Expanded PTFE (ePTFE) Market by Form (Sheets, Tapes, Membranes, Fibers), Application (Gaskets, Filtration & Sepration, Dielectric Constant), End-Use Industry (Oil & Gas, Chemical, Medical, and Transportation), and Region - Global Forecast to 2024

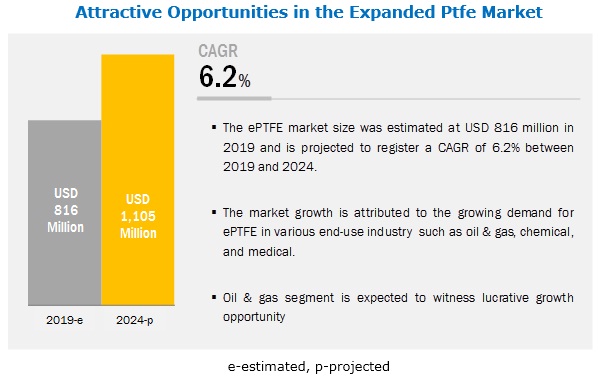

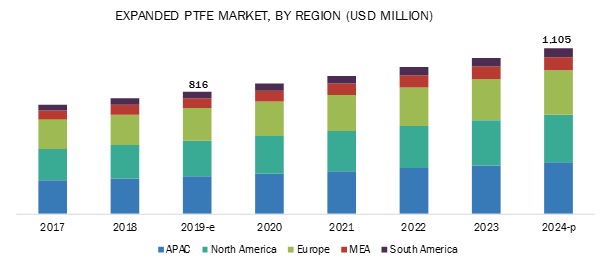

ePTFE Market was valued at USD 816 million in 2019 and is projected to reach USD 1,105 million by 2024, growing at a cagr 6.2% from 2019 to 2024. The demand for Expanded PTFE (ePTFE) is driven mainly by its growing demand in oil & gas, medical, and chemical end-use industries.

According to the form, the sheets segment is expected to be the most significant contributor in the ePTFE market during the forecast period.

Based on form, the sheets segment is likely to account for the largest share of the market in 2019. The growth in this segment is attributed to its increasing usage of sheets from various end-use industries such as the medical , oil & gas, and automotive end-use industry is owing to their extraordinary characteristics such as UV, Chemical, temperature resistance, and flexible nature. These factors are expected to drive demand during the forecast period.

By application, the gaskets segment is expected to be the most significant contributor in the ePTFE market during the forecast period.

Based on the application, the gaskets segment is likely to account for the largest share of the market in 2019. The growth in this segment is attributed to its increasing usage in various end-use industries as these gaskets are easy to cut, can seal irregular and rough surface reduces cold flow, and possess high temperature and chemical resistance. These factors are expected to drive demand during the forecast period.

APAC is expected to account for the largest market size during the forecast period

APAC is the largest and fastest-growing ePTFE market, owing to its increasing usage in various end-use industries such as chemical, medical, transportation, among others. Furthermore, increasing investments in the automotive and growing oil & gas industries will also drive the market in this region during the forecast period. Moreover, countries such as China and India have been scaling up the size of their manufacturing sector. These factors are expected to fuel the demand for ePTFE in the region during the forecast period.

Key Market Players

The major vendors in the ePTFE has been dominated by players such as W.L. Gore & Associates, Inc. (US), Donaldson Company, Inc. (US), Teadit (Austria) Zeus Industrial Products, Inc. (US), Dexmet Corporation (US), Phillips Scientific, Inc. (US), Rogers Corporation (US), Poly Fluoro Ltd (India), Markel Corporation (US), Shanghai Lanle Plastics Co.Ltd (China).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Form, Application, End-Use Industry, and Region |

|

Geographies covered |

North America, APAC, Europe, South America, and Middle East & Africa |

|

Companies covered |

W.L. Gore & Associates, Inc. (US), Donaldson Company, Inc. (US), Teadit (Austria) Zeus Industrial Products, Inc. (US), Dexmet Corporation (US), Phillips Scientific, Inc. (US), Rogers Corporation (US), Poly Fluoro Ltd (India), Markel Corporation (US), Shanghai Lanle Plastics Co.Ltd. (China). |

This research report categorizes the Expanded PTFE ( ePTFE) market based on form, application, end-use industry, and region.

EPTFE Market, by Form:

- Sheets

- Tapes

- Membrane

- Fiber

- Others ( tubes, rods)

EPTFE Market, by Application:

- Gaskets

- Filteration & Separation

- Dielectric Constant

- Others ( packing, fuel cell membrane)

EPTFE Market, by End-Use Industry:

- Oil & Gas

- Chemical

- Medical

- Transportation

- Others ( electrical & electronics, food & beverage, semiconductor, building & construction)

EPTFE Market, by Region:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In February 2018, Zeus Industrial Products started a new manufacturing facility in Aiken County. The new manufacturing facility will help the company to meet the growing demand in Europe and expand its footprint globally.

- In April 2016, Gore & Associates launched a new product known as low drag filter bags. This innovative product is used in fume and fine powder applications. This new product launch will help the company to enhance its product portfolio and will also help in strengthening its position in the global market.

Key Questions addressed by the report

- Which are the future revenue pockets in the ePTFE market?

- Which key developments are expected to have a high impact on the market?

- Which products/technologies are expected to overpower the existing technologies?

- How the regulatory scenario further is expected to impact the market?

- What will be the future product mix in the ePTFE market?

- What are the prime strategies of leaders in the market?

Frequently Asked Questions (FAQ):

What are the factors Influencing the growth expanded polytetrafluoroethylene (PTFE) market?

Growing demand of expanded PTEF in various end-use industries, such as, automotive and aerospace, electronics & electrical, chemical & industrial processing, health care, building & construction, and consumer goods, is major factor Influencing the growth in the market. Moreover, high demand in emerging countries in APAC is also driving the demand for expanded PTEF products.

How many forrm of expanded polytetrafluoroethylene (PTFE) are available in the market?

PTFE is available mainly in four grades—virgin PTFE, filled PTFE, mPTFE, and ePTFE.

Which region show highest growth?

APAC is the largest and the fastest-growing market for PTFE. This is backed by the increased demand for PTFE from the growing chemical & industrial processing industry in the region. This factors have provided growth opportunities to PTFE in the form of plain bearings, gears, slide plates, dough hoppers, mixing bowls, and conveyor systems in industrial machinery.

Who are the major manufacturers?

Major manufactures include Chemours (US), Dongyue Group (China), Daikin (Japan), Gujarat Fluorochemicals (GFL) (India), 3M (US), Solvay (Germany), Asahi Glass Company (AGC) (Japan), Zhejiang Juhua (China), Shanghai 3F (China), HaloPolymer (Russia) and others.

What is the major application of expanded polytetrafluoroethylene (PTFE)?

Chemical & industrial processing is the largest end-use industry of PTFE. The various properties of PTFE including chemical inertness, thermal stability, and corrosion resistance make it suitable for use in vessel linings, seals, gaskets, spacers, plain bearings, gears, pipes, slide plates, and drilling parts. High growth potential in the chemical industry is driving the demand for PTFE.

What is the biggest Restraint for expanded polytetrafluoroethylene (PTFE)?

Increasing prices of polytetrafluoroethylene (PTFE) is the major restraint in the market. The prices of PTFE have fluctuated and witnessed an increase in the recent years due to shutting down of various Chinese and European manufacturing units. Moreover, the arrival of a large number of relatively low-cost Chinese products in the global market has resulted in the increasing price pressure on PTFE manufacturers in other countries. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Expanded PTFE Market Definition

1.3 Market Scope

1.3.1 Expanded PTFE Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Base Number Calculation

2.2.1 Supply Side Analysis

2.2.1.1 Approach 1

2.2.1.2 Approach 2

2.2.2 Demand Side Analysis

2.3 Market Size Estimation

2.3.1 Market Size Estimation Methodology: Bottom-Up Approach

2.3.2 Market Size Estimation Methodology: Top-Down Approach

2.4 Primary Data

2.4.1 Key Data From Primary Sources

2.4.1.1 Breakdown of Primary Interviews

2.5 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Expanded PTFE Market

4.2 Expanded PTFE Market, By Region

4.3 Expanded PTFE Market in APAC, By Country and Form, 2018

4.4 Global Expanded PTFE Market, By Key Countries

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for ePTFE Gaskets From the Oil & Gas and Chemical Industries

5.2.2 Restraints

5.2.2.1 High Production Cost of ePTFE

5.2.3 Opportunities

5.2.3.1 Growing Use in Microfiltration and Venting Applications, and Medical Accessories

5.2.4 Challenges

5.2.4.1 Fluctuating Oil & Gas Prices

6 Industry Trends (Page No. - 36)

6.1 Porter’s Five Forces Analysis

6.1.1 Bargaining Power of Suppliers

6.1.2 Threat of New Entrants

6.1.3 Threat of Substitutes

6.1.4 Bargaining Power of Buyers

6.1.5 Intensity of Competitive Rivalry

6.2 Macroeconomic Indicators

6.2.1 Trends of Oil Production and Drilling

6.2.2 Trends of Gas Production

6.2.3 Trends and Forecast of GDP

6.2.4 Contribution of Healthcare Spending to GDP

6.3 Expanded Polytetrafluoroethylene (ePTFE) Patent Analysis

7 Expanded PTFE Market, By Form (Page No. - 48)

7.1 Introduction

7.2 Sheets

7.2.1 ePTFE Sheets are Used as Sealing Materials in Various Industries

7.3 Tapes

7.3.1 The Soft and Flexible Nature of ePTFE Tapes Help Provide Seal on Irregular Surfaces

7.4 Membranes

7.4.1 ePTFE Membranes Have High Filtration Efficiency and Air Permeability

7.5 Fibers

7.5.1 ePTFE Fabrics Can Be Bonded to Many Materials Using Resins

7.6 Others

8 Expanded PTFE Market, By Application (Page No. - 54)

8.1 Introduction

8.2 Gaskets

8.2.1 Increased Demand for Acoustic Insulation in the Construction Industry is Expected to Boost the Market

8.3 Filtration & Separation

8.3.1 Aerosol Sampling, Air Venting, and Gas Filtration are Among the Major Uses of ePTFE Filters

8.4 Dielectric Materials

8.4.1 Cables for High Data Rate, Power and Signal Delivery, and CAPACitors are Some of the Key Uses of ePTFE-Based Dielectric Materials

8.5 Others

9 Expanded PTFE Market, By End-Use Industry (Page No. - 59)

9.1 Introduction

9.2 Oil & Gas

9.2.1 ePTFE is Used in Pipe Liners, Coatings, Control Line Encapsulation, Power Cables, and Other Applications in This End-Use Industry

9.3 Chemical

9.3.1 ePTFE Prevents Contamination of Products and Maintains Purity of Processing Streams

9.4 Transportation

9.4.1 ePTFE is Used in Low Friction Applications in the Automotive Industry

9.5 Medical

9.5.1 The Applications of ePTFE are Growing in This End-Use Industry

9.6 Others

10 Expanded PTFE Market, By Region (Page No. - 65)

10.1 Introduction

10.2 APAC

10.2.1 China

10.2.1.1 China is the Largest Producer of the Major Raw Materials for Fluoropolymer

10.2.2 Japan

10.2.2.1 High Growth Prospects of the Chemical Industry in the Country are Expected to Propel the Market in the Future

10.2.3 India

10.2.3.1 Increasing Demand From the Chemical Industry is Fueling the Market

10.2.4 South Korea

10.2.4.1 The Automotive Industry is One of the Key End Users of ePTFE in the Country

10.2.5 Indonesia

10.2.5.1 Urbanization is Expected to Indirectly Influence the Demand for ePTFE in the Country

10.2.6 Rest of APAC

10.3 North America

10.3.1 US

10.3.1.1 Increasing Demand From the Chemical Industry is Expected to Drive the Market

10.3.2 Canada

10.3.2.1 The Growing Chemical Industry is Boosting the Market

10.3.3 Mexico

10.3.3.1 The Country’s Electronics Industry Holds Potential for Market Growth

10.4 Europe

10.4.1 Germany

10.4.1.1 As an Automotive Production Hub, Germany Witnesses Demand for ePTFE From the Country’s Automotive Industry

10.4.2 France

10.4.2.1 The Chemical Industry Offers Opportunities for ePTFE Manufacturers in the Country

10.4.3 Russia

10.4.3.1 The Country’s Pharmaceutical Industry is Promising for the Growth of the ePTFE Market

10.4.4 UK

10.4.4.1 The Consumption of ePTFE is Growing in the Country’s Machinery Production Sector

10.4.5 Italy

10.4.5.1 The Recovery of the Country’s Chemical Industry is Positive for the ePTFE Market Growth

10.4.6 Spain

10.4.6.1 Growing End-Use Industries and Economic Expansion are Driving the Market

10.4.7 Rest of Europe

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.1.1 The Petrochemical Industry is Impacting the Demand for ePTFE Positively

10.5.2 Iran

10.5.2.1 The Country has A Significant Number of Onshore Crude Oil Reserves

10.5.3 UAE

10.5.3.1 The Country is One of the World’s 10 Largest Oil and Natural Gas Producers

10.5.4 Rest of Middle East & Africa

10.6 South America

10.6.1 Brazil

10.6.1.1 The Growth of the Chemical Industry is Expected to Increase the Demand for ePTFE

10.6.2 Argentina

10.6.2.1 Argentina has the Third-Largest Automobile Industry in the Region

10.6.3 Rest of South America

11 Competitive Landscape (Page No. - 106)

11.1 Introduction

11.2 Market Ranking of Key Players

11.3 Competitive Scenario

11.3.1 Expansion

11.3.2 New Product Launch

12 Company Profiles (Page No. - 109)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 W.L. Gore & Associates, Inc.

12.2 Donaldson Company, Inc.

12.3 Teadit

12.4 Zeus Industrial Products, Inc.

12.5 Dexmet Corporation

12.6 Phillips Scientific Inc.

12.7 Rogers Corporation

12.8 Poly Fluoro Ltd.

12.9 Markel Corporation

12.10 Shanghai Lanle Plastics Co.,Ltd.

12.11 Other Players

12.11.1 Wuxi Rayflon Polymer Technology Co.

12.11.2 Nitto Denko

12.11.3 Teflex Gasket

12.11.4 Sealmax

12.11.5 Sanghvi Techno Products

12.11.6 KWO Dichtungstechnik GmbH

12.11.7 Ningbo Changqi International Co., Ltd

12.11.8 Zhejiang Jiari Fluoroplastic Co., Ltd.

12.11.9 Inventro Polymers

12.11.10 International Polymer Engineering

12.11.11 Adtech Polymer Engineering

12.11.12 PAR Group

12.11.13 Avko

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 128)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (96 Tables)

Table 1 Applications of Expanded PTFE in the Medical Industry

Table 2 Oil Production, 2017 (Thousand Barrels Daily)

Table 3 Oil & Gas Wells Drilled, By Region

Table 4 Gas Production, 2017 (Billion Cubic Metres)

Table 5 Trends and Forecast of GDP, 2015 -2022 (USD Billion)

Table 6 The Section Covers the Country-Wise Per Capita Healthcare Spending. the Us Had the Largest Per Capita Healthcare Spending in 2017 and 2018.

Table 7 Contribution of Per Capita Healthcare Spending, 2017 and 2018

Table 8 Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 9 Sheets: Expanded PTFE Market Size, By Region, 2017–2024 (USD Million)

Table 10 Tapes: Expanded PTFE Market Size , By Region, 2017–2024 (USD Million)

Table 11 Membranes: Expanded PTFE Market Size , By Region, 2017–2024 (USD Million)

Table 12 Fibers: Expanded PTFE Market Size , By Region, 2017–2024 (USD Million)

Table 13 Other Forms: Expanded PTFE Market Size , By Region, 2017–2024 (USD Million)

Table 14 Expanded PTFE Market Size, By Application, 2017–2024 (USD Million)

Table 15 Expanded PTFE Market Size in Gaskets Application, 2017–2024 (USD Million)

Table 16 Expanded PTFE Market Size in Filtration & Separation Application, 2017–2024 (USD Million)

Table 17 Expanded PTFE Market Size in Dielectric Materials Application, 2017–2024 (USD Million)

Table 18 Expanded PTFE Market Size in Other Applications, 2017–2024 (USD Million)

Table 19 Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 20 Expanded PTFE Market Size in Oil & Gas End-Use Industry, By Region, 2017–2024 (USD Million)

Table 21 Expanded PTFE Market Size in Chemical End-Use Industry, By Region, 2017–2024 (USD Million)

Table 22 Expanded PTFE Market Size in Transportation End-Use Industry, By Region, 2017–2024 (USD Million)

Table 23 Expanded PTFE Market Size in Medical End-Use Industry, By Region, 2017–2024 (USD Million)

Table 24 Expanded PTFE Market Size in Other End-Use Industries, By Region, 2017–2024 (USD Million)

Table 25 Expanded PTFE Market Size, By Region, 2017–2024 (USD Million)

Table 26 Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 27 Expanded PTFE Market Size, By Application, 2017–2024 (USD Million)

Table 28 Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 29 APAC: Expanded PTFE Market Size, By Country, 2017–2024 (USD Million)

Table 30 APAC: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 31 APAC: Expanded PTFE Market Size, By Application, 2017–2024 (USD Million)

Table 32 APAC: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 33 China: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 34 China: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 35 Japan: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 36 Japan: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 37 India: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 38 India: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 39 South Korea: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 40 South Korea: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 41 Indonesia: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 42 Indonesia: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 43 Rest of APAC: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 44 Rest of APAC: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 45 North America: Expanded PTFE Market Size, By Country, 2017–2024 (USD Million)

Table 46 North America: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 47 North America: Expanded PTFE Market Size, By Application, 2017–2024 (USD Million)

Table 48 North America: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 49 US: Expanded PTFE Market Size, By Form, 2017–2024 ( USD Million)

Table 50 US: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 51 Canada: Expanded PTFE Market Size, By Form, 2017-2024 (USD Million)

Table 52 Canada: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 53 Mexico: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 54 Mexico: Expanded PTFE Market Size, End-Use Industry, 2017–2024 (USD Million)

Table 55 Europe: Expanded PTFE Market Size, By Country, 2017–2024 (USD Million)

Table 56 Europe: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 57 Europe: Expanded PTFE Market Size, By Application, 2017–2024 (USD Million)

Table 58 Europe: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 59 Germany: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 60 Germany: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 61 France: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 62 France: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 63 Russia: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 64 Russia: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 65 UK: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 66 UK: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 67 Italy: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 68 Italy: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 69 Spain: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 70 Spain: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 71 Rest of Europe: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 72 Rest of Europe: Expanded PTFE Market Size, End-Use Industry, 2017–2024 (USD Million)

Table 73 Middle East & Africa: Expanded PTFE Market Size, By Country, 2017–2024 (USD Million)

Table 74 Middle East & Africa: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 75 Middle East & Africa: Expanded PTFE Market Size, By Application, 2017–2024 (USD Million)

Table 76 Middle East & Africa: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 77 Saudi Arabia: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 78 Saudi Arabia: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 79 Iran: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 80 Iran: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 81 UAE: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 82 UAE: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 83 Rest of Middle East & Africa: Expanded PTFE Market Size, By Form, 2017–2024 (USD Million)

Table 84 Rest of Middle East & Africa: Expanded PTFE Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 85 South America: Expanded PTFE Market Size, By Country, 2019–2024 (USD Million)

Table 86 South America: Expanded PTFE Market Size, By Form, 2019–2024 (USD Million)

Table 87 South America: Expanded PTFE Market Size, By Application, 2019–2024 (USD Million)

Table 88 South America: Expanded PTFE Market Size, By End-Use Industry, 2019–2024 (USD Million)

Table 89 Brazil: Expanded PTFE Market Size, By Form, 2019–2024 (USD Million)

Table 90 Brazil: Expanded PTFE Market Size, By End-Use Industry, 2019–2024 (USD Million)

Table 91 Argentina: Expanded PTFE Market Size, By Form, 2019–2024 (USD Million)

Table 92 Argentina: Expanded PTFE Market Size, By End-Use Industry, 2019–2024 (USD Million)

Table 93 Rest of South America: Expanded PTFE Market Size, By Form, 2019–2024 (USD Million)

Table 94 Rest of South America: Expanded PTFE Market Size, By End-Use Industry, 2019–2024 (USD Million)

Table 95 Expansion, 2015–2018

Table 96 New Product Launch, 2015–2018

List of Figures (33 Figures)

Figure 1 Sheets Segment Was the Leading Form of Expanded PTFE in 2018

Figure 2 Gaskets to Be the Fastest-Growing Application of Expanded PTFE

Figure 3 Oil & Gas Was the Largest End-Use Industry of Expanded PTFE

Figure 4 APAC Was the Largest Expanded PTFE Market in 2018

Figure 5 Growing Chemical Industry to Drive the Market During the Forecast Period (2019-2024)

Figure 6 APAC to Be the Largest Market

Figure 7 China and Sheets Segment Accounted for the Largest Market Shares

Figure 8 India to Be the Fastest-Growing Market

Figure 9 Drivers, Restraints, Opportunities, and Challenges in the Expanded PTFE Market

Figure 10 Porter’s Five Forces Analysis of Expanded PTFE Market

Figure 11 Publication Trends - Last 10 Years

Figure 12 Trend Analysis and Graphical Representation

Figure 13 Top Assignees

Figure 14 Sheets to Be the Largest Form of ePTFE

Figure 15 Gaskets to Be the Largest Application of Expanded PTFE During the Forecast Period

Figure 16 Oil & Gas Segment to Lead the Expanded PTFE Market

Figure 17 APAC to Be the Fastest-Growing Market

Figure 18 APAC: Expanded PTFE Market Snapshot

Figure 19 North America: Expanded PTFE Market Snapshot

Figure 20 Europe: Expanded PTFE Market Snapshot

Figure 21 Middle East & Africa: Expanded PTFE Market Snapshot

Figure 22 South America: Expanded PTFE Market Snapshot

Figure 23 Companies Adopted New Product Launch and Expansion as Key Growth Strategies Between 2015 and 2018

Figure 24 Ranking of Expanded PTFE Manufacturers in 2018

Figure 25 W.L. Gore & Associates: SWOT Analysis

Figure 26 Donaldson Company: Company Snapshot

Figure 27 Donaldson Company: SWOT Analysis

Figure 28 Teadit: SWOT Analysis

Figure 29 Zeus Industrial Products: SWOT Analysis

Figure 30 Dexmet Corporation: SWOT Analysis

Figure 31 Phillips Scientific Inc.: SWOT Analysis

Figure 32 Rogers Corporation: Company Snapshot

Figure 33 Rogers Corporation: SWOT Analysis

The study involved four major activities in estimating the current market size of ePTFE. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation was used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg Business Week, Factiva, World Bank, and Industry Journals have been referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, and databases.

Primary Research

The ePTFE market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Developments in the ePTFE market characterize the demand side. The supply side is characterized by market consolidation activities undertaken by the manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents–

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the ePTFE market. These methods were also used extensively to determine the extent of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the ePTFE market.

Report Objectives

- To define, describe, and forecast ePTFE market size, in terms of value

- To provide information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the ePTFE market size based on form, end-use industry, application, and region

- To predict the market size concerning key areas, namely, North America, Asia Pacific (APAC), Europe, Middle East & Africa, and South America

- To strategically analyze the market for individual growth trends, prospects, and their contribution to the overall market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe algae products market into Norway, and Denmark

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Expanded PTFE (ePTFE) Market