Railway Platform Security Market by Sensors (Radar, Microwave, & Infrared), Video Surveillance Systems (Camera, Video Management & Video Analytics), Alarm Systems & PSDs, Services, Applications (Subway & Trains) and Region - Global Forecast to 2024

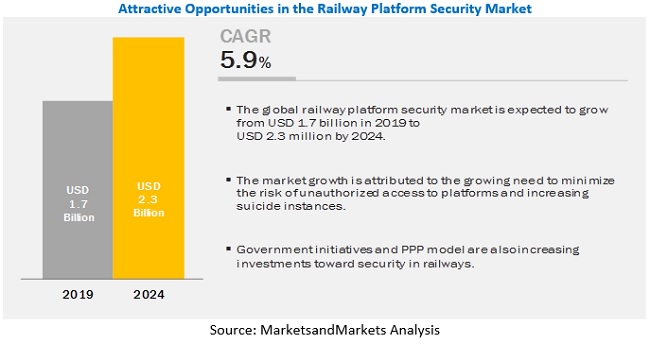

[151 Pages Report] MarketsandMarkets projects the global railway platform security market size to grow from USD 1.7 billion in 2019 to USD 2.3 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 5.9% during the forecast period. Major factors expected to drive the growth of the railway platform security market include the increasing suicide instances, growing need to minimize the risk of unauthorized access to platforms, and increasing demand for additional support and advanced solutions for security management.

By component, the solutions segment to hold a larger market size during the forecast period

Based on components, the global market is segmented into solutions and services. Enterprises are deploying perimeter intrusion solutions, such as sensors and video surveillance systems, to prevent security intrusion. They are more focused on protecting fences, gates, and walls through sensors, such as fiber optic sensors, radar sensors, microwave sensors, and infrared sensors. The railway platform security market is a solution-driven market. The solutions play a crucial role in handling all the railway platform security-related activities that include passenger safety and security. Moreover, the solutions are used to improve operational efficiency and railways management systems.

Among services, the managed services segment to grow at a higher CAGR during the forecast period

The railway platform security market is segregated into professional services and managed services. Managed service vendors are third-party IT service providers who remotely manage clients IT infrastructure and systems for the backup and recovery of business-critical data. Managed Service Providers (MSPs) deliver technologically advanced offerings to their commercial clients for providing the best-in-class services. Enterprises opt for MSPs to overcome the challenges of budget constraints and technical expertise, as they have skilled human resources, infrastructure, and industry certifications. Managed services are designed to provide technical support round-the-clock, maximize overall performance, and achieve cost optimization.

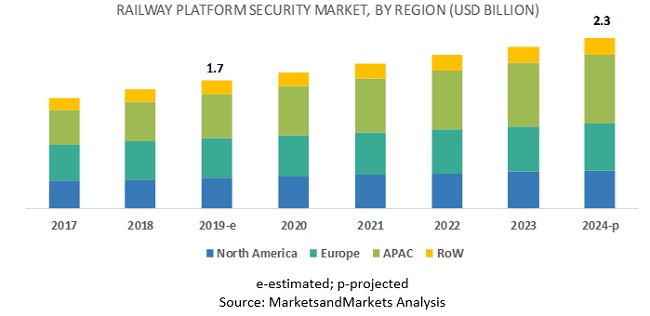

Asia Pacific to account for the highest market share during the forecast period

The regional analysis of the railway platform security market covers North America, Europe, APAC, and Rest of the World (RoW). APAC is expected to have the highest market share and growth potential in the market during the forecast period. This growth can be attributed to the rapid deployment of surveillance solutions and Platform Screen Doors (PSDs) in China and high-speed rail, smart transportation, and railway modernization projects in most of the APAC countries.

Key Railway Platform Security Market Players

Key and emerging market players include Honeywell (US), Indra Sistemas (Spain), Huawei (China), Bosch (Germany), Atos (France), FLIR Systems (US), Axis Communications (Sweden), telent (UK), Zhejiang Dahua (US), Hikvision (China), STANLEY (US), Wabtec (US), L&T Technology Services (India), Mitsubishi Electric (Japan), Genetec (Canada), Knorr-Bremse (Germany), Nabtesco (Japan), Senstar (Canada), Avnet (US), and Anixter (US). These players have adopted various strategies to grow in the market. They focus on inorganic and organic growth strategies to strengthen their market position.

Scope of Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2024 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Components, Applications, and Regions |

|

Regions covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Honeywell (US), Indra Sistemas (Spain), Huawei (China), Bosch (Germany), Atos (France), FLIR Systems (US), Axis Communications (Sweden), telent (UK), Zhejiang Dahua (US), Hikvision (China), STANLEY (US), Wabtec (US), L&T Technology Services (India), Mitsubishi Electric (Japan), Genetec (Canada), Knorr-Bremse (Germany), Nabtesco (Japan), Senstar (Canada), Avnet (US), and Anixter (US) |

This research report categorizes the market to forecast revenue and analyze trends in each of the following submarkets:

Railway Platform Security Market Based on Components:

- Solutions

- Sensors

- Microwave sensors

- Infrared sensors

- Fiber optic sensors

- Radar sensors

- Other sensors

- Video Surveillance Systems

- Software

- Intelligent Video Analytics

- Video Management Software

- Hardware

- Camera

- Analog Cameras

- IP Cameras

- Storage Devices

- Camera

- Software

- Platform Edge Doors (PEDs)/Platform Screen Doors (PSDs)

- Alert/alarm system

- Sensors

- Services

- Professional Services

- System Integration and Deployment

- Support and Maintenance

- Managed Services

- Professional Services

Railway Platform Security Market Based on Applications:

- Subways

- Trains

Based on regions:

- North America

- US

- Canada

- Europe

- UK

- Germany

- Spain

- Rest of Europe

- APAC

- China

- India

- Japan

- Rest of APAC

- RoW

- Middle East and Africa (MEA)

- Latin America

Recent Developments

- In September 2019, Honeywell launched a new software that simplifies, strengthens, and scales cybersecurity for asset-intensive businesses and critical infrastructure facing cyber threats. The new software safely moves data from one site to another, uses operations data to strengthen endpoint and network security, and improves cybersecurity compliance.

- In February 2019, Wabtec Corporation completed its merger with GE Transportation.

- In February 2019, Indra Sistemas partnered with Begirale, a technology-based company specialized in computer vision and computer intelligence technologies. According to the partnership, Indra Sistemas would use Begirales products, begicrossing and begirail, to improve railway safety.

- In November 2018, Hikvision updated the versions of its thermal deep learning bullet cameras, which offer various enhanced capabilities to perimeter security, along with the advanced fire detection technology.

- In September 2018, Brazilian Urban Trains Company (CBTU) inaugurated a new phase of surveillance operation with the acquisition of 1,380 high-resolution cameras from Dahua Technology to deploy the surveillance system for the Pernambuco subway in Brazil.

Critical Questions the Report Answers:

- Where will all these developments take the railway platform security industry in the long term?

- What are the upcoming trends for the railway platform security market?

- Which segment provides the most opportunity for market growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

Frequently Asked Questions (FAQ):

What is Railway Platform Security?

The railway platform security focuses on ensuring the safety of passengers and assets at platforms designed for both subways and trains. It aims at minimizing accidents on platforms and includes systems, approaches, and procedures that are used to monitor the platforms to reduce the instances of trespassing and suicides through sensors, video surveillance, intrusion detection alarms, and Platform Screen Doors (PSDs).

How is the growth of railway platform security market??

MarketsandMarkets projects the global railway platform security market size to grow from USD 1.7 billion in 2019 to USD 2.3 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 5.9% during the forecast period.

Which are the top industry players in the railway platform security market?

Honeywell, Indra Sistemas, Huawei, Bosch, Atos, FLIR Systems, Axis Communications and Wabtec are some of the top industry players offering railway platform security solutions and services.

What are the top trends in railway platform security market?

Trends that are impacting the railway platform security market includes:

- Growing need to minimize the risk of unauthorized access to platforms

- Need for platform security due to the increasing instances of suicides

- Requirement of additional support and advanced solutions for security management

Opportunities for the railway platform security market:

- Smart city initiatives boost platform security

- Growing publicprivate partnership investment for enhanced platform security

- Requirement of object identification through artificial intelligence

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.4 Market Forecast

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Attractive Market Opportunities in the Railway Platform Security Market

4.2 Market, By Component, 2019

4.3 Market, By Solution, 20172024

4.4 Market, By Service, 2019 vs 2024

4.5 Market Investment Scenario

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Need to Minimize the Risk of Unauthorized Access to Platforms

5.2.1.2 Rising Need for Enhanced Staff Security for Public and Passenger Safety

5.2.1.3 Increasing Need for Additional Support and Advanced Solutions for Security Management

5.2.1.4 Growing Need for Platform Security Due to the Increasing Instances of Suicides

5.2.2 Restraints

5.2.2.1 Heavy Infrastructure Investments Required for Platform Security

5.2.3 Opportunities

5.2.3.1 Smart City Initiatives Boost Platform Security

5.2.3.2 Growing PublicPrivate Partnership Investment for Enhanced Platform Security

5.2.3.3 Requirement of Object Identification Through Artificial Intelligence

5.2.4 Challenges

5.2.4.1 Growing Privacy and Security Concerns Leading to Numerous Threats to Platform Security

5.2.4.2 Rising Cases of False Alarms

5.3 Impact of Disruptive Technologies

5.3.1 Artificial Intelligence

5.3.2 Internet of Things

5.4 Connected Markets

5.4.1 Physical Security Market

5.4.2 Perimeter Intrusion Detection System Market

5.5 Emerging Safety Practices

5.5.1 Platform Screen Doors

5.5.2 Blue LED Lights and Mirrors

6 Railway Platform Security Market, By Component (Page No. - 42)

6.1 Introduction

6.2 Solutions

6.2.1 Sensors

6.2.1.1 Microwave Sensors

6.2.1.2 Infrared Sensors

6.2.1.3 Fiber Optic Sensors

6.2.1.4 Radar Sensors

6.2.1.5 Other Sensors

6.2.2 Video Surveillance Systems

6.2.2.1 Software

6.2.2.1.1 Intelligent Video Analytics

6.2.2.1.2 Video Management Software

6.2.2.2 Hardware

6.2.2.2.1 Camera

6.2.2.2.1.1 Analog Camera

6.2.2.2.1.2 IP Camera

6.2.2.2.2 Storage Device

6.2.3 Platform Edge Doors/Platform Screen Doors

6.2.4 Alert/Alarm Systems

6.3 Services

6.3.1 Professional Services

6.3.1.1 System Integration and Deployment

6.3.1.2 Support and Maintenance

6.3.2 Managed Services

7 Railway Platform Security Solutions Market, By Application (Page No. - 61)

7.1 Introduction

7.2 Subways

7.3 Trains

8 Railway Platform Security Market, By Region (Page No. - 65)

8.1 Introduction

8.2 North America

8.2.1 United States

8.2.2 Canada

8.3 Europe

8.3.1 United Kingdom

8.3.2 Spain

8.3.3 Germany

8.3.4 Rest of Europe

8.4 Asia Pacific

8.4.1 India

8.4.2 China

8.4.3 Japan

8.4.4 Rest of Asia Pacific

8.5 Rest of the World

8.5.1 Middle East and Africa

8.5.2 Latin America

9 Competitive Landscape (Page No. - 102)

9.1 Introduction

9.2 Competitive Scenario

9.2.1 Partnerships

9.2.2 New Product Launches

9.2.3 Acquisitions

9.2.4 Business Expansions

10 Company Profiles (Page No. - 107)

10.1 Introduction

(Business Overview, Solutions, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

10.2 Honeywell

10.3 Indra Sistemas

10.4 Huawei

10.5 Bosch

10.6 ATOS

10.7 FLIR Systems

10.8 Axis Communications

10.9 Telent

10.10 Dahua Technology

10.11 Hikvision

10.12 STANLEY Access Technology

10.13 WabTec Corporation

10.14 L&T Technology Services

10.15 Mitsubishi Electric

10.16 Genetec

10.17 Knorr-Bremse

10.18 Nabtesco

10.19 Senstar

10.20 Avnet

10.21 Anixter

*Details on Business Overview, Solutions, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 145)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (126 Tables)

Table 1 United States Dollar Exchange Rate, 20162018

Table 2 Factor Analysis

Table 3 Railway Platform Security Market Size, By Component, 20172024 (USD Million)

Table 4 Solutions: Market Size, By Type, 20172024 (USD Million)

Table 5 Solutions: Market Size, By Region, 20172024 (USD Million)

Table 6 Sensors Market Size, By Type, 20172024 (USD Million)

Table 7 Sensors Market Size, By Region, 20172024 (USD Million)

Table 8 Microwave Sensors Market Size, By Region, 20172024 (USD Million)

Table 9 Infrared Sensors Market Size, By Region, 20172024 (USD Million)

Table 10 Fiber Optic Sensors Market Size, By Region, 20172024 (USD Million)

Table 11 Radar Sensors Market Size, By Region, 20172024 (USD Million)

Table 12 Other Sensors Market Size, By Region, 20172024 (USD Million)

Table 13 Video Surveillance Systems Market Size, By Type, 20172024 (USD Million)

Table 14 Video Surveillance Systems Market Size, By Region, 20172024 (USD Million)

Table 15 Software Market Size, By Type, 20172024 (USD Million)

Table 16 Software Market Size, By Region 20172024 (USD Million)

Table 17 Intelligent Video Analytics Market Size, By Region, 20172024 (USD Million)

Table 18 Video Management Software Market Size, By Region, 20172024 (USD Million)

Table 19 Hardware Market Size, By Type, 20172024 (USD Million)

Table 20 Hardware Market Size, By Region, 20172024 (USD Million)

Table 21 Camera Market Size, By Type, 20172024 (USD Million)

Table 22 Camera Market Size, By Region, 20172024 (USD Million)

Table 23 Analog Camera Market Size, By Region, 20172024 (USD Million)

Table 24 IP Camera Market Size, By Region, 20172024 (USD Million)

Table 25 Storage Device Market Size, By Region, 20172024 (USD Million)

Table 26 Platform Edge Doors/Platform Screen Doors Market Size, By Region, 20172024 (USD Million)

Table 27 Alert/Alarm Systems Market Size, By Region, 20172024 (USD Million)

Table 28 Services: Railway Platform Security Market Size, By Type, 20172024 (USD Million)

Table 29 Services: Railway Platform Security Market Size, By Region, 20172024 (USD Million)

Table 30 Professional Services Market Size, By Type, 20172024 (USD Million)

Table 31 Professional Services Market Size, By Region, 20172024 (USD Million)

Table 32 System Integration and Deployment Market Size, By Region, 20172024 (USD Million)

Table 33 Support and Maintenance Market Size, By Region, 20172024 (USD Million)

Table 34 Managed Services Market Size, By Region, 20172024 (USD Million)

Table 35 Railway Platform Security Market Size, By Application, 20172024 (USD Million)

Table 36 Subways: Market Size, By Region, 20172024 (USD Million)

Table 37 Trains: Market Size, By Region, 20172024 (USD Million)

Table 38 Railway Platform Security Market Size, By Region, 20172024 (USD Million)

Table 39 North America: Railway Platform Security Market Size, By Component, 20172024 (USD Million)

Table 40 North America: Railway Platform Security Solutions Market Size, By Type, 20172024 (USD Million)

Table 41 North America: Sensors Market Size, By Type, 20172024 (USD Million)

Table 42 North America: Video Surveillance System Market Size, By Type, 20172024 (USD Million)

Table 43 North America: Software Market Size, By Type, 20172024 (USD Million)

Table 44 North America: Hardware Market Size, By Type, 20172024 (USD Million)

Table 45 North America: Camera Market Size, By Type, 20172024 (USD Million)

Table 46 North America: Railway Platform Security Services Market Size, By Type, 20172024 (USD Million)

Table 47 North America: Professional Services Market Size, By Type, 20172024 (USD Million)

Table 48 North America: Railway Platform Security Market Size, By Application, 20172024 (USD Million)

Table 49 North America: Market Size, By Country, 20172024 (USD Million)

Table 50 United States: Railway Platform Security Market Size, By Component, 20172024 (USD Million)

Table 51 United States: Railway Platform Security Solutions Market Size, By Type, 20172024 (USD Million)

Table 52 United States: Sensors Market Size, By Type, 20172024 (USD Million)

Table 53 United States: Video Surveillance System Market Size, By Type, 20172024 (USD Million)

Table 54 United States: Software Market Size, By Type, 20172024 (USD Million)

Table 55 United States: Hardware Market Size, By Type, 20172024 (USD Million)

Table 56 United States: Camera Market Size, By Type, 20172024 (USD Million)

Table 57 United States: Railway Platform Security Services Market Size, By Type, 20172024 (USD Million)

Table 58 United States: Professional Services Market Size, By Type, 20172024 (USD Million)

Table 59 United States: Railway Platform Security Market Size, By Application, 20172024 (USD Million)

Table 60 Europe: Railway Platform Security Market Size, By Component, 20172024 (USD Million)

Table 61 Europe: Railway Platform Security Solutions Market Size, By Type, 20172024 (USD Million)

Table 62 Europe: Sensors Market Size, By Type, 20172024 (USD Million)

Table 63 Europe: Video Surveillance System Market Size, By Type, 20172024 (USD Million)

Table 64 Europe: Software Market Size, By Type, 20172024 (USD Million)

Table 65 Europe: Hardware Market Size, By Type, 20172024 (USD Million)

Table 66 Europe: Camera Market Size, By Type, 20172024 (USD Million)

Table 67 Europe: Railway Platform Security Services Market Size, By Type, 20172024 (USD Million)

Table 68 Europe: Professional Services Market Size, By Type, 20172024 (USD Million)

Table 69 Europe: Market Size, By Application, 20172024 (USD Million)

Table 70 Europe: Market Size, By Country, 20172024 (USD Million)

Table 71 United Kingdom: Railway Platform Security Market Size, By Component, 20172024 (USD Million)

Table 72 United Kingdom: Railway Platform Security Solutions Market Size, By Type, 20172024 (USD Million)

Table 73 United Kingdom: Sensors Market Size, By Type, 20172024 (USD Million)

Table 74 United Kingdom: Video Surveillance System Market Size, By Type, 20172024 (USD Million)

Table 75 United Kingdom: Software Market Size, By Type, 20172024 (USD Million)

Table 76 United Kingdom: Hardware Market Size, By Type, 20172024 (USD Million)

Table 77 United Kingdom: Camera Market Size, By Type, 20172024 (USD Million)

Table 78 United Kingdom: Railway Platform Security Services Market Size, By Type, 20172024 (USD Million)

Table 79 United Kingdom: Professional Services Market Size, By Type, 20172024 (USD Million)

Table 80 United Kingdom: Market Size, By Application, 20172024 (USD Million)

Table 81 Spain: Railway Platform Security Market Size, By Component, 20172024 (USD Million)

Table 82 Spain: Railway Platform Security Solutions Market Size, By Type, 20172024 (USD Million)

Table 83 Spain: Sensors Market Size, By Type, 20172024 (USD Million)

Table 84 Spain: Video Surveillance System Market Size, By Type, 20172024 (USD Million)

Table 85 Spain: Software Market Size, By Type, 20172024 (USD Million)

Table 86 Spain: Hardware Market Size, By Type, 20172024 (USD Million)

Table 87 Spain: Camera Market Size, By Type, 20172024 (USD Million)

Table 88 Spain: Railway Platform Security Services Market Size, By Type, 20172024 (USD Million)

Table 89 Spain: Professional Services Market Size, By Type, 20172024 (USD Million)

Table 90 Spain: Market Size, By Application, 20172024 (USD Million)

Table 91 Asia Pacific: Railway Platform Security Market Size, By Component, 20172024 (USD Million)

Table 92 Asia Pacific: Railway Platform Security Solutions Market Size, By Type, 20172024 (USD Million)

Table 93 Asia Pacific: Sensors Market Size, By Type, 20172024 (USD Million)

Table 94 Asia Pacific: Video Surveillance System Market Size, By Type, 20172024 (USD Million)

Table 95 Asia Pacific: Software Market Size, By Type, 20172024 (USD Million)

Table 96 Asia Pacific: Hardware Market Size, By Type, 20172024 (USD Million)

Table 97 Asia Pacific: Camera Market Size, By Type, 20172024 (USD Million)

Table 98 Asia Pacific: Railway Platform Security Services Market Size, By Type, 20172024 (USD Million)

Table 99 Asia Pacific: Professional Services Market Size, By Type, 20172024 (USD Million)

Table 100 Asia Pacific: Market Size, By Application, 20172024 (USD Million)

Table 101 Asia Pacific: Market Size, By Country, 20172024 (USD Million)

Table 102 India: Railway Platform Security Market Size, By Component, 20172024 (USD Million)

Table 103 India: Railway Platform Security Solutions Market Size, By Type, 20172024 (USD Million)

Table 104 India: Sensors Market Size, By Type, 20172024 (USD Million)

Table 105 India: Video Surveillance System Market Size, By Type, 20172024 (USD Million)

Table 106 India: Software Market Size, By Type, 20172024 (USD Million)

Table 107 India: Hardware Market Size, By Type, 20172024 (USD Million)

Table 108 India: Camera Market Size, By Type, 20172024 (USD Million)

Table 109 India: Railway Platform Security Services Market Size, By Type, 20172024 (USD Million)

Table 110 India: Professional Services Market Size, By Type, 20172024 (USD Million)

Table 111 India: Market Size, By Application, 20172024 (USD Million)

Table 112 Rest of the World: Railway Platform Security Market Size, By Component, 20172024 (USD Million)

Table 113 Rest of the World: Railway Platform Security Solutions Market Size, By Type, 20172024 (USD Million)

Table 114 Rest of the World: Sensors Market Size, By Type, 20172024 (USD Million)

Table 115 Rest of the World: Video Surveillance System Market Size, By Type, 20172024 (USD Million)

Table 116 Rest of the World: Software Market Size, By Type, 20172024 (USD Million)

Table 117 Rest of the World: Railway Platform Security Hardware Market Size, By Type, 20172024 (USD Million)

Table 118 Rest of the World: Camera Market Size, By Type, 20172024 (USD Million)

Table 119 Rest of the World: Railway Platform Security Services Market Size, By Type, 20172024 (USD Million)

Table 120 Rest of the World: Professional Services Market Size, By Type, 20172024 (USD Million)

Table 121 Rest of the World: Railway Platform Security Market Size, By Application, 20172024 (USD Million)

Table 122 Rest of the World: Market Size, By Sub-Region, 20172024 (USD Million)

Table 123 Partnerships, 2019

Table 124 New Product/Service Launches and Product Enhancements, 20182019

Table 125 Acquisitions, 2019

Table 126 Business Expansions, 2018

List of Figures (38 Figures)

Figure 1 Railway Platform Security Market: Research Design

Figure 2 Market Size Estimation MethodologyApproach 1 (Supply Side): Revenue of Solutions/Services of Railway Platform Security Vendors

Figure 3 Market Size Estimation MethodologyApproach 1, Bottom Up (Supply Side): Collective Revenue of All Solutions/Services of Railway Platform Security Vendors

Figure 4 Market Size Estimation Methodology: Approach 2, Top Down (Demand Side): Share of Railway Platform Security Through Overall Railway Spending

Figure 5 Global Railway Platform Security Market to Witness Steady Growth During the Forecast Period

Figure 6 Top 3 Leading Segments in the Market in 2019

Figure 7 Market: Regional Snapshot

Figure 8 Rising Need to Curb the Instances of Unauthorized Access and Suicides to Drive the Market Growth

Figure 9 Solutions Segment to Hold A Higher Market Share in the Railway Platform Security Market in 2019

Figure 10 Video Surveillance System to Account for the Highest Market Share Among the Railway Platform Security Solutions During the Forecast Period

Figure 11 Professional Services Segment to Lead the Railway Platform Security Services in Terms of Market Share During the Forecast Period

Figure 12 Asia Pacific to Emerge as the Best Market for Investment During the Forecast Period

Figure 13 Railway Platform Security Market: Drivers, Restraints, Opportunities, and Challenges

Figure 14 Services Segment to Grow at A Higher CAGR During the Forecast Period as Compared to the Solutions Segment

Figure 15 Managed Services Segment to Grow at A Higher CAGR During the Forecast Period

Figure 16 Trains Segment to Grow at A Higher CAGR During the Forecast Period

Figure 17 Asia Pacific to Exhibit the Highest CAGR in the Railway Platform Security Market During the Forecast Period

Figure 18 Europe: Market Snapshot

Figure 19 Asia Pacific: Market Snapshot

Figure 20 Key Developments in the Railway Platform Security Market (20182019)

Figure 21 Market Evaluation Framework, 20182019

Figure 22 Honeywell: Company Snapshot

Figure 23 Honeywell: SWOT Analysis

Figure 24 Indra Sistemas: Company Snapshot

Figure 25 Indra Sistemas: SWOT Analysis

Figure 26 Huawei: Company Snapshot

Figure 27 Huawei: SWOT Analysis

Figure 28 Bosch: Company Snapshot

Figure 29 Bosch: SWOT Analysis

Figure 30 ATOS: Company Snapshot

Figure 31 FLIR Systems: Company Snapshot

Figure 32 FLIR Systems: SWOT Analysis

Figure 33 Dahua Technology: Company Snapshot

Figure 34 Hikvision: Company Snapshot

Figure 35 STANLEY Access Technology: Company Snapshot

Figure 36 Wabtec Corporation: Company Snapshot

Figure 37 L&T Technology Services: Company Snapshot

Figure 38 Mitsubishi Electric: Company Snapshot

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

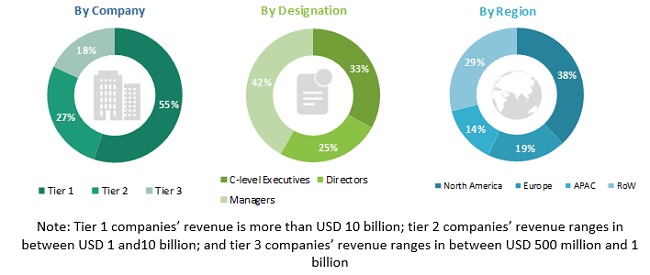

The railway platform security market comprises several stakeholders, such as government agencies, railway platform security Original Equipment Manufacturers (OEMs), railway platform security service providers, system integrators, consulting firms, research organizations, resellers and distributors, managed service providers, regulatory authorities and associations, Information Technology (IT) service providers, consultants/consultancies/advisory firms, and training providers.

The demand side of the railway platform security market consists of the firms operating in several industry verticals. The supply side includes railway platform security providers offering railway platform security solutions and services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakup of the primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global railway platform security market and its various other dependent submarkets. An exhaustive list of all the vendors offering solutions and services in the market was prepared while using the top-down approach. The market share of all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its components (solutions and services). The aggregate of all companies revenue was extrapolated to reach the overall market size.

Furthermore, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and marketing executives.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the railway platform security market by component (solutions and services), applications, and regions

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to 4 main regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as mergers and acquisitions, new product developments, and Research and Development (R&D) activities, in the market

Available Customizations

- With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Canadian railway platform security market by component

- Further breakup of the France market by component

- Further breakup of the China market by component

- Further breakup of the MEA market by component

- Further breakup of the Latin American railway platform security market by component

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Railway Platform Security Market