Paint Protection Films Market by Material (Thermoplastic Polyurethane, Polyvinyl Chloride), End-Use Industry (Automotive, Electronics, Construction), and Region (North America, Europe, Asia Pacific, MEA, South America) - Global Forecast to 2024

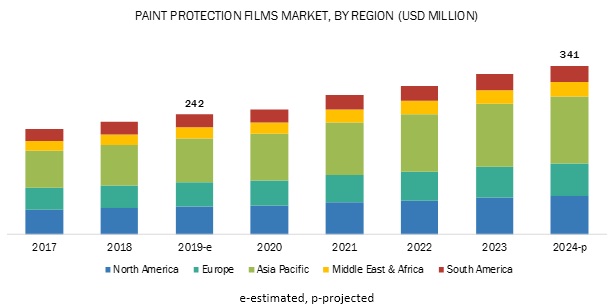

The paint protection films market is projected to reach USD 341 million by 2024, at a CAGR of 7.1%. Increasing thermoplastic consumption, coupled with rising sales of luxury cars, is expected to drive the growth of paint protection films industry during the forecast period. Moreover, China, being one of the largest producer & consumer of thermoplastic polyurethane (TPU) material, creates a scope for sustainable growth of paint protection films.

Thermoplastic polyurethane (TPU) is expected to lead the paint protection films market during the forecast period.

Properties such as self-healing, elasticity, non-yellowing, and recyclability, among others, are expected to drive the growth of thermoplastic polyurethane-based paint protection films during the forecast period. Moreover, the availability of the material is expected to further propel the growth of the market in the near future.

Automotive end-use industry to register the largest share in paint protection films market during the forecast period.

Based on end-use industry, the paint protection films market has been classified into automotive, electronics, construction, and others. Among these, the automotive segment accounted for the largest share and is expected to grow significantly during the forecast period. This growth can be attributed towards increasing cautiousness for maintaining showroom finish of the vehicles, increasing resale value, and minimal impact of the automotive industry slowdown on the sales of luxury cars throughout the globe.

Asia Pacific to remain the largest paint protection films market during the forecast period.

Asia Pacific is the largest consumer of paint protection films and is expected to grow at the highest CAGR during the forecast period. This growth is attributed towards the increasing sales of luxury cars in the Asia Pacific region coupled with China being the largest producer & consumer of thermoplastic polyurethane material, which is the main base material for manufacturing paint protection films.

Key Market Players in Paint Protection Films Market

Companies such as 3M Company (US), XPEL, Inc. (US), Eastman Performance Films, LLC (US), Hexis S.A. (France),PremiumShield Limited (US), STEK-USA (US), Reflek Technologies Corporation (US), GRAFITYP Selfadhesive Products NV (Belgium), ORAFOL Europe GmbH (Germany), OPTICSHIELD (Czechia), SCHWEITZER-MAUDUIT INTERNATIONAL, INC. (US), and Avery Dennison Corporation (US), are the major players in the paint protection film market. These players have been focusing on strategies such as acquisitions, new product developments & launches, agreements, and investments that have helped them to expand their businesses in untapped and potential markets. The diversified product portfolio and multiple uses are factors responsible for strengthening the position of these companies in the paint protection films market.

Paint Protection Films Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2024 |

|

Forecast units |

Value (USD) & Volume (Thousand Square Meters) |

|

Segments covered |

Material, End-use Industry, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies covered |

3M Company (US), XPEL, Inc. (US), Eastman Performance Films, LLC (US), Hexis S.A. (France),PremiumShield Limited (US), STEK-USA (US), Reflek Technologies Corporation (US), GRAFITYP Selfadhesive Products NV (Belgium), ORAFOL Europe GmbH (Germany), OPTICSHIELD (Czechia), SCHWEITZER-MAUDUIT INTERNATIONAL, INC. (US), Avery Dennison Corporation (US), and others are considered for the study. |

This report categorizes the paint protection films market based on material, end-use industry, and region.

Based on material

- Thermoplastic Polyurethane

- Polyvinyl Chloride

- Others (Polyester, Polyethylene Terephthalate(PET))

Based on the end-use industry

- Automotive

- Electronics

- Construction

- Others (Transportation, Marine)

Based on the region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments in Paint Protection Films Market

- In May 2019, Avery Dennison Corporation added new products to its portfolio which includes new Supreme Wrapping™ Film colours, Supreme Protection Film XI (SPF-XI) film and a comprehensive range of automotive window films. This new launch provides cost-effective solutions for protecting vehicles and other areas against external damage on paint from stone chips, road debris, and other occurrences while travelling.

- In March 2019, Eastman Chemical Company through its subsidiary, Eastman Performance Films, LLC introduced a new high-impact resistant film, which is added to its paint protection film portfolio under the LLumar® and SunTek® brands. This new offering is approximately 50% thicker and provides stronger protection for heavy impact areas as compared with LLumar and SunTek standard PPF. This product will cater to the US and Canadian markets by late spring 2019.

- In November 2018, XPEL, Inc. acquired Apogee Corporation, a Taiwan-based automotive paint protection, and window film distributor. Through this acquisition, XPEL was able to sell directly to its customers in Taiwan, Hong Kong, and Macau and provide enhanced local support for all customers throughout Asia

- In September 2017, Hexis S.A. invested Euro 17 million (USD 18.8 or 19 Million) as part of their five-year strategic plan up to 2020. This investment involves the acquisition of lands, modernization of production systems, and addition of a new manufacturing line. This investment helped the company in owning two fully autonomous production sites which were crucial for sustainability and deployment.

Key Questions addressed by the Report

- What are the future revenue pockets in the paint protection films market?

- Which key developments are expected to have a long-term impact on the paint protection film market?

- Which materials are expected to cannibalize existing markets?

- How is the current regulatory framework expected to impact the market?

- What will be the future product mix of the paint protection films market?

- What are the prime strategies of leaders in the paint protection film market?

Frequently Asked Questions (FAQ):

How big is the Paint Protection Film Market Industry?

The paint protection films market is projected to reach USD 341 million by 2024, At a CAGR of 7.1%.

Who leading market players in Paint Protection Film Market Industry?

Key players in the paint protection films market are 3M Company (US), XPEL, Inc. (US), Eastman Performance Films, LLC (US), and Hexis S.A. (France), and 20 others are considered for the study.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Primary and Secondary Research (Volume Market)- Approach 1

2.1.2 Primary and Secondary Research (Value Market)- Approach 1

2.1.3 Paint Protection Films Market (Value)- Approach 2

2.1.4 Paint Protection Film Market (Value)- Approach 3- By Material

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Secondary Data

2.4 Primary Data

2.5 Research Assumptions and Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 26)

4.1 Attractive Opportunities in the Paint Protection Films Market

4.2 Paint Protection Films Market, By Material

4.3 Paint Protection Film Market, By End-Use Industry

4.4 Paint Protection Films Market, By Region

4.5 Asia Pacific Paint Protection Film Market, By Material and Country

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand From the Automotive and Electronics Industries

5.2.2 Restraints

5.2.2.1 Cheaper Alternatives to Ppfs

5.2.3 Opportunities

5.2.3.1 Increasing Applicability in Other End-Use Industries

5.2.4 Challenges

5.2.4.1 Lack of Skilled Workforce

5.2.4.2 High Cost of Installation

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 Automotive

6 Paint Protection Films Market, By Material (Page No. - 36)

6.1 Introduction

6.2 Thermoplastic Polyurethane

6.2.1 Self-Healing, Non-Yellowing, Pliable, and Puncture-Proof Properties of Tpu Material are Expected to Drive the Growth of the Paint Protection Films Market

6.3 Polyvinyl Chloride

6.3.1 Cost-Effectiveness of Pvc-Based Paint Protection Films is Expected to Drive the Growth of the Market

6.4 Others

6.4.1 Cost-Effectiveness of Paint Protection Films is Expected to Drive the Growth of the Paint Protection Films Market

7 Paint Protection Film Market, By End-Use Industry (Page No. - 41)

7.1 Introduction

7.2 Automotive

7.2.1 Increasing Resale Value of Vehicles, Coupled With Low Effect of the Slowdown in the Automotive Industry on the Sales of Luxury Cars is Expected to Drive the Paint Protection Films Market During the Forecast Period.

7.3 Electronics

7.3.1 Growth of the Electronics Industry Around the Globe is Expected to Drive the Growth of the Paint Protection Film Market During the Forecast Period.

7.4 Construction

7.4.1 Growth of the Construction Industry is Expected to Drive the Growth of the Paint Protection Films Market During the Forecast Period.

7.5 Others

7.5.1 Increasing Demand for Luxury Buses is Expected to Fuel the Growth of the Paint Protection Film Market During the Forecast Period.

8 Regional Analysis (Page No. - 47)

8.1 Introduction

8.2 Asia Pacific

8.2.1 China

8.2.1.1 China is Projected to Lead Paint Protection Films Market in the Asia Pacific During the Forecast Period

8.2.2 Japan

8.2.2.1 Increasing Sales of Luxury Cars in the Country is Expected to Drive the Growth of Japan’s Paint Protection Films Market

8.2.3 India

8.2.3.1 Increasing Fdi Investments in the Automotive Sector are Expected to Fuel the Growth of the Paint Protection Films Market in India

8.2.4 South Korea

8.2.4.1 Rising Sales of Luxury Cars are Expected to Drive the Growth of Paint Protection Films Market in South Korea

8.2.5 Indonesia

8.2.5.1 Growth of the Automotive Industry is Expected to Drive the Growth of the Paint Protection Films Market in Indonesia

8.2.6 Rest of Asia Pacific

8.2.6.1 Growing Industries and Increasing Investments are Expected to Fuel the Growth of the Paint Protection Film Market in the Rest of Asia Pacific

8.3 North America

8.3.1 US

8.3.1.1 The Presence of Large Manufacturers of Paint Protection Films is Expected to Fuel the Growth of the Paint Protection Films Market in the US

8.3.2 Mexico

8.3.2.1 Increasing Investments Due to Favorable Policies are Expected to Contribute to the Growth of the Paint Protection Film Market in Mexico

8.3.3 Canada

8.3.3.1 Increasing Investments in Infrastructure Development Projects are Expected to Drive the Growth of Paint Protection Films Market in Canada During the Forecast Period

8.4 Europe

8.4.1 Germany

8.4.1.1 Presence of Luxury Car Manufacturers in the Country is Expected to Drive the Growth of Paint Protection Films Market

8.4.2 UK

8.4.2.1 Increasing Income Levels are Expected to Fuel the Market

8.4.3 Russia

8.4.3.1 Recovering Sales of Luxury Cars are Expected to Fuel the Growth of the Market in Russia

8.4.4 France

8.4.4.1 The Flourishing Automotive Industry is Expected to Drive the Growth of the Market in France

8.4.5 Italy

8.4.5.1 Recovering Sales of Luxury Cars are Expected to Fuel the Growth of the Market in Italy

8.4.6 Spain

8.4.6.1 Reduction in Tax Rates and Significant Sales of Hybrid Electric Cars are Leading to the Growth of the Market in Spain

8.4.7 Rest of Europe

8.4.7.1 Rising Consumption of Thermoplastic Polyurethane Material is Expected to Fuel the Growth of the Market in the Rest of Europe

8.5 Middle East & Africa

8.5.1 UAE

8.5.1.1 High Consumer Spending and Tax-Free Salary are Some of the Drivers for the Growth of the Market in the UAE

8.5.2 Saudi Arabia

8.5.2.1 Significant Sales of Luxury Cars are Expected to Contribute to the Growth of the Market in Saudi Arabia

8.5.3 South Africa

8.5.3.1 Increasing Investments in the Automotive Industry are Expected to Drive the Growth of the Market in South Africa

8.5.4 Rest of Middle East & Africa

8.5.4.1 Increase in Sales of Luxury Cars is Expected to Fuel the Growth of the Market in the Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.1.1 Rapidly Increasing Sales of Luxury Cars are Expected to Drive the Growth of Brazil’s Market

8.6.2 Argentina

8.6.2.1 Ongoing Investments and Increased Consumer Spending are Expected to Drive the Growth of Paint Protection Films Market in Argentina

8.6.3 Rest of South America

8.6.3.1 Free Trade Zone and the Presence of Trained Workforce are Expected to Fuel the Growth of the Market in the Rest of South America

9 Competitive Landscape (Page No. - 82)

9.1 Introduction

9.1.1 Visionaries

9.1.2 Innovators

9.1.3 Dynamic Differentiators

9.1.4 Emerging Companies

9.2 Strength of Product Portfolio

9.3 Business Strategy Excellence

9.4 Market Share of Key Players in the Paint Protection Films Market

10 Company Profiles (Page No. - 87)

10.1 3M Company

(Business Overview, Products Offered, SWOT Analysis, and MnM View)*

10.2 XPEL, Inc.

10.3 Eastman Chemical Company

10.4 Avery Dennison Corporation

10.5 Hexis S.A.

10.6 SCHWEITZER-MAUDUIT INTERNATIONAL, INC.

10.7 GRAFITYP Selfadhesive Products Nv

10.8 ORAFOL Europe GmbH

10.9 Premiumshield Limited

10.10 Saint-Gobain Performance Plastics Corporation

10.11 Kangde Xin Composite Material Group Co. Ltd (Kdx)

10.12 Sharpline Converting Inc.

10.13 Other Companies

10.13.1 Scorpion Window Film

10.13.2 Ziebart International Corporation

10.13.3 Ad-Winner Co., Ltd.

10.13.4 Garware Suncontrol

10.13.5 Prestige Film Technologies

10.13.6 Dingxin Films

10.13.7 Reflek Technologies Corporation

10.13.8 STEK-USA

10.13.9 Klingshield

10.13.10 Madico, Inc.

10.13.11 OPTICSHIELD

10.13.12 Haverkamp GmbH

10.13.13 Tesa Se - A Beiersdorf Company

*Details on Business Overview, Products Offered, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 114)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (102 Tables)

Table 1 Paint Protection Films Market Snapshot

Table 2 Asia Pacific Sales of Luxury Cars in 2018 (Units)

Table 3 Europe Sales of Luxury Cars in 2018 (Units)

Table 4 North America Sales of Luxury Cars in 2018 (Units)

Table 5 Rest of the World Sales of Luxury Cars in 2018 (Units)

Table 6 Number of Millionaires in Top Region of the World

Table 7 Paint Protection Films Market, By Material, 2017–2024 (Thousand Square Meters)

Table 8 Paint Protection Film Market, By Material, 2017–2024 (USD Million)

Table 9 Thermoplastic Polyurethane Material, By Region, 2017–2024 (Thousand Square Meters)

Table 10 Thermoplastic Polyurethane Material, By Region, 2017–2024 (USD Million)

Table 11 Polyvinyl Chloride Material, By Region, 2017–2024 (Thousand Square Meters)

Table 12 Polyvinyl Chloride Material, By Region, 2017–2024 (USD Million)

Table 13 Other Materials, By Region, 2017–2024 (Thousand Square Meters)

Table 14 Other Materials, By Region, 2017–2024 (USD Million)

Table 15 Paint Protection Films Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 16 Paint Protection Film Market, By End-Use Industry, 2017–2024 (USD Million)

Table 17 Paint Protection Films Market for Automotive, By Region, 2017–2024 (Thousand Square Meters)

Table 18 Paint Protection Film Market for Automotive, By Region, 2017–2024 (USD Million)

Table 19 Paint Protection Films Market for Electronics, By Region, 2017–2024 (Thousand Square Meters)

Table 20 Paint Protection Film Market for Electronics, By Region, 2017–2024 (USD Million)

Table 21 Paint Protection Films Market for Construction, By Region, 2017–2024 (Thousand Square Meters)

Table 22 Paint Protection Film Market for Construction, By Region, 2017–2024 (USD Million)

Table 23 Paint Protection Films Market for Others, By Region, 2017–2024 (Thousand Square Meters)

Table 24 Paint Protection Film Market for Others, By Region, 2017–2024 (USD Million)

Table 25 Paint Protection Films Market, By Region, 2017–2024 (Thousand Square Meters)

Table 26 Paint Protection Film Market, By Region, 2017–2024 (USD Million)

Table 27 Asia Pacific Paint Protection Films Market, By Country, 2017–2024 (Thousand Square Meters)

Table 28 Asia Pacific Market, By Country, 2017–2024 (USD Million)

Table 29 Asia Pacific Market, By Material, 2017–2024 (Thousand Square Meters)

Table 30 Asia Pacific Market, By Material, 2017–2024 (USD Million)

Table 31 Asia Pacific Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 32 Asia Pacific Market, By End-Use Industry, 2017–2024 (USD Million)

Table 33 China Paint Protection Film Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 34 China Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 35 Japan Paint Protection Films Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 36 Japan Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 37 India Paint Protection Films Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 38 India Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 39 South Korea Paint Protection Film Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 40 South Korea Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 41 Indonesia Paint Protection Films Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 42 Indonesia Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 43 Rest of Asia Pacific Paint Protection Film Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 44 Rest of Asia Pacific Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 45 North America Paint Protection Films Market, By Country, 2017–2024 (Thousand Square Meters)

Table 46 North America Market, By Country, 2017–2024 (USD Million)

Table 47 North America Market, By Material, 2017–2024 (Thousand Square Meters)

Table 48 North America Market, By Material, 2017–2024 (USD Million)

Table 49 North America Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 50 North America Market, By End-Use Industry, 2017–2024 (USD Million)

Table 51 US Paint Protection Films Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 52 US Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 53 Mexico Paint Protection Film Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 54 Mexico Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 55 Canada Paint Protection Films Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 56 Canada Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 57 Europe Paint Protection Films Market, By Country, 2017–2024 (Thousand Square Meters)

Table 58 Europe Market, By Country, 2017–2024 (USD Million)

Table 59 Europe Market, By Material, 2017–2024 (Thousand Square Meters)

Table 60 Europe Market, By Material, 2017–2024 (USD Million)

Table 61 Europe Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 62 Europe Market, By End-Use Industry, 2017–2024 (USD Million)

Table 63 Germany Paint Protection Film Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 64 Germany Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 65 UK Paint Protection Films Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 66 UK Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 67 Russia Paint Protection Films Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 68 Russia Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 69 France Paint Protection Films Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 70 France Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 71 Italy Paint Protection Films Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 72 Italy Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 73 Spain Paint Protection Films Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 74 Spain Market, By End-Use Industry, 2017–2024 (USD Thousands)

Table 75 Rest of Europe Paint Protection Films Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 76 Rest of Europe Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 77 Middle East & Africa Paint Protection Film Market, By Country, 2017–2024 (Thousand Square Meters)

Table 78 Middle East & Africa Market, By Country, 2017–2024 (USD Million)

Table 79 Middle East & Africa Market, By Material, 2017–2024 (Thousand Square Meters)

Table 80 Middle East & Africa Market, By Material, 2017–2024 (USD Million)

Table 81 Middle East & Africa Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 82 Middle East & Africa Market, By End-Use Industry, 2017–2024 (USD Million)

Table 83 UAE Paint Protection Films Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 84 UAE Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 85 Saudi Arabia Paint Protection Films Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 86 Saudi Arabia Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 87 South Africa Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 88 South Africa Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 89 Rest of Middle East & Africa Paint Protection Film Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 90 Rest of Middle East & Africa Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 91 South America Paint Protection Films Market, By Country, 2017–2024 (Thousand Square Meters)

Table 92 South America Market, By Country, 2017–2024 (USD Million)

Table 93 South America Market, By Material, 2017–2024 (Thousand Square Meters)

Table 94 South America Market, By Material, 2017–2024 (USD Million)

Table 95 South America Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 96 South America Market, By End-Use Industry, 2017–2024 (USD Million)

Table 97 Brazil Paint Protection Films Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 98 Brazil Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 99 Argentina Paint Protection Film Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 100 Argentina Market, By End-Use Industry, 2017–2024 (USD Thousand)

Table 101 Rest of South America Paint Protection Films Market, By End-Use Industry, 2017–2024 (Thousand Square Meters)

Table 102 Rest of South America Market, By End-Use Industry, 2017–2024 (USD Thousand)

List of Figures (34 Figures)

Figure 1 Paint Protection Films Market Segmentation

Figure 2 Paint Protection Film Market: Bottom-Up Approach

Figure 3 Paint Protection Films Market: Top-Down Approach

Figure 4 Thermoplastic Polyurethane Material is Projected to Lead the Paint Protection Films Market Between 2019 and 2024

Figure 5 The Automotive Industry is Projected to Lead the Paint Protection Film Market Between 2019 and 2024

Figure 6 The Asia Pacific Paint Protection Films Market is Projected to Grow at the Highest CAGR in Terms of Volume From 2019 to 2024

Figure 7 Thermoplastic Polyurethane Material Accounted for the Largest Share of the Paint Protection Films Market in 2018, in Terms of Volume

Figure 8 The Automotive Industry is Projected to Lead the Paint Protection Film Market From 2019 to 2024, in Terms of Volume

Figure 9 The Asia Pacific Accounted for the Largest Share of the Paint Protection Films Market in 2018

Figure 10 Thermoplastic Polyurethane Material and China Accounted for the Largest Share of the Asia Pacific Paint Protection Films Market in 2018, in Terms of Volume

Figure 11 Paint Protection Film Market Dynamics

Figure 12 Porter’s Five Forces Analysis

Figure 13 Thermoplastic Polyurethane Material Segment is Projected to Grow at the Higher CAGR During Forecast Period, in Terms of Value

Figure 14 The Automotive End-Use Industry to Grow at the Highest CAGR During the Forecast Period, in Terms of Value

Figure 15 The Asia Pacific Paint Protection Films Market is Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 16 Asia Pacific Paint Protection Film Market Snapshot

Figure 17 North America Paint Protection Films Market Snapshot

Figure 18 Europe Paint Protection Film Market Snapshot

Figure 19 Middle East Paint Protection Films Market Snapshot

Figure 20 South America Paint Protection Film Market Snapshot

Figure 21 Competitive Landscape Mapping, 2018

Figure 22 3M Company: Company Snapshot

Figure 23 3M Company: SWOT Analysis

Figure 24 XPEL, Inc.: Company Snapshot

Figure 25 XPEL, Inc.: SWOT Analysis

Figure 26 Eastman Chemical Company: Company Snapshot

Figure 27 Eastman Chemical Company: SWOT Analysis

Figure 28 Avery Dennison Corporation: Company Snapshot

Figure 29 Avery Dennison Corporation: SWOT Analysis

Figure 30 Hexis S.A.: SWOT Analysis

Figure 31 SCHWEITZER-MAUDUIT INTERNATIONAL, INC.: Company Snapshot

Figure 32 SCHWEITZER-MAUDUIT INTERNATIONAL, INC.: SWOT Analysis

Figure 33 GRAFITYP Selfadhesive Products Nv: SWOT Analysis

Figure 34 ORAFOL Europe GmbH: SWOT Analysis

The study involved four major activities in estimating the current market size for paint protection films. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Paint Protection Films Market Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study. Secondary sources include annual reports, press releases & investor presentations of companies, whitepapers, certified publications, articles by recognized authors, gold standard & silver standard websites, associations, regulatory bodies, trade directories, and databases.

Paint Protection Films Market Primary Research

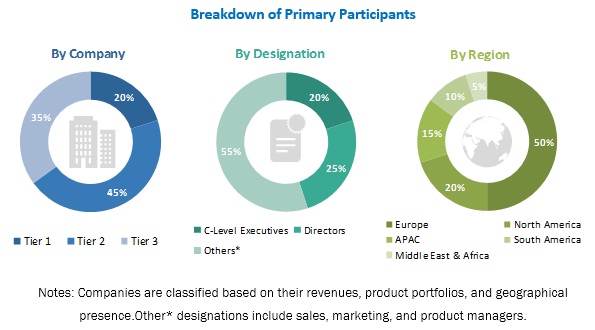

The paint protection films market comprises several stakeholders such as raw material suppliers, paint protection films manufacturers, OEMs, installers, end product users, and regulatory organizations in the supply chain. The demand side of this market is characterized by the developments in the automotive, electronics, construction, and other end-use industries. The supply side is characterized by market consolidation activities undertaken by paint protection films producers. Several primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following are the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Paint Protection Films Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the paint protection films market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value & volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Paint Protection Films Market Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Paint Protection Films Market Report Objectives

- To analyze and forecast the size of the paint protection films market in terms of volume & value

- To define, describe, and forecast the market size based on material, end-use industry, and region

- To estimate and forecast the size of the market in North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with their respective key countries

- To provide detailed information about the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze markets with respect to individual growth trends, future prospects, and their contribution to the market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To strategically profile the key players and comprehensively analyze their market share and core competencies

Paint Protection Films Market Report Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Paint Protection Films Market Regional Analysis

- A further breakdown of the regional paint protection films market to the country level by material

Country Information

- Regional market split by major countries

Paint Protection Films Market Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Paint Protection Films Market