Riflescopes Market by Sight Type (Telescopic, Reflex), Application (Armed Forces, Hunting, Shooting Sports), Technology (EO/IR, Thermal Imaging, Laser), End User, Weapon Compatibility, Function, Range and Region (2020-2025)

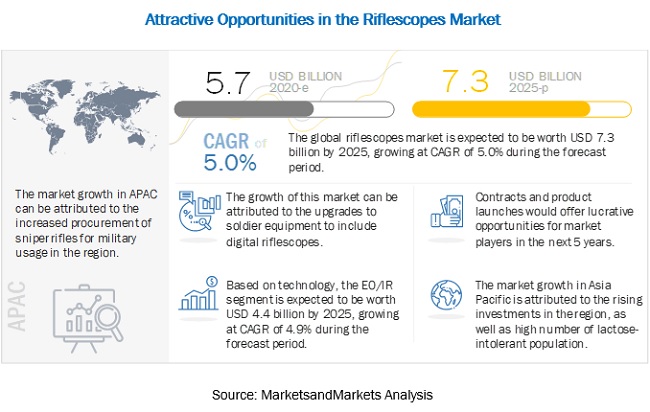

[280 Pages Report] The Riflescopes Market is expected to grow from USD 5.7 Billion in 2020 to USD 7.3 Billion by 2025, at a CAGR of 5.0% during the forecast period. The advancements in technology for precision attack and their increasing demand for hunting and shooting sports are some of the factors expected to drive the growth of the Riflescopes Industry. However, Hight cost of riflescopes is a challenge the market is facing. There are multiple opportunities for manufacturers to gain a substantial market share through military modernization contracts.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global Riflescopes Market

The COVID-19 pandemic has caused a multi-level impact on economies globally. The global manufacturing of optical lens, sensors, and components and their assembly lines have been moderately impacted.

The supply of riflescopes for military use is of prime importance; however, as these instruments are not regularly changed/replaced due to their high durability, the market for them is not severely impacted.

Resuming the manufacturing and deliveries of riflescopes depends on the level of COVID-19 exposure a country is facing, the level at which manufacturing operations are running, import-export regulations, among others. Although companies may still be taking in orders, delivery schedules might not be fixed.

Riflescopes Market Dynamics

Driver: Advancements in Riflescope Technology for Precision Attack

Technology has rapidly evolved in the riflescopes market. In the military, precision is of paramount importance. Soldiers guarding borders or those in particular missions, such as desert storm, need rifles with scopes that can easily spot intended targets with high precision.

Rapid Adaptive Zoom for Assault Rifles (RAZAR) technology enables riflemen to toggle between high and low magnifications at a push of a button without having to remove their eyes from the targets or their hands from the rifles. Bushnell (US) and Vortex Optics (US) are among the major companies offering RAZOR technology used in long-range riflescopes.

There are other technological developments, such as integration with night vision goggles and riflescopes for smart rifles, which are expected to herald the growth of new and technologically advanced riflescopes.

Restraint: Ban on Hunting

Riflescopes are primarily used in hunting. There are countries, including Australia and New Zealand, where hunting is encouraged as a measure to control the animal population. However, in countries such as India, there are strict wildlife regulations, and some communities do not allow the hunting of certain species. Botswana had banned trophy hunting on public lands in 2014; Zambia banned the hunting of leopards or lions, both of which are disappearing across Africa; and Costa Rica passed a law that bans all sport hunting and trapping, both inside and outside protected areas. Various animals are on the verge of extinction and have been declared endangered. Thus, hunting, which constitutes about 40–45% revenue streams of riflescope manufacturing companies, is expected to get affected in the future due to the ban on animal hunting.

Opportunity: Military Modernization Programs

There have been advancements in military optics technology, particularly in telescopic sights, in the past decade. These advancements in telescopic sights have enabled the armies to deliver precise shots over greater distances than conventional infantry weapons.

There is a huge opportunity for the riflescopes market, owing to rising soldier/military modernization programs. For instance, in June 2019, the Indian government signed contracts with Fabbrica d'Armi Pietro Beretta S.p.A. (Italy) and Barrett (US) for the procurement of 5,719 sniper rifles. Similarly, in January 2019, SIG Sauer (Germany) signed a contract with the US Department of Defense (DOD) to provide the US Special Operations Forces (SOF) with a new riflescope and gun mount, more specifically, the Electro-Optics Tango6T 1-6×24 Second Focal Plane (SFP) Riflescope and Alpha4 Ultralight Mount. The contract will cost US DOD USD 12 million per year for the next five years.

Opportunities for the riflescopes market have also increased with the increasing adoption of riflescopes by militaries for different variants of rifles in different platforms. Additionally, the growing concept of integration of weapon systems at the platform level is expected to boost the market for riflescopes globally.

Challenge: High Cost of Riflescopes

The price of riflescopes is high. This high cost is expected to impact their demand, thus proving to be a major challenge for the growth of the riflescopes market. The price of riflescopes varies in accordance with their specifications, such as magnification, diameter objective lens, and range required for different applications, such as hunting, shooting sports, and self-defense.

Considering the flourishing optics market, there is also a trend to buy low-cost scopes, as several imported optics equipped with promising features cost 10 times more. Companies such as Bushnell (US), Leupold & Stevens, Inc. (US), and Burris Company (US), among others, manufacture high magnifying optics for better aim. However, the cost of such riflescopes is high and, therefore, scopes with lesser cost are preferred.

Based on Sight Type, the Telescopic Segment of the Riflescopes Market is Projected to Grow at the Highest CAGR During the Forecast Period.

Based on sight type, the telescopic segment is projected to grow at the highest CAGR from 2020 to 2025. Telescopic sights are optical telescopes loaded with different forms of graphic image pattern reticles installed in the optical equipment to offer an accurate aiming point. Telescopic riflescopes are expected to have greater market share than reflex due to their existing as well as increasing demand for hunting applications.

The Armed Forces Segment of the Riflescopes Market is Projected to Grow at the Highest CAGR From 2020 to 2025.

By application, the armed forces market segment is expected to register the highest CAGR during the forecast period due to military modernization programs in various countries. Developing countries, in particular, are replacing conventional rifles used by their armed forces with new assault rifles mounted with advanced riflescopes. For instance, in June 2019, India announced its plan to manufacture 650,000 AK-203 assault rifles loaded with new riflescopes.

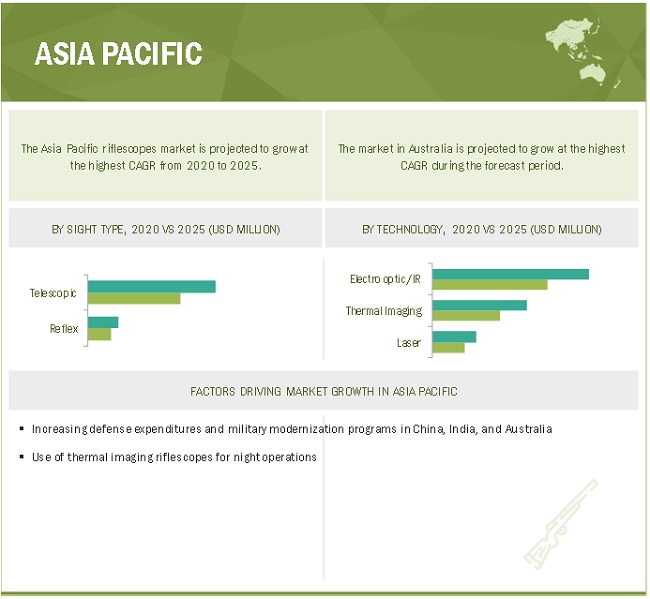

“The Asia Pacific Riflescopes Market is Projected to Grow at the Highest CAGR During the Forecast Period.”

The Asia Pacific riflescopes market is projected to grow at the highest CAGR from 2020 to 2025. Countries such as China, India, Australia, Japan, and South Korea are considered in this regional market analysis. One of the strongest growth factors for the riflescopes industry in China is the increased defense budget of the country. High domestic production base and increased consumption of assault and sniper rifles by its defense sector are expected to drive the market for riflescopes in China.

As a result of the COVID-19 crisis, many countries have decided to cut their overall defense budgets. According to industry experts, defense departments would focus more on sectors of high importance to national security, and the budgets for research and non-critical sectors would be temporarily cut. However, countries like the US, China, and some European countries have increased their planned defense spending during this time, contrary to other countries.

To know about the assumptions considered for the study, download the pdf brochure

Riflescopes Industry Companies: Top Key Market Players

The Riflescopes Companies are dominated by globally established players such as SIG Sauer, Inc., (US) Vortex Optics, (US) and Leupold & Stevens, Inc., (US) Burris Company, Inc., (US) Trijicon, Inc., (US) and Nightforce Optics (US). Contracts and new product launches were key strategies adopted by the leading players to achieve growth in the riflescopes market.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 5.7 billion in 2020 |

|

Projected Market Size |

USD 7.3 billion in 2025 |

|

Growth Rate |

5.0% |

|

Forecast Period |

2020-2025 |

|

On Demand Data Available |

2030 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Key Market Driver | Advancements in Riflescope Technology for Precision Attack |

| Key Market Opportunity | Military Modernization Programs |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Telescopic Segment |

| Highest CAGR Segment | Armed Forces Segment |

| Largest Application Market Share | Defense Sector |

This research report categorizes the Riflescopes Market based on magnification, sight type, application, technology, end use, weapon compatibility, function, range, and region.

By Magnification

- 1-8x

- 8-15x

- > 15x

Sight Type

- Telescopic

- Reflex

Application

- Armed Forces

- Hunting

- Shooting Sports

Technology

- Electro-optic/Infrared

- Thermal Imaging

- Laser

Weapon Compatibility

- Sniper Rifles

- Automatic Rifles

Function

- Day Sights

- Night Sights

End Use

- Defense

- Commercial

Range

- Short (50 to 100 yards)

- Medium (100 to 500 yards)

- Long (> 500 Yards)

Recent Developments

- Leupold & Stevens, Inc., in partnership with Aimpoint, was awarded a military optics contract worth USD 42.8 million to provide Mark 6 riflescopes along with Mark 6 riflescope-integrated mounting systems. This contract will act as the base for the next generation of integrated optical aiming systems for modern small arms.

- SIG Sauer was awarded a contract worth USD 12 million by the US SOCOM for the supply of its Electro-Optics TANGO6T 1-6×24 Second Focal Plane (SFP) Riflescope and ALPHA4 Ultralight Mount, thus allowing the company to increase its share in the riflescopes market.

- Nightforce Optics was awarded a contract worth USD 15 million by US SOCOM to provide Squad-Variable Powered Scopes (First Focal Plane) in support of US Special Operations Command.

Frequently Asked Questions (FAQ):

What is the current size of the global riflescopes market?

The riflescopes market is projected to grow from USD 5.7 Billion in 2020 to USD 7.3 Billion by 2025, at a CAGR of 5.0% from 2020 to 2025.

Who are the winners in the global riflescopes market?

SIG Sauer, Inc., (US) Vortex Optics, (US) and Leupold & Stevens, Inc., (US) Burris Company, Inc., (US) Trijicon, Inc., (US) and Nightforce Optics (US) are some of the winners in the market. These players have a high market share and offer technologically advanced riflescopes.

What is the COVID-19 impact on riflescopes manufacturers?

Industry experts believe that the global riflescopes industry could be negatively impacted by 5-15% in 2020. However, since the defense of a country is a key to its security, it is estimated that the riflescopes and optics industry will recover quickly.

What are some of the technological advancements in the market?

Night vision riflescopes, integrated advanced ballistic calculators, precision-guided firearms, rapid adaptive zoom for assault rifles among others, are some of the technological advancements in the market.

What are the factors driving the growth of the market?

Increasing demand for riflescopes for hunting and shooting sports, advancements in riflescope technology and military modernizations are major factors driving the growth of the riflescopes market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 42)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 RIFLESCOPES INDUSTRY SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY & PRICING

TABLE 1 USD EXCHANGE RATES

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

FIGURE 1 RIFLESCOPES INDUSTRY TO GROW AT A HIGHER RATE COMPARED TO PREVIOUS REPORT ESTIMATES

2 RESEARCH METHODOLOGY (Page No. - 47)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH FLOW

FIGURE 3 RIFLESCOPES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET DEFINITION & SCOPE

2.2.2 SEGMENT DEFINITIONS

2.2.2.1 by Magnification

2.2.2.2 by Sight Type

2.2.2.3 by Application

2.2.2.4 by Technology

2.2.2.5 by Range

2.2.2.6 by End Use

2.2.2.7 by Weapon Compatibility

2.2.2.8 by Function

2.2.3 EXCLUSIONS

2.3 RESEARCH APPROACH & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Riflescopes Market

2.3.1.2 by Technology

2.3.1.3 by Sight Type

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

FIGURE 8 ASSUMPTIONS FOR THE RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 9 BY SIGHT TYPE, TELESCOPIC SEGMENT PROJECTED TO LEAD THE RIFLESCOPES INDUSTRY FROM 2020 TO 2025

FIGURE 10 BY TECHNOLOGY, THERMAL IMAGING SEGMENT PROJECTED TO REGISTER THE HIGHEST CAGR FROM 2020 TO 2025

FIGURE 11 BY APPLICATION, HUNTING SEGMENT PROJECTED TO REGISTER THE HIGHEST CAGR FROM 2020 TO 2025

FIGURE 12 BY WEAPON COMPATIBILITY, SNIPER RIFLES SEGMENT PROJECTED TO REGISTER THE HIGHEST CAGR FROM 2020 TO 2025

FIGURE 13 BY FUNCTION, NIGHT SIGHTS SEGMENT PROJECTED TO REGISTER THE HIGHEST CAGR FROM 2020 TO 2025

FIGURE 14 BY END USE, NIGHT SIGHTS SEGMENT PROJECTED TO REGISTER THE HIGHEST CAGR FROM 2020 TO 2025

FIGURE 15 BY RANGE, LONG RANGE SEGMENT PROJECTED TO GROW AT THE HIGHEST RATE FROM 2020 TO 2025

FIGURE 16 ASIA PACIFIC REGION PROJECTED TO WITNESS THE HIGHEST CAGR FROM 2020 TO 2025

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN INDUSTRY

FIGURE 17 INCREASING SOLDIER MODERNIZATION PROGRAMS DRIVING THE GROWTH OF THE RIFLESCOPES INDUSTRY

4.2 RIFLESCOPES MARKET, BY TECHNOLOGY

FIGURE 18 EO/IR TECHNOLOGY SEGMENT ESTIMATED TO CAPTURE THE LARGEST SHARE OF THE RIFLESCOPES INDUSTRY IN 2020

4.3 RIFLESCOPES MARKET, BY APPLICATION

FIGURE 19 ARMED FORCES APPLICATION SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.4 RIFLESCOPES MARKET, BY WEAPON COMPATIBILITY

FIGURE 20 AUTOMATIC RIFLES SEGMENT TO LEAD THE RIFLESCOPES INDUSTRY FROM 2020 TO 2025

4.5 RIFLESCOPES MARKET, BY FUNCTION

FIGURE 21 NIGHT SIGHTS SEGMENT TO LEAD THE RIFLESCOPES INDUSTRY FROM 2020 TO 2025

4.6 RIFLESCOPES MARKET, BY END USE

FIGURE 22 DEFENSE SEGMENT TO LEAD THE RIFLESCOPES INDUSTRY FROM 2020 TO 2025

5 MARKET OVERVIEW (Page No. - 65)

5.1 INTRODUCTION

TABLE 2 LIST OF COUNTRIES WHERE HUNTING IS LEGAL

5.2 MARKET DYNAMICS

FIGURE 23 RIFLESCOPES INDUSTRY DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand for riflescopes for hunting and shooting sports

TABLE 3 NUMBER OF RIFLES IMPORTED FROM OTHER COUNTRIES INTO THE US BETWEEN 2010 AND 2018

TABLE 4 RIFLES IMPORTED FROM OTHER COUNTRIES INTO THE US IN 2018, BY COUNTRY

5.2.1.2 Advancements in riflescope technology for precision attack

5.2.2 RESTRAINTS

5.2.2.1 Ban on hunting

TABLE 5 NUMBER OF RIFLES MANUFACTURED IN THE US BETWEEN 2013 AND 2018

TABLE 6 NUMBER OF HUNTERS IN VARIOUS EUROPEAN AND NORTH AMERICAN COUNTRIES

5.2.3 OPPORTUNITIES

5.2.3.1 Military modernization programs

TABLE 7 MILITARY MODERNIZATION PROGRAMS

TABLE 8 SOLDIER MODERNIZATION PROGRAMS IN EMERGING COUNTRIES

5.2.4 CHALLENGES

5.2.4.1 High cost of riflescopes

TABLE 9 RIFLESCOPES AND THEIR PRICES

5.2.5 AVERAGE SELLING PRICE TREND

TABLE 10 AVERAGE SELLING PRICE TREND FOR SHORT RANGE RIFLESCOPES

TABLE 11 AVERAGE SELLING PRICE TREND FOR MEDIUM RANGE RIFLESCOPES

TABLE 12 AVERAGE SELLING PRICE TREND FOR LONG RANGE RIFLESCOPES

5.2.6 TECHNOLOGY ANALYSIS

FIGURE 24 TECHNOLOGY ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS

5.2.7 COVID-19 IMPACT ON THE RIFLESCOPES MARKET

6 INDUSTRY TRENDS (Page No. - 77)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 NIGHT VISION RIFLESCOPES

6.2.2 FIBER LASER TECHNOLOGY

6.2.3 ADVANCED BALLISTIC CALCULATOR

6.2.4 MINIATURIZED ELECTRO-OPTICS

6.2.5 PRECISION-GUIDED FIREARM

6.2.6 RAPID ADAPTIVE ZOOM FOR ASSAULT RIFLES (RAZAR)

6.2.7 ADVANCED TECHNOLOGIES DEVELOPED BY COMPANIES IN THE RIFLESCOPES INDUSTRY

TABLE 13 ADVANCED TECHNOLOGIES DEVELOPED BY COMPANIES IN THE RIFLESCOPES INDUSTRY

6.3 INNOVATIONS & PATENT REGISTRATIONS

TABLE 14 IMPORTANT INNOVATIONS & PATENT REGISTRATIONS, 2001–2017

6.4 IMPACT OF MEGA TRENDS

7 RIFLESCOPES MARKET, BY MAGNIFICATION (Page No. - 81)

7.1 INTRODUCTION

7.2 1-8X

7.2.1 1-8X MAGNIFICATION IS BEST SUITED FOR HUNTING APPLICATION

7.3 8-15X

7.3.1 8-15X MAGNIFICATION IS WIDELY USED IN MILITARY AND SHOOTING SPORTS FOR MEDIUM RANGE APPLICATIONS

7.4 >15X

7.4.1 >15X MAGNIFICATION IS IDEAL FOR LONG RANGE HUNTING AND SHOOTING SPORTS APPLICATIONS

8 RIFLESCOPES MARKET, BY SIGHT TYPE (Page No. - 82)

8.1 INTRODUCTION

FIGURE 26 BY SIGHT TYPE, TELESCOPIC SEGMENT PROJECTED TO LEAD THE RIFLESCOPES MARKET FROM 2020 TO 2025

TABLE 15 INDUSTRY SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 16 INDUSTRY SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

8.2 TELESCOPIC

8.2.1 INCREASING DEMAND FROM NORTH AMERICA AND EUROPE

TABLE 17 TELESCOPIC SIGHT SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 18 TELESCOPIC SIGHT SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

8.3 REFLEX

8.3.1 TECHNOLOGICAL ADVANCEMENT HAS LED TO INCREASED DEMAND

TABLE 19 REFLEX SIGHT SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 20 REFLEX SIGHT SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

9 RIFLESCOPES MARKET, BY APPLICATION (Page No. - 86)

9.1 INTRODUCTION

FIGURE 27 ARMED FORCES SEGMENT PROJECTED TO LEAD THE RIFLESCOPES MARKET FROM 2020 TO 2025

TABLE 21 INDUSTRY SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 22 INDUSTRY SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.2 ARMED FORCES

9.2.1 MILITARY MODERNIZATION PROGRAMS OF DEVELOPING COUNTRIES

9.3 HUNTING

9.3.1 INCREASING DEMAND FOR RIFLESCOPES FOR HUNTING APPLICATION IN NORTH AMERICA AND EUROPE

9.4 SHOOTING SPORTS

9.4.1 INCREASING SHOOTING SPORTS AND RELATED EVENTS WORLDWIDE

10 RIFLESCOPES MARKET, BY TECHNOLOGY (Page No. - 90)

10.1 INTRODUCTION

FIGURE 28 BY TECHNOLOGY, EO/IR SEGMENT PROJECTED TO LEAD THE RIFLESCOPES MARKET FROM 2020 TO 2025

TABLE 23 INDUSTRY SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 24 INDUSTRY SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

10.2 EO/IR

10.2.1 DEVELOPMENT OF MICRO ELECTRO-OPTICS SYSTEMS

10.3 THERMAL IMAGING

10.3.1 INCREASING ADOPTION OF THERMAL IMAGING TECHNOLOGY DURING LOW VISIBILITY/NIGHTTIME

10.4 LASER

10.4.1 INTEGRATION OF LASER-BASED RIFLESCOPES WITH SOLDIERS’ WEARABLES

11 RIFLESCOPES MARKET, BY WEAPON COMPATIBILITY (Page No. - 94)

11.1 INTRODUCTION

FIGURE 29 AUTOMATIC RIFLES SEGMENT PROJECTED TO LEAD THE RIFLESCOPES MARKET FROM 2020 TO 2025 (USD BILLION)

TABLE 25 MARKET SIZE, BY WEAPON COMPATIBILITY, 2017–2019 (USD MILLION)

TABLE 26 MARKET SIZE, BY WEAPON COMPATIBILITY, 2020–2025 (USD MILLION)

11.2 SNIPER RIFLES

11.2.1 INCREASED NEED TO ENGAGE LONG-RANGE TARGETS DRIVES THE SEGMENT

TABLE 27 SNIPER RIFLES: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 28 SNIPER RIFLES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

11.3 AUTOMATIC RIFLES

11.3.1 INCREASE IN USE OF THERMAL RIFLESCOPES FOR SOLDIERS ENHANCES DEMAND

TABLE 29 AUTOMATIC RIFLES: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 30 AUTOMATIC RIFLES: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 31 SCOPES FOR AUTOMATIC RIFLES, BY MANUFACTURER

12 RIFLESCOPES MARKET, BY FUNCTION (Page No. - 99)

12.1 INTRODUCTION

FIGURE 30 NIGHT SIGHTS SEGMENT PROJECTED TO LEAD THE RIFLESCOPES MARKET FROM 2020 TO 2025

TABLE 32 INDUSTRY SIZE, BY FUNCTION, 2017–2019 (USD MILLION)

TABLE 33 INDUSTRY SIZE, BY FUNCTION, 2020–2025 (USD MILLION)

12.2 DAY SIGHTS

12.2.1 INCREASED USE OF RED DOT SIGHTS BY TACTICAL SHOOTERS BOOSTS DEMAND

TABLE 34 DAY SIGHTS IN FUNCTION SEGMENT SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 35 DAY SIGHTS IN FUNCTION SEGMENT SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 36 DAY SIGHTS, BY MANUFACTURER

12.3 NIGHT SIGHTS

12.3.1 DEMAND FOR NIGHT SIGHTS WITH THERMAL IMAGING DRIVES SEGMENT GROWTH

TABLE 37 NIGHT SIGHTS FUNCTION SEGMENT SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 38 NIGHT SIGHTS FUNCTION SEGMENT SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 39 NIGHT SIGHTS, BY MANUFACTURER

13 RIFLESCOPES MARKET, BY END USE (Page No. - 103)

13.1 INTRODUCTION

FIGURE 31 DEFENSE SEGMENT PROJECTED TO LEAD THE RIFLESCOPES MARKET FROM 2020 TO 2025

TABLE 40 RIFLESCOPES MARKET SIZE, BY END USE, 2017–2019 (USD MILLION)

TABLE 41 INDUSTRY SIZE, BY END USE, 2020–2025 (USD MILLION)

13.2 DEFENSE

13.2.1 ADVANCEMENTS IN DIGITAL RIFLESCOPE TECHNOLOGY DRIVE THE DEFENSE SEGMENT

TABLE 42 DEFENSE INDUSTRY SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 43 DEFENSE INDUSTRY SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 44 SNIPER RIFLES IN SERVICE, BY COUNTRY

13.3 COMMERCIAL

13.3.1 INTRODUCTION OF NEW FEATURES IN DIGITAL RIFLESCOPES BOOST COMMERCIAL SEGMENT

TABLE 45 COMMERCIAL RIFLESCOPES MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 46 COMMERCIAL RIFLESCOPES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 47 FEATURES AND SELLING PRICE OF DIGITAL RIFLESCOPES, BY MANUFACTURER

14 RIFLESCOPES MARKET, BY RANGE (Page No. - 109)

14.1 INTRODUCTION

FIGURE 32 BY RANGE, MEDIUM SEGMENT PROJECTED TO LEAD THE RIFLESCOPES MARKET FROM 2020 TO 2025

TABLE 48 RANGE SEGMENT SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 49 RANGE SEGMENT SIZE, BY RANGE, 2020–2025 (USD MILLION)

14.2 SHORT (50 TO 100 YARDS)

14.2.1 ADOPTION IN CARBINES AND SEMI-AUTOMATIC RIFLES WILL LEAD TO INCREASED PROCUREMENT OF SHORT RANGE RIFLESCOPES

TABLE 50 LIST OF SHORT RANGE HUNTING RIFLESCOPES, PRICING, AND DISTRIBUTION CHANNELS

14.3 MEDIUM (100 TO 500 YARDS)

14.3.1 DEMAND FROM NORTH AMERICA AND EUROPE IS EXPECTED TO FUEL THE MARKET GROWTH OF MEDIUM RANGE RIFLESCOPES

TABLE 51 LIST OF MID RANGE HUNTING RIFLE SCOPES, PRICING, AND DISTRIBUTION CHANNELS

14.4 LONG (>500 YARDS)

14.4.1 INCREASING DEMAND FROM SNIPER UNITS IN MILITARY

TABLE 52 LIST OF LONG RANGE HUNTING RIFLE SCOPES, PRICING, AND DISTRIBUTION CHANNELS

15 RIFLESCOPES MARKET, BY REGION (Page No. - 124)

15.1 INTRODUCTION

15.2 GLOBAL COVID-19 IMPACT

FIGURE 33 REGIONAL SNAPSHOT

TABLE 53 INDUSTRY SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 54 INDUSTRY SIZE, BY REGION, 2020–2025 (USD MILLION)

FIGURE 34 INDUSTRY: VOLUME (UNITS) 2017-2025

TABLE 55 INDUSTRY SIZE, BY REGION, OPTIMISTIC FORECAST, 2020–2025 (USD MILLION)

TABLE 56 RIFLESCOPES INDUSTRY SIZE, BY REGION, PESSIMISTIC FORECAST, 2020–2025 (USD MILLION)

15.3 NORTH AMERICA

15.3.1 NORTH AMERICA: PESTLE ANALYSIS

FIGURE 35 NORTH AMERICA REGION SNAPSHOT

TABLE 57 NORTH AMERICA: REGIONAL SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 58 NORTH AMERICA: REGIONAL SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 59 NORTH AMERICA: REGIONAL SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 60 NORTH AMERICA: REGIONAL SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 61 NORTH AMERICA: TELESCOPIC SIGHT TYPE SEGMENT SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 62 NORTH AMERICA: TELESCOPIC SIGHT TYPE SEGMENT SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 63 NORTH AMERICA: REFLEX SIGHT TYPE SEGMENT SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 64 NORTH AMERICA: REFLEX SIGHT TYPE SEGMENT SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 65 NORTH AMERICA: REGIONAL SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 66 NORTH AMERICA: REGIONAL SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 67 NORTH AMERICA: REGIONAL SIZE, BY WEAPON COMPATIBILITY, 2017–2019 (USD MILLION)

TABLE 68 NORTH AMERICA: REGIONAL SIZE, BY WEAPON COMPATIBILITY, 2020–2025 (USD MILLION)

TABLE 69 NORTH AMERICA: REGIONAL SIZE, BY FUNCTION, 2017–2019 (USD MILLION)

TABLE 70 NORTH AMERICA: REGIONAL SIZE, BY FUNCTION, 2020–2025 (USD MILLION)

TABLE 71 NORTH AMERICA: REGIONAL SIZE, BY END USE, 2017–2019 (USD MILLION)

TABLE 72 NORTH AMERICA: REGIONAL SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 73 NORTH AMERICA: REGIONAL SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 74 NORTH AMERICA: REGIONAL SIZE, BY RANGE, 2020–2025 (USD MILLION)

TABLE 75 NORTH AMERICA: DEFENSE END USE SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 76 NORTH AMERICA: RIFLESCOPES MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

15.3.2 US

15.3.2.1 Increasing soldier modernization programs and growing hunting activities are driving the riflescopes market in the US

TABLE 77 US: REGIONAL SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 78 US: SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 79 US: TELESCOPIC SIGHT TYPE SEGMENT SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 80 US: TELESCOPIC SIGHT TYPE SEGMENT SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 81 US: REFLEX SIGHT TYPE SEGMENT SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 82 US: REFLEX SIGHT TYPE SEGMENT SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 83 US: INDUSTRY SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 84 US: INDUSTRY SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 85 US: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 86 US: RIFLESCOPES INDUSTRY SIZE, BY RANGE, 2020–2025 (USD MILLION)

15.3.3 CANADA

15.3.3.1 Large number of hunters, resulting in the increased demand for hunting rifles in Canada

TABLE 87 CANADA: INDUSTRY SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 88 CANADA: INDUSTRY SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 89 CANADA: TELESCOPIC SIGHT TYPE SEGMENT SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 90 CANADA: TELESCOPIC SIGHT TYPE SEGMENT SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 91 CANADA: REFLEX SIGHT TYPE SEGMENT SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 92 CANADA: REFLEX SIGHT TYPE SEGMENT SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 93 CANADA: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 94 CANADA: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 95 CANADA: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 96 CANADA: SIZE, BY RANGE, 2020–2025 (USD MILLION)

15.4 EUROPE

15.4.1 EUROPE: PESTLE ANALYSIS

FIGURE 36 EUROPE RIFLESCOPES INDUSTRY SNAPSHOT

TABLE 97 EUROPE: SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 98 EUROPE: SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 99 EUROPE: SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 100 EUROPE: SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 101 EUROPE: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 102 EUROPE: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 103 EUROPE: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 104 EUROPE: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 105 EUROPE: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 106 EUROPE: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 107 EUROPE: SIZE, BY WEAPON COMPATIBILITY, 2017–2019 (USD MILLION)

TABLE 108 EUROPE: SIZE, BY WEAPON COMPATIBILITY, 2020–2025 (USD MILLION)

TABLE 109 EUROPE: SIZE, BY FUNCTION, 2017–2019 (USD MILLION)

TABLE 110 EUROPE: SIZE, BY FUNCTION, 2020–2025 (USD MILLION)

TABLE 111 EUROPE: DEFENSE RIFLESCOPES MARKET SIZE, BY END USE, 2017–2019 (USD MILLION)

TABLE 112 EUROPE: SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 113 EUROPE: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 114 EUROPE: SIZE, BY RANGE, 2020–2025 (USD MILLION)

TABLE 115 EUROPE: SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 116 EUROPE: SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

15.4.2 RUSSIA

15.4.2.1 Russia has one of the highest numbers of hunters using rifles for hunting

TABLE 117 RUSSIA: INDUSTRY SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 118 RUSSIA: INDUSTRY SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 119 RUSSIA: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 120 RUSSIA: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 121 RUSSIA: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 122 RUSSIA: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 123 RUSSIA: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 124 RUSSIA: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 125 RUSSIA: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 126 RUSSIA: SIZE, BY RANGE, 2020–2025 (USD MILLION)

15.4.3 GERMANY

15.4.3.1 Upgradation of handheld firearms in Germany is fueling the growth of the riflescopes market in the country

TABLE 127 GERMANY: RIFLESCOPES INDUSTRY SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 128 GERMANY: SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 129 GERMANY: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 130 GERMANY: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 131 GERMANY: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 132 GERMANY: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 133 GERMANY: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 134 GERMANY: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 135 GERMANY: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 136 GERMANY: SIZE, BY RANGE, 2020–2025 (USD MILLION)

15.4.4 FRANCE

15.4.4.1 Procurement of advanced rifles by law enforcement agencies resulting in the growth of the riflescopes market in France

TABLE 137 FRANCE: RIFLESCOPES INDUSTRY SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 138 FRANCE: SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 139 FRANCE: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 140 FRANCE: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 141 FRANCE: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 142 FRANCE: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 143 FRANCE: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 144 FRANCE: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 145 FRANCE: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 146 FRANCE: SIZE, BY RANGE, 2020–2025 (USD MILLION)

15.4.5 UK

15.4.5.1 Shooting sports and hunting programs have contributed to the growth of riflescopes market in the UK

TABLE 147 UK: RIFLESCOPES INDUSTRY SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 148 UK: REGIONAL SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 149 UK: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 150 UK: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 151 UK: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 152 UK: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 153 UK: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 154 UK: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 155 UK: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 156 UK: SIZE, BY RANGE, 2020–2025 (USD MILLION)

15.4.6 ITALY

15.4.6.1 Increasing demand for rifles by homeland security agencies resulting in the growth of the riflescopes market in Italy

TABLE 157 ITALY: RIFLESCOPES INDUSTRY SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 158 ITALY: REGIONAL SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 159 ITALY: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 160 ITALY: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 161 ITALY: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 162 ITALY: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 163 ITALY: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 164 ITALY: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 165 ITALY: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 166 ITALY: SIZE, BY RANGE, 2020–2025 (USD MILLION)

15.4.7 SPAIN

15.4.7.1 Adoption of long and medium-range rifles equipped with advanced riflescopes resulting in the growth of the riflescopes market in Spain

TABLE 167 SPAIN: RIFLESCOPES INDUSTRY SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 168 SPAIN: SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 169 SPAIN: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 170 SPAIN: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 171 SPAIN: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 172 SPAIN: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 173 SPAIN: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 174 SPAIN: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 175 SPAIN: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 176 SPAIN: SIZE, BY RANGE, 2020–2025 (USD MILLION)

15.4.8 UKRAINE

15.4.8.1 Shooting sports segment projected to witness the highest growth during the forecast period in Ukraine

TABLE 177 UKRAINE: RIFLESCOPES INDUSTRY SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 178 UKRAINE: SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 179 UKRAINE: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 180 UKRAINE: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 181 UKRAINE: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 182 UKRAINE: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 183 UKRAINE: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 184 UKRAINE: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 185 UKRAINE: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 186 UKRAINE: SIZE, BY RANGE, 2020–2025 (USD MILLION)

15.4.9 NETHERLANDS

15.4.9.1 Hunting and shooting sports are major events driving the market growth of riflescopes in the Netherlands

TABLE 187 NETHERLANDS: RIFLESCOPES INDUSTRY SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 188 NETHERLANDS: REGIONAL SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 189 NETHERLANDS: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 190 NETHERLANDS: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 191 NETHERLANDS: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 192 NETHERLANDS: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 193 NETHERLANDS: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 194 NETHERLANDS: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 195 NETHERLANDS: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 196 NETHERLANDS: SIZE, BY RANGE, 2020–2025 (USD MILLION)

15.5 ASIA PACIFIC

15.5.1 ASIA PACIFIC: PESTLE ANALYSIS

FIGURE 37 ASIA PACIFIC REGIONAL SNAPSHOT

TABLE 197 ASIA PACIFIC: REGIONAL SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 198 ASIA PACIFIC: INDUSTRY SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 199 ASIA PACIFIC: SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 200 ASIA PACIFIC: SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 201 ASIA PACIFIC: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 202 ASIA PACIFIC: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 203 ASIA PACIFIC: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 204 ASIA PACIFIC: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 205 ASIA PACIFIC: REGIONAL SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 206 ASIA PACIFIC: REGIONAL SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 207 ASIA PACIFIC: REGIONAL SIZE, BY WEAPON COMPATIBILITY, 2017–2019 (USD MILLION)

TABLE 208 ASIA PACIFIC: REGIONAL SIZE, BY WEAPON COMPATIBILITY, 2020–2025 (USD MILLION)

TABLE 209 ASIA PACIFIC: REGIONAL SIZE, BY FUNCTION, 2017–2019 (USD MILLION)

TABLE 210 ASIA PACIFIC: REGIONAL SIZE, BY FUNCTION, 2020–2025 (USD MILLION)

TABLE 211 ASIA PACIFIC: DEFENSE RIFLESCOPES MARKET SIZE, BY END USE, 2017–2019 (USD MILLION)

TABLE 212 ASIA PACIFIC: SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 213 ASIA PACIFIC: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 214 ASIA PACIFIC: SIZE, BY RANGE, 2020–2025 (USD MILLION)

TABLE 215 ASIA PACIFIC: SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 216 ASIA PACIFIC: SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

15.5.2 CHINA

15.5.2.1 Rise in the procurement of riflescopes in China due to geopolitical tensions with neighboring countries

TABLE 217 CHINA: RIFLESCOPES INDUSTRY SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 218 CHINA: SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 219 CHINA: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 220 CHINA: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 221 CHINA: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 222 CHINA: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 223 CHINA: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 224 CHINA: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 225 CHINA: SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 226 CHINA: SIZE, BY RANGE, 2020–2025 (USD MILLION)

15.5.3 JAPAN

15.5.3.1 Development of high-end indigenous technologies is driving the growth of the riflescopes market in Japan

TABLE 227 JAPAN: RIFLESCOPES INDUSTRY SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 228 JAPAN: SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 229 JAPAN: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 230 JAPAN: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 231 JAPAN: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 232 JAPAN: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 233 JAPAN: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 234 JAPAN: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 235 JAPAN: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 236 JAPAN: SIZE, BY RANGE, 2020–2025 (USD MILLION)

15.5.4 INDIA

15.5.4.1 Increased spending on the modernization of armed forces is fueling the growth of the riflescopes market in India

TABLE 237 INDIA: RIFLESCOPES INDUSTRYSIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 238 INDIA: REGIONAL SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 239 INDIA: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 240 INDIA: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 241 INDIA: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 242 INDIA: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 243 INDIA: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 244 INDIA: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 245 INDIA: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 246 INDIA: SIZE, BY RANGE, 2020–2025 (USD MILLION)

15.5.5 AUSTRALIA

15.5.5.1 Rising demand for technologically advanced products and increased adoption of advanced weapon systems by defense forces of the country

TABLE 247 AUSTRALIA: RIFLESCOPES INDUSTRY SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 248 AUSTRALIA: REGIONAL SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 249 AUSTRALIA: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 250 AUSTRALIA: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 251 AUSTRALIA: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 252 AUSTRALIA: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 253 AUSTRALIA: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 254 AUSTRALIA: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 255 AUSTRALIA: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 256 AUSTRALIA: SIZE, BY RANGE, 2020–2025 (USD MILLION)

15.5.6 SOUTH KOREA

15.5.6.1 Rising hunting and shooting activities are expected to fuel the growth of the riflescopes in South Korea

TABLE 257 SOUTH KOREA: RIFLESCOPES INDUSTRY SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 258 SOUTH KOREA: SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 259 SOUTH KOREA: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 260 SOUTH KOREA: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 261 SOUTH KOREA: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 262 SOUTH KOREA: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 263 SOUTH KOREA: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 264 SOUTH KOREA: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 265 SOUTH KOREA: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 266 SOUTH KOREA: SIZE, BY RANGE, 2020–2025 (USD MILLION)

15.6 REST OF THE WORLD

TABLE 267 REST OF THE WORLD: RIFLESCOPES INDUSTRY SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 268 REST OF THE WORLD: SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 269 REST OF THE WORLD: SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 270 REST OF THE WORLD: SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 271 REST OF THE WORLD: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 272 REST OF THE WORLD: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 273 REST OF THE WORLD: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 274 REST OF THE WORLD: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 275 REST OF THE WORLD: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 276 REST OF THE WORLD: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 277 REST OF THE WORLD: SIZE, BY WEAPON COMPATIBILITY, 2017–2019 (USD MILLION)

TABLE 278 REST OF THE WORLD: SIZE, BY WEAPON COMPATIBILITY, 2020–2025 (USD MILLION)

TABLE 279 REST OF THE WORLD: SIZE, BY FUNCTION, 2017–2019 (USD MILLION)

TABLE 280 REST OF THE WORLD: SIZE, BY FUNCTION, 2020–2025 (USD MILLION)

TABLE 281 REST OF THE WORLD: DEFENSE RIFLESCOPES MARKET SIZE, BY END USE, 2017–2019 (USD MILLION)

TABLE 282 REST OF THE WORLD: SIZE, BY END USE, 2020–2025 (USD MILLION)

TABLE 283 REST OF THE WORLD: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 284 REST OF THE WORLD: SIZE, BY RANGE, 2020–2025 (USD MILLION)

TABLE 285 REST OF THE WORLD: SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 286 REST OF THE WORLD: SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

15.6.1 ISRAEL

15.6.1.1 Higher adoption of advanced weapons systems in the past few years is leading to the growth of the riflescope market in Israel

TABLE 287 ISRAEL: RIFLESCOPES INDUSTRY SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 288 ISRAEL: SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 289 ISRAEL: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 290 ISRAEL: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 291 ISRAEL: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 292 ISRAEL: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 293 ISRAEL: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 294 ISRAEL: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 295 ISRAEL: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 296 ISRAEL: SIZE, BY RANGE, 2020–2025 (USD MILLION)

15.6.2 MEXICO

15.6.2.1 Increasing demand for hunting application is expected to fuel the market for riflescopes in Mexico

TABLE 297 MEXICO: RIFLESCOPES INDUSTRY SIZE, BY SIGHT TYPE, 2017–2019 (USD MILLION)

TABLE 298 MEXICO: SIZE, BY SIGHT TYPE, 2020–2025 (USD MILLION)

TABLE 299 MEXICO: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 300 MEXICO: TELESCOPIC SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 301 MEXICO: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 302 MEXICO: REFLEX SIGHT TYPE SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 303 MEXICO: SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 304 MEXICO: SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 305 MEXICO: DEFENSE RIFLESCOPES MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 306 MEXICO: SIZE, BY RANGE, 2020–2025 (USD MILLION)

16 COMPANY LANDSCAPE (Page No. - 208)

16.1 INTRODUCTION

FIGURE 38 COMPANIES ADOPTED NEW PRODUCT LAUNCH AS THE KEY GROWTH STRATEGY FROM 2016 TO 2019

16.2 MARKET SHARE ANALYSIS 2019

FIGURE 39 MARKET SHARE ANALYSIS 2019

16.3 COMPANY RANK ANALYSIS, 2019

16.4 BRAND ANALYSIS

TABLE 307 BRAND ANALYSIS OF TOP PLAYERS IN THE RIFLESCOPE MARKET

16.5 RANK ANALYSIS

16.5.1 RANKING BASED ON REVENUE

TABLE 308 RANKING BASED ON REVENUE, 2019

16.5.2 RANKING BASED ON POPULARITY

TABLE 309 RANKING BASED ON POPULARITY, 2019

16.5.3 RANKING BASED ON BREADTH OF OFFERINGS

TABLE 310 RANKING BASED ON BREADTH OF OFFERINGS, 2018

16.6 COMPETITIVE SITUATIONS AND TRENDS

16.6.1 CONTRACTS

TABLE 311 CONTRACTS, 2016–2019

16.6.2 NEW PRODUCT LAUNCHES

TABLE 312 NEW PRODUCT LAUNCHES, 2016–2019

16.6.3 NEW PRODUCT DEVELOPMENTS

TABLE 313 NEW PRODUCT DEVELOPMENTS, 2016–2019

16.6.4 PARTNERSHIPS & ACQUISITIONS

TABLE 314 PARTNERSHIPS & ACQUISITION, 2016–2019

17 COMPANY EVALUATION AND COMPANY PROFILES (Page No. - 216)

17.1 COMPANY EVALUATION MATRIX – MAJOR PLAYERS

17.1.1 STAR

17.1.2 EMERGING LEADERS

17.1.3 PERVASIVE

17.1.4 EMERGING COMPANIES

FIGURE 40 COMPANY EVALUATION MATRIX FOR MAJOR PLAYERS, 2019

17.2 COMPANY EVALUATION MATRIX- START-UPS, 2019

17.2.1 PROGRESSIVE COMPANIES

17.2.2 RESPONSIVE COMPANIES

17.2.3 STARTING BLOCKS

17.2.4 DYNAMIC COMPANIES

FIGURE 41 COMPETITIVE LEADERSHIP MAPPING OF START-UPS, 2019

17.3 COMPANY PROFILES

(Business overview, Products offered, Recent developments, Growth strategies (Organic) & MnM View)*

17.3.1 LEUPOLD & STEVENS, INC.

17.3.2 BUSHNELL CORPORATION

17.3.3 BURRIS COMPANY

17.3.4 SCHMIDT & BENDER GMBH & CO. KG

17.3.5 NIGHTFORCE OPTICS, INC.

17.3.6 HAWKE OPTICS

17.3.7 BSA OPTICS

17.3.8 HENSOLDT

17.3.9 VORTEX OPTICS

17.3.10 CARL ZEISS AG

FIGURE 42 CARL ZEISS AG: COMPANY SNAPSHOT

17.3.11 AIMPOINT

17.3.12 NIKON

FIGURE 43 NIKON: COMPANY SNAPSHOT

17.3.13 SIG SAUER

17.3.14 STEINER

17.3.15 FLIR SYSTEMS

FIGURE 44 FLIR SYSTEMS: COMPANY SNAPSHOT

17.3.16 TRIJICON, INC.

17.3.17 LEICA CAMERA

17.3.18 EOTECH

17.3.19 U.S. OPTICS

17.3.20 PRIMARY ARMS

17.3.21 ATN CORPORATION

17.3.22 SIGHTMARK

17.3.23 BAE SYSTEMS, PLC

FIGURE 45 BAE SYSTEMS, PLC.: COMPANY SNAPSHOT

17.3.24 SWAROVSKI OPTIK

17.3.25 BARSKA

17.3.26 PULSAR

*Details on Business overview, Products offered, Recent developments, Growth strategies (Organic) & MnM View might not be captured in case of unlisted companies.

18 RIFLESCOPES ADJACENT MARKET (Page No. - 264)

18.1 SPORTS OPTICS MARKET, BY PRODUCT

18.1.1 INTRODUCTION

FIGURE 46 BINOCULARS TO HOLD LARGEST SHARE OF SPORTS OPTICS MARKET, IN TERMS OF VALUE, BY 2025

TABLE 315 SPORTS OPTICS MARKET, BY PRODUCT, 2016–2024 (USD MILLION)

18.1.2 TELESCOPES

18.1.2.1 Increasing adoption in water sports and winter sports is driving the market for telescopes

18.1.3 BINOCULARS

18.1.3.1 Binoculars hold the largest share in the sports optics market

18.1.4 RIFLESCOPES

18.1.4.1 Increasing number of events related to shooting sports is expected to fuel the sports optics market

18.1.5 RANGEFINDERS

18.1.5.1 Golf is a prominent game using rangefinders

18.2 NIGHT VISION DEVICES MARKET, BY DEVICE TYPE

18.2.1 INTRODUCTION

FIGURE 47 NIGHT VISION DEVICES MARKET, BY DEVICE TYPE, 2015 & 2020 (USD MILLION)

TABLE 316 NIGHT VISION DEVICES MARKET, BY DEVICE TYPE, 2014–2020 (USD MILLION)

18.2.2 NIGHT VISION CAMERAS

FIGURE 48 NIGHT VISION CAMERAS MARKET, BY REGION, 2015 & 2020 (USD MILLION)

18.2.3 NIGHT VISION SCOPES

FIGURE 49 NIGHT VISION SCOPES MARKET, BY REGION, 2015 & 2020 (USD MILLION)

18.2.4 NIGHT VISION GOGGLES

FIGURE 50 NIGHT VISION GOGGLES MARKET, BY REGION, 2015 & 2020 (USD MILLION)

18.3 RANGEFINDERS MARKET, BY TYPE

18.3.1 INTRODUCTION

FIGURE 51 ULTRASONIC SEGMENT TO RECORD HIGHER CAGR FROM 2017 TO 2022

TABLE 317 RANGEFINDERS MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

18.3.2 LASER

18.3.3 ULTRASONIC

18.4 IMAGE INTENSIFIER MARKET, BY END-USE APPLICATION

18.4.1 INTRODUCTION

FIGURE 52 GOGGLES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 318 IMAGE INTENSIFIER MARKET, BY END-USE APPLICATION, 2015–2024 (USD MILLION)

18.4.2 CAMERAS

18.4.2.1 As part of soldier modernization programs, combat systems are being integrated with cameras worldwide

18.4.3 SCOPES

18.4.3.1 Increasing investments in the defense sector boosting the market for scopes

18.4.4 GOGGLES

18.4.4.1 Image intensifier-integrated night vision goggles play a key role in the defense segment

18.4.5 X-RAY DETECTORS

18.4.5.1 Image intensifiers are widely used in X-ray detectors and are cheaper than advanced flat-panel systems

19 APPENDIX (Page No. - 273)

19.1 DISCUSSION GUIDE

19.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

19.3 AVAILABLE CUSTOMIZATIONS

19.4 RELATED REPORTS

19.5 AUTHOR DETAILS

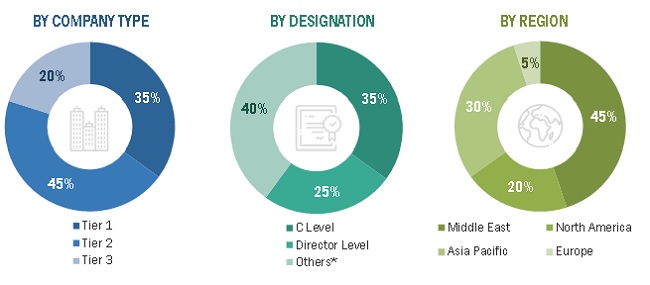

This research study conducted on the riflescopes market involved the extensive use of secondary sources, directories, and databases such as Hoovers and Factiva to identify and collect information relevant to the riflescopes market. The primary sources considered included industry experts from the concerned market as well as preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this industry. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information as well as to assess the growth prospects of the market.

Secondary Research

The market share of companies in the riflescopes market was determined using secondary data made available through paid and unpaid sources and by analyzing product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources that were referred to for this research study on the riflescopes market included government sources, such as the US Department of Defense (DoD); defense budgets; military modernization program documents; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations. This secondary data was collected and analyzed to arrive at the overall size of the riflescopes market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the riflescopes market through secondary research. Several primary interviews were conducted with the market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, and Rest of the World (RoW). This primary data was collected through questionnaires, emails, and telephonic interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

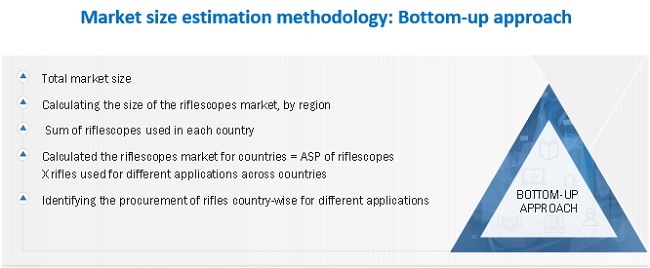

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the riflescopes market. The following figure offers a representation of the overall market size estimation process employed for this study on the riflescopes market.

The research methodology used to estimate the market size included the following details:

- Key players in the riflescopes market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the riflescopes market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the riflescopes market.

- This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the riflescopes market from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, the data triangulation and market breakdown procedures explained below were implemented, wherever applicable.

Report Objectives

- To define, describe, segment, and forecast the size of the riflescopes market based on magnification, range, sight type, application, technology, function, weapon compatibility, end use, and region for the forecast period from 2020 to 2025

- To forecast the size of various segments of the riflescopes market with respect to 4 major regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), along with the major countries in each of these regions

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the riflescopes market

- To identify opportunities for stakeholders in the market by studying key market and technology trends

- To analyze competitive developments, such as contracts, partnerships, new product launches & developments, and R&D activities in the market

- To track technological advancements in riflescopes and to estimate their procurement by different countries

- To provide a comprehensive competitive landscape of the market along with an overview of the different strategies adopted by key players to strengthen their position in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Rest of the World riflescopes market, by region

- Market sizing and forecast for additional countries

- Additional company profiles (up to 5)

Growth opportunities and latent adjacency in Riflescopes Market