Car Sunroof Market by Rooftop (Hardtop, Soft Top), Vehicle Class (Luxury, Semi-Luxury), Body (Sedan, SUV, Roadster), EV (BEV, HEV, PHEV, FCEV), Material (PVC, Carbon Fiber, Others), Propulsion, & Region - Global Forecast to 2027

The car sunroof market size was valued at USD 3 billion in 2018 and is projected to reach USD 2.4 billion by 2027, at a CAGR of 7.4%, during the forecast period. The base year considered for the study is 2017 and the forecast period is 2018 to 2027. Factors such as the growing demand for premium vehicles, advances in material technology, and increasing consumer preference for car sunroof in developing nations are driving the growth of the market. Objectives of the Study:

- To segment and forecast the global car sunroof market size in terms of value (USD million) and volume (’000 units)

- To define, describe, and forecast the global market based on rooftop type, material type, vehicle class type, body style type, electric vehicle type, propulsion type, and region

- To segment and forecast the market size by rooftop type (hardtop and soft top)

- To segment and forecast the market size by propulsion type (ICE and EV)

- To segment and forecast the market size by material type (PVC, carbon fiber, and others)

- To segment and forecast the market size by vehicle class type (luxury and semi-luxury)

- To segment and forecast the market size based on the body style type (sedan/hatchback, SUV, and roadster/sports car)

- To segment and forecast the market size based on electric vehicle (hybrid electric vehicle, plug-in hybrid electric vehicle, fuel cell electric vehicle, and battery electric vehicle)

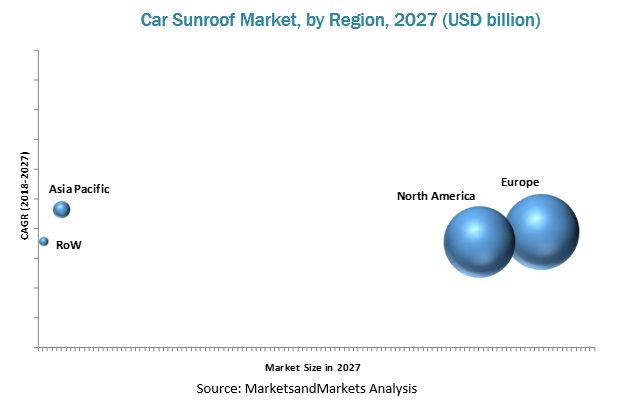

- To forecast the market size with respect to key regions, namely, North America, Europe, Asia Pacific, and the rest of the world (RoW)

- To provide detailed information regarding the major factors influencing market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market with respect to individual growth trends, future prospects, and contribution to the total market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

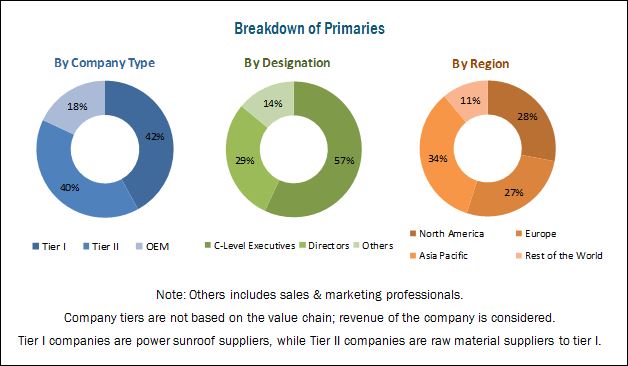

The research methodology used in the report involves primary and secondary sources. Secondary sources include associations such as International Organization of Motor Vehicle Manufacturers (OICA), Emission Controls Manufacturers Association (ECMA), European Automobile Manufacturers Association (ACEA), Environmental Protection Agency (EPA), and International Council on Clean Transportation (ICCT) and paid databases and directories such as Factiva and Bloomberg. In the primary research stage, experts from related industries, manufacturers, and suppliers have been interviewed to understand the present situation and future trends in the car sunroof market. The market size, in terms of volume (thousand units) and value (USD million), has been derived from forecasting techniques based on vehicle sales and car sunroof application.

The figure below illustrates the profiles of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, Request for Free Sample Report

The car sunroof market ecosystem consists of manufacturers such as Webasto (Germany), Magna International (Canada), and Valmet Automotive (Finland). Car sunroofs are supplied to major OEMs in the automotive industry, including Toyota (Japan), General Motors (US), and Honda (Japan).

Target Audience

- Automotive components manufacturers and suppliers

- Car sunroof manufacturers and suppliers

- Automotive dealers and distributors

- Automotive OEMs (vehicle manufacturers)

- Automotive Raw material suppliers

- Automotive software providers

- Distributors and suppliers of car sunroof

- EV manufacturers

- Industry associations and automotive experts

- Investors

- Luxury car manufacturers

Scope of the Report

-

Car sunroof market, by Rooftop Type

- Hardtop

- Soft Top

-

Car sunroof market, by Material Type

- PVC

- Carbon Fiber

- Others

-

Car sunroof market market, by Propulsion Type

- ICE

- Electric Vehicle

-

Car sunroof market, by Body Style Type

- Sedan/Hatchback

- SUV

- Roadster/Sports Car

-

Car sunroof market, by Vehicle Class Type

- Luxury Vehicles

- Semi-Luxury Vehicles

-

Car sunroof market, by Electric Vehicle Type

- BEV

- HEV

- PHEV

- FCEV

-

Car sunroof market, by Region

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

Europe

- France

- Germany

- Italy

- Spain

- UK

-

North America

- Canada

- Mexico

- US

-

Rest of the World

- Brazil

- Russia

-

Asia Pacific

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-wise analysis of the car sunroof market, by vehicle class type (any 3 country)

- Additional country-wise analysis of the car sunroof market, by body style type (any 3 country)

The car sunroof market is projected to grow at a CAGR of 7.4%, during the forecast period, and is projected to reach USD 2.4 billion by 2027 from USD 1.3 billion in 2018. The growth of the market can be attributed to the growing demand for premium vehicles. Additionally, advances in material technology and increasing consumer preference for car sunroof in developing nations are further boosting the market globally.

The soft top segment is estimated to be the leading rooftop type segment, in terms of both volume and value, as these systems offer all-round visibility and maximum ventilation.

The luxury vehicles segment of the car sunroof market is expected to grow at the highest CAGR, during the forecast period, as the current demand for luxury cars is high in countries such as Germany, Italy, the UK, Spain, and France. Moreover, Germany is a hub for technological innovations, leading to the substantial growth of the luxury vehicles market.

The sedan/hatchback car segment is estimated to account for the largest share of the car sunroof market, in terms of volume. The increasing demand for luxury vehicles will contribute to the growth of the market for sedan/hatchback cars. In the current automotive market, hatchbacks are a popular body type in developing countries such as China, Brazil, and India. The use of SUVs is continuously increasing, especially in the US.

The HEV segment is estimated to be the leading segment, by electric vehicle type, in terms of both volume and value. Hybrid electric vehicles mostly come equipped with soft tops which provide all-round visibility and maximum ventilation. The Toyota RAV 4 XLE is the latest model of HEV equipped with a convertible soft top roof top which costs around USD 24,550.

To know about the assumptions considered for the study, download the pdf brochure

Europe is estimated to be the largest car sunroof market because of the trend of integrating additional features for enhancing comfort and driving experience and the increase in premium vehicle sales. Additionally, the region is a hub for automotive giants and premium vehicles. Germany houses the largest automotive industry in Europe and is home to major automobile manufacturers such as Volkswagen, BMW, Audi, and Daimler.

However, the increasing application of panoramic sunroofs and limited application of car sunroofs in mid-segment vehicles are the major restraints for manufacturers.

The car sunroof market is dominated by a few global players. Some of the key manufacturers operating in the market are Webasto (Germany), Magna International (Canada), and Valmet Automotive (Finland).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 13)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 17)

2.1 RESEARCH DATA

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES

2.2.2 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 FACTOR ANALYSIS

2.4.1 DEMAND-SIDE ANALYSIS

2.4.1.1 Growth in luxury vehicle sales

2.4.1.2 Increased demand for aesthetics

2.4.2 SUPPLY-SIDE ANALYSIS

2.4.2.1 Regulations regarding light-weight materials

2.5 MARKET SIZE ESTIMATION

2.5.1 BOTTOM-UP APPROACH

2.6 MARKET BREAKDOWN AND DATA TRIANGULATION

2.7 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 27)

4 PREMIUM INSIGHTS (Page No. - 33)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CAR SUNROOF MARKET

4.2 MARKET SHARE OF MARKET, BY REGION

4.3 MARKET, BY MATERIAL TYPE, 2017 VS 2027

4.4 MARKET, BY GLASS TYPE, 2017 VS 2027

4.5 MARKET, BY FABRIC TYPE, 2017 VS 2027

4.6 MARKET, BY VEHICLE TYPE, 2017 VS 2027

4.7 MARKET, BY ELECTRIC VEHICLE TYPE, 2017 VS 2027

5 MARKET OVERVIEW (Page No. - 38)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increased demand for premium segment vehicles to drive the demand for power sunroof

5.2.1.2 Innovations in glass technology to drive the automotive sunroof market

5.2.2 RESTRAINTS

5.2.2.1 Low penetration of power sunroof in low segment vehicles

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing penetration of panoramic sunroof

5.2.3.2 Increasing penetration of solar sunroof in electric vehicles across the globe

5.2.4 CHALLENGES

5.2.4.1 High cost of regular maintenance

5.2.4.2 Incidences of shattering of sunroof

5.3 MACRO-INDICATOR ANALYSIS

5.3.1 PREMIUM VEHICLE SALES AS A PERCENTAGE OF TOTAL SALES

5.3.2 GDP (USD BILLION)

5.3.3 GNI PER CAPITA, ATLAS METHOD (USD)

5.3.4 GDP PER CAPITA PPP (USD)

5.3.5 MACRO INDICATORS INFLUENCING THE AUTOMOTIVE SUNROOF MARKET FOR TOP 3 COUNTRIES

5.3.5.1 US

5.3.5.2 Germany

5.3.5.3 China

5.4 SUPPLY CHAIN ANALYSIS

6 TECHNOLOGY OVERVIEW (Page No. - 47)

6.1 OLED SOLAR SUNROOF

6.2 ANTI-PINCH SUNROOF TECHNOLOGY

6.3 SPD – SMART GLASS TECHNOLOGY

7 CAR SUNROOF MARKET, BY MATERIAL TYPE (Page No. - 49)

7.1 INTRODUCTION

7.2 FABRIC MATERIAL

7.3 GLASS MATERIAL

8 CAR SUNROOF MARKET, BY FABRIC TYPE (Page No. - 54)

8.1 INTRODUCTION

8.2 FOLDABLE SUNROOF

8.3 REMOVABLE SUNROOF

9 CAR SUNROOF MARKET, BY GLASS TYPE (Page No. - 60)

9.1 INTRODUCTION

9.2 INBUILT SUNROOF

9.3 PANORAMIC SUNROOF

9.4 SOLAR SUNROOF

9.5 SPOILER/TILT&SLIDE SUNROOF

9.6 TOP-MOUNT SUNROOF

10 CAR SUNROOF MARKET, BY VEHICLE TYPE (Page No. - 73)

10.1 INTRODUCTION

10.2 SEDAN/HATCHBACK

10.3 SPORT UTILITY VEHICLE (SUV)

10.4 OTHERS

11 CAR SUNROOF MARKET, BY ELECTRIC VEHICLE TYPE (Page No. - 79)

11.1 INTRODUCTION

11.2 BATTERY ELECTRIC VEHICLE (BEV)

11.3 FUEL CELL ELECTRIC VEHICLE (FCEV)

11.4 HYBRID ELECTRIC VEHICLE (HEV)

11.5 PLUG-IN HYBRID VEHICLE (PHEV)

12 CAR SUNROOF MARKET, BY REGION (Page No. - 87)

12.1 INTRODUCTION

12.2 ASIA PACIFIC

12.2.1 CHINA

12.2.2 INDIA

12.2.3 JAPAN

12.2.4 SOUTH KOREA

12.3 EUROPE

12.3.1 FRANCE

12.3.2 GERMANY

12.3.3 ITALY

12.3.4 SPAIN

12.3.5 UK

12.4 NORTH AMERICA

12.4.1 CANADA

12.4.2 MEXICO

12.4.3 US

12.5 ROW

12.5.1 BRAZIL

12.5.2 RUSSIA

13 COMPETITIVE LANDSCAPE (Page No. - 110)

13.1 INTRODUCTION

13.2 MARKET RANKING ANALYSIS

13.3 WHO SUPPLIES WHOM: TOP 3 MARKET PLAYERS

13.4 COMPETITIVE SITUATION & TRENDS

13.4.1 NEW PRODUCT DEVELOPMENTS

13.4.2 EXPANSION

14 COMPANY PROFILES (Page No. - 113)

(Overview, products offered, New product launches/expansions, SWOT analysis, MnM view)*

14.1 WEBASTO

14.2 INALFA ROOF SYSTEMS

14.3 INTEVA

14.4 MAGNA INTERNATIONAL

14.5 AISIN SEIKI

14.6 CIE

14.7 YACHIYO INDUSTRY

14.8 JOHNAN MANUFACTURING

14.9 AUTOMOTIVE SUNROOF COMPANY

14.1 BOS

*Details on Overview, products offered, New product launches/expansions, SWOT analysis, MnM view might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 131)

15.1 KEY INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.4.1 DETAILED ANALYSIS AND PROFILING OF ADDITIONAL COUNTRIES (UP TO 3)

15.4.2 COUNTRY-WISE ANALYSIS OF CAR SUNROOF BY VEHICLE TYPE

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

List of Tables (77 Tables)

Table 1 Currency Exchange Rates (Per 1 USD)

Table 2 Car Sunroof Market Snapshot

Table 3 Country Wise SUV Production Data, 2016 & 2017

Table 4 Market, By Body Style Type, 2016–2025 (‘000 Units)

Table 5 Market, By Body Style Type, 2016–2025 (USD Million)

Table 6 Sedan/Hatchback: Market, By Region, 2016–2025 (‘000 Units)

Table 7 Sedan/Hatchback: Market, By Region, 2016–2025 (USD Million)

Table 8 SUV: Market, By Region, 2016–2025 (‘000 Units)

Table 9 SUV: Market, By Region, 2016–2025 (USD Million)

Table 10 Roadster/Sports Car: Market, By Region, 2016–2025 (‘000 Units)

Table 11 Roadster/Sports Car: Market, By Region, 2016–2025 (USD Million)

Table 12 Market Size, By Electric Vehicle Type, 2016–2025 (Units)

Table 13 Market Size, By Electric Vehicle Type, 2016–2025 (USD Thousand)

Table 14 Battery Electric Vehicle: Market Size, By Region, 2016–2025 (Units)

Table 15 Battery Electric Vehicle: Market Size, By Region, 2016–2025 (USD Thousand)

Table 16 Fuel Cell Electric Vehicle: Market Size, By Region, 2016–2025 (Units)

Table 17 Fuel Cell Electric Vehicle: Market Size, By Region, 2016–2025 (USD Thousand)

Table 18 Hybrid Electric Vehicle: Car Sunroof Market Size, By Region, 2016–2025 (Units)

Table 19 Hybrid Electric Vehicle: Market Size, By Region, 2016–2025 (USD Thousand)

Table 20 Plug-In Hybrid Electric Vehicle: Market Size, By Region, 2016–2025 (Units)

Table 21 Plug-In Hybrid Electric Vehicle: Market Size, By Region, 2016–2025 (USD Thousand)

Table 22 Global Market Size, By Propulsion Type, 2016–2025 (Units)

Table 23 Global Market Size, By Propulsion Type, 2016–2025 (USD Million)

Table 24 EV: Market Size, By Region, 2016–2025 (Units)

Table 25 EV: Market Size, By Region, 2016–2025 (USD Million)

Table 26 ICE: Market Size, By Region, 2016–2025 (Units)

Table 27 ICE: Market Size, By Region, 2016–2025 (USD Million)

Table 28 Market Size, By Rooftop Type, 2016–2025 (‘000 Units)

Table 29 Market Size, By Rooftop Type, 2016–2025 (USD Million)

Table 30 Hardtop: Market Size, By Region, 2016–2025 (‘000 Units)

Table 31 Hardtop: Market Size, By Region, 2016–2025 (USD Million)

Table 32 Soft Top: Market Size, By Region, 2016–2025 (‘000 Units)

Table 33 Soft Top: Market Size, By Region, 2016–2025 (USD Million)

Table 34 Market Size, By Vehicle Class Type, 2016–2025 (‘000 Units)

Table 35 Luxury Vehicles: Market Size, By Region, 2016–2025 (‘000 Units)

Table 36 Semi-Luxury Vehicles: Market Size, By Region, 2016–2025 (‘000 Units)

Table 37 Car Sunroof Market, By Region, 2016–2025 (‘000 Units)

Table 38 Market, By Region, 2016–2025 (USD Million)

Table 39 Asia Pacific: Market, By Country, 2016–2025 (‘000 Units)

Table 40 Asia Pacific: Market, By Country, 2016–2025 (USD Million)

Table 41 China: Market, By Rooftop Type, 2016–2025 (‘000 Units)

Table 42 China: Market, By Rooftop Type, 2016–2025 (USD Million)

Table 43 India: Market, By Rooftop Type, 2016–2025 (Units)

Table 44 India: Market, By Rooftop Type, 2016–2025 (USD Million)

Table 45 Japan: Market, By Rooftop Type, 2016–2025 (‘000 Units)

Table 46 Japan: Market, By Rooftop Type, 2016–2025 (USD Million)

Table 47 South Korea: Market, By Rooftop Type, 2016–2025 (‘000 Units)

Table 48 South Korea: Market, By Rooftop Type, 2016–2025 (USD Million)

Table 49 Europe: Market, By Country, 2016–2025 (‘000 Units)

Table 50 Europe: Market, By Country, 2016–2025 (USD Million)

Table 51 France: Market, By Rooftop Type, 2016–2025 (‘000 Units)

Table 52 France: Market, By Rooftop Type, 2016–2025 (USD Million)

Table 53 Germany: Market, By Rooftop Type, 2016–2025 (‘000 Units)

Table 54 Germany: Market, By Rooftop Type, 2016–2025 (USD Million)

Table 55 Italy: Market, By Rooftop Type, 2016–2025 (‘000 Units)

Table 56 Italy: Market, By Rooftop Type, 2016–2025 (USD Million)

Table 57 Spain: Market, By Rooftop Type, 2016–2025 (‘000 Units)

Table 58 Spain: Market, By Rooftop Type, 2016–2025 (USD Million)

Table 59 UK: Market, By Rooftop Type, 2016–2025 (‘000 Units)

Table 60 UK: Market, By Rooftop Type, 2016–2025 (USD Million)

Table 61 North America: Market, By Country, 2016–2025 (‘000 Units)

Table 62 North America: Market, By Country, 2016–2025 (USD Million)

Table 63 Canada: Market, By Rooftop Type, 2016–2025 (‘000 Units)

Table 64 Canada: Market, By Rooftop Type, 2016–2025 (USD Million)

Table 65 Mexico: Market, By Rooftop Type, 2016–2025 (‘000 Units)

Table 66 Mexico: Market, By Rooftop Type, 2016–2025 (USD Million)

Table 67 US: Market, By Rooftop Type, 2016–2025 (‘000 Units)

Table 68 US:Market, By Rooftop Type, 2016–2025 (USD Million)

Table 69 RoW: Market, By Country, 2016–2025 (‘000 Units)

Table 70 RoW: Market, By Country, 2016–2025 (USD Million)

Table 71 Brazil: Market, By Rooftop Type, 2016–2025 (‘000 Units)

Table 72 Brazil: Market, By Rooftop Type, 2016–2025 (USD Million)

Table 73 Russia: Market, By Rooftop Type, 2016–2025 (‘000 Units)

Table 74 Russia: Market, By Rooftop Type, 2016–2025 (USD Million)

Table 75 Car Sunroof Market Analysis: 2017

Table 76 New Product Developments, 2015–2017

Table 77 Expansions, 2014

List of Figures (40 Figures)

Figure 1 Car Sunroof Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Global Luxury Vehicle Sales Data (2015 vs 2016)

Figure 6 Market: Bottom-Up Approach

Figure 7 Data Triangulation

Figure 8 Market, By Region, 2018–2025 (USD Million)

Figure 9 Market, By Body Style Type, 2018 vs 2025 (USD Million)

Figure 10 Market, By Rooftop Type, 2018 vs 2025 (USD Million)

Figure 11 Market, By Vehicle Class Type, 2018 vs 2025 (‘000 Units)

Figure 12 Market, By Propulsion Type, 2018 vs 2025 (USD Million)

Figure 13 Market, By Electric Vehicle Type, 2018 vs 2025 (USD Thousand)

Figure 14 Increase in Demand for Premium Vehicles and Comfort Features is Anticipated to Fuel the Growth of Market From 2018 to 2025

Figure 15 Europe is Estimated to Hold the Largest Share of the Market in 2018

Figure 16 Soft Top Segment is Estimated to Hold the Largest Market Share in 2018

Figure 17 Sedan/Hatchback is Estimated to Hold the Largest Share of Market in 2018

Figure 18 Semi-Luxury Vehicle Segment is Estimated to Hold the Largest Share of Market in 2018

Figure 19 HEV Segment is Estimated to Hold the Largest Share of Market in 2018

Figure 20 ICE Segment is Estimated to Hold the Largest Share of Market in 2018

Figure 21 Car Sunroof Market: Market Dynamics

Figure 22 Market, By Body Style Type, 2018 vs 2025 (USD Million)

Figure 23 Market, By Electric Vehicle Type, 2018 Vs. 2025 (USD Thousand)

Figure 24 Market, By Propulsion Type, 2018 Vs. 2025 (USD Million)

Figure 25 Market, By Rooftop Type, 2018 Vs. 2025 (USD Million)

Figure 26 Market, By Vehicle Class Type, 2018 vs 2025 (‘000 Units)

Figure 27 Asia Pacific is Estimated to be the Fastest Growing Market for Car Sunroof During the Forecast Period (2018–2025)

Figure 28 China Accounts for the Largest Market Share in the Asia Pacific Market, 2018 vs 2025

Figure 29 Europe: Market Snapshot

Figure 30 North America: Market Snapshot

Figure 31 Key Developments By Leading Players in the Car Sunroof Market, 2014–2017

Figure 32 Webasto: Company Snapshot

Figure 33 Webasto: SWOT Analysis

Figure 34 Magna International: Company Snapshot

Figure 35 Magna International: SWOT Analysis

Figure 36 Valmet Automotive: SWOT Analysis

Figure 37 Aisin Seiki: Company Snapshot

Figure 38 Aisin Seiki: SWOT Analysis

Figure 39 Continental: Company Snapshot

Figure 40 Continental: SWOT Analysis

Growth opportunities and latent adjacency in Car Sunroof Market