Polyfilm Market by Resin Type (LLDPE, LDPE, HDPE, BoPP, CPP, PVC, BoPET, BoPA), End-use Industry (Agriculture, Packaging, Building & Construction, Consumer Goods, Medical) and Region - Global Forecast to 2026

[187 Pages Report] The global Polyfilm Market is estimated to reach USD 167.57 Billion by 2026, at a CAGR of 4.0% from 2016 to 2026. This report aims to estimate the market size and future growth potential of the polyfilm market across different segments such as resin type, end-use industry, and region. Factors influencing the market growth such as drivers, restraints, opportunities, and industry-specific challenges have been studied in the report. The report analyzes the opportunities in the market for stakeholders and presents the competitive landscape for the market leaders.

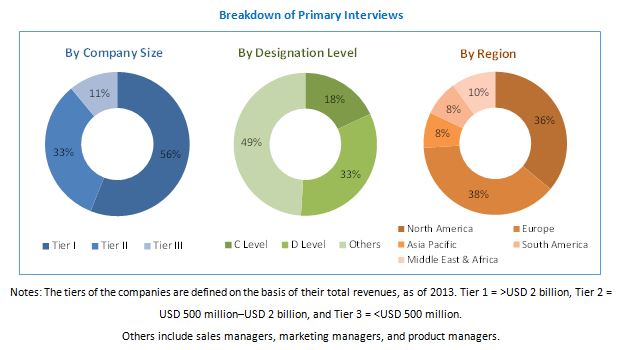

The top-down and bottom-up approaches have been used to estimate and validate the size of the global polyfilm market and estimate the sizes of various other dependent submarkets. The research study involved the use of extensive secondary sources, directories and databases, such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government associations. Private & company websites have also been used to identify and collect information useful for the technical, market-oriented, and commercial study of the global polyfilm market. After arriving at the total market size, the overall market has been split into several segments and subsegments. The figure given below provides a breakdown of the primaries conducted during the research study, on the basis of company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

The raw material for polyfilm is derived from petroleum based resins, such as polyethylene, and polypropylene, among others or bio-based materials, including cellophane and cellulosic. These raw materials are extruded as per customer requirement or application. The finished products are then sent to different retail stores and OEM manufacturers.

The major manufacturers of raw materials such as polyethylene, are ExxonMobil Corporation (U.S.), LyondellBasell Industries N.V. (Netherlands), and Reliance Industries (India). Some of the prominent polyfilm manufacturers include Jindal Polyfilm (India), Cosmo Films (India), Formosa Plastics Corporation (Taiwan), and Taghleef Industries (UAE).

Key Target Audience:

- Polyfilm Manufacturers

- Polyfilm Distributors and Suppliers

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- Research & Development (R&D) Institutions

- Environment Support Agencies

- Raw Material Suppliers

Scope of the Report:

This research report categorizes the polyfilm market on the basis of resin type, application, and region.

On the basis of Resin Type:

- LDPE

- LLDPE

- HDPE

- BoPP

- CPP

- PVC

- BoPET

- BoPA

- Others

On the basis of End-Use Industry:

- Packaging

- Agriculture

- Building & Construction

- Consumer Goods

- Medical

- Others

On the basis of Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The market is further analyzed for the key countries in each of these regions.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the global polyfilm market by application

Company Information:

- Detailed analysis and profiles of additional market players

The global polyfilm market is projected to reach USD 167.57 Billion by 2026, at a CAGR of 4.0% from 2016 to 2026. Polyfilm are used in end-use industries such as packaging, agriculture, consumer goods, medical, and others, including tapes & labels and automotive. The rising demand from these end-use industries is expected to fuel the growth of the polyfilm market in near future.

In terms of end-use industry, the packaging and agriculture segment are expected to witness significant growth. The demand of polyfilms is increasing in packaging, due to rise in the use in food packaging and improving retail market. Furthermore, there has been an increasing use of greenhouse films for increased crop yield, which has led to the growth of the agriculture segment of the market.

The largest market, by resin type is LLDPE. LLDPE is a preferred resin type, due to its properties such as high mechanical strength, transparency, glossy appearance, improved sealing property, and low production cost. LLDPE also performs well when blended with other resins.

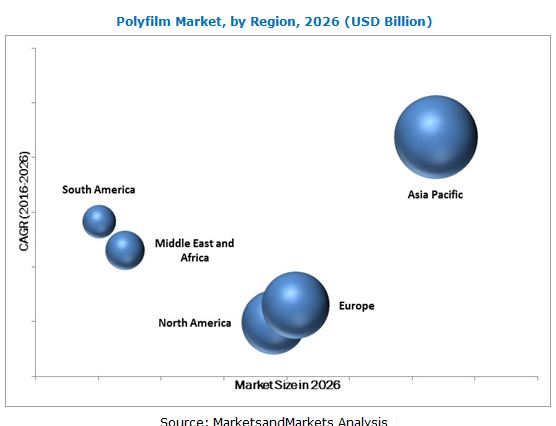

In terms of volume, Asia-Pacific is the largest market, as most of the leading polyfilm manufacturers are located in India. Factors such as rising demand from food industry, technological developments in agriculture, increasing manufacturing units of BoPET and BoPP films to cater to various end-use industries have led to the growth of the polyfilm market in Asia-Pacific. China is one of the major markets for polyfilms, as various companies have made significant investments to set up manufacturing units in the country. Changing lifestyle, increased health awareness, long shelf life of the film has led to the rise in the demand for polyfilms in the China. There is a high demand for bio-based polyfilms. These bio-based films are environment-friendly; the only disadvantage of these films is their high cost.

Stringent environmental regulations, low demand from Europe, and decreasing demand of magnetic and photographic films may restrain the growth of the market.

The key players in the polyfilm market include Jindal Polyfilm (India), Formosa Plastics Corporation (Taiwan), Chiripal Polyfilm (India), Cosmo Films (India), Polyplex Corporation (India), Uflex Limited (India), Taghleef Industries (UAE), Vacmet India Pvt Limited (India), Garware Polyester (India), Max Speciality Films (India), and SRF Limited (India).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities for Players in Polyfilm Market

4.2 Polyfilm Market, By Application

4.3 Global Polyfilm Market: Developed vs Developing Nations

4.4 U.S. and China Dominated Global Polyfilm Market in 2015

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growing Food Packaging Application in Retail

5.3.1.2 Growing Demand From Asia-Pacific Region

5.3.1.3 Demand for Food Packaging Driven By Growing Population in Asia-Pacific

5.3.1.4 Increasing Demand for BOPET Films

5.3.2 Restraints

5.3.2.1 Matured European Market

5.3.2.2 Falling Demand for Photographic and Magnetic Films

5.3.2.3 Strict Environmental and Government Regulations

5.3.3 Opportunities

5.3.3.1 Demand for Green House Films

5.3.3.2 Growing Demand for Polyfilm in Pharmaceutical and Medical Applications

5.3.3.3 Demand for Bio-Based Polyfilm

5.3.3.4 Improved Shelf Life of BOPP and BOPET Films

5.3.4 Challenges

5.3.4.1 Difficulty in Recycling of Plastics

5.3.4.2 Trash Bag Application Reaches Saturation

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Patent Analysis (Page No. - 45)

7.1 Introduction

7.2 Patent Details

8 Polyfilm Market, By Resin Type (Page No. - 50)

8.1 Introduction

8.1.1 LDPE

8.1.2 LLDPE

8.1.3 HDPE (High Density Polyethylene)

8.1.4 BOPP

8.1.5 CPP

8.1.6 PVC

8.1.7 BOPET

8.1.8 BOPA

8.1.9 Others

9 Polyfilm Market, By End-User Industry (Page No. - 64)

9.1 Introduction

9.2 Packaging

9.3 Agriculture

9.4 Building & Construction

9.5 Consumer Goods

9.6 Medical

9.7 Others

10 Polyfilm Market, By Region (Page No. - 73)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 Italy

10.3.4 U.K.

10.3.5 Turkey

10.3.6 Russia

10.4 Asia-Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 South Korea

10.4.5 Rest of Asia-Pacific

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 Iran

10.5.3 South Africa

10.5.4 UAE

10.5.5 Rest of Middle East & Africa

10.6 South America

10.6.1 Brazil

10.6.2 Argentina

10.6.3 Rest of South America

11 Competitive Landscape (Page No. - 117)

11.1 Overview

11.2 Maximum Developments in 2016

11.3 Growth Strategies in the Polyfilm Market

11.4 Competitive Situation and Trends

11.4.1 Investment & Expansion

11.4.2 New Product Development & Launch

11.4.3 Merger & Acquisition

11.4.4 Agreement/Partnership/Collaboration/Joint Venture

11.5 Global Polyfilm Market Share Analysis and Regional Mapping

12 Company Profile (Page No. - 126)

12.1 Jindal Poly Films Limited

12.1.1 Business Overview

12.1.2 Products Offered

12.1.2.1 Metallized Films

12.1.2.1.1 BOPET Films

12.1.2.1.2 Opp Films Product

12.1.2.2 Coated Films

12.1.2.2.1 BOPET Films PVDC Coated

12.1.2.2.2 Opp Films

12.1.3 Recent Developments

12.1.4 SWOT Analysis

12.1.5 MnM View

12.2 Taghleef Industries

12.2.1 Business Overview

12.2.2 Products Offered

12.2.3 Recent Developments

12.2.4 MnM View

12.3 Treofan Group

12.3.1 Business Overview

12.3.2 Products Offered

12.3.2.1 Packaging Film

12.3.2.2 Label Film

12.3.2.3 Tobacco Film

12.3.2.4 Technical Film

12.3.3 Recent Developments

12.3.4 SWOT Analysis

12.3.5 MnM View

12.4 SRF Limited

12.4.1 Business Overview

12.4.2 Products Offered

12.4.2.1 BOPP

12.4.2.2 BOPET

12.4.3 Recent Developments

12.4.4 SWOT Analysis

12.4.5 MnM View

12.5 Formosa Plastics Corporation

12.5.1 Business Overview

12.5.2 Products Offered

12.5.3 Recent Developments

12.5.4 SWOT Analysis

12.5.5 MnM View

12.6 Vacmet India Private Limited

12.6.1 Business Overview

12.6.2 Products Offered

12.6.3 Recent Developments

12.6.4 MnM View

12.7 Cosmo Films

12.7.1 Business Overview

12.7.2 Products Offered

12.7.3 Recent Developments

12.7.4 SWOT Analysis

12.7.5 MnM View

12.8 Max Speciality Films Limited (MSFL)

12.8.1 Business Overview

12.8.2 Products Offered

12.8.2.1 Packaging Films

12.8.2.2 Labels

12.8.2.3 Thermal Sampler

12.8.3 Recent Developments

12.9 Chiripal Poly Films

12.9.1 Business Overview

12.9.2 Products Offered

12.9.2.1 BOPP Films

12.9.2.2 BOPET Film

12.9.2.3 Metallized Films

12.9.3 Recent Developments

12.10 Polyplex Corporation Limited

12.10.1 Business Overview

12.10.2 Products Offered

12.10.3 Recent Developments

12.10.4 SWOT Analysis

12.10.5 MnM View

12.11 Uflex Limited

12.11.1 Business Overview

12.11.2 Products Offered

12.11.3 Recent Developments

12.11.4 SWOT Analysis

12.11.5 MnM View

12.12 Garware Polyester Limited

12.12.1 Business Overview

12.12.2 Products Offered

12.12.3 MnM View

13 Appendix (Page No. - 179)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (108 Tables)

Table 1 Market Segmentation, By Resin Type

Table 2 Polyfilm Market Segmentation, By End-User Industry

Table 3 Impact Analysis:

Table 4 Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 5 Polyfilm Market Size, By Type, 20142026 (USD Billion)

Table 6 LDPE: Global Polyfilm Market Size, By Region, 20142026 (Kiloton)

Table 7 LDPE: Global Polyfilm Market Size, By Region, 20142026 (USD Billion)

Table 8 LLDPE: Global Polyfilm Market Size, By Region, 20142026 (Kiloton)

Table 9 LLDPE: Global Polyfilm Market Size, By Region, 20142026 (USD Billion)

Table 10 HDPE: Global Polyfilm Market Size, By Region, 20142026 (Kiloton)

Table 11 HDPE: Global Polyfilm Market Size, By Region, 20142026 (USD Billion)

Table 12 BOPP: Global Polyfilm Market Size, By Region, 20142026 (Kiloton)

Table 13 BOPP: Global Polyfilm Market Size, By Region, 20142026 (USD Billion)

Table 14 CPP: Global Polyfilm Market Size, By Region, 20142026 (Kiloton)

Table 15 CPP: Global Polyfilm Market Size, By Region, 20142026 (USD Million)

Table 16 Comparison of Properties: BOPP vs CPP

Table 17 PVC: Global Polyfilm Market Size, By Region, 20142026 (Kiloton)

Table 18 PVC: Global Polyfilm Market Size, By Region, 20142026 (USD Billion)

Table 19 BOPET: Global Polyfilm Market Size, By Region, 20142026 (Kiloton)

Table 20 BOPET: Global Polyfilm Market Size, By Region, 20142026 (USD Billion)

Table 21 BOPA: Global Polyfilm Market Size, By Region, 20142026 (Kiloton)

Table 22 BOPA: Global Polyfilm Market Size, By Region, 20142026 (USD Million)

Table 23 Others: Global Polyfilm Market Size, By Region, 20142026 (Kiloton)

Table 24 Others: Global Polyfilm Market Size, By Region, 20142026 (USD Million)

Table 25 Polyfilm Market, By End-User Industry, 20142026 (Kiloton)

Table 26 Polyfilm Market, By End-User Industry, 20142026 (USD Billion)

Table 27 Packaging End-User Industry: Global Polyfilm Market, By Region, 20142026 (Kiloton)

Table 28 Packaging End-User Industry: Global Polyfilm Market, By Region, 20142026 (USD Billion)

Table 29 Agriculture End-User Industry: Global Polyfilm Market, By Region, 20142026 (Kiloton)

Table 30 Agriculture End-User Industry: Global Polyfilm Market, By Region, 20142026 (USD Billion)

Table 31 Building & Construction End-User Industry: Global Polyfilm Market, By Region, 20142026 (Kiloton)

Table 32 Building & Construction End-User Industry: Global Polyfilm Market, By Region, 20142026 (USD Billion)

Table 33 Consumer Goods End-User Industry: Global Polyfilm Market, By Region, 20142026 (Kiloton)

Table 34 Consumer Goods End-User Industry: Global Polyfilm Market, By Region, 20142026 (USD Billion)

Table 35 Medical End-User Industry: Global Polyfilm Market, By Region, 20142026 (Kiloton)

Table 36 Medical End-User Industry: Global Polyfilm Market, By Region, 20142026 (USD Million)

Table 37 Others End-User Industry: Global Polyfilm Market, By Region, 20142026 (Kiloton)

Table 38 Others End-User Industry: Global Polyfilm Market, By Region, 20142026 (USD Million)

Table 39 Global Polyfilm Market Size, By Region, 20142026 (Kiloton)

Table 40 Global Polyfilm Market Size, By Region, 20142026 (USD Billion)

Table 41 North America: Polyfilm Market Size, By Country, 20142026 (Kiloton)

Table 42 North America: Polyfilm Market Size, By Country, 20142026 (USD Billion)

Table 43 North America: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 44 North America: Polyfilm Market Size, By Type, 20142026 (USD Billion)

Table 45 U.S.: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 46 U.S.: Polyfilm Market Size, By Type, 20142026 (USD Billion)

Table 47 Canada: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 48 Canada: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 49 Mexico: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 50 Mexico: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 51 Europe: Polyfilm Market Size, By Country, 20142026 (Kiloton)

Table 52 Europe: Polyfilm Market Size, By Country, 20142026 (USD Billion)

Table 53 Europe: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 54 Europe: Polyfilm Market Size, By Type, 20142026 (USD Billion)

Table 55 Germany: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 56 Germany: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 57 France: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 58 France: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 59 Italy: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 60 Italy: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 61 U.K.: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 62 U.K.: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 63 Turkey: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 64 Turkey: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 65 Russia: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 66 Russia: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 67 Asia-Pacific: Polyfilm Market Size, By Country, 20142026 (Kiloton)

Table 68 Asia-Pacific: Polyfilm Market Size, By Country, 20142026 (USD Billion)

Table 69 Asia-Pacific: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 70 Asia-Pacific: Polyfilm Market Size, By Type, 20142026 (USD Billion)

Table 71 China: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 72 China: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 73 India: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 74 India: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 75 Japan: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 76 Japan: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 77 South Korea: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 78 South Korea: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 79 Rest of Asia-Pacific: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 80 Rest of Asia-Pacific: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 81 Middle East & Africa: Polyfilm Market Size, By Country, 20142026 (Kiloton)

Table 82 Middle East & Africa: Polyfilm Market Size, By Country, 20142026 (USD Billion)

Table 83 Middle East & Africa: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 84 Middle East & Africa: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 85 Saudi Arabia: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 86 Saudi Arabia: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 87 Iran: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 88 Iran: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 89 South Africa: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 90 South Africa: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 91 UAE: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 92 UAE: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 93 Rest of Middle East & Africa: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 94 Rest of Middle East & Africa: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 95 South America: Polyfilm Market Size, By Country, 20142026 (Kiloton)

Table 96 South America: Polyfilm Market Size, By Country, 20142026 (USD Million)

Table 97 South America: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 98 South America: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 99 Brazil: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 100 Brazil: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 101 Argentina: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 102 Argentina: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 103 Rest of South America: Polyfilm Market Size, By Type, 20142026 (Kiloton)

Table 104 Rest of South America: Polyfilm Market Size, By Type, 20142026 (USD Million)

Table 105 Investment & Expansion, 2011 2016

Table 106 New Product Launch, 2011 2016

Table 107 Merger & Acquisition, 2011 2016

Table 108 Agreement/Partnership/Collaboration/Joint Venture, 20112016

List of Figures (44 Figures)

Figure 1 Polyfilm: Market Segmentation

Figure 2 Polyfilm Market: Research Design

Figure 3 Key Data From Secondary Sources

Figure 4 Key Data From Primary Sources

Figure 5 Market Size Estimation: Bottom-Up Approach

Figure 6 Market Size Estimation: Top-Down Approach

Figure 7 Polyfilm: Data Triangulation

Figure 8 Research Assumptions

Figure 9 LLDPE Polyfilm Consumption to Be the Highest Between 2016-2026 (USD Billion)

Figure 10 Polyfilm Market for Packaging End-User Industry to Record Highest Growth Between 2016-2026 (USD Billion)

Figure 11 Asia-Pacific to Be Largest and Fastest-Growing Polyfilm Market Globally Between 2016-2026

Figure 12 Emerging Economies to Offer Lucrative Growth Opportunities for Polyfilm Market Players Between 2016-2026

Figure 13 Polyfilm Market for Packaging End-User Industry to Record Highest CAGR Between 2016-2026 (USD Billion)

Figure 14 China and India Accounted for Largest Share in Asia-Pacific Polyfilm Market in 2015 (USD Billion)

Figure 15 Polyfilm Market in Developing Nations to Grow Faster Than in Developed Ones (USD Billion)

Figure 16 India and China to Record Highest CAGR in Global Polyfilm Market Between 2016-2026

Figure 17 Drivers, Restraints, Opportunities, and Challenges in the Polyfilm Market

Figure 18 Raw Material Accounts for the Major Value Addition

Figure 19 Porters Five Forces Analysis

Figure 20 Europe Accounted for Highest Number of Polyfilm Patents Filed Between 2014-2016

Figure 21 Lg Chem, Ltd. Held Highest Number of Polyfilm Patents Between 2014-2016

Figure 22 Geographic Snapshot: Polyfilm Market in China and India to Record Highest CAGR Between 2016-2021

Figure 23 North America: Polyfilm Market Snapshot

Figure 24 Europe: Polyfilm Market Snapshot

Figure 25 Asia-Pacific: Polyfilm Market Snapshot

Figure 26 Companies Adopted Investment & Expansion as the Key Growth Strategy Between 2011-2016

Figure 27 Global Polyfilm Market Witnessed Maximum Developments in 2016

Figure 28 Investment & Expansion: the Most Popular Growth Strategy

Figure 29 Formosa Plastics Corporation Dominates Global Polyfilm Market

Figure 30 Jindal Poly Films Limited: Company Snapshot

Figure 31 Jindal Poly Films Limited: SWOT Analysis

Figure 32 Treofan Industries: SWOT Analysis

Figure 33 SRF Limited: Company Snapshot

Figure 34 SRF Limited: SWOT Analysis

Figure 35 Formosa Plastics Corporation: Company Snapshot

Figure 36 Formosa Plastics Corporation: SWOT Analysis

Figure 37 Cosmo Films: Company Snapshot

Figure 38 Cosmo Films: SWOT Analysis

Figure 39 MSFL: Company Snapshot

Figure 40 Polyplex Corporation Limited: Company Snapshot

Figure 41 Polyplex Corporation: SWOT Analysis

Figure 42 Uflex Limited: Company Snapshot

Figure 43 Uflex Limited: SWOT Analysis

Figure 44 Garware Polyester Limited: Company Snapshot

Growth opportunities and latent adjacency in Polyfilm Market