Protective Films Market by Class (Adhesive-Coated, Self-Adhesive), Type (Polyethylene, Polypropylene, Polyethylene Terephthalate), End-Use Industry (Building & Construction, Transportation, Electronics), and Region - Global Forecast to 2022

[152 Pages Report] Protective Films Market size was valued at USD 12.20 Billion in 2016 and is projected to reach USD 17.57 Billion by 2022, at a CAGR of 6.23% during the forecast period. In this study, 2016 has been considered the base year and 2017 to 2022 the forecast period to estimate the market size for protective films.

Objectives of the Study

- To analyze and forecast the global protective films market, in terms of value (USD million)

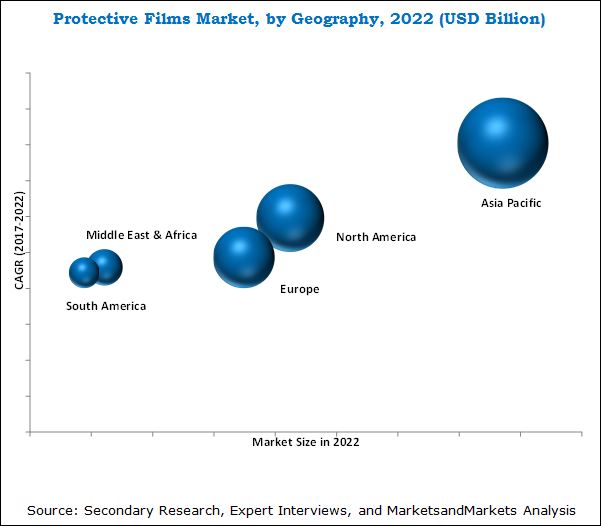

- To estimate and forecast the market size on the basis of five regions, namely, Europe, Asia Pacific, North America, the Middle East & Africa, and South America

- To provide detailed information about the key growth factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the size of the market on the basis of, class, type, and end-use industries

- To estimate and forecast the market size for protective films at the country-level in each of the regions

- To analyze the market opportunities and competitive landscapes of the stakeholders and market leaders

- To analyze competitive developments such as new product developments, expansions, mergers & acquisitions, and joint ventures & partnerships in the protective films market

- To strategically identify and profile the key market players and analyze their core competencies*

Core competencies* of the companies are determined in terms of their key developments and key strategies to sustain in the market.

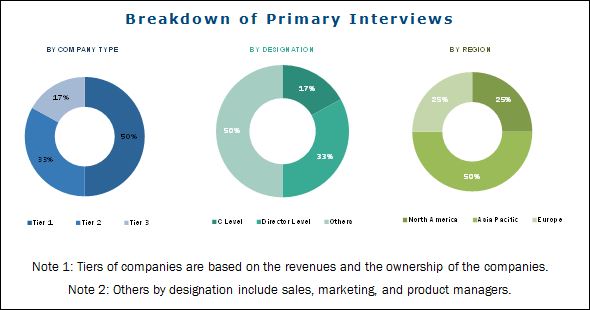

This research study involves extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, BusinessWeek, and Factiva to identify and collect information useful for this technical, market-oriented, and commercial study of the protective films market. The primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, and organizations related to different segments of the industrys supply chain. The bottom-up approach has been used to estimate the market size of the protective films on the basis of class, type, end-use industry, and region in terms of value. The top-down approach was implemented to validate the market size by value. With the data triangulation procedure and validation of the data through primary interviews, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study.

To know about the assumptions considered for the study, download the pdf brochure

Major Players

The protective films market is led by major players, such as Nitto Denko Corporation (Japan), Saint-Gobain (France), 3M (US), Chargeurs (France), DuPont (US), Arkema (France), Avery Dennison (US), and Polifilm Group (Germany). These key players have adopted various business strategies to maintain their shares in the protective films market.

Target Audience:

- Manufacturers of Protective Films

- Traders, Distributors, and Suppliers of Protective Films

- End-use Market Participants of Different Segments of the Protective Films Market

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- R&D Institutions

- Environment Support Agencies

- Investment Banks and Private Equity Firms

This study answers several questions for the stakeholders, primarily which market segments they need to focus upon during the next two to five years to prioritize their efforts and investments.

Scope of the Report:

This research report categorizes the protective films market based on class, type, end-use industry, and region. It forecasts revenue growth and analyzes the trends in each of the submarkets.

Protective Films Market, By Class:

- Adhesive-coated

- Self-adhesive

Protective Films Market, By Type:

- Polyethylene

- Polypropylene

- Polyethylene Terephthalate

- Polyvinyl Chloride

- Others

Protective Films Market, By End-use Industry:

- Building & Construction

- Transportation

- Electronics

- Packaging

- Others

Protective Films Market, By Region:

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- Italy

- UK

- Russia

- Turkey

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

These segments are further described in detail along with their subsegments in the report. The value forecasts for these segments and subsegments have also been provided till 2022.

Available Customizations: The following customization options are available in the report:

- Company Information

Analysis and profiles of additional global as well as regional market players (up to three)

The protective films market is projected to reach USD 17.57 Billion by 2022, at a CAGR of 6.23% between 2017 and 2022. Growth of this market is primarily attributed to the increasing demand for protective films from various end-use industries such as building & construction, transportation, electronics, and others. The demand for protective films has increased in these sectors, as manufacturers are more conscious in protecting their products from dirt, scratches, and chemicals, among others and making them more durable. Protective films are also growing popular in the aftermarket products of these industries, as these protect surfaces from any damages caused by UV rays, abrasion, and weathering, among others.

Adhesive-coated is the largest segment of the protective films market. This class of protective films are the most commonly used protective films due to the greater compatibility with different substrates such as glass, metals, and plastics, among others, and easier manufacturing processes compared to self-adhesive protective films.

Polyethylene type protective films had the largest market share among the different types of protective films such as polypropylene, polyethylene terephthalate, polyvinyl chloride, and others in 2016. This is due to the fact that polyethylene protective films are made of the polyethylene polymer which is the most commonly available polymer and are the cheapest among protective films.

The building and construction segment is the largest end-use industry segment of the protective films market. Growth in the building and construction industry can be attributed to the growing construction industry worldwide, especially in emerging regions. Due to the growing construction industry, production of building materials such as window profiles, glazed panels, window frames, floors, cabinets, and carpets is also expected to increase, thereby increasing the demand for protective films for these applications.

The Asia Pacific is the largest regional segment of the protective films market, in terms of value. Countries in this region such as China, India, Japan, and South Korea are witnessing a gradual increase in the demand for protective films. The growing construction industry in the region due to rapid urbanization, and the increase in the production of automotive and electronics goods are expected to play a significant role in driving the protective films market in the region.

Although the protective films market is growing at a rapid pace, market growth is affected by a few factors. Protective films are difficult to recycle as these are made of common polymeric materials. Therefore, direct disposal of protective films raises concerns of environmental damage. This, in turn, acts as a restraint, impacting the growth of the protective films market.

Nitto Denko Corporation (Japan), Saint-Gobain (France), 3M (US), Chargeurs (France), DuPont (US), and Arkema (France) are the leading players in the protective films market. These companies have a wide breadth and depth of protective films products in their product portfolios and have also adopted various growth strategies, such as expansions, mergers & acquisitions, collaborations/partnerships/agreements, and new product launches to enhance their shares in the protective films market. The competition among these players is high, and they mostly compete with each other on the prices and quality of the products, their product portfolios, and customized solutions, among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in Protective Films Market

4.2 Protective Films Market Growth, By Type

4.3 Protective Films Market Growth, By End-Use Industry

4.4 Asia-Pacific Protective Films Market Share, By Country and End-Use Industry, 2016

4.5 Protective Films Market Attractiveness

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth in Building & Construction Industry Due to Rapid Urbanization in Emerging Economies of Asia-Pacific

5.2.1.2 Developing Transportation Sector Around the World

5.2.2 Restraints

5.2.2.1 Difficulty in Recycling of Polymer Plastics

5.2.3 Opportunities

5.2.3.1 Growing Demand for Films in Pharmaceutical and Medical Applications

5.2.4 Challenges

5.2.4.1 Development of New Bio-Based Protective Films

5.2.4.2 Stringent Environmental and Government Regulations

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Bargaining Power of Suppliers

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Overview and Trends

5.4.1 Introduction

5.4.2 Trends and Forecast of GDP

5.4.3 Trends of Automotive Industry

5.4.4 Trends of Disposable Income

5.4.5 Trends of Construction Industry

6 Protective Films Market, By Class (Page No. - 47)

6.1 Introduction

6.2 Adhesive-Coated Protective Films

6.3 Self-Adhesive Protective Films

7 Protective Films Market, By Type (Page No. - 52)

7.1 Introduction

7.2 Polyethylene

7.3 Polypropylene

7.4 Polyethylene Terephthalate

7.5 Polyvinyl Chloride

7.6 Others (Ps, Evac Copolymers, and PVF)

8 Protective Films Market, By End-Use Industry (Page No. - 60)

8.1 Introduction

8.2 Building & Construction

8.3 Transportation

8.4 Electronics

8.5 Packaging

8.6 Others

9 Protective Films Market, By Region (Page No. - 69)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 South Korea

9.2.5 Rest of Asia-Pacific

9.3 North America

9.3.1 U. S.

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 France

9.4.3 Italy

9.4.4 U.K.

9.4.5 Turkey

9.4.6 Russia

9.4.7 Rest of Europe

9.5 Middle East & Africa

9.5.1 UAE

9.5.2 Qatar

9.5.3 South Africa

9.5.4 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of South America

10 Competitive Landscape (Page No. - 109)

10.1 Introduction

10.2 Competitive Leadership Mapping

10.2.1 Visionary Leaders

10.2.2 Innovators

10.2.3 Dynamic Differentiators

10.2.4 Emerging Companies

10.3 Competitive Benchmarking

10.3.1 Strength of Product Portfolio (25 Players)

10.3.2 Business Strategy Excellence (25 Players)

10.4 Market Ranking of Key Players

11 Company Profiles (Page No. - 115)

(Business Overview, Products Offered, Scorecard of Product Offering, Scorecard of Business Strategy, and New Product Launch)

11.1 Avery Dennison

11.2 Nitto Denko Corporation.

11.3 Chargeurs

11.4 Saint-Gobain S.A.

11.5 Arkema S.A.

11.6 Hitachi Chemical Co., Ltd.

11.7 Toray Industries Inc.

11.8 E.I. Du Pont De Nemours and Company

11.9 The 3M Company

11.10 Polifilm Group

11.11 Additional Company Profiles

11.11.1 Pregis LLC

11.11.2 Surface Armor LLC

11.11.3 Covertec SRL

11.11.4 Echotape

11.11.5 Dunmore

11.11.6 Lamin-X Protective Films

11.11.7 BP Plastics Holding BHD

11.11.8 Mactac

11.11.9 KAO Chia Plastic Co., Ltd.

11.11.10 Panduit

11.11.11 MT Tapes

11.11.12 Presto Tape

11.11.13 Bischof + Klein Se & Co. Kg

11.11.14 Echoplast Ltd.

11.11.15 Dute Industries Group

*Details Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 145)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (85 Tables)

Table 1 Trend of Growth in World GDP Per Capita, USD Million (20162022)

Table 2 Sales Data of Passenger Cars, Region-Wise, 2010 - 2015

Table 3 Production Data of Automotive, Region-Wise, 2011 - 2016

Table 4 Household Disposable Income, Net Annual Growth Rate (%), 20102015

Table 5 Trends and Forecast of Construction Industry, By Country, 20142021 (USD Billion)

Table 6 Protective Films Market Size, By Class, 20152022 (USD Million)

Table 7 Adhesive-Coated Protective Films Market Size, By Region, 20152022 (USD Million)

Table 8 Self-Adhesive Protective Films Market Size, By Region, 20152022 (USD Million)

Table 9 Protective Films Market Size, By Type, 20152022 (USD Million)

Table 10 Polyethylene Protective Films Market Size, By Region, 20152022 (USD Million)

Table 11 Polypropylene Protective Films Market Size, By Region, 20152022, (USD Million)

Table 12 Polyethylene Terephthalate Protective Films Market Size, By Region, 20152022 (USD Million)

Table 13 Polyvinyl Chloride Protective Films Market Size, By Region, 20152022, (USD Million)

Table 14 Other Protective Films Market Size, By Region, 20152022 (USD Million)

Table 15 Protective Films Market Size, By End-Use Industry, 20152022 (USD Million)

Table 16 Protective Films Market Size in Building & Construction, By Region, 20152022 (USD Million)

Table 17 Protective Films By Market Size in Transportation, By Region, 20152022 (USD Million)

Table 18 By Market Size in Electronics, By Region, 20152022 (USD Million)

Table 19 Protective Films By Market Size in Packaging, By Region, 20152022 (USD Million)

Table 20 By Market Size in Other Industries, By Region, 20152022 (USD Million)

Table 21 Protective Films By Market Size, By Region, 20152022 (USD Million)

Table 22 Asia-Pacific: Protective Films Market Size, By Country, 20152022 (USD Million)

Table 23 Asia-Pacific: Market Size, By Class, 20152022 (USD Million)

Table 24 Asia-Pacific: Protective Films Market Size, By Type, 20152022 (USD Million)

Table 25 Asia-Pacific: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 26 China: Protective Films Market Size, By Type, 20152022 (USD Million)

Table 27 China: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 28 India: Protective Films Market Size, By Type, 20152022 (USD Million)

Table 29 India: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 30 Japan: Protective Films Market Size, By Type, 20152022 (USD Million)

Table 31 Japan: Protective Films Market Size, By End-Use Industry, 20152022 (USD Million)

Table 32 South Korea: Protective Films Market Size, By Type, 20152022 (USD Million)

Table 33 South Korea: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 34 Rest of Asia-Pacific: Protective Films Market Size, By Type, 20152022 (USD Million)

Table 35 Rest of Asia-Pacific: Protective Films Market Size, By End-Use Industry, 20152022 (USD Million)

Table 36 North America: Market Size, By Country, 20152022 (USD Million)

Table 37 North America: Protective Films Market Size, By Class, 20152022 (USD Million)

Table 38 North America: Market Size, By Type, 20152022 (USD Million)

Table 39 North America: Protective Films Market Size, By End-Use Industry, 20152022 (USD Million)

Table 40 U.S.: Market Size, By Type, 20152022 (USD Million)

Table 41 U.S.: Protective Films Market Size, By End-Use Industry, 20152022 (USD Million)

Table 42 Canada: Market Size, By Type, 20152022 (USD Million)

Table 43 Canada: Protective Films Market Size, By End-Use Industry, 20152022 (USD Million)

Table 44 Mexico: Market Size, By Type, 20152022 (USD Million)

Table 45 Mexico: Protective Films Market Size, By End-Use Industry, 20152022 (USD Million)

Table 46 Europe: Market Size, By Country, 20152022 (USD Million)

Table 47 Europe: Protective Films Market Size, By Class, 20152022 (USD Million)

Table 48 Europe: Market Size, By Type, 20152022 (USD Million)

Table 49 Europe: Protective Films Market Size, By End-Use Industry, 20152022 (USD Million)

Table 50 Germany: Protective Films Market Size, By Type, 20152022 (USD Million)

Table 51 Germany: Protective Films Market Size, By End-Use Industry, 20152022 (USD Million)

Table 52 France: Protective Films Market Size, By Type, 20152022 (USD Million)

Table 53 France: Protective Films Market Size, By End-Use Industry, 20152022 (USD Million)

Table 54 Italy: Protective Films Market Size, By Type, 20152022 (USD Million)

Table 55 Italy: Market Size, By End-Use Industyry, 20152022 (USD Million)

Table 56 U.K.: Protective Films Market Size, By Type, 20152022 (USD Million)

Table 57 U.K.: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 58 Turkey: Market Size, By Type, 20152022 (USD Million)

Table 59 Turkey: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 60 Russia: Protective Films Market Size, By Type, 20152022 (USD Million)

Table 61 Russia: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 62 Rest of Europe: Protective Films Market Size, By Type, 20152022 (USD Million)

Table 63 Rest of Europe: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 64 Middle East & Africa: Protective Films Market Size, By Country, 20152022 (USD Million)

Table 65 Middle East & Africa: Market Size, By Class 20152022 (USD Million)

Table 66 Middle East & Africa: Market Size, By Type, 20152022 (USD Million)

Table 67 Middle East & Africa: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 68 UAE: Protective Films Market Size, By Type, 20152022 (USD Million)

Table 69 UAE: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 70 Qatar: Market Size, By Type, 20152022 (USD Million)

Table 71 Qatar: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 72 South Africa: Protective Films Market Size, By Type, 20152022 (USD Million)

Table 73 South Africa: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 74 Rest of Middle East & Africa: Protective Films Market Size, By Type, 20152022 (USD Million)

Table 75 Rest of Middle East & Africa: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 76 South America: Protective Films Market Size, By Country, 20152022 (USD Million)

Table 77 South America: Market Size, By Class, 20152022 (USD Million)

Table 78 South America: Market Size, By Type, 20152022 (USD Million)

Table 79 South America: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 80 Brazil: Market Size, By Type, 20152022 (USD Million)

Table 81 Brazil: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 82 Argentina: Market Size, By Type, 20152022 (USD Million)

Table 83 Argentina: Market Size, By End-Use Industry, 20152022 (USD Million)

Table 84 Rest of South America: lms Market Size, By Type, 20152022 (USD Million)

Table 85 Rest of South America: Market Size, By End-Use Industry, 20152022 (USD Million)

List of Figures (48 Figures)

Figure 1 Protective Films Market Segmentation

Figure 2 Protective Films Market: Research Design

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Protective Films: Data Triangulation

Figure 6 Adhesive-Coated Protective Films to Be the Largest Class of Protective Films During Forecast Period

Figure 7 Polyethylene Type to Dominate the Protective Films Market During Forecast Period

Figure 8 Building & Construction Industry to Dominate Protective Films Market During Forecast Period

Figure 9 Asia-Pacific to Dominate the Protective Films Market in 2016

Figure 10 Protective Films Market to Witness High Growth During Forecast Period

Figure 11 Polyethylene to Be the Fastest and Largest Growing Type of Protective Films

Figure 12 Building & Construction to Be the Fastest-Growing End-Use Industry

Figure 13 China Accounted for the Largest Share in Asia-Pacific Protective Films Market in 2016

Figure 14 India to Emerge as the Most Lucrative Market for Protective Films Between 2017 and 2022

Figure 15 Drivers, Restraints, Opportunities, and Challenges in Protective Films Market

Figure 16 Porters Five Forces Analysis

Figure 17 Adhesive-Coated Protective Films to Be the Largest and Fastest-Growing Segment of Market Between 2017 and 2022

Figure 18 Asia-Pacific to Be the Largest Adhesive-Coated Protective Films Market Between 2017 and 2022

Figure 19 Self-Adhesive Protective Films Market in Europe to Witness the Fastest Growth Between 2017 and 2022

Figure 20 Polyethylene to Dominate Protective Films Market Between 2017 and 2022

Figure 21 Asia-Pacific to Be the Largest Polyethylene Protective Films Market Between 2017 and 2022

Figure 22 Asia-Pacific to Be the Largest Market for Polypropylene Protective Films Between 2017 and 2022

Figure 23 Asia-Pacific is the Largest and Fastest-Growing Market for Polyethylene Terephthalate Protective Films Between 2017 and 2022

Figure 24 Asia-Pacific to Be the Largest and Fastest-Growing Market for Polyvinyl Chloride Protective Films Between 2017 and 2022

Figure 25 Asia-Pacific to Be the Largest Market for Other Protective Films Between 2017 and 2022

Figure 26 Building & Construction Industry to Lead the Protective Films Market Between 2017 and 2022

Figure 27 Asia-Pacific to Be the Largest Protective Films Market in Building & Construction Industry Between 2017 and 2022

Figure 28 Asia-Pacific to Be the Fastest-Growing Protective Films Market in Transportation Industry Between 2017 and 2022

Figure 29 Asia-Pacific to Dominate Protective Films Market in Electronics Industry Between 2017 and 2022

Figure 30 Asia-Pacific Followed By Europe to Lead Protective Films Market in Packaging Industry Between 2017 and 2022

Figure 31 Asia-Pacific to Be the Largest Protective Films Market for Other Industries Between 2017 and 2022

Figure 32 Regional Market Snapshot: Asia-Pacific to Be the Fastest-Growing Protective Films Market, 20172022

Figure 33 Asia-Pacific Market Snapshot: China to Be the Largest Protective Films Market, 20172022

Figure 34 North American Market Snapshot: U.S. Was the Largest and Mexico the Fastest Protective Films Market in 2016

Figure 35 Europe Market Snapshot: Germany to Be Largest and Turkey the Fastest-Growing Market, 20172022

Figure 36 Middle East & Africa Market Snapshot, 2017-2022

Figure 37 South America Market Snapshot, 2017-2022

Figure 38 Protective Films Market (Global) Competitive Leadership Mapping, 2016

Figure 39 Protective Films Market Ranking Analysis

Figure 40 Avery Dennison: Company Snapshot

Figure 41 Nitto Denko Corporation: Company Snapshot

Figure 42 Chargeurs: Company Snapshot

Figure 43 Saint-Gobain S.A.: Company Snapshot

Figure 44 Arkema S.A.: Company Snapshot

Figure 45 Hitachi Chemical Co., Ltd.: Company Snapshot

Figure 46 Toray Industries Inc.: Company Snapshot

Figure 47 E.I. Du Pont De Nemours and Company: Company Snapshot

Figure 48 The 3M Company: Company Snapshot

Growth opportunities and latent adjacency in Protective Films Market