Sports Optic Market by Products (Telescopes, Binoculars, Rangefinders, And Riflescopes), Games (Shooting Sports, Golf, Water Sports, Wheel Sports, Snow Sports, Horse Racing), and Geography (North America, Europe, Apac, Row) - Global Forecast to 2025-2034

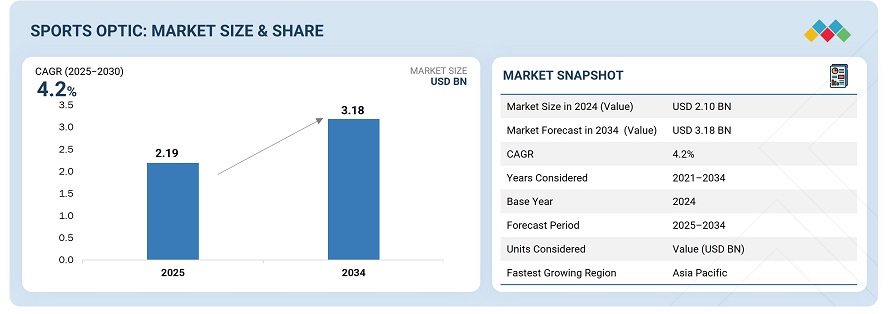

The global sports optic market was valued at USD 2.10 billion in 2024 and is estimated to reach USD 3.18 billion by 2034, at a CAGR of 4.2% between 2025 and 2034.

The sports optics market is primarily driven by increasing participation in outdoor recreational activities such as hunting, birdwatching, hiking, and nature observation, as well as the growing popularity of sports like archery and shooting. Technological advancements have significantly enhanced the performance and accessibility of products like binoculars, riflescopes, rangefinders, and spotting scopes, attracting both professionals and hobbyists. Rising disposable incomes, particularly in developing regions, have also contributed to greater consumer spending on high-quality optics.

Sports optics refers to a category of optical devices designed to enhance visual accuracy, clarity, and performance during outdoor and sporting activities. These include equipment such as binoculars, riflescopes, spotting scopes, rangefinders, and monoculars. Sports optics are widely used in applications like hunting, birdwatching, wildlife observation, shooting sports, golf, hiking, and marine navigation. They help users see distant objects more clearly, improve targeting precision, and enhance overall situational awareness, making them essential tools for both recreational enthusiasts and professionals in fields requiring accurate long-distance viewing.

Market by Products

Binoculars

Binoculars dominate the sports optics market due to their wide range of applications, ease of use, and broad consumer appeal. Unlike more specialized optics like riflescopes or rangefinders, binoculars are versatile and commonly used for activities such as birdwatching, hiking, wildlife observation, sports events, and general outdoor recreation. Their compact and portable design makes them accessible to users of all ages and skill levels. Additionally, advancements in lens technology, image stabilization, and waterproofing have made modern binoculars more effective and durable, further boosting their popularity. Their affordability compared to other high-precision optics also contributes to their leading market share.

Telescopes

Telescopes are the fastest-growing segment in the sports optics market, driven by increasing public engagement in space science, the influence of social media, and the availability of affordable, user-friendly telescopes designed for beginners and hobbyists. Technological advancements such as digital connectivity, automated tracking systems, and high-resolution imaging have also made telescopes more appealing and accessible. Furthermore, the integration of telescopes into educational programs and STEM initiatives continues to expand their adoption, making them the leading driver of growth in the sports optics sector.

Rifle Scopes

Rifle scopes are experiencing significant growth in the sports optics market, largely due to the rising popularity of shooting sports, hunting, and tactical training activities worldwide. Increased demand for precision and accuracy, both in recreational and professional settings, has led to the adoption of advanced rifle scopes with features like variable magnification, illuminated reticles, and ballistic calculators. Technological improvements and product innovation have made rifle scopes more efficient and user-friendly, attracting a broader customer base. Additionally, military and law enforcement agencies continue to invest in high-performance optics, further contributing to the growth of this segment.

Market by Games

Shooting Sports

Shooting sports dominate the sports optics market because they rely heavily on precision and accuracy, making optical devices like rifle scopes, red dot sights, and rangefinders essential for performance. The popularity of recreational and competitive shooting, particularly in countries like the United States, drives consistent demand for high-quality optics. Additionally, the growth of hunting as a sport and pastime further fuels this segment. Advancements in scope technology—such as improved magnification, low-light performance, and digital targeting features—have enhanced user experience and broadened the appeal to both amateur and professional shooters. The support of shooting ranges, clubs, and competitive leagues also contributes to sustained market dominance.

Water sports

Water sports is one of the fastest-growing segments in the sports optics market, driven by rising participation in activities like kayaking, surfing, and paddleboarding. This growth fuels demand for specialized eyewear and optics that offer waterproof, fog-resistant, and polarized lenses to enhance performance and safety. Technological advancements are leading to more durable, lightweight, and high-performance products tailored for water environments. Additionally, the Asia Pacific region is experiencing rapid market expansion due to increasing interest and investment in outdoor and water-based sports.

Market by Geography

Geographically, the sports optics market is witnessing strong growth across Europe, North America, Asia Pacific, and the Rest of the World (RoW). Europe leads the market, driven by increasing consumer preference for high-performance sports optics, rising investments in advanced optical technologies, and a strong presence of established brands. North America follows closely, supported by high demand for premium sports optics in outdoor recreation, hunting, and tactical applications. The Asia Pacific region is experiencing rapid growth due to rising urbanization, increasing disposable incomes, and growing participation in outdoor and water sports. Meanwhile, the Rest of the World shows promising expansion fueled by rising demand for affordable and innovative sports optics solutions, infrastructure development, and growing interest in outdoor activities in emerging economies.

Market Dynamics

Driver: Enhanced fan engagement/experience

Enhanced fan engagement and experience is increasingly influencing the sports optics market. As spectators seek more immersive and dynamic ways to enjoy live sports, the demand for high-performance optical devices such as binoculars, monoculars, and spotting scopes has increased. These devices enable fans to view action from a distance with exceptional clarity and detail, particularly in large venues like stadiums, race tracks, or open-air arenas. Innovations such as image stabilization, high-definition lenses, and lightweight, ergonomic designs are making sports optics more accessible and user-friendly. Additionally, fans are investing in personal optics to enhance their viewing experiences at live events. This trend is further supported by increased availability of premium optics through online and retail channels. As sports events continue to attract global audiences and in-person attendance rebounds, the demand for optics that enhance real-time engagement and deliver an enriched fan experience is expected to grow steadily.

Restraint: High costs of advanced sports optics

High costs of advanced sports optics limit market growth. Advanced technologies such as image stabilization, high-definition lenses, lightweight materials, and durable waterproof designs increase production expenses, which are reflected in the retail prices. These higher prices can restrict accessibility for casual users or budget-conscious consumers. Additionally, the cost barrier may slow adoption in emerging markets where disposable income is lower. As a result, while advanced sports optics offer superior performance and enhanced user experience, their premium pricing can deter widespread usage, especially among amateur sports enthusiasts and occasional users, thereby constraining overall market expansion.

Opportunity: Emerging application in sports technology

Emerging applications in sports technology present a significant opportunity for the sports optics market. Innovations such as augmented reality (AR) integration, smart optics with real-time data display, and advanced tracking systems are transforming how athletes and fans engage with sports. These technologies enhance training, performance analysis, and fan experiences by providing precise, actionable insights and immersive viewing. As technology continues to evolve, there is growing potential to develop next-generation sports optics that combine traditional optical performance with digital enhancements. This convergence opens new avenues for product innovation, market expansion, and differentiation, attracting tech-savvy consumers and professional athletes alike. Additionally, increased investment in research and development within this space promises to unlock further opportunities for growth and adoption across various sports disciplines.

Challenge: Competition from in-house entertainment systems

Competition from in-house entertainment systems poses a challenge to the sports optics market. With the rise of large-screen TVs, virtual reality (VR), and augmented reality (AR) home setups, many sports fans prefer watching events from the comfort of their homes rather than investing in sports optics for live or outdoor viewing. These advanced entertainment systems offer immersive experiences with multiple camera angles, instant replays, and interactive features, reducing the perceived need for optical devices. As a result, the demand for personal sports optics may be limited, especially among casual viewers who prioritize convenience and accessibility over specialized equipment. This shift in consumer preference creates pressure on sports optics manufacturers to innovate and differentiate their products to remain relevant and appealing in a rapidly evolving entertainment landscape.

Future Outlook

Between 2025 and 2030, the sports optics market is expected to expand significantly, driven by increasing consumer interest in outdoor and live sports experiences. Advances in technology, including the integration of digital enhancements like augmented reality (AR) and smart connectivity, will improve the functionality and appeal of sports optics devices. The growing popularity of outdoor activities such as hiking, birdwatching, and water sports will fuel demand for high-performance, lightweight, and durable optical products. Additionally, developments in compact optics, improved lens coatings, and enhanced image stabilization will make sports optics more user-friendly and accessible. As smart devices and IoT integration become more common, sports optics are likely to feature connectivity options that provide real-time data and enhanced viewing experiences.

Key Market Players

Top sports optic companies Nikon (Japan), ZEISS Group (Germany), Leupold & Stevens (US), Bushnell (US), and Trijicon (US).

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 12)

1.1 Study Objective

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

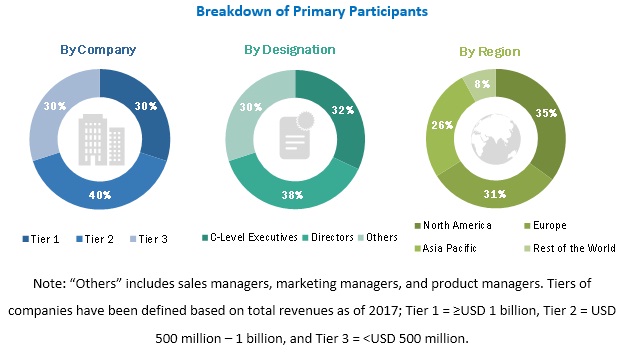

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Size By Bottom-Up Analysis (Demand Side)

2.2.1.2 Approach for Capturing Market Size Considering Various Players in Value Chain of Sports Optics Market

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Size By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in Sports Optic Market (2019–2024)

4.2 Sports Telescopes Market, By Games

4.3 Sports Optics Market for Golf, By Products

4.4 North American Sports Optic Market

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Enhanced Fan Engagement/Experience

5.2.1.2 Superior Performance Specifications Such as Clarity, Sharpness, Portability, and Magnification

5.2.2 Restraints

5.2.2.1 High Cost of Advanced Sports Optic

5.2.3 Opportunities

5.2.3.1 Increasing Games Using Sports Optic

5.2.3.2 Emerging Application in Sports Technology

5.2.4 Challenge

5.2.4.1 Competition From In-House Entertainment Systems

5.3 Value Chain Analysis

6 Sports Optic Market, By Products (Page No. - 39)

6.1 Introduction

6.2 Telescopes

6.2.1 Increasing Adoption of Telescopes in Water Sport and Snow Sport is Driving the Telescopes Market

6.3 Binoculars

6.3.1 Binoculars Hold A Larger Share in the Sports Optic Market

6.4 Rifle Scopes

6.4.1 Increasing Number of Sports Shooting Events is Expected to Fuel the Rifle Scopes Market

6.5 Rangefinders

6.5.1 Golf is the Prominent Game Using Rangefinders

7 Sports Optic Market, By Games (Page No. - 46)

7.1 Introduction

7.2 Shooting Sports

7.2.1 Shooting Sports Holds A Larger Share in the Sports Optic Market

7.3 Golf

7.3.1 Rangefinders in Golf Have an Important Impact on the Performance of the Players,

7.4 Water Sport

7.4.1 Telescopes Hold A Major Share in Water Sport

7.5 Wheel Sport

7.5.1 Increasing Participation of Cycling Activities and Recreational Activities is Driving the Wheel Sport Market

7.6 Snow Sport

7.6.1 Binoculars Hold A Major Share in the Snow Sports

7.7 Horse Racing

7.7.1 Rangefinders are Expected to Grow at A Highest Rate in Horse Racing Sport

7.8 Other Games

7.8.1 Increasing Number of Sports Leagues are Expected to Drive the Sports Optics Market for Other Games

8 Geographic Analysis (Page No. - 56)

8.1 Introduction

8.2 Europe

8.2.1 Increasing Number of Events is Boosting Sports Optic Market in Europe

8.3 North America

8.3.1 North America is A Key Region in the Sports Optics Market in Terms of Market Share

8.4 Asia Pacific

8.4.1 APAC Holds Vast Opportunities for the Development and Use of Advanced Sports Optic Market.

8.5 RoW

8.5.1 Sustainable Sport Facility Investments in MEA is Expected to Fuel the Sports Optic Market

9 Competitive Landscape (Page No. - 66)

9.1 Overview

9.2 Ranking Analysis

9.3 Competitive Leadership Mapping

9.3.1 Visionary Leaders

9.3.2 Dynamic Differentiators

9.3.3 Innovators

9.3.4 Emerging Companies

9.4 Competitive Scenario

9.4.1 Product Launch and Development

9.4.2 Exhibition, Award, and Event

9.4.3 Partnership

9.4.4 Acquisition

10 Company Profiles (Page No. - 74)

(Business overview, Products offered, Recent developments, Key relationships, SWOT Analysis, and MnM view)*

10.1 Key Players

10.1.1 Nikon

10.1.2 Carl Zeiss

10.1.3 Leupold & Stevens

10.1.4 Bushnell

10.1.5 Trijicon

10.1.6 Celestron

10.1.7 Burris

10.1.8 Leica Camera

10.1.9 Swarovski Optik

10.1.10 ATN Corporation

10.2 Other Key Companies

10.2.1 Hawke

10.2.2 Vortex Optics

10.2.3 Nightforce Optics

10.2.4 Athlon Optics

10.2.5 Flir Systems

10.2.6 Meopta

10.2.7 U.S. Optics

10.2.8 SIG Sauer

10.2.9 Eotech

10.2.10 Primary Arms

*Details on Business overview, Products offered, Recent developments, Key relationships, SWOT Analysis, and MnM view might not be captured in case of unlisted companies.

11 Appendix (Page No. - 104)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (34 Tables)

Table 1 Sports Optic Market, By Products, 2016–2024 (USD Million)

Table 2 Sports Telescopes Market, By Games, 2016–2024 (USD Million)

Table 3 Sports Telescopes Market, By Region, 2016–2024 (USD Million)

Table 4 Sports Binoculars Market, By Games, 2016–2024 (USD Million)

Table 5 Sports Binocular Market, By Region, 2016–2024 (USD Million)

Table 6 Sports Rifle Scopes Market, By Games, 2016–2024 (USD Million)

Table 7 Sports Rifle Scopes Market, By Region 2016–2024 (USD Million)

Table 8 Sports Rangefinder Market, By Games, 2016–2024 (USD Million)

Table 9 Sports Rangefinder Market, By Region, 2016–2024 (USD Million)

Table 10 Sports Optic Market, By Games, 2016–2024 (USD Million)

Table 11 Market for Shooting Sports, By Products, 2016–2024 (USD Million)

Table 12 Market for Shooting Sports, By Region, 2016–2024 (USD Million)

Table 13 Market for Golf, By Products, 2016–2024 (USD Million)

Table 14 Market for Golf, By Region, 2016–2024 (USD Million)

Table 15 Market for Water Sport, By Products, 2016–2024 (USD Million)

Table 16 Sports Optic Market for Water Sport, By Region, 2016–2024 (USD Million)

Table 17 Market for Wheel Sport, By Products, 2016–2024 (USD Million)

Table 18 Market for Wheel Sport, By Region, 2016–2024 (USD Million)

Table 19 Market for Snow Sport, By Products, 2016–2024 (USD Million)

Table 20 Sports Optic Market for Snow Sport, By Region, 2016–2024 (USD Million)

Table 21 Market for Horse Racing, By Products, 2016–2024 (USD Million)

Table 22 Market for Horse Racing, By Region, 2016–2024 (USD Million)

Table 23 Market for Other Games, By Products, 2016–2024 (USD Million)

Table 24 Market for Other Games, By Region, 2016–2024 (USD Million)

Table 25 Market, By Region, 2016–2024 (USD Million)

Table 26 Europe Sports Optic Market, By Games, 2016–2024 (USD Million)

Table 27 North American Sports Optic Market, By Games, 2016–2024 (USD Million)

Table 28 APAC Sports Optic Market, By Games, 2016–2024 (USD Million)

Table 29 RoW Sports Optic Market, By Games 2016–2024 (USD Million)

Table 30 Ranking of Top 5 Players in Sports Optic Market (2018)

Table 31 Product Launch, Development, and Deployment (2016–2019)

Table 32 Exhibition, Award, and Event (2018–2019)

Table 33 Partnership (2016–2019)

Table 34 Acquisition (2018)

List of Figures (25 Figures)

Figure 1 Sports Optics Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Binoculars to Hold Larger Size in Sports Optics Market By 2024

Figure 6 Shooting Sports to Hold Larger Size of Sports Optic Market Based on Games By 2024

Figure 7 Europe Held Largest Share of Sports Optic Market in 2018

Figure 8 Enhanced Fan Engagement/Experience Drives Sports Optic Market Growth

Figure 9 Water Sport to Hold Largest Market for Sports Telescopes Market By 2024

Figure 10 Binocular to Hold Largest Market Size in Golf By 2024

Figure 11 Golf to Hold Largest Share of North American Sports Optic Market By 2024

Figure 12 Superior Performance Specifications and Enhanced Fan Engagement/Experience is Driving the Sports Optic Market

Figure 13 Value Chain: Sports Optic Market, 2018

Figure 14 Binoculars to Hold A Larger Share of the Sports Optic Market in Terms of Value, By 2024

Figure 15 Shooting Sports to Hold A Larger Share in Sports Optic Market in Terms of Value, By 2024

Figure 16 Rangefinders to Grow at Highest CAGR in Sports Optic Market for Horse Racing During Forecast Period

Figure 17 Geographic Snapshot of Sports Optic Market, 2018–2024

Figure 18 Market Snapshot in Europe

Figure 19 Market Snapshot in North America

Figure 20 Market Snapshot in APAC

Figure 21 Shooting Sports to Hold A Larger Share in RoW for Sports Optic Market

Figure 22 Product Launch and Development as Key Strategy Adopted By Players in Sports Optic Market (2016–2019)

Figure 23 Sports Optic Market (Global) Competitive Leadership Mapping, 2018

Figure 24 Nikon: Company Snapshot

Figure 25 Carl Zeiss: Company Snapshot

The study involved 4 major activities for estimating the current size of the sports optic market. An exhaustive secondary research was done to collect information on the market, as well as its peer and parent markets. The next step was validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include International Sports Technology Association, Ontario Rifle Association (ORA), British Sporting Rifle Club, National Rifle Association of America press releases, and financials of companies; white papers; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the sports optic market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research has been conducted to gather information, as well as verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the sports optic market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends identified from both demand and supply sides, in consumer electronics, enterprise & industrial, and healthcare. Along with this, the market size has been validated using both top-down and bottom-up approaches.

The following are the major objectives of the study.

- To describe and forecast the overall sports optics market, in terms of value, segmented on the basis of products and games where sports optic products are used.

- To forecast the market size for various segments, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the sports optics market

- To provide sports optics value chain analysis

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the overall sports optics market for stakeholders by identifying high-growth segments

- To profile key players and comprehensively analyze their market ranking in terms of revenues and core competencies2 and provide details of the competitive landscape for the sports optics market leaders

- To analyze growth strategies such as contracts, mergers and acquisitions, product launches and developments, and research and development (R&D) in the overall sports optics market

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) in billion |

|

Segments covered |

Product, games, and region |

|

Geographies covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Nikon (Japan), Carl Zeiss (Germany), Leupold & Stevens (US), Bushnell (US), Trijicon (US), Celestron (US), Burris (US), Leica Camera (Germany), Swarovski Optik (Austria), and ATN (US) |

This research report categorizes the sports optic market based on product, games, and region.

By Products

- Telescopes

- Binoculars

- Rifle scopes

- Rangefinder

By Games

- Shooting Sports

- Golf

- Water Sport

- Wheel Sport

- Snow Sport

- Horse Racing

- Others (Cricket, Basketball, Volleyball, Football, Hockey, Soccer, And Baseball)

By Geography

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per clients’ specific requirements. The available customization options are as follows:

Growth opportunities and latent adjacency in Sports Optic Market