Meat Testing Market by Target Tested (Pathogen, Species, Allergen, GMO, Mycotoxin, Heavy Metal, Veterinary Drug Residue), Sample (Meat and Seafood), Technology (PCR, Immunoassay, Chromatography, Spectroscopy), and Region - Global Forecast to 2023

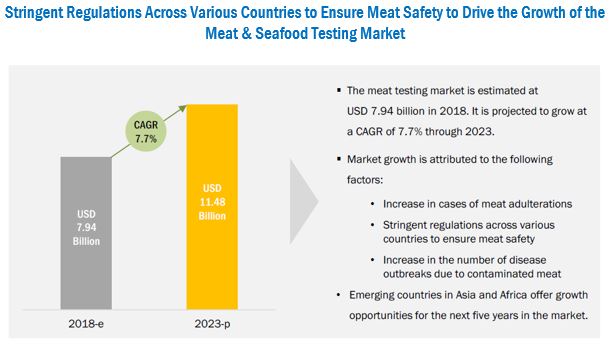

[252 Pages Report] The Meat Testing Market is projected to grow at a CAGR of 7.7%, to reach USD 11.48 billion by 2023. The basic objective of the report is to define, segment, and project the global market size for meat testing on the basis of technology, sample type, target tested, and region. The other objectives include analyzing the opportunities in the market for stakeholders and providing a competitive landscape of market trends, analyzing the macro and microeconomic indicators of this market to provide factor analysis, and to project the growth rate of the meat testing market.

For more details on this research, Request Free Sample Report

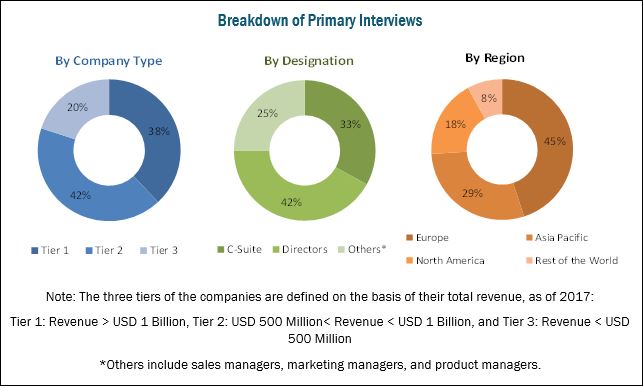

This report includes estimations of the meat testing market size in terms of value (USD million). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global meat testing market and to estimate the size of various other dependent submarkets. The key players in the market have been identified through secondary research (from sources such as press releases, paid databases such as Factiva and Bloomberg), annual reports, and financial journals; their market shares in respective regions have also been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources. The figure below shows the breakdown of the profiles of industry experts that participated in the primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The key players that are profiled in the report include SGS (Switzerland), Eurofins (Luxemburg), Bureau Veritas (France), Intertek (UK), TUV SUD (Germany), ALS (Australia), Mérieux NutriSciences (US), AsureQuality (New Zealand), Romer Labs (Austria), LGC Limited (UK), Genetic ID (US), and Microbac Laboratories (US).

This report is targeted at the existing players in the industry, which include the following:

- Regulatory and research organizations

- Meat testing service providers

- Meat product producers, suppliers, distributors, and retailers

- Meat testing kit or equipment manufacturers, traders, distributors, and dealers

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Scope of the Report

On the basis of Target Tested, the market has been segmented as follows:

- Pathogens

- Species identification

- GMOs

- Allergens

- Mycotoxins

- Heavy metals

- Veterinary drug residues

- Others (pesticide and chemical residues)

On the basis of Sample Type, the market has been segmented as follows:

-

Meat

- Poultry

- Pigmeat

- Beef

- Sheep and goat meat

- Others (camel, rabbit, horse, venison, and wild boar)

- Seafood

On the basis of Technology, the market has been segmented as follows:

- Traditional

-

Rapid

- Immunoassay

- PCR

- Chromatography

- Spectroscopy

On the basis of Region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW (South America, Middle East & Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs. The following customization options are available for the report:

Segmental Analysis

- Further breakdown of meat testing in meat samples such as chicken, lamb, fish, and other seafood such as crabs and lobsters.

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific meat testing market, by key country

- Further breakdown of other countries in the Rest of the World meat testing market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

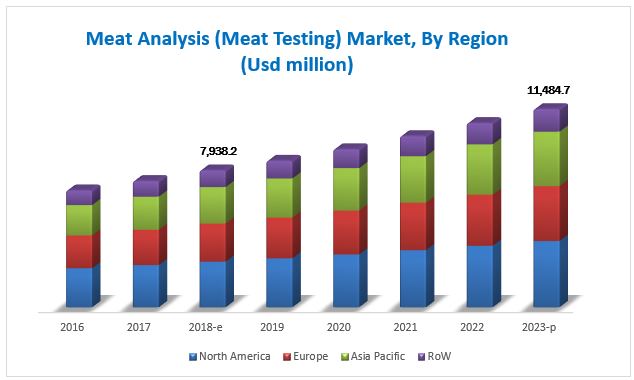

The global meat testing market is estimated at USD 7.94 billion in 2018 and is projected to grow at a CAGR of 7.7%, to reach USD 11.48 billion by 2023. Outbreaks of diseases due to contaminated meat & seafood have massively transformed the industry, leading to increased government regulations on meat products and their quality. Increasing incidents of such frauds are a major concern in the industry. These factors are the major drivers of the meat testing industry, globally.

On the basis of target tested, the pathogen testing segment accounted for the largest share, followed by the species identification segment, in 2018. Improper storage of raw meat can cause pathogen contamination in raw meat; also, cross-contamination leads to the contamination of meat & seafood by foreign particles, which leads to food recalls. Additionally, due to the complex process and supply chain, concerns about cross contamination during storage, transportation, handling, and repacking are rising. This gives rise to food safety and standard issues with respect to contaminants and undeclared species that may be life-threatening to consumers. This is driving the market for species identification testing.

The meat testing market, on the basis of sample type, is segmented into pigmeat, poultry, sheep & goat, beef, and seafood. Poultry meat accounted for the largest market share in 2018, followed by pigmeat. The poultry segment in the market includes meat from various breeds of hen, ducks, turkeys, quails, and pheasants. The consumption of poultry meat is increasing worldwide as there are more ready-to-eat products available in the market containing poultry meat as compared to other meat; hence, consumer concerns regarding the safety of poultry meat products are rising.

On the basis of technology, PCR technology accounted for the largest share in 2018, followed by immunoassay testing technologies. The benefit of PCR technology is its automated approach to testing that provides quick results. Thus, it is used widely for the detection of unidentified species.

For more details on this research, Request Free Sample Report

North America accounted for the largest share of the meat testing market in 2018. This market is driven by the increased awareness of safe food products among consumers, the growing number of meat product recalls, and stringent food safety regulations in the region.

The major restraining factor for the market is high capital investment and complexity of testing technologies. This can be attributed to the fact that the testing process requires advanced equipment, which is capital-intensive. The cost of equipment and precise results in a shorter time also add to the cost of the product.

Companies such as SGS (Switzerland), Eurofins (Luxembourg), and Intertek (UK) have acquired leading market positions through the provision of a broad service portfolio, along with a focus on diverse end-user segments. They are also focused on innovations and are geographically diversified.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 23)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 27)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Limitations

2.5 Research Assumptions

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 39)

4.1 Opportunities in the Meat & Seafood Testing Market

4.2 Meat & Seafood Testing Market: Key Country/Region

4.3 Meat & Seafood Testing Market, By Rapid Technology & Region

4.4 Developed vs Developing Markets for Meat & Seafood Testing in Food

4.5 Meat & Seafood Testing Market, By Target Tested & Region

4.6 Meat & Seafood Testing Market, By Sample Type

4.7 North America: Meat Testing Market, By Meat Sample Type & Country, 2017

5 Market Overview (Page No. - 46)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing International Trade of Meat Products

5.2.1.1.1 Cross Contamination Due to Gaps in Supply Chain

5.2.1.2 Increasing Meat & Seafood Consumption

5.2.1.2.1 Consumer Demand for Processed Meat

5.2.1.3 Increasing Cases of Meat Adulteration

5.2.1.3.1 Growing Demand for Religious Food Certifications

5.2.1.3.2 Growing Number of Product Recalls

5.2.1.4 Stringent Regulations Across Various Countries to Ensure Meat Safety

5.2.1.4.1 Suppliers’ Need to Comply With Labeling & Certification Mandates

5.2.1.5 Increase in the Number of Outbreaks Due to Contaminated Meat

5.2.1.5.1 Contamination Leading to Meat Poisoning

5.2.2 Restraints

5.2.2.1 High Capital Investment

5.2.2.1.1 Increasing Product Cost Attributed to the High Testing Cost

5.2.2.2 Complexity of Testing Techniques

5.2.2.2.1 Varying Test Results With Different Test Methods

5.2.2.3 Unorganized Supply Chain & Distribution Channels in Meat Processing Sector

5.2.3 Opportunities

5.2.3.1 Emerging Economies to Offer High Growth Opportunities

5.2.3.2 Launch of Advanced Technologies

5.2.3.2.1 Upgradation of New Technologies By Service Providers

5.2.3.2.2 Increase in R&D Activities

5.2.3.2.3 Development in Rapid Testing Technologies for Low Turnaround Time

5.2.3.2.4 Multi-Contaminant Detection Systems

5.2.3.3 Expansions in Service Portfolio for Meat & Seafood Testing

5.2.3.3.1 Organic Meat

5.2.3.3.2 Cultured Meat

5.2.3.4 Growing Consumer Awareness About Safety of Food Products

5.2.3.4.1 Food Authentication to Promote the Need for Meat & Seafood Testing

5.2.4 Challenges

5.2.4.1 Lack of Food Control Infrastructure & Resources in Developing Countries

5.2.4.2 Consumer Inclination Towards Meat Substitutes

5.2.4.3 Difficulty in Sample Collection

6 Regulations (Page No. - 66)

6.1 Introduction

6.2 International Body for Food Safety Standards and Regulations

6.2.1 Codex Alimentarius Commission (CAC)

6.3 North America

6.3.1 US Regulations

6.3.1.1 Haccp Regulation in the Us

6.3.1.2 US Regulation for Foodborne Pathogens in Poultry

6.3.1.3 GMOS Regulation in the Us

6.3.1.4 Fda Food Safety Modernization Act (FSMA)

6.3.2 Canada

6.3.3 Mexico

6.4 Europe

6.4.1 European Union Regulations

6.4.1.1 Dioxin and Pbcs

6.4.1.2 Mycotoxin Regulation

6.4.1.3 Polycyclic Aromatic Hydrocarbons (PAH)

6.4.2 Germany

6.4.3 UK

6.4.4 France

6.4.5 Italy

6.5 Asia Pacific

6.5.1 China

6.5.1.1 The Regulating Bodies for Food Safety in China Are:

6.5.1.2 Major Efforts of China Have Been to Standardize Its Food Safety System, Which Includes:

6.5.2 Japan

6.5.3 India

6.5.4 Australia

6.5.5 New Zealand

6.5.6 Indonesia

6.5.7 Regulations on Mycotoxins in Food

6.5.8 Allergen: Regulation on Allergen Labeling in Food

7 Meat Testing Market, By Target Tested (Page No. - 78)

7.1 Introduction

7.2 Pathogens

7.3 Species

7.4 GMOS

7.5 Allergens

7.6 Mycotoxins

7.7 Heavy Metals

7.8 Veterinary Drug Residues

7.9 Others

8 Meat Testing Market, By Sample Type (Page No. - 105)

8.1 Introduction

8.2 Meat

8.2.1 Poultry

8.2.2 Pork

8.2.3 Beef

8.2.4 Sheep & Goat Meat

8.2.5 Other Meat

8.3 Seafood

9 Meat Testing Market, By Technology (Page No. - 115)

9.1 Introduction

9.2 Traditional Testing

9.2.1 Agar Culture

9.3 Rapid Testing

9.3.1 Immunoassay

9.3.2 PCR

9.3.3 Chromatography

9.3.3.1 Lc-Ms

9.3.3.2 Gc-Ms

9.3.3.3 Lc-Ms/Ms

9.3.4 Spectroscopy

9.3.4.1 ICP-OES

9.3.4.2 ICP-Ms

9.3.4.3 Atomic Absorption Spectroscopy (AAS)

10 Meat Testing Market, By Form (Page No. - 125)

10.1 Introduction

10.2 Raw Meat

10.3 Processed Meat

11 Meat Testing Market, By Region (Page No. - 128)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Germany

11.3.2 UK

11.3.3 France

11.3.4 Russia

11.3.5 Italy

11.3.6 Spain

11.3.7 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 Australia & New Zealand

11.4.5 Malaysia

11.4.6 Rest of Asia Pacific

11.5 Rest of the World (RoW)

11.5.1 South America

11.5.2 Middle East

11.5.3 Africa

12 Competitive Landscape (Page No. - 190)

12.1 Overview

12.2 Market Ranking

12.3 Competitive Scenario

12.3.1 Acquisitions

12.3.2 Expansions and Investments

12.3.3 New Service Launches

12.3.4 Agreements, Collaborations, Joint Ventures, and Partnerships

13 Company Profiles (Page No. - 196)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 SGS

13.2 Eurofins

13.3 Intertek

13.4 ALS Limited

13.5 Mérieux Nutrisciences

13.6 TUV SUD

13.7 Bureau Veritas

13.8 Asurequality

13.9 Microbac Laboratories

13.10 Genetic ID

13.11 Romer Labs

13.12 LGC Limited

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 232)

14.1 Discussion Guide

14.2 More Company Developments

14.2.1 Expansions & Investments

14.2.2 New Service Launches

14.2.3 Acquisitions

14.2.4 Agreements, Collaborations, Joint Ventures, and Partnerships

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (157 Tables)

Table 1 US Dollar Exchange Rates Considered for the Study, 2015–2017

Table 2 Microorganisms Causing Meat Spoilage

Table 3 Cancer Risk Due to Processed Meat & Seafood

Table 4 Recent Fda Recalls of Meat & Seafood in the Us, 2018

Table 5 Fsis Recalls in the Us, 2018

Table 6 Meat Products From the US Banned in Other Countries

Table 7 Gmo Labeling in Asia Pacific Countries

Table 8 Maximum Permissible Dose in Irradiation of Meat & Seafood Products

Table 9 Meat & Seafood Testing Market Size, By Target Tested, 2016–2023 (USD Million)

Table 10 Meat Testing Market Size, By Target Tested, 2016–2023 (USD Million)

Table 11 Seafood Testing Market Size, By Target Tested, 2016–2023 (USD Million)

Table 12 Foodborne Disease-Causing Organisms

Table 13 Food Pathogens: Inspection Rate & Incidences of Foodborne Illness (Per 100,000 Population), 2013

Table 14 Meat & Seafood Testing for Pathogens Market Size, By Sample Type, 2016–2023 (USD Million)

Table 15 Meat & Seafood Testing for Pathogens Market Size, By Technology, 2016–2023 (USD Million)

Table 16 Meat Testing for Pathogens Market Size, By Region, 2016–2023 (USD Million)

Table 17 Seafood Testing for Pathogens Market Size, By Region, 2016–2023 (USD Million)

Table 18 Meat & Seafood Testing for Pathogens Market Size, By Region, 2016–2023 (USD Million)

Table 19 Meat & Seafood Testing for Species Market Size, By Sample Type, 2016–2023 (USD Million)

Table 20 Meat Testing for Species Market Size, By Region, 2016–2023 (USD Million)

Table 21 Seafood Testing for Species Market Size, By Region, 2016–2023 (USD Million)

Table 22 Meat & Seafood Testing for Species Market Size, By Region, 2016–2023 (USD Million)

Table 23 Meat & Seafood Testing for GMOS Market Size, By Sample Type, 2016–2023 (USD Million)

Table 24 Meat Testing for GMOS Market Size, By Region, 2016–2023 (USD Million)

Table 25 Seafood Testing for GMOS Market Size, By Region, 2016–2023 (USD Million)

Table 26 Meat & Seafood Testing for GMOS Market Size, By Region, 2016–2023 (USD Million)

Table 27 Seafood & Meat Products: Major Allergens & Adverse Reactions

Table 28 Meat & Seafood Testing for Allergens Market Size, By Sample Type, 2016–2023 (USD Million)

Table 29 Meat Testing for Allergens Market Size, By Region, 2016–2023 (USD Million)

Table 30 Seafood Testing for Allergens Market Size, By Region, 2016–2023 (USD Million)

Table 31 Meat & Seafood Testing for Allergens Market Size, By Region, 2016–2023 (USD Million)

Table 32 Mycotoxins: Occurrence, Source, and Health Effect

Table 33 Meat & Seafood Testing for Mycotoxins Market Size, By Sample Type, 2016–2023 (USD Million)

Table 34 Meat Testing for Mycotoxins Market Size, By Region, 2016–2023 (USD Million)

Table 35 Seafood Testing for Mycotoxins Market Size, By Region, 2016–2023 (USD Million)

Table 36 Meat & Seafood Testing for Mycotoxins Market Size, By Region, 2016–2023 (USD Million)

Table 37 Estimated Daily Intake (EDI) of Heavy Metals for the Population of Kampala City Through the Consumption of Street-Roasted and Vended Meats (µgkg-1day-1)

Table 38 Meat & Seafood Testing for Heavy Metals Market Size, By Sample Type, 2016–2023 (USD Million)

Table 39 Meat Testing for Heavy Metals Market Size, By Region, 2016–2023 (USD Million)

Table 40 Seafood Testing for Heavy Metals Market Size, By Region, 2016–2023 (USD Million)

Table 41 Meat & Seafood Testing for Heavy Metals Market Size, By Region, 2016–2023 (USD Million)

Table 42 Meat & Seafood Testing for Veterinary Drug Residues Market Size, By Sample Type, 2016–2023 (USD Million)

Table 43 Meat Testing for Veterinary Drug Residues Market Size, By Region, 2016–2023 (USD Million)

Table 44 Seafood Testing for Veterinary Drug Residues Market Size, By Region, 2016–2023 (USD Million)

Table 45 Meat & Seafood Testing for Veterinary Drug Residues Market Size, By Region, 2016–2023 (USD Million)

Table 46 Meat & Seafood Testing for Other Targets Market Size, By Sample Type, 2016–2023 (USD Million)

Table 47 Meat Testing for Other Targets Market Size, By Region, 2016–2023 (USD Million)

Table 48 Seafood Testing for Other Targets Market Size, By Region, 2016–2023 (USD Million)

Table 49 Meat & Seafood Testing for Other Targets Market Size, By Region, 2016–2023 (USD Million)

Table 50 Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 51 Market Size, By Sample Type, 2016–2023 (USD Million)

Table 52 Market Size, By Region, 2016–2023 (USD Million)

Table 53 Poultry Meat Testing Market Size, By Region, 2016–2023 (USD Million)

Table 54 Pork Meat Testing Market Size, By Region, 2016–2023 (USD Million)

Table 55 Beef Testing Market Size, By Region, 2016–2023 (USD Million)

Table 56 Sheep & Goat Meat Testing Market Size, By Region, 2016–2023 (USD Million)

Table 57 Other Meat Testing: Market Size, By Region, 2016–2023 (USD Million)

Table 58 Seafood Testing Market Size, By Region, 2016–2023 (USD Million)

Table 59 Meat & Seafood Testing Market Size, By Technology, 2016–2023 (USD Million)

Table 60 Traditional Meat & Seafood Testing Market Size, By Region, 2016–2023 (USD Million)

Table 61 Rapid Meat & Seafood Testing Market Size, By Region, 2016–2023 (USD Million)

Table 62 Meat & Seafood Testing Market Size, By Rapid Technology, 2016–2023 (USD Million)

Table 63 Immunoassay: Meat & Seafood Testing Market Size, By Region, 2016–2023 (USD Million)

Table 64 Sequence of PCR Primers Used in Swine & Poultry Species Testing

Table 65 PCR: Meat & Seafood Testing Market Size, By Region, 2016–2023 (USD Million)

Table 66 Chromatography: Meat & Seafood Testing Market Size, By Region, 2016–2023 (USD Million)

Table 67 Spectroscopy: Meat & Seafood Testing Market Size, By Region, 2016–2023 (USD Million)

Table 68 Conditions for Pathogen Growth in Meat & Seafood

Table 69 Meat & Seafood Testing Market Size, By Region, 2016–2023 (USD Million)

Table 70 North America: Meat & Seafood Testing Market Size, By Country, 2016–2023 (USD Million)

Table 71 North America: Meat Testing Market Size, By Country, 2016–2023 (USD Million)

Table 72 North America: Seafood Testing Market Size, By Country, 2016–2023 (USD Million)

Table 73 North America: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 74 North America: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 75 North America: Market Size, By Target Tested, 2016–2023 (USD Million)

Table 76 North America: Seafood Testing Market Size, By Target Tested, 2016–2023 (USD Million)

Table 77 North America: Meat & Seafood Testing Market Size, By Technology, 2016–2023 (USD Million)

Table 78 North America: Meat & Seafood Testing Market Size, By Rapid Technology, 2016–2023 (USD Million)

Table 79 US: Food Fraud Details

Table 80 US: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 81 US: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 82 Canada: Food Fraud Details

Table 83 Canada: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 84 Canada: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 85 Mexico: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 86 Mexico: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 87 Europe: Meat & Seafood Testing Market Size, By Country, 2016–2023 (USD Million)

Table 88 Europe: Meat Testing Market Size, By Country, 2016–2023 (USD Million)

Table 89 Europe: Seafood Testing Market Size, By Country, 2016–2023 (USD Million)

Table 90 Europe: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 91 Europe: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 92 Europe: Market Size, By Target Tested, 2016–2023 (USD Million)

Table 93 Europe: Seafood Testing Market Size, By Target Tested, 2016–2023 (USD Million)

Table 94 Europe: Meat & Seafood Testing Market Size, By Technology, 2016–2023 (USD Million)

Table 95 Europe: Meat & Seafood Testing Market Size, By Rapid Technology, 2016–2023 (USD Million)

Table 96 Germany: Meat & Seafood Fraud Details

Table 97 Germany: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 98 Germany: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 99 UK: Meat & Seafood Fraud Details

Table 100 UK: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 101 UK: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 102 France: Meat & Seafood Fraud Details

Table 103 France: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 104 France: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 105 Russia: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 106 Russia: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 107 Italy: Meat & Seafood Fraud Details

Table 108 Italy: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 109 Italy: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 110 Spain: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 111 Spain: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 112 Rest of Europe: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 113 Rest of Europe: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 114 Asia Pacific: Meat & Seafood Testing Market Size, By Country/Region, 2016–2023 (USD Million)

Table 115 Asia Pacific: Meat Testing Market Size, By Country/Region, 2016–2023 (USD Million)

Table 116 Asia Pacific: Seafood Testing Market Size, By Country/Region, 2016–2023 (USD Million)

Table 117 Asia Pacific: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 118 Asia Pacific: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 119 Asia Pacific: Market Size, By Target Tested, 2016–2023 (USD Million)

Table 120 Asia Pacific: Seafood Testing Market Size, By Target Tested, 2016–2023 (USD Million)

Table 121 Asia Pacific: Meat & Seafood Testing Market Size, By Technology, 2016–2023 (USD Million)

Table 122 Asia Pacific: Meat & Seafood Testing Market Size, By Rapid Technology, 2016–2023 (USD Million)

Table 123 China: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 124 China: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 125 Japan: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 126 Japan: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 127 India: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 128 India: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 129 Australia & New Zealand: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 130 Australia & New Zealand: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 131 Malaysia: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 132 Malaysia: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 133 Rest of Asia Pacific: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 134 Rest of Asia Pacific: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 135 RoW: Meat & Seafood Testing Market Size, By Region, 2016–2023 (USD Million)

Table 136 RoW: Meat Testing Market Size, By Region, 2016–2023 (USD Million)

Table 137 RoW: Seafood Testing Market Size, By Region, 2016–2023 (USD Million)

Table 138 RoW: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 139 RoW: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 140 RoW: Market Size, By Target Tested, 2016–2023 (USD Million)

Table 141 RoW: Seafood Testing Market Size, By Target Tested, 2016–2023 (USD Million)

Table 142 RoW: Meat & Seafood Testing Market Size, By Technology, 2016–2023 (USD Million)

Table 143 RoW: Meat & Seafood Testing Market Size, By Rapid Technology, 2016–2023 (USD Million)

Table 144 South America: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 145 South America: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 146 Middle East: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 147 Middle East: Market Size, By Sample Type, 2016–2023 (USD Million)

Table 148 Africa: Meat & Seafood Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 149 Africa: Meat Testing Market Size, By Sample Type, 2016–2023 (USD Million)

Table 150 Acquisitions

Table 151 Expansions and Investments

Table 152 New Service Launches

Table 153 Agreements, Collaborations, Joint Ventures, and Partnerships

Table 154 Expansions & Investments, 2013–2017

Table 155 New Service Launches, 2013–2017

Table 156 Acquisitions, 2013–2017

Table 157 Agreements, Collaborations, Joint Ventures, and Partnerships , 2013–2017

List of Figures (84 Figures)

Figure 1 Meat Testing Market Segmentation

Figure 2 Meat Testing Market: Geographic Segmentation

Figure 3 Research Design: Meat & Seafood Testing

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Meat & Seafood Testing Market Snapshot, By Target Tested, 2018 vs 2023

Figure 8 Meat & Seafood Testing Market Size, By Sample Type, 2018–2023

Figure 9 Meat & Seafood Testing Market Size, By Rapid Technology, 2018–2023

Figure 10 Asia Pacific to Grow at the Highest CAGR in the Meat & Seafood Testing Market, 2018–2023

Figure 11 Meat & Seafood Testing Market Share, By Region

Figure 12 Stringent Regulations Across Various Countries to Ensure Meat Safety to Drive the Growth of the Meat & Seafood Testing Market

Figure 13 China to Be the Fastest-Growing Country in the Meat & Seafood Testing Market By 2023

Figure 14 PCR Segment to Dominate the Market Through 2023

Figure 15 Developing Countries to Grow at the Highest Rates During the Forecast Period

Figure 16 Pathogen Segment Dominated the Meat & Seafood Testing Market Across All Targets Tested in 2017

Figure 17 Meat Segment Dominated the Meat & Seafood Testing Market Across All Sample Types

Figure 18 US Accounted for the Largest Share in 2017

Figure 19 Market Dynamics: Meat & Seafood Testing Market

Figure 20 Global Beef Export, 2014 (KT)

Figure 21 Major Markets for US Pork Export, 2015 vs 2016 (USD Million)

Figure 22 Per Capita Meat & Seafood Consumption, 2008–2013 (Kg/Annum)

Figure 23 US Food Recalls, 2012–2014

Figure 24 Estimated Annual Cost of Foodborne Illness Caused By Salmonella in the Us, 2013 (USD Million)

Figure 25 Estimated Annual Cost of Foodborne Illness Caused By Listeria in the Us, 2013 (USD Million)

Figure 26 Growth in Aquaculture Production, 2011–2015 (Million Metric Tons)

Figure 27 US Federal R&D Expenditure Across All Major Agencies, 2016

Figure 28 Legislation Process in the EU

Figure 29 Role of EFSA to Reduce Campylobacteriosis

Figure 30 Food Commodities Associated With Foodborne Illnesses, 2008–2012

Figure 31 Meat & Seafood Testing Market Size, By Target Tested, 2018 vs 2023 (USD Million)

Figure 32 Meat & Seafood Testing for Pathogens Market Size, By Region, 2018 vs 2023 (USD Million)

Figure 33 Annual Meat Production Data, 2010–2014 (Million Tons)

Figure 34 Meat & Seafood Testing Market Size, By Sample Type, 2018 vs 2023 (USD Million)

Figure 35 Per Capita Global Meat Consumption, 2017 (Kg/Annum)

Figure 36 Poultry Meat Testing Market Size, By Region, 2018 vs 2023 (USD Million)

Figure 37 Meat & Seafood Testing Market Size, By Technology, 2018 vs 2023 (USD Million)

Figure 38 PCR: Meat & Seafood Testing Market Size, By Region, 2018 vs 2023 (USD Million)

Figure 39 Cancer Risk By Consumption of Raw and Processed Red Meat, 2017

Figure 40 US Held the Largest Share in the Meat & Seafood Testing Market, 2017

Figure 41 North America: Market Snapshot

Figure 42 US: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 43 US: Number of Cases, Hospitalizations, and Deaths Caused By Pathogens, 2015

Figure 44 Canada: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 45 Mexico: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 46 EU: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 47 European Meat & Seafood Testing Market Snapshot: Spain Accounted for the Largest Share in 2017

Figure 48 Russia: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 49 Asia Pacific: Market Snapshot

Figure 50 Top 10 Meat Suppliers to China, 2012–2016 (KT)

Figure 51 China: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 52 Japan: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 53 India: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 54 Australia: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 55 New Zealand: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 56 Malaysia: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 57 Pakistan: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 58 Bangladesh: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 59 Thailand: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 60 Indonesia: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 61 Vietnam: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 62 Philippines: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 63 Brazil: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 64 Argentina: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 65 Peru: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 66 Chile: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 67 Iran: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 68 Sub-Saharan Africa: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 69 Egypt: Per Capita Meat Consumption, 2017 (Kg/Annum)

Figure 70 Key Developments of the Leading Players in the Meat Testing Market, 2013–2018

Figure 71 Top Five Companies in the Meat Testing Market, 2017

Figure 72 Market Evaluation Framework

Figure 73 SGS: Company Snapshot

Figure 74 SGS: SWOT Analysis

Figure 75 Eurofins: Company Snapshot

Figure 76 Eurofins: SWOT Analysis

Figure 77 Intertek: Company Snapshot

Figure 78 Intertek: SWOT Analysis

Figure 79 ALS Limited: Company Snapshot

Figure 80 ALS: SWOT Analysis

Figure 81 Mérieux Nutrisciences: SWOT Analysis

Figure 82 TUV SUD: Company Snapshot

Figure 83 Bureau Veritas: Company Snapshot

Figure 84 Asurequality: Company Snapshot

Growth opportunities and latent adjacency in Meat Testing Market