Industrial Packaging Market by Product type, Material (Paperboard, Plastic, Wood, Metal), Application (Food & Beverage, Building & Construction, Pharmaceutical, Chemical, Automotive, Oil & Lubricant) and Region - Global Forecast to 2025

Updated on : March 21, 2024

Industrial Packaging Market

The Industrial Packaging Market size was valued at USD 58.8 billion in 2020 and is projected to reach USD 72.6 billion by 2025, growing at 4.3% cagr from 2020 to 2025. The market is expected to witness significant growth in the future due to its increased demand in end-use industries, such as food & beverage and pharmaceutical. Growth in modern retailing, high consumer income, and acceleration in industrial activities, especially in the emerging economies, are likely to support the growth of the market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global industrial packaging market

The global industrial packaging market is expected to witness a moderate decrease in its growth rate in 2020-2021, as the bulk packaging for chemicals, agriculture, construction amongst other applications, will witness a significant decline in its demand. However, there will be an increase in the demand for industrial packaging solutions for food & beverage and pharmaceutical applications, during COVID-19.

- People are resorting to panic-buying and bulk stocking due to the fear of lockdowns. More people are ordering daily staples and fresh food through online channels, which leads to an increase in the demand for bulk industrial packaging solutions. Governments of many affected countries, for instance, India, have asked the food industry players to ramp up production to avoid supply-side shocks and shortages and maintain uninterrupted supply. FMCG companies are responding by demanding more of industrial packaging products. For example, Britannia Industries has urged the Indian government to ensure interstate movements of suppliers of raw materials and packaging materials.

- The demand for industrial packaging in the pharmaceutical industry, is expected to remain robust as hospitals, drugs, and PPE manufacturers are responding to the crisis. The demand for household essentials, healthcare, and medical goods is not expected to decrease dramatically, and retail distribution for these types of products through online delivery can be expected to increase. This in turn, boosts the demand for industrial packaging solutions for the timely delivery of raw materials and finished goods to their respective end users.

Industrial Packaging Market Dynamics

Driver: Increased demand for industrial packaging from chemical and construction industry

The increased production in many industries and trade of products, such as chemicals and petroleum products, have boosted the demand for bulk packaging and crates/totes. Industrial packaging companies cater to various end-use industries, such as building & construction and chemical. The growing trade among countries and the safe transportation of products lead to an increased demand for effective industrial packaging from these industries. The rise in demand from the chemicals and petroleum industries is a major growth driver of the industrial packaging market.

Restraint: Volatility in raw materials prices

Crude oil and natural gas are the major sources of naphtha and ethylene, which are the basic materials used to manufacture polypropylene. The polypropylene market and manufacturers have been facing challenges in areas, such as the supply of raw material, and fluctuation in demand and pricing volatility. Owing to an increase in the cost of raw materials, vendors increase the price of their products or reduce their profit margins, which will have an adverse effect on market growth.

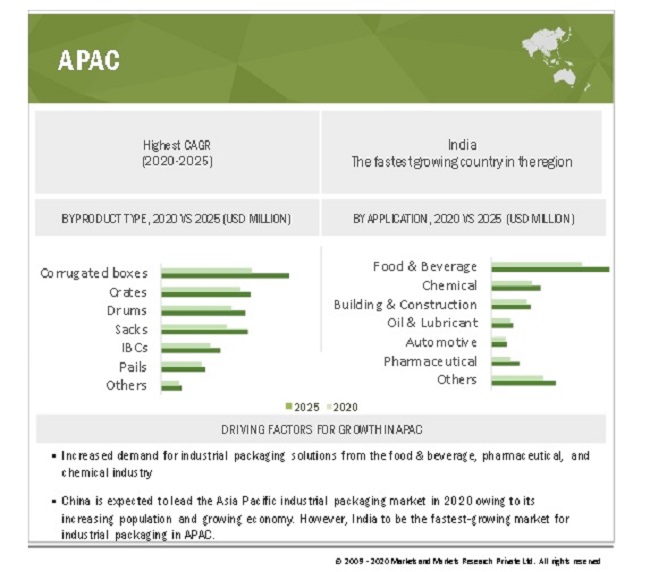

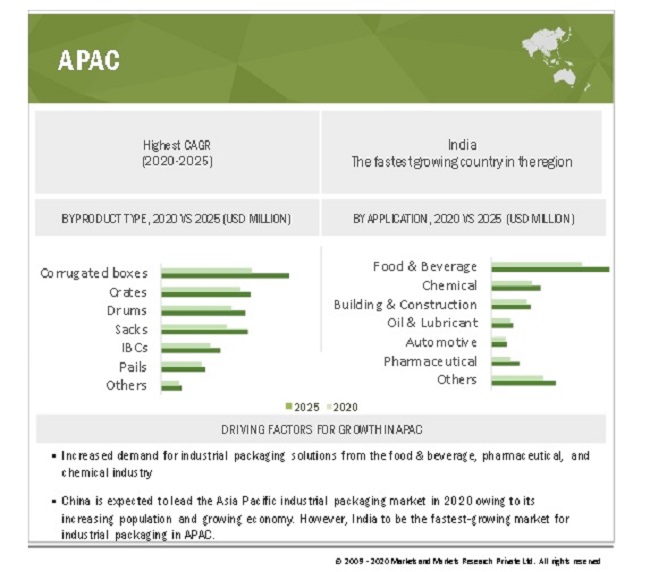

Opportunity: Rising demand for industrial packaging from APAC region

The industrial packaging market in APAC is expected to witness tremendous growth during the forecast period because of the growing population and the rise in currency rates. Growth in the market has come in the backdrop of strong production and consumption of bulk packaging products from economies, such as China and India, which have been witnessing stable demand from major consuming countries. Apart from leading countries (which include China and India), there is high market growth in other countries, including Singapore, Hong Kong, and New Zealand, due to the efficient labor market, excellent infrastructure, and a good transportation system. Grain mill products and vegetables will drive the food industry in industrial packaging in APAC during the forecast period. The growth in these sectors in the emerging economies will lead to considerable demand for packaging sacks.

Challenge: Recycling & environmental concerns associated with industrial packaging

According to the World Economic Forum, every year, at least 8 million tons of plastic leaks into the ocean, which is equivalent to dumping the contents of one garbage truck into the ocean every minute. This is expected to increase to two per minute by 2030 and four per minute by 2050, which can destroy the ecosystem. About 90% of all the trash in the oceans is from plastic. Estimates suggest that industrial packaging represents the major share. Hence, recycling becomes a major challenge in the industrial packaging industry, which provides re-use value, and results in lower wastage.

Corrugated boxes widely preferred for industrial packaging

Based on product type, the corrugated boxes segment is projected to be the largest market for industrial packaging. The dominant market position of the segment can be attributed to the increase in the demand for these product type across various applications in food & beverage, pharmaceutical and automotive industries. The increase in the demand for corrugated boxes can be attributed to the rise in the demand for lightweight and convenient packaging solutions.

Significant increase in the food & beverage products during COVID-19 pandemic

By application, the food & beverage segment is projected to be the largest segment in the industrial packaging market. People are resorting to panic-buying and bulk stocking due to the fear of lockdowns. More people are ordering daily staples, FMCG and fresh food through e-commerce & online channels, which leads to an increase in the demand for bulk industrial packaging solutions. This in turn, boost the demand for industrial packaging solutions for food & beverage application.

APAC region to lead the global industrial packaging market by 2025

The APAC region accounted for the largest market share in 2019. Factors such as improving global economy, expanding working population, rising domestic demand for ready-to-eat & convinence food products are expected to boost the market for industrial packaging. The market for industrial packaging in APAC is growing in the afood, automotive, chemical, pharmaceutical, and construction industries due to the functional properties offered by industrial packaging, such as safety, cost-effectiveness, durability, strength, lightweight, environmental-friendliness, and logistical convenience.

To know about the assumptions considered for the study, download the pdf brochure

Industrial Packaging Market Players

The industrial packaging market is dominated by a few globally established players, such as Greif Inc. (US), Amcor (Australia), Berry Global Inc. (US), Mondi (South Africa), Sonoco (US), International Paper (US), Orora Limited (Australia), and Sigma Plastics Group (US), among many others.

Industrial Packaging Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 58.8 billion |

|

Revenue Forecast in 2025 |

USD 72.6 billion |

|

CAGR |

4.3% |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) and Volume (Million Unit) |

|

Segments covered |

Product Type, Material, Application and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies covered |

Greif Inc. (US), Amcor (Australia), Berry Global Inc. (US), Mondi (South Africa), Sonoco (US), International Paper (US), Orora Limited (Australia), Sigma Plastics Group (US), and Mauser Packaging Solutions (Germany) |

This research report categorizes the industrial packaging market based on product type, material, application and region.

On the basis of product type:

- Drums

- IBCs

- Sacks

- Crates

- Pails

- Corrugated boxes

- Others (includes pallets, wrap films, wrapping strips, and flexible packaging materials)

On the basis of material:

- Plastic

- Wood

- Metal

- Paperboard

On the basis of application:

- Food & beverage

- Automotive

- Pharmaceutical

- Chemical

- Oil & Lubricant

- Building & Construction

- Others (includes rubber & plastic, agricultural, and metal fabrication)

On the basis of region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In September 2020, Mauser Packaging Solutions acquired EuroVeneta Fusti, through Joint Venture NCG-Maider in Italy. This acquisition is expected to expand the company’s presence in Italy, and extend the offering of current plastic industrial packaging as well as steel drum packaging and reconditioning IBC services within the Italian market.

- In July 2020, Mauser Packaging Solutions has introduced a new 1-piece consumer pack. The 1-Piece Consumer Pack is ideal for use in industries, such as home care, candy and confection, pool care, and food products. An attached, tamper-evident, hinged lid provides end-users with easy and full access to tub contents, allowing them to quickly grab contents and close the lid in one quick click. Furthermore, post its use, the package is 100% recyclable or can be reused by the consumer.

- In April 2020, Greif, Inc. acquired a minority stake in Centurion Container LLC to expand its intermediate bulk container (IBC) reconditioning network in North America. The investment in Centurion Container LLC is expected to enhance the company’s IBC and IBC reconditioning businesses.

- In 2020, Saeplast, a brand of Berry Global, launched a new model into its wet storage container range, designed for the handling of live shellfish, including oysters, clams and mussels. The Saeplast DWS352 provides a complete system that enables the container to be used for harvesting on the water, shipping to the factory, purging and purification of the contents, and subsequent storage. The new container has already been adopted by family run oyster farm Bill and Stanley Oyster Co, based in Nova Scotia, Canada.

Frequently Asked Questions (FAQ):

What is the current size of global industrial packaging market?

The global industrial packaging market size is projected to grow from USD 58.8 billion in 2020 to USD 72.6 billion by 2025, at a CAGR of 4.30% from 2020 to 2025.

How is the industrial packaging market aligned?

The industrial packaging market is highly fragmented, and has a large number of global, regional and domestic players who have a very strong presence in the market. These players have strong and well-established procurement and distribution networks, which help in cost-efficient production.

Who are the key players in the global industrial packaging market?

The key players operating in the industrial packaging market are Greif Inc. (US), Amcor (Australia), Berry Global Inc. (US), Mondi (South Africa), Sonoco (US), International Paper (US), Orora Limited (Australia), Sigma Plastics Group (US), and Mauser Packaging Solutions (Germany).

What are the latest ongoing trends in the industrial packaging market?

The players operating in the industrial packaging market aim to offer a low-cost, sustainable, and environmentally friendly, owing to a shift in trend (use of lightweight, and recycled materials for the industrial packaging) among the end-users who are engaged in the production of food & beverage, pharmaceutical, building & construction, automotive, and chemical products. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.3.2 REGIONS COVERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

2.2 MARKET SIZE ESTIMATION

2.3 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 30)

4 PREMIUM INSIGHTS (Page No. - 34)

4.1 EMERGING ECONOMIES TO WITNESS A RELATIVELY HIGHER DEMAND FOR INDUSTRIAL PACKAGING

4.2 APAC: INDUSTRIAL PACKAGING MARKET, BY APPLICATION AND COUNTRY

4.3 INDUSTRIAL PACKAGING MARKET, BY PRODUCT TYPE

4.4 INDUSTRIAL PACKAGING MARKET, BY APPLICATION

4.5 INDUSTRIAL PACKAGING MARKET, BY COUNTRY

5 MARKET OVERVIEW (Page No. - 37)

5.1 INTRODUCTION

5.2 EVOLUTION

5.3 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Increasing demand for plastic sacks

5.3.1.2 Rise in demand for industrial packaging from construction and chemical industries

5.3.1.3 High optimization in pack size

5.3.2 RESTRAINTS

5.3.2.1 Low ultra-violet resistance of FIBCs

5.3.2.2 Volatility in raw material prices

5.3.2.3 Stringent packaging regulations

5.3.3 OPPORTUNITIES

5.3.3.1 Globalization and international trade

5.3.3.2 Rising demand for industrial packaging from APAC region

5.3.3.3 Rise in product innovation for industrial packaging

5.3.4 CHALLENGES

5.3.4.1 Pricing pressure for small manufacturers

5.3.4.2 Recycling and environmental concerns associated with industrial packaging

6 YC-YCC DRIVERS (Page No. - 44)

6.1 USAGE OF BIODEGRADABLE ALTERNATIVES

6.2 ADOPTION OF FLEET MANAGEMENT

6.3 INCREASED DEMAND FOR CUSTOMIZATION

6.4 RESURGENCE IN DEMAND FOR MATERIAL HANDLING CONTAINERS

7 INDUSTRY TRENDS (Page No. - 47)

7.1 INTRODUCTION

7.2 VALUE CHAIN ANALYSIS

7.2.1 VALUE CHAIN ANALYSIS

7.2.2 PROMINENT COMPANIES

7.2.3 SMALL & MEDIUM ENTERPRISES

7.3 PORTER'S FIVE FORCES ANALYSIS

7.3.1 THREAT OF NEW ENTRANTS

7.3.2 THREAT OF SUBSTITUTES

7.3.3 BARGAINING POWER OF SUPPLIERS

7.3.4 BARGAINING POWER OF BUYERS

7.3.5 INTENSITY OF COMPETITIVE RIVALRY

8 COVID-19 IMPACT ON INDUSTRIAL PACKAGING MARKET (Page No. - 52)

8.1 COVID-19 IMPACT ON INDUSTRIAL PACKAGING END-USE APPLICATIONS

9 INDUSTRIAL PACKAGING MARKET, BY PRODUCT TYPE (Page No. - 54)

9.1 INTRODUCTION

9.2 DRUMS

9.2.1 DRUMS OFFERS REUSE AND RE-CONDITIONED OPTIONS TO THE END-USE INDUSTRIES

9.3 IBC

9.3.1 REUSABLE INDUSTRIAL CONTAINER FOR TRANSPORT AND STORAGE OF BULK LIQUID AND GRANULATED SUBSTANCES

9.4 SACKS

9.4.1 CONSTRUCTION INDUSTRY CONTRIBUTES TO THE LARGEST DEMAND FOR PACKAGING SACKS

9.5 PAILS

9.5.1 PLASTIC PAILS ARE AN EXCELLENT CHOICE FOR CHEMICAL APPLICATION

9.6 CRATES

9.6.1 PLASTIC CRATES TO BE WIDELY PREFERRED FOR SHIPPING HEAVY GOODS

9.7 CORRUGATED BOXES

9.7.1 CORRUGATED BOXES LED THE INDUSTRIAL PACKAGING MARKET IN 2020

9.8 OTHERS

10 INDUSTRIAL PACKAGING MARKET, BY MATERIAL (Page No. - 60)

10.1 INTRODUCTION

10.2 PLASTIC

10.2.1 PLASTIC TO BE THE LARGELY USED MATERIAL FOR INDUSTRIAL PACKAGING

10.3 METAL

10.3.1 MANUFACTURERS AIM TO PRODUCE LIGHTWEIGHT AND RECYCLED METAL-BASED INDUSTRIAL PACKAGING SOLUTIONS

10.4 WOOD

10.4.1 WOODEN CRATES AND CASES ARE AN IDEAL CHOICE FOR SHIPPING LIGHTWEIGHT OR BREAKABLE ITEMS

10.5 PAPERBOARD

10.5.1 FIBER DRUMS TO BE THE WIDELY USED PAPER-BASED PACKAGING PRODUCTS FOR INDUSTRIAL APPLICATION

11 INDUSTRIAL PACKAGING MARKET, BY APPLICATION (Page No. - 64)

11.1 INTRODUCTION

11.2 CHEMICAL

11.2.1 CHEMICAL INDUSTRY HAS WITNESSED RAPID GROWTH FOR MORE THAN FIFTY YEARS

11.3 PHARMACEUTICAL

11.3.1 PHARMACEUTICAL TO BE THE FASTEST-GROWING APPLICATION FOR INDUSTRIAL PACKAGING BY 2025

11.4 BUILDING & CONSTRUCTION

11.4.1 BUILDING & CONSTRUCTION TO BE THE LARGEST CONSUMER OF PLASTIC BULK PACKAGING SOLUTIONS

11.5 FOOD & BEVERAGE

11.5.1 FOOD & BEVERAGE TO DOMINATE THE INDUSTRIAL PACKAGING MARKET BY 2025

11.6 OIL & LUBRICANT

11.6.1 OIL & GAS COMPANIES SWITCHING TO ENVIRONMENT-FRIENDLY AND BIODEGRADABLE PACKAGING SOLUTIONS

11.7 AUTOMOTIVE

11.7.1 LIGHTWEIGHT INDUSTRIAL PACKAGING TO BE HIGHLY PREFERRED FOR AUTOMOTIVE APPLICATIONS

11.8 OTHERS

12 INDUSTRIAL PACKAGING MARKET, BY REGION (Page No. - 69)

13.1 INTRODUCTION

13.2 APAC

13.2.1 CHINA

13.2.1.1 China to dominate the industrial packaging market in the region

13.2.2 JAPAN

13.2.2.1 Increase in the demand for foodstuffs to boost the need for industrial packaging

13.2.3 INDIA

13.2.3.1 Country to be the fastest-growing market globally for industrial packaging by 2025

13.2.4 AUSTRALIA

13.2.4.1 Export of construction commodities to drive the industrial packaging market

13.2.5 SOUTH KOREA

13.2.5.1 Increasing imports and exports to boost the market

13.2.6 REST OF APAC

13.3 EUROPE

13.3.1 GERMANY

13.3.1.1 Country to lead the industrial packaging market in the region

13.3.2 UK

13.3.2.1 Increase in construction spending to boost the market for industrial packaging

13.3.3 FRANCE

13.3.3.1 Growth in the demand for bulk packaging in automotive industry to boost the market in the country

13.3.4 RUSSIA

13.3.4.1 Increase in construction activities to drive the consumption of industrial packaging products in the country

13.3.5 ITALY

13.3.5.1 Significant boost in pharmaceutical industry to drive the demand for industrial packaging products

13.3.6 SPAIN

13.3.6.1 The largest market for manufacturing of industrial vehicles

13.3.7 REST OF EUROPE

13.4 NORTH AMERICA

13.4.1 US

13.4.1.1 US to lead the industrial packaging market in the region from 2020 to 2025

13.4.2 CANADA

13.4.2.1 Increasing government support to boost the manufacturing industry to accelerate the demand for industrial packaging

13.4.3 MEXICO

13.4.3.1 Country to be the fastest-growing industrial packaging market in the region

13.5 MIDDLE EAST & AFRICA

13.5.1 UAE

13.5.1.1 UAE to be the fastest-growing market for industrial packaging in the region

13.5.2 SAUDI ARABIA

13.5.2.1 Increasing construction activities to drive the market for industrial packaging in the country

13.5.3 SOUTH AFRICA

13.5.3.1 Increase in the number of healthcare units to boost the use of industrial packaging products

13.5.4 TURKEY

13.5.4.1 Turkey to dominate industrial packaging market in the region by 2025

13.5.5 REST OF MIDDLE EAST & AFRICA

13.6 SOUTH AMERICA

13.6.1 BRAZIL

13.6.1.1 Brazil to dominate the industrial packaging market in South America

13.6.2 ARGENTINA

13.6.2.1 Increased investment in infrastructure development to boost the demand for industrial packaging in the country

13.6.3 REST OF SOUTH AMERICA

14 COMPETITIVE LANDSCAPE (Page No. - 134)

14.1 OVERVIEW

14.2 MARKET RANKING

14.3 COMPETITIVE LEADERSHIP MAPPING

14.3.1 STAR

14.3.2 EMERGING LEADERS

14.3.3 PERVASIVE

14.3.4 EMERGING COMPANIES

14.4 STRENGTH OF PRODUCT PORTFOLIO

14.5 BUSINESS STRATEGY EXCELLENCE

14.6 COMPETITIVE SCENARIO

14.6.1 ACQUISITION

14.6.2 EXPANSION & INVESTMENT

14.6.3 NEW PRODUCT DEVELOPMENT

14.6.4 AGREEMENT

15 COMPANY PROFILES (Page No. - 145)

15.1 GREIF, INC.

15.1.1 BUSINESS OVERVIEW

15.1.2 FINANCIAL ASSESSMENT

15.1.3 OPERATIONAL ASSESSMENT

15.1.4 PRODUCTS OFFERED

15.1.5 RECENT DEVELOPMENTS

15.1.6 SWOT ANALYSIS

15.1.7 WINNING IMPERATIVES

15.1.8 CURRENT FOCUS AND STRATEGIES

15.1.9 THREAT FROM COMPETITION

15.1.10 RIGHT TO WIN

15.2 SONOCO

15.2.1 BUSINESS OVERVIEW

15.2.2 FINANCIAL ASSESSMENT

15.2.3 OPERATIONAL ASSESSMENT

15.2.4 PRODUCTS OFFERED

15.2.5 SWOT ANALYSIS

15.2.6 CURRENT FOCUS AND STRATEGIES

15.2.7 THREAT FROM COMPETITION

15.2.8 RIGHT TO WIN

15.3 BERRY GLOBAL INC.

15.3.1 BUSINESS OVERVIEW

15.3.2 FINANCIAL ASSESSMENT

15.3.3 OPERATIONAL ASSESSMENT

15.3.4 PRODUCTS OFFERED

15.3.5 RECENT DEVELOPMENTS

15.3.6 COVID-19 RELATED DEVELOPMENTS/STRATEGIES

15.3.7 SWOT ANALYSIS

15.3.8 WINNING IMPERATIVES

15.3.9 CURRENT FOCUS AND STRATEGIES

15.3.10 THREAT FROM COMPETITION

15.3.11 RIGHT TO WIN

15.4 AMCOR

15.4.1 BUSINESS OVERVIEW

15.4.2 FINANCIAL ASSESSMENT

15.4.3 OPERATIONAL ASSESSMENT

15.4.4 PRODUCTS OFFERED

15.4.5 RECENT DEVELOPMENTS

15.4.6 COVID-19 RELATED DEVELOPMENTS/STRATEGIES

15.4.7 SWOT ANALYSIS

15.4.8 CURRENT FOCUS AND STRATEGIES

15.4.9 THREAT FROM COMPETITION

15.4.10 RIGHT TO WIN

15.5 MONDI

15.5.1 BUSINESS OVERVIEW

15.5.2 FINANCIAL ASSESSMENT

15.5.3 OPERATIONAL ASSESSMENT

15.5.4 PRODUCTS OFFERED

15.5.5 RECENT DEVELOPMENTS

15.5.6 COVID-19 RELATED DEVELOPMENTS/STRATEGIES

15.5.7 SWOT ANALYSIS

15.5.8 CURRENT FOCUS AND STRATEGIES

15.5.9 THREAT FROM COMPETITION

15.5.10 RIGHT TO WIN

15.6 INTERNATIONAL PAPER

15.6.1 BUSINESS OVERVIEW

15.6.2 FINANCIAL ASSESSMENT

15.6.3 OPERATIONAL ASSESSMENT

15.6.4 PRODUCTS OFFERED

15.6.5 RECENT DEVELOPMENTS

15.6.6 COVID-19 RELATED STRATEGIES/ DEVELOPMENT

15.6.7 RIGHT TO WIN

15.7 WESTROCK COMPANY

15.7.1 BUSINESS OVERVIEW

15.7.2 FINANCIAL ASSESSMENT

15.7.3 PRODUCTS OFFERED

15.7.4 RIGHT TO WIN

15.8 ORORA LIMITED

15.8.1 BUSINESS OVERVIEW

15.8.2 FINANCIAL ASSESSMENT

15.8.3 OPERATIONAL ASSESSMENT

15.8.4 PRODUCTS OFFERED

15.8.5 RIGHT TO WIN

15.9 MAUSER PACKAGING SOLUTIONS

15.9.1 BUSINESS OVERVIEW

15.9.2 OPERATIONAL ASSESSMENT

15.9.3 PRODUCTS OFFERED

15.9.4 RECENT DEVELOPMENTS

15.9.5 COVID-19-RELATED DEVELOPMENTS/STRATEGIES

15.9.6 RIGHT TO WIN

15.1 SIGMA PLASTICS GROUP

15.10.1 BUSINESS OVERVIEW

15.10.2 OPERATIONAL ASSESSMENT

15.10.3 PRODUCTS OFFERED

15.10.4 RIGHT TO WIN

15.11 OTHER PLAYERS

15.11.1 TAIHUA GROUP

15.11.2 SNYDER INDUSTRIES

15.11.3 VEN PACK

15.11.4 CHEM-TAINER INDUSTRIES

15.11.5 B.A.G. CORP.

15.11.6 MYERS CONTAINER

15.11.7 AMERIGLOBE LLC

15.11.8 WUXI SIFANG GROUP CO., LTD

15.11.9 COMPOSITE CONTAINERS, LLC

15.11.10 CLEVELAND STEEL CONTAINER CORPORATION

16 APPENDIX (Page No. - 191)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

LIST OF TABLES (141 Tables)

TABLE 1 SUMMARY OF CHANGES MADE IN THE REVAMPED VERSION

TABLE 2 INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 3 INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 4 INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 5 INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 6 INDUSTRIAL PACKAGING MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 7 INDUSTRIAL PACKAGING MARKET SIZE, BY REGION, 2018-2025 (MILLION UNIT)

TABLE 8 INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 9 INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 10 INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 11 INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 12 APAC: INDUSTRIAL PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 13 APAC: INDUSTRIAL PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION UNIT)

TABLE 14 APAC: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 15 APAC: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 16 APAC: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 17 APAC: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 18 CHINA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 19 CHINA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 20 CHINA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 21 CHINA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 22 JAPAN: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 23 JAPAN: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 24 JAPAN: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 25 JAPAN: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 26 INDIA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 27 INDIA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 28 INDIA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 29 INDIA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 30 AUSTRALIA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 31 AUSTRALIA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 32 AUSTRALIA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 33 AUSTRALIA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 34 SOUTH KOREA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 35 SOUTH KOREA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 36 SOUTH KOREA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 37 SOUTH KOREA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 38 REST OF APAC: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 39 REST OF APAC: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 40 REST OF APAC: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 41 REST OF APAC: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 42 EUROPE: INDUSTRIAL PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 43 EUROPE: INDUSTRIAL PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION UNIT)

TABLE 44 EUROPE: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 45 EUROPE: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 46 EUROPE: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 47 EUROPE: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 48 GERMANY: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 49 GERMANY: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 50 GERMANY: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 51 GERMANY: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 52 UK: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 53 UK: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 54 UK: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 55 UK: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 56 FRANCE: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 57 FRANCE: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 58 FRANCE: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 59 FRANCE: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 60 RUSSIA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 61 RUSSIA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 62 RUSSIA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 63 RUSSIA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 64 ITALY: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 65 ITALY: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 66 ITALY: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 67 ITALY: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 68 SPAIN: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 69 SPAIN: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 70 SPAIN: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 71 SPAIN: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 72 REST OF EUROPE: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 73 REST OF EUROPE: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 74 REST OF EUROPE: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 75 REST OF EUROPE: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 76 NORTH AMERICA: INDUSTRIAL PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 77 NORTH AMERICA: INDUSTRIAL PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION UNIT)

TABLE 78 NORTH AMERICA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 79 NORTH AMERICA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 80 NORTH AMERICA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 81 NORTH AMERICA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 82 US: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 83 US: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 84 US: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 85 US: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 86 CANADA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 87 CANADA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 88 CANADA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 89 CANADA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 90 MEXICO: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 91 MEXICO: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 92 MEXICO: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 93 MEXICO: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 94 MIDDLE EAST & AFRICA: INDUSTRIAL PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 95 MIDDLE EAST & AFRICA: INDUSTRIAL PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION UNIT)

TABLE 96 MIDDLE EAST & AFRICA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 97 MIDDLE EAST & AFRICA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 98 MIDDLE EAST & AFRICA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 99 MIDDLE EAST & AFRICA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 100 UAE: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 101 UAE: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 102 UAE: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 103 UAE: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 104 SAUDI ARABIA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 105 SAUDI ARABIA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 106 SAUDI ARABIA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 107 SAUDI ARABIA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 108 SOUTH AFRICA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 109 SOUTH AFRICA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 110 SOUTH AFRICA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 111 SOUTH AFRICA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 112 TURKEY: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 113 TURKEY: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 114 TURKEY: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 115 TURKEY: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 116 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 117 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 118 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 119 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 120 SOUTH AMERICA: INDUSTRIAL PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 121 SOUTH AMERICA: INDUSTRIAL PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION UNIT)

TABLE 122 SOUTH AMERICA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 123 SOUTH AMERICA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 124 SOUTH AMERICA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 125 SOUTH AMERICA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 126 BRAZIL: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 127 BRAZIL: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 128 BRAZIL: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 129 BRAZIL: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 130 ARGENTINA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 131 ARGENTINA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 132 ARGENTINA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 133 ARGENTINA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 134 REST OF SOUTH AMERICA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (USD MILLION)

TABLE 135 REST OF SOUTH AMERICA: INDUSTRIAL PACKAGING MARKET SIZE, BY PRODUCT TYPE, 2018-2025 (MILLION UNIT)

TABLE 136 REST OF SOUTH AMERICA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 137 REST OF SOUTH AMERICA: INDUSTRIAL PACKAGING MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION UNIT)

TABLE 138 ACQUISITION

TABLE 139 EXPANSION & INVESTMENT

TABLE 140 NEW PRODUCT DEVELOPMENT

TABLE 141 AGREEMENT

LIST OF FIGURES (46 Figures)

FIGURE 1 INDUSTRIAL PACKAGING MARKET SEGMENTATION

FIGURE 2 APPROACH 1 (BOTTOM-UP, BASED ON REGIONAL MARKET)

FIGURE 3 APPROACH 2 (TOP-DOWN, BASED ON PRODUCT TYPE, MARKET SHARE, BY REGION)

FIGURE 4 INDUSTRIAL PACKAGING MARKET: DATA TRIANGULATION

FIGURE 5 KEY MARKET INSIGHTS

FIGURE 6 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 7 CORRUGATED BOXES TO BE THE FASTEST-GROWING PRODUCT TYPE IN INDUSTRIAL PACKAGING MARKET

FIGURE 8 FOOD & BEVERAGE TO BE THE LARGEST APPLICATION IN THE INDUSTRIAL PACKAGING MARKET

FIGURE 9 APAC LED THE INDUSTRIAL PACKAGING MARKET IN 2019

FIGURE 10 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES IN THE INDUSTRIAL PACKAGING MARKET DURING THE FORECAST PERIOD

FIGURE 11 CHINA WAS THE LARGEST MARKET FOR INDUSTRIAL PACKAGING IN APAC IN 2019

FIGURE 12 CORRUGATED BOXES PRODUCT TYPE TO LEAD THE INDUSTRIAL PACKAGING MARKET

FIGURE 13 FOOD & BEVERAGE TO BE THE LARGEST APPLICATION IN THE INDUSTRIAL PACKAGING MARKET BY 2025

FIGURE 14 INDUSTRIAL PACKAGING MARKET IN INDIA IS PROJECTED TO GROW AT THE HIGHEST CAGR

FIGURE 15 EVOLUTION OF INDUSTRIAL PACKAGING

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE INDUSTRIAL PACKAGING MARKET

FIGURE 17 CRUDE OIL PRICE TREND

FIGURE 18 YC-YCC DRIVERS

FIGURE 19 VALUE CHAIN ANALYSIS:

FIGURE 20 INDUSTRIAL PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

FIGURE 21 CORRUGATED BOXES TO EXHIBIT HIGH GROWTH RATE DURING THE FORECAST PERIOD

FIGURE 22 FOOD & BEVERAGE SEGMENT TO DOMINATE THE GLOBAL INDUSTRIAL PACKAGING MARKET

FIGURE 23 REGIONAL SNAPSHOT: INDIA IS PROJECTED TO BE THE FASTEST-GROWING COUNTRY-LEVEL MARKET FROM 2020 TO 2025

FIGURE 24 APAC: INDUSTRIAL PACKAGING MARKET SNAPSHOT

FIGURE 25 COMPANIES ADOPTED EXPANSION & INVESTMENT AS THE KEY GROWTH STRATEGY BETWEEN 2016 AND 2020

FIGURE 26 MARKET RANKING OF KEY PLAYERS, 2019

FIGURE 27 INDUSTRIAL PACKAGING MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 28 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN INDUSTRIAL PACKAGING MARKET

FIGURE 29 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN INDUSTRIAL PACKAGING MARKET

FIGURE 30 GREIF, INC.: COMPANY SNAPSHOT

FIGURE 31 GREIF, INC.: SWOT ANALYSIS

FIGURE 32 SONOCO: COMPANY SNAPSHOT

FIGURE 33 SONOCO: SWOT ANALYSIS

FIGURE 34 WINNING IMPERATIVES

FIGURE 35 BERRY GLOBAL INC.: COMPANY SNAPSHOT

FIGURE 36 BERRY GLOBAL INC.: SWOT ANALYSIS

FIGURE 37 WINNING IMPERATIVES: BERRY GLOBAL INC.

FIGURE 38 AMCOR: COMPANY SNAPSHOT

FIGURE 39 AMCOR: SWOT ANALYSIS

FIGURE 40 WINNING IMPERATIVES

FIGURE 41 MONDI: COMPANY SNAPSHOT

FIGURE 42 MONDI: SWOT ANALYSIS

FIGURE 43 WINNING IMPERATIVES

FIGURE 44 INTERNATIONAL PAPER: COMPANY SNAPSHOT

FIGURE 45 WESTROCK COMPANY: COMPANY SNAPSHOT

FIGURE 46 ORORA LIMITED: COMPANY SNAPSHOT

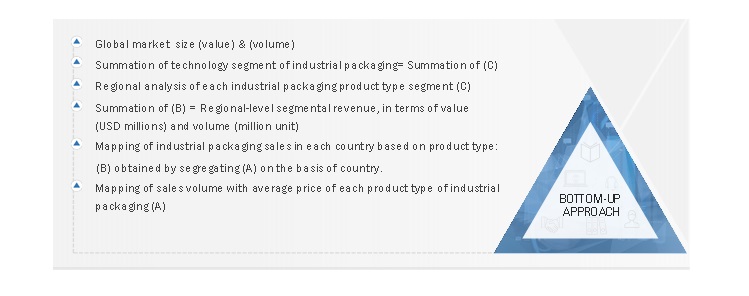

The study involved four major activities for estimating the current global size of the industrial packaging market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of industrial packaging through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the industrial packaging market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the industrial packaging market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the industrial packaging market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the industrial packaging industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Note: The three tiers of the companies were decided based on their revenues in 2019.

Tier 1 companies: revenue greater than USD 5 billion, Tier 2 companies: revenue between USD 1 billion and USD 5 billion, and Tier 3 companies: revenue less than USD 1 billion

Market Size Estimation

To know about the assumptions considered for the study, Request for Free Sample Report

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the industrial packaging market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the industrial packaging market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the industrial packaging market in terms of value and volume based on product type, material, application, and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product developments, expansions & investments, acquisitions, and agreements in the industrial packaging market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the industrial packaging report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the industrial packaging market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Industrial Packaging Market