Dunnage Packaging Market by Material (Corrugated Plastic, Molded Plastic, Steel, Aluminum, Foam, Corrugated Paper, Wood, Fabric Dunnage), End-Use Industry, Region (North America, Europe, APAC, MEA, South America) - Global Forecast to 2024

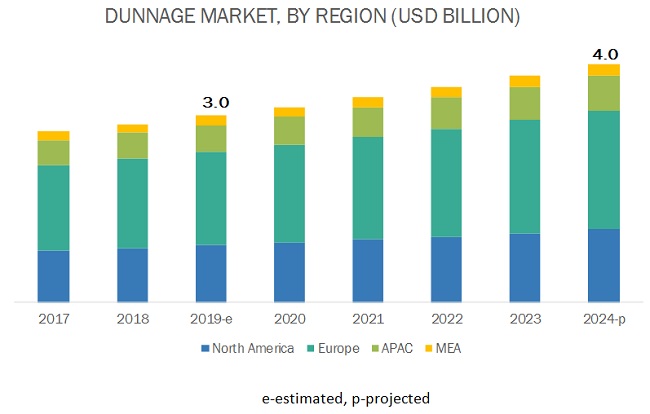

[180 Pages Report] The dunnage packaging market is projected to grow from USD 3.0 billion in 2019 to USD 4.0 billion by 2024, at a CAGR of 5.0% between 2019 and 2024. The market is growing due to the high demand from the automotive, electronics, aerospace, and food & beverage industries.

The electronics end-use industry is expected to witness high CAGR between 2019 and 2024

Dunnage packaging is finding increasing application in the automotive end-use industry due to the growing demand for eco-friendly, and 360 degree product safety property. The dunnage packaging is used in various applications in the automotive industry. This packaging helps in creating lightweight packaging for components while maintaining structural integrity, lowering the handling & transportation costs. Chinese, American, and Russian companies are some of the early adopters of dunnage packaging.

APAC is expected to lead the dunnage packaging market during the forecast period.

APAC is the largest and the fastest-growing dunnage packaging market. The automotive, and electronics industries are the major consumers of dunnage packaging in the region. Presence of a large number of manufacturers makes the region the most important market for dunnage packaging. The growth is also attributed to the high demand for dunnage packaging in the automotive, electronics, and aerospace end-use industries. China and Japan have been considered as a major part of the APAC dunnage packaging market. Taiwan, South Korea, Indonesia and other Asian countries have been taken as rest of APAC into consideration, as this dynamic technology is not yet commercialized in these countries. However, R&D activities in Japan and China, which makes these countries potential markets for this technology.

Some of the key players in the dunnage packaging market are DS Smith (UK), Menasha Corporation (US), Schoeller Allibert (Netherlands), Myers Industries (US), Nefab (Sweden), UFP Technologies (US), Reusable Transport Packaging (Florida), Amatech Inc. (US), MJSolpac Ltd. (UK), Rehrig Pacific Company (US). The key strategies adopted by the major players for enhancing their business revenue are expansion, agreement, divestment and investment.

Scope of the Report

|

Report Metric |

Details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This research report categorizes the dunnage packaging market based on the material, end-use industries, and region.

Based on Material, the dunnage packaging market has been segmented as follows:

- Corrugated Plastic

- Molded Plastic

- Foam

- Steel

- Aluminum

- Wood

- Fabric Dunnage

- Corrugated Paper

- Others (Glass, Rubber, and Anti-Static)

Based on End-User Industry, the dunnage packaging market has been segmented as follows:

- Automotive

- Aerospace

- Electronics

- Food & Beverages

- Consumer Durables

- Healthcare

- Others (Construction, Oil & Lubricants, and Chemicals)

Based on the Region, the dunnage packaging market has been segmented as follows:

- Asia Pacific (APAC)

- North America

- Europe

- Middle East & Africa (MEA)

- South America

Key Questions Addressed by the Report

- Which are the major end-use industries of dunnage packaging?

- Which construction method is used majorly in dunnage packaging?

- Which material type is used majorly in dunnage packaging?

- Which largest and fastest-growing regional dunnage packaging market?

- What are the major strategies adopted by leading market players?

Frequently Asked Questions (FAQ):

What are the factors Influencing the growth of dunnage packaging Market?

The increasing urban population contributes to the growth in demand for products, such as automotive goods, FMCG, and other consumer durables, that use dunnage packaging. In APAC, the population shift from rural to urban areas has elevated the growth rate even further. According to the United Nations Population Division, the total population of the region is projected to reach 5.1 billion by 2050, with the urban population accounting for at least 64%.

How is dunnage packaging different from others?

One of the key factors driving the dunnage packaging industry is the shape of the pack, which is optimized to help save cargo space without compromising on the protection of the product packed inside. Companies are investing in R&D in order to manufacture innovative and better-performing packaging solutions. Dunnage packaging systems offer the benefit of saving on transportation costs as they are lightweight and stackable, thereby eliminating wastage of space.

What are the driving factors of the dunnage packaging market?

The high optimization of pack size, various benefits of dunnage packaging, strong demand for dunnage packaging from end-use industries, and increasing urban population act as the driving factors for the market.

Why dunnage packaging is an expensive process?

The manufacturing of dunnage packaging is a capital-intensive process, with the initial capital involved in the setting up of a product manufacturing plant being high. Rapid technological innovations have led to the development of highly advanced equipment, which is expensive to buy. Players with high investment capabilities enter the market, as returns are high only in the long term. Therefore, product manufacturing becomes difficult for small manufacturers and new entrants. The demands of customers with respect to shapes, sizes, and materials used also differ. This means that production lines need to be fully equipped to produce dunnage packaging products according to different specifications. Small manufacturers fail to achieve the cost-benefit ratio in the long run as they do not possess the initial investment capacity.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Units Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 25)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.2 Market Size Estimation

2.2.1.1 Bottom-Up Approach

2.2.1.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 37)

4.1 Attractive Opportunities in the Dunnage Packaging Market

4.2 Dunnage Packaging Market, By Material, and Region

4.3 Dunnage Packaging Market, By Material

4.4 Dunnage Packaging Market, By End-Use Industry

4.5 Dunnage Packaging Market, By Country

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Urban Population

5.2.1.2 Strong Demand for Dunnage Packaging From End-Use Industries

5.2.1.3 Benefits of Dunnage Packaging

5.2.1.4 High Optimization in Pack Size

5.2.2 Restraints

5.2.2.1 Small Manufacturers and New Entrants Face Difficulty While Investing in Highly Advanced Equipment

5.2.3 Opportunities

5.2.3.1 Emerging Economies

5.2.3.2 Increasing R&D Investments

5.2.4 Challenges

5.2.4.1 Varying Environmental Mandates Across Regions

5.2.4.2 Challenges in the Management of the Packaging Supply Chain

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Threat of New Entrants

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Dunnage Packaging Market, By Material (Page No. - 48)

6.1 Introduction

6.2 Corrugated Plastic

6.2.1 Corrugated Plastic to Hold the Largest Market Share Through 2024

6.3 Molded Plastic

6.3.1 Molded Plastic Can Fit the Exact Panel Or Part and is Therefore Preferred Widely for Dunnage Packaging

6.4 Aluminum

6.4.1 Superior Properties of Aluminum Contribute Toward Its Higher Share Than Steel Material

6.5 Steel

6.5.1 Steel is A Non-Toxic Material, Which is Ideal for Food & Beverage Packaging

6.6 Fabric Dunnage

6.6.1 Fabric Dunnage Material Saves Space While Packaging of the Components

6.7 Corrugated Paper

6.7.1 Corrugated Paper has Outstanding Load Stabilizing Capacity That Creates Demand From Various End-Use Industries

6.8 Wood

6.8.1 Wood to Grow at the Highest Cagr, in Terms of Volume

6.9 Foams

6.9.1 Increased Demand for Fragile Products to Drive the Foam Packaging Market

6.1 Others

7 Dunnage Packaging Market, By End-Use Industry (Page No. - 62)

7.1 Introduction

7.2 Automotive

7.2.1 Automotive Industry to Lead the Demand for Dunnage Packaging

7.3 Aerospace

7.3.1 The Demand for Class A Dunnage Packaging Materials to Drive the Demand in the Aerospace End-Use Industry

7.4 Electronics

7.4.1 Demand From Electronics Industry has Increased for Specific Dunnage Packaging

7.5 Food & Beverage

7.5.1 Rising Demand for Innovative Packaging Technologies to Drive the Market in the Food & Beverage Industry

7.6 Consumer Durables

7.6.1 Rising Demand for Safe and Secure Packaging to Drive the Market in Consumer Durables

7.7 Healthcare

7.7.1 Increasing Need for Additional Level of Protection in Healthcare Products to Boost the Dunnage Packaging Market in Healthcare End-Use Industry

7.8 Others

7.8.1 Dunnage Packaging Plays an Important Role in the Supply Chain of Construction Products

8 Dunnage Packaging Market, By Region (Page No. - 73)

8.1 Introduction

8.2 Europe

8.2.1 Germany

8.2.1.1 Germany to Dominate the Dunnage Packaging Market in Europe

8.2.2 France

8.2.2.1 France to Be the Third-Largest Market for Dunnage Packaging in Europe

8.2.3 UK

8.2.3.1 Increasing Demand for Sustainable Packaging From the Food & Beverage Industry to Support the Growth of the Dunnage Packaging Market in the UK

8.2.4 Spain

8.2.4.1 Demand for Industrial Bulk Containers is Expected to Increase at A Faster Pace in Spain, in Terms of Value

8.2.5 Russia

8.2.5.1 Stringent Government Regulations Regarding Sustainability to Boost the Dunnage Packaging Market in Russia

8.2.6 Rest of Europe

8.2.6.1 Corrugated Plastic to Remain the Largest Segment of the Dunnage Packaging Market in Rest of Europe

8.3 North America

8.3.1 US

8.3.1.1 The US is the Largest Market for Dunnage Packaging, Globally

8.3.2 Canada

8.3.2.1 Favorable Free Trade Agreements and Growing Automotive Industry to Support the Canadian Dunnage Packaging Market

8.3.3 Mexico

8.3.3.1 Rapidly Growing End-Use Industries to Drive the Dunnage Packaging Market in Mexico

8.4 APAC

8.4.1 China

8.4.1.1 High Growth Prospects Exist in the Country’s E-Commerce Industry for the Dunnage Packaging Market

8.4.2 Japan

8.4.2.1 the Automotive Industry is A Major Driver for the Market

8.4.3 Australia

8.4.3.1 Increasing Food Manufacturing Activities are Likely to Boost the Market

8.4.4 India

8.4.4.1 The Growing Spending Capacity of the Population is Impacting the Market, Positively

8.4.5 Rest of APAC

8.5 MEA

8.5.1 UAE

8.5.1.1 As The Second-Largest Automotive Market in Gcc, the UAE is A Significant Market for Dunnage Packaging

8.5.2 Saudi Arabia

8.5.2.1 The Extensive Use of Convenient and Durable Packaging Across All the End-Use Segments is Fueling the Market

8.5.3 Turkey

8.5.3.1 The Increasing Demand for Fmcg is Helping the Growth of the Market

8.5.4 South Africa

8.5.4.1 Growing Industrialization and Urbanization are Supporting the Growth of the Dunnage Packaging Market

8.5.5 Rest of MEA

8.6 South America

8.6.1 Brazil

8.6.1.1 Government’s Plans for the Development of the Manufacturing Sector are Likely to Propel the Market

8.6.2 Argentina

8.6.2.1 The Growing Fmcg and Automotive Industries are Boosting the Market in Argentina

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 145)

9.1 Introduction

9.2 Competitive Leadership Mapping

9.2.1 Visionary Leaders

9.2.2 Dynamic Differentiators

9.2.3 Emerging Companies

9.2.4 Innovators

9.3 Strength of Product Portfolio

9.4 Business Strategy Excellence

9.5 Market Ranking of Key Players, 2018

9.6 Competitive Scenario

9.6.1 Expansion

9.6.2 Acquisition

9.6.3 Agreement

9.6.4 Investment

9.6.5 Divestment

10 Company Profiles (Page No. - 153)

10.1 DS Smith

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.2 Menasha Corporation

10.3 Schoeller Allibert

10.4 Myers Industries

10.5 Nefab Group

10.6 UFP Technologies

10.7 Reusable Transport Packaging

10.8 Amatech Inc.

10.9 Mjsolpac Ltd.

10.10 Rehrig Pacific Company

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

10.11 Other Players

10.11.1 Ckdpack Packaging Inc.

10.11.2 Gwp Group

10.11.3 Interior Packaging Design, LLC

10.11.4 Packaging Corporation of America

10.11.5 Dunnage Engineering

10.11.6 Salco Engineering & Mfg.

10.11.7 Package Design & Manufacturing

10.11.8 Keener Corporation

10.11.9 Jida Industrial Solutions

10.11.10 Artisanz Fabrication and Machine, LLC

11 Appendix (Page No. - 175)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (172 Tables)

Table 1 APAC Urbanization Prospects

Table 2 Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 3 Market Size, By Material, 2017–2024 (Million Unit)

Table 4 Corrugated Plastic Dunnage Packaging Market Size, By Region, 2017–2024 (USD Million)

Table 5 Corrugated Plastic Dunnage Packaging Market Size, By Region, 2017–2024 (Million Unit)

Table 6 Molded Plastic Dunnage Packaging Market Size, By Region, 2017–2024 (USD Million)

Table 7 Molded Plastic Dunnage Packaging Market Size, By Region, 2017–2024 (Million Unit)

Table 8 Aluminum Dunnage Packaging Market Size, By Region, 2017–2024 (USD Million)

Table 9 Aluminum Dunnage Packaging Market Size, By Region, 2017–2024 (Million Unit)

Table 10 Steel Dunnage Packaging Market Size, By Region, 2017–2024 (USD Million)

Table 11 Steel Dunnage Packaging Market Size, By Region, 2017–2024 (Million Unit)

Table 12 Fabric Dunnage Packaging Market Size, By Region, 2017–2024 (USD Million)

Table 13 Fabric Dunnage Packaging Market Size, By Region, 2017–2024 (Million Unit)

Table 14 Corrugated Paper Dunnage Packaging Market Size, By Region, 2017–2024 (USD Million)

Table 15 Corrugated Paper Dunnage Packaging Market Size, By Region, 2017–2024 (Million Unit)

Table 16 Wood Dunnage Packaging Market Size, By Region, 2017–2024 (USD Million)

Table 17 Wood Dunnage Packaging Market Size, By Region, 2017–2024 (Million Unit)

Table 18 Foam Dunnage Packaging Market Size, By Region, 2017–2024 (USD Million)

Table 19 Foam Dunnage Packaging Market Size, By Region, 2017–2024 (Million Unit)

Table 20 Other Dunnage Packaging Materials Market Size, By Region, 2017–2024 (USD Million)

Table 21 Other Dunnage Packaging Materials Market Size, By Region, 2017–2024 (Million Unit)

Table 22 Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 23 Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 24 Market Size in Automotive Industry, By Region, 2017–2024 (USD Million)

Table 25 Market Size in Automotive Industry, By Region, 2017–2024 (Million Unit)

Table 26 Market Size in Aerospace Industry, By Region, 2017–2024 (USD Million)

Table 27 Market Size in Aerospace Industry, By Region, 2017–2024 (Million Unit)

Table 28 Market Size in Electronics Industry, By Region, 2017–2024 (USD Million)

Table 29 Market Size in Electronics Industry, By Region, 2017–2024 (Million Unit)

Table 30 Market Size in Food & Beverage Industry, By Region, 2017–2024 (USD Million)

Table 31 Market Size in Food & Beverage Industry, By Region, 2017–2024 (Million Unit)

Table 32 Market Size in Consumer Durables Industry, By Region, 2017–2024 (USD Million)

Table 33 Market Size in Consumer Durables Industry, By Region, 2017–2024 (Million Unit)

Table 34 Market Size in Healthcare Industry, By Region, 2017–2024 (USD Million)

Table 35 Market Size in Healthcare Industry, By Region, 2017–2024 (Million Unit)

Table 36 Market Size in Other Industries, By Region, 2017–2024 (USD Million)

Table 37 Market Size in Other Industries, By Region, 2017–2024 (Million Unit)

Table 38 Market Size, By Region, 2017–2024 (USD Million)

Table 39 Market Size, By Region, 2017–2024 (Million Unit)

Table 40 Europe: Dunnage Packaging Market Size, By Country, 2017–2024 (USD Million)

Table 41 Europe: Market Size, By Country, 2017–2024 (Million Unit)

Table 42 Europe: Market Size, By Material, 2017–2024 (USD Million)

Table 43 Europe: Market Size, By Material, 2017–2024 (Million Unit)

Table 44 Europe: Market Size, By Class A Application, 2017–2024 (USD Million)

Table 45 Europe: Market Size, By Class A Application, 2017–2024 (Thousand Unit)

Table 46 Europe: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 47 Europe: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 48 Germany: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 49 Germany: Market Size, By Material, 2017–2024 (Million Unit)

Table 50 Germany: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 51 Germany: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 52 France: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 53 France: Market Size, By Material, 2017–2024 (Million Unit)

Table 54 France: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 55 France: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 56 UK: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 57 UK: Market Size, By Material, 2017–2024 (Million Unit)

Table 58 UK: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 59 UK: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 60 Spain: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 61 Spain: Market Size, By Material, 2017–2024 (Million Unit)

Table 62 Spain: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 63 Spain: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 64 Russia: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 65 Russia: Market Size, By Material, 2017–2024 (Million Unit)

Table 66 Russia: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 67 Russia: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 68 Rest of Europe: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 69 Rest of Europe: Market Size, By Material, 2017–2024 (Million Unit)

Table 70 Rest of Europe: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 71 Rest of Europe: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 72 North America: Dunnage Packaging Market Size, By Country, 2017–2024 (USD Million)

Table 73 North America: Market Size, By Country, 2017–2024 (Million Unit)

Table 74 North America: Market Size, By Material, 2017–2024 (USD Million)

Table 75 North America: Market Size, By Material, 2017–2024 (Million Unit)

Table 76 North America: Market Size, By Class A Application, 2017–2024 (USD Million)

Table 77 North America: Market Size, By Class A Application, 2017–2024 (Thousand Unit)

Table 78 North America: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 79 North America: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 80 US: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 81 US: Market Size, By Material, 2017–2024 (Million Unit)

Table 82 US: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 83 US: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 84 Canada: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 85 Canada: Market Size, By Material, 2017–2024 (Million Unit)

Table 86 Canada: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 87 Canada: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 88 Mexico: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 89 Mexico: Market Size, By Material, 2017–2024 (Million Unit)

Table 90 Mexico: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 91 Mexico: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 92 APAC: Dunnage Packaging Market Size, By Country, 2017–2024 (USD Million)

Table 93 APAC: Market Size, By Country, 2017–2024 (Million Unit)

Table 94 APAC: Market Size, By Material, 2017–2024 (USD Million)

Table 95 APAC: Market Size, By Material, 2017–2024 (Million Unit)

Table 96 APAC: Market Size, By Class A Application, 2017–2024 (USD Million)

Table 97 APAC: Market Size, By Class A Application, 2017–2024 (Thousand Unit)

Table 98 APAC: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 99 APAC: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 100 China: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 101 China: Market Size, By Material, 2017–2024 (Million Unit)

Table 102 China: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 103 China: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 104 Japan: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 105 Japan: Market Size, By Material, 2017–2024 (Million Unit)

Table 106 Japan: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 107 Japan: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 108 Australia: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 109 Australia: Market Size, By Material, 2017–2024 (Million Unit)

Table 110 Australia: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 111 Australia: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 112 India: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 113 India: Market Size, By Material, 2017–2024 (Million Unit)

Table 114 India: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 115 India: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 116 Rest of APAC: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 117 Rest of APAC: Market Size, By Material, 2017–2024 (Million Unit)

Table 118 Rest of APAC: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 119 Rest of APAC: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 120 MEA: Dunnage Packaging Market Size, By Country, 2017–2024 (USD Million)

Table 121 MEA: Market Size, By Country, 2017–2024 (Million Unit)

Table 122 MEA: Market Size, By Material, 2017–2024 (USD Million)

Table 123 MEA: Market Size, By Material, 2017–2024 (Million Unit)

Table 124 MEA: Market Size, By Class A Application, 2017–2024 (USD Million)

Table 125 MEA: Market Size, By Class A Application, 2017–2024 (Million Unit)

Table 126 MEA: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 127 MEA: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 128 UAE: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 129 UAE: Market Size, By Material, 2017–2024 (Million Unit)

Table 130 UAE: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 131 UAE: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 132 Saudi Arabia: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 133 Saudi Arabia: Market Size, By Material, 2017–2024 (Million Unit)

Table 134 Saudi Arabia: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 135 Saudi Arabia: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 136 Turkey: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 137 Turkey: Market Size, By Material, 2017–2024 (Million Unit)

Table 138 Turkey: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 139 Turkey: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 140 South Africa: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 141 South Africa: Market Size, By Material, 2017–2024 (Million Unit)

Table 142 South Africa: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 143 South Africa: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 144 Rest of MEA: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 145 Rest of MEA: Market Size, By Material, 2017–2024 (Million Unit)

Table 146 Rest of MEA: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 147 Rest of MEA: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 148 South America: Dunnage Packaging Market Size, By Country, 2017–2024 (USD Million)

Table 149 South America: Market Size, By Country, 2017–2024 (Million Unit)

Table 150 South America: Market Size, By Material, 2017–2024 (USD Million)

Table 151 South America: Market Size, By Material, 2017–2024 (Million Unit)

Table 152 South America: Market Size, By Class A Application, 2017–2024 (USD Million)

Table 153 South America: Market Size, By Class A Application, 2017–2024 (Million Unit)

Table 154 South America: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 155 South America: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 156 Brazil: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 157 Brazil: Market Size, By Material, 2017–2024 (Million Unit)

Table 158 Brazil: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 159 Brazil: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 160 Argentina: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 161 Argentina: Market Size, By Material, 2017–2024 (Million Unit)

Table 162 Argentina: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 163 Argentina: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 164 Rest of South America: Dunnage Packaging Market Size, By Material, 2017–2024 (USD Million)

Table 165 Rest of South America: Market Size, By Material, 2017–2024 (Million Unit)

Table 166 Rest of South America: Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 167 Rest of South America: Market Size, By End-Use Industry, 2017–2024 (Million Unit)

Table 168 Expansions, 2016–2019

Table 169 Acquisitions, 2016–2019

Table 170 Agreements, 2016-2019

Table 171 Investments, 2016–2019

Table 172 Divestments, 2016-2019

List of Figures (34 Figures)

Figure 1 Dunnage Packaging Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 The Following Methodology for “Supply-Side” Sizing of the Dunnage Packaging has Been Used

Figure 5 Dunnage Packaging Market: Data Triangulation

Figure 6 Corrugated Plastic Segment to Lead the Market of Dunnage Packaging

Figure 7 Automotive Industry Led the Market of Dunnage Packaging in 2018

Figure 8 Europe Led the Market of Dunnage Packaging in 2018

Figure 9 US to Be the Largest Market of Dunnage Packaging

Figure 10 Increasing Demand for Dunnage Packaging From Various End-Use Industries to Drive the Market

Figure 11 Europe Was the Largest Market for Dunnage Packaging in 2018

Figure 12 Corrugated Plastic Segment to Lead the Market of Dunnage Packaging During the Forecast Period

Figure 13 Electronics Segment to Grow at the Highest Rate From 2019 to 2024

Figure 14 Dunnage Packaging Market in China to Grow at the Highest Cagr Between 2019 and 2024

Figure 15 Drivers, Restraints, Opportunities, and Challenges in the Dunnage Packaging Market

Figure 16 Dunnage Packaging Market: Porter’s Five Forces Analysis

Figure 17 Corrugated Plastic to Be Widely Used Material for Dunnage Packaging

Figure 18 Automotive End-Use Industry to Account for Largest Market Share in the Dunnage Packaging

Figure 19 APAC to Register Highest Cagr in the Automotive End-Use Industry

Figure 20 China to Register the Highest Growth Rate Between 2019 and 2024

Figure 21 Europe: Dunnage Packaging Market Snapshot

Figure 22 North America: Dunnage Packaging Market Snapshot

Figure 23 APAC: Dunnage Packaging Market Snapshot

Figure 24 Merger & Acquisition is the Key Growth Strategy Adopted Between 2016 and 2019

Figure 25 Dunnage Packaging Market: Competitive Leadership Mapping, 2018

Figure 26 DS Smith: Company Snapshot

Figure 27 DS Smith: SWOT Analysis

Figure 28 Menasha Corporation: SWOT Analysis

Figure 29 Schoeller Allibert: Company Snapshot

Figure 30 Schoeller Allibert: SWOT Analysis

Figure 31 Myers Industries: Company Snapshot

Figure 32 Myers Industries: SWOT Analysis

Figure 33 Nefab Group: SWOT Analysis

Figure 34 UFP Technologies: Company Snapshot

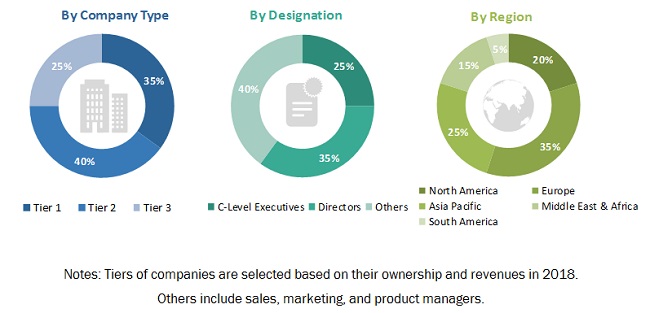

The study involved four major activities in estimating the current dunnage packaging market size. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the size of market segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The dunnage packaging market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of various industry sectors such as building, and infrastructure. Advancements in technology across diverse applications characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total dunnage packaging market size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation process, as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in end-use industries.

Objectives of the Report

- To define, describe, and forecast the market size of dunnage packaging, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To provide detailed information about the technological advancements influencing the growth of the market

- To forecast the market based on the material, and end-use industries

- To define, describe, and forecast the market based on five regions, namely, North America, Europe, Asia Pacific (APAC), MEA and South America

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze recent developments such as expansion, investment, agreement, acquisition, and divestment in the market

- To strategically profile the key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of North America dunnage packaging market

- Further breakdown of Rest of Europe dunnage packaging market

- Further breakdown of the Rest of Asia Pacific dunnage packaging market

- Further breakdown of MEA Others dunnage packaging market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Dunnage Packaging Market