Railway Cybersecurity Market by Type (Infrastructural & On-board), Offering, Security Type (Network, Application, Endpoint, System Administration and Data Protection), Application (Passenger & Freight), Rail Type and Region - Global Forecast to 2027

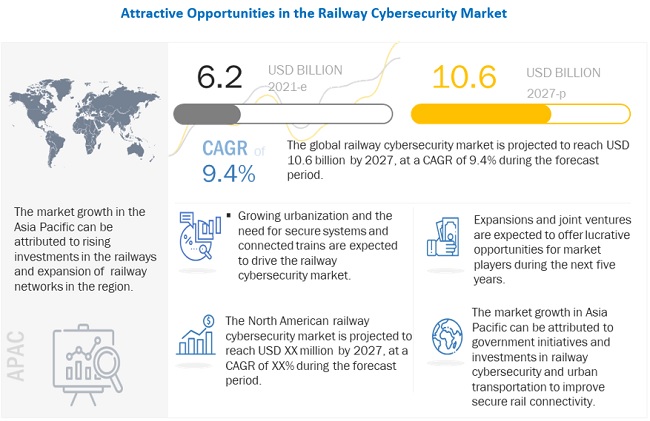

[259 Pages Report] The railway cybersecurity market, by value, is estimated to be USD 6.2 billion in 2021 and is projected to reach USD 10.6 billion by 2027, at a CAGR of 9.4% from 2021 to 2027. Internet technology captured the application area in railways with smart cities, smart transportation, rail traffic management systems, CBTC, and PTC. Advanced technologies include PIS, smart ticketing, passenger infotainment, rail analytics, cloud and IoT services, freight information and analytics, freight rail solutions such as fleet monitoring, automatic stock management, intelligent and smart devices, and scheduling and optimization capabilities. All these technologies face the threat of cybersecurity. In addition to this, due to the emergence of advanced systems and solutions, IoT in the railway industry has become more prone to cybersecurity threats. These factors would support growth of the deployment of railway cybersecurity solutions.

The increase in data breaches or data leakages is fueling the market for railway cybersecurity products, solutions and services. With the advancements in technologies, automated and sophisticated cyberattacks are accelerating. The increasing sophistication of attacks is triggering railway operators across the globe to adopt cybersecurity solutions and services to combat cyberattacks. For example, in May 2021, SNCF with its partner Alstom, Bosch, SpirOps, Thales, and the Railenium Technology Research Institute announced the launch to develop prototype for autonomous train in France. Cybersecurity is a key major concern for autonomous train, consortium partners are working with ANSSI (Agence Nationale de la Sécurité des Systèmes d'Information) French national cybersecurity authority from start of the project. In 2020, Alstom invested USD 7 Million in Cylus, an Israel-based cybersecurity specialist company to provide the best in class cybersecurity solutions for the rail market.

The deployment of smart digitalized railway systems requires joint efforts from various stakeholders such as telecom operators, infrastructure providers, service providers, manufacturers, public sectors, and user groups. Government authorities are adopting Public Private Partnership (PPP) models, which enable private sector companies participate in smart, digital and connected railway initiatives of governments for deploying and financing transportation projects. This would impact the demand for number of railway cybersecurity projects.

Asia Pacific is estimated to be the fastest-growing region in the railway cybersecurity market. Governments of countries in Asia Pacific are also working closely with information technology companies and railway cybersecurity companies to deploy driverless train technology widely. In 2020, the world’s fastest driverless bullet train was launched in China. The new driverless bullet train connecting the Chinese cities of Beijing and Zhangjiakou is capable of reaching a top speed of up to 217mph (350km/h), making it the world’s fastest autonomous train in operation. These trains are equipped with a number of safety systems, infotainment systems, entertainment systems, and other state-of-the-art systems, which require cybersecurity solutions. With the increased focus on high-speed rail programs in China, investments in the country’s digital rail infrastructure and equipment may increase. High-speed rails operate in different infrastructures and hence operate with sophisticated communication & management solutions. Thus, an increase in the adoption rate of connected high-speed trains would increase the demand for railway cybersecurity for the segment across the globe.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics :

Driver: Government initiatives for smart railways

Increasing urbanization across the globe is resulting in the evolution of smart cities. Governments around the world are undertaking various smart city initiatives to provide better transportation infrastructure and speeding up operational activities in public transportation services. For instance, in March 2020, the Government of India has proposed to develop 100 smart cities in the next few years. The Government of Singapore is implementing digital technology in transportation to accomplish its Smart Nation vision. Transportation is considered one of the most important pillars of a country’s economic development, and hence, these smart city initiatives are expected to drive market growth.

The deployment of smart railway systems requires joint efforts from various stakeholders such as telecom operators, infrastructure providers, service providers, manufacturers, public sectors, and user groups. Government authorities are adopting Public Private Partnership (PPP) models which enable private sector companies participate in smart railways initiatives of governments for deploying and financing transportation projects. These initiative taken on a national level are expected to drive growth for the railway cybersecurity market in the forecasted period.

Restraint: High development cost

One of the key restraints in railway cybersecurity market is the high installation cost. The lack of efficient infrastructure in countries such as Brazil, South Africa, and India hinders the implementation of several solutions and services. Land acquisitions for railway transportation projects also require high cost, government clearance, and PPP (public-private partnership) agreements. IoT is being adopted in every sector, including rail solutions that demand large networks. Thus, the delay in the development of infrastructure leads to slow adoption of advanced technologies and solutions and thereby would act as a restraint for the adoption of railway cybersecurity.

The initial cost involved in deploying cybersecurity solutions is high and requires huge initial investments to set up field-level devices, replace aging infrastructure, introduction of advanced technologies such as predictive maintenance, artificial intelligence, big data, cloud computing in urban rail, arrange for transmission networks between end users, and manage new and existing systems within premises. High operational and maintenance costs post-deployment are also a huge concern for railway authorities. Moreover, the limited budgets for railways pose a restraining factor in the deployment of advanced railway technologies and solutions by governments as well as private players. Hence, the high initial cost of deploying cybersecurity solutions is expected to hamper the railway cybersecurity market growth in the coming years.

Opportunity: Increasing demand for cloud based services

The demand for cloud-based services, analytics, and mobile internet technologies is increasing due to their efficient IT management and reliable security environment. With the rapid increase in big data applications, the level of complexity is also expected to increase, given the sprouting data pool, emerging technologies, and constant need to optimize cost. These factors are expected to influence the growth of new analytics platforms and data storage.

The signaling system has been considered to operate on a closed network for safety. Currently, these systems are becoming more centralized and integrated and have become IT-based using regular computer and COTS (commercial off-the-shelf) components and thereby becoming vulnerable to cyberthreats. Thus, it becomes necessary to deploy cloud-based services in railways. Cloud computing uses the collected data and distributes data to one or more computer systems associated with performing different functions. Thus, minimizing the risk of a cyberattack on critical and non-critical data would further fuel the growth of the railway cybersecurity market.

Challenge: Lack of cybersecurity expertise and strategic planning

The lack of skills among security professionals is a major concern prevalent across all major security companies. Security professionals require the latest know-how, advanced skills in analytics, forensic investigations, and cloud computing security to combat cyberattacks. The increasing cybersecurity threats have given rise to the dearth of relevant IT security skills and professionals. Railway cybersecurity providers and service operators need to take additional steps to help minimize the gap created by the lack of cybersecurity skills.

Railway companies should opt for proactive strategies to deploy cyber-secured design and train staff to predict the attack by closely monitoring data and investigate attacks later. The lack of pre-planning would hamper enterprises’ security operations and functionalities on a large scale. Pre-planning helps enterprises in selecting solutions that have the functionalities of big data, machine learning, and AI. The lack of proactive safety planning is becoming a significant challenge in the railway cybersecurity market.

Passenger train segment accounts for a major share of the market during the forecast period

The passenger trains segment is expected to lead the market for railway cybersecurity during the forecast period. The security of the passenger rail network is more complex than the freight segment as there is an open infrastructure, multiple access points, and a vast user base. In recent times, cities such as London and New York have been prone to passenger railway cyberattacks, and this highlighted the importance of railway cybersecurity. Governments across the globe are encouraging cybersecurity solutions for their passenger and freight railways. For example, in April 2020, the US Government Accountability Office released a report containing the assessment of the passenger railway cyberattacks in the US and European region and passed guidelines to limit them. These initiatives by the government are expected to fuel the growth of the railway cybersecurity market during the forecast period.

The Asia Pacific is projected to be the fastest-growing market, by 2027

Rapid urbanization and the growing population are major factors driving the development of rail networks and thereby urban rail and mainline infrastructure construction in Asia Pacific. Key players in the Asia Pacific region include Hitachi Ltd., Huawei, Toshiba, and Tech Mahindra Ltd. Increasing penetration of advanced technologies, increasing GDPs of countries, steady growth, and emerging economies. The Asia Pacific region covers some of the potential markets, namely, China, India, Japan, and Rest of Asia Pacific. China is expected to lead the market followed by India, Japan, and Rest of Asia Pacific in terms of share and growth rate among all countries during the forecast period. The growth of this infrastructural construction will drive the railway cybersecurity market in the region. Cybersecurity is dependent on railway management systems, which can be hacked for data breaches. China and Japan have the most sophisticated rail infrastructure in the region.

China has the largest rail network and is undergoing rapid improvement and expansion of the existing infrastructure. China has nearly 35,000 km of the high-speed rail network as of 2020, making it the largest in the world. The country is also aggressive in expanding its urban transit network. India is also expected to emerge as the next promising market for railway cybersecurity. This can be attributed to the ongoing projects related to urban transit and high-speed rail. In 2021, the European Investment Bank (EIB) signed a finance contract worth USD 182 million with the Indian government for the Pune Metro Rail project’s second portion in Maharashtra through a virtual signing ceremony. This project is expected to offer urban mobility to a large population, including the working class.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players considered in the analysis of the Railway Cybersecurity Market are Thales Group (France), Siemens AG (Germany), Alstom (France), Wabtec (US), and Nokia Networks (Finland). These companies offer extensive products for the Railway Cybersecurity industry and have strong distribution networks, and they invest heavily in R&D to develop new products.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2021-2027 |

|

Forecast Market Size |

Value (USD Million) |

|

Segments covered |

Offering [Solution (risk and compliance management, encryption, firewall, antivirus/antimalware, intrusion detection system/intrusion prevention system, and others ) and services (design and implementation, risk and threat assessment, support and maintenance, and others)]; security type (application security, network security, data protection, endpoint security, and system administration); type (infrastructure and on-board); application (passenger trains, and freight trains); rail type (passenger trains, urban transit, and high-speed rail); and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America) -Global Forecast to 2027. |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

Thales Group (France), Siemens AG (Germany), Alstom (France), Wabtec (US), and Nokia Networks (Finland). |

This research report categorizes the global railway cybersecurity market based on offering (solutions & services), security type, type, application, rail type and region

Market, by Offering

-

Solutions

- Risk And Compliance Management

- Encryption

- Firewall,

- Antivirus/Antimalware

- Intrusion Detection System/Intrusion Prevention System

- Others

-

Services

- Design And Implementation

- Risk And Threat Assessment

- Support And Maintenance

- Others

Market, by Security Type

- Application Security

- Network Security

- Data Protection

- Endpoint Security

- System Administration

Market, by Type

- Infrastructure

- On-board

Market, by Application

- Passenger Trains

- Freight Trains

Market, by Rail Type

- Conventional Passenger Trains

- Urban Transit

- High-Speed Rail

Market, by Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In May 2021, Wabtec was awarded a supply contract worth USD 15 million by Delhi-Meerut Regional Rapid Transport Systems (RRTS). The company will be supplying advanced technology brake systems, pantographs, roof disconnector switches, and fully integrated passenger information systems to RRTS for building coaches for this project.

- In May 2021, Siemens announced the acquisition of RailTerm, a Canada-based rail service provider. This acquisition will help the company expand its product portfolio with on-ground track and signaling, electrification, and communication systems.

- In March 2021, Wabtec announced the acquisition of Nordco, a North American supplier of new, rebuilt, and used maintenance of way equipment having products such as mobile railcars movers and ultrasonic rail flaw detection technologies. Through this acquisition, the company aims to expand its product portfolio and widen its global presence.

- In March 2021, Thales developed the DIVA (Distributed Intelligent Video Analytics) solution for passenger railways. This solution will be useful for leveraging existing CCTV networks on stations and onboard trains to provide real-time information and passenger density

- In February 2020, Thales signed a supply contract with L&T Metro Rail Limited, Hyderabad (India), to supply advanced signaling and train control technology solutions. In January 2021, Nokia signed a supply contract with WESTbahn fleet, Austria. Nokia will be supplying train-to-ground solutions to the operator to enhance the user experience of the onboard passengers.

- In December 2020, Alstom and ASELSAN entered into a collaboration agreement to establish a framework of cooperation and coordination in the field of ETCS Signaling Onboard. The main objective of this collaboration is the establishment of a long-term partnership to enable the two leading companies to cooperate in the field of rail systems.

- In September 2020, Thales secured a supply contract in Vancouver’s Broadway Subway Project for the supply of Communications Based Train Control (CBTC) systems. The trains will be equipped with Thales’s SelTrac solutions.

Frequently Asked Questions (FAQ):

What is the current size of the railway cybersecurity market?

The railway cybersecurity market, by value, is estimated to be USD 6.2 billion in 2021 and is projected to reach USD 10.6 billion by 2027, at a CAGR of 9.4% from 2021 to 2027.

Who are the STARS in the market?

Thales Group (France), Siemens AG (Germany), Alstom (France), Wabtec (US), and Nokia Networks (Finland) and others. They have a strong portfolio of railway cybersecurity offerings. These vendors have been marking their presence in this market by offering easily deployable solutions, coupled with their robust business strategies to achieve constant growth in the market. Moreover, these companies have a strong presence across the globe.

What are the new market trends impacting the growth of the market?

Developed countries have initiated plans for the advancement of driverless train networks, which is expected to propel the growth of the transportation sector. Countries such as China, India, South Korea, the US, the UK, Mexico, Brazil, and South Africa are planning to revolutionize their rail networks with the introduction of driverless trains. Technology manufacturers are working to improve connectivity by partnering with telecommunication companies. Recently, Siemens announced digitalizing the US rail network by combining a network of sensors with an IoT platform. Developed regions like North America and Europe are improving the safety and security of railways by retrofitting trains and replacing existing systems with advanced systems.

Which countries are considered in the Asia Pacific region?

The report covers market sizing for countries such as China, Japan, India, South Korea, and Rest of Asia Pacific. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS IN THE RAILWAY CYBERSECURITY MARKET

1.3.2 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 2 CURRENCY EXCHANGE RATES (USD)

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 2 RAILWAY CYBERSECURITY MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES

2.2.2 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

FIGURE 6 RESEARCH APPROACH

2.5 MARKET SIZE ESTIMATION

2.5.1 TOP-DOWN APPROACH

FIGURE 7 MARKET: TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY FOR THEMARKET

FIGURE 9 MARKET: RESEARCH DESIGN & METHODOLOGY

FIGURE 10 MARKET: RESEARCH METHODOLOGY ILLUSTRATION OF THALES GROUP REVENUE ESTIMATION

2.6 MARKET BREAKDOWN & DATA TRIANGULATION

2.7 FACTOR ANALYSIS

2.7.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND- AND SUPPLY-SIDE

2.8 ASSUMPTIONS

2.9 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 11 RAILWAY CYBERSECURITY: MARKET DYNAMICS

FIGURE 12 ON-BOARD SECURITY EXPECTED TO GROW AT A HIGHER CAGR FROM 2021 TO 2027

FIGURE 13 PASSENGER TRAINS SEGMENT TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD

FIGURE 14 COVID-19 IMPACT ON MARKET, 2017–2027

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 15 INCREASED VEHICLE OWNERSHIP IS EXPECTED TO DRIVE THE MARKET FOR RAILWAY CYBERSECURITY

4.2 MARKET, BY REGION

FIGURE 16 EUROPE IS ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE OF THE MARKET IN 2021

4.3 MARKET, BY SECURITY TYPE

FIGURE 17 NETWORK SECURITY IS ESTIMATED TO LEAD THE MARKET FROM 2021 TO 2027

4.4 MARKET, BY APPLICATION

FIGURE 18 THE PASSENGER TRAINS SEGMENT PROJECTED TO LEAD THE MARKET FROM 2021 TO 2027

4.5 MARKET, BY RAIL TYPE

FIGURE 19 THE HIGH-SPEED RAIL SEGMENT IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

TABLE 3 IMPACT OF MARKET DYNAMICS

5.2 MARKET DYNAMICS

FIGURE 20 RAILWAY CYBERSECURITY MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing number of cyberattacks

TABLE 4 RECENT RAILWAY CYBERATTACKS

TABLE 5 TOP GROWING SMART CITIES/COUNTRIES

5.2.1.2 Increased adoption of IoT and automation technologies

TABLE 6 EXISTING AND UPCOMING RAILWAY TELEMATICS MODELS

5.2.1.3 Government initiatives for smart cities and digital transportation

TABLE 7 ADVANTAGES OF DIGITALIZATION OF RAILS

5.2.2 RESTRAINTS

5.2.2.1 High cost

5.2.2.2 Lack of infrastructure and standardization for railway cybersecurity

FIGURE 21 SECURITY MEASURES FOR OES

5.2.3 OPPORTUNITIES

5.2.3.1 Increased demand for cloud-based services

TABLE 8 MAIN RAILWAY SIGNALLING SYSTEM

FIGURE 22 ASSET CLOUD IN RAILWAY NETWORK

5.2.3.2 Open gateway for telecommunication providers

FIGURE 23 URBAN RAIL CLOUD SOLUTIONS

5.2.4 CHALLENGES

5.2.4.1 Lack of cybersecurity expertise and strategic planning

TABLE 9 GOOD CYBER DEFENSE PLAN FOR RAILWAY COMPANIES

5.2.4.2 Data privacy and security concerns

FIGURE 24 CHARACTERISTICS TARGETS FOR RAILWAY CYBERATTACKS

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 25 PORTER’S FIVE FORCES: MARKET

TABLE 10 MARKET: IMPACT OF PORTERS FIVE FORCES

5.3.1 THREAT OF SUBSTITUTES

5.3.1.1 Cybersecurity solutions do not have alternatives, and therefore the threat of substitutes is low

5.3.2 THREAT OF NEW ENTRANTS

5.3.2.1 Lack of standardization leads to a high threat of new entrants

5.3.3 BARGAINING POWER OF BUYERS

5.3.3.1 Increasing demand for railway cybersecurity leads to the moderate bargaining power of buyers

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.4.1 Consortium of companies to deploy railway projects leads to moderate demand for cybersecurity suppliers

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.3.5.1 Large number of players leads to high competition in the railway cybersecurity market

5.4 MARKET ECOSYSTEM

FIGURE 26 MARKET: ECOSYSTEM ANALYSIS

FIGURE 27 RAILWAY STAKEHOLDERS

FIGURE 28 MARKET: ECOSYSTEM MAPPING

TABLE 11 MARKET: ROLE OF COMPANIES IN THE ECOSYSTEM

5.5 VALUE CHAIN ANALYSIS

FIGURE 29 VALUE CHAIN ANALYSIS: RAILWAY CYBER SECURITY MARKET

5.6 PATENT ANALYSIS

5.7 REGULATORY OVERVIEW

FIGURE 30 REGULATORS OVERVIEW: RAILWAY CYBER SECURITY MARKET

TABLE 12 MAIN EU DIRECTIVES AND REGULATIONS FOR CYBERSECURITY

5.7.1 EUROPEAN NETWORK AND INFORMATION SECURITY AGENCY (ENISA)

TABLE 13 EUROPEAN NETWORK AND INFORMATION SECURITY AGENCY STANDARDS

5.7.2 GENERAL DATA PROTECTION REGULATION (GDPR)

5.7.3 INTERNATIONAL UNION OF RAILWAYS (UIC)

5.8 CASE STUDY

5.8.1 ALSTOM DEPLOYED CYBERSECURITY FOR MASS TRANSIT SYSTEMS IN MIDDLE EAST & AFRICA

5.8.2 ALSTOM PARTNERED WITH SNC-LAVALIN FOR REM PROJECT IN CANADA

5.9 REVENUE SHIFT FOR RAILWAY CYBERSECURITY SOLUTION PROVIDERS

FIGURE 31 REVENUE SHIFT FOR RAILWAY CYBERSECURITY SOLUTION PROVIDERS

5.10 COVID-19 IMPACT ANALYSIS

5.10.1 INTRODUCTION TO COVID-19

5.10.2 COVID-19 HEALTH ASSESSMENT

TABLE 14 SELECTED MEASURES BY RAILWAYS IN VARIOUS COUNTRIES DURING THE COVID-19 PANDEMIC

5.11 MARKET, SCENARIOS (2021–2027)

FIGURE 32 IMPACT OF COVID-19 ON THE MARKET, 2021–2027

5.11.1 MOST LIKELY SCENARIO

TABLE 15 MARKET (MOST LIKELY), BY REGION, 2021–2027 (USD MILLION)

5.11.2 OPTIMISTIC SCENARIO

TABLE 16 MARKET (OPTIMISTIC), BY REGION, 2021–2027 (USD MILLION)

5.11.3 PESSIMISTIC SCENARIO

TABLE 17 MARKET (PESSIMISTIC), BY REGION, 2021–2027 (USD MILLION)

5.12 TECHNOLOGICAL ANALYSIS

5.12.1 IOT IN RAILWAYS

5.12.2 BIG DATA ANALYTICS AND CLOUD COMPUTING IN RAILWAYS

5.12.3 CONNECTED TRAINS

5.12.3.1 Positive Train Control (PTC)

5.12.3.2 Communication/Computer-Based Train Control (CBTC)

5.12.3.3 Passenger Information System (PIS)

5.12.4 AUTONOMOUS TRAINS

6 GLOBAL MARKET, BY OFFERING (Page No. - 84)

6.1 INTRODUCTION

FIGURE 33 RAILWAY CYBERSECURITY MARKET, BY OFFERING, 2021 VS. 2027

TABLE 18 MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 19 MARKET, BY OFFERING, 2021–2027 (USD MILLION)

6.2 OPERATIONAL DATA

TABLE 20 COMPANIES OFFERING RAILWAY CYBERSECURITY SOLUTIONS AND SERVICES

6.2.1 ASSUMPTIONS

6.2.2 RESEARCH METHODOLOGY

6.3 SOLUTIONS

6.3.1 SOLUTIONS FORM A STRONG LINE OF DEFENSE FOR RAILWAY OPERATORS TO SECURE THEIR ENDPOINTS

TABLE 21 RAILWAY CYBERSECURITY SOLUTIONS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 22 RAILWAY CYBERSECURITY SOLUTIONS MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 23 RAILWAY CYBERSECURITY SOLUTIONS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 24 RAILWAY CYBERSECURITY SOLUTIONS MARKET, BY TYPE, 2021–2027 (USD MILLION)

6.3.2 RISK AND COMPLIANCE MANAGEMENT

6.3.3 ENCRYPTION

6.3.4 FIREWALL

6.3.5 ANTIVIRUS/ANTIMALWARE

6.3.6 INTRUSION DETECTION SYSTEM/INTRUSION PREVENTION SYSTEM

6.3.7 OTHERS

6.4 SERVICES

TABLE 25 RAILWAY CYBERSECURITY SERVICES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 RAILWAY CYBERSECURITY SERVICES MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 27 RAILWAY CYBERSECURITY SERVICES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 28 RAILWAY CYBERSECURITY SERVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

6.4.1 DESIGN AND IMPLEMENTATION

6.4.2 RISK AND THREAT ASSESSMENT

6.4.3 SUPPORT AND MAINTENANCE

6.4.4 OTHERS

6.5 KEY PRIMARY INSIGHTS

FIGURE 34 KEY PRIMARY INSIGHTS

7 GLOBAL MARKET, BY SECURITY TYPE (Page No. - 95)

7.1 INTRODUCTION

FIGURE 35 RAILWAY CYBERSECURITY MARKET, BY SECURITY TYPE, 2021 VS. 2027

TABLE 29 MARKET, BY SECURITY TYPE, 2017–2020 (USD MILLION)

TABLE 30 MARKET, BY SECURITY TYPE, 2021–2027 (USD MILLION)

7.2 OPERATIONAL DATA

TABLE 31 COMPANIES OFFERING TYPES OF RAILWAY CYBERSECURITY SECURITY

7.2.1 ASSUMPTIONS

7.2.2 RESEARCH METHODOLOGY

7.3 APPLICATION SECURITY

7.3.1 INCREASED ATTACKS ON BUSINESS-SENSITIVE APPLICATIONS IS DRIVING THIS SEGMENT

TABLE 32 APPLICATION SECURITY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 APPLICATION SECURITY MARKET, BY REGION, 2021–2027 (USD MILLION)

7.4 NETWORK SECURITY

7.4.1 RISE IN VIRTUALIZATION OF SERVERS AND ENHANCED USE OF CLOUD COMPUTING SERVICES ARE DRIVING THIS SEGMENT

TABLE 34 NETWORK SECURITY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 NETWORK SECURITY MARKET, BY REGION, 2021–2027 (USD MILLION)

7.5 DATA PROTECTION

7.5.1 GOVERNMENT REGULATIONS RELATED TO DATA PROTECTION ARE EXPECTED TO DRIVE THE MARKET

TABLE 36 DATA PROTECTION SECURITY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 DATA PROTECTION SECURITY MARKET, BY REGION, 2021–2027 (USD MILLION)

7.6 ENDPOINT SECURITY

7.6.1 ENDPOINT SECURITY PROVIDE REAL-TIME THREAT DETECTION, PREVENTION, AND RESPONSE TO THE ENDPOINT

TABLE 38 ENDPOINT SECURITY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 ENDPOINT SECURITY MARKET, BY REGION, 2021–2027 (USD MILLION)

7.7 SYSTEM ADMINISTRATION

7.7.1 INCREASED USE OF COMMUNICATIONS-BASED TRAIN CONTROL IS DRIVING THIS SEGMENT

TABLE 40 SYSTEM ADMINISTRATION MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 SYSTEM ADMINISTRATION MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.8 KEY PRIMARY INSIGHTS

FIGURE 36 KEY PRIMARY INSIGHTS

8 GLOBAL MARKET, BY TYPE (Page No. - 106)

8.1 INTRODUCTION

FIGURE 37 RAILWAY CYBERSECURITY MARKET, BY TYPE, 2021 VS. 2027

TABLE 42 MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 43 MARKET, BY TYPE, 2021–2027 (USD MILLION)

8.2 OPERATIONAL DATA

TABLE 44 COMPANIES OFFERING RAILWAY CYBERSECURITY TYPES

FIGURE 38 VULNERABILITY IN RAILWAY SYSTEMS: ON-BOARD VS. INFRASTRUCTURAL

8.2.1 ASSUMPTIONS

8.2.2 RESEARCH METHODOLOGY

8.3 INFRASTRUCTURAL

8.3.1 INCREASE IN CONNECTED AND DIGITALIZED INFRASTRUCTURE IN ASIA PACIFIC REGION WILL DRIVE THIS SEGMENT

TABLE 45 RAILWAY INFRASTRUCTURAL CYBERSECURITY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 RAILWAY INFRASTRUCTURAL CYBERSECURITY MARKET, BY REGION, 2021–2027 (USD MILLION)

8.4 ON-BOARD

8.4.1 INCREASING GOVERNMENT NORMS RELATED TO PASSENGER SECURITY WILL PROPEL THE GROWTH OF ON-BOARD SECURITY

TABLE 47 RAILWAY ON-BOARD CYBERSECURITY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 RAILWAY ON-BOARD CYBERSECURITY MARKET, BY REGION, 2021–2027 (USD MILLION)

8.5 KEY PRIMARY INSIGHTS

FIGURE 39 KEY PRIMARY INSIGHTS

9 GLOBAL MARKET, BY APPLICATION (Page No. - 114)

9.1 INTRODUCTION

FIGURE 40 MARKET, BY APPLICATION, 2021 VS. 2027

TABLE 49 MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 50 MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

9.2 OPERATIONAL DATA

TABLE 51 ROLLING STOCK SALES, BY TYPE (UNITS), 2017-2020

9.2.1 ASSUMPTIONS

9.2.2 RESEARCH METHODOLOGY

9.3 PASSENGER TRAINS

9.3.1 INCREASED DIGITALIZATION OF RAILWAYS IS EXPECTED TO FUEL THE GROWTH OF THIS SEGMENT

TABLE 52 MARKET IN PASSENGER TRAINS, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 MARKET IN PASSENGER TRAINS, BY REGION, 2021–2027 (USD MILLION)

9.4 FREIGHT TRAINS

9.4.1 INCREASING GOVERNMENT NORMS RELATED TO FREIGHT TRANSPORT WILL PROPEL ON-BOARD SECURITY

TABLE 54 MARKET IN FREIGHT TRAINS, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 MARKET IN FREIGHT TRAINS, BY REGION, 2021–2027 (USD MILLION)

9.5 KEY PRIMARY INSIGHTS

FIGURE 41 KEY PRIMARY INSIGHTS

10 GLOBAL MARKET, BY RAIL TYPE (Page No. - 121)

10.1 INTRODUCTION

FIGURE 42 MARKET, BY RAIL TYPE, 2021 VS. 2027

TABLE 56 MARKET, BY RAIL TYPE, 2017–2020 (USD MILLION)

TABLE 57 MARKET, BY RAIL TYPE, 2021–2027 (USD MILLION)

10.2 OPERATIONAL DATA

TABLE 58 PROJECTS FOR RAILWAY CYBERSECURITY AS PER RAIL TYPE

10.2.1 ASSUMPTIONS

10.2.2 RESEARCH METHODOLOGY

10.3 CONVENTIONAL PASSENGER TRAINS

10.3.1 IMPROVING PASSENGER RAIL NETWORK IS EXPECTED TO FUEL GROWTH FOR THE MARKET

10.4 URBAN TRANSIT

10.4.1 GOVERNMENT INVESTMENTS TOWARD SMART CITIES ENCOURAGE THE GROWTH OF THE METRO AND LIGHT RAILWAY PROJECTS

10.5 HIGH-SPEED RAIL

10.6 KEY PRIMARY INSIGHTS

FIGURE 43 KEY PRIMARY INSIGHTS

11 GLOBAL MARKET, BY REGION (Page No. - 127)

11.1 INTRODUCTION

FIGURE 44 MARKET, BY REGION, 2021 VS. 2027 (USD MILLION)

TABLE 59 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 60 MARKET, BY REGION, 2021–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 METRO/MONORAIL PROJECTS IN NORTH AMERICA

TABLE 61 METRO/MONORAIL PROJECTS IN NORTH AMERICA

11.2.2 HIGH-SPEED RAIL/BULLET TRAIN PROJECTS IN NORTH AMERICA

TABLE 62 HIGH-SPEED RAIL/BULLET TRAIN PROJECTS IN NORTH AMERICA

11.2.3 RAPID TRANSIT PROJECTS IN NORTH AMERICA

TABLE 63 RAPID TRANSIT PROJECTS IN NORTH AMERICA

TABLE 64 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

11.2.4 US

11.2.4.1 Safety regulations on systems such as PTC and rail corridor risk management systems expected to drive the market

TABLE 66 US: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 67 US: MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.2.5 CANADA

11.2.5.1 Upcoming high-speed rail projects in the country are a major factor driving the market

TABLE 68 CANADA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 69 CANADA: MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.2.6 MEXICO

11.2.6.1 Government investments to improve the rail infrastructure expected to drive the market

TABLE 70 MEXICO: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 71 MEXICO: MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.3 EUROPE

11.3.1 METRO/MONORAIL PROJECTS IN EUROPE

TABLE 72 METRO/MONORAIL PROJECTS IN EUROPE

11.3.2 HIGH-SPEED RAIL/BULLET TRAIN PROJECTS IN EUROPE

TABLE 73 HIGH-SPEED RAIL/BULLET TRAIN PROJECTS IN EUROPE

11.3.3 RAPID TRANSIT PROJECTS IN EUROPE

TABLE 74 RAPID TRANSIT PROJECTS IN EUROPE

FIGURE 45 EUROPE: MARKET SNAPSHOT

TABLE 75 EUROPE: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 76 EUROPE: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

FIGURE 46 EUROPE: MARKET, BY COUNTRY, 2021 VS. 2027 (USD MILLION)

11.3.4 UK

11.3.4.1 Increased investments for digitally advanced rail infrastructure expected to drive the market

TABLE 77 UK: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 78 UK: MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.3.5 GERMANY

11.3.5.1 Railway network expansion is expected to drive the market in Germany

TABLE 79 GERMANY: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 80 GERMANY: MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.3.6 FRANCE

11.3.6.1 Increased adoption of advanced technologies in railway infrastructure is driving the market

TABLE 81 FRANCE: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 82 FRANCE: MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.3.7 RUSSIA

11.3.7.1 Upcoming high-speed rail projects expected to support the market growth

TABLE 83 RUSSIA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 84 RUSSIA: MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.3.8 ITALY

11.3.8.1 Sophisticated rail network in Italy to support the market growth for cybersecurity

TABLE 85 ITALY: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 86 ITALY: MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.3.9 SPAIN

11.3.9.1 New investments and high-speed rai projected to drive the market

TABLE 87 SPAIN: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 88 SPAIN: MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.3.10 REST OF EUROPE

11.3.10.1 Introduction of different norms to tackle cybersecurity threats expected to drive the market

TABLE 89 REST OF EUROPE: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 90 REST OF EUROPE: MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 RAPID TRANSIT PROJECTS IN ASIA PACIFIC

TABLE 91 RAPID TRANSIT PROJECTS IN ASIA PACIFIC

11.4.2 LIGHT RAIL PROJECTS IN ASIA PACIFIC

TABLE 92 LIGHT RAIL PROJECTS IN ASIA PACIFIC

11.4.3 UPCOMING HIGH-SPEED RAIL/BULLET TRAIN PROJECTS IN ASIA PACIFIC

TABLE 93 LIGHT RAIL PROJECTS IN ASIA PACIFIC

FIGURE 47 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 94 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

11.4.4 CHINA

11.4.4.1 Developments in the expansion of subways/metros and rail networks are driving the market

TABLE 96 SEVEN PROMINENT RAIL ROUTES TO EUROPE

TABLE 97 CHINA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 98 CHINA: MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.4.5 JAPAN

11.4.5.1 Government investments in the railway sector are expected to boost the growth of the market

TABLE 99 JAPAN: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 100 JAPAN: MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.4.6 INDIA

11.4.6.1 Government focus on the expansion of the electrified network is expected to boost the market

TABLE 101 INDIA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 102 INDIA: MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.4.7 SOUTH KOREA

11.4.7.1 A well-developed high-speed rail network in South Korea supports the market growth

TABLE 103 SOUTH KOREA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 104 SOUTH KOREA: MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.4.8 REST OF ASIA PACIFIC

11.4.8.1 High-speed train projects expected to drive the market

TABLE 105 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 106 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.5 MIDDLE EAST & AFRICA (MEA)

11.5.1 METRO/MONORAIL PROJECTS IN THE MIDDLE EAST & AFRICA

TABLE 107 METRO/MONORAIL PROJECTS IN THE MIDDLE EAST & AFRICA

11.5.2 RAPID TRANSIT PROJECTS IN THE MIDDLE EAST & AFRICA

TABLE 108 RAPID TRANSIT PROJECTS IN THE MIDDLE EAST & AFRICA

TABLE 109 MEA: RAILWAY CYBER SECURITY MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 110 MEA: RAILWAY CYBER SECURITY MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.5.3 UAE

11.5.3.1 Development projects related to rail infrastructure expected to drive the market

11.5.4 EGYPT

11.5.4.1 Increased investments in railways and the demand for locomotives expected to drive the market

11.5.5 SOUTH AFRICA

11.5.5.1 Government initiatives to develop railway infrastructure expected to drive the market

11.6 LATIN AMERICA

TABLE 111 LATIN AMERICA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 112 LATIN AMERICA: MARKET, BY TYPE, 2021–2027 (USD MILLION)

11.6.1 BRAZIL

11.6.1.1 Increased metro projects projected to drive the market in this country

11.6.2 REST OF LATIN AMERICA

11.6.2.1 Phasing out of carriages for long-haul distance trains is expected to drive the aftermarket

12 COMPETITIVE LANDSCAPE (Page No. - 169)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS FOR RAILWAY CYBERSECURITY

TABLE 113 MARKET SHARE ANALYSIS, 2020

FIGURE 48 MARKET SHARE ANALYSIS, 2020

12.3 REVENUE ANALYSIS

FIGURE 49 REVENUE ANALYSIS FOR TOP FIVE COMPANIES

12.3.1 NEW PRODUCT LAUNCHES

TABLE 114 PRODUCTS LAUNCHES, 2017–2021

12.3.2 DEALS

TABLE 115 DEALS, 2017–2021

12.3.3 OTHERS

TABLE 116 OTHERS, 2017–2021

12.4 COMPETITIVE LEADERSHIP MAPPING

12.4.1 STARS

12.4.2 EMERGING LEADERS

12.4.3 PERVASIVE

12.4.4 PARTICIPANTS

FIGURE 50 RAILWAY CYBER SECURITY MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

TABLE 117 RAILWAY CYBER SECURITY MARKET: COMPANY FOOTPRINT, 2021

TABLE 118 RAILWAY CYBER SECURITY MARKET: COMPANY SOLUTION FOOTPRINT, 2021

12.4.5 MARKET: REGIONAL FOOTPRINT, 2021

12.5 SME COMPETITIVE LEADERSHIP MAPPING

12.5.1 PROGRESSIVE COMPANIES

12.5.2 RESPONSIVE COMPANIES

12.5.3 DYNAMIC COMPANIES

12.5.4 STARTING BLOCKS

FIGURE 51 SME MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

12.6 WINNERS VS. TAIL-ENDERS

TABLE 119 WINNERS VS. TAIL-ENDERS

13 COMPANY PROFILE (Page No. - 186)

13.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

13.1.1 THALES GROUP

TABLE 120 THALES GROUP: BUSINESS OVERVIEW

FIGURE 52 THALES GROUP: OVERVIEW

FIGURE 53 THALES GROUP: COMPANY SNAPSHOT

TABLE 121 THALES GROUP: PRODUCTS/SERVICES OFFERED

TABLE 122 THALES GROUP: NEW PRODUCT DEVELOPMENTS

TABLE 123 THALES GROUP: DEALS

TABLE 124 THALES GROUP: OTHERS

13.1.2 SIEMENS AG

TABLE 125 SIEMENS AG: BUSINESS OVERVIEW

FIGURE 54 SIEMENS: REGION WISE REVENUE

FIGURE 55 SIEMENS AG: COMPANY SNAPSHOT

TABLE 126 SIEMENS AG: PRODUCTS/SERVICES OFFERED

TABLE 127 SIEMENS AG: NEW PRODUCT DEVELOPMENTS

TABLE 128 SIEMENS AG: DEALS

13.1.3 ALSTOM

TABLE 129 ALSTOM: BUSINESS OVERVIEW

FIGURE 56 ALSTOM: GEOGRAPHIC PRESENCE

FIGURE 57 ALSTOM: COMPANY SNAPSHOT

FIGURE 58 BOMBARDIER: COMPANY SNAPSHOT

TABLE 130 ALSTOM: NEW PRODUCT DEVELOPMENTS

TABLE 131 ALSTOM: DEALS

TABLE 132 ALSTOM: OTHERS

13.1.4 WABTEC

TABLE 133 WABTEC: BUSINESS OVERVIEW

FIGURE 59 WABTEC: FUTURE OUTLOOK

FIGURE 60 WABTEC: COMPANY SNAPSHOT

TABLE 134 WABTEC: PRODUCTS OFFERED

TABLE 135 WABTEC: DEALS

TABLE 136 WABTEC: OTHERS

13.1.5 HITACHI LTD.

TABLE 137 HITACHI LTD.: BUSINESS OVERVIEW

FIGURE 61 HITACHI LTD.: COMPANY PERFORMANCE IN RAILWAY SECTOR FOR 2020

FIGURE 62 HITACHI LTD.: COMPANY SNAPSHOT

TABLE 138 HITACHI LTD.: DEALS

13.1.6 NOKIA NETWORKS

TABLE 139 NOKIA NETWORKS: BUSINESS OVERVIEW

FIGURE 63 NOKIA NETWORKS: PATENTS FILED IN 2020

FIGURE 64 NOKIA NETWORKS: COMPANY SNAPSHOT

TABLE 140 NOKIA NETWORKS: DEALS

13.1.7 IBM

TABLE 141 IBM: BUSINESS OVERVIEW

FIGURE 65 IBM: Q1 RESULTS COMPARISON OF 2020 AND 2021

FIGURE 66 IBM: COMPANY SNAPSHOT

TABLE 142 IBM: NEW PRODUCT DEVELOPMENTS

TABLE 143 IBM: DEALS

TABLE 144 IBM: OTHERS

13.1.8 CISCO

TABLE 145 CISCO: BUSINESS OVERVIEW

FIGURE 67 CISCO: COMPANY SNAPSHOT

TABLE 146 CISCO: DEALS

13.1.9 RAYTHEON TECHNOLOGIES (COLLINS AEROSPACE)

FIGURE 68 COLLINS AEROSPACE: SALES PORTFOLIO

TABLE 147 RAYTHEON TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 69 RAYTHEON TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 148 RAYTHEON TECHNOLOGIES: NEW PRODUCT DEVELOPMENTS

TABLE 149 RAYTHEON TECHNOLOGIES: DEALS

13.1.10 HUAWEI

TABLE 150 HUAWEI: BUSINESS OVERVIEW

FIGURE 70 HUAWEI: GLOBAL PRESENCE

FIGURE 71 HUAWEI: COMPANY SNAPSHOT

TABLE 151 HUAWEI: NEW PRODUCT DEVELOPMENTS

TABLE 152 HUAWEI: DEALS

13.1.11 TOSHIBA

TABLE 153 TOSHIBA: BUSINESS OVERVIEW

FIGURE 72 TOSHIBA: SEGMENT DIVISION

FIGURE 73 TOSHIBA: COMPANY SNAPSHOT

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 TECH MAHINDRA LTD.

13.2.2 TÜV RHEINLAND

13.2.3 CAPGEMINI (SOGETI)

13.2.4 ABB

13.2.5 BAE SYSTEMS

13.2.6 CYLUS

13.2.7 CERVELLO

13.2.8 SHIFT5

13.2.9 CRITIFENCE

13.2.10 RAZORSECURE

13.2.11 SELECTRON SYSTEMS AG

13.2.12 EUROMICRON GROUP

13.2.13 ENSCO INC.

13.2.14 BARBARA

13.2.15 ICSS

13.2.16 AIRBUS CYBERSECURITY

14 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 250)

14.1 CHINA, INDIA, AND EUROPE ARE KEY FOCUS MARKETS FOR RAILWAY CYBERSECURITY

14.2 PASSENGER TRAINS WILL BE THE MOST IMPORTANT SEGMENT IN THE MARKET

14.3 CONCLUSION

15 APPENDIX (Page No. - 252)

15.1 KEY INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

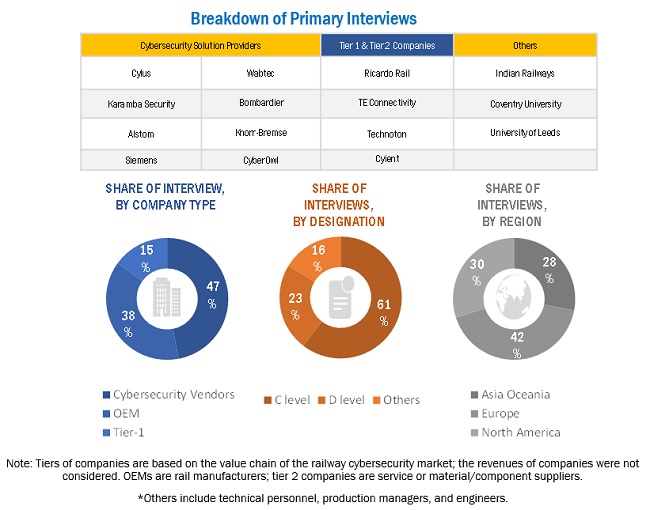

The study involved four major activities in estimating the current size of the railway cybersecurity market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of railway cybersecurity vendors, rolling stock OEMs, International Railway Journal (IRJ), Federal Transit Administration (FTA), American Public Transportation Association (APTA), Regional Transportation Authority (RTA), country/region-level railway associations and trade organizations, and the US Department of Transportation (DOT)], railway cybersecurity magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, government organizations websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global railway cybersecurity market.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the railway cybersecurity market scenario through secondary research. Several primary interviews were conducted with market experts from both demand-side rail operators (transportation companies such as the Indian Railways and SNCF) and supply-side (OEMs and cybersecurity vendors such as Alstom, Thales Group, and Wabtec) across five major regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa (MEA), and Latin America. 23% and 77% of the primary interviews were conducted from the demand- and supply-side, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations were tried to be covered, which included sales, operations, and administration to provide a holistic viewpoint in the report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Primary Participants

In-depth interviews have been conducted with the target groups to collect industry-related data, technology-related information, and validation of our analysis.

- Associations related to the Railway Industry

- Connected Rail Solution Vendors

- Cybersecurity solution providers

- Digital Rail Solution Vendors

- Government Authorities

- Infrastructure Providers for Railway Lines

- IT Companies

- IT Service Providers

- Legal and Regulatory Authorities

- Rail Connectivity Solution and Services Providers

- Rail Consultants

- Rail Leasing Authorities

- Railway Contract Suppliers and Users

- Railway Manufacturers

- Rolling Stock Industry Associations

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the railway cybersecurity market and other dependent submarkets, as mentioned below:

- Key players in the railway cybersecurity were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights.

- All major penetration rates, percentage shares, splits, and breakdowns for the railway cybersecurity market were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study were accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To analyze and forecast the size of the railway cybersecurity market in terms of value (USD million)

- To analyze and forecast the size of the market based on offering [solutions (risk and compliance management, encryption, firewall, antivirus/antimalware, intrusion detection system/intrusion prevention system, and others ) and services (design and implementation, risk and threat assessment, support and maintenance, and others)].

- To analyze and forecast the size of the market based on security type (application security, network security, data protection, endpoint security, and system administration)

- To analyze and forecast the size of the market based on type (infrastructure and on-board)

- To analyze and forecast the size of the market based on application (passenger trains, and freight trains)

- To analyze and forecast the size of the market based on rail type (conventional passenger trains, urban transit, and high-speed rail)

- To define, describe, and project the size of the market based on region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America)

- To identify the dynamics, including drivers, restraints, opportunities, and challenges, and analyze their impact on the market

- To track and analyze competitive developments such as new product launches, deals, and others carried out by key industry participants to strengthen their positions in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in line with company-specific needs.

-

Additional Company Profiles

- Business Overview

- SWOT Analysis

- Recent Developments

- MnM View

- Detailed analysis of the railway cybersecurity market, by solutions and services

- Country-level analysis of the railway cybersecurity market, by application

- Detailed analysis of the cybersecurity market, by rail type

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Railway Cybersecurity Market

How do emerging markets offer revenue expansion opportunities in Railway Cybersecurity Market?