Polyvinyl Chloride Market by Raw Material (EDC & Acetylene), Polymerization Process, Product, End User Industry (Construction, Automotive, Electrical, Packaging, Footwear), Type of Application, & Geography - Trends and Forecasts to 2018

[176 Pages Report] Polyvinyl Chloride (PVC) is one of the most widely used plastics. It is produced by polymerizing vinyl chloride monomers. It has an amorphous structure with polar chlorine atoms and possesses fire retarding properties, durability, and oil/chemical resistance. It is added with modifiers to modify its properties according to the end user demand in the polyvinyl chloride market. Various properties like abrasion resistance, light weight, good mechanical strength, and toughness enable its wide use in construction, automotive, packaging, and the electrical industries. It is widely employed for manufacturing pipes, fittings, profiles, tubes, films, sheets, wires, cables, bottles, and so on.

The Polyvinyl Chloride market has grown considerably during the past few years and is expected to grow at a rapid pace in the next five years, mainly driven by the growing demand in the Asia-Pacific region and economic viability of Polyvinyl Chloride based products. The Asia-Pacific is the largest market, consuming more than half of the total PVC demanded, globally. The Market is mainly employed for manufacturing various products that serve to the construction and packaging industry in the region, with both the end-user industries also expected to drive the market along with the electrical industry.

This study aims to estimate the global market and to project the expected demand of the same by 2018. This market research study provides a detailed qualitative and quantitative analysis of the polyvinyl chloride market. It provides a comprehensive review of the major drivers, restraints, opportunities, winning imperatives, challenges, and key issues in the market. The industry is further segmented and projected for major regions such as Asia-Pacific, North America, Europe, and ROW, which is further segmented for key countries in each region. We have used various secondary sources such as encyclopedia, directories and databases to identify and collect information useful for this extensive commercial study of PVC. The primary sources–experts from related industries and suppliers have been interviewed to obtain and verify critical information and to assess the prospects of Polyvinyl Chloride.

The competitive scenarios of the top players in the polyvinyl chloride industry have been discussed in detail. We have also profiled the leading players in this industry with their recent developments and other strategic industry activities. These include, Shin-Etsu Chemical Co. Ltd (Japan), Formosa Plastics Group (Taiwan), Occidental Petroleum Corporation (U.S.), INEOS (U.K.), and Solvay S.A. (Belgium), AXIALL Corporation (U.S.), Mexichem S.A.B. (Mexico), Kem One (France), Vinnolit GmbH & Co. KG (Germany), and Xinjiang Zhongtai Chemical Co. Ltd (China).

Scope of the report:

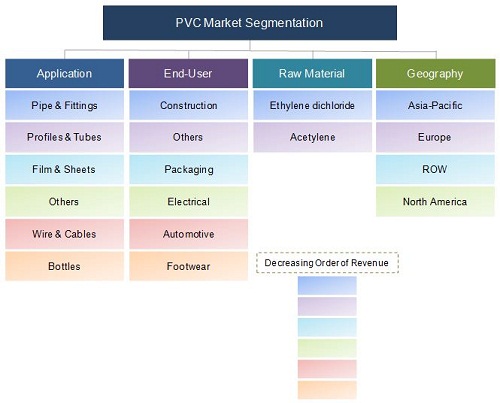

This research report categorizes the global polyvinyl chloride market on the basis of its applications, end-user industries, raw materials, polymerization processes, and geography along with forecasts of volumes, revenue and trends in each of the submarkets.

On the basis of product: The market is segmented on the basis of industry applications as pipe & fittings, profiles & tubes, films & sheets, wire & cables, bottles, and others. Each application is further described in detail in the report with volume and revenue forecasts.

On the basis of end-user industry: The market is segmented on the basis of end-user industries as construction, packaging, electrical, automotive, footwear, and others. Each end-user industry is further described in detail in the report with volume and revenue forecasts.

On the basis of raw material: The polyvinyl chloride market is segmented on the basis of raw material, as ethylene dichloride (EDC) and acetylene. Each segment is further described in detail in the report with volume and revenue forecasts.

On the basis of polymerization process: The market is segmented on the basis of polymerization processes such as emulsion, suspension, microsuspension, and bulk/mass polymerization. Each segment is further described in detail in the report with volume and revenue forecasts.

On the basis of type of application: The market is segmented on the basis of type of applications as rigid and flexible. Each segment is further described in detail in the report with volume and revenue forecasts.

On the basis of geography: A country level segmentation is done for both Polyvinyl Chloride and its applications for various regions segmented as Asia-Pacific, North America, Europe, and ROW, and further for key countries in each region. These countries include U.S., Canada, Mexico, Germany, Italy, Turkey, Russia, China, Japan, South Korea, Taiwan, India, Saudi Arabia, and Brazil.

Polyvinyl chloride market will reach 48,320.85 kilotons by 2018, signifying a firm annualized growth rate of over 5.2%. The global market has been witnessing a significant growth since last few years which is estimated to persist in the coming years. PVC is a key building block to manufacture various pipes, fittings, profiles, tubes, films, sheets, wires, cables, bottles, and so on. It also further serves diverse industries, including construction, automotive, packaging, medical, and electrical.

Currently, Asia-Pacific consumes largest amount of Polyvinyl Chloride, which is more than half of the total global consumption. In 2012, among all the countries, China led the polyvinyl chloride market with consumption of the maximum volume of PVC. Europe is the second largest market and is growing considerably, driven by growing demand for PVC products in Turkey and Russia. The consumption of Polyvinyl Chloride in ROW regions is quite fragmented and is expected to grow at the highest CAGR during the forecasted period.

The Polyvinyl Chloride Market was mainly consumed by pipe & fittings manufacturers in 2012, which is expected to increase at an estimated CAGR of 5.15% from 2013 to2018. Subsequently, profiles & tubes and films & sheets manufacturing segments were the major consumers of PVC, with a consumption of 7,050.90 kilo tons and 6,308.7 kilo tons, respectively (globally in 2012). As an end-user, the demand for PVC products is dominated by the construction segment due to friendly properties and price competency.

Major producers of the market include Shin-Etsu Chemical Co. Ltd (Japan), Formosa Plastics Group (Taiwan), Occidental Petroleum Corporation (U.S.), INEOS (U.K.), and Solvay S.A. (Belgium), AXIALL Corporation (U.S.), Mexichem S.A.B. (Mexico), Kem One (France), Vinnolit GmbH & Co. KG (Germany), and Xinjiang Zhongtai Chemical Co. Ltd (China).

Polyvinyl Chloride Market Segmentation

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

This report covers the polyvinyl chloride market by various regions and major countries in each region. It also provides a detailed segmentation of the market based on major applications, along with its projection till 2018.

Table Of Contents

1 Introduction (Page No. - 15)

1.1 Key Deliverables

1.2 Report Description

1.3 Stakeholders

1.4 Research Methodology

1.4.1 Market Size Estimation Methodology

1.4.2 Major Secondary Sources Used

1.4.3 Key Data Taken From Secondary Sources

1.4.4 Key Data Taken From Primary Sources

1.4.5 Assumptions

2 Executive Summary (Page No. - 20)

3 Premium Insights (Page No. - 23)

3.1 Polyvinyl Chloride Market Segments

3.2 Market Dynamics

3.3 Market Global Outlook

3.4 Market Segmentation

4 Polyvinyl Chloride Market Overview (Page No. - 29)

4.1 Introduction

4.2 Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.1.1 Dynamic Growth in The Building & Construction Segment

4.3.1.2 Growth in The Automobile Market

4.3.1.3 Growing Medical Devices Market

4.3.1.4 Emerging Demand of Plastic Film & Sheets

4.3.2 Restraints

4.3.2.1 Prohibited Use of PVC in The Construction of Green Buildings

4.3.2.2 Stiff Competition From Steel & Concrete Pipes

4.3.2.3 Debt Crisis in Europe & Slow Economic Recovery in North America

4.3.3 Opportunities

4.3.3.1 Renewable Energy Growth & Use of High Efficient Pumps

4.3.3.2 Growing Electric Vehicle Demand

4.3.3.3 Emerging Wood-Plastics Composites Market

4.3.3.4 Renewable PVC Developments

4.4 Burning Issues

4.4.1 Influence of Bio-Based Polymeric Additives on PVC

4.4.2 Non Phthalate Plasticizers Development

4.5 Winning Imperatives

4.5.1 Backward Integration

4.6 Regulations

4.7 Raw Material Analysis

4.7.1 Ethylene

4.7.2 Chlorine

4.8 Porter’s Five Forces Analysis

4.8.1 Threat of New Entrants

4.8.2 Threat of Substitutes

4.8.3 Buyers’ Bargaining Power

4.8.4 Suppliers’ Bargaining Power

4.8.5 Degree of Competition

4.9 Market Share Analysis

5 Market By Raw Material (Page No. - 53)

5.1 Introduction

5.2 Edc

5.3 Acetylene

6 Market By Polymerization Process (Page No. - 57)

6.1 Introduction

6.2 Suspension Polymerization

6.3 Emulsion Polymerization

6.4 Microsuspension Polymerization

6.5 Mass Polymerization

7 Market By Product Type (Page No. - 63)

7.1 Introduction

7.2 Pipes & Fittings

7.3 Profiles & Tubes

7.4 Film & Sheets

7.5 Wire & Cables

7.6 Bottles

7.7 Others

8 Market By Type of Application (Page No. - 81)

8.1 Introduction

8.2 Rigid Polyvinyl Chloride

8.3 Flexible Polyvinyl Chloride

9 Market By End-User Industry (Page No. - 74)

9.1 Introduction

9.2 Building & Construction

9.3 Automotive

9.4 Electrical

9.5 Footwear

9.6 Packaging

9.7 Others

10 Market By Geography (Page No. - 82)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 China

10.2.2 South Korea

10.2.3 Taiwan

10.2.4 India

10.2.5 Japan

10.3 Europe

10.3.1 Germany

10.3.2 Italy

10.3.3 Turkey

10.3.4 Russia

10.4 ROW

10.4.1 Brazil

10.4.2 Saudi Arabia

10.5 North America

10.5.1 U.S.

10.5.2 Canada

10.5.3 Mexico

11 Competitive Landscape (Page No. - 142)

11.1 Introduction

11.2 Expansion: The Most Popular Growth Strategy

11.3 Maximum Developments in 2013

11.4 North America: Region With Maximum Developments

11.5 Georgia Gulf Corporation, Mexichem S.A.B., Vinnolit Gmbh & Co. Kg: Leading Market Participants

12 Company Profiles (Overview, Financial*, Products & Services, Strategy, and Developments) (Page No. - 149)

12.1 Shin-Etsu Chemical Co. Ltd.

12.2 Formosa Plastics Group

12.3 Occidental Petroleum Corporation

12.4 Ineos Chlorvinyls Ltd

12.5 Solvay S.A.

12.6 Axiall Corporation

12.7 Mexichem S.A.B.

12.8 KEM one

12.9 Vinnolit Gmbh & Co. Kg

12.10 Xinjiang Zhongtai Chemical Co. Ltd.

*Details Might Not Be Captured in Case of Unlisted Companies.

List of Tables (88 Tables)

Table 1 Polyvinyl Chloride Market Size, By Geography, 2011–2018 (Kt)

Table 2 Polyvinyl Chloride: Market Size, By Geography, 2011–2018 ($Million)

Table 3 Global Construction Industry, 2012

Table 4 Automobile Production, By Geography, 2011-2018 (‘000 Units)

Table 5 Medical Devices: Polyvinyl Chloride Market Growth Rate, 2008-2013

Table 6 PVC-Based Plastic Film & Sheets Market Size, 2011-2018

Table 7 Alternative Energy Investments & Capacity Additions

Table 8 Electric Vehicles Production Units, 2012-2014

Table 9 Ethylene: Average Price, 2011–2018 ($/Ton)

Table 10 Polyvinyl Chloride: Market Size By Edc Raw Material, 2011-2018

Table 11 Market Size By Acetylene Raw Material, 2011-2018

Table 12 Market Size, By Suspension Polymerization Process, 2011-2018

Table 13 Polyvinyl Chloride: Market Size, By Emulsion Polymerization Process, 2011-2018

Table 14 Market Size, By Microsuspension Polymerization Process, 2011-2018

Table 15 Market Size, By Bulk Polymerization Process, 2011-2018

Table 16 Market Size For Pipes & Fittings, 2011-2018

Table 17 Market Size For Profile & Tubes, 2011-2018

Table 18 Market Size For Film & Sheets, 2011-2018

Table 19 Market Size For Wire & Cables, 2011-2018

Table 20 Market Size For Bottles, 2011-2018

Table 21 Market Size For Others, 2011-2018

Table 22 Rigid Polyvinyl Chloride Market Size, 2011-2018

Table 23 Flexible Market Size, 2011-2018

Table 24 Market Size, For Building & Construction Industry, 2011-2018

Table 25 Market Size, For Automotive Industry, 2011-2018

Table 26 Market Size, For Electrical Industry, 2011-2018

Table 27 Market Size, For Footwear Industry, 2011-2018

Table 28 Market Size, For Packaging Industry, 2011-2018

Table 29 Market Size, For Other Industries, 2011-2018

Table 30 Asia-Pacific: Market Size, 2011-2018

Table 31 China: Major PVC Export Markets, 2012

Table 32 China: Major Import Markets, 2012

Table 33 China: Market Size, By End-User Industry, 2011–2018 (Kt)

Table 34 China: Market Size, By End-User Industry, 2011–2018 ($Million)

Table 35 South Korea: Major PVC Export Markets, 2012

Table 36 South Korea: Major Import Markets, 2012

Table 37 South Korea: Market Size, By End-User Industry, 2011–2018 (Kt)

Table 38 South Korea: Market Size, By End-User Industry, 2011–2018 ($Million)

Table 39 Taiwan: Major PVC Export Markets, 2012

Table 40 Taiwan: Major Import Markets, 2012

Table 41 Taiwan: Market Size, By End-User Industry, 2011–2018 (Kt)

Table 42 Taiwan: Market Size, By End-User Industry, 2011–2018 ($Million)

Table 43 India: Major PVC Export Markets, 2012

Table 44 India: Major Import Markets, 2012

Table 45 India: Polyvinyl Chloride Market Size, By End-User Industry, 2011–2018 (Kt)

Table 46 India: Market Size, By End-User Industry, 2011–2018 ($Million)

Table 47 Japan: Major PVC Export Markets, 2012

Table 48 Japan: Major Import Markets, 2012

Table 49 Japan: Market Size, By End-User Industry, 2011–2018 (Kt)

Table 50 Japan: Market Size, By End-User Industry, 2011–2018 ($Million)

Table 51 Europe: Market Size, 2011-2018

Table 52 Germany: Major PVC Export Markets, 2012

Table 53 Germany: Major Import Markets, 2012

Table 54 Germany: Market Size, By End-User Industry, 2011–2018 (Kt)

Table 55 Germany: Market Size, By End-User Industry, 2011–2018 ($Million)

Table 56 Italy: Major PVC Export Markets, 2012

Table 57 Italy: Major Import Markets, 2012

Table 58 Italy: Market Size, By End-User Industry, 2011–2018 (Kt)

Table 59 Italy: Market Size, By End-User Industry, 2011–2018 ($Million)

Table 60 Turkey: Major PVC Export Markets, 2012

Table 61 Turkey: Major Import Markets, 2012

Table 62 Turkey: Market Size, By End-User Industry, 2011–2018 (Kt)

Table 63 Turkey: Market Size, By End-User Industry, 2011–2018 ($Million)

Table 64 Russia: Major PVC Export Markets, 2012

Table 65 Russia: Major Import Markets, 2012

Table 66 Russia: Market Size, By End-User Industry, 2011–2018 (Kt)

Table 67 Russia: Market Size, By End-User Industry, 2011–2018 ($Million)

Table 68 ROW: Market Size, 2011-2018

Table 69 Brazil: Major PVC Export Markets, 2012

Table 70 Brazil: Major Import Markets, 2012

Table 71 Brazil: Market Size, By End-User Industry, 2011–2018 (Kt)

Table 72 Brazil: Market Size, By End-User Industry, 2011–2018 ($Million)

Table 73 Saudi Arabia: Major PVC Import Markets, 2012

Table 74 Saudi Arabia: Market Size, By End-User Industry, 2011–2018 (Kt)

Table 75 Saudi Arabia: Market Size, By End-User Industry, 2011–2018 ($Million)

Table 76 North America: Market Size, 2011–2018

Table 77 U.S.: Major PVC Export Markets, 2012

Table 78 U.S.: Major Import Markets, 2012

Table 79 U.S.: Polyvinyl Chloride Market Size, By End-User Industry, 2011–2018 (Kt)

Table 80 U.S.: Market Size, By End-User Industry, 2011–2018 ($Million)

Table 81 Canada: Major PVC Export Markets, 2012

Table 82 Canada: Major Import Markets, 2012

Table 83 Canada: Polyvinyl Chloride Market Size, By End-User Industry, 2011–2018 (Kt)

Table 84 Canada: Market Size, By End-User Industry, 2011–2018 ($Million)

Table 85 Mexico: Major PVC Export Markets, 2012

Table 86 Mexico: Major Import Markets, 2012

Table 87 Mexico: Polyvinyl Chloride: Market Size, By End-User Industry, 2011–2018 (Kt)

Table 88 Mexico: Polyvinyl Chloride Market Size, By End-User Industry, 2011–2018 ($Million)

List of Figures (27 Figures)

Figure 1 Polyvinyl Chloride: Market Segments

Figure 2 Polyvinyl Chloride: Market Dynamics

Figure 3 PVC Porter’s Five Forces Analysis

Figure 4 PVC Regional Market Life Cycle

Figure 5 Market Share (Volume), 2012 & Demand, By Region,2011–2018

Figure 6 Market Share (Volume), 2012

Figure 7 Overview of PVC Value Chain

Figure 8 Impact of Major Drivers on The Polyvinyl Chloride: Market, 2013-2018

Figure 9 Impact of Major Restraints on The Polyvinyl Chloride: Market, 2013-2018

Figure 10 Impact of Major Opportunities on The Polyvinyl Chloride Market, 2013-2018

Figure 11 Backward Integration

Figure 12 Porter’s Five Forces Analysis

Figure 13 Market Share (Volume), By Company, 2012

Figure 14 Market Share (Volume), By Raw Material, 2012

Figure 15 Market Share (Volume), By Polymerization Process, 2012

Figure 16 Market Share (Volume), By Products, 2012

Figure 17 Market Share (Volume), By Application, 2012

Figure 18 Market Share (Volume), By End-User Industry, 2012

Figure 19 Market Share (Volume), By Geography, 2012

Figure 20 Asia-Pacific: Market Share (Volume), By Country, 2012

Figure 21 Europe: Market Share (Volume), By Country, 2012

Figure 22 ROW: PVC Market Share (Volume), By Country, 2012

Figure 23 North America: PVC Market Share (Volume), By Country, 2012

Figure 24 Polyvinyl Chloride Market Strategy Distribution, By Growth Startegy, 2010-2013

Figure 25 PVC: Market Developments, 2010–2013

Figure 26 Polyvinyl Chloride: Market Growth Strategies, By Geography, 2010–2013

Figure 27 Polyvinyl Chloride Market Activity Share, By Company, 2010–2013

Growth opportunities and latent adjacency in Polyvinyl Chloride Market