TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 SMALL ARMS MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS

1.5 CURRENCY CONSIDERED

1.6 STUDY LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH FLOW

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary data sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

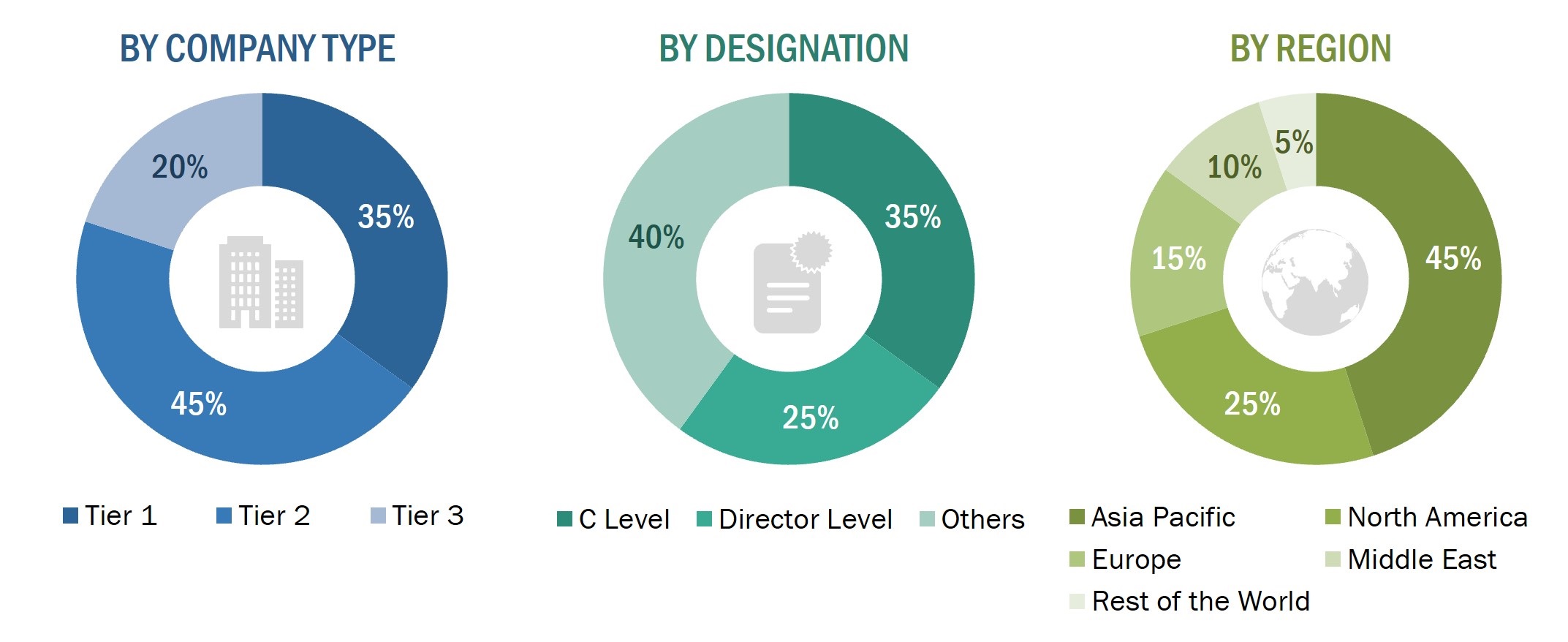

2.1.2.2 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 FACTOR ANALYSIS

2.2.1 DEMAND-SIDE INDICATORS

2.2.2 SUPPLY-SIDE ANALYSIS

2.3 MARKET SIZE ESTIMATION

TABLE 2 SEGMENTS AND SUBSEGMENTS

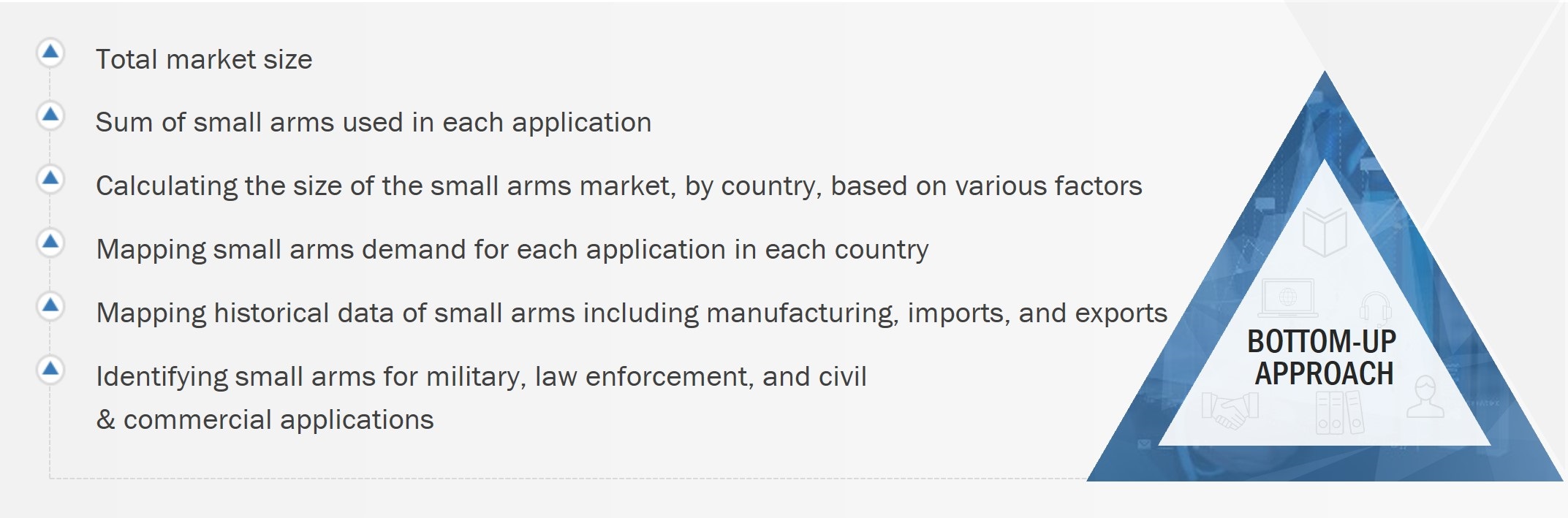

2.4 RESEARCH APPROACH & METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

2.4.1.1 Small arms market for military

2.4.1.2 Small arms market for law enforcement

2.4.1.3 Small arms market for civil & commercial

2.4.1.4 Small arms market size, by segment

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.6 GROWTH RATE ASSUMPTIONS

2.7 RESEARCH ASSUMPTIONS

2.8 RISKS

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 7 CIVIL & COMMERCIAL SMALL ARMS TO BE LARGER SEGMENT DURING FORECAST PERIOD

FIGURE 8 9MM CALIBER TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 9 RIFLE SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 10 SMOOTH BORE SEGMENT TO BE LARGER SEGMENT DURING FORECAST PERIOD

FIGURE 11 GUIDED SMALL ARMS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 12 GAS-OPERATED SMALL ARMS TO LEAD MARKET DURING FORECAST PERIOD

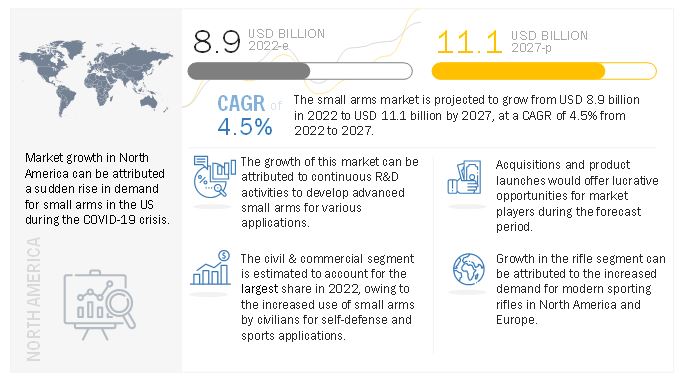

FIGURE 13 NORTH AMERICA SMALL ARMS MARKET TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN SMALL ARMS MARKET

FIGURE 14 INCREASING DEMAND FOR SMALL ARMS IN CIVIL & COMMERCIAL APPLICATIONS TO DRIVE MARKET

4.2 SMALL ARMS MARKET, BY END USER

FIGURE 15 CIVIL & COMMERCIAL SEGMENT TO LEAD MARKET FROM 2018 TO 2027

4.3 SMALL ARMS MARKET, BY TYPE

FIGURE 16 RIFLES SEGMENT TO LEAD MARKET FROM 2018 TO 2027

4.4 SMALL ARMS MARKET, BY CALIBER

FIGURE 17 9MM SEGMENT TO LEAD MARKET FROM 2018 TO 2027

4.5 SMALL ARMS MARKET, BY COUNTRY

FIGURE 18 INDIA TO BE FASTEST-GROWING MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF SMALL ARMS MARKET

5.2.1 DRIVERS

5.2.1.1 Change of warfare dynamics

5.2.1.2 Rise in criminal violence across globe

5.2.1.3 Militarization and modernization of law enforcement personnel

5.2.1.4 Increasing territorial conflict, terrorism, and political unrest

TABLE 3 GLOBAL TERRORISM INDEX, BY COUNTRY, 2022

5.2.1.5 Rising military expenditure in developing countries to increase the arms procurement

FIGURE 20 SHARE OF TOP 10 MAJOR ARMS EXPORTERS, 2017–2021

FIGURE 21 SHARE OF TOP 10 MAJOR ARMS IMPORTERS, 2017–2021

5.2.1.6 Modernization programs by military forces in major economies

5.2.1.7 Increasing use of small arms by civilians for commercial activities

TABLE 4 US: FEDERAL REGULATIONS ON POSSESSION & DISCHARGE OF FIREARMS

5.2.2 RESTRAINTS

5.2.2.1 Stringent and varying legal, economic, and political regulations affecting procurement of small arms

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in sales of small arms for self-defense in North America during COVID-19

5.2.3.2 Rising investments in development of new and advanced firearms

5.2.3.3 Modernization of small arms

5.2.3.4 Rising demand for advanced modern sporting rifles (MSR) for civil and commercial use

TABLE 5 MODERN SPORTING RIFLES (AR-15) PRODUCTION PLUS IMPORTS LESS EXPORTS UNITS, (1990–2017)

5.2.4 CHALLENGES

5.2.4.1 Proliferation of illicit small arms manufacturers

5.2.4.2 International measures to control sales and use of small arms

5.3 SMALL ARMS MARKET ECOSYSTEM

5.3.1 PROMINENT COMPANIES

5.3.2 PRIVATE AND SMALL ENTERPRISES

5.3.3 END USERS

FIGURE 22 MARKET ECOSYSTEM MAP: SMALL ARMS

TABLE 6 SMALL ARMS MARKET: MARKET ECOSYSTEM

FIGURE 23 COMPANY CATEGORIZATION, BY PRODUCT OFFERING

5.4 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING DISTRIBUTION PHASE

5.5 TRENDS/DISRUPTION IMPACTING CUSTOMER BUSINESS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SMALL ARMS MANUFACTURERS

FIGURE 25 REVENUE SHIFT IN SMALL ARMS MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 KEY SMALL ARMS MARKET: PORTER’S FIVE FORCE ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 DEGREE OF COMPETITION

5.7 USE CASE ANALYSIS: SMALL ARMS MARKET

5.7.1 300 BLACKOUT COMMERCIAL-GRADE FIREARMS SEEING INCREASED ADOPTION BY MAJOR ARMED FORCES

5.7.2 DEVELOPMENT OF SUPERIOR 6.8MM AMMUNITION BY US ARMED FORCES TO REPLACE EXISTING 5.56MM AMMUNITION

5.8 TRADE ANALYSIS

5.8.1 IMPORT-EXPORT TRENDS: SMALL ARMS, LIGHT WEAPONS, AND AMMUNITIONS

5.8.1.1 Imports (small arms, light weapons, and ammunition)

TABLE 8 IMPORT DATA

5.8.1.2 Exports (small arms, light weapons, and ammunition)

TABLE 9 EXPORT DATA

5.9 REGULATORY LANDSCAPE

5.10 PRICING ANALYSIS

5.10.1 AVERAGE SELLING PRICE OF SMALL ARMS, BY TYPE

5.10.2 SELLING PRICE OF PISTOLS, BY MANUFACTURER

TABLE 10 SELLING PRICE OF PISTOL, BY MANUFACTURER, 2021 (USD)

5.10.3 SELLING PRICE OF RIFLES, BY MANUFACTURER

TABLE 11 SELLING PRICE OF RIFLES, BY MANUFACTURER, 2021 (USD)

5.10.4 SELLING PRICE OF REVOLVERS, BY MANUFACTURER

TABLE 12 SELLING PRICE OF REVOLVERS, BY MANUFACTURER, 2021 (USD)

5.11 KEY STAKEHOLDERS & BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR 2 APPLICATIONS

TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR 2 APPLICATIONS (%)

5.11.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR TOP 2 APPLICATIONS

TABLE 14 KEY BUYING CRITERIA FOR TOP 2 APPLICATIONS

5.12 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 15 SMALL ARMS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6 INDUSTRY TRENDS (Page No. - 92)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 POLYMER FRAMES

TABLE 16 FIREARMS WITH POLYMER FRAMES

6.2.2 3D-PRINTED SMALL GUNS

6.2.3 SMART SMALL GUNS

6.2.4 LIGHTWEIGHT SMALL ARMS TECHNOLOGY

6.2.5 METAL INJECTION MOLDING (MIM) TECHNOLOGY

6.2.6 CORNER SHOT ASSAULT RIFLES

TABLE 17 CORNER SHOT SYSTEM MANUFACTURERS

6.2.7 BULL PUP WEAPONS

6.2.8 PRECISION-GUIDED FIREARMS

6.2.9 ADVANCEMENTS IN BARREL MATERIALS

6.3 ADVANCEMENTS IN SMALL ARMS PRODUCTION PROCESS

6.3.1 DESIGN AND MANUFACTURING

6.3.1.1 Advanced materials

6.3.1.2 Improved design

6.3.1.3 Efficient production

6.3.2 MARKING, RECORD-KEEPING, AND TRACING

6.3.2.1 Laser technology

6.3.2.2 Micro-stamping

6.3.2.3 Improved stockpile management

6.4 TECHNOLOGY ANALYSIS

6.4.1 HIGH DEMAND FOR PREMIUM AND TECHNOLOGICALLY ADVANCED PRODUCTS

6.4.1.1 Rapid adaptive zoom for assault rifles (RAZAR)

6.4.1.2 Miniaturized electro-optics for small arms

6.5 IMPACT OF MEGATRENDS

6.5.1 INTRODUCTION

6.6 INNOVATION & PATENT REGISTRATIONS

TABLE 18 INNOVATION & PATENT REGISTRATIONS

7 SMALL ARMS MARKET, BY CALIBER (Page No. - 102)

7.1 INTRODUCTION

FIGURE 28 9MM SEGMENT TO DOMINATE SMALL ARMS MARKET FROM 2022 TO 2027

TABLE 19 SMALL ARMS MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 20 SMALL ARMS MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

7.1.1 5.56MM

7.1.1.1 5.56x45mm–widely used caliber in military applications

7.1.2 9MM

7.1.2.1 9x19mm Parabellum–most preferred handgun caliber by law enforcement agencies worldwide

7.1.3 7.62MM

7.1.3.1 Increase in procurement of 7.62x51mm from defense forces

7.1.4 12.7MM

7.1.4.1 12.7mm caliber–primarily used by armed forces

7.1.5 14.5MM

7.1.5.1 Increase in demand for 14.5mm small arms for mounted small arms

7.1.6 OTHERS

8 SMALL ARMS MARKET, BY TECHNOLOGY (Page No. - 106)

8.1 INTRODUCTION

FIGURE 29 UNGUIDED SMALL ARMS SEGMENT TO DOMINATE MARKET FROM 2022 TO 2027

TABLE 21 SMALL ARMS MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 22 SMALL ARM MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

8.2 GUIDED

8.2.1 RISING DEMAND FOR RIFLES WITH SCOPES, RED DOTS, AND RANGEFINDERS IN MILITARY APPLICATIONS

8.3 UNGUIDED

8.3.1 INCREASING USE OF UNGUIDED HANDGUNS AND SHOTGUNS IN CIVIL & COMMERCIAL APPLICATIONS

9 SMALL ARMS MARKET, BY TYPE (Page No. - 109)

9.1 INTRODUCTION

FIGURE 30 RIFLE SEGMENT PROJECTED TO LEAD SMALL ARMS MARKET FROM 2022 TO 2027

TABLE 23 SMALL ARMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 24 SMALL ARM MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

9.2 PISTOL

9.2.1 HIGH DEMAND FOR PISTOLS AMONG LAW ENFORCEMENT AGENCIES

9.3 REVOLVER

9.3.1 INCREASED USE OF REVOLVERS FOR SELF-DEFENSE IN NORTH AMERICA AND EUROPE

9.4 RIFLE

9.4.1 ASSAULT RIFLES

9.4.1.1 Growing demand for assault rifles by armed forces

9.4.2 SNIPER RIFLES

9.4.2.1 Changing warfare tactics to lead to procurement of advanced sniper weapon systems

9.4.3 OTHERS

9.4.3.1 AR-15 platform-based rifles preferred for sporting and hunting across North America and Europe

9.5 MACHINE GUN

9.5.1 DEMAND FOR LIGHT MACHINE GUNS GROWING IN US AND INDIA

9.6 SHOTGUN

9.6.1 RISING USE OF SHOTGUNS BY CIVILIANS FOR SPORTING AND HUNTING ACTIVITIES

9.7 OTHERS

10 SMALL ARMS MARKET, BY MODE OF OPERATIONS (Page No. - 132)

10.1 INTRODUCTION

10.1.1 HIGH USE OF SEMI-AUTOMATIC SMALL ARMS IN HUNTING AND SPORTING ACTIVITIES

10.2 AUTOMATIC

10.2.1 INCREASED DEMAND FOR AUTOMATIC RIFLES BY ARMED FORCES

11 SMALL ARMS MARKET, BY CUTTING TYPE (Page No. - 114)

11.1 INTRODUCTION

FIGURE 31 SMOOTH BORE SEGMENT TO LEAD SMALL ARMS MARKET FROM 2022 TO 2027

TABLE 25 SMALL ARMS MARKET SIZE, BY CUTTING TYPE, 2018–2021 (USD MILLION)

TABLE 26 SMALL ARM MARKET SIZE, BY CUTTING TYPE, 2022–2027 (USD MILLION)

11.2 SMOOTH BORE

11.2.1 GROWING DEMAND FOR HANDGUNS AND SHOTGUNS TO LEAD TO GROWTH OF SMOOTH BORE SEGMENT

11.3 THREADED/RIFLED

11.3.1 INCREASING PROCUREMENT OF ADVANCED THREADED SNIPER AND ASSAULT RIFLES BY MILITARY AND LAW ENFORCEMENT FORCES

12 SMALL ARMS MARKET, BY FIRING SYSTEM (Page No. - 116)

12.1 INTRODUCTION

FIGURE 32 GAS-OPERATED SMALL ARMS TO LEAD MARKET FROM 2022 TO 2027

TABLE 27 SMALL ARMS MARKET SIZE, BY FIRING SYSTEM, 2018–2021 (USD MILLION)

TABLE 28 SMALL ARM MARKET SIZE, BY FIRING SYSTEM, 2022–2027 (USD MILLION)

12.2 GAS-OPERATED

12.2.1 PROCUREMENT OF HANDGUNS AND RIFLES FEATURING GAS-OPERATED FIRING SYSTEM ON RISE

12.3 RECOIL-OPERATED

12.3.1 HIGH USE OF RIFLES FEATURING RECOIL-OPERATED FIRING IN HUNTING AND SHOOTING SPORTS

12.4 MANUAL

12.4.1 MANUALLY OPERATED FIREARMS FOR CIVILIAN SINGLE-SHOT APPLICATIONS

13 SMALL ARMS MARKET, BY END USER (Page No. - 119)

13.1 INTRODUCTION

FIGURE 33 CIVIL & COMMERCIAL SEGMENT TO LEAD SMALL ARMS MARKET FROM 2022 TO 2027

TABLE 29 SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 30 SMALL ARM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

13.2 DEFENSE

TABLE 31 DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 32 DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

13.2.1 MILITARY

13.2.1.1 Increased spending on modernization and upgrade of aging small arms inventory

13.2.2 LAW ENFORCEMENT

13.2.2.1 Militarization of law enforcement agencies to ensure public safety from internal threats to boost segment growth

TABLE 33 AVERAGE REGIONAL AND GLOBAL POLICE FIREARMS RATIO

13.3 CIVIL & COMMERCIAL

TABLE 34 CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 35 CIVIL & COMMERCIAL SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

13.3.1 SPORTING

13.3.1.1 Increasing adoption of modern sporting rifles for shooting sports to fuel segment growth

13.3.2 HUNTING

13.3.2.1 Increasing demand for AR-15 style rifles for hunting

13.3.3 SELF-DEFENSE

13.3.3.1 Rising concerns over individual safety during COVID-19 led to increased adoption of personal weapons

13.3.4 OTHERS

14 SMALL ARMS MARKET, BY REGION (Page No. - 129)

14.1 INTRODUCTION

FIGURE 34 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF SMALL ARMS MARKET IN 2022

TABLE 36 SMALL ARMS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 SMALL ARM MARKET SIZE, BY REGION, 2022–20277 (USD MILLION)

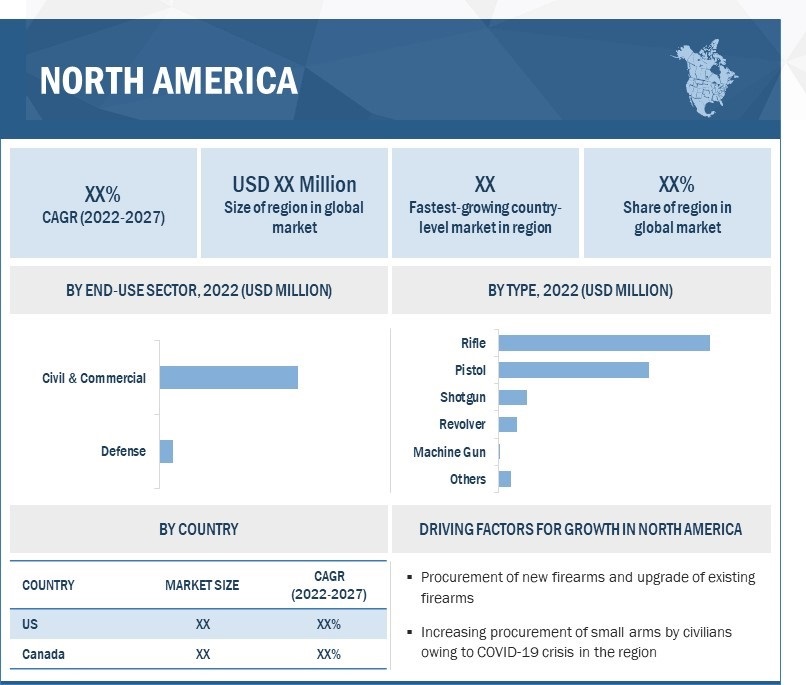

14.2 NORTH AMERICA

14.2.1 PESTEL ANALYSIS: NORTH AMERICA

FIGURE 35 NORTH AMERICA SMALL ARMS MARKET SNAPSHOT: US TO COMMAND LARGEST SHARE

TABLE 38 NORTH AMERICA: SMALL ARM MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 39 NORTH AMERICA: SMALL ARM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 40 NORTH AMERICA: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 41 NORTH AMERICA: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 42 NORTH AMERICA: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 43 NORTH AMERICA: CIVIL & COMMERCIAL SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY CUTTING TYPE, 2018–2021 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY CUTTING TYPE, 2022–2027 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY FIRING SYSTEM, 2018–2021 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY FIRING SYSTEM, 2022–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: SMALL ARM MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: SMALL ARMS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

14.2.2 US

14.2.2.1 Increased demand for small arms for civilians for personal security

TABLE 56 SMALL ARMS MANUFACTURED IN US, 1986–2017 (UNITS)

TABLE 57 SMALL ARMS EXPORTED FROM US, 1986–2017 (UNITS)

TABLE 58 SMALL ARMS IMPORTED INTO US, 1986–2018 (UNITS)

TABLE 59 SMALL ARMS IMPORTED INTO US, BY COUNTRY, 2018 (UNITS)

TABLE 60 KEY FIREARMS USED BY US ARMED FORCES

TABLE 61 KEY FIREARMS USED BY US LAW ENFORCEMENT

TABLE 62 US: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 63 US: SMALL ARM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 64 US: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 65 US: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 66 US: CIVIL & COMMERCIAL SMALL ARM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 67 US: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 68 US: MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 69 US: MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 70 US: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 71 US: SMALL ARM MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.2.3 CANADA

14.2.3.1 Negative impact on market due to government ban on 1500 varieties of assault weapons

TABLE 72 KEY FIREARMS USED BY CANADIAN ARMED FORCES

TABLE 73 KEY FIREARMS USED BY CANADIAN LAW ENFORCEMENT

TABLE 74 CANADA: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 75 CANADA: SMALL ARM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 76 CANADA: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 77 CANADA: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 78 CANADA: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 79 CANADA: CIVIL & COMMERCIAL SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 80 CANADA: MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 81 CANADA: MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 82 CANADA: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 83 CANADA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.3 EUROPE

14.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 36 EUROPE SMALL ARMS MARKET SNAPSHOT: GERMANY TO HAVE HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 84 EUROPE: MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 86 EUROPE: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 87 EUROPE: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 88 EUROPE: CIVIL & COMMERCIAL SMALL ARM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 89 EUROPE: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 92 EUROPE: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE, BY CUTTING TYPE, 2018–2021 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE, BY CUTTING TYPE, 2022–2027 (USD MILLION)

TABLE 96 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 97 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE, BY FIRING SYSTEM, 2018–2021 (USD MILLION)

TABLE 99 EUROPE: SMALL ARM MARKET SIZE, BY FIRING SYSTEM, 2022–2027 (USD MILLION)

TABLE 100 EUROPE: SMALL ARM MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 101 EUROPE: SMALL ARMS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

14.3.2 UK

14.3.2.1 Upgrade of standard combat rifles to drive market

TABLE 102 KEY FIREARMS USED BY UK ARMED FORCES

TABLE 103 KEY FIREARMS USED BY UK LAW ENFORCEMENT AGENCIES

TABLE 104 UK: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 105 UK: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 106 UK: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 107 UK: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 108 UK: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 109 UK: CIVIL & COMMERCIAL SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 110 UK: MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 111 UK: MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 112 UK: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 113 UK: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.3.3 FRANCE

14.3.3.1 Procurement of pistols and rifles by armed forces to increase

TABLE 114 KEY FIREARMS USED BY FRENCH ARMED FORCES

TABLE 115 KEY FIREARMS USED BY FRENCH LAW ENFORCEMENT AGENCIES

TABLE 116 FRANCE: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 117 FRANCE: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 118 FRANCE: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 119 FRANCE: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 120 FRANCE: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 121 FRANCE: CIVIL & COMMERCIAL SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 122 FRANCE: MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 123 FRANCE: MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 124 FRANCE: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 125 FRANCE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.3.4 GERMANY

14.3.4.1 German armed forces to be equipped with advanced assault rifles that fire 5.56mm and 7.62mm NATO-grade ammunition

TABLE 126 KEY FIREARMS USED BY GERMAN ARMED FORCES

TABLE 127 GERMANY: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 128 GERMANY: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 129 GERMANY: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 130 GERMANY: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 131 GERMANY: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 132 GERMANY: CIVIL & COMMERCIAL SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 133 GERMANY: MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 134 GERMANY: MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 135 GERMANY: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 136 GERMANY: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.3.5 SPAIN

14.3.5.1 Demand for small arms from Spanish armed forces and law enforcement agencies on the rise

TABLE 137 KEY FIREARMS USED BY SPANISH ARMED FORCES

TABLE 138 KEY FIREARMS USED BY SPANISH LAW ENFORCEMENT

TABLE 139 SPAIN: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 140 SPAIN: SMALL ARM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 141 SPAIN: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 142 SPAIN: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 143 SPAIN: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 144 SPAIN: CIVIL & COMMERCIAL SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 145 SPAIN: MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 146 SPAIN: MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 147 SPAIN: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 148 SPAIN: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.3.6 ITALY

14.3.6.1 Increasing demand for small arms by armed forces for training activities

TABLE 149 KEY FIREARMS USED BY ITALIAN ARMED FORCES

TABLE 150 KEY FIREARMS USED BY ITALIAN LAW ENFORCEMENT

TABLE 151 ITALY: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 152 ITALY: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 153 ITALY: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 154 ITALY: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 155 ITALY: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 156 ITALY: CIVIL & COMMERCIAL SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 157 ITALY: MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 158 ITALY: MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 159 ITALY: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 160 ITALY: SMALL ARM MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.3.7 RUSSIA

14.3.7.1 Russian small arms industry home to well-established players with strong export potential

TABLE 161 KEY FIREARMS USED BY RUSSIAN ARMED FORCES

TABLE 162 RUSSIA: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 163 RUSSIA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 164 RUSSIA: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 165 RUSSIA: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 166 RUSSIA: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 167 RUSSIA: CIVIL & COMMERCIAL SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 168 RUSSIA: MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 169 RUSSIA: MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 170 RUSSIA: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 171 RUSSIA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.3.8 REST OF EUROPE

TABLE 172 REST OF EUROPE: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 173 REST OF EUROPE: SMALL ARM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 174 REST OF EUROPE: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 175 REST OF EUROPE: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 176 REST OF EUROPE: CIVIL & COMMERCIAL SMALL ARM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 177 REST OF EUROPE: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 178 REST OF EUROPE: MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 179 REST OF EUROPE: MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 180 REST OF EUROPE: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 181 REST OF EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.4 ASIA PACIFIC

14.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 37 ASIA PACIFIC SMALL ARMS MARKET SNAPSHOT: CHINA TO BE LARGEST MARKET

TABLE 182 ASIA PACIFIC: SMALL ARM MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 183 ASIA PACIFIC: SMALL ARM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 184 ASIA PACIFIC: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 185 ASIA PACIFIC: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 186 ASIA PACIFIC: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 187 ASIA PACIFIC: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 188 ASIA PACIFIC: MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 189 ASIA PACIFIC: MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 190 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 191 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 192 ASIA PACIFIC: MARKET SIZE, BY CUTTING TYPE, 2018–2021 (USD MILLION)

TABLE 193 ASIA PACIFIC: MARKET SIZE, BY CUTTING TYPE, 2022–2027 (USD MILLION)

TABLE 194 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 195 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 196 ASIA PACIFIC: SMALL ARMS MARKET SIZE, BY FIRING SYSTEM, 2018–2021 (USD MILLION)

TABLE 197 ASIA PACIFIC: SMALL ARM MARKET SIZE, BY FIRING SYSTEM, 2022–2027 (USD MILLION)

TABLE 198 ASIA PACIFIC: SMALL ARMS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 199 ASIA PACIFIC: SMALL ARM MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

14.4.2 CHINA

14.4.2.1 Procurement of small arms in China rising due to geopolitical tensions with neighboring countries

TABLE 200 KEY FIREARMS USED BY CHINESE ARMED FORCES

TABLE 201 CHINA: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 202 CHINA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 203 CHINA: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 204 CHINA: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 205 CHINA: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 206 CHINA: CIVIL & COMMERCIAL SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 207 CHINA: MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 208 CHINA: MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 209 CHINA: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 210 CHINA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.4.3 INDIA

14.4.3.1 Increasing investment in assault rifles, snipers, and light machine guns under Make in India initiative

TABLE 211 KEY FIREARMS USED BY INDIAN ARMED FORCES

TABLE 212 KEY FIREARMS USED BY INDIAN LAW ENFORCEMENT

TABLE 213 INDIA: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 214 INDIA: SMALL ARM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 215 INDIA: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 216 INDIA: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 217 INDIA: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 218 INDIA: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 219 INDIA: MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 220 INDIA: MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 221 INDIA: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 222 INDIA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.4.4 SOUTH KOREA

14.4.4.1 Increasing import of hunting, sporting, and outdoor small arms

TABLE 223 KEY FIREARMS USED BY SOUTH KOREAN ARMED FORCES

TABLE 224 SOUTH KOREA: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 225 SOUTH KOREA: SMALL ARM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 226 SOUTH KOREA: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 227 SOUTH KOREA: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 228 SOUTH KOREA: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 229 SOUTH KOREA: CIVIL & COMMERCIAL SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 230 SOUTH KOREA: MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 231 SOUTH KOREA: MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 232 SOUTH KOREA: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 233 SOUTH KOREA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.4.5 JAPAN

14.4.5.1 Development of high-end indigenous military technology to drive market

TABLE 234 KEY FIREARMS USED BY JAPANESE ARMED FORCES

TABLE 235 KEY FIREARMS USED BY JAPANESE LAW ENFORCEMENT

TABLE 236 JAPAN: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 237 JAPAN: SMALL ARM MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 238 JAPAN: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 239 JAPAN: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 240 JAPAN: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 241 JAPAN: CIVIL & COMMERCIAL SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 242 JAPAN: SMALL ARMS MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 243 JAPAN: SMALL ARM MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 244 JAPAN: SMALL ARMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 245 JAPAN: SMALL ARM MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.4.6 AUSTRALIA

14.4.6.1 Rising demand for advanced small arms by defense forces

TABLE 246 KEY FIREARMS USED BY AUSTRALIAN ARMED FORCES

TABLE 247 AUSTRALIA: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 248 AUSTRALIA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 249 AUSTRALIA: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 250 AUSTRALIA: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 251 AUSTRALIA: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 252 AUSTRALIA: CIVIL & COMMERCIAL SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 253 AUSTRALIA: SMALL ARM MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 254 AUSTRALIA: SMALL ARMS MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 255 AUSTRALIA: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 256 AUSTRALIA: SMALL ARM MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.4.7 REST OF ASIA PACIFIC

TABLE 257 REST OF ASIA PACIFIC: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 258 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 259 REST OF ASIA PACIFIC: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 260 REST OF ASIA PACIFIC: DEFENSE MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 261 REST OF ASIA PACIFIC: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 262 REST OF ASIA PACIFIC: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 263 REST OF ASIA PACIFIC: MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 264 REST OF ASIA PACIFIC: MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 265 REST OF ASIA PACIFIC: SMALL ARMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 266 REST OF ASIA PACIFIC: SMALL ARM MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.5 MIDDLE EAST

14.5.1 PESTLE ANALYSIS: MIDDLE EAST

TABLE 267 MIDDLE EAST: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 268 MIDDLE EAST: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 269 MIDDLE EAST: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 270 MIDDLE EAST: DEFENSE SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 271 MIDDLE EAST: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 272 MIDDLE EAST: CIVIL & COMMERCIAL SMALL ARM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 273 MIDDLE EAST: SMALL ARMS MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 274 MIDDLE EAST: MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 275 MIDDLE EAST: MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 276 MIDDLE EAST: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 277 MIDDLE EAST: MARKET SIZE, BY CUTTING TYPE, 2018–2021 (USD MILLION)

TABLE 278 MIDDLE EAST: MARKET SIZE, BY CUTTING TYPE, 2022–2027 (USD MILLION)

TABLE 279 MIDDLE EAST: MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 280 MIDDLE EAST: MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 281 MIDDLE EAST: MARKET SIZE, BY FIRING SYSTEM, 2018–2021 (USD MILLION)

TABLE 282 MIDDLE EAST: MARKET SIZE, BY FIRING SYSTEM, 2022–2027 (USD MILLION)

TABLE 283 MIDDLE EAST: MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 284 MIDDLE EAST: SMALL ARM MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

14.5.2 SAUDI ARABIA

14.5.2.1 Increased procurement of small arms in Saudi Arabia to drives market

TABLE 285 KEY FIREARMS USED BY SAUDI ARABIAN ARMED FORCES

TABLE 286 SAUDI ARABIA: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 287 SAUDI ARABIA: SMALL ARMS MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 288 SAUDI ARABIA: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 289 SAUDI ARABIA: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 290 SAUDI ARABIA: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 291 SAUDI ARABIA: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 292 SAUDI ARABIA: SMALL ARMS MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 293 SAUDI ARABIA: SMALL ARMS MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 294 SAUDI ARABIA: SMALL ARMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 295 SAUDI ARABIA: SMALL ARMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.5.3 TURKEY

14.5.3.1 Focus on strengthening armed forces to support small arms market

TABLE 296 KEY FIREARMS USED BY TURKISH ARMED FORCES

TABLE 297 KEY FIREARMS USED BY TURKISH LAW ENFORCEMENT

TABLE 298 TURKEY: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 299 TURKEY: SMALL ARMS MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 300 TURKEY: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 301 TURKEY: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 302 TURKEY: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 303 TURKEY: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 304 TURKEY: SMALL ARMS MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 305 TURKEY: SMALL ARMS MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 306 TURKEY: SMALL ARMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 307 TURKEY: SMALL ARMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.5.4 ISRAEL

14.5.4.1 Military modernization programs to increase demand for small arms

TABLE 308 KEY FIREARMS USED BY ISRAELI ARMED FORCES

TABLE 309 KEY FIREARMS USED BY ISRAELI LAW ENFORCEMENT

TABLE 310 ISRAEL: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 311 ISRAEL: SMALL ARMS MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 312 ISRAEL: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 313 ISRAEL: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 314 ISRAEL: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 315 ISRAEL: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 316 ISRAEL: SMALL ARMS MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 317 ISRAEL: SMALL ARMS MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 318 ISRAEL: SMALL ARMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 319 ISRAEL: SMALL ARMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.5.5 UAE

14.5.5.1 Growth in tourism to propel demand for small arms for sporting applications

TABLE 320 KEY FIREARMS USED BY UAE ARMED FORCES

TABLE 321 KEY FIREARMS USED BY UAE LAW ENFORCEMENT

TABLE 322 UAE: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 323 UAE: SMALL ARMS MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 324 UAE: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 325 UAE: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 326 UAE: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 327 UAE: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 328 UAE: SMALL ARMS MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 329 UAE: SMALL ARMS MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 330 UAE: SMALL ARMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 331 UAE: SMALL ARMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.6 LATIN AMERICA

14.6.1 PESTEL ANALYSIS: LATIN AMERICA

TABLE 332 LATIN AMERICA: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 333 LATIN AMERICA: SMALL ARMS MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 334 LATIN AMERICA: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 335 LATIN AMERICA: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 336 LATIN AMERICA: SMALL ARMS MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 337 LATIN AMERICA: SMALL ARMS MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 338 LATIN AMERICA: SMALL ARMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 339 LATIN AMERICA: SMALL ARMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 340 LATIN AMERICA: SMALL ARMS MARKET SIZE, BY CUTTING TYPE, 2018–2021 (USD MILLION)

TABLE 341 LATIN AMERICA SMALL ARMS MARKET SIZE, BY CUTTING TYPE, 2022–2027 (USD MILLION)

TABLE 342 LATIN AMERICA: SMALL ARMS MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 343 LATIN AMERICA: SMALL ARMS MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 344 LATIN AMERICA: SMALL ARMS MARKET SIZE, BY FIRING SYSTEM, 2018–2021 (USD MILLION)

TABLE 345 LATIN AMERICA: SMALL ARMS MARKET SIZE, BY FIRING SYSTEM, 2022–2027 (USD MILLION)

TABLE 346 LATIN AMERICA: SMALL ARMS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 347 LATIN AMERICA: SMALL ARMS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

14.6.2 BRAZIL

14.6.2.1 Growing gun violence to lead to increased use of small arms by civilians for self-defense

TABLE 348 KEY FIREARMS USED BY BRAZILIAN ARMED FORCES

TABLE 349 BRAZIL: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 350 BRAZIL: SMALL ARMS MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 351 BRAZIL: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 352 BRAZIL: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 353 BRAZIL: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 354 BRAZIL: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 355 BRAZIL: SMALL ARMS MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 356 BRAZIL: SMALL ARMS MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 357 BRAZIL: SMALL ARMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 358 BRAZIL: SMALL ARMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.6.3 ARGENTINA

14.6.3.1 Procurement of rifles and pistols for armed forces to drive market in Argentina

TABLE 359 KEY FIREARMS USED BY ARGENTINE ARMED FORCES

TABLE 360 KEY FIREARMS USED BY ARGENTINE LAW ENFORCEMENT

TABLE 361 ARGENTINA: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 362 ARGENTINA: SMALL ARMS MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 363 ARGENTINA: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 364 ARGENTINA: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 365 ARGENTINA: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

TABLE 366 ARGENTINA: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 367 ARGENTINA: SMALL ARMS MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 368 ARGENTINA: SMALL ARMS MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 369 ARGENTINA: SMALL ARMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 370 ARGENTINA: SMALL ARMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.6.4 MEXICO

14.6.4.1 Increasing drug trafficking resulting in demand for small arms by law enforcement and civilians

TABLE 371 KEY FIREARMS USED BY MEXICAN ARMED FORCES

TABLE 372 KEY FIREARMS USED BY MEXICAN LAW ENFORCEMENT

TABLE 373 MEXICO: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 374 MEXICO: SMALL ARMS MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 375 MEXICO: SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 376 MEXICO: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 377 MEXICO: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 378 MEXICO: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 379 MEXICO: SMALL ARMS MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 380 MEXICO: SMALL ARMS MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 381 MEXICO: SMALL ARMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 382 MEXICO: SMALL ARMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.7 AFRICA

14.7.1 PESTLE ANALYSIS: AFRICA

TABLE 383 AFRICA: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 384 AFRICA: SMALL ARMS MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 385 AFRICA: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 386 AFRICA: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 387 AFRICA: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 388 AFRICA: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 389 AFRICA: SMALL ARMS MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 390 AFRICA: SMALL ARMS MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 391 AFRICA: SMALL ARMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 392 AFRICA: SMALL ARMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 393 AFRICA: SMALL ARMS MARKET SIZE, BY CUTTING TYPE, 2018–2021 (USD MILLION)

TABLE 394 AFRICA: SMALL ARMS MARKET SIZE, BY CUTTING TYPE, 2022–2027 (USD MILLION)

TABLE 395 AFRICA: SMALL ARMS MARKET SIZE, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 396 AFRICA: SMALL ARMS MARKET SIZE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 397 AFRICA: SMALL ARMS MARKET SIZE, BY FIRING SYSTEM, 2018–2021 (USD MILLION)

TABLE 398 AFRICA: SMALL ARMS MARKET SIZE, BY FIRING SYSTEM, 2022–2027 (USD MILLION)

TABLE 399 AFRICA: SMALL ARMS MARKET SIZE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 400 AFRICA: SMALL ARMS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

14.7.2 SOUTH AFRICA

14.7.2.1 Replacement of aging military equipment to drive market

TABLE 401 KEY FIREARMS USED BY SOUTH AFRICAN ARMED FORCES

TABLE 402 KEY FIREARMS USED BY SOUTH AFRICAN LAW ENFORCEMENT

TABLE 403 SOUTH AFRICA: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 404 SOUTH AFRICA: SMALL ARMS MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 405 SOUTH AFRICA: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 406 SOUTH AFRICA: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 407 SOUTH AFRICA: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 408 SOUTH AFRICA: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 409 SOUTH AFRICA: SMALL ARMS MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 410 SOUTH AFRICA: SMALL ARMS MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 411 SOUTH AFRICA: SMALL ARMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 412 SOUTH AFRICA: SMALL ARMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

14.7.3 EGYPT

14.7.3.1 Increased focus on multilateral training exercises to strengthen armed forces to fuel market

TABLE 413 KEY FIREARMS USED BY EGYPTIAN ARMED FORCES

TABLE 414 KEY FIREARMS USED BY EGYPTIAN LAW ENFORCEMENT

TABLE 415 EGYPT: SMALL ARMS MARKET SIZE, BY END USER, 2018–2021 (USD MILLION)

TABLE 416 EGYPT: SMALL ARMS MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 417 EGYPT: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 418 EGYPT: DEFENSE SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 419 EGYPT: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 420 EGYPT: CIVIL & COMMERCIAL SMALL ARMS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 421 EGYPT: SMALL ARMS MARKET SIZE, BY CALIBER, 2018–2021 (USD MILLION)

TABLE 422 EGYPT: SMALL ARMS MARKET SIZE, BY CALIBER, 2022–2027 (USD MILLION)

TABLE 423 EGYPT: SMALL ARMS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 424 EGYPT: SMALL ARMS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

15 COMPANY LANDSCAPE (Page No. - 263)

15.1 INTRODUCTION

15.2 MARKET SHARE ANALYSIS, 2021

FIGURE 38 MARKET SHARE ANALYSIS - 2021

15.3 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2021

FIGURE 39 REVENUE ANALYSIS OF TOP 3 PLAYERS IN SMALL ARMS MARKET

15.4 COMPANY RANK ANALYSIS, 2021

FIGURE 40 COMPANY RANKING ANALYSIS, 2021

15.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 425 COMPANY PRODUCT FOOTPRINT

TABLE 426 COMPANY PLATFORM FOOTPRINT

TABLE 427 COMPANY REGION FOOTPRINT

15.6 COMPANY EVALUATION MATRIX

15.6.1 STAR

15.6.2 EMERGING LEADERS

15.6.3 PERVASIVE

15.6.4 PARTICIPANT

FIGURE 41 COMPANY EVALUATION QUADRANT, 2021

15.7 START-UP EVALUATION QUADRANT

15.7.1 PROGRESSIVE COMPANIES

15.7.2 RESPONSIVE COMPANIES

15.7.3 STARTING BLOCKS

15.7.4 DYNAMIC COMPANIES

FIGURE 42 COMPETITIVE LEADERSHIP MAPPING OF START-UPS, 2021

15.7.5 COMPETITIVE BENCHMARKING

TABLE 428 SMALL ARMS MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 429 SMALL ARMS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

15.8 COMPETITIVE SITUATIONS AND TRENDS

15.8.1 PRODUCT LAUNCHES

TABLE 430 SMALL ARMS MARKET: PRODUCT LAUNCHES, APRIL 2018–JULY 2020

15.8.2 DEALS

TABLE 431 SMALL ARMS MARKET: DEALS, APRIL 2018–SEPTEMBER 2022

TABLE 432 SMALL ARMS MARKET: EXPANSIONS, AUGUST 2019

TABLE 433 SMALL ARMS MARKET: OTHERS, SEPTEMBER 2022

16 COMPANY PROFILES (Page No. - 288)

16.1 INTRODUCTION

(Business overview, Products offered, Recent developments & MnM View)*

16.2 KEY PLAYERS

16.2.1 SMITH & WESSON

TABLE 434 SMITH & WESSON: BUSINESS OVERVIEW

FIGURE 43 SMITH & WESSON: COMPANY SNAPSHOT

16.2.2 STURM, RUGER & CO., INC.

TABLE 435 STURM, RUGER & CO., INC.: BUSINESS OVERVIEW

FIGURE 44 STURM, RUGER & CO., INC.: COMPANY SNAPSHOT

16.2.3 BERETTA

TABLE 436 BERETTA: BUSINESS OVERVIEW

FIGURE 45 BERETTA: COMPANY SNAPSHOT

16.2.4 COLT’S MANUFACTURING COMPANY LLC

TABLE 437 COLT’S MANUFACTURING COMPANY LLC: BUSINESS OVERVIEW

16.2.5 HERSTAL GROUP

TABLE 438 HERSTAL GROUP: BUSINESS OVERVIEW

16.2.6 SIG SAUER

TABLE 439 SIG SAUER: BUSINESS OVERVIEW

16.2.7 HECKLER & KOCH GMBH

TABLE 440 HECKLER & KOCH GMBH: BUSINESS OVERVIEW

16.2.8 ISRAEL WEAPONS INDUSTRY (IWI)

TABLE 441 ISRAEL WEAPONS INDUSTRY (IWI): BUSINESS OVERVIEW

16.2.9 FREEDOM GROUP

TABLE 442 FREEDOM GROUP: BUSINESS OVERVIEW

16.2.10 GLOCK GES.M.B.H.

TABLE 443 GLOCK GES.M.B.H.: BUSINESS OVERVIEW

16.2.11 CESKÁ ZBROJOVKA A.S.

TABLE 444 CESKÁ ZBROJOVKA A.S.: BUSINESS OVERVIEW

16.2.12 KALASHNIKOV GROUP

TABLE 445 KALASHNIKOV GROUP: BUSINESS OVERVIEW

16.2.13 BARRETT

TABLE 446 BARRETT: BUSINESS OVERVIEW

16.2.14 NORINCO

TABLE 447 NORINCO: BUSINESS OVERVIEW

16.3 OTHER PLAYERS

16.3.1 STEYR ARMS

TABLE 448 STEYR ARMS: BUSINESS OVERVIEW

16.3.2 ACCURACY INTERNATIONAL

TABLE 449 ACCURACY INTERNATIONAL: BUSINESS OVERVIEW

16.3.3 CARL WALTHER GMBH

TABLE 450 CARL WALTHER GMBH: BUSINESS OVERVIEW

16.3.4 DANIEL DEFENSE INC

TABLE 451 DANIEL DEFENSE INC: BUSINESS OVERVIEW

16.3.5 O. F. MOSSBERG & SONS, INC.

TABLE 452 O. F. MOSSBERG & SONS, INC.: BUSINESS OVERVIEW

16.3.6 SAVAGE

TABLE 453 SAVAGE: BUSINESS OVERVIEW

16.3.7 SPRINGFIELD ARMORY

TABLE 454 SPRINGFIELD ARMORY: BUSINESS OVERVIEW

16.3.8 TAURUS ARMAS S.A.

TABLE 455 TAURUS ARMAS S.A.: BUSINESS OVERVIEW

16.3.9 TEXTRON INC.

TABLE 456 TEXTRON INC.: BUSINESS OVERVIEW

FIGURE 46 TEXTRON INC.: COMPANY SNAPSHOT

16.3.10 ZASTAVA ARMS

TABLE 457 ZASTAVA ARMS: BUSINESS OVERVIEW

16.3.11 ARSENAL JSCO

TABLE 458 ARSENAL JSCO: BUSINESS OVERVIEW

16.3.12 BRUGGER & THOMET (B&T) AG

TABLE 459 BRUGGER & THOMET (B&T) AG: BUSINESS OVERVIEW

16.3.13 BENELLI ARMI SPA

TABLE 460 BENELLI ARMI SPA: BUSINESS OVERVIEW

16.3.14 KNIGHTS ARMAMENT CO

TABLE 461 KNIGHT’S ARMAMENT CO.: BUSINESS OVERVIEW

16.3.15 LEWIS MACHINE & TOOL CO.

TABLE 462 LEWIS MACHINE & TOOL CO.: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

17 APPENDIX (Page No. - 354)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Small Arms Market

I am working on an in-depth study on the competitiveness of the global small arms industry to the discipline of Strategic Analysis.