PTFE Membrane Market by Type (Hydrophobic and Hydrophilic), Application (Industrial Filtration, Medical & Pharmaceutical, Textiles, Water & Wastewater Treatment, Architecture), and Region - Global Forecast to 2025

Updated on : June 18, 2024

PTFE Membrane Market

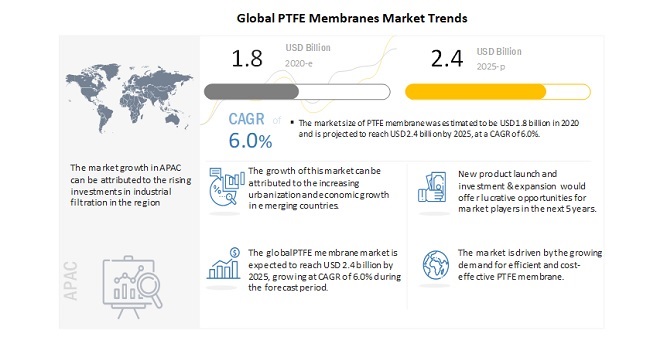

PTFE Membrane Market was valued at USD 1.8 billion in 2020 and is projected to reach USD 2.4 billion by 2025, at a CAGR of 6.0%. The growing demand for PTFE membranes is due to the increasing wastewater treatment activities and stringent regulations regarding emissions and water treatment.

To know about the assumptions considered for the study, Request for Free Sample Report

Global PTFE Membranes Market Trends

COVID-19 impact on Global PTFE Membranes Market

The PTFE membranes are used in various industries such as chemical, oil & gas, food & beverages, wastewater treatment, textile and others. COVID-19 has severely impacted these industries.

- The lockdown in various countries and logistical restrictions have adversely impacted the industries. Supply chain disruptions, workforce unavailability, logistical restrictions, limited availability of components, demand drop, low company liquidity, and shutdown of manufacturing due to lockdown in various countries have adversely affected the industry. Raw material suppliers and other related businesses are forced to re-evaluate their strategies to cater to this industry during this crisis period.

- Due to lockdown, many food & beverage processing industries, textile, and water & wastewater treatment industries activities are halted. The companies are taking precautions to avoid the spread of the virus. Governments of different countries are keeping a close watch on the disruption and taking every necessary step to mitigate the impact of COVID-19 by promoting food processing. For instance, The UAE has tripled its local food production and is aiming to increase domestic production of essential items, such as dairy products, cooking oil, and packaging of dates, fresh poultry, fish, seafood, and other items.

- Even where shutdowns have not been imposed, restrictions on the movement of people and supplies have delayed operations. In the second half of 2020, countries have lifted restrictions and gradually started business operations in various sectors. Even after the lifting of lockdown, it will be challenging for PTFE membrane manufacturers to get back to normal working situations. This will subsequently affect the PTFE membrane market.

PTFE Membranes Market Dynamics

Driver: Stringent regulations pertaining to emission and treatment of municipal and industrial wastes

Stringent regulatory and sustainability mandates have increased the demand for water purification and wastewater treatment. To control the level of pollution, various emission control acts have been enforced in most countries around the world to ensure that disposed wastes pose lower environmental risks. For instance, the US, the UK, Canada, and Australia are updating their emission standards to reduce pollution levels in the atmosphere. These countries and a few developing countries, such as Brazil, South Africa, India, China, and Saudi Arabia, have set five-year targets to reduce pollution levels. In Canada, over 150 billion liters of untreated wastewater are released into waterways every year, which is one of the major health, environmental, and economic issues in the country. The European Union (EU) follows the 7th Environment Action Program (EAP), which is likely to guide the environment policies until 2020. The EU Drinking Water Directive (DWD) has also proposed several water purifications mandates and regulations to maintain the purity and potability of drinking water.

These regulations ensure that high-quality standards are maintained for drinking water and wastewater treatment and will increase the demand for PTFE membranes for water & wastewater treatment applications

Restrain: High production cost of PTFE membranes

The major raw material used for the manufacturing of PTFE membranes is PTFE. Recently, PTFE prices have been increasing continuously due to the shutdown of various Chinese and European manufacturing units. These companies were flouting environmental laws and dumping effluents in nearby villages. China accounted for more than 40% of the global consumption of PTFE in 2016 and is also the world’s largest PTFE manufacturer. The entrance of a large number of relatively low-cost Chinese products in the global market has resulted in the increasing price pressure on PTFE manufacturers in other countries. Many countries, including India, impose import duties on Chinese PTFE products. Other factors affecting the PTFE prices are prices of its raw materials, including fluorspar; demand and supply gap; and the changing regulatory environment. The fluctuating prices of PTFE are restraining the market growth by increasing the production cost of PTFE membranes.

Opportunity: Increasing demand for treated water in emerging economies

The demand for treated water in emerging economies, such as China, India, and Indonesia, is increasing at a fast pace. According to CABI, a member of The Association of International Research and Development Centers for Agriculture (AIRCA), APAC alone consumes around 2.85 trillion cubic liters of water every day. The growing population is the major driver for this demand, which has augmented the scope for desalination in this region. The requirement of process water in power, food & beverage, chemical, petrochemical, and other industries is expected to grow during the forecast period. This is expected to significantly increase the demand for PTFE membranes in these regions.

Challenge: Fluctuating oil and gas prices

In the current scenario, the oil & gas industry is witnessing a high supply and low demand ratio, which has resulted in reduced prices. Increased activity in unconventional reserves in North America has led to the oversupply of oil and gas, leading to low prices. The subsequent consequences of the disproportionate demand and supply of oil and gas have resulted in severe losses faced by a lot of upstream operators. Hence, these operators have reduced their Capex for new fields, as oil and natural gas prices have been witnessing a downward trend in the past four years. These factors have affected the demand for new pumps in the oil & gas industry, thereby affecting the demand for gaskets and, in turn, the demand for PTFE membranes.

Hydrophobic type segment captured the highest share in PTFE membranes market.

PTFE membranes are naturally hydrophobic in nature. The hydrophobic type is the most-widely used PTFE membrane owing to its various physical properties, such as high porosity, chemical & abrasion resistance, particle retention, convenience in handling, high filtration efficiency, and high flow rates. Due to these properties, hydrophobic PTFE finds extensive use in filtration applications involving exposure to aqueous solutions and gasses. It is extensively used in gas and aqueous solution filtration applications in food & beverage, chemical & petrochemical, medical & pharmaceutical, processing, and other industries

Industrial filtration to be the largest application of PTFE membranes.

Based on application, the PTFE membranes market is segmented into industrial filtration, medical & pharmaceutical textile, water & wastewater treatment, architecture, and others. The industrial filtration application segment accounted for the larger market share in 2019. This is because of the unique properties, such as chemical inertness, ability to sustain high temperature, good mechanical properties, and high filtration efficiency, possess by PTFE membranes makes it suitable for industrial filtration applications involving exposure to corrosive environments and contact with gases, acids, solvents, and alkaline solutions.

APAC is projected to be the fastest-growing PTFE membranes market during the forecast period.

APAC was the largest market for PTFE membranes in 2019 and is also expected to be the fastest-growing market during the forecast period. It accounted for a share of 40.0% in terms of value, of the global market in 2019. The market in APAC is projected to register a CAGR of 7.5% between 2020 and 2025. The market growth in this region is primarily attributed to its rapidly growing population, urbanization, and industrialization. The demand for PTFE membranes is high in developing economies, such as China, India, Brazil, and Argentina. The growing demand from the food & beverage processing, medical & pharmaceuticals, and water & wastewater treatment is playing a crucial role in fueling the market for PTFE membrane in APAC. Implementation of strict regulations regarding water treatment & industrial wastewater discharge is also expected to drive the PTFE membrane market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

PTFE Membrane Market Players

The key players profiled in this report include Pall (US), Cytiva (US), W.L. Gore (US), Merck Millipore (US), Corning (US), Donaldson (US), Saint Gobain (France), Markel (US), Sartorius (Germany), and Hyundai Micro (South Korea). These companies have adopted various organic as well as inorganic growth strategies between 2016 and 2020 to enhance their regional presence and meet the growing demand for PTFE membranes from emerging economies.

PTFE Membrane Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Billion) |

|

Segments |

Type, Application, and Region |

|

Regions |

APAC, Europe, North America, South America, and Middle East & Africa. |

|

Companies |

Total of 10 major players covered: |

This research report categorizes the PTFE membranes market based on type, application, and region.

Based on Type:

- Hydrophobic Membranes

- Hydrophilic Membranes

Based on the application:

- Industrial Filtration

- Medical & Pharmaceuticals

- Textiles

- Water&Wastewater Treatment

- Architecture

- Others

Based on the region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In July 2020, Merck Millipore announced an investment of USD 21.23 million to build a laboratory facility in Buchs, Switzerland, to support its rapidly growing material business. This will help to continue to drive innovation and expand the R&D of analytical standards.

- In January 2020, Cytiva has announced to build a new 7,360 square meter facility in Grens, Switzerland for the manufacturing of single-use kits. This facility will meet global regulatory requirements and is expected to be fully operational in 2022.

- In November 2019, L. Gore launched Gore Low Drag Filter Bags for use in pulse-jet carbon black manufacturing operations. This will help in providing sustainable and low-cost of ownership solutions for reverse-air carbon black operations.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.3.1 PTFE MEMBRANE MARKET – FORECAST TO 2025

TABLE 1 PTFE MEMBRANE MARKET: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

FIGURE 1 PTFE MEMBRANE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 PTFE MEMBRANE MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 3 PTFE MEMBRANE MARKET: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 4 PTFE MEMBRANE MARKET: DATA TRIANGULATION

2.3.1 PTFE MEMBRANE MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

FIGURE 5 PTFE MEMBRANE MARKET ANALYSIS THROUGH SECONDARY INTERVIEWS

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 28)

FIGURE 6 HYDROPHOBIC SEGMENT DOMINATED THE MARKET IN 2019

FIGURE 7 INDUSTRIAL FILTRATION WAS THE LARGEST APPLICATION OF PTFE MEMBRANE IN 2019

FIGURE 8 APAC ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

4 PREMIUM INSIGHTS (Page No. - 31)

4.1 ATTRACTIVE OPPORTUNITIES IN PTFE MEMBRANE MARKET

FIGURE 9 PTFE MEMBRANE MARKET TO REGISTER HIGH GROWTH DURING THE FORECAST PERIOD

4.2 PTFE MEMBRANE MARKET, BY TYPE

FIGURE 10 HYDROPHOBIC TO BE LARGER TYPE OF PTFE MEMBRANE

4.3 PTFE MEMBRANE MARKET, BY APPLICATION

FIGURE 11 INDUSTRIAL FILTRATION TO BE THE LARGEST APPLICATION OF PTFE MEMBRANE

4.4 APAC PTFE MEMBRANE MARKET, BY APPLICATION AND COUNTRY, 2019

FIGURE 12 INDUSTRIAL FILTRATION SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES

4.5 PTFE MEMBRANE MARKET, BY KEY COUNTRIES

FIGURE 13 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL PTFE MEMBRANE MARKET

5 MARKET OVERVIEW (Page No. - 34)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PTFE MEMBRANE MARKET

5.2.1 DRIVERS

5.2.1.1 Increased demand for PTFE membranes from oil & gas and chemical industries

5.2.1.2 Stringent regulations pertaining to emission and treatment of municipal and industrial wastes

5.2.2 RESTRAINTS

5.2.2.1 High production cost of PTFE membranes

5.2.3 OPPORTUNITIES

5.2.3.1 Growing use of EPTFE membranes in microfiltration and venting applications and medical accessories

TABLE 2 APPLICATION OF EPTFE MEMBRANES IN MEDICAL INDUSTRY

5.2.3.2 Increasing demand for treated water in emerging economies

5.2.4 CHALLENGES

5.2.4.1 Fluctuating oil and gas prices

FIGURE 15 CAPEX IN OIL & GAS INDUSTRY (2016-2020)

5.3 TARIFFS AND REGULATIONS

TABLE 3 TARIFFS AND REGULATIONS, BY COUNTRY

5.4 TECHNOLOGY ANALYSIS

5.5 PORTER’S FIVE FORCES

FIGURE 16 PTFE MEMBRANE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5.1 THREAT OF SUBSTITUTES

5.5.2 BARGAINING POWER OF SUPPLIERS

5.5.3 THREAT OF NEW ENTRANTS

5.5.4 BARGAINING POWER OF BUYERS

5.5.5 INTENSITY OF COMPETITIVE RIVALRY

5.6 IMPACT OF COVID-19 PANDEMIC ON PTFE MEMBRANE MARKET

FIGURE 17 COVID19’S PACE OF GLOBAL PROPAGATION IS UNPRECEDENTED

5.7 MACROECONOMIC INDICATORS

5.7.1 GLOBAL GDP TRENDS AND FORECASTS

TABLE 4 ANNUAL PERCENTAGE CHANGE OF REAL GDP GROWTH RATES FROM 2016 TO 2021

5.7.2 TRENDS IN POPULATION GROWTH

TABLE 5 TOTAL POPULATION GROWTH, 2016-2019 (MILLION)

5.8 VALUE CHAIN ANALYSIS

FIGURE 18 PTFE MEMBRANE VALUE CHAIN ANALYSIS

5.8.1 R&D

5.8.2 MANUFACTURING

5.8.3 DISTRIBUTORS, MARKETING, AND SALES

5.9 CASE STUDY

5.10 ADJACENT/RELATED MARKETS

5.10.1 INTRODUCTION

5.10.2 LIMITATION

5.10.3 MARKET ECOSYSTEM AND INTERCONNECTED MARKET

5.10.4 MEMBRANE MARKET

5.10.4.1 Market definition

5.10.4.2 Market overview

5.10.5 MEMBRANE MARKET, BY MATERIAL

TABLE 6 MEMBRANE MARKET SIZE, BY MATERIAL, 2017–2024 (USD MILLION)

5.10.5.1 Polymeric

5.10.5.2 Ceramic

5.10.6 MEMBRANE MARKET, BY TECHNOLOGY

TABLE 7 MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2017–2024 (USD MILLION)

5.10.6.1 RO

5.10.6.2 UF

5.10.6.3 MF

5.10.6.4 NF

5.10.7 MEMBRANE MARKET, BY APPLICATION

TABLE 8 MEMBRANE MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

5.10.7.1 Water & Wastewater Treatment

5.10.7.2 Industrial Processing

5.10.8 MEMBRANE MARKET, BY REGION

TABLE 9 MEMBRANE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

6 PTFE MEMBRANE MARKET, BY TYPE (Page No. - 54)

6.1 INTRODUCTION

FIGURE 19 HYDROPHOBIC TO BE THE LEADING TYPE IN THE OVERALL MARKET

TABLE 10 PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

6.2 HYDROPHOBIC

6.2.1 MOST WIDELY USED FOR WATER & WASTEWATER TREATMENT

6.3 HYDROPHILIC

6.3.1 LOW MANUFACTURING AND OPERATING COST IS BOOSTING THEIR DEMAND

7 PTFE MEMBRANE MARKET, BY APPLICATION (Page No. - 57)

7.1 INTRODUCTION

FIGURE 20 INDUSTRIAL FILTRATION TO BE THE LARGEST APPLICATION OF PTFE MEMBRANE

TABLE 11 PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

7.2 INDUSTRIAL FILTRATION

7.2.1 CHEMICAL & POWER GENERATION

7.2.1.1 Increasing demand in the chemical industry to boost the market

7.2.2 FOOD & BEVERAGE

7.2.2.1 Stringent hygiene standards in the food & beverage industry boosting the market

7.2.3 OTHERS

7.3 MEDICAL & PHARMACEUTICAL

7.3.1 COMPLEX DRUG PRODUCTION REQUIRES PTFE MEMBRANE

7.4 TEXTILE

7.4.1 HIGH FLOW RATE, HIGH POROSITY, AND CHEMICAL RESISTIVITY TO INCREASE THE DEMAND

7.5 WATER & WASTEWATER TREATMENT

7.5.1 INCREASING GLOBAL POPULATION AND INDUSTRIALIZATION RESULTING IN HIGH WATER & WASTEWATER TREATMENT

7.6 ARCHITECTURE

7.6.1 INCREASING DEMAND FOR PTFE MEMBRANE IN ROOFING APPLICATION

7.7 OTHERS

7.7.1 ELECTRONICS & ELECTRICAL

7.7.2 AUTOMOTIVE

7.7.3 OTHERS

8 PTFE MEMBRANE MARKET, BY REGION (Page No. - 63)

8.1 INTRODUCTION

FIGURE 21 APAC TO BE THE LARGEST AND FASTEST-GROWING PTFE MEMBRANE

TABLE 12 PTFE MEMBRANE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.2 APAC

FIGURE 22 APAC: PTFE MEMBRANE MARKET SNAPSHOT

TABLE 13 APAC: PTFE MEMBRANE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 APAC: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 15 APAC: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.2.1 CHINA

8.2.1.1 Water treatment sector witnessing heavy government investments

TABLE 16 CHINA: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 17 CHINA: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.2.2 SOUTH KOREA

8.2.2.1 South Korea’s economic growth driving PTFE membrane market

TABLE 18 SOUTH KOREA: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 19 SOUTH KOREA: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.2.3 INDIA

8.2.3.1 New government initiatives to drive the market

TABLE 20 INDIA: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 21 INDIA: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.2.4 JAPAN

8.2.4.1 Development of food & beverage and pharmaceutical industries driving the market

TABLE 22 JAPAN: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 23 JAPAN: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.2.5 AUSTRALIA

8.2.5.1 Drastic climate changes resulting in water storage

TABLE 24 AUSTRALIA: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 25 AUSTRALIA: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.2.6 REST OF APAC

TABLE 26 REST OF APAC: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 27 REST OF APAC: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.3 NORTH AMERICA

FIGURE 23 NORTH AMERICA: PTFE MEMBRANE MARKET SNAPSHOT

TABLE 28 NORTH AMERICA: PTFE MEMBRANE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 29 NORTH AMERICA: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 30 NORTH AMERICA: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.3.1 US

8.3.1.1 Most mature PTFE membrane market in the region

TABLE 31 US: PTFE MEMBRANE SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 32 US: PTFE MEMBRANE SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.3.2 CANADA

8.3.2.1 Presence of a large number of food & beverage processors to drive the market

TABLE 33 CANADA: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 34 CANADA: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.3.3 MEXICO

8.3.3.1 High demand from pharmaceutical industry to boost PTFE membrane market in Mexico

TABLE 35 MEXICO: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 36 MEXICO: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4 EUROPE

FIGURE 24 EUROPE: PTFE MEMBRANE MARKET SNAPSHOT

TABLE 37 EUROPE: PTFE MEMBRANE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 38 EUROPE: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 39 EUROPE: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.1 GERMANY

8.4.1.1 Strong industrial base likely to drive the PTFE membrane market

TABLE 40 GERMANY: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 41 GERMANY: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.2 UK

8.4.2.1 Growth of chemical and water & wastewater treatment to spur the market

TABLE 42 UK: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 43 UK: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.3 ITALY

8.4.3.1 Rapid industrialization to drive the demand for PTFE membrane

TABLE 44 ITALY: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 45 ITALY: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.4 FRANCE

8.4.4.1 Well-developed industrial infrastructure to lead the market growth

TABLE 46 FRANCE: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 47 FRANCE: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.5 SPAIN

8.4.5.1 Food & beverage industry and water & wastewater treatment norms to drive the market

TABLE 48 SPAIN: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 49 SPAIN: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.6 SWEDEN

8.4.6.1 Manufacturing sector to fuel demand for PTFE membrane

TABLE 50 SWEDEN: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 51 SWEDEN: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.7 RUSSIA

8.4.7.1 Increasing industrial output to drive the market

TABLE 52 RUSSIA: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 53 RUSSIA: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.4.8 REST OF EUROPE

TABLE 54 REST OF EUROPE: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 55 REST OF EUROPE: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.5 MIDDLE EAST & AFRICA

TABLE 56 MIDDLE EAST & AFRICA: PTFE MEMBRANE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.5.1 SAUDI ARABIA

8.5.1.1 South Arabia witnessing increasing demand for PTFE membrane for water & wastewater treatment

TABLE 59 SAUDI ARABIA: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 60 SAUDI ARABIA: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.5.2 UAE

8.5.2.1 One of the most water-stressed countries in the world

TABLE 61 UAE: PTFE MEMBRANE MARKET SIZE, BY TYPE,2018–2025 (USD MILLION)

TABLE 62 UAE: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.5.3 EGYPT

8.5.3.1 Government initiatives for addressing water scarcity to spur market growth

TABLE 63 EGYPT: PTFE MEMBRANE MARKET SIZE, BY TYPE,2018–2025 (USD MILLION)

TABLE 64 EGYPT: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 65 REST OF MIDDLE EAST & AFRICA: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 66 REST OF MIDDLE EAST & AFRICA: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.6 SOUTH AMERICA

TABLE 67 SOUTH AMERICA: PTFE MEMBRANE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 68 SOUTH AMERICA: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 69 SOUTH AMERICA: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.6.1 BRAZIL

8.6.1.1 Food & beverage industry to drive the PTFE membrane market

TABLE 70 BRAZIL: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 71 BRAZIL: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.6.2 ARGENTINA

8.6.2.1 Strong growth of industrial sector fueling the market

TABLE 72 ARGENTINA: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 73 ARGENTINA: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

8.6.3 REST OF SOUTH AMERICA

TABLE 74 REST OF SOUTH AMERICA: PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 75 REST OF SOUTH AMERICA: PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 106)

9.1 OVERVIEW

FIGURE 25 COMPANIES ADOPTED INVESTMENT & EXPANSION AS THE KEY GROWTH STRATEGY BETWEEN 2016 AND 2020

9.2 MARKET EVALUATION FRAMEWORK

TABLE 76 MARKET EVALUATION FRAMEWORK

9.3 MARKET SHARE

FIGURE 26 TOP 5 COMPANIES DOMINATED THE PTFE MEMBRANE MARKET IN 2019

9.4 MARKET RANKING

FIGURE 27 MARKET RANKING OF KEY PLAYERS, 2019

9.4.1 PALL

9.4.2 CYTIVA

9.4.3 W.L. GORE

9.4.4 MERCK MILLIPORE

9.4.5 CORNING

9.5 KEY MARKET DEVELOPMENTS

9.6 NEW PRODUCT LAUNCH

TABLE 77 NEW PRODUCT LAUNCH, 2016–2020

9.7 INVESTMENT & EXPANSION

TABLE 78 INVESTMENT & EXPANSION, 2016–2020

9.8 MERGER & ACQUISITION

TABLE 79 MERGER & ACQUISITION, 2016–2020

10 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 111)

10.1 COMPANY EVALUATION MATRIX DEFINITIONS

10.1.1 STAR

10.1.2 EMERGING LEADERS

10.1.3 PERVASIVE

10.1.4 EMERGING PLAYERS

FIGURE 28 COMPANY EVALUATION MATRIX, 2019

10.2 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 29 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN PTFE MEMBRANE MARKET

10.3 BUSINESS STRATEGY EXCELLENCE

FIGURE 30 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN PTFE MEMBRANE MARKET

10.4 COMPANY PROFILES

(Business overview, Products offered, Recent developments, SWOT analysis, Current focus and strategies & Right to win)*

10.4.1 PALL

FIGURE 31 PALL: SWOT ANALYSIS

10.4.2 CYTIVA

FIGURE 32 CYTIVA: SWOT ANALYSIS

10.4.3 W.L. GORE

FIGURE 33 W.L. GORE: SWOT ANALYSIS

10.4.4 MERCK MILLIPORE

FIGURE 34 MERCK MILLIPORE: COMPANY SNAPSHOT

FIGURE 35 MERCK MILLIPORE: SWOT ANALYSIS

10.4.5 CORNING

FIGURE 36 CORNING: COMPANY SNAPSHOT

FIGURE 37 CORNING: SWOT ANALYSIS

10.4.6 DONALDSON

FIGURE 38 DONALDSON: COMPANY SNAPSHOT

10.4.7 SAINT GOBAIN

FIGURE 39 SAINT GOBAIN: COMPANY SNAPSHOT

10.4.8 MARKEL

10.4.9 SARTORIUS

FIGURE 40 SARTORIUS: COMPANY SNAPSHOT

10.4.10 HYUNDAI MICRO

10.5 STARTUP/SME PROFILES

10.5.1 AERONAUTEC

10.5.2 COBETTER FILTRATION

10.5.3 FIBERLON

10.5.4 GVS

10.5.5 HAWACH SCIENTIFIC

10.5.6 KOMEMTEC

10.5.7 METIC LAB

10.5.8 PHILLIPS SCIENTIFIC

10.5.9 POREX

10.5.10 SHANDONG SENRONG NEW MATERIALS

10.5.11 SUMITOMO ELECTRIC INDUSTRIES

10.5.12 THEWAY MEMBRANES

10.5.13 TRINITY FILTRATION TECHNOLOGY

10.5.14 ZEUS

10.5.15 ZHEJIANG YANPAI FILTRATION TECHNOLOGY

*Details on Business overview, Products offered, Recent developments, SWOT analysis, Current focus and strategies & Right to win might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 137)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

The study involves four major activities in estimating the current market size of PTFE membranes. Extensive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; and databases.

Primary Research

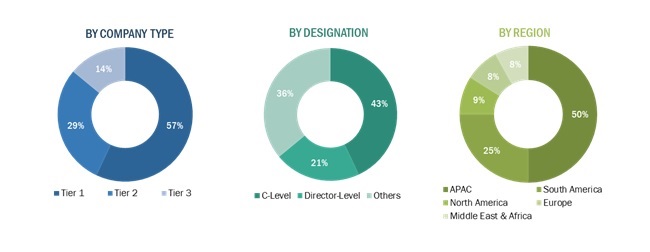

The PTFE membranes market comprises several stakeholders, such as raw material suppliers, manufacturers, and distributors of PTFE membranes, industry associations, end-users, and regulatory organizations in the supply chain. The demand side of this market consists of major construction companies, whereas the supply side consists of PTFE system manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary interviews—

To know about the assumptions considered for the study, download the pdf brochure

Notes: Tiers of companies are classified on the basis of their total revenue in 2019 as Tier 1 = > USD 7 billion, Tier 2 = USD 500 million – USD 7 billion, and Tier 3 = < USD P million.< 500>

Others include sales, marketing, and product managers.

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the PTFE membranes market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. Data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study:

- To define and analyze the PTFE membranes market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market by type, application, and region

- To forecast the size of the market with respect to five regions; Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micro markets with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments in the market, such as new product launch, investment & expansion, merger & acquisition and partnership & agreement.

- To strategically profile key players and comprehensively analyze their market shares and core competencies

Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies, along with the market data. The following customization options are available for this report:

Product Analysis

- A product matrix that provides a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of APAC PTFE membranes market

Company Information:

- Detailed analysis and profiles of additional market players.

Growth opportunities and latent adjacency in PTFE Membrane Market

need informaton about gore automoitve product production and sales details as company profile

Detail portion of market size per each application. PTFE membrane market size among textile (only PTFE membrane or laminate).

PTFE or ePTFE stretched films market (in m2) by application, forecast, cost structure, and price analysis

Report on PTFE Medical Membranes for medical markets only