Global Returnable Packaging Market by Product Type (Pallets, Crates, Intermediate Bulk Containers, Drums & Barrels, Bottles, Dunnage), Material (Plastic, Metal, Wood, Glass, Foam), End-use Industry, and Region - Global Forecast to 2026

Updated on : September 02, 2025

Returnable Packaging Market

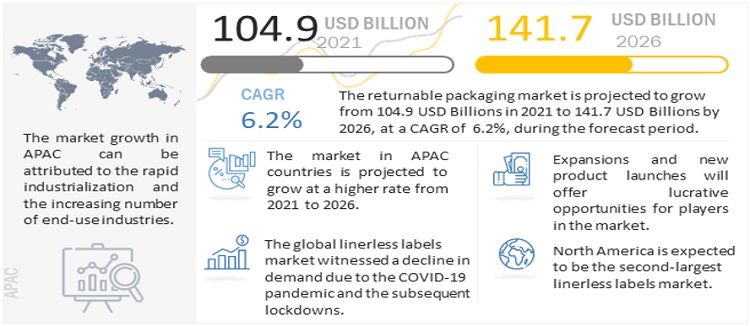

The global returnable packaging market was valued at USD 104.9 billion in 2021 and is projected to reach USD 141.7 billion by 2026, growing at 6.2% cagr from 2021 to 2026. The market for returnable packaging is expected to witness significant growth in the future owing to its benefits as well as its increasing popularity and usage in the packaging industry. Strong demand for returnable packaging from end-use industries, such as automotive, food & beverage, and consumer durables; growth in the e-commerce sector; high consumer income; and acceleration in industrial activities, especially in emerging economies; are factors likely to support the growth of the returnable packaging market during the forecast period.

Global Returnable Packaging Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Returnable Packaging Market Dynamics

Driver: Strong demand for returnable packaging from end-use industries

One of the key factors driving the returnable packaging industry is the returnable packaging systems have made a profound impact on the automotive industry, with many reusable handheld and bulk containers, racks, pallets, and lids, as well as dunnage designed to facilitate automotive part protection. The food & beverage industry is one of the leading consumers of returnable packaging. This industry is witnessing improved sales volumes due to rising disposable incomes. The e-commerce business has experienced tremendous growth in recent years because of technological innovations, resulting in a large online customer base.

Restraint: Volatility in raw material prices

Raw material and energy used to produce returnable packaging have volatile prices and are set to continue in the forecast period. The prices of these materials directly affect the units of the value chain, which includes procurement and operation costs. A sudden increase or decrease in price affects the profit margin of manufacturers as well. Furthermore, with an increase in the cost of raw materials, vendors increase the price of their products or reduce their profit margins, which will have an adverse effect on the market growth.

Opportunity: Increasing R&D investments

Packaging manufacturers are now focused on developing sustainable and green packaging products, which can be recycled and reused. These manufacturers are investing in R&D activities and technologies to develop sustainable packaging solutions that are environment-friendly, cost-effective, and, at the same time, do not compromise on the protection level offered to the packed product. Growing concerns about the environment have increased the demand for environment-friendly and sustainable packaging

Challenge: Varying environmental mandates across regions

Rising environmental concerns regarding the use of synthetic plastics, i.e., plastics mainly made from petroleum feedstock have encouraged industry players to develop eco-friendly plastics for consumers. Firms such as The Dow Chemical Company and Braskem have been investing heavily in the development of technologies to produce bio-based polymers through biomass. . Biodegradable raw materials are costlier than their non-biodegradable counterparts, which increases operational costs, thus limiting the growth of the returnable packaging market. However, environmental mandates in the packaging industry differ across countries; this makes it challenging for companies to adjust to the packaging materials used according to the regulations applicable in that specific region.

Based on material, plastic is the dominant segment of the returnable packaging market

Based on materials, the returnable packaging market is segmented into plastic, metal, wood, glass, and foam. Plastic segment has the dominant market share in returnable packaging market. Due to their durability, low weight, great corrosion resistance, and solvent resistance, high-density polyethylene (HDPE) and polypropylene (PP) polymers are frequently used in the production of goods such pallets, crates, IBCs, and drums. Furthermore, because to their great impact resistance, items made of plastic-based RTP sustain little to no damage when handled roughly by forklifts and other material handling machinery. Additionally, RTP products made of plastic have great chemical and weather resistance, making them appropriate for use in the food and drug industries.

Automotive industry is expected to have largest market share during the forecast period

By end-use industry, automotive sector is projected to be the largest segment in the returnable packaging market. In the automotive industry, plastics and steel are used for returnable packaging as they offer durability and tamper resistance. Returnable containers are often used by automakers to convey various vehicle component portions to component suppliers. The components are then transported to assembly facilities to be put together. Because they are strong and tamper-resistant, steel and plastic are used in the car sector for returnable packing. Due to OEM pressure to cut costs to compete in the market, the need for returnable packaging is gradually rising in the automotive sector.

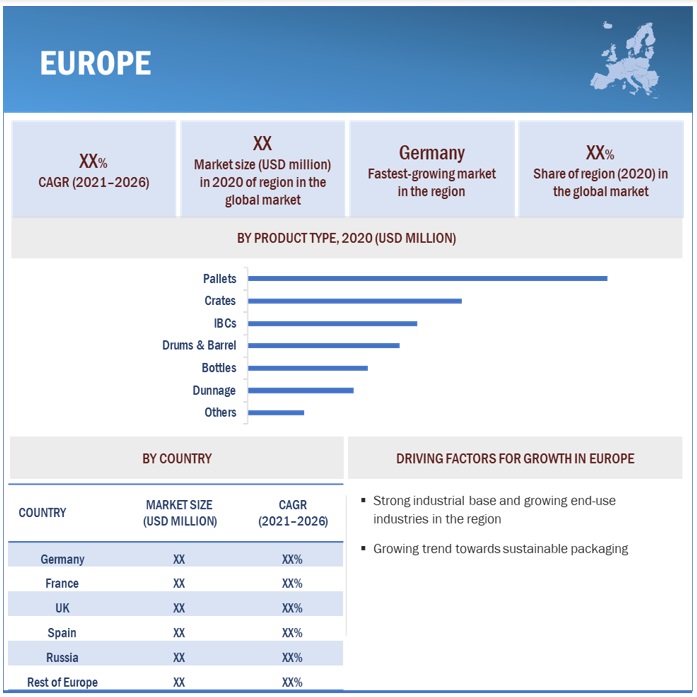

Europe region is expected to be the fastest growing region during the forecast period.

Europe led the global returnable packaging market with a share of 44.0% in 2020. Germany is one of the largest economies in Europe. It is projected to be the largest market for returnable packaging in the European region by 2026. The country also has highly developed food & beverage, automotive, and consumer goods industries, which is expected to be a major driver for the growth of the market in Germany. Germany is the largest producer of chemicals in Europe, and there is increasing demand for chemical-resistant plastic drums and metallic IBCs for the storage of chemicals in the country.

To know about the assumptions considered for the study, download the pdf brochure

Returnable Packaging Market Players

Key manufacturers in the returnable packaging market are Brambles (Australia), Schoeller Allibert (Netherlands), Menasha Corporation (US), DS Smith (UK), and Myers Industries (US), amongst others.

Returnable Packaging Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2019-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) and Volume (Million Units) |

|

Segments covered |

Product Type, Material, End-Use Industry, and Region |

|

Geographies covered |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies covered |

Brambles (Australia), Schoeller Allibert (Netherlands), Menasha Corporation (US), DS Smith (UK), and Myers Industries (US), among others. |

This research report categorizes the returnable packaging market based on product type, material, end-use industry, and region.

Returnable Packaging Market based on Product Type:

- Pallets

- Crates

- Intermediate Bulk Containers (IBCs)

- Dunnage

- Drums & Barrel

- Bottles

- Others

Returnable Packaging Market based on Material:

- Plastic

- Metal

- Wood

- Glass

- Foam

Returnable Packaging Market based on End-use Industry:

- Food & Beverage

- Automotive

- Consumer Durables

- Healthcare

- Others

Returnable Packaging Market based on region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Recent Developments in Global Returnable Packaging Market

- In August 2021, fab Group has introduced FiberFlute, an eco-friendly alternative to foam. This new product is a result of the partnership between Nefab Group AB (Nefab) and Corruven Canada Inc. (Corruven). Through Nefab’s global footprint and exclusivity of Corruven’s FiberFlute, customers can protect their products while minimizing total costs and environmental impact. FiberFlute is different from plastic-based packaging because it is 100% fiber-based and paper-recyclable solution. Moreover, FiberFlute can absorb more shock with less material compared to polyethylene foam, perform in both dry and humid conditions, and resist multiple drops.

- In May 2021, Nefab has expanded its footprint in the North American region. The company has added production sites in Houston (Texas), Tucson (Arizona), and Gainesville (Florida) in the US.

- In March 2021, Suhutz, in order to meet the requirements in the supply chain and fulfill customer expectations, has added the new Ecobulk MX 560 to its extensive product range. This new IBC has a lower height than standard models and a nominal volume of 560 liters or 150 gallons, which makes it ideal for applications where smaller containers are an advantage, but where maximum performance and the highest quality are also decisive.

- In 2021, Schoeller Allibert has introduced a pallet box made from recycled fishing nets. With this upcycling result, the company is reinforcing its sustainability strategy in recent years. Under the motto 'Making plastic packaging too good to waste,' the company further focuses on increasing the sustainable benefits of its packaging products.

- In 2020, Schoeller Allibert has launched a JumboNest—a sustainable, hygienic, fully stackable and designed to maximize freight storage, returnable packaging product. The launched product is food safe, robust, and manufactured to withstand extreme temperatures from 44.6° F to +104°F and is a suitable choice for industries including food & food processing, beverage, agriculture, retail, industrial manufacturing, and recycling.

Frequently Asked Questions (FAQs):

What is the current size of the global returnable packaging market?

The global returnable packaging market size is projected to grow from USD 104.9 billion in 2021 to USD 141.7 billion by 2026, at a CAGR of 6.2% from 2021 to 2026.

Who are the key players in the global returnable packaging market?

Key manufacturers in the returnable packaging market are Brambles (Australia), Schoeller Allibert (Netherlands), Menasha Corporation (US), DS Smith (UK), and Myers Industries (US), amongst others.

What are the factors driving the growth of the returnable packaging market?

The growth of the returnable packaging market is attributed to the increase in demand for returnable packaging in numerous end-use industries, particularly for food & beverage industry. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSION AND EXCLUSION

TABLE 1 INCLUSION AND EXCLUSION

1.4 MARKET SCOPE

FIGURE 1 RETURNABLE PACKAGING MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

FIGURE 2 RETURNABLE PACKAGING MARKET, BY REGION

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 3 RETURNABLE PACKAGING MARKET: RESEARCH DESIGN

2.2 MARKET SIZE ESTIMATION

FIGURE 4 APPROACH 1: BASED ON REUSABLE PACKAGING ASSOCIATION

FIGURE 5 APPROACH 2: BOTTOM-UP APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 RETURNABLE PACKAGING MARKET: DATA TRIANGULATION

2.3.1 SECONDARY DATA

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

2.4.3 RISK ASSESSMENT

TABLE 2 LIMITATIONS & ASSOCIATED RISKS

TABLE 3 RISKS

3 EXECUTIVE SUMMARY (Page No. - 32)

FIGURE 7 PALLETS SEGMENT TO DOMINATE THE RETURNABLE PACKAGING MARKET BY 2026

FIGURE 8 PLASTIC SEGMENT TO DOMINATE THE RETURNABLE PACKAGING MARKET BY 2026

FIGURE 9 AUTOMOTIVE TO BE THE LARGEST SEGMENT IN THE RETURNABLE PACKAGING MARKET DURING THE FORECAST PERIOD

FIGURE 10 EUROPE LED THE RETURNABLE PACKAGING MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 EMERGING ECONOMIES TO WITNESS A RELATIVELY HIGHER DEMAND FOR RETURNABLE PACKAGING

FIGURE 11 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES IN THE RETURNABLE PACKAGING MARKET DURING THE FORECAST PERIOD

4.2 APAC: RETURNABLE PACKAGING MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 12 CHINA WAS THE LARGEST MARKET FOR RETURNABLE PACKAGING IN APAC IN 2020

4.3 RETURNABLE PACKAGING MARKET, BY PRODUCT TYPE

FIGURE 13 PALLETS TO LEAD THE RETURNABLE PACKAGING MARKET DURING THE FORECAST PERIOD

4.4 RETURNABLE PACKAGING MARKET, BY MATERIAL

FIGURE 14 PLASTIC TO LEAD THE RETURNABLE PACKAGING MARKET DURING THE FORECAST PERIOD

4.5 RETURNABLE PACKAGING MARKET, BY END-USE INDUSTRY

FIGURE 15 AUTOMOTIVE TO BE THE LARGEST END-USE INDUSTRY FOR THE GLOBAL RETURNABLE PACKAGING MARKET BY 2026

4.6 RETURNABLE PACKAGING MARKET, BY COUNTRY

FIGURE 16 THE RETURNABLE PACKAGING MARKET IN CHINA TO GROW AT THE HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 RETURNABLE PACKAGING MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing urban population

FIGURE 18 ASIA PACIFIC URBANIZATION PROSPECTS

5.2.1.2 Strong demand for returnable packaging from end-use industries

5.2.1.3 Benefits of returnable packaging

5.2.1.4 High optimization in pack size

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

FIGURE 19 CRUDE OIL PRICE TREND

5.2.2.2 Storage space requirement and potential loss of material

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging economies

5.2.3.2 Increasing R&D investments

5.2.4 CHALLENGES

5.2.4.1 Varying environmental mandates across regions

5.2.4.2 Cost-to-benefit ratio a concern to small manufacturers

5.2.4.3 Challenges in the management of the packaging supply chain

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 20 RETURNABLE PACKAGING MARKET: SUPPLY CHAIN

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 RETURNABLE PACKAGING MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

6 COVID-19 IMPACT ON THE RETURNABLE PACKAGING MARKET (Page No. - 50)

6.1 INTRODUCTION

6.2 IMPACT OF COVID-19 ON THE RETURNABLE PACKAGING MARKET

7 RETURNABLE PACKAGING MARKET, BY PRODUCT TYPE (Page No. - 52)

7.1 INTRODUCTION

FIGURE 22 IBCS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 5 RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 6 RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

7.2 PALLETS

7.2.1 PALLETS TO DOMINATE THE RETURNABLE PACKAGING MARKET

7.3 CRATES

7.3.1 FOOD & BEVERAGE INDUSTRY TO DRIVE THE DEMAND FOR CRATES

7.4 INTERMEDIATE BULK CONTAINERS (IBC)

7.4.1 EXPANSION OF COMMODITY TRADE IN THE DEVELOPING ECONOMIES TO DRIVE THE DEMAND FOR IBC

7.5 DUNNAGE

7.5.1 RISING DEMAND FOR A SAFE MODE OF PACKAGING FUELS THE USAGE OF DUNNAGE

7.6 DRUMS & BARRELS

7.6.1 INCREASING USAGE OF DRUMS & BARRELS IN FOOD AND CHEMICAL INDUSTRIES TO BOOST ITS DEMAND

7.7 BOTTLES

7.7.1 RISING CONSUMER AWARENESS REGARDING SUSTAINABLE PACKAGING IS DRIVING THE DEMAND FOR REUSABLE BOTTLES

7.8 OTHERS

8 RETURNABLE PACKAGING MARKET, BY MATERIAL (Page No. - 57)

8.1 INTRODUCTION

FIGURE 23 WOOD SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 7 RETURNABLE PACKAGING MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 8 RETURNABLE PACKAGING MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION UNITS)

8.2 PLASTIC

8.2.1 PLASTIC TO DOMINATE THE MARKET FOR RETURNABLE PACKAGING

8.3 METAL

8.3.1 SUPERIOR PROPERTIES OF METAL CONTRIBUTE TOWARD ITS SECOND-LARGEST SHARE IN RETURNABLE PACKAGING

8.4 WOOD

8.4.1 WOOD TO GROW AT THE HIGHEST CAGR BY 2O26

8.5 GLASS

8.5.1 SHIFT TOWARD REUSABLE GLASS BOTTLES FROM PLASTIC AND METAL TO DRIVE THE DEMAND FOR GLASS FOR RETURNABLE PACKAGING

8.6 FOAM

8.6.1 DEMAND FOR FRAGILE PRODUCTS IS EXPECTED TO DRIVE THE FOAM PACKAGING MARKET

9 RETURNABLE PACKAGING MARKET, BY END-USE INDUSTRY (Page No. - 62)

9.1 INTRODUCTION

FIGURE 24 CONSUMER DURABLES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 9 RETURNABLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 10 RETURNABLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION UNITS)

9.2 AUTOMOTIVE

9.2.1 AUTOMOTIVE INDUSTRY TO DOMINATE THE RETURNABLE PACKAGING MARKET

9.3 FOOD & BEVERAGES

9.3.1 SIGNIFICANT FOCUS ON SUSTAINABILITY TO DRIVE THE DEMAND FOR RETURNABLE PACKAGING

9.4 CONSUMER DURABLES

9.4.1 RISING DEMAND FOR SAFE AND SECURE PACKAGING DURING SHIPPING

9.5 HEALTHCARE

9.5.1 INCREASING NEED FOR ADDITIONAL LEVEL OF PROTECTION IN HEALTHCARE PRODUCTS

9.6 OTHERS

10 RETURNABLE PACKAGING MARKET, BY REGION (Page No. - 67)

10.1 INTRODUCTION

FIGURE 25 REGIONAL SNAPSHOT: CHINA IS PROJECTED TO BE THE FASTEST-GROWING COUNTRY-LEVEL MARKET FROM 2021 TO 2026

TABLE 11 GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 12 MARKET SIZE, BY REGION, 2019–2026 (MILLION UNITS)

TABLE 13 MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 14 MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

TABLE 15 MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 16 MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION UNITS)

TABLE 17 MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 18 GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION UNITS)

10.2 EUROPE

FIGURE 26 EUROPE: GLOBAL RETURNABLE PACKAGING MARKET SNAPSHOT

TABLE 19 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 20 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION UNITS)

TABLE 21 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 22 EUROPE: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.2.1 GERMANY

10.2.1.1 Germany to lead the market for returnable packaging in Europe

TABLE 23 GERMANY: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 24 GERMANY: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.2.2 UK

10.2.2.1 Government schemes to minimize packaging/shipping waste to drive the demand for returnable packaging

TABLE 25 UK: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 26 UK: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.2.3 FRANCE

10.2.3.1 High growth in the automotive industry to offer opportunities for returnable packaging

TABLE 27 FRANCE: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 28 FRANCE: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.2.4 RUSSIA

10.2.4.1 Stringent regulations regarding sustainability to accelerating the use of returnable packaging products

TABLE 29 RUSSIA: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 30 RUSSIA: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.2.5 SPAIN

10.2.5.1 Significant demand for industrial bulk containers for export operations to drive the market

TABLE 31 SPAIN: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 32 SPAIN: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.2.6 REST OF EUROPE

TABLE 33 REST OF EUROPE: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 34 REST OF EUROPE: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.3 APAC

FIGURE 27 APAC: RETURNABLE PACKAGING MARKET SNAPSHOT

TABLE 35 APAC: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 36 APAC: RETURNABLE PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION UNITS)

TABLE 37 APAC: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 38 APAC: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.3.1 CHINA

10.3.1.1 China to be the fastest-growing market for returnable packaging globally

TABLE 39 CHINA: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 40 CHINA: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.3.2 JAPAN

10.3.2.1 Growth in the end-use industries to offer growth opportunities for the returnable packaging market

TABLE 41 JAPAN: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 42 JAPAN: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.3.3 INDIA

10.3.3.1 Increasing demand for returnable packaging from the automotive industry

TABLE 43 INDIA: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 44 INDIA: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.3.4 AUSTRALIA

10.3.4.1 Growing number of food manufacturing activities to drive the demand for returnable packaging

TABLE 45 AUSTRALIA: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 46 AUSTRALIA: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.3.5 REST OF APAC

TABLE 47 REST OF APAC: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 48 REST OF APAC: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.4 NORTH AMERICA

TABLE 49 NORTH AMERICA: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 50 NORTH AMERICA: RETURNABLE PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION UNITS)

TABLE 51 NORTH AMERICA: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.4.1 US

10.4.1.1 The US to dominate the market for returnable packaging in North America

TABLE 53 US: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 54 US: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.4.2 CANADA

10.4.2.1 Favorable free trade agreements support the Canadian returnable packaging market

TABLE 55 CANADA: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 56 CANADA: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.4.3 MEXICO

10.4.3.1 Growing demand for reusable packaging products from several end-use industries

TABLE 57 MEXICO: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 58 MEXICO: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.5 MIDDLE EAST & AFRICA

TABLE 59 MIDDLE EAST & AFRICA: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA: RETURNABLE PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION UNITS)

TABLE 61 MIDDLE EAST & AFRICA: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.5.1 UAE

10.5.1.1 The UAE to dominate the returnable packaging market in the Middle East & African region

TABLE 63 UAE: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 64 UAE: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.5.2 SAUDI ARABIA

10.5.2.1 Saudi Arabia to be the fastest-growing country in the Middle East & Africa region

TABLE 65 SAUDI ARABIA: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 66 SAUDI ARABIA: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.5.3 SOUTH AFRICA

10.5.3.1 Growing demand for returnable packaging for protection of in-transit products

TABLE 67 SOUTH AFRICA: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 68 SOUTH AFRICA: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.5.4 TURKEY

10.5.4.1 Increasing demand for FMCGs to accelerate the use of returnable packaging

TABLE 69 TURKEY: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 70 TURKEY: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 71 REST OF MIDDLE EAST & AFRICA: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 72 REST OF MIDDLE EAST & AFRICA: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.6 SOUTH AMERICA

TABLE 73 SOUTH AMERICA: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 74 SOUTH AMERICA: RETURNABLE PACKAGING MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION UNITS)

TABLE 75 SOUTH AMERICA: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 76 SOUTH AMERICA: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.6.1 BRAZIL

10.6.1.1 Brazil to dominate the market for returnable packaging in South America

TABLE 77 BRAZIL: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 78 BRAZIL: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.6.2 ARGENTINA

10.6.2.1 Increasing demand for returnable packaging from end-use industries

TABLE 79 ARGENTINA: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 80 ARGENTINA: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

10.6.3 REST OF SOUTH AMERICA

TABLE 81 REST OF SOUTH AMERICA: GLOBAL RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 82 REST OF SOUTH AMERICA: RETURNABLE PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

11 COMPETITIVE LANDSCAPE (Page No. - 106)

11.1 OVERVIEW

FIGURE 28 COMPANIES ADOPTED EXPANSION AS THE KEY GROWTH STRATEGY, 2016–2021

11.2 MARKET RANKING

FIGURE 29 MARKET RANKING OF KEY PLAYERS, 2020

11.2.1 BRAMBLES

11.2.2 MENASHA CORPORATION

11.2.3 SCHOELLER ALLIBERT

11.2.4 DS SMITH

11.2.5 MYERS INDUSTRIES

11.3 COMPETITIVE LEADERSHIP MAPPING

11.3.1 STAR

11.3.2 EMERGING LEADERS

11.3.3 PERVASIVE

11.3.4 EMERGING COMPANIES

FIGURE 30 RETURNABLE PACKAGING MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

11.4 COMPETITIVE SCENARIO

TABLE 83 RETURNABLE PACKAGING MARKET: NEW PRODUCT DEVELOPMENT, 2016–2021

TABLE 84 RETURNABLE PACKAGING MARKET: DEALS, 2016- 2021

TABLE 85 RETURNABLE PACKAGING MARKET: OTHERS, 2016–2021

12 COMPANY PROFILES (Page No. - 112)

12.1 MAJOR PLAYERS

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Weaknesses and competitive threats, Strategic choices made, right to win)*

12.1.1 BRAMBLES

TABLE 86 BRAMBLES: COMPANY OVERVIEW

FIGURE 31 BRAMBLES: COMPANY SNAPSHOT

12.1.2 SCHOELLER ALLIBERT

TABLE 87 SCHOELLER ALLIBERT: COMPANY OVERVIEW

FIGURE 32 SCHOELLER ALLIBERT: COMPANY SNAPSHOT

TABLE 88 SCHOELLER ALLIBERT: NEW PRODUCT DEVELOPMENT

12.1.3 MENASHA CORPORATION

TABLE 89 MENASHA CORPORATION: COMPANY OVERVIEW

12.1.4 DS SMITH

TABLE 90 DS SMITH: COMPANY OVERVIEW

FIGURE 33 DS SMITH: COMPANY SNAPSHOT

12.1.5 MYERS INDUSTRIES

TABLE 91 MYERS INDUSTRIES: COMPANY OVERVIEW

FIGURE 34 MYERS INDUSTRIES: COMPANY SNAPSHOT

12.1.6 NEFAB GROUP

TABLE 92 NEFAB GROUP: COMPANY OVERVIEW

12.1.7 IPL PLASTICS

TABLE 93 IPL PLASTICS: COMPANY OVERVIEW

FIGURE 35 IPL PLASTICS: COMPANY SNAPSHOT

12.1.8 VETROPACK HOLDING

TABLE 94 VETROPACK HOLDING: COMPANY OVERVIEW

FIGURE 36 VETROPACK HOLDING: COMPANY SNAPSHOT

12.1.9 SCHUTZ GMBH & CO. KGAA

TABLE 95 SCHUTZ GMBH & CO. KGAA: COMPANY OVERVIEW

12.1.10 REHRIG PACIFIC COMPANY

TABLE 96 REHRIG PACIFIC COMPANY: COMPANY OVERVIEW

12.2 ADDITIONAL PLAYERS

12.2.1 AMATECH INC.

12.2.2 REUSABLE TRANSPORT PACKAGING

12.2.3 MONOFLO INTERNATIONAL

12.2.4 MJSOLPAC LTD.

12.2.5 CABKA GROUP

12.2.6 UFP TECHNOLOGIES

12.2.7 PLASMIX PRIVATE LIMITED

12.2.8 CKDPACK PACKAGING LTD.

12.2.9 MULTIPAC SYSTEMS

12.2.10 TRI-WALL LIMITED

12.2.11 GWP GROUP

12.2.12 WEIGAND-GLAS GMBH

12.2.13 MPACT LIMITED

12.2.14 TOYO GLASS CO., LTD.

12.2.15 RPP CONTAINERS

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Weaknesses and competitive threats, Strategic choices made, right to win might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 155)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

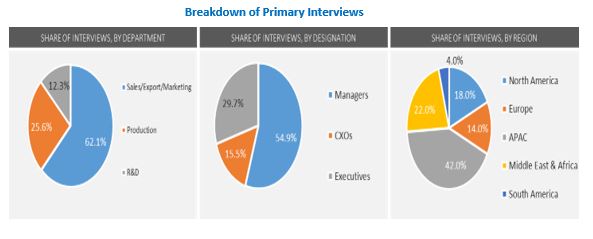

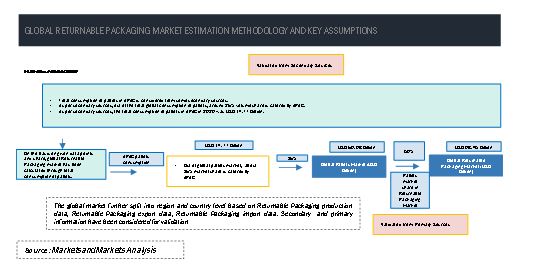

The study involved four major activities for estimating the current global size of the returnable packaging market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of returnable packaging through primary research. The bottom-up approach was employed to estimate the overall size of the returnable packaging market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Global Returnable Packaging Market Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the returnable packaging market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Global Returnable Packaging Market Primary Research

Various primary sources from both the supply and demand sides of the returnable packaging market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the returnable packaging industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Global Returnable Packaging Market Size Estimation

The above approach was used to estimate and validate the global size of the returnable packaging market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Returnable Packaging Market Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the returnable packaging market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Global Returnable Packaging Market Report Objectives

- To define, analyze, and project the size of the returnable packaging market in terms of value and volume based on product type, material, end-use industry and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, APAC, Middle East & Africa, and South America.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Global Returnable Packaging Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the returnable packaging report:

Global Returnable Packaging Market Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies.

Global Returnable Packaging Market Regional Analysis

- Further analysis of the returnable packaging market for additional countries

Global Returnable Packaging Market Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Global Returnable Packaging Market