Smart Fleet Management Market by Transportation (Automotive, Rolling Stock, Marine), Hardware (Tracking, Optimization, ADAS, and Diagnostic), Connectivity (Short, Long, and Cloud), Solution (Tracking and Optimization), and Region - Global Forecast to 2022

The smart fleet management market is projected to grow at a CAGR of 8.0% during the forecast period, to reach USD 462.48 Billion by 2022. In this study, 2016 has been considered as base year, and 2017 to 2022 as forecast period, for estimating the smart fleet management marketmarket size of the management.

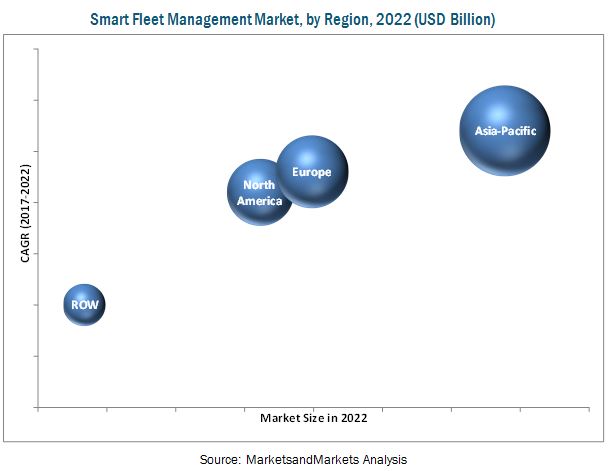

The report segments market and forecasts its size, by volume and value, based on mode of transportation, hardware, connectivity, solution, and region. North America is estimated to have highest market share from 2017 to 2022 followed by Europe and Asia Pacific. The market is driven by the legislations pertaining to transport safety, advancement in technology, and increased demand for large ships and vessel containers across the globe.

The report defines and forecasts the market size of smart fleet management in key countries for automotive, rolling stock, and marine transport. Additionally, the study analyzes market dynamics, recent industry developments, profiles of key smart fleet manufacturers, and competition mapping on a global level.

The research methodology used in the report involves various secondary sources including paid databases and directories such as MarkLines, Organisation Internationale des Constructeurs d'Automobiles (OICA), Society of Automotive Engineers (SAE), and Automotive Component Manufacturers Association (ACMA). Experts from related industries and suppliers have been interviewed to understand the key trends in the smart fleet management market. The bottom-up approach has been used to estimate the market size, in which country-wise fleet production and penetration rates of the stated technologies have been considered.

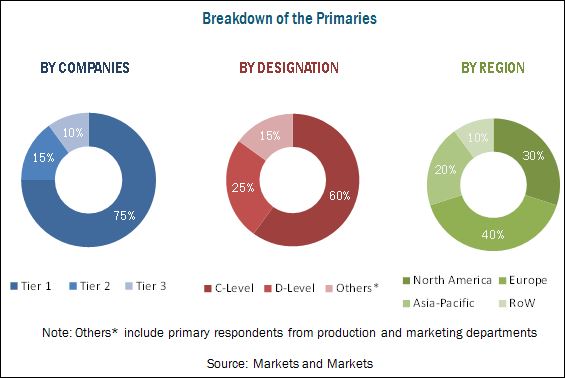

The vehicle production has been considered to arrive at the smart fleet management market size, in terms of volume. The region-wise market volume is then multiplied with the region-wise average OE price of each technology. This then gives the region-wise market size for that particular technology, in terms of value. The same approach has been used to calculate the market size of remaining technologies. The summation of the region-wise market size, in terms of value, gives the global market size. The figure below shows the break-up of profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The smart fleet management market eco-system consists of a parent industry vehicle intelligence and security, which includes manufacturers such as Continental AG (Germany), Denso Corporation (Japan), and Robert Bosch GmbH (Germany) among others, sensor manufacturers such as Infineon Technologies AG (Germany), vehicle manufacturers such as General Motors (U.S.), BMW (Germany), and Hyundai Motors (South Korea), maritime solutions providers such as Precious Shipping Company Private Limited (Thailand) and Otto Marine Limited (Singapore) among others.

Target Audience

- Fleet operators

- Automotive electronic system manufacturers

- Rolling Stock manufacturers

- Investment firms

- Equity research firms

- Private equity firms

Scope of the Report

-

Market, By Transportation

- Automotive

- Rolling Stock

- Marine

-

Market, By Hardware

- Tracking

- Optimization

- ADAS

- Remote Diagnostics

-

Market, By Connectivity

- Short Range Communication

- Long Range Communication

- Cloud

-

Market, By Solutions

- Vehicle Tracking

- Fleet Optimization

-

Market, By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World (RoW)

Available Customizations

- Market, By Solutions for Marine

- Additional Company Profiles

The smart fleet management market size is projected to grow at a CAGR of 8.0% during the forecast period, to reach USD 462.48 Billion by 2022.

It enhances the safety of vehicles and offers cloud storage facilities & data analytics, which would collectively contribute to the growth of this market globally.

Real Time Monitoring is estimated to have the highest growth potential in the global smart fleet management market. It is projected to grow at a promising CAGR from 2017 to 2022. This growth can be attributed to the proven benefits of the system in transport safety. The National Transportation Safety Board, U.S. included adaptive cruise control in its ten most wanted safety improvements in 2013. The European parliament also has plans to make adaptive cruise control mandatory in the next few years. These regulations are expected to drive the growth of the ADAS market in the next few years.

The smart fleet management market, by connectivity type, is led by the short range communication type during the forecast period. The short range communication technology can be used to share information regarding traffic jams, position, and best possible route and can also help in avoiding collisions. These advance system would further reduce traffic fatalities and increase operational efficiency thereby contributing to growth of short range communication market. The market for these technologies is on the rise and regulatory bodies in Europe and North America are planning to mandate some of these technologies. For example, in Europe, eCall has been mandated for all the new vehicles in the near future.

The key factors restraining the growth of this market include high cost of these systems and complex nature. Driver assistance systems have several electronic components, which make the system complex and increase the overall cost of the system.

The global smart fleet management market is dominated by key manufacturers such as Continental AG (Germany), Denso Corporation (Japan), Robert Bosch GmbH (Germany), IBM Corporation (U.S.) and Precious Shipping Company Public Limited (Thailand) among others. These companies have been focusing on developing new products and forming partnerships and collaborations with key organizations to expand their presence in the global tracking system market. Continental AG is currently the market leader and has adopted partnerships and collaborations as the key strategy to gain traction in the market. For instance, it entered into a strategic collaboration agreement with China Automotive Technology & Research Center (CATARC) to work closely in areas such as automotive security.

The Asia-Pacific region is estimated to be the largest market for smart fleet management during the review period. With increase in transport facilities in developing countries such as Japan, China, and India and stringent safety regulations, demand for market is to rise. It is expected with increase in adoption of connectivity technology, market for ADAS and telematics would rise in Asia-Pacific region. In 2015, the Indian government reviewed the policy for the usage of radar-based technologies in India, which would lead to an increase in the usage of ADAS system in the Indian market. The region also has some of the most stringent vehicle safety regulations in the world, which would boost the market for advanced driver assistance technologies and telematics.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Smart Fleet Management Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.1.2 Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Sampling Techniques & Data Collection Methods

2.1.3 Primary Participants

2.2 Data Triangulation

2.3 Factor Analysis

2.3.1 Introduction

2.3.2 Demand Side Analysis

2.3.2.1 Safety Concerns in Fleet Management

2.3.2.2 Mandate on Cost-Containment

2.3.3 Supply Side Analysis

2.3.3.1 Technological Advancement

2.3.3.2 Need of Connectivity for Safety and Security

2.4 Market Size Estimation

2.5 Assumptions

3 Executive Summary (Page No. - 29)

3.1 Smart Fleet Management Market, By Region

3.2 Market, By Mode of Transport

3.3 Market, By Connectivity

3.4 Market, By Solutions

3.5 Market, By Hardware

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in this Market

4.2 Market, By Region & Hardware, 2017

4.3 Regional Market Share of Smart Fleet Management, 2017 vs. 2022

4.4 Market, By Connectivity Type

4.5 Market, By Mode of Transport

5 Smart Fleet Management Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Hardware

5.2.2 By Mode of Transport

5.2.3 By Mode of Connectivity

5.2.4 By Solutions

5.2.5 By Region

5.3 Smart Fleet Management Market Dynamics

5.3.1 Drivers

5.3.1.1 Government Regulations

5.3.1.2 Need of High Speed Network

5.3.2 Restraints

5.3.2.1 Complex and Expensive Technology

5.3.2.2 Lack of Adaptability in Developing Nations

5.3.3 Opportunities

5.3.3.1 Fleets Integration With Artificial Intelligence

5.3.4 Challenges

5.3.4.1 Cost and Quality

5.3.4.2 Safety and Security Threats

6 Smart Fleet Management Market, By Mode of Transport (Page No. - 45)

6.1 Introduction

6.2 Market, By Mode of Transport

6.2.1 Automotive

6.2.1.1 Automotive Market

6.2.2 Rolling Stock

6.2.2.1 Rolling Stock Smart Fleet Management Market

6.2.3 Marine

6.2.3.1 Marine Smart Fleet Management Market

7 Market, By Hardware (Page No. - 52)

7.1 Introduction

7.2 Automotive

7.2.1 Global Automotive Smart Fleet Management

7.2.1.1 Tracking

7.2.1.2 Optimization

7.2.1.3 ADAS

7.2.1.4 Diagnostics

7.3 Rolling Stock

7.3.1 Global Rolling Stock Smart Fleet Management

7.3.1.1 Tracking

7.3.1.2 Optimisation

7.3.1.3 ADAS

7.3.1.4 Diagnostics

7.4 Marine

7.4.1 Global Marine Smart Fleet Management

7.4.1.1 Tracking

7.4.1.2 Optimisation

7.4.1.3 ADAS

7.4.1.4 Diagnostics

8 Smart Fleet Management Market, By Product (Page No. - 68)

8.1 Introduction

8.2 Automotive

8.2.1 Market

8.2.1.1 Tracking

8.2.1.2 Optimization

8.2.1.3 ADAS

8.2.1.4 Diagnostics

8.3 Rolling Stock

8.3.1 Rolling Stock Smart Fleet Management Market

8.3.1.1 Tracking

8.3.1.2 Optimization

8.3.1.3 ADAS

8.3.1.4 Diagnostics

8.4 Marine

8.4.1 Marine Smart Fleet Management Market

8.4.1.1 Tracking

8.4.1.2 Optimization

8.4.1.3 ADAS

8.4.1.4 Diagnostics

9 Smart Fleet Management Market, By Connectivity (Page No. - 88)

9.1 Introduction

9.2 Cloud

9.3 Short Range Communication Market

9.4 Long Range Communication Market

10 Smart Fleet Management Market, By Solutions (Page No. - 92)

10.1 Introduction

10.2 By Solutions

10.2.1 By Tracking Solutions

10.2.2 By Optimization Solutions

11 Smart Fleet Management Market, By Region (Page No. - 95)

11.1 Introduction

11.2 Automotive

11.2.1 Global Market

11.2.2 Asia-Pacific

11.2.3 Europe

11.2.4 North America

11.2.5 RoW

11.3 Rolling Stock

11.3.1 Global Rolling Stock Smart Fleet Management Market

11.3.2 Asia-Pacific

11.3.3 Europe

11.3.4 North America

11.3.5 RoW

11.4 Marine

11.4.1 Global Marine Smart Fleet Management Market

11.4.2 Asia-Pacific

11.4.3 Europe

11.4.4 North America

11.4.5 RoW

12 Competitive Landscape (Page No. - 116)

12.1 Introduction

12.1.1 Vanguards

12.1.2 Innovators

12.1.3 Dynamic

12.1.4 Emerging

12.2 Competitive Benchmarking

12.2.1 Analysis of Product Portfolio of Major Players in the Smart Fleet Management (25 Players)

12.2.2 Business Strategies Adopted By Major Players in the Smart Fleet Management (25 Players)

12.3 Market Ranking Analysis: Smart Fleet Management

13 Company Profiles (Page No. - 121)

13.1 Robert Bosch GmbH

13.1.1 Overview

13.1.2 Product Offering Scorecard

13.1.3 Business Strategy Scorecard

13.1.4 Recent Developments

13.2 Continental Ag

13.2.1 Overview

13.2.2 Product Offering Scorecard

13.2.3 Business Strategy Scorecard

13.2.4 Recent Developments

13.3 Denso Corporation

13.3.1 Overview

13.3.2 Product Offering Scorecard

13.3.3 Business Strategy Scorecard

13.3.4 Recent Developments

13.4 Harman International Industries, Inc.

13.4.1 Overview

13.4.2 Product Offering Scorecard

13.4.3 Business Strategy Scorecard

13.4.4 Recent Developments

13.5 Siemens AG

13.5.1 Overview

13.5.2 Product Offering Scorecard

13.5.3 Business Strategy Scorecard

13.5.4 Recent Developments

13.6 IBM Corporation

13.6.1 Overview

13.6.2 Product Offering Scorecard

13.6.3 Business Strategy Scorecard

13.6.4 Recent Developments

13.7 Sierra Wireless, Inc.

13.7.1 Overview

13.7.2 Business Strategy Scorecard

13.7.3 Business Strategy Scorecard

13.7.4 Recent Developments

13.8 Cisco Systems, Inc.

13.8.1 Overview

13.8.2 Business Strategy Scorecard

13.8.3 Business Strategy Scorecard

13.8.4 Recent Developments

13.9 Calamp Corp.

13.9.1 Overview

13.9.2 Business Strategy Scorecard

13.9.3 Business Strategy Scorecard

13.9.4 Recent Developments

13.10 Precious Shipping Public Company Ltd.

13.10.1 Overview

13.10.2 Product Offering Scorecard

13.10.3 Business Strategy Scorecard

13.11 Otto Marine Limited

13.11.1 Overview

13.11.2 Product Offering Scorecard

13.11.3 Business Strategy Scorecard

13.11.4 Recent Developments

13.12 Orbcomm, Inc.

13.12.1 Overview

13.12.2 Product Offering Scorecard

13.12.3 Business Strategy Scorecard

13.12.4 Recent Developments

13.13 Jutha Maritime Public Company Limited

13.13.1 Overview

13.13.2 Product Offering Scorecard

13.13.3 Business Strategy Scorecard

13.14 Globecomm Systems, Inc.

13.14.1 Overview

13.14.2 Product Offering Scorecard

13.14.3 Business Strategy Scorecard

13.14.4 Recent Developments

14 Appendix (Page No. - 160)

14.1 Key Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (112 Tables)

Table 1 Market, By Mode of Transport, 2015–2022 (Million Units)

Table 2 Market, By Mode of Transport, 2015–2022 (USD Billion)

Table 3 Smart Fleet Management Market, By Region, 2015–2022 (Million Units)

Table 4 Market, By Region, 2015–2022 (USD Billion)

Table 5 Rolling Stock Market, By Region, 2015–2022 (Million Units)

Table 6 Rolling Stock Market, By Region, 2015–2022 (USD Billion)

Table 7 Marine Market, By Region, 2015–2022 (Million Units)

Table 8 Marine Market, By Region, 2015–2022 (USD Billion)

Table 9 Global Market, By Hardware, 2015–2022 (Million Units)

Table 10 Global Market, By Hardware, 2015–2022 (USD Billion)

Table 11 Tracking: Market, By Hardware Type, 2015–2022 (Million Units)

Table 12 Tracking: Market, By Hardware, 2015–2022 (USD Billion)

Table 13 Optimization: Automotive Market, By Hardware Type, 2015–2022 (Million Units)

Table 14 Optimization: Automotive Market, By Hardware Type, 2015–2022 (USD Billion)

Table 15 ADAS: Automotive Market, By Hardware Type, 2015–2022 (Million Units)

Table 16 ADAS: Automotive Market, By Hardware Type, 2015–2022 (USD Billion)

Table 17 Diagnostics: Automotive Market, By Hardware Type, 2015–2022 (Million Units)

Table 18 Diagnostics: Automotive Market, By Hardware Type, 2015–2022 (USD Billion)

Table 19 Global Rolling Stock Market, By Hardware, 2015–2022 (Million Units)

Table 20 Global Rolling Stock Market, By Hardware, 2015–2022 (USD Billion)

Table 21 Tracking: Rolling Stock Market, By Hardware Type, 2015–2022 (Million Units)

Table 22 Tracking: Rolling Stock Market, Hardware, 2015–2022 (USD Billion)

Table 23 Optimisation: Rolling Stock Market, By Hardware Type, 2015–2022 (Million Units)

Table 24 Optimisation: Rolling Stock Market,By Hardware Type, 2015–2022 (USD Billion)

Table 25 ADAS: Rolling Stock Market, By Hardware Type, 2015–2022 (Million Units)

Table 26 ADAS: Rolling Stock Market, By Hardware Type, 2015–2022 (USD Billion)

Table 27 Diagnostics: Rolling Stock Smart Fleet Management Market, By Hardware Type, 2015–2022 (Million Units)

Table 28 Diagnostics: Rolling Stock Market, By Hardware Type, 2015–2022(USD Billion)

Table 29 Global Marine Market, By Hardware, 2015–2022 (Million Units)

Table 30 Global Marine Market, By Hardware, 2015–2022 (USD Billion)

Table 31 Tracking: Marine Market, By Hardware Type, 2015–2022 (Million Units)

Table 32 Tracking: Marine Market, By Product, 2015–2022 (USD Billion)

Table 33 Optimisation: Marine Market, By Hardware Type, 2015–2022 (Million Units)

Table 34 Optimisation: Marine Market, By Hardware Type, 2015–2022 (USD Billion)

Table 35 ADAS: Marine Market, By Hardware Type, 2015–2022 (Million Units)

Table 36 ADAS: Marine Market, By Hardware Type, 2015–2022 (USD Billion)

Table 37 Diagnostics: Marine Market, By Hardware Type, 2015–2022 (Million Units)

Table 38 Diagnostics: Marine Market, By Hardware Type, 2015–2022 (USD Billion)

Table 39 Market, By Product, 2015–2022 (Million Units)

Table 40 Smart Fleet Management Market, By Product, 2015–2022 (USD Billion)

Table 41 Tracking: Automotive Market, By Region, 2015–2022, (Million Units)

Table 42 Tracking: Automotive Market, By Region, 2015–2022, (USD Billion)

Table 43 Optimization: Automotive Market, By Region, 2015–2022, (Million Units)

Table 44 Optimization: Automotive Market, By Region, 2015–2022, (USD Billion)

Table 45 ADAS: Automotive Market, By Region, 2015–2022, (Million Units)

Table 46 ADAS: Automotive Market, By Region, 2015–2022, (USD Billion)

Table 47 Diagnostics: Automotive Market, By Region, 2015–2022, (Million Units)

Table 48 Diagnostics: Automotive Market, By Region, 2015–2022, (USD Billion)

Table 49 Rolling Stock Smart Fleet Management Market, By Product, 2015–2022 (Million Units)

Table 50 Rolling Stock Market, By Product, 2015–2022 (USD Billion)

Table 51 Rolling Stock Market, By Product, 2015–2022 (Million Units)

Table 52 Rolling Stock Market, By Product, 2015–2022 (USD Billion)

Table 53 Tracking: Rolling Stock Market, By Region, 2015–2022, (Million Units)

Table 54 Tracking: Rolling Stock Market, By Region, 2015–2022, (USD Billion)

Table 55 Optimization: Rolling Stock Market, By Region, 2015–2022, (Million Units)

Table 56 Optimization: Rolling Stock Market, By Region, 2015–2022, (USD Billion)

Table 57 ADAS: Rolling Stock Market, By Region, 2015–2022, (Million Units)

Table 58 ADAS: Rolling Stock Market, By Region, 2015–2022, (USD Billion)

Table 59 Diagnostics: Rolling Stock Market, By Region, 2015–2022, (Million Units)

Table 60 Diagnostics: Rolling Stock Market, By Region, 2015–2022, (USD Billion)

Table 61 Marine Smart Fleet Management Market, By Product, 2015–2022 (Million Units)

Table 62 Marine Market, By Product, 2015–2022 (USD Billion)

Table 63 Marine Market, By Product, 2015–2022 (Million Units)

Table 64 Marine Market, By Product, 2015–2022 (USD Billion)

Table 65 Tracking: Smart Fleet Management Marine Market, By Region, 2015–2022, (Million Units)

Table 66 Tracking: Smart Fleet Management Marine Market, By Region, 2015–2022, (USD Billion)

Table 67 Optimization: Marine Market, By Region, 2015–2022 (Million Units)

Table 68 Optimization: Marine Market, By Region, 2015–2022 (USD Billion)

Table 69 ADAS: Marine Market, By Region, 2015–2022 (Million Units)

Table 70 ADAS: Marine Market, By Region, 2015–2022 (USD Billion)

Table 71 Diagnostics: Marine Market, By Region, 2015–2022 (Million Units)

Table 72 Diagnostics: Marine Market, By Region, 2015–2022 (USD Billion)

Table 78 Smart Fleet Management Market, By Solutions, 2015–2022 (USD Million)

Table 79 Market, By Tracking Solutions, 2015–2022 (USD Million)

Table 80 Market, By Optimization Solutions, 2015–2022 (USD Million)

Table 81 Global Market, By Region, 2015–2022 (USD Billion)

Table 82 Global Automotive Market, By Region, 2015–2022 (Million Units)

Table 83 Global Automotive Market, 2015-2022 (USD Billion)

Table 84 Asia-Pacific Automotive Market, By Hardware, 2015–2022 (Million Units)

Table 85 Asia-Pacific Automotive Market, By Hardware, 2015–2022 (USD Billion)

Table 86 Europe Automotive Market, By Hardware, 2015–2022 (Million Units)

Table 87 Europe Automotive Market, By Hardware, 2015–2022 (USD Billion)

Table 88 North America Automotive Market, By Hardware, 2015–2022 ( Million Units)

Table 89 North America Automotive Market, By Hardware, 2015–2022 (USD Billion)

Table 90 RoW Automotive Market, By Hardware, 2015–2022 (Million Units)

Table 91 RoW Automotive Market, By Hardware, 2015–2022 (USD Billion)

Table 92 Global Rolling Stock Market, By Hardware, 2015–2022 (Million Units)

Table 93 Global Rolling Stock Market, By Hardware, 2015–2022 (USD Billion)

Table 94 Asia-Pacific Rolling Stock Market, By Hardware, 2015–2022 (Million Units)

Table 95 Asia-Pacific Rolling Stock Market, By Hardware, 2015–2022 (USD Billion)

Table 96 Europe Rolling Stock Market, By Hardware, 2015–2022 (Million Units)

Table 97 Europe Rolling Stock Market, By Hardware, 2015–2022 ( USD Billion)

Table 98 North America Rolling Stock Market,By Hardware, 2015–2022 (Million Units)

Table 99 North America Rolling Stock Market, By Hardware, 2015–2022 (USD Billion)

Table 100 RoW Rolling Stock Smart Fleet Management Market, By Hardware, 2015–2022 (Million Units)

Table 101 RoW Rolling Stock Market, By Hardware, 2015–2022 (USD Billion)

Table 102 Global Marine Market, By Hardware, 2015–2022 (Million Units)

Table 103 Global Marine Market, By Hardware, 2015–2022 (USD Billion)

Table 104 Asia-Pacific Marine Market, By Hardware, 2015–2022 (Million Units)

Table 105 Asia-Pacific Marine Market, By Hardware, 2015–2022 (USD Billion)

Table 106 Europe Marine Market, By Hardware, 2015–2022 (Million Units)

Table 107 Europe Marine Market, By Hardware, 2015–2022 (USD Billion)

Table 108 North America Marine Market, By Hardware, 2015–2022 (Million Units)

Table 109 North America Marine Market, By Hardware, 2015–2022 (USD Billion)

Table 110 RoW Marine Market, By Hardware, 2015–2022 (Million Units)

Table 111 RoW Marine Market, By Hardware, 2015–2022 (USD Million)

Table 112 Global Market Ranking: 2017

List of Figures (50 Figures)

Figure 1 Smart Fleet Management: Markets Covered

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Global Market, By Hardware: Bottom-Up Approach

Figure 6 Asia-Pacific is Expected to Emerge As the Largest Growing Market, 2017–2022 (USD Billion)

Figure 7 Marine is Estimated to Hold the Largest Market Share, 2017–2022 (USD Billion)

Figure 8 Cloud is Projected to Hold the Largest Market Share, 2017–2022 (USD Billion)

Figure 9 Optimization is Estimated to Be the Largest Market, 2017–2022 (USD Billion)

Figure 10 ADAS Segment to Have the Largest Market Share of Smart Fleet Management, 2017–2022 (USD Billion)

Figure 11 Government Regulations & Changing Preferences of Fleet Operators Expected to Drive the Demand for Smart Fleets

Figure 12 Asia-Pacific to Dominate the Market in 2017

Figure 13 Asia-Pacific to Account for the Largest Share, By Value, of the Smart Fleet Management, 2017–2022

Figure 14 Cloud to Dominate the Market in 2017

Figure 15 Marine to Hold the Largest Market Share, By Value, in the Smart Fleet Management in 2017

Figure 16 Smart Fleet Management: Market Segmentation

Figure 17 Smart Fleet Management Market, By Hardware

Figure 18 Market, By Mode of Transport

Figure 19 Market, By Mode of Connectivity

Figure 20 Market, By Solutions

Figure 21 Market, By Region

Figure 22 Smart Fleet Management: Market Dynamics

Figure 23 The North American Market is Expected to Lead the Market, By Region, 2017 vs 2022 (USD Billion)

Figure 24 The European Market is Expected to Lead the Rolling Stock Smart Fleet Management Market

Figure 25 The Market in Asia-Pacific is Expected to Lead the Marine Smart Fleet Management, By Region, 2017 vs 2022 (USD Billion)

Figure 26 ADAS is to Lead Market, By Hardware Type, 2017 vs. 2022 (USD Billion)

Figure 27 Market, By Hardware Type, 2017 vs. 2022 (USD Billion)

Figure 28 ADAS is to Lead Marine Smart Fleet Management Market, By Hardware Type, 2017 vs. 2022 (USD Billion)

Figure 29 The ADAS Segment is Expected to Lead the Market, By Product, 2017 vs 2022 (USD Billion)

Figure 30 The Optimization Segment is Expected to Lead the Rolling Stock Smart Fleet Management Market, By Product, 2017 vs 2022 (Million Units)

Figure 31 The ADAS Segment is Expected to Lead the Marine Smart Fleet Management Market, By Product, 2017 vs 2022 (USD Billion)

Figure 32 Cloud is Estimated to Lead the Market, By Connectivity, 2017 vs. 2022 (USD Billion)

Figure 33 The North American Market Holds the Largest Share of the Smart Fleet Management, By Solutions, From 2017 to 2022

Figure 34 Market Outlook, By Region (2017-2022)

Figure 35 Asia-Pacific Market, 2017–2022

Figure 36 North America Market, 2017–2022

Figure 37 Dive Chart

Figure 38 Robert Bosch GmbH: Company Snapshot

Figure 39 Continental AG: Company Snapshot

Figure 40 Denso Corporation: Company Snapshot

Figure 41 Harman International Industries, Inc.: Company Snapshot

Figure 42 Siemens AG: Company Snapshot

Figure 43 IBM Corporation: Company Snapshot

Figure 44 Sierra Wireless, Inc.: Company Snapshot

Figure 45 Cisco Systems, Inc.: Company Snapshot

Figure 46 Calamp Corp.: Company Snapshot

Figure 47 Precious Shipping Public Company Ltd.: Company Snapshot

Figure 48 Otto Marine Limited: Company Snapshot

Figure 49 Orbcomm, Inc.: Company Snapshot (2016)

Figure 50 Jutha Maritime PCL: Company Snapshot (2016)

Growth opportunities and latent adjacency in Smart Fleet Management Market