Railway Telematics Market by Solution (Fleet Management, Automatic Stock Control, Shock Detection, Reefer Wagon Management, ETA), Railcar (Hoppers, Tank Cars, Well Cars, Boxcars, Reefer Cars), Component & Region - Global Forecast to 2026

[222 Pages Report] The railway telematics market size was valued at USD 5.1 billion in 2021 and projected to reach USD 7.3 billion by 2026, growing at a CAGR of 7.5% from during the forecast period. The future of the freight rail industry is expected to rely on smart digital transportation systems that leverage technologies over larger railcar networks.New technologies such as integrated service management, asset management, and predictive analytics, shock detection, and automatic stock control are expected to help rail management companies manage optimal routes, schedules, capacities, and idle railcars in near real-time. Due to the increasing presence of smart technologies in rail transportation, the associated solutions and services markets are also expected to grow at high rates, globally. Emerging technologies such as refrigerated wagon management, estimated time of arrival of railcars are expected to enable efficient and better freight rail transportation. This is also expected to improve timely decision-making for issues such as asset deployment, utilization, and railcar maintenance.

North America accounted for the largest share of the market in 2021. The presence of OEMs such as Siemens (Germany), Bosch (Germany), Knorr-Bremse (Germany), Amsted Digital (US) and their investments in rail telematics is one of the major factors fueling the growth of railway telematics market in North America and Europe regions. For instance, in 2020, major US rail companies such as GATX corporation, Norfolk Southern, Genesee & Wyoming, Watco, and Trinity Rail announced a joint venture Rail Pulse, which is expected to accelerate the adoption of GPS and other telematics technologies in the near future across the North American railcar fleet. This is expected to enable competitiveness in the rail sector between freight transportation companies due to improvements in the location monitoring and condition monitoring of railcars. As technology evolves, the safety of railcars and other solutions are expected to be adopted by railcar fleet owners. Due to the new telematics technologies, railcar owners are expected to be able to capture data such as whether a railcar is partially or fully loaded, its onboard bearing temperature, whether doors or hatches are closed or open, wheel impact detection data, and other possible solutions to enable running railcar fleets efficiently, manage data generated through the use of technology and improvise on idle rail cars, maintenance, reduce turnaround time of railcars, control stock, and others. The rising adoption of telematics solutions by rail car leasing operators is expected to drive the market in future.

To know about the assumptions considered for the study, Request for Free Sample Report

Driver: Government initiatives for smart railways

Increasing urbanization across the globe is resulting in the evolution of smart cities. Governments around the world are undertaking various smart city initiatives to provide better transportation infrastructure and speeding-up operational activities in public transportation services. For instance, in March 2020, the Government of India has proposed to develop 100 smart cities in the next few years. The Government of Singapore is implementing digital technology in transportation to accomplish its Smart Nation vision. Transportation is considered one of the most important pillars of a country’s economic development, and hence, these smart city initiatives are expected to drive market growth.

The deployment of smart railway systems requires joint efforts from various stakeholders such as telecom operators, infrastructure providers, service providers, manufacturers, public sectors, and user groups. Government authorities are adopting Public Private Partnership (PPP) models which enable private sector companies participate in smart railways initiatives of governments for deploying and financing transportation projects.

Restraint: High development cost

One of the key restraints in railway telematics market is the high installation cost. The telematics system also requires high maintenance and data collection platforms, which further increases the expenditure. In the traditional method, the expenses are compensated either through tax payments on fuel or rubber or by budget allocations from the national income. An Automated Fare Collection (AFC) system comprises equipment and products based on advanced technologies, making the system complex and expensive. The system offers a solution for traffic congestion issues; however, it simultaneously increases the cost of the tolling process, which ultimately increases the toll price. Moreover, in the AFC system, a large, centralized Traffic Management Center (TMC) is required to be co-located with transportation managers, system operators, dispatchers, and response agencies. All these factors lead to significant initial investments.

The initial cost involved in deploying smart railway solutions is high and requires significant initial investments to set up field-level devices, replace aging infrastructure, arrange for transmission networks between end users, and manage new and existing systems within premises. High operational and maintenance costs post deployment are also a significant concern for railway authorities. Moreover, the limited budgets allocated for the railways are a restraining factor in the deployment of advanced railway technologies and solutions by governments as well as private players. Hence, the high initial cost of deploying smart railway solutions and components is expected to hamper market growth for railway telematics in the coming years.

Opportunity: Increasing need for railway telematics

The need for telematics in freight and cargo transportation by rail has increased over the years. Population is increasing annually every year all over the world. Transportation infrastructure is a significant challenge for many countries across the world. Countries which are in the developmental stage lag in terms of efficient freight transportation services. The global rail industry is undergoing continuous changes in terms of technology for higher efficiency and safety.

Several countries have realized that the development of railway infrastructure is one of the important factors driving economic development. A number of countries are investing significantly in railway infrastructure. Regions such as Europe and North America are advanced as against the other regions and are therefore able to provide advanced telematics solutions for the high interoperability of rail cars. The North American freight rail network runs almost 140,000 route miles annually and accounts for 27.9% of the total freight movement as of 2020 in the country as per the US Department of Transportation’s Federal Railroad Administration. In November 2020, US operators, namely, Norfolk Southern, Genesee, Wyoming, and Watco joined the manufacturers, TrinityRail and GATX Corp as part of their joint venture for the purpose of accelerating the adoption of GPS location and other telematics solutions across the North American freight wagon fleet. As far as the European region is concerned, mandates by governments regarding smart railcars have given a boost to the railway telematics market in that region.

Challenge: Data privacy and security concerns

Railway telematics solutions are an integration of different technology elements such as hardware, software, and network elements, which can be complex to configure at times. The integration of different hardware devices along with railway software over legacy system infrastructure may become complex. Legacy systems are also not compatible with new generation smart devices due to protocol issues. Hence, traditional, and legacy systems are not capable enough to communicate efficiently with technologically advanced systems. These integration issues are projected to be one of the major challenges in the development of railway projects.

One of the major problems in implementing connected freight transport is integrating it with information technology. The implementation of several information technologies involves a process of interrelated stages. The stage of integrating several information technologies with smart transportation systems is critical. The connected transportation ecosystem integrates different technology elements such as hardware, software, and network elements. Moreover, the deployment of these elements involves more than one vendor. The implementation of updated technologies over the existing transportation architecture becomes complex. Additionally, due to the lack of open interface and protocol issues, smart devices and sensors are not able to integrate with the existing system architecture. The major difficulty of the smart transportation system is the synthesis and integration of all the data collected from these sensors. Thus, deploying a multi-sensor data fusion technology which collates all recorded signals to create a more informed environment for traffic control, and remote sensing is a major challenge. Hence, traditional legacy systems are not capable of communicating efficiently with technologically advanced systems. Upgrading these systems is expected to require high investments. These complexities are expected to hinder market growth in the coming years

Hopper railcars account for a major share of the market during the forecast period

Due to the new GSM and GPS modules, a significant cost reduction could be achieved. Interfaces for complementing sensors such as shock detection, digital/analog inputs/outputs, etc. are integrated. In addition, based on the analysis of user requirements, the development of a reliable load sensing technology for freight cars has been launched. This is a result of the fact that today most of the freight cars in operation in the railways do not use the full load capacity as cost-effective measurement of the load does not exist, especially during the filling-up process such as in the area of bulk freight. These advanced solutions are expected to support the growth of the railway telematics market.

The APAC is projected to be the fastest-growing railway telematics market, by 2026

Increasing penetration of advanced technologies, increasing GDPs of countries, steady growth, and emerging economies. The APAC region covers some of the potential markets, namely, China, India, Japan, and Rest of Asia Pacific. China is expected to lead the market followed by India, Japan, and Rest of Asia Pacific in terms of share and growth rate among all countries during the forecast period.

The APAC region is expected to offer significant growth opportunities due to the untapped market strength. Increasing awareness about driver safety and accident prevention, presence of leading OEM players, growing freight transportation and logistics industries, advent of the 4G LTE technology, and the adoption of smart railcars in North America and Europe due to the availability of embedded OEM telematics solutions are leading to market growth. The logistics sectors in India and China are on the cusp of disruption. Robust economic growth and technology improvements have led to significant developments. Despite significant country-specific trends and nuances, the underlying themes of economic growth, digital disruption and changing customer preferences prevail. These powerful themes are expected to shape the future of the logistics industry over the next few years. Based on reliable on-line telematics data, dispatchers will be able to inform their customers about changes in transport schedules earlier than is possible presently, increasing reliability and satisfying stakeholders, thus driving growth.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players considered in the analysis of the Railway Telematics market are Siemens (Germany), Hitachi Ltd. (Japan), Alstom (France), Knorr-Bremse (Germany), and Robert Bosch (US). These companies offer extensive products for the Railway Telematics industry and have strong distribution networks, and they invest heavily in R&D to develop new products.

Scope of the Report

|

Report Attributes |

Details |

|

Market size value in 2021: |

USD 5.1 billion |

|

Projected to reach by 2026: |

USD 7.3 billion |

|

CAGR: |

7.5% |

|

Base Year Considered: |

2020 |

|

Forecast Period: |

2021-2026 |

|

Largest Market: |

Asia Pacific |

|

Region Covered: |

Asia Pacific, North America, Europe, and the RoW |

|

Segments Covered: |

by solution (fleet management, automatic stock control, shock detection, reefer wagon management, railcar tracking and tracing, remote data access, eta & others), railcar (hoppers, tank cars, well cars, boxcars, reefer cars & others), component (TCU and sensor) & Region |

|

Companies Covered: |

Siemens (Germany), Hitachi Ltd. (Japan), Alstom (France), Knorr-Bremse (Germany), and Robert Bosch (US) A total of 25 major company profiles covered and provided. |

This research report categorizes the railway telematics market based on train type, application, component, cable type, voltage, material type, wire length, end use and region

By Solution

- Fleet Management

- Automatic Stock Control

- Shock Detection

- Remote data access

- Railcar tracking and tracing

- Reefer Wagon Management

- ETA

- others

By Railcar

- Hoppers

- Tank cars

- Well cars

- Boxcars

- Refrigerated Boxcars

- Others

By Components

- TCU

- Sensor

By Region

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- UK

- Rest of Europe

-

RoW

- Brazil

- Argentina

- Others

Recent Developments

- In April 2021, Hitachi Rail announced the acquisition of UK’s Perpetuum for enhancing the company’s digital rail maintenance activity. The company is expected to handle the maintenance for all rail original equipment manufacturers and operators across the global rail market.

- In November 2019, Alstom and Mumbai Metro Rail Corporation (MMRC) unveiled the life-sized mock-up of the trainset for Mumbai Metro Line 3 (Aqua Line). The new, iconic, and exclusive design for Mumbai meets all technical and manufacturing parameters.

- In September 2019, Wabtec launched two new offerings designed to modernize its globally installed 23,000 locomotives. Wabtec has developed FDL Advantage, which is a fuel-saving engine upgrade package for its FDL locomotive platform. Another offering is the Modular Control Architecture - Fleet Migration (MCA FM), a next-generation control system replacement that is applicable throughout Wabtec’s locomotive installed base. Both solutions introduce next-generation data and software capabilities to position railroads for the future of transportation with improved fuel efficiency and reliability.

- In February 2021, Trinity Rail Group launched Trinsight, which is a digital platform for providing real-time solutions such as location, condition, and status of the rail equipment. The purpose of this platform is to enhance the safety, efficiency, and management of fleet operations.

- In December 2020, ORBCOMM launched ST 9100, which is a dual-mode telematics device targeted for monitoring and controlling assets in the most remote areas.

- In July 2020, DB Cargo headed a consortium with five Europeans companies for the development of automatic rail coupling. The German Federal of Ministry of Transport and Digital Infrastructure awarded this project to six companies from Germany, Austria, Switzerland, and France.

- In March 2021, Siemens announced the full digitalization of Finnentrop interlocking in the state of North-Rhine Westphalia. The company declared that 404 interlocking units are expected to be replaced, which include signal, switch point, and derailers. 15 level crossings are also expected to be equipped with digital interfaces and four of them are expected to receive new safety systems.

- In October 2020, Robert Bosch announced the signing of supply contract with Lineas for the digitalization of Linea’s wagon fleet. 2,600 wagons are expected to be installed with Bosch’s Nexeed Track and Trace software part of material and asset tracking for the optimization of Linea’s fleet.

Frequently Asked Questions (FAQ):

What is the current size of the Railway Telematics market?

The railway telematics market, by value, is estimated to be USD 5.1 billion in 2021 and is projected to reach USD 7.3 billion by 2026, at a CAGR of 7.5% from 2021 to 2026

Who are the STARS in the Railway Telematics market?

Siemens (Germany), Bosch (Germany), Knorr-Bremse (Germany), Hitachi Ltd. (Japan), Alstom (France), and others. They have a strong portfolio of railway telematics offerings. These vendors have been marking their presence in the railway telematics market by offering easily deployable solutions, coupled with their robust business strategies to achieve constant growth in this market. Moreover, these companies have a strong presence across the globe.

What are the new market trends impacting the growth of the Railway Telematics market?

Developed countries have initiated plans for the advancement of driverless train networks, which is expected to propel the growth of the transportation sector. Countries such as China, India, South Korea, the US, the UK, Mexico, Brazil, and South Africa are planning to revolutionize their rail networks with the introduction of driverless trains. Rail manufacturers are expanding geographically by investing in infrastructure for the manufacture of driverless trains. Developed regions like North America and Europe are improving the safety and security of railways by retrofitting trains and replacing existing systems with advanced systems.

Which countries are considered in the Asia Pacific region?

The report covers market sizing for countries such as India, China, Japan, South Korea, France, Germany, Spain, UK, US, Canada, Mexico, UAE, Egypt, South Africa, Brazil and Russia. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS FOR RAILWAY TELEMATICS MARKET

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 2 CURRENCY EXCHANGE RATES (USD)

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 RESEARCH DATA

FIGURE 1 RAILWAY TELEMATICS MARKET: RESEARCH DESIGN

FIGURE 2 RESEARCH METHODOLOGY MODEL

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES

2.2.2 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

2.3.1 SAMPLING TECHNIQUES AND DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 MARKET ESTIMATION METHODOLOGY

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.5 MARKET SIZE ESTIMATION

2.5.1 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY FOR THE RAILWAY TELEMATICS MARKET: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR THE MARKET: TOP-DOWN APPROACH

2.5.2 DEMAND-SIDE APPROACH

FIGURE 7 MARKET: RESEARCH METHODOLOGY ILLUSTRATION OF KNORR-BREMSE REVENUE ESTIMATION

2.5.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

2.6 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.7 FACTOR ANALYSIS

2.8 ASSUMPTIONS

2.9 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 9 RAILWAY TELEMATICS : MARKET DYNAMICS

FIGURE 10 RAILWAY TELEMATICS MARKET, BY REGION, 2021–2026

FIGURE 11 RAILCAR TRACKING & TRACING SEGMENT PROJECTED TO LEAD THE MARKET FROM 2021 TO 2026

FIGURE 12 NORTH AMERICA PROJECTED TO LEAD THE MARKET DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 ATTRACTIVE OPPORTUNITIES IN THE RAILWAY TELEMATICS MARKET

FIGURE 13 INCREASING FREIGHT RAIL TRANSPORTATION IS EXPECTED TO BOOST THE GROWTH OF THE MARKET

4.2 MARKET, REGIONAL SNAPSHOT

FIGURE 14 ASIA PACIFIC IS PROJECTED TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 MARKET, BY SOLUTION

FIGURE 15 RAILCAR TRACKING & TRACING SEGMENT PROJECTED TO LEAD THE MARKET, 2021 VS. 2026 (USD MILLION)

4.4 MARKET, BY RAILCAR TYPE

FIGURE 16 THE HOPPERS SEGMENT IS PROJECTED TO BE THE LARGEST IN THE MARKET FROM 2021 TO 2026

4.5 MARKET, BY COMPONENT

FIGURE 17 THE TCU SEGMENT IS PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.6 MARKET, BY REGION

FIGURE 18 NORTH AMERICA IS EXPECTED TO BE THE LARGEST MARKET FOR RAILWAY TELEMATICS DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

TABLE 3 IMPACT OF MARKET DYNAMICS

5.2 MARKET DYNAMICS

FIGURE 19 RAILWAY TELEMATICS : MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Government initiatives for smart railways

TABLE 4 TOP GROWING SMART CITIES/COUNTRIES

5.2.1.2 Digitalization of railways

TABLE 5 ADVANTAGES OF DIGITALIZATION OF RAILS

5.2.1.3 Technological shift towards railway telematics

FIGURE 20 TELEMATICS OPERABILITY FOR CARGO

5.2.2 RESTRAINTS

5.2.2.1 High development cost

5.2.2.2 Lack of infrastructure for railway telematics

5.2.2.3 Lack of component and production standardization

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing need for railway telematics

TABLE 6 GOVERNMENT AGENCIES EQUIPPING FREIGHT TRANSPORT WITH TELEMATICS SOLUTIONS

5.2.3.2 Growing freight railway market to impact telematics market

TABLE 7 DEMAND FOR FREIGHT TRANSPORTATION PROJECTED TO RISE IN THE FUTURE

5.2.4 CHALLENGES

5.2.4.1 Data privacy and security concerns

5.2.4.2 Lack of infrastructure for railway telematics

5.3 PORTER’S FIVE FORCES

FIGURE 21 PORTER’S FIVE FORCES: RAILWAY TELEMATICS MARKET

TABLE 8 MARKET: IMPACT OF PORTERS FIVE FORCES

5.3.1 THREAT OF SUBSTITUTES

5.3.1.1 Telematics solutions do not have alternatives and therefore the threat of substitutes is low

5.3.2 THREAT OF NEW ENTRANTS

5.3.2.1 Lack of standardization leads to high threat of new entrants

5.3.3 BARGAINING POWER OF BUYERS

5.3.3.1 Increasing demand for railway telematics leads to moderate bargaining power for buyers

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.4.1 Lack of standardization leads to moderate demand for telematics in the long run

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.3.5.1 Large number of players and high switching costs lead to high competition in the market

5.4 EXISTING AND UPCOMING RAILWAY TELEMATICS MODELS

TABLE 9 EXISTING AND UPCOMING RAILWAY TELEMATICS MODELS

5.5 MARKET ECOSYSTEM

FIGURE 22 MARKET: ECOSYSTEM ANALYSIS

TABLE 10 MARKET: ROLE OF COMPANIES IN THE ECOSYSTEM

5.6 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: RAILWAY TELEMATICS

5.7 PATENT ANALYSIS

5.8 REGULATORY OVERVIEW

5.9 CASE STUDY

5.9.1 RAILNOVA’S TIE-UP WITH POD GROUP INCREASED FLEET CONNECTIVITY

5.9.2 HOYER RELIES ON RAILWAY TELEMATICS SOLUTIONS OFFERED BY IMT FOR THE TRANSPORT OF THEIR CONTAINERS

5.10 TRADE/REGISTRATION DATA

TABLE 11 TOP IMPORTERS OF RAILWAY FREIGHT CARS - 2019

FIGURE 24 IMPORT DATA IN TERMS OF PERCENTAGE FOR 2019

TABLE 12 TOP EXPORTERS OF RAILWAY FREIGHT CARS - 2019

FIGURE 25 EXPORT DATA IN TERMS OF PERCENTAGE FOR 2019

5.11 REVENUE SHIFT FOR RAILWAY TELEMATICS MANUFACTURERS

5.12 COVID-19 IMPACT ANALYSIS

5.12.1 INTRODUCTION TO COVID-19

5.12.2 COVID-19 HEALTH ASSESSMENT

TABLE 13 SELECTED MEASURES BY RAILWAYS IN VARIOUS COUNTRIES DURING THE COVID-19 PANDEMIC

5.13 MARKET, SCENARIOS (2021–2026)

FIGURE 26 IMPACT OF COVID-19 ON THE MARKET, 2021–2026

5.13.1 MARKET, MOST LIKELY SCENARIO

TABLE 14 RAILWAY TELEMATICS (MOST LIKELY), BY REGION, 2021–2026 (USD MILLION)

5.13.2 RAILWAY TELEMATICS, OPTIMISTIC SCENARIO

TABLE 15 RAILWAY TELEMATICS (OPTIMISTIC), BY REGION, 2021–2026 (USD MILLION)

5.13.3 RAILWAY TELEMATICS, PESSIMISTIC SCENARIO

TABLE 16 RAILWAY TELEMATICS (PESSIMISTIC), BY REGION, 2021–2026 (USD MILLION)

6 GLOBAL MARKET, BY SOLUTION (Page No. - 69)

6.1 INTRODUCTION

FIGURE 27 RAILWAY TELEMATICS MARKET, BY SOLUTION, 2021 VS. 2026

TABLE 17 MARKET, BY SOLUTION, 2017–2026 (USD MILLION)

6.2 OPERATIONAL DATA

TABLE 18 COMPANIES OFFERING RAILWAY TELEMATICS SOLUTIONS

6.2.1 ASSUMPTIONS

6.2.2 RESEARCH METHODOLOGY

6.3 FLEET MANAGEMENT

6.3.1 WIDE ADOPTION OF FLEET MANAGEMENT SOLUTIONS EXPECTED TO LEAD TO MARKET GROWTH

TABLE 19 FLEET MANAGEMENT: MARKET, BY REGION, 2017–2026 (USD MILLION)

6.4 SHOCK DETECTION

6.4.1 SHOCK DETECTORS DETECT SPEEDS BEYOND THE REGISTERED THRESHOLD LIMITS HENCE SECURE CARGO TRANSPORTATION THROUGH RAIL

TABLE 20 SHOCK DETECTION: MARKET, BY REGION, 2017–2026 (USD MILLION)

6.5 AUTOMATIC STOCK CONTROL

6.5.1 AUTOMATIC STOCK HELPS OPERATORS UNDERSTAND HOW MANY RAILCARS ARE ACTUALLY NEEDED

TABLE 21 AUTOMATIC STOCK CONTROL: MARKET, BY REGION, 2017–2026 (USD MILLION)

6.6 REMOTE DATA ACCESS

6.6.1 REMOTE DATA ACCESS SOLUTION EXPECTED TO ENABLE TRANSPARENT RAIL TRANSPORTATION IN FUTURE

TABLE 22 REMOTE DATA ACCESS: MARKET, BY REGION, 2017–2026 (USD MILLION)

6.7 ESTIMATED TIME OF ARRIVAL

6.7.1 MARKET FOR THE ESTIMATED TIME OF ARRIVAL SEGMENT IS DRIVEN BY THE DEMAND TO IMPROVE TRACEABILITY OF THE LOAD

TABLE 23 ESTIMATED TIME OF ARRIVAL: MARKET, BY REGION, 2017–2026 (USD MILLION)

6.8 RAILCAR TRACKING & TRACING

6.8.1 RAILCAR TRACKING & TRACING SOLUTION EXPECTED TO IMPROVE FLEET OPTIMIZATION

TABLE 24 RAILCAR TRACKING & TRACING: MARKET, BY REGION, 2017–2026 (USD MILLION)

6.9 REFRIGERATED WAGON MANAGEMENT

6.9.1 REFRIGERATED WAGON MANAGEMENT SOLUTIONS ARE EXPECTED TO HAVE HIGHER ADOPTION DUE TO THE INCREASING DEMAND FOR REFRIGERATED GOODS

TABLE 25 REFRIGERATED WAGON MANAGEMENT, MARKET, BY REGION, 2017–2026 (USD MILLION)

6.10 OTHERS

6.10.1 CONSTANT UPDATION OF TELEMATICS TECHNOLOGY EXPECTED TO DRIVE GROWTH OF THE MARKET

TABLE 26 OTHERS, MARKET, BY REGION, 2017–2026 (USD MILLION)

6.11 KEY PRIMARY INSIGHTS

FIGURE 28 KEY PRIMARY INSIGHTS

7 GLOBAL MARKET, BY RAILCAR TYPE (Page No. - 83)

7.1 INTRODUCTION

FIGURE 29 RAILWAY TELEMATICS MARKET, BY RAILCAR TYPE, 2021 VS. 2026

TABLE 27 MARKET, BY RAILCAR TYPE, 2017–2026 (USD MILLION)

7.2 OPERATIONAL DATA

TABLE 28 RAILCAR TYPES LEASED BY COMPANIES

7.2.1 ASSUMPTIONS

7.2.2 RESEARCH METHODOLOGY

7.3 HOPPERS

7.3.1 SIGNIFICANT FLEET OF HOPPERS IN FREIGHT RAIL TO ENSURE DOMINANT POSITION OF THE SEGMENT

TABLE 29 HOPPERS: MARKET, BY REGION, 2017–2026 (USD MILLION)

7.4 TANK CARS

7.4.1 MAINTENANCE OF TEMPERATURE AND PRESSURE IS REQUIRED IN TANK CARS

TABLE 30 TANK CARS: MARKET, BY REGION, 2017–2026 (USD MILLION)

7.5 BOXCARS

7.5.1 TELEMATICS INSTALLED BOXCARS ARE THE HIGHEST USED FOR LOGISTICS FLEET OPERATORS DUE TO THEIR VERSATILITY AND COST-EFFICIENCY

TABLE 31 BOXCARS: MARKET, BY REGION, 2017–2026 (USD MILLION)

7.6 WELL CARS

7.6.1 COST-EFFICIENT AND INTELLIGENT TELEMATICS-BASED INFORMATION SERVICES ENABLE REAL-TIME TRACKING OF WELL CARS

TABLE 32 WELL CARS: MARKET, BY REGION, 2017–2026 (USD MILLION)

7.7 REFRIGERATED BOXCARS

7.7.1 THE DEMAND FOR REFRIGERATED BOXCARS IS EXPERIENCING STABLE GROWTH WITH THE INCREASE IN LONG-HAUL PERISHABLE FREIGHT TRANSPORTATION

TABLE 33 REFRIGERATED BOXCARS: MARKET, BY REGION, 2017–2026 (USD MILLION)

7.8 OTHERS

7.8.1 TELEMATICS SOLUTIONS ENABLE QUICKLY FIND AND DEPLOY IDLE RAILCARS

TABLE 34 OTHERS: MARKET, BY REGION, 2017–2026 (USD MILLION)

7.9 KEY PRIMARY INSIGHTS

FIGURE 30 KEY PRIMARY INSIGHTS

8 GLOBAL MARKET, BY COMPONENT (Page No. - 94)

8.1 INTRODUCTION

FIGURE 31 RAILWAY TELEMATICS MARKET, BY COMPONENT, 2021 VS. 2026

TABLE 35 MARKET, BY COMPONENT, 2017–2026 (USD MILLION)

8.2 OPERATIONAL DATA

TABLE 36 MARKET COMPONENT OFFERING

8.2.1 ASSUMPTIONS

8.2.2 RESEARCH METHODOLOGY

8.3 TCUS

8.3.1 TCUS ENABLE FLEET MANAGERS PROVIDE REAL-TIME DATA TO RAILCAR LEASE OPERATORS

TABLE 37 TCUS: MARKET, BY REGION, 2017–2026 (USD MILLION)

8.4 SENSORS

8.4.1 SENSORS ENABLE ADVANCED RAILCAR MANAGEMENT PROVIDING INCREASED PRODUCTIVITY AND DECREASED OPERATING AND MAINTENANCE COSTS

TABLE 38 SENSORS: MARKET, BY REGION, 2017–2026 (USD MILLION)

8.5 KEY PRIMARY INSIGHTS

FIGURE 32 KEY PRIMARY INSIGHTS

9 GLOBAL MARKET, BY REGION (Page No. - 100)

9.1 INTRODUCTION

FIGURE 33 RAILWAY TELEMATICS MARKET, BY REGION, 2021 VS. 2026 (USD MILLION)

TABLE 39 RAILWAY TELEMATICS MARKET, BY REGION, 2017–2026 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 40 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2026 (USD MILLION)

9.2.1 CHINA

9.2.1.1 Developments in the expansion of freight corridors is driving the market

9.2.2 INDIA

9.2.2.1 Demand for temperature-controlled transportation expected to boost market growth

9.2.3 JAPAN

9.2.3.1 Country is experiencing significant strategic rebalancing in the logistics and supply chain industry, driving market growth

9.2.4 REST OF ASIA PACIFIC

9.2.4.1 Economic and industrial growth in the region drive the market for efficient freight transportation

9.3 EUROPE

TABLE 41 EUROPE: MARKET, BY COUNTRY, 2017–2026 (USD MILLION)

FIGURE 35 EUROPE: MARKET, BY COUNTRY, 2021 VS. 2026 (USD MILLION)

9.3.1 FRANCE

9.3.1.1 New coalition of participants in France’s rail freight targeting doubling freight volumes

9.3.2 GERMANY

9.3.2.1 Presence of major rail freight companies support market growth

9.3.3 UK

9.3.3.1 Initiatives for further enhancements in railway telematics services to drive the market

9.3.4 REST OF EUROPE

9.3.4.1 Adoption of high-speed freight trains in the region projected to drive the market

9.4 NORTH AMERICA

TABLE 42 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2026 (USD MILLION)

9.4.1 US

9.4.1.1 Healthcare industry is driving the demand for telematics embedded box railcars in the country

9.4.2 CANADA

9.4.2.1 Proximity to the US helping Canada procure and source raw materials

9.4.3 MEXICO

9.4.3.1 Development of trade propelling the demand for full visibility of railcars

9.5 ROW

TABLE 43 ROW: MARKET, BY COUNTRY, 2017–2026 (USD MILLION)

FIGURE 36 ROW: MARKET, BY COUNTRY, 2021 VS. 2026 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 The development of new railway infrastructure is expected to lead to the rapid adoption of smart railway solutions

9.5.2 ARGENTINA

9.5.2.1 Government initiatives are expected to lead to the growth of the overall freight market

9.5.3 OTHERS

9.5.3.1 Untapped markets offer significant opportunities for the growth of railway telematics

10 COMPETITIVE LANDSCAPE (Page No. - 117)

10.1 OVERVIEW

FIGURE 37 KEY DEVELOPMENTS BY LEADING PLAYERS, 2017–2021

10.2 MARKET SHARE ANALYSIS FOR THE RAILWAY TELEMATICS

TABLE 44 MARKET SHARE ANALYSIS, 2020

FIGURE 38 MARKET SHARE ANALYSIS, 2020

10.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 39 TOP PUBLIC/LISTED PLAYERS DOMINATING THE RAILWAY TELEMATICS MARKET DURING THE LAST FIVE YEARS

10.4 COMPETITIVE SCENARIO

10.4.1 NEW PRODUCT LAUNCHES

TABLE 45 PRODUCT LAUNCHES, 2017–2021

10.4.2 DEALS

TABLE 46 DEALS, 2017–2021

10.4.3 OTHERS

TABLE 47 OTHERS, 2017-2021

10.5 COMPETITIVE LEADERSHIP MAPPING

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE

10.5.4 PARTICIPANTS

FIGURE 40 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

TABLE 48 MARKET: COMPANY FOOTPRINT, 2021

TABLE 49 MARKET: SOLUTION FOOTPRINT, 2021

10.5.5 MARKET: REGIONAL FOOTPRINT, 2021

TABLE 50 WINNERS VS. TAIL-ENDERS

11 COMPANY PROFILES (Page No. - 140)

11.1 KEY PLAYERS

(Business overview, Products offered, Products offered, Mnm view)*

11.1.1 SIEMENS AG

TABLE 51 SIEMENS AG: BUSINESS OVERVIEW

FIGURE 41 SIEMENS: REGION WISE REVENUE

FIGURE 42 SIEMENS AG: COMPANY SNAPSHOT

TABLE 52 SIEMENS AG: SERVICES OFFERED

TABLE 53 SIEMENS AG: DEALS

11.1.2 ROBERT BOSCH

TABLE 54 ROBERT BOSCH: BUSINESS OVERVIEW

FIGURE 43 ROBERT BOSCH: COMPANY SNAPSHOT

TABLE 55 ROBERT BOSCH: DEALS

11.1.3 HITACHI LTD.

TABLE 56 HITACHI LTD.: BUSINESS OVERVIEW

FIGURE 44 HITACHI LTD.: MOBILITY SOLUTIONS

FIGURE 45 HITACHI LTD.: COMPANY SNAPSHOT

TABLE 57 HITACHI LTD.: NEW PRODUCT DEVELOPMENTS

TABLE 58 HITACHI LTD.: DEALS

11.1.4 ALSTOM

TABLE 59 ALSTOM: BUSINESS OVERVIEW

FIGURE 46 ALSTOM: COMPANY SNAPSHOT

FIGURE 47 ALSTOM: GEOGRAPHIC PRESENCE

TABLE 60 ALSTOM: NEW PRODUCT DEVELOPMENTS

TABLE 61 ALSTOM: DEALS

TABLE 62 ALSTOM: OTHERS

11.1.5 KNORR- BREMSE SYSTEME FUR SCHIENENFAHRZEUGE GMBH

TABLE 63 KNORR- BREMSE SYSTEME FUR SCHIENENFAHRZEUGE GMBH: BUSINESS OVERVIEW

FIGURE 48 KNORR- BREMSE SYSTEME FUR SCHIENENFAHRZEUGE GMBH: RESEARCH & DEVELOPMENT EXPENDITURE

FIGURE 49 KNORR- BREMSE SYSTEME FUR SCHIENENFAHRZEUGE GMBH: SCHEMATIC DIAGRAM OF PRODUCT OFFERINGS

FIGURE 50 KNORR- BREMSE SYSTEME FUR SCHIENENFAHRZEUGE GMBH: COMPANY SNAPSHOT

TABLE 64 KNORR- BREMSE SYSTEME FUR SCHIENENFAHRZEUGE GMBH: PRODUCTS OFFERED

TABLE 65 KNORR- BREMSE SYSTEME FUR SCHIENENFAHRZEUGE GMBH: DEALS

TABLE 66 KNORR- BREMSE SYSTEME FUR SCHIENENFAHRZEUGE GMBH: OTHERS

11.1.6 WABTEC

TABLE 67 WABTEC: BUSINESS OVERVIEW

FIGURE 51 WABTEC: FUTURE OUTLOOK

FIGURE 52 WABTEC: COMPANY SNAPSHOT

TABLE 68 WABTEC: PRODUCTS OFFERED

TABLE 69 WABTEC: NEW PRODUCT DEVELOPMENTS

TABLE 70 WABTEC: DEALS

TABLE 71 WABTEC: OTHERS

11.1.7 INTREX TELEMATICS

TABLE 72 INTREX TELEMATICS: BUSINESS OVERVIEW

TABLE 73 INTREX TELEMATICS: PRODUCTS OFFERED

11.1.8 TRINITY INDUSTRIES

TABLE 74 TRINITY INDUSTRIES: BUSINESS OVERVIEW

FIGURE 53 TRINITY INDUSTRIES: COMPANY SNAPSHOT

TABLE 75 TRINITY INDUSTRIES: NEW PRODUCT DEVELOPMENTS

11.1.9 CANDO RAIL AND TERMINALS

TABLE 76 CANDO RAIL AND TERMINALS: BUSINESS OVERVIEW

TABLE 77 CANDO RAIL & TERMINALS: DEALS

TABLE 78 CANDO RAIL & TERMINALS: OTHERS

11.1.10 ORBCOMM

FIGURE 54 ORBCOMM: CLIENTELE

TABLE 79 ORBCOMM: BUSINESS OVERVIEW

FIGURE 55 ORBCOMM: COMPANY SNAPSHOT

TABLE 80 ORBCOMM: PRODUCTS OFFERED

TABLE 81 ORBCOMM: NEW PRODUCT DEVELOPMENTS

TABLE 82 ORBCOMM: DEALS

11.1.11 RAILNOVA

TABLE 83 RAILNOVA: BUSINESS OVERVIEW

TABLE 84 RAILNOVA: PRODUCTS OFFERED

TABLE 85 RAILNOVA: DEALS

11.1.12 INTERMODAL TELEMATICS

TABLE 86 INTERMODAL TELEMATICS: BUSINESS OVERVIEW

TABLE 87 INTERMODAL TELEMATICS: PRODUCTS OFFERED

TABLE 88 INTERMODAL TELEMATICS: DEALS

11.1.13 SAVVY TELEMATICS

TABLE 89 SAVVY TELEMATICS: BUSINESS OVERVIEW

TABLE 90 SAVVY TELEMATICS: PRODUCTS OFFERED

TABLE 91 SAVVY TELEMATICS: DEALS

11.1.14 A1 DIGITAL

TABLE 92 A1 DIGITAL: BUSINESS OVERVIEW

TABLE 93 A1 DIGITAL: PRODUCTS OFFERED

TABLE 94 A1 DIGITAL: DEALS

11.1.15 ERMEWA SA

TABLE 95 ERMEWA SA: BUSINESS OVERVIEW

TABLE 96 ERMEWA SA: PRODUCTS OFFERED

TABLE 97 ERMEWA SA: DEALS

11.1.16 NORFOLK SOUTHERN

TABLE 98 NORFOLK SOUTHERN: BUSINESS OVERVIEW

FIGURE 56 NORFOLK SOUTHERN: COMPANY SNAPSHOT

TABLE 99 NORFOLK SOUTHERN: PRODUCTS OFFERED

TABLE 100 NORFOLK SOUTHERN: NEW PRODUCT DEVELOPMENTS

TABLE 101 NORFOLK SOUTHERN: DEALS

TABLE 102 NORFOLK SOUTHERN: OTHERS

11.1.17 VTG AG

TABLE 103 VTG AG: BUSINESS OVERVIEW

FIGURE 57 VTG AG: COMPANY SNAPSHOT

TABLE 104 VTG AG: PRODUCTS OFFERED

TABLE 105 VTG AG: DEALS

TABLE 106 VTG AG: OTHERS

*Details on Business overview, Products offered, Products offered, Mnm view might not be captured in case of unlisted companies.

11.2 OTHER KEY PLAYERS

11.2.1 STARTRAK GPS

11.2.2 AMSTED DIGITAL

11.2.3 TRAXENS

11.2.4 TECH MAHINDRA LTD

11.2.5 SIERRA WIRELESS

11.2.6 CALAMP CORP.

11.2.7 IBM CORPORATION

11.2.8 ATOS CORPORATION

11.2.9 J.M. VOITH

11.2.10 LAT-LON

11.2.11 CISCO

11.2.12 TRIMBLE

11.2.13 SAVI TECHNOLOGY

11.2.14 WASCOSA

12 APPENDIX (Page No. - 215)

12.1 KEY INDUSTRY INSIGHTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

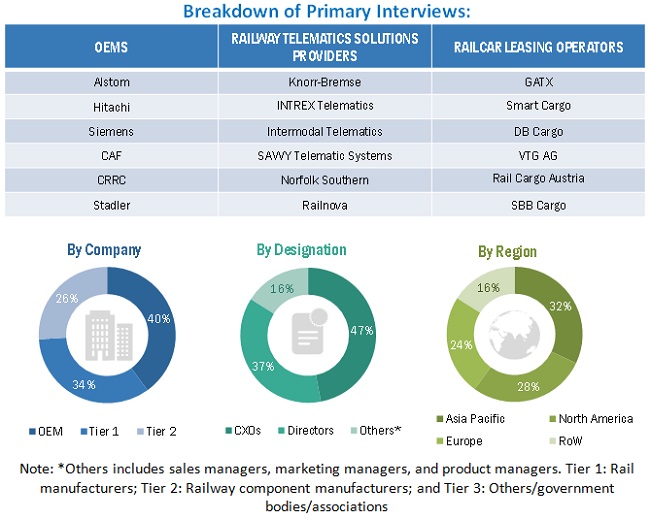

The study involved four major activities in estimating the current size of the railway telematics market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of railway telematics OEMs, International Railway Journal (IRJ), Federal Transit Administration (FTA), American Public Transportation Association (APTA), Regional Transportation Authority (RTA), country-level railway associations and trade organizations, and the US Department of Transportation (DOT)], railway telematics magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, government organizations websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global railway telematics market.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the global market scenario through secondary research. Several primary interviews have been conducted with market experts from both, the demand-side (rolling stock manufacturers, railway operators) and supply-side (railway telematics solution vendors, software providers, and component manufacturers) across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 52% and 48% of primary interviews have been conducted from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

primary participants

In-depth interviews have been conducted with the target groups to collect industry-related data, technology-related information, and validation of our analysis.

- Connected Rail Solution Vendors

- Digital Rail Solution Vendors

- Railway Operators

- Railway Telematics Solution Providers

- Raw Material Suppliers for Railway Telematics

- Rolling Stock Manufacturers

- Telematic Component Manufacturers

- Transportation Companies

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the railway telematics market and other dependent submarkets, as mentioned below:

- Key players in the railway telematics were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights.

- All major penetration rates, percentage shares, splits, and breakdowns for the market were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study were accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To analyze and forecast the size of the railway telematics market in terms of value (USD million)

- To analyze and forecast the size of the market based on solution (automatic stock control, estimated time of arrival, fleet management, railcar tracking & tracing, refrigerated wagon management, remote data access, shock detection, and others)

- To analyze and forecast the size of the market based on railcar type (hoppers, tank cars, boxcars, well cars, refrigerated boxcars, and others)

- To analyze and forecast the size of the market based on component (telematics control unit and sensors)

- To define, describe, and project the size of the market based on region (Asia Pacific, North America, Europe, and the Rest of the World (RoW))

- To identify the dynamics, including drivers, restraints, opportunities, and challenges, and analyze their impact on the market

- To track and analyze competitive developments such as new product launches, deals, and others carried out by key industry participants to strengthen their positions in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Railway telematics market, by solution, at the country-level (For countries covered in the report)

- Railway telematics market, by railcar type, at the country-level (For countries covered in the report)

Company Information

- Profiles of additional market players (Up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Railway Telematics Market

How is the technology segment is expecting to hold a major share of the global Railway Telematics from 2022 to 2028?