul (MRO) due to COVID-19

TABLE 30 AEROSPACE & DEFENSE: SHAPE MEMORY ALLOYS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 31 AEROSPACE & DEFENSE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4 AUTOMOTIVE

7.4.1 INCREASING AUTOMOBILE PRODUCTION AND USAGE OF SMAS IN PARTS/COMPONENT MANUFACTURING TO LEAD TO MARKET GROWTH

FIGURE 32 PASSENGER CAR MARKET TREND INDEX (2019=100)

TABLE 32 VEHICLE PRODUCTION DATA, BY COUNTRY, 2019–2020

TABLE 33 AUTOMOTIVE: SHAPE MEMORY ALLOY MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 34 AUTOMOTIVE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.5 CONSUMER ELECTRONICS & HOME APPLIANCES

7.5.1 HEALTHY GROWTH OF CONSUMER ELECTRONICS AND INCREASING PER-CAPITA SPENDING ACROSS THE GLOBE TO SUPPORT MARKET GROWTH

TABLE 35 CONSUMER ELECTRONICS & HOME APPLIANCES: SHAPE MEMORY ALLOYS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 36 CONSUMER ELECTRONICS & HOME APPLIANCES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.6 OTHERS

TABLE 37 OTHERS: SHAPE MEMORY ALLOYS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 38 OTHERS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 GLOBAL SHAPE MEMORY ALLOYS MARKET, BY REGION (Page No. - 101)

8.1 INTRODUCTION

FIGURE 33 REGIONAL SNAPSHOT: RAPIDLY GROWING MARKETS ARE EMERGING AS NEW HOTSPOTS

TABLE 39 SHAPE MEMORY ALLOY MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 40 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 34 NORTH AMERICA: SHAPE MEMORY ALLOYS MARKET SNAPSHOT

TABLE 41 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 45 NORTH AMERICA: SHAPE MEMORY ALLOY MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.2.1 US

8.2.1.1 Growing investment in biomedical and aerospace & defense industries to support market growth

FIGURE 35 TOP A&D PRODUCT EXPORT DESTINATION, 2019

FIGURE 36 US: PASSENGER CAR PRODUCTION, 2015-2020

TABLE 47 US: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 48 US: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 49 US: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 50 US: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Increasing healthcare expenditure and count of implant surgeries to drive the market

TABLE 51 CANADA: SHAPE MEMORY ALLOY MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 52 CANADA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 53 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 54 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.2.3 MEXICO

8.2.3.1 Increasing investment in the automotive industry to drive the market

FIGURE 37 MEXICO: PASSENGER CAR PRODUCTION, 2017-2020

TABLE 55 MEXICO: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 56 MEXICO: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 57 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 58 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.3 EUROPE

TABLE 59 EUROPE: SHAPE MEMORY ALLOY MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 60 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 62 EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 64 EUROPE: SHAPE MEMORY ALLOY MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Increasing healthcare spending and R&D research in the country to propel the market

FIGURE 38 GERMANY: AUTOMOBILE PRODUCTION AND EXPORT, 2018-2021

TABLE 65 GERMANY: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 66 GERMANY: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 67 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 68 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.3.2 FRANCE

8.3.2.1 The government initiatives to promote the automotive industry to drive the market

FIGURE 39 FRANCE: AUTOMOBILE PRODUCTION, 2017-2020

TABLE 69 FRANCE: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 70 FRANCE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 71 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 72 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.3.3 UK

8.3.3.1 Expected recovery of the manufacturing sector from the repercussion of COVID-19 to drive the market

FIGURE 40 UK: TOTAL AUTOMOBILE PRODUCTION, 2017-2020

TABLE 73 UK: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 74 UK: MARKET SIZE, BY TYPE,2021–2026 (USD MILLION)

TABLE 75 UK: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 76 UK: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.3.4 ITALY

8.3.4.1 Government initiative to promote automotive and aerospace industries in the country to boost the demand

FIGURE 41 ITALY: AUTOMOBILE PRODUCTION, 2017-2020

TABLE 77 ITALY: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 78 ITALY: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 79 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 80 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.3.5 SPAIN

8.3.5.1 Significant recovery of the economy and the automotive industry to drive the market

FIGURE 42 SPAIN: TOTAL AUTOMOBILE PRODUCTION, 2017-2020

TABLE 81 SPAIN: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 82 SPAIN: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 83 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 84 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.3.6 REST OF EUROPE

TABLE 85 REST OF EUROPE: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 86 REST OF EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 87 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 88 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.4 APAC

FIGURE 43 APAC: SHAPE MEMORY ALLOYS MARKET SNAPSHOT

TABLE 89 APAC: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 90 APAC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 91 APAC: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 92 APAC: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 93 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 94 APAC: SHAPE MEMORY ALLOY MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.4.1 CHINA

8.4.1.1 Double-digit growth of medical & healthcare industry in the country to provide an impetus for market growth

FIGURE 44 CHINA: PASSENGER CAR PRODUCTION, 2017-2020

TABLE 95 CHINA: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 96 CHINA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 97 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 98 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.4.2 INDIA

8.4.2.1 Healthy growth of medical & healthcare industry and increasing FDI investment in the country will boost the market in the upcoming years

FIGURE 45 INDIA: PASSENGER CAR PRODUCTION, 2017-2020

FIGURE 46 CURRENT HEALTH EXPENDITURE PER CAPITA (CURRENT USD), 2016 - 2019

TABLE 99 INDIA: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 100 INDIA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 101 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 102 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.4.3 JAPAN

8.4.3.1 Aging population, coupled with a significant production capacity of biomedical implants, to drive the market

FIGURE 47 JAPAN: AUTOMOBILE PRODUCTION, 2017-2020

TABLE 103 JAPAN: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 104 JAPAN: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 105 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 106 JAPAN: SHAPE MEMORY ALLOY MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.4.4 SOUTH KOREA

8.4.4.1 Increasing automobile manufacturing to push demand for SMAs during the forecast period

TABLE 107 SOUTH KOREA: STATUS OF COMPANIES IN THE AVIATION INDUSTRY, BY AREA

TABLE 108 SOUTH KOREA: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 109 SOUTH KOREA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 110 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 111 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.4.5 TAIWAN

8.4.5.1 Development in consumer electronics and home appliances to drive the market

TABLE 112 TAIWAN: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 113 TAIWAN: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 114 TAIWAN: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 115 TAIWAN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.4.6 REST OF APAC

TABLE 116 REST OF APAC: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 117 REST OF APAC: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 118 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 119 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.5 SOUTH AMERICA

TABLE 120 SOUTH AMERICA: SHAPE MEMORY ALLOYS MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 121 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 122 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 123 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 124 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 125 SOUTH AMERICA: SHAPE MEMORY ALLOY MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.5.1 BRAZIL

8.5.1.1 The government’s initiative to support the automotive industry will drive the SMAs demand

FIGURE 48 BRAZIL: TOTAL VEHICLE PRODUCTION, 2017-2020

TABLE 126 BRAZIL: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 127 BRAZIL: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 128 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 129 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.5.2 ARGENTINA

8.5.2.1 Increasing passenger car sales to boost the market

TABLE 130 ARGENTINA: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 131 ARGENTINA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 132 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 133 ARGENTINA: SHAPE MEMORY ALLOY MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.5.3 REST OF SOUTH AMERICA

TABLE 134 REST OF SOUTH AMERICA: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 135 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 136 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 137 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.6 MIDDLE EAST & AFRICA

TABLE 138 MIDDLE EAST & AFRICA: SHAPE MEMORY ALLOYS MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 140 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 141 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.6.1 SAUDI ARABIA

8.6.1.1 Vision 2030 and other government plans to boost the automotive industry

FIGURE 49 SAUDI ARABIA: BUDGET EXPENDITURE, BY SECTOR, 2020

TABLE 144 SAUDI ARABIA: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 145 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 146 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 147 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.6.2 ISRAEL

8.6.2.1 Increasing healthcare spending to drive the shape memory alloys market

TABLE 148 ISRAEL: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 149 ISRAEL: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 150 ISRAEL: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 151 ISRAEL: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.6.3 REST OF MIDDLE EAST & AFRICA

TABLE 152 REST OF MIDDLE EAST & AFRICA: SHAPE MEMORY ALLOYS MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 153 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 154 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2016–2020 (USD MILLION)

TABLE 155 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 161)

9.1 KEY PLAYER STRATEGIES/ RIGHT TO WIN

FIGURE 50 ACQUISITION IS THE KEY STRATEGY ADOPTED BY PLAYERS BETWEEN 2018 AND 2021

9.2 MARKET SHARE ANALYSIS

FIGURE 51 MARKET SHARE OF KEY PLAYERS, 2020

9.3 COMPANY EVALUATION QUADRANT

9.3.1 STAR

9.3.2 PERVASIVE

9.3.3 EMERGING LEADER

9.3.4 PARTICIPANT

FIGURE 52 SHAPE MEMORY ALLOYS MARKET: COMPANY EVALUATION MATRIX, 2020

9.3.4.1 Company Product Footprint

FIGURE 53 COMPANY FOOTPRINT BY END-USE INDUSTRY

9.4 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

9.4.1 DYNAMIC COMPANIES

9.4.2 STARTING BLOCKS

FIGURE 54 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2020

9.5 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2020

FIGURE 55 RANKING ANALYSIS OF TOP FIVE PLAYERS IN SHAPE MEMORY ALLOYS MARKET, 2020

9.6 COMPETITIVE SCENARIO AND TRENDS

9.6.1 SHAPE MEMORY ALLOYS MARKET: DEALS, 2018-2021

10 COMPANY PROFILES (Page No. - 170)

10.1 KEY PLAYERS

(Business Overview, Product/ Solution/ Service Offered, Recent Developments, Winning Imperatives, MNM View, Key strengths/ Right to win, Strategic choices made, and Weaknesses and competitive threats)*

10.1.1 ATI SPECIALTY ALLOYS & COMPONENTS

TABLE 156 ATI SPECIALTY ALLOYS & COMPONENTS: BUSINESS OVERVIEW

FIGURE 56 ATI SPECIALTY ALLOYS & COMPONENTS: COMPANY SNAPSHOT

TABLE 157 ATI SPECIALTY ALLOYS & COMPONENTS: PRODUCT/ SOLUTION/ SERVICE OFFERINGS

TABLE 158 ATI SPECIALTY ALLOYS & COMPONENTS: DEALS

FIGURE 57 ATI SPECIALTY ALLOYS & COMPONENTS CAPABILITY IN SHAPE MEMORY ALLOYS MARKET

10.1.2 SAES GETTERS S.P.A.

TABLE 159 SAES GETTERS S.P.A.: BUSINESS OVERVIEW

FIGURE 58 SAES GETTERS S.P.A.: COMPANY SNAPSHOT

TABLE 160 SAES GETTERS S.P.A.: PRODUCT/ SOLUTION/ SERVICE OFFERINGS

FIGURE 59 SAES GETTERS S.P.A.’S CAPABILITY IN SHAPE MEMORY ALLOYS MARKET

10.1.3 JOHNSON MATTHEY PLC

TABLE 161 JOHNSON MATTHEY: BUSINESS OVERVIEW

FIGURE 60 JOHNSON MATTHEY: COMPANY SNAPSHOT

TABLE 162 JOHNSON MATTHEY: PRODUCT/ SOLUTION/ SERVICE OFFERINGS

FIGURE 61 JOHNSON MATTHEY PLC’S CAPABILITY IN SHAPE MEMORY ALLOYS MARKET

10.1.4 NIPPON STEEL & SUMITOMO METAL

TABLE 163 NIPPON STEEL & SUMITOMO METAL: BUSINESS OVERVIEW

FIGURE 62 NIPPON STEEL & SUMITOMO METAL: COMPANY SNAPSHOT

TABLE 164 NIPPON STEEL & SUMITOMO METAL: PRODUCT/ SOLUTION/ SERVICE OFFERINGS

TABLE 165 NIPPON STEEL & SUMITOMO METAL: DEALS

FIGURE 63 NIPPON STEEL & SUMITOMO METAL’S CAPABILITY IN SHAPE MEMORY ALLOYS MARKET

10.1.5 FURUKAWA ELECTRIC CO., LTD

TABLE 166 FURUKAWA ELECTRIC COMPANY : BUSINESS OVERVIEW

FIGURE 64 FURUKAWA ELECTRIC CO., LTD: COMPANY SNAPSHOT

TABLE 167 FURUKAWA ELECTRIC COMPANY: PRODUCT/ SOLUTION/ SERVICE OFFERINGS

TABLE 168 FURUKAWA ELECTRIC COMPANY: DEALS

FIGURE 65 FURUKAWA ELECTRIC COMPANY’S CAPABILITY IN SHAPE MEMORY ALLOYS MARKET

10.1.6 FORT WAYNE METALS

TABLE 169 FORT WAYNE METALS: BUSINESS OVERVIEW

TABLE 170 FORT WAYNE METALS: PRODUCT/ SOLUTION/ SERVICE OFFERINGS

TABLE 171 FORT WAYNE METALS: DEALS

10.1.7 NIPPON SEISEN CO. LTD.

TABLE 172 NIPPON SEISEN CO. LTD.: BUSINESS OVERVIEW

TABLE 173 NIPPON SEISEN CO. LTD.: PRODUCT/ SOLUTION/ SERVICE OFFERINGS

10.1.8 XIAN SAITE METAL MATERIALS DEVELOPMENT COMPANY LIMITED

TABLE 174 XIAN SAITE METAL MATERIALS DEVELOPMENT COMPANY: BUSINESS OVERVIEW

TABLE 175 XIAN SAITE METAL MATERIALS DEVELOPMENT COMPANY: PRODUCT/ SOLUTION/ SERVICE OFFERINGS

10.1.9 SEABIRD METAL MATERIAL CO., LTD.

TABLE 176 SEABIRD METAL MATERIAL: BUSINESS OVERVIEW

TABLE 177 SEABIRD METAL MATERIAL: PRODUCT/ SOLUTION/ SERVICE OFFERINGS

10.1.10 DYNALLOY INC.

TABLE 178 DYNALLOY: BUSINESS OVERVIEW

TABLE 179 DYNALLOY: PRODUCT/ SOLUTION/ SERVICE OFFERINGS

10.2 OTHER PLAYERS

10.2.1 METALWERKS PMD, INC.

TABLE 180 METALWERKS PMD, INC.: BUSINESS OVERVIEW

TABLE 181 METALWERKS PMD, INC.: PRODUCT OFFERINGS

10.2.2 ULTIMATE WIREFORMS, INC.

TABLE 182 ULTIMATE WIREFORMS, INC.: BUSINESS OVERVIEW

TABLE 183 ULTIMATE WIREFORMS, INC.: PRODUCT OFFERINGS

10.2.3 DAIDO STEEL CO., LTD.

TABLE 184 DAIDO STEEL CO., LTD.: BUSINESS OVERVIEW

TABLE 185 DAIDO STEEL CO., LTD: PRODUCT OFFERINGS

10.2.4 GENERAL RESEARCH INSTITUTE FOR NONFERROUS METALS (GRINM)

TABLE 186 GENERAL RESEARCH INSTITUTE FOR NONFERROUS METALS (GRINM): BUSINESS OVERVIEW

10.2.5 EUROFLEX GMBH

TABLE 187 EUROFLEX GMBH: BUSINESS OVERVIEW

TABLE 188 EUROFLEX GMBH: PRODUCT OFFERINGS

10.2.6 CONFLUENT MEDICAL TECHNOLOGIES

TABLE 189 CONFLUENT MEDICAL TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 190 CONFLUENT MEDICAL TECHNOLOGIES: PRODUCT OFFERINGS

10.2.7 PRECISION CASTPARTS CORP.

TABLE 191 PRECISION CASTPARTS CORP.: BUSINESS OVERVIEW

10.2.8 NANOSHEL LLC

TABLE 192 NANOSHEL LLC: BUSINESS OVERVIEW

TABLE 193 NANOSHEL LLC: PRODUCT OFFERINGS

10.2.9 STANFORD ADVANCED MATERIALS

TABLE 194 STANFORD ADVANCED MATERIALS: BUSINESS OVERVIEW

TABLE 195 STANFORD ADVANCED MATERIALS: PRODUCT OFFERINGS

10.2.10 SUNRISE TITANIUM TECHNOLOGY

TABLE 196 SUNRISE TITANIUM TECHNOLOGY: BUSINESS OVERVIEW

TABLE 197 SUNRISE TITANIUM TECHNOLOGY: PRODUCT OFFERINGS

10.2.11 BOSTON CENTERLESS

TABLE 198 BOSTON CENTERLESS: BUSINESS OVERVIEW

10.2.12 SMA WIRES INDIA

TABLE 199 SMA WIRES INDIA: BUSINESS OVERVIEW

TABLE 200 SMA WIRES INDIA: PRODUCT OFFERINGS

10.2.13 ALB MATERIALS INC.

TABLE 201 ALB MATERIALS INC.: BUSINESS OVERVIEW

10.2.14 M & T(TAIWAN) CO., LTD.

TABLE 202 M & T(TAIWAN) CO., LTD.: BUSINESS OVERVIEW

TABLE 203 M & T(TAIWAN) CO., LTD.: PRODUCT OFFERINGS

10.2.15 LUMENOUS PEIERTECH

TABLE 204 LUMENOUS PEIERTECH: BUSINESS OVERVIEW

TABLE 205 LUMENOUS PEIERTECH: PRODUCT OFFERINGS

*Details on Business Overview, Product/ Solution/ Service Offered, Recent Developments, Winning Imperatives, MNM View, Key strengths/ Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 ADJACENT AND RELATED MARKETS (Page No. - 213)

11.1 INTRODUCTION

11.2 LIMITATIONS

11.3 ACTUATORS MARKET

11.3.1 MARKET DEFINITION

11.3.2 ACTUATORS MARKET, BY ACTUATION

TABLE 206 ACTUATORS MARKET SIZE, BY ACTUATION, 2017–2020 (USD BILLION)

TABLE 207 ACTUATORS MARKET SIZE, BY ACTUATION, 2021–2027 (USD BILLION)

11.3.3 ACTUATORS MARKET, BY APPLICATION

TABLE 208 ACTUATORS MARKET SIZE, BY APPLICATION, 2017–2020 (USD BILLION)

TABLE 209 ACTUATORS MARKET SIZE, BY APPLICATION, 2021–2027 (USD BILLION)

11.3.4 ACTUATORS MARKET, BY TYPE

TABLE 210 ACTUATORS MARKET SIZE, BY TYPE, 2017–2020 (USD BILLION)

TABLE 211 ACTUATORS MARKET SIZE, BY TYPE, 2021–2027 (USD BILLION)

11.3.5 ACTUATORS MARKET, BY VERTICAL

TABLE 212 ACTUATORS MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 213 ACTUATORS MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 214 ACTUATORS VOLUME, BY VERTICAL, 2017–2020 (MILLION)

TABLE 215 ACTUATORS VOLUME, BY VERTICAL, 2021–2027 (MILLION)

11.3.6 ACTUATORS MARKET, BY REGION

TABLE 216 ACTUATORS MARKET SIZE, BY REGION, 2017–2020 (USD BILLION)

TABLE 217 ACTUATORS MARKET SIZE, BY REGION, 2021–2027 (USD BILLION)

11.4 ORTHODONTIC SUPPLIES MARKET

11.4.1 MARKET DEFINITION

11.4.2 ORTHODONTIC SUPPLIES MARKET, BY PRODUCT

TABLE 218 ORTHODONTIC SUPPLIES MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

11.4.3 ORTHODONTIC SUPPLIES MARKET, BY PATIENT

TABLE 219 ORTHODONTIC SUPPLIES MARKET SIZE, BY PATIENT, 2019–2026 (USD MILLION)

11.4.4 ORTHODONTIC SUPPLIES MARKET, BY END USER

TABLE 220 ORTHODONTIC SUPPLIES MARKET SIZE, BY END USER, 2019–2026 (USD MILLION)

11.4.5 ORTHODONTIC SUPPLIES MARKET, BY REGION

TABLE 221 ORTHODONTIC SUPPLIES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11.5 METAL IMPLANTS AND MEDICAL ALLOYS MARKET

11.5.1 MARKET DEFINITION

11.5.2 METAL IMPLANTS AND MEDICAL ALLOYS MARKET, BY TYPE

TABLE 222 METAL IMPLANTS AND MEDICAL ALLOYS MARKET SIZE, BY TYPE, 2017–2024 (USD MILLION)

11.5.3 METAL IMPLANTS AND MEDICAL ALLOYS MARKET, BY APPLICATION

TABLE 223 METAL IMPLANTS AND MEDICAL ALLOYS MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

11.5.4 METAL IMPLANTS AND MEDICAL ALLOYS MARKET, BY REGION

TABLE 224 METAL IMPLANTS AND MEDICAL ALLOYS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

12 APPENDIX (Page No. - 224)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities for estimating the current size of the global shape memory alloys market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The COVID-19 pandemic impact on the demand with respect to end-use industries, application areas and countries were comprehended. The next step was to validate these findings, assumptions and sizes with the industry experts across the supply chain of shape memory alloys through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the shape memory alloys market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the shape memory alloys market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

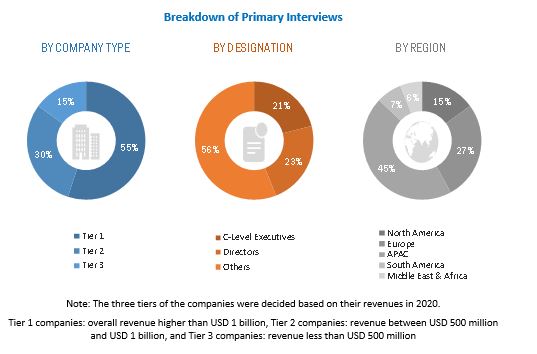

Various primary sources from both the supply and demand sides of the shape memory alloys market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the shape memory alloys industry. The primary sources from the demand side included key executives from end-use industries. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the global shape memory alloys market. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- Impact of COVID-19 pandemic was ascertained

- All percentage split and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the shape memory alloys market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the shape memory alloys market in terms of value based on type, end-use industry and region

- To project the size of the market and its segments with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, COVID-19 pandemic impact, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the shape memory alloys market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the shape memory alloy report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further breakdown of the Rest of APAC shape memory alloys market into more nations not covered in the study

- Further breakdown of Rest of Europe shape memory alloys market into more nations not covered in the study

- Further breakdown of Rest of South America shape memory alloys market into more nations not covered in the study

- Further breakdown of Rest of Middle East & Africa shape memory alloys market into more nations not covered in the study

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Shape Memory Alloys Market