Residue Testing Market by Type (Pesticides, Toxins, Heavy Metals, Allergens), Technology (Chromatography, Spectroscopy, Immunoassay), Food Tested (Meat & Poultry, Dairy Products, Processed Food, Fruits & Vegetables, Cereals) - Global Forecast to 2021

The residue testing market, in terms of value, is projected to reach USD 4.41 Billion by 2021, at a CAGR of 6.4% from 2016. Increase in outbreaks of chemical contamination in food processing industries, growth in allergic reactions among consumers, and implementation of stringent food safety regulations are some of the factors driving this market.

The years considered for the study are as follows:

- Base year – 2015

- Estimated year – 2016

- Projected year – 2021

- Forecast period – 2016 to 2021

The objectives of the report

- To define, segment, and project the size of the global residue testing market on the basis of type, food tested, technology

- To understand the structure of the residue testing market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of market trends

- To project the size of the market and its submarkets, in terms of value, with respect to five regions (along with their respective key countries): North America, Europe, Asia-Pacific, and Rest of the World (RoW)

Research Methodology:

- Major regions were identified, along with countries contributing the maximum share

- Secondary research was done to find the number of residue testing for regions such as North America, Europe, Asia-Pacific, and RoW; trends for food safety testing industry, and their contribution

- The key players were identified through secondary sources such as Codex Alimentaurius Commission (CODEX), Centers for Disease Control and Prevention (CDC), The European Federation of National Associations of Measurement, Testing, and Analytical Laboratories (EUROLAB), and Food and Agriculture Organization (FAO), while their market share in respective regions have been determined through both, primary and secondary research. The research methodology includes the study of annual and financial reports of top market players, as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both, quantitative and qualitative) for the residue testing market.

To know about the assumptions considered for the study, download the pdf brochure

Target Audience

The stakeholders for the report are as follows:

- Residue testing service providers

- Residue testing laboratories

- Food processors

- Food manufacturers

- Government and research organizations

- Trade associations and industry bodies

Scope of the Report:

This research report categorizes the residue testing market based on type, food tested, technology, and region.

Based on Type, the market has been segmented as follows:

- Pesticide residues

- Toxins

- Heavy metals

- Food allergens

- Others residues (veterinary drugs, processing induced chemicals, and dioxins & PCBs)

Based on Technology, the market has been segmented as follows:

- Chromatography based (HPCL, GC, LC, LC-MS/MS)

- Spectroscopy

- Immunoassay

- Other technologies (PCR and other rapid technologies)

Based on Food Tested, the market has been segmented as follows:

- Meat & poultry

- Dairy products

- Processed foods

- Fruits & vegetables

- Cereals, grains & pulses

- Nuts, seed & spice

- Other food tested (food additives and functional food ingredients)

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW (Brazil, Argentina, and Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The residue testing market size is projected to reach USD 4.41 Billion by 2021, at a CAGR of 6.4% from 2016. The market is driven by increasing outbreaks of chemical contamination in foods, growing allergic reactions among children and adults, global movement of organic revolution, implementation of food safety regulations, and international trade of food materials.

The global market, based on the residue type, has been segmented into pesticides, toxins, heavy metals, food allergens, and others. The pesticides and the food allergen segments are the fastest-growing segments in residue testing. The pesticide residues have been further segmented into herbicides, fungicides, insecticides, and others (including acaricides, nematicides, rodenticides, fumigants, and disinfectants). The toxins have been subsegmented into mycotoxins such as aflatoxins, ochratoxins, patulin, fusarium toxins, and others (including alkaloids, sterigmatocystin, cyclopiazonic acid, citrinin, and other plant toxins). The heavy metals have been subsegmented into arsenic, cadmium, lead, mercury and others (including chromium, tin, and nickel). The food allergens have been subsegmented into peanut & soy, wheat, milk protein, egg protein, tree nuts, and others (including sulfites, sesame seeds, and celery).

The global market, based on technology has been segmented into chromatography, spectroscopy, immunoassay and other molecular technologies such as PCR and other rapid tests. Residue testing through chromatography technology is the fastest-growing in the residue testing market. Residue testing by food tested has been segmented into meat & poultry, dairy products, processed foods, fruits & vegetables, cereals & grains, nuts, seeds & spice products, and others (including food additives and functional food ingredients).

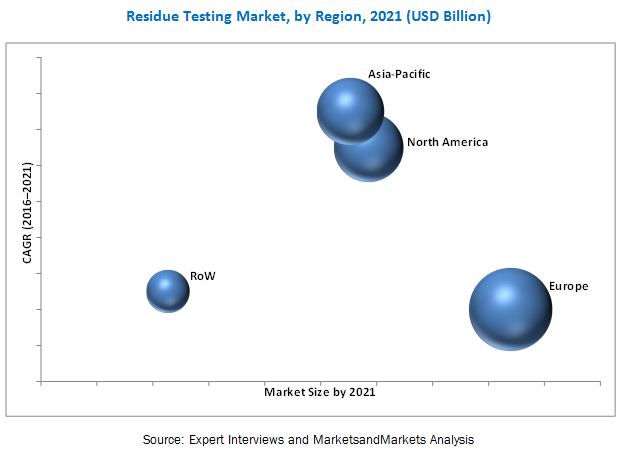

The residue testing market was dominated by the European region in 2015. The recorded food safety issues, stringent policies, which follow the strategy of food safety “from farm to fork” were the key factors that have driven the market in this region. However, as the importance of food safety is rising, it is witnessed that cases of foodborne outbreaks have reduced. Gradually, public awareness is increasing in countries such as Germany, the U.K., France, Poland, and Italy.

Asia-Pacific is the fastest-growing region for residue testing due to the increasing number of outbreaks in food residues. Food safety is gaining importance in the region due to incidences of food contamination with chemical residues; for instance, various cases of food allergens, and toxicity were recorded. Growth in this region is driven by various rules & regulations implemented by different countries. Food security standards are becoming increasingly stringent to ensure safer supply of food to individuals in local and foreign countries, which further drives the market.

Lack of food control infrastructure and resources, especially in developing countries and lack of awareness about food safety regulations among upcoming food manufacturers are the major constrains in this market. Inappropriate standard of sample collection and lack of standardization of food safety regulations are considered to be challenging factors in the residue testing market.

Some of the key players of the residue testing are SGS S.A. (Switzerland), Intertek Group plc. (U.K.), Silliker Inc. (U.S.), Bureau Veritas S.A. (France), and Eurofins Scientific (Luxembourg). The other players who are active in the industry are ALS Limited (Australia), AsureQuality Laboratories (New Zealand), Microbac Laboratories, Inc. (U.S.), and TUV SUD (Germany) in 2015. In May 2014, Eurofins Scientific (Luxembourg) expanded its Auckland microbiology, chemistry, and food-testing laboratory to strengthen its footprint in the Asia-Pacific region. In April 2014, Intertek (U.K.) expanded its global footprint by opening three new food testing laboratories around the world; these laboratories were located in the U.K., the Philippines, and Germany, in order to service its growing global client network.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Periodization Considered for the Study

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

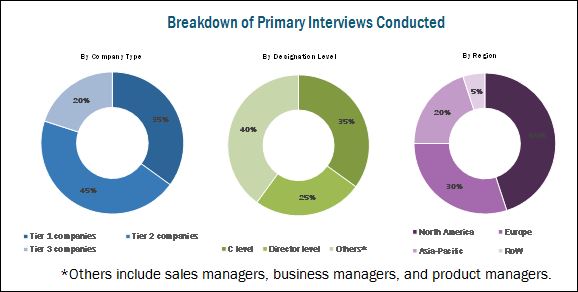

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 35)

4.1 Opportunities in this Market

4.2 Major Countries

4.3 Residue Testing Market, By Type, 2016 vs 2021

4.4 Developed vs Emerging Residue Testing Markets, 2016 vs 2021

4.5 Residue Testing Technology Market Size, By Region

4.6 Residue Testing Type Market, By Region

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.1.1 Pesticides

5.2.1.2 Toxins

5.2.1.3 Heavy Metals

5.2.1.4 Food Allergens

5.2.2 By Technology

5.2.3 By Food Tested

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Outbreaks of Chemical Contamination in Food Processing Industries

5.3.1.2 Growing Allergic Reactions Among Consumers

5.3.1.3 Global Movement of Organic Revolution

5.3.1.4 Implementation of Stringent Food Safety Regulations

5.3.1.5 International Trade of Food Materials

5.3.2 Restraints

5.3.2.1 Lack of Food Control Infrastructure & Resources in Developing Countries

5.3.2.2 Lack of Awareness About Safety Regulations Among Food Manufacturers

5.3.3 Opportunities

5.3.3.1 Expansion Opportunities in Emerging Markets for Residue Testing

5.3.3.2 Increasing Consumers’ Demand for Food Safety

5.3.4 Challenges

5.3.4.1 Inappropriate Standard of Sample Collection

5.3.4.2 Lack of Standardization of Food Safety Regulations

6 Residue Testing Market, By Type (Page No. - 55)

6.1 Introduction

6.2 Pesticides

6.2.1 Herbicides

6.2.2 Insecticides

6.2.3 Fungicides

6.2.4 Other Pesticides

6.3 Toxins

6.3.1 Mycotoxins

6.3.1.1 Aflatoxins

6.3.1.2 Ochratoxins

6.3.1.3 Patulin

6.3.1.4 Fusarium

6.3.2 Other Toxins

6.4 Heavy Metals

6.4.1 Arsenic

6.4.2 CADMium

6.4.3 Lead

6.4.4 Mercury

6.4.5 Others

6.5 Food Allergens

6.5.1 Peanut & Soy

6.5.2 Wheat

6.5.3 Milk

6.5.4 Egg

6.5.5 Tree Nuts

6.5.6 Other Allergens

6.6 Other Residues

7 Residue Testing Market, By Technology (Page No. - 75)

7.1 Introduction

7.2 Chromatography (HPCL, GC, LC, LC-MS/MS)

7.3 Spectroscopy

7.4 Immunoassay

7.5 Other Technologies

8 Residue Testing Market, By Food Tested (Page No. - 82)

8.1 Introduction

8.2 Meat & Poultry

8.3 Dairy Products

8.4 Processed Food

8.5 Fruits & Vegetables

8.6 Cereals, Grains & Pulses

8.7 Nut, Seed & Spice Products

8.8 Other Foods Tested

9 Residue Testing Market, By Region (Page No. - 93)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 U.K.

9.3.4 Italy

9.3.5 Poland

9.3.6 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 India

9.4.3 Japan

9.4.4 Australia & New Zealand

9.4.5 Rest of Asia-Pacific

9.5 Rest of the World (RoW)

9.5.1 Brazil

9.5.2 Argentina

9.5.3 South Africa

9.5.4 Others in RoW

10 Regulations (Page No. - 125)

10.1 Introduction

10.2 International Body for Food Safety Standards and Regulations

10.2.1 Codex Alimentarius Commission (CAC)

10.3 Global Food Safety Initiative (GFSI)

10.4 North America

10.4.1 U.S. Environmental Protection Agency (EPA)

10.4.1.1 Federal Pesticide Laws

10.4.1.2 Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA)

10.4.1.3 Federal Food, Drug, and Cosmetic Act (FFDCA)

10.4.1.4 Food Quality Protection Act of 1996

10.4.1.5 The Pesticide Registration Improvement Act of 2003 (PRIA)

10.4.1.6 The Pesticide Label

10.4.1.7 HACCP Regulation in the U.S.

10.4.1.8 Food Safety Regulations for Fruit & Vegetable Growers

10.4.1.9 FDA Food Safety Modernization Act (FSMA)

10.4.1.10 Food Allergen Labeling and Consumer Protection Act

10.4.1.11 The Toxic Substances Control Act of 1976

10.4.1.12 U.S. Food and Drug ADMinistration (FDA)

10.4.2 Canada

10.4.2.1 Health Canada Food Allergens Labeling

10.4.2.2 Pesticides

10.4.2.2.1 Federal (Pest Management Regulatory Agency of Health Canada)

10.4.2.2.2 Provincial/Territorial

10.4.2.2.3 Municipal

10.4.2.3 Prohibition of Certain Toxic Substances Regulations, 2012 (SOR/2012-285)

10.5 Mexico

10.6 Europe

10.6.1 European Union Regulations

10.6.1.1 General Food Law for Food Safety

10.6.1.2 Toxins Regulation

10.6.1.2.1 Ochratoxin A

10.6.1.2.2 Dioxin and PBCS

10.6.1.2.3 Fusarium Toxins

10.6.1.2.4 Aflatoxins

10.6.1.2.5 Polycyclic Aromatic Hydrocarbons (PAH)

10.6.2 European Food Information Council - Food Allergen Labeling

10.6.3 Germany

10.6.4 U.K.

10.7 Asia-Pacific

10.7.1 China

10.7.2 India

10.7.2.1 Food Safety Standards Amendment Regulations, 2012

10.7.2.2 Food Safety and Standards Act, 2006

10.7.3 Australia

10.7.3.1 Food Standards Australia New Zealand

10.7.4 New Zealand

11 Competitive Landscape (Page No. - 138)

11.1 Overview

11.2 Competitive Situations & Trends

11.2.1 Acquisitions

11.2.2 Expansions & Investments

11.2.3 New Service Launches

11.2.4 Partnerships, Collaborations & Accreditations

12 Company Profiles (Page No. - 145)

(Business overview, Services offered, Recent developments, SWOT analysis & MnM View)*

12.1 Introduction

12.2 Eurofins Scientific SE

12.3 Bureau Veritas S.A.

12.4 SGS S.A.

12.5 Intertek Group PLC

12.6 Silliker, Inc.

12.7 ALS Limited

12.8 Asurequality Limited

12.9 SCS Global Services

12.10 Microbac Laboratories, Inc.

12.11 Symbio Alliance

*Details on Business overview, Services offered, Recent developments, SWOT analysis & MnM View might not be captured in case of unlisted companies.

13 Appendix (Page No. - 169)

13.1 Industry Insights

13.2 Discussion Guide

13.3 More Company Developments

13.3.1 Acquisitions

13.3.2 Expansions & Investments

13.3.3 Agreements, Accreditations and Partnerships

13.3.4 New Service Launches

13.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.5 Introducing RT : Real Time Market Intelligence

13.6 Available Customizations

13.7 Related Reports

List of Tables (73 Tables)

Table 1 Recent Chemical Outbreaks in the World

Table 2 Causes of Food-Induced Anaphylaxis in Children, By Country

Table 3 Limitations of Toxin Contaminants in Foods in India

Table 4 Number of Certification Agencies and Laboratories in China

Table 5 Market Size, By Type, 2014–2021 (USD Million)

Table 6 Pesticide Residue Testing Market Size, By Sub-Type, 2014–2021 (USD Million)

Table 7 Pesticide Residue Testing Market Size, By Region, 2014–2021 (USD Million)

Table 8 Pesticide Residue Testing Market Size, By Food Tested, 2014–2021 (USD Million)

Table 9 Toxin Residue Testing Market Size, By Sub-Type, 2014–2021 (USD Million)

Table 10 Toxin Residue Testing Market, By Region, 2014–2021 (USD Million)

Table 11 Toxin Residue Testing Market Size, By Food Tested, 2014–2021 (USD Million)

Table 12 Specified Limits for Metal Contaminants in Food By FSSAI

Table 13 Heavy Metals Testing Market, By Sub-Type, 2014-2021 (USD Million)

Table 14 Heavy Metal Residue Testing Market Size, By Region, 2014–2021 (USD Million)

Table 15 Heavy Metal Residue Testing Market Size, By Food Tested, 2014–2021 (USD Million)

Table 16 Allergen Residue Testing Market Size, By Sub-Type, 2014–2021 (USD Million)

Table 17 Allergen Residue Testing Market Size, By Region, 2014–2021 (USD Million)

Table 18 Allergen Residue Testing Market Size, By Food Tested, 2014–2021 (USD Million)

Table 19 Other Residue Testing Market Size, By Region, 2014–2021 (USD Million)

Table 20 Other Residue Testing Market Size, By Food Tested, 2014–2021 (USD Million)

Table 21 Residue Testing Market Size, By Technology, 2014-2021 (USD Million)

Table 22 Chromatography Based Residue Testing Market Size, By Region, 2014-2021 (USD Million)

Table 23 Spectroscopy Based Residue Testing Market Size, By Region, 2014-2021 (USD Million)

Table 24 Immunoassay Market Size, By Region, 2014-2021 (USD Million)

Table 25 Residue Testing Market Size for Other Technologies, By Region, 2014-2021 (USD Million)

Table 26 Market Size, By Food Tested, 2014-2021 (USD Million)

Table 27 Meat & Poultry Testing Market Size, By Residue Type, 2014–2021 (USD Million)

Table 28 Dairy Products Testing Market Size, By Residue Type, 2014–2021 (USD Million)

Table 29 Processed Food Testing Market Size, By Residue Type, 2014–2021 (USD Million)

Table 30 Fruits & Vegetables Market Size, By Residue Type, 2014–2021 (USD Million)

Table 31 Cereals & Grains Market Size, By Residue Type, 2014–2021 (USD Million)

Table 32 Nut, Seed & Spice Products Testing Market, By Residue Type, 2014–2021 (USD Million)

Table 33 Food Residues Market in Other Foods, By Type, 2014–2021 (USD Million)

Table 34 Residue Testing Market Size, By Region, 2014-2021 (USD Million)

Table 35 North America: Residue Testing Market Size, By Country, 2014-2021 (USD Million)

Table 36 North America: Market, By Type, 2014-2021 (USD Million)

Table 37 North America: Food Residues Testing Market, By Technology, 2014-2021 (USD Million)

Table 38 U.S.: Residue Testing Market Size, By Type, 2014-2021 (USD Million)

Table 39 Canada: Residue Testing Market Size, By Type, 2014-2021 (USD Million)

Table 40 Mexico: Residue Testing Market Size, By Type, 2014-2021 (USD Million)

Table 41 Europe: Residue Testing Market Size, By Country, 2014–2021 (USD Million)

Table 42 Europe: Market, By Type, 2014-2021 (USD Million)

Table 43 Europe: Food Residues Testing Market, By Technology, 2014-2021 (USD Million)

Table 44 Germany: Residue Testing Market Size, By Type, 2014–2021 (USD Million)

Table 45 France: Residue Testing Market Size, By Type, 2014–2021 (USD Million)

Table 46 U.K.: Residue Testing Market Size, By Type, 2014–2021 (USD Million)

Table 47 Italy: Residue Testing Market Size, By Type, 2014–2021 (USD Million)

Table 48 Poland: Residue Testing Market Size, By Type, 2014–2021 (USD Million)

Table 49 Rest of Europe: Residue Testing Market Size, By Type, 2014–2021 (USD Million)

Table 50 Asia-Pacific: Residue Testing Market, By Country, 2014-2021 (USD Million)

Table 51 Asia-Pacific: Market, By Type, 2014-2021 (USD Million)

Table 52 Asia-Pacific: Food Residues Testing Market, By Technology, 2014-2021 (USD Million)

Table 53 China: Residue Testing Market, By Type, 2014-2021 (USD Million)

Table 54 India: Residue Testing Market, By Type, 2014-2021 (USD Million)

Table 55 Japan: Residue Testing Market, By Type, 2014-2021 (USD Million)

Table 56 Australia & New Zealand: Residue Testing Market, By Type, 2014-2021 (USD Million)

Table 57 Rest of Asia-Pacific: Residue Testing Market, By Type, 2014-2021 (USD Million)

Table 58 RoW: Pesticide Residue Testing Market, By Country, 2014–2021 (USD Million)

Table 59 RoW: Market, By Type, 2014-2021 (USD Million)

Table 60 RoW: Food Residues Testing Market, By Technology, 2014-2021 (USD Million)

Table 61 Brazil: Residue Testing Market, By Type, 2014–2021 (USD Million)

Table 62 Argentina: Residue Testing Market, By Type, 2014–2021 (USD Million)

Table 63 South Africa: Residue Testing Market, By Type, 2014–2021 (USD Million)

Table 64 Others in RoW: Residue Testing Market, By Type, 2014–2021 (USD Million)

Table 65 Commission Regulation for Ochratoxin A

Table 66 Acquisitions, 2011–2016

Table 67 Expansions & Investments, 2011–2016

Table 68 New Service Launches, 2011–2016

Table 69 Partnerships, Collaborations & Accreditations, 2011–2016

Table 70 Acquisitions, 2011–2016

Table 71 Expansions, 2011–2016

Table 72 Agreements, Accreditations and Partnerships, 2011–2016

Table 73 New Service Launches, 2010–2016

List of Figures (62 Figures)

Figure 1 Market Segmentation

Figure 2 Market, By Type

Figure 3 Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Residue Testing Market Size, 2016 vs 2021 (USD Million)

Figure 8 Market Snapshot, By Type, 2016 vs 2021

Figure 9 Market Size (Value), By Region, 2016–2021

Figure 10 Market Size, By Technology, 2016–2021

Figure 11 Market Size, By Food Tested, 2016–2021

Figure 12 Residue Testing Market Share (Value), By Region, 2015

Figure 13 Increase in Outbreaks of Chemical Contamination Due to Residues to Drive the Growth of the Residue Testing Market

Figure 14 China Projected to Grow at the Highest Rate, 2016–2021

Figure 15 Pesticide Residue Testing is Projected to Record High Growth Between 2016 & 2021

Figure 16 Markets in China & India are Projected to Grow at the Highest CAGR

Figure 17 Chromatography Segment Was the Largest, 2015

Figure 18 Pesticide Residue Testing Market to Grow at the Highest Rate, 2016–2021

Figure 19 Market, By Type

Figure 20 Market, By Technology

Figure 21 Market, By Food Tested

Figure 22 Market Snapshot, By Region

Figure 23 Market Dynamics: Residue Testing

Figure 24 One-Third of Americans Believe Chemicals in Food is the Most Important Food Safety Issue

Figure 25 Food Recall Statistics (2006–2015)

Figure 26 Pesticides is Projected to Form the Fastest-Growing Segment in the Residue Testing Market, 2015

Figure 27 FDA’s Pesticide Regulatory Monitoring Data, 2013

Figure 28 Europe is Estimated to Dominate the Pesticide Residue Testing Market in 2016

Figure 29 Biotoxin Recalls, 2006–2015

Figure 30 Europe Estimated to Dominate the Heavy Metal Residue Testing Market, 2016–2021

Figure 31 Undeclared Allergen Recalls, 2006–2015

Figure 32 Types of Chemicals & Other Contaminant Recalls, 2006–2015

Figure 33 Key Factors Responsible for Food Contamination & Foodborne Illnesses, 2013–2014

Figure 34 Chromatography Technology Advancement Drives the Residue Testing Market Growth

Figure 35 Asia-Pacific is Projected to Be the Fastest-Growing in the Residue Testing Market, 2016–2021

Figure 36 Food Categories Associated With Food Recalls

Figure 37 Processed Food Dominated the Residue Testing Market, 2015

Figure 38 Pesticide Testing in Meat & Poultry is Projected to Be the Fastest-Growing Segment

Figure 39 Toxins Residue Testing in Cereals & Grains is Estimated to Be the Largest Segment, 2016

Figure 40 The U.S. Held the Largest Share in the Residue Testing Market, 2015

Figure 41 North American Market Snapshot: U.S. Commands the Largest Share in the Residue Testing Market (2016–2021)

Figure 42 European Market Snapshot: France to Command the Largest Share in Residue Testing Market (2016–2021)

Figure 43 Asia-Pacific Market Snapshot: Japan & China Accounted for the Largest Share in the Residue Testing Market in 2015

Figure 44 Pesticides Production, Consumption, and Import/Export of China (10,000 Tons)

Figure 45 RoW Snapshot: Brazil to Command the Largest Share in the Residue Testing Market (2016–2021)

Figure 46 Legislation Process in the European Union

Figure 47 FSA Response in Relation to Other Government Departments

Figure 48 Acquisitions and Expansions: Leading Approach of Key Companies

Figure 49 Service Portfolio Capitalizes on Acquisitions, 2014–2016

Figure 50 Acquisitions: Popular Strategy for the Global Residue Testing Market

Figure 51 Geographic Revenue Mix of Top Market Players

Figure 52 Eurofins Scientific SE: Company Snapshot

Figure 53 Eurofins Scientific SE: SWOT Analysis

Figure 54 Bureau Veritas S.A.: Company Snapshot

Figure 55 Bureau Veritas SA: SWOT Analysis

Figure 56 SGS S.A.: Company Snapshot

Figure 57 SGS S.A.: SWOT Analysis

Figure 58 Intertek Group PLC: Company Snapshot

Figure 59 Intertek Group PLC: SWOT Analysis

Figure 60 Silliker Inc.:SWOT Analysis

Figure 61 ALS Limited: Company Snapshot

Figure 62 Asurequality Limited: Company Snapshot

Growth opportunities and latent adjacency in Residue Testing Market