Remote Asset Management Market by Component (Solutions (APM, Analytics and Reporting) and Services (Professional Services, Managed Services)), Asset Type (Fixed, Mobile), Deployment Mode, Organization Size, Vertical, and Region - Global Forecast to 2025

Remote Asset Management Market Growth & Trends

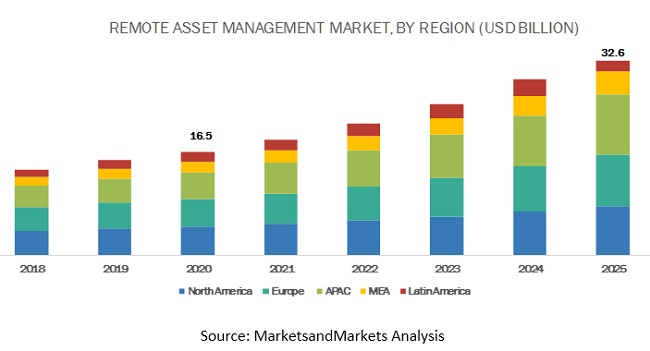

The global Remote Asset Management Market size was valued at $16.5 billion in 2020 and is projected to reach $32.6 billion by 2025, growing at a CAGR of 14.6% from 2020 to 2025. The major factors driving the remote asset management market include the adoption of IoT-enabled remote asset management solutions to manage assets efficiency, decreasing cost of IoT-based sensors optimize asset life cycle through remote asset management solutions, and use of predictive maintenance to boost the adoption of remote asset management, thereby reducing operational costs of remote assets.

Solution segment to lead the remote asset management market in 2020

Based on components, the solutions segment of the market is projected to lead the market in 2020. With the rapid adoption of connected devices to monitor assets remotely in real time and analyze the downtime proactively, these solutions are gaining traction all over the globe.

Analytics and reporting solution sub segment to grow at a higher CAGR during the forecast period

Based on the solutions, the analytics and reporting solution segment is projected to grow at a higher CAGR from 2020 to 2025. Analytics and reporting solutions help organizations evaluate the daily field operations and identify the areas of improvement, leading to better service delivery. These solutions allow organizations to simplify those data sources and represent the sources into a catchy visual dashboard. Analytics and reporting solutions offer automated report generation, which enables organizations to gain real-time information anywhere, anytime.

Mobile asset segment to grow at a higher CAGR during the forecast period

Based on the asset types, the mobile asset segment is projected to grow at a higher CAGR from 2020 to 2025. The growth is attributed to the increasing adoption of disruptive technologies that provide real-time, graphical representation of asset health, utilization, and availability to help utilities implement remote visual monitoring and alarm response management. Mobile assets with the integration of Geographic Information System (GIS) systems provide better access to business and spatial data in a single view, offer improved management of work assets within the context of location, and give better ability to visualize and search for assets on a map.

On-premises segment to lead the remote asset management market in 2020

Based on deployment modes, the on-premises segment is projected to lead the market from 2020 to 2025. Organizations deploying on-premises remote asset management solutions can have total control over the security of information about assets. Increased security concern for large enterprises is one of the major growth factors of the on-premises deployment mode. The growth of the on-premises deployment mode is also attributed to the complete control over the remote asset solutions, as it is physically implemented at the premises.

Small and medium-sized enterprises segment to grow at a higher CAGR during the forecast period

Based on organization size, the SMEs segment is projected to grow at a higher CAGR during the forecast period. SMEs across verticals are witnessing an increasing need for remote asset management solutions and services to manage their assets for enhancing their productivity and reducing operational costs. Increased use of digital technology across verticals has augmented profits for SMEs and greatly enhanced their business productivity.

Manufacturing vertical to lead the remote asset management market in 2020

Based on verticals, the manufacturing vertical is projected to lead the market from 2020 to 2025. Remote asset management in manufacturing is an essential part of asset-intensive industries. Remote asset management solutions help collect and analyze information from devices and assets, thereby enabling automated system alerting and energy optimization. The digital twin technology plays a crucial role in the manufacturing vertical by remotely analyzing assets through a virtual representation of assets.

North America to lead the remote asset management market in 2020

North America is estimated to hold the highest market share of the remote asset management market in 2020. It is the most advanced region in terms of technological adoption and infrastructure development. It is one of the largest contributors to the market. The market growth in this region is majorly driven by the presence of large IT companies and rapid technological advancements, such as digitalization in the US and Canada. The increased adoption of smart, secure, and connected technologies for asset-centric applications is expected to increase the market growth. In Asia Pacific (APAC), the market is projected to grow at the highest CAGR of 17.3% during the forecast period due to the demand for remote asset management solutions and services in countries, such as China, Japan, India, and rest of APAC. The market in APAC is driven by the growing acceptance of cloud-based solutions and emerging technologies, such as the IoT, and big data analytics, and mobility.

Remote Asset Management Companies

The major factor expected to hinder the growth of the remote asset management market is the growing concerns of organizations related to data security and confidentiality.

Key market players profiled in this report include Siemens AG (Germany), AT&T (US), Cisco Systems, Inc. (US), Hitachi Ltd. (Japan), Schneider Electric (France), PTC (US), Infosys Limited (India), IBM Corporation (US), Rockwell Automation, Inc. (US), SAP (Germany), Verizon (US), Bosch.IO (Germany), Meridium Inc. (US), Vodafone Group (UK), RapidValue Solutions (US), RCS Technologies (India), EAMbrace (US), Accruent (US), ROAMWORKS (UAE), and Ascent Intellimation Pvt. Ltd.(India). These players have adopted various growth strategies, such as partnerships, and collaborations, and new product launches and product enhancements, to further expand their presence in the market and broaden their customer base.

Scope of Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Components, Solution, Services, Asset Types (Fixed Asset and Mobile Asset), Deployment Modes, Organization Size, and Verticals |

|

Regions covered |

North America, Europe, APAC, Latin America, and MEA |

|

List of Companies in Remote Asset Management |

Siemens AG (Siemens), AT&T (AT&T), Cisco Systems, Inc. (Cisco Systems), Hitachi Ltd. (Hitachi), Schneider Electric (Schneider Electric), PTC (PTC), Infosys Limited (Infosys), IBM Corporation (IBM), Rockwell Automation, Inc. (Rockwell Automation), SAP (SAP), Verizon (Verizon), Bosch.IO (Bosch.IO), Meridium Inc. (Meridium), Vodafone Group (Vodafone), RapidValue Solutions (RapidValue), RCS Technologies (RCS), EAMbrace (EAMbrace), Accruent (Accruent), ROAMWORKS (ROAMWORKS), and Ascent Intellimation Pvt. Ltd. (Ascent Intellimation) |

This research report categorizes the market to forecast revenues and analyze trends in each of the following submarkets:

Based on components, the remote asset management market has the following segments:

- Solution

- Services

Based on asset types, the market has the following segments:

- Fixed Asset

- Mobile Asset

Based on deployment modes, the market has the following segments

- On-premises

- Cloud

Based on organization size, the remote asset management market has the following segments

- SMEs

- Large Enterprises

Based on verticals, the market has the following segments

- Building Automation

- Manufacturing

- Healthcare

- Retail

- Energy and Utilities

- Transportation and Logistics

- Metal and Mining

- Others

Based on Regions, the remote asset management market has the following segments

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

-

MEA

- United Arab Emirates

- Kingdom of Saudi Arabia

- Qatar

- Rest of MEA

Recent Developments

- In October 2019, Siemens acquired Pixeom’s edge computing platform. The platform is essential for Siemen’s future industrial edge ecosystem. With this open ecosystem, companies can easily analyze, create, and manage edge applications in data and in factory environments, as well as can be used for applications and devices from different manufacturers.

- In March 2020, AT&T enabled public safety agencies across the country to use FirstNet App Catalog in their response to COVID-19. FirstNet is America’s public safety communications platform; it helps address public safety’s needs. First responders are using this app’s ecosystem to tackle everyday emergencies in large and small communities.

- In January 2019, Cisco launched a new Cisco Validated Design (CVD) for remote and mobile assets solutions. The new solution lowers operating costs and drives new revenue streams from thousands of dispersed assets.

- In February 2019, Hitachi launched Hitachi Digital Solution for the logistics/delivery optimization service. The solution focuses on creating effective delivery plans by utilizing advanced digital technology, such as AI and IoT for logistics operations in Japan, China, and Thailand.

Key questions addressed by the report

- What are the growth opportunities in the remote asset management market?

- What is the competitive landscape scenario in the market?

- What are the regulations that are expected to have an impact on the market?

- How have remote asset management solutions and services evolved from traditional technologies?

- What are the dynamics of the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 1 GLOBAL REMOTE ASSET MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

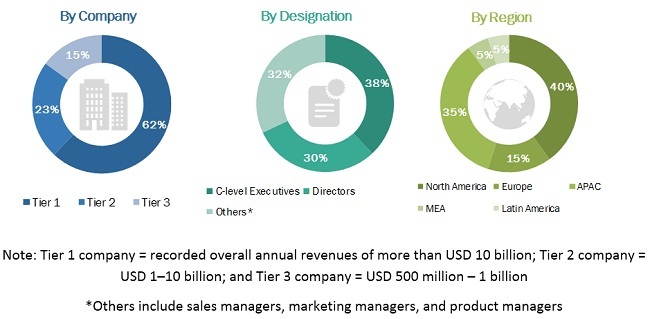

2.1.2.1 Breakdown of primary profiles

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF THE REMOTE ASSET MANAGEMENT MARKET

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTION/SERVICE/FIXED ASSET/MOBILE ASSET OF THE REMOTE ASSET MANAGEMENT MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 TOP DOWN: SHARE OF REMOTE ASSET MANAGEMENT MARKET THE OVERALL IOT SPENDING

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 6 REMOTE ASSET MANAGEMENT MARKET SIZE, 2020–2025

FIGURE 7 BASED ON COMPONENTS, SOLUTIONS SEGMENT TO LEAD THE REMOTE ASSET MANAGEMENT MARKET IN 2020

FIGURE 8 BASED ON SOLUTIONS, ASSET PERFORMANCE MANAGEMENT SEGMENT TO ACCOUNT FOR THE HIGHEST MARKET SHARE IN 2020

FIGURE 9 BASED ON ASSET TYPES, MOBILE ASSET SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 10 BASED ON DEPLOYMENT MODES, ON-PREMISES SEGMENT TO ACCOUNT FOR A HIGHER MARKET SHARE IN 2020

FIGURE 11 BASED ON ORGANIZATION SIZE, SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 12 BASED ON VERTICALS, MANUFACTURING VERTICAL TO ACCOUNT FOR THE HIGHEST MARKET SHARE IN 2020

FIGURE 13 REMOTE ASSET MANAGEMENT MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN THE REMOTE ASSET MANAGEMENT MARKET

FIGURE 14 GROWING ADOPTION OF INTERNET OF THINGS INCREASES THE EFFICIENCY OF MANAGING ASSETS REMOTELY LEADING TO THE MARKET GROWTH FROM 2020 TO 2025

4.2 ASIA PACIFIC REMOTE ASSET MANAGEMENT MARKET, BY COMPONENT AND COUNTRY

FIGURE 15 SOLUTIONS SEGMENT AND CHINA TO ACCOUNT FOR HIGH MARKET SHARES IN ASIA PACIFIC IN 2020

4.3 REMOTE ASSET MANAGEMENT MARKET: MAJOR COUNTRIES

FIGURE 16 CHINA AND INDIA PROJECTED TO REGISTER THE HIGHEST CAGR FROM 2020 TO 2025

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 59)

5.1 MARKET OVERVIEW

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES:

FALSE

5.2.1 DRIVERS

5.2.1.1 Surge in the adoption of IoT-enabled remote asset management solutions to manage assets efficiency

5.2.1.2 Decreasing cost of IoT-based sensors optimize asset life cycle through remote asset management solutions

5.2.1.3 Predictive maintenance to boost the adoption of remote asset management, thereby reducing operational cost of remote assets

5.2.2 RESTRAINTS

5.2.2.1 Concerns of organizations related to data security and confidentiality

5.2.3 OPPORTUNITIES

5.2.3.1 Extending remote asset life cycle using advanced technologies

5.2.3.2 Demand for remote asset management solutions due to pandemic, such as COVID-19

5.2.3.3 Advancement of IoT and cloud computing technology offering economic benefits

5.2.4 CHALLENGES

5.2.4.1 Selecting the right solution that aligns with the remote asset management needs

5.2.4.2 Agile technological changes offer new challenges to the existing vendors

5.3 VALUE CHAIN ANALYSIS

FIGURE 18 REMOTE MANAGEMENT SYSTEM: VALUE CHAIN ANALYSIS

5.4 INDUSTRY USE CASES

5.4.1 USE CASE 1: IBM HELPED CHENIERE DEPLOY IBM MAXIMO ASSET MANAGEMENT SOLUTION FOR TRANSFORMING THE MAINTENANCE OF COMPLEX ASSETS AT THE UPGRADED SABINE PASS FACILITY

5.4.2 USE CASE 2: SAP HELPED NETZSCH TO STANDARDIZE ITS ASSET PORTAL AND UNDERGO A DIGITAL TRANSFORMATION THROUGH SAP ASSET INTELLIGENCE NETWORK

5.4.3 USE CASE 3: PTC HELPED BELL AND HOWELL DROVE INNOVATION AND BUSINESS TRANSFORMATION WITH INDUSTRIAL INTERNET OF THINGS-ENABLED SERVICE OFFERINGS

5.4.4 USE CASE: BOSCH.IO HELPED HAGER IMPROVED ITS HOME ENERGY MANAGEMENT SYSTEM USING ITS BOSCH INTERNET OF THINGS SUITE

5.5 IMPACT OF DISRUPTIVE TECHNOLOGIES

5.5.1 ARTIFICIAL INTELLIGENCE

5.5.2 BIG DATA AND ANALYTICS

5.5.3 AUGMENTED REALITY

5.5.4 DIGITAL TWIN

5.6 REGULATORY BODIES IN THE REMOTE ASSET MANAGEMENT MARKET

5.6.1 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION STANDARDS

5.6.1.1 ISO/IEC JTC 1

5.6.1.2 ISO/IEC 27001

5.6.1.3 ISO/IEC JTC 1/SWG 5

5.6.1.4 I SO/IEC JTC 1SC 31

5.6.1.5 ISO/IEC JTC 1/SC 27

5.6.1.6 ISO/IEC JTC 1/WG 7 sensors

5.6.2 INSTITUTE OF ELECTRICAL AND ELECTRONICS ENGINEERS

5.6.3 CEN/ISO

5.6.4 CEN/CENELEC

5.6.5 EUROPEAN TELECOMMUNICATIONS STANDARDS INSTITUTE

5.6.6 ITU-T

6 IMPACT OF COVID-19 ON REMOTE ASSET MANAGEMENT (Page No. - 69)

7 REMOTE ASSET MANAGEMENT MARKET, BY COMPONENT (Page No. - 71)

7.1 INTRODUCTION

FIGURE 19 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 3 REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

7.2 SOLUTIONS

TABLE 4 SOLUTIONS: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

FIGURE 20 ANALYTICS AND REPORTING SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 5 REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

7.2.1 REAL-TIME LOCATION SYSTEM

7.2.1.1 Real-time location system: Remote asset management market drivers

TABLE 6 REAL-TIME LOCATION SYSTEM: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.2.2 ANALYTICS AND REPORTING

7.2.2.1 Analytics and reporting: Remote asset management market drivers

TABLE 7 ANALYTICS AND REPORTING: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.2.3 ASSET PERFORMANCE MANAGEMENT

TABLE 8 ASSET PERFORMANCE MANAGEMENT: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 ASSET PERFORMANCE MANAGEMENT: REMOTE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

7.2.3.1 Asset condition monitoring

7.2.3.1.1 Asset condition monitoring: Remote asset management market drivers

TABLE 10 ASSET CONDITION MONITORING: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.2.3.2 Predictive Maintenance

7.2.3.2.1 Predictive maintenance: Remote asset management market drivers

TABLE 11 PREDICTIVE MAINTENANCE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.2.4 SURVEILLANCE AND SECURITY

7.2.4.1 Surveillance and security: Remote asset management market drivers

TABLE 12 SURVEILLANCE AND SECURITY: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.2.5 NETWORK BANDWIDTH MANAGEMENT

7.2.5.1 Network bandwidth management: Remote asset management market drivers

TABLE 13 NETWORK BANDWIDTH MANAGEMENT: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.2.6 MOBILE WORKFORCE MANAGEMENT

7.2.6.1 Mobile workforce management: Remote asset management market drivers

TABLE 14 MOBILE WORKFORCE MANAGEMENT: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.2.7 OTHERS

TABLE 15 OTHERS: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3 SERVICES

TABLE 16 SERVICES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

FIGURE 21 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 17 SERVICES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

7.3.1 PROFESSIONAL SERVICES

TABLE 18 PROFESSIONAL SERVICES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 PROFESSIONAL SERVICES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

7.3.1.1 Consulting

7.3.1.1.1 Consulting: Remote asset management market drivers

TABLE 20 CONSULTING: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3.1.2 Implementation

7.3.1.2.1 Implementation: Remote asset management market drivers

TABLE 21 IMPLEMENTATION: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3.1.3 Support and maintenance

7.3.1.3.1 Support and maintenance: Remote asset management market drivers

TABLE 22 SUPPORT AND MAINTENANCE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3.2 MANAGED SERVICES

7.3.2.1 Managed services: Remote asset management market drivers

TABLE 23 MANAGED SERVICES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8 REMOTE ASSET MANAGEMENT MARKET, BY ASSET TYPE (Page No. - 91)

8.1 INTRODUCTION

FIGURE 22 MOBILE ASSET SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 24 REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

8.2 FIXED ASSET

8.2.1 FIXED ASSET: REMOTE ASSET MANAGEMENT MARKET DRIVERS

TABLE 25 FIXED ASSET: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.3 MOBILE ASSET

8.3.1 MOBILE ASSET: REMOTE ASSET MANAGEMENT MARKET DRIVERS

TABLE 26 MOBILE ASSET: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9 REMOTE ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE (Page No. - 95)

9.1 INTRODUCTION

FIGURE 23 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 27 REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

9.2 ON-PREMISES

9.2.1 ON-PREMISES: REMOTE ASSET MANAGEMENT MARKET DRIVERS

TABLE 28 ON-PREMISES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.3 CLOUD

9.3.1 CLOUD: REMOTE ASSET MANAGEMENT MARKET DRIVERS

TABLE 29 CLOUD: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10 REMOTE ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE (Page No. - 100)

10.1 INTRODUCTION

FIGURE 24 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 30 REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

10.2 SMALL AND MEDIUM-SIZED ENTERPRISES

10.2.1 SMALL AND MEDIUM-SIZED ENTERPRISES: REMOTE ASSET MANAGEMENT MARKET DRIVERS

TABLE 31 SMALL AND MEDIUM-SIZED ENTERPRISES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.3 LARGE ENTERPRISES

10.3.1 LARGE ENTERPRISES: REMOTE ASSET MANAGEMENT MARKET DRIVERS

TABLE 32 LARGE ENTERPRISES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11 REMOTE ASSET MANAGEMENT, BY VERTICAL (Page No. - 104)

11.1 INTRODUCTION

FIGURE 25 HEALTHCARE VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 33 REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

11.2 BUILDING AUTOMATION

11.2.1 BUILDING AUTOMATION: REMOTE ASSET MANAGEMENT MARKET DRIVERS

TABLE 34 BUILDING AUTOMATION: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.3 MANUFACTURING

11.3.1 MANUFACTURING: REMOTE ASSET MANAGEMENT MARKET DRIVERS

TABLE 35 MANUFACTURING: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.4 HEALTHCARE

11.4.1 HEALTHCARE: REMOTE ASSET MANAGEMENT MARKET DRIVERS

TABLE 36 HEALTHCARE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.5 RETAIL

11.5.1 RETAIL: REMOTE ASSET MANAGEMENT MARKET DRIVERS

TABLE 37 RETAIL: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.6 ENERGY AND UTILITIES

11.6.1 ENERGY AND UTILITIES: REMOTE ASSET MANAGEMENT MARKET DRIVERS

TABLE 38 ENERGY AND UTILITIES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.7 TRANSPORTATION AND LOGISTICS

11.7.1 TRANSPORTATION AND LOGISTICS: REMOTE ASSET MANAGEMENT MARKET DRIVERS

TABLE 39 TRANSPORTATION AND LOGISTICS: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.8 METAL AND MINING

11.8.1 METAL AND MINING: REMOTE ASSET MANAGEMENT MARKET DRIVERS

TABLE 40 METAL AND MINING: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.9 OTHERS

TABLE 41 OTHERS VERTICAL: REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

12 REMOTE ASSET MANAGEMENT MARKET, BY REGION (Page No. - 115)

12.1 INTRODUCTION

FIGURE 26 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 42 REMOTE ASSET MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET REGULATORY IMPLICATIONS

FIGURE 27 NORTH AMERICA: MARKET SNAPSHOT

TABLE 43 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 44 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 45 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 46 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 47 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 48 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 49 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 50 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 51 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 52 NORTH AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.2.2 UNITED STATES

12.2.2.1 United States: Remote asset management market drivers

TABLE 53 UNITED STATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 54 UNITED STATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 55 UNITED STATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 56 UNITED STATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 57 UNITED STATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 58 UNITED STATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 59 UNITED STATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 60 UNITED STATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 61 UNITED STATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

12.2.3 CANADA

12.2.3.1 Canada: Remote asset management market drivers

TABLE 62 CANADA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 63 CANADA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 64 CANADA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 65 CANADA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 66 CANADA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 67 CANADA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 68 CANADA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 69 CANADA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 70 CANADA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

12.3 EUROPE

12.3.1 EUROPE: REMOTE ASSET MANAGEMENT MARKET REGULATORY IMPLICATIONS

TABLE 71 EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 72 EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 73 EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 74 EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 75 EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 76 EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 77 EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 78 EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 79 EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 80 EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.3.2 UNITED KINGDOM

12.3.2.1 United Kingdom: Remote asset management market drivers

TABLE 81 UNITED KINGDOM: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 82 UNITED KINGDOM: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 83 UNITED KINGDOM: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 84 UNITED KINGDOM: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 85 UNITED KINGDOM: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 86 UNITED KINGDOM: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 87 UNITED KINGDOM: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 88 UNITED KINGDOM: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 89 UNITED KINGDOM: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

12.3.3 GERMANY

12.3.3.1 Germany: Remote asset management market drivers

TABLE 90 GERMANY: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 91 GERMANY: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 92 GERMANY: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 93 GERMANY: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 94 GERMANY: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 95 GERMANY: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 96 GERMANY: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 97 GERMANY: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 98 GERMANY: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

12.3.4 FRANCE

12.3.4.1 France: Remote asset management market drivers

TABLE 99 FRANCE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 100 FRANCE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 101 FRANCE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 102 FRANCE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 103 FRANCE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 104 FRANCE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 105 FRANCE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 106 FRANCE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 107 FRANCE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

12.3.5 REST OF EUROPE

TABLE 108 REST OF EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 109 REST OF EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 110 REST OF EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 111 REST OF EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 112 REST OF EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 113 REST OF EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 114 REST OF EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 115 REST OF EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 116 REST OF EUROPE: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET REGULATORY IMPLICATIONS

FIGURE 28 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 117 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 118 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 119 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 120 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 121 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 122 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 123 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 124 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 125 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 126 ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.4.2 CHINA

12.4.2.1 China: Remote asset management market drivers

TABLE 127 CHINA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 128 CHINA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 129 CHINA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 130 CHINA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 131 CHINA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 132 CHINA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 133 CHINA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 134 CHINA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 135 CHINA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

12.4.3 JAPAN

12.4.3.1 Japan: Remote asset management market drivers

TABLE 136 JAPAN: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 137 JAPAN: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 138 JAPAN: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 139 JAPAN: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 140 JAPAN: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 141 JAPAN: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 142 JAPAN: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 143 JAPAN: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 144 JAPAN: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

12.4.4 INDIA

12.4.4.1 India: Remote asset management market drivers

TABLE 145 INDIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 146 INDIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 147 INDIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 148 INDIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 149 INDIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 150 INDIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 151 INDIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 152 INDIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 153 INDIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

12.4.5 REST OF ASIA PACIFIC

TABLE 154 REST OF APAC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 155 REST OF ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 156 REST OF ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 157 REST OF ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

MILLION)

TABLE 159 REST OF ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 160 REST OF ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 161 REST OF ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 162 REST OF ASIA PACIFIC: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

12.5 LATIN AMERICA

12.5.1 LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET REGULATORY IMPLICATIONS

TABLE 163 LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 164 LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 165 LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 166 LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 167 LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 168 LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 169 LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 170 LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 171 LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 172 LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.5.2 BRAZIL

12.5.2.1 Brazil: Remote asset management market drivers

TABLE 173 BRAZIL: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 174 BRAZIL: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 175 BRAZIL: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 176 BRAZIL: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 177 BRAZIL: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 178 BRAZIL: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 179 BRAZIL: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 180 BRAZIL: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 181 BRAZIL: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

12.5.3 MEXICO

12.5.3.1 Mexico: Remote asset management market drivers

TABLE 182 MEXICO: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 183 MEXICO: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 184 MEXICO: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 185 MEXICO: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 186 MEXICO: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 187 MEXICO: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 188 MEXICO: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 189 MEXICO: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 190 MEXICO: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

12.5.4 REST OF LATIN AMERICA

TABLE 191 REST OF LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 192 REST OF LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 193 REST OF LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 194 REST OF LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 195 REST OF LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 196 REST OF LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 197 REST OF LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 198 REST OF LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 199 REST OF LATIN AMERICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

12.6 MIDDLE EAST AND AFRICA

12.6.1 MIDDLE EAST AND AFRICA: REMOTE ASSET MANAGEMENT MARKET REGULATORY IMPLICATIONS

TABLE 200 MIDDLE EAST AND AFRICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 201 MIDDLE EAST AND AFRICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 202 MIDDLE EAST AND AFRICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 203 MIDDLE EAST AND AFRICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 204 MIDDLE EAST AND AFRICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 205 MIDDLE EAST AND AFRICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 206 MIDDLE EAST AND AFRICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 207 MIDDLE EAST AND AFRICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 208 MIDDLE EAST AND AFRICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 209 MIDDLE EAST AND AFRICA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

12.6.2 UNITED ARAB EMIRATES

12.6.2.1 United Arab Emirates: Remote asset management market drivers

TABLE 210 UNITED ARAB EMIRATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 211 UNITED ARAB EMIRATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 212 UNITED ARAB EMIRATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 213 UNITED ARAB EMIRATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 214 UNITED ARAB EMIRATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 215 UNITED ARAB EMIRATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 216 UNITED ARAB EMIRATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 217 UNITED ARAB EMIRATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 218 UNITED ARAB EMIRATES: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

12.6.3 KINGDOM OF SAUDI ARABIA

12.6.3.1 Kingdom of Saudi Arabia: Remote asset management market drivers

TABLE 219 KINGDOM OF SAUDI ARABIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 220 KINGDOM OF SAUDI ARABIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 221 KINGDOM OF SAUDI ARABIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 222 KINGDOM OF SAUDI ARABIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 223 KINGDOM OF SAUDI ARABIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 224 KINGDOM OF SAUDI ARABIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 225 KINGDOM OF SAUDI ARABIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 226 KINGDOM OF SAUDI ARABIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 227 KINGDOM OF SAUDI ARABIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

12.6.4 QATAR

12.6.4.1 Qatar: Remote asset management market drivers

TABLE 228 QATAR: REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 229 QATAR: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 230 QATAR: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 231 QATAR: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 232 QATAR: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 233 QATAR: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 234 QATAR: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 235 QATAR: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 236 QATAR: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

12.6.5 REST OF MIDDLE EAST AND AFRICA

TABLE 237 REST OF MIDDLE EAST AND ASIA REMOTE ASSET MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 238 REST OF MIDDLE EAST AND ASIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 239 REST OF MIDDLE EAST AND ASIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET PERFORMANCE MANAGEMENT, 2018–2025 (USD MILLION)

TABLE 240 REST OF MIDDLE EAST AND ASIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 241 REST OF MIDDLE EAST AND ASIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 242 REST OF MIDDLE EAST AND ASIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ASSET TYPE, 2018–2025 (USD MILLION)

TABLE 243 REST OF MIDDLE EAST AND ASIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 244 REST OF MIDDLE EAST AND ASIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 245 REST OF MIDDLE EAST AND ASIA: REMOTE ASSET MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 213)

13.1 COMPETITIVE LEADERSHIP MAPPING (GLOBAL)

13.1.1 VISIONARY LEADERS

13.1.2 INNOVATORS

13.1.3 DYNAMIC DIFFERENTIATORS

13.1.4 EMERGING COMPANIES

FIGURE 29 REMOTE ASSET MANAGEMENT MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING

13.2 STRENGTH OF PRODUCT PORTFOLIO (GLOBAL)

FIGURE 30 PRODUCT PORTFOLIO ANALYSIS OF KEY PLAYERS IN THE GLOBAL REMOTE ASSET MANAGEMENT MARKET

13.3 BUSINESS STRATEGY EXCELLENCE (GLOBAL)

FIGURE 31 BUSINESS STRATEGY EXCELLENCE OF KEY PLAYERS IN THE GLOBAL REMOTE ASSET MANAGEMENT MARKET

13.4 KEY PLAYERS IN THE REMOTE ASSET MANAGEMENT MARKET, 2020

13.5 REMOTE ASSET MANAGEMENT MARKET: COMPETITIVE LEADERSHIP MAPPING (STARTUP)

13.5.1 PROGRESSIVE

13.5.2 RESPONSIVE

13.5.3 DYNAMIC COMPANIES

13.5.4 STARTING BLOCKS

FIGURE 32 REMOTE ASSET MANAGEMENT MARKET (STARTUPS) COMPETITIVE LEADERSHIP MAPPING, 2019

13.6 STRENGTH OF PRODUCT PORTFOLIO (STARTUP)

FIGURE 33 PRODUCT PORTFOLIO ANALYSIS OF KEY STARTUP PLAYERS IN THE REMOTE ASSET MANAGEMENT MARKET

13.7 BUSINESS STRATEGY EXCELLENCE (STARTUP)

FIGURE 34 BUSINESS STRATEGY EXCELLENCE OF KEY STARTUP PLAYERS IN THE REMOTE ASSET MANAGEMENT MARKET

14 COMPANY PROFILES (Page No. - 222)

(Business Overview, Solutions and Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

14.1 INTRODUCTION

14.2 SIEMENS

FIGURE 35 SIEMENS: COMPANY SNAPSHOT

FIGURE 36 SIEMENS: SWOT ANALYSIS

14.3 AT&T

FIGURE 37 AT&T: COMPANY SNAPSHOT

FIGURE 38 AT&T: SWOT ANALYSIS

14.4 CISCO

FIGURE 39 CISCO: COMPANY SNAPSHOT

FIGURE 40 CISCO: SWOT ANALYSIS

14.5 HITACHI

FIGURE 41 HITACHI: COMPANY SNAPSHOT

FIGURE 42 HITACHI: SWOT ANALYSIS

14.6 SCHNEIDER ELECTRIC

FIGURE 43 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

FIGURE 44 SCHNEIDER ELECTRIC: SWOT ANALYSIS

14.7 PTC

FIGURE 45 PTC: COMPANY SNAPSHOT

14.8 INFOSYS

FIGURE 46 INFOSYS: COMPANY SNAPSHOT

14.9 IBM

FIGURE 47 IBM: COMPANY SNAPSHOT

14.10 ROCKWELL AUTOMATION

FIGURE 48 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

14.11 SAP

FIGURE 49 SAP: COMPANY SNAPSHOT

14.12 VERIZON

FIGURE 50 VERIZON: COMPANY SNAPSHOT

14.13 BOSCH.IO

14.14 MERIDIUM

14.15 VODAFONE GROUP

14.16 RAPIDVALUE SOLUTIONS

14.17 RCS TECHNOLOGIES

14.18 EAMBRACE

14.19 ACCRUENT

14.20 ROAMWORKS

14.21 ASCENT INTELLIMATION

14.22 RIGHT-TO-WIN

*Details on Business Overview, Solutions and Services Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 261)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved four major activities to estimate the current market size for the remote asset management market. An exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the market.

Secondary Research

In the secondary research process, various secondary sources, such as D & B Hoovers and Bloomberg BusinessWeek, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies, whitepapers, and articles by recognized authors, gold standard, and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The remote asset management market comprises several stakeholders, such as remote asset management operators, remote asset management service providers, venture capitalists, government organizations, regulatory authorities, policymakers and financial organizations, consulting firms, research organizations, academic institutions, resellers and distributors, and training providers. The demand side of the market consists of all the firms operating in several industry verticals. The supply side includes remote asset management providers, offering remote asset management solutions. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global remote asset management market and various other dependent submarkets in the overall market. An exhaustive list of all the players offering solutions and services in the market was prepared while using the top-down approach. The market share for all the players in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each player was evaluated based on its component (solution and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and marketing executives.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global remote asset management market by component (solution and services [professional services and managed services]), asset type (fixed asset and mobile asset), deployment mode, organization size, vertical, and by region from 2020 to 2025, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall remote asset management market

- To profile key market players; generate a comparative analysis based on their business overviews, service offerings, regional presence, business strategies, and key financials; and provide companies with in-house statistical tools required to understand the competitive landscape

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

- To provide detailed information about major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the remote asset management market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Remote Asset Management Market