Automotive Glazing Market by Application (Sidelite, Backlite, Sunroof, Lighting, Rear Quarter Glass), Vehicle Type (Passenger Car, Light and Heavy Commercial, Off-Highway, Electric), and Region - Global Forecast to 2025

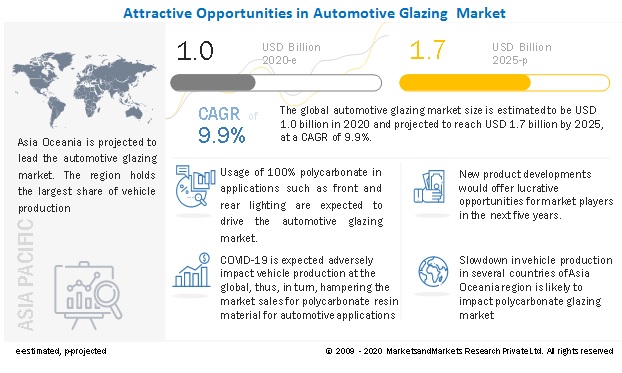

[251 Pages Report] The Global Automotive Glazing Market size is expected to grow at a CAGR of 9.9%, by value, during the forecast period. As per our post-COVID forecasts, the market is estimated to reach USD 1.0 billion in 2020 and is projected to achieve USD 1.7 billion by 2025. Post-COVID, factors that push the market forward are driven primarily by the usage of polycarbonate in headlights and the increasing adoption of sunroof and rear quarter glass-equipped premium vehicles such as sedans and SUVs. The rising demand for complex glazing design and lightweight vehicles is also driving the growth of the automotive glazing market for polycarbonate.

COVID-19 IMPACT ON AUTOMOTIVE GLAZING MARKET

The automotive glazing market includes major Tier I and II suppliers like SABIC, Covestro AG, Webasto SE, Trinseo, Teijin, and others. These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and Middle East & Africa. COVID-19 has impacted all of its businesses globally; these players have announced a temporary shutdown of production due to lockdown and also to protect the safety of their employees, which basically created lowered demand and supply chain disruptions in US, France, Germany, Italy, Spain, and others during the COVID-19 pandemic. As a result, the demand for overall automotive production has decline, which directly affects the automotive glazing market in 2020. Going forward, manufacturers are likely to adjust production to prevent bottlenecks and plan production according to demand from OEMs and tier 1 manufacturers.

Major OEM manufacturers lost revenues in Q1 & Q2 2020, and a similar scenario is likely to be repeated in Q3 2020. Vehicle production is expected to resume, however, not at full capacity due to the severity of the pandemic, due to which, especially in the US and major European countries, tier 1 players suspect a further decline in revenue in the remaining quarters of 2020.

Automotive Glazing Market: Market Dynamics:

Driver: Increased use of polycarbonate glazing as it is lighter in weight than glass

Carbon emission has increased in the last few decades and has resulted in climate change across the globe. Due to this, governing bodies in several regions have imposed stringent emission norms in the automotive industry, which accounts for around 18% of carbon emission worldwide. To comply with the emission norms, OEMs have increased the use of lightweight materials in automotive components to reduce the overall weight of the vehicle. According to a recent study, the reduction in vehicle weight significantly increases fuel efficiency. As per EPA, a reduction of 100 pounds of vehicle weight increases fuel economy by 1% to 2%. This increase in fuel economy will benefit not only the vehicle owner but also OEMs by helping them to achieve their fleet-level emission targets. Hence, vehicle component manufacturers such as glazing manufacturers are focusing on launching, and manufacturing glazing products made up of polycarbonate. According to SABIC, the use of polycarbonate in glazing instead of glass can reduce the weight of a vehicle by 16–20 Kg, which will improve fuel efficiency and decrease vehicle emissions.

Additionally, as per bisphenol-a-Europe, the use of polycarbonate in headlamps and panorama roof applications can save 14–22 kg CO2 emissions/kg over a vehicle’s life cycle compared to glass or metal. For instance, SABIC launched polyester-based, high heat technology XENOY HTX resin for automotive structural application, which is light in weight, impact-resistant, and has high performance. Applications include body in white components, structural reinforcement, and battery protection system for electric vehicles. Hence, the adoption of polycarbonate in glazing can help OEMs to achieve stringent emission targets and better fuel efficiency, which in turn will drive the demand for polycarbonate in automotive glazing.

Restraint: Volatile and high cost of polycarbonate market

Polycarbonates are made of bisphenol A, which is the most widely produced transparent plastic made from crude oil. The price of polycarbonate varies with changes in Bisphenol A prices. Due to irregular supply and increasing demand, crude oil has shown volatile pricing trends in the last few years. This irregular pricing of raw material affects the overall profitability of the manufacturer and, hence, creates instability in the market. Glass, which accounts for the highest market share in automotive glazing, is made of sand and silica. As sand and silica are available in abundance, the price of glass is as low as 25% of polycarbonate sheet price. Given the high cost, OEMs are reluctant to adopt polycarbonate glazing in their vehicles. In addition, due to the COVID-19 pandemic, major OEMs have suspended vehicle production on a massive scale. The demand for new vehicles is expected to be low in Q1 and Q2 of 2021, as the global market will be recovering the pandemic and economic slump.

Additionally, disruption in raw material demand and price fluctuation are expected during the recovery. For instance, Covestro has planned adjustments in its production in the short term to avoid excess inventory. The company is focused on leveraging its network across the globe to mitigate supply chain interruptions. Hence, instability in the polycarbonate raw material coupled with the high price of polycarbonate is estimated to hinder the growth of the market.

Opportunity: Polycarbonate usage to remove blind spot area-A-pillar

A-pillar is the pillar that joins the hood to the bonnet of a vehicle. This pillar affects the vision of the driver as it often creates a blind spot, which creates accident-prone scenarios. Numerous vehicles have a particular vision problem. In sports cars with aggressively raked windshields, A-pillars of various thicknesses can severely block the view. On extreme or tight curves, it’s very common for the pillar to obscure the road ahead critically. This is frustrating for drivers and can be dangerous as well. Many people are at risk of accidents due to the blind spot created by A-pillar. Many OEMs are trying to find solutions using multiple techniques. In this regard, Toyota and Volvo have already registered a patent for a different type of A-pillar. This may provide an opportunity to polycarbonate glazing manufacturers as polycarbonate provides the strength needed for the A-pillar. Additionally, as polycarbonate is transparent, it provides wide range visibility to the driver and eradicates the possibility of a blind spot because of A-pillar.

Challenge: Scratch prone property and low visibility of polycarbonate material over automotive glass

The glazing components are mainly used for seeing through purpose. Therefore, clear vision is the most important attribute of any automotive glazing component. Visibility from the vehicle is not only the aspect of safety but also of convenience. Polycarbonate material faces a few challenges in the area of visibility. Even though light transmission of polycarbonate sheets is more than glass, polycarbonate glazing is prone to scratches. These scratches can be fatal as they can impact the visibility of the driver. In spite of the benefits of weight reduction and tensile strength provided by polycarbonate, OEMs and government authorities are against the usage of polycarbonate in windshields. Additionally, the scratch-prone attributes of polycarbonate affect not only visibility but also the durability of the automotive glazing application. The scratchy windshield or sidelite can require a number of replacements in the vehicle lifetime. At the same time, many advanced coatings can help to avoid scratches on polycarbonate glazing. However, in applications such as sunroof, Webasto is using high quality (AS4700 hardcoat) coating, which is highly resistant to scratches, weathering, and UV radiations.

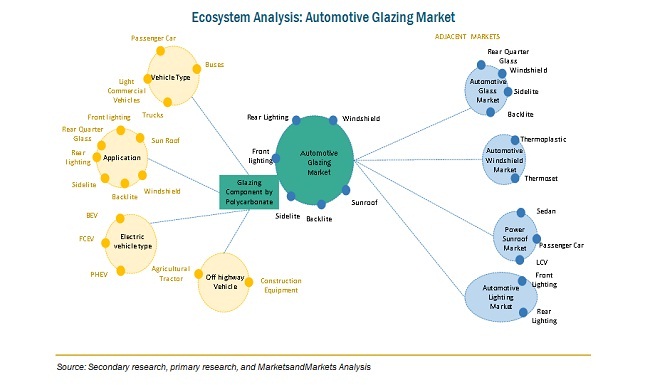

ECOsystem ANalysis: automotive glazing market

Bus is expected to be the fastest-growing segment in the automotive glazing market, by vehicle type, during the forecast period

As per MNM analysis, the average size of glazing for buses is highest than any other vehicle type. The average glazing area of the bus is 2 to 3 times more than passenger cars. This is because of the higher surface area of applications such as sidelite and windscreen. Buses account for the smallest share of global vehicle production. However, the polycarbonate usage in buses for glazing is estimated to have a high impact on their fuel efficiency. The increasing urbanization rate has increased the number of megacities resulting in the demand for cheap and faster travel—this why the production of buses is estimated to increase. Hence, the fuel efficiency impact, coupled with growing bus production, is estimated to drive the automotive glazing market for buses at the highest CAGR.

Front lighting application is anticipated to be the largest segment of the automotive glazing market

All vehicles are equipped with front lighting; the average size of front lighting depends on the type of vehicle. Additionally, polycarbonate has 100% penetration in front lighting applications from the last few years. Thus, increasing vehicle production has a direct impact on the polycarbonate glazing market. Moreover, the average lighting size has been increased owing to the DRL mandates. Increased average size, coupled with the highest penetration of polycarbonate in lighting applications is estimated to drive the front lighting application segment.

BEV is estimated to be the fastest-growing segment of the electric vehicle automotive glazing market during the forecast period

Because of stringent emission norms, the sale of electric vehicles has increased tremendously in the last few years. As per MarketsandMarkets analysis, this trend will drive the market for electric vehicles such as BEVs. BEVs are propelled by an electric motor and have high power rechargeable battery packs. Thus, weight reduction is the predominant criteria in BEVs. Therefore, polycarbonate glazing is expected to have a significant market share in BEVs. Additionally, a majority of BEVs fall under the premium vehicle category. So, safety and aesthetic features play an important role in these vehicles, which, in turn, are projected to drive the growth of the BEV segment at the highest CAGR in the automotive glazing market for electric vehicles.

Asia Oceania expected to be the largest automotive glazing market

Asia Oceania is the largest automotive glazing market and is expected to retain its position during the forecast period. Asia Oceania has emerged as a hub for automotive production in recent years owing to the increasing population and urbanization. According to OICA, Asia Oceania accounted for ~46% of the global vehicle production in 2018 because of the presence of OEMs such as SAIC, Hyundai, Toyota, Suzuki, Tata, and Honda. Manufacturers in this region are focused on developing specific solutions that address fuel efficiency mandates. As consumers in the region are showing an increased inclination toward convenience and safety, it has witnessed higher growth than the matured markets of Europe and North America.

Key Market Players

Some of the key players in the automotive glazing market are SABIC (Suadi Arabia), Covestro AG (Germany), Teijin (Japan), Webasto SE (Germany), Trinseo (US), Mitsubishi (Japan), Chi Mei Corporation (Taiwan), Freeglass (Germany), KRD Sicherheitstechnik (Germany), and Idemitsu (Japan). SABIC and Covestro adopted the strategies of expansion, and new product development, to retain its leading position in the automotive glazing market.

Scope of the Report:

|

Report Metric |

Details |

|

Market Size Available for years |

2016-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) and Volume (Thousand Square Meter) |

|

Segments covered |

By Off-highway, by application, Vehicle type, By Electric Vehicle & by Region |

By Off-highway

- Agricultural Tractors

- Construction Equipment

By Application

- Windscreen

- Sidelite

- Backlite

- Front lighting

- Rear Lighting

- Rear Quarter glass

- Sunroof

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Buses

- Trucks

By Electric Vehicle

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Fuel cell Electric Vehicle (FCEV)

By Region

- Asia Oceania

- Europe

- North America

- RoW

Recent Developments

- In October 2019, Covestro launched its new interior design concept for autonomous, electric, and shared mobility wherein a three-dimensional multifunctional display was made using Makrolon Ai polycarbonate and Makrofol polycarbonate film. A combination of in-mold decoration and film insert molding was used for surface design and durability.

- In October 2019, SABIC launched polyester-based, high heat technology XENOY HTX resin for automotive structural application, which is light in weight, impact-resistant, and has high performance. Applications include body in white components, structural reinforcement, and battery protection system for electric vehicles.

- In October 2019, SABIC was first to launch its polycarbonate based on certified renewable feedstock in the industry. This solution would reduce CO2 emission and usage of fossil feedstock during production

- In December 2018, Covestro started to build a new manufacturing line for polycarbonate films at Map Ta Phut Industrial Estate, Thailand. With this new capacity, the company will serve the fast-growing demand in Asia Pacific and strengthen its position as a market leader. The project is the first step in a global capacity increase for Covestro´s polycarbonate film production. The total investment of more than USD 115 million also includes an expansion of the associated infrastructure and logistics.

- In August 2018, Covestro announced that it would be launching flame-retardant battery housings for electric mobility or transparent and/or light-diffusing polycarbonates for energy-efficient LED lighting technology for automotive.

Frequently Asked Questions (FAQ):

Who are the key players in the global automotive glazing market? What strategies have these companies adopted?

Some of the key players in the automotive glazing market are SABIC (Suadi Arabia), Covestro AG (Germany), Teijin (Japan), Webasto SE (Germany), Trinseo (US), Mitsubishi (Japan), Chi Mei Corporation (Taiwan), Freeglass (Germany), KRD Sicherheitstechnik (Germany), and Idemitsu (Japan). SABIC and Covestro adopted the strategies of expansion, and new product development, to retain its leading position in the automotive glazing market

Which type of glazing in on-highway vehicles is expected to dominate in the future?

As the demand for polycarbonate glazing in automotive applications would increase, the market for polycarbonate glazing would likely grow in the next few years. Currently, front lighting and rear lighting have 100% polycarbonate glazing. Hence, with an increase in the adoption of polycarbonate glazing in other applications such as sunroof, backlite, and others, demand for polycarbonate glazing in on-highway vehicles would rise.

What are the current market dynamics in the automotive polycarbonate glazing market?

Polycarbonate properties such as high impact resistance, high tensile strength, lighter in weight than glass, moldable property to achieve the complex design, and others are few current market trends, which would likely boost automotive glazing market.

What is the average cost of a polycarbonate glazing on a vehicle?

The average cost of polycarbonate glazing would vary from type of vehicles such as passenger cars, light commercial vehicles, buses, trucks, and off-highway vehicles.

The study indicates that a passenger car holds the maximum share of the automotive glazing market. How would change in market trends impact the usage of polycarbonate glazing? What would be the regional growth rate for the next five years?

Automotive OEMs are focused on developing lightweight material to improvise vehicle efficiency. Thus, the adoption of polycarbonate resin for various automotive applications would rise as it is lighter than glass. With an increase in vehicle sales, the market for polycarbonate in passenger cars would likely grow. In addition, the passenger car segment is estimated to hold the largest market share by value in 2020. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 INCLUSIONS & EXCLUSIONS

1.3.2 YEARS CONSIDERED IN THE REPORT

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES IN THE REPORT

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES FOR VEHICLE PRODUCTION

2.2.2 KEY SECONDARY SOURCES FOR MARKET SIZING

2.2.3 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.6 ASSUMPTIONS

2.6.1 AVERAGE NUMBER OF APPLICATIONS IN EACH VEHICLE TYPE

3 EXECUTIVE SUMMARY

3.1 PRE- & POST-COVID-19 SCENARIO

3.2 AUTOMOTIVE GLAZING MARKET: MARKET OUTLOOK

4 PREMIUM INSIGHTS

4.1 GLOBAL AUTOMOTIVE GLAZING MARKET TRENDS

4.2 MARKET, BY APPLICATION

4.3 MARKET, BY ELECTRIC VEHICLE

4.4 MARKET, BY OFF HIGHWAY VEHICLE

4.5 MARKET, BY VEHICLE TYPE

4.6 MARKET, BY COUNTRY

4.7 MARKET, BY REGION

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increased use of polycarbonate glazing as it is lighter in weight than glass

5.2.1.2 Flexibility of polycarbonate enables advanced designing in automotive applications

5.2.1.3 Adoption of polycarbonate glazing in sunroofs

5.2.1.4 Higher use of impact-resistant polycarbonate over glass in off highway vehicles

5.2.2 RESTRAINTS

5.2.2.1 Low familiarity of engineers in advanced plastic glazing

5.2.2.2 Volatile market and high cost of polycarbonate

5.2.3 OPPORTUNITIES

5.2.3.1 Increased adoption of polycarbonate glazing applications such as windshields

5.2.3.2 Polycarbonate usage to remove blind spot area-A-pillar

5.2.4 CHALLENGES

5.2.4.1 Scratch-prone property and low visibility of polycarbonate material over automotive glass

5.2.4.2 Consumer preference for glass over polycarbonate which has higher tensile strength and is lighter

5.2.5 IMPACT OF MARKET DYNAMICS

5.3 PORTER'S FIVE FORCES

5.4 REVENUE IMPACT

5.5 ECOSYSTEM

5.6 AVERAGE SELLING PRICE ANALYSIS

5.7 USE CASES

5.7.1 SABIC: LEXAN RESIN FOR AUTOMOTIVE APPLICATIONS

5.7.2 COVESTRO: MARKOLON RESIN FOR AUTOMOTIVE LIGHTING

5.8 TECHNOLOGICAL ANALYSIS

5.8.1 OVERVIEW

5.8.2 PROSPECTS FOR MATERIAL SUPPLIERS

5.8.3 OEM INITIATIVES

5.9 GOVERNMENT REGULATIONS

5.1 PATENT ANALYSIS

5.10.1 METHODOLOGY

5.10.2 PATENT REGISTRATION

6 INDUSTRY TRENDS IN AUTOMOTIVE GLAZING MARKET

6.1 INTRODUCTION

6.2 THE ADVANCED APPLICATIONS

6.2.1 HEAD-UP DISPLAY

6.2.2 LARGE WINDSCREEN

6.2.3 SWITCHABLE GLAZING

6.2.4 HYDROPHOBIC GLAZING

6.2.5 SUN CONTROL GLAZING

6.3 SCENARIO

6.3.1 NORMAL SCENARIO

6.3.2 PESSIMISTIC SCENARIO

6.3.3 OPTIMISTIC SCENARIO

6.4 VALUE CHAIN ANALYSIS

7 COVID-19 IMPACT ANALYSIS

7.1 COVID-19 IMPACT ANALYSIS ON THE WINDSCREEN GLAZING MARKET

7.2 COVID-19 IMPACT ANALYSIS ON THE AUTOMOTIVE GLAZING MARKET

7.2.1 MARKET BY POLYCARBONATE SCENARIO ANALYSIS

7.2.1.1 Realistic scenario

7.2.1.2 Low impact scenario

7.2.1.3 High impact scenario

8 AUTOMOTIVE GLAZING MARKET, BY OFF HIGHWAY VEHICLE

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

8.1.3 INDUSTRY INSIGHTS

8.2 CONSTRUCTION EQUIPMENT

8.2.1 SOPS AND FOPS SAFETY REGULATIONS TO DRIVE THE DEMAND FOR POLYCARBONATE GLAZING IN CONSTRUCTION EQUIPMENT ON CONSTRUCTION EQUIPMENT GLAZING MARKET

8.3 AGRICULTURAL TRACTORS

8.3.1 EUROPE IS EXPECTED TO BE THE LARGEST GLAZING MARKET FOR AGRICULTURAL TRACTORS

9 AUTOMOTIVE GLAZING MARKET, BY APPLICATION

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS CONSIDERED FOR THE CHAPTER

9.1.3 INDUSTRY INSIGHTS

9.2 WINDSCREEN

9.2.1 WINDSCREEN MARKET IS ESTIMATED TO GROW AT A SIGNIFICANT GROWTH RATE OWING TO UPDATED MANDATES REGARDING POLYCARBONATE IN WINDSCREEN

9.3 SIDELITE

9.3.1 ASIA OCEANIA IS EXPECTED TO BE THE LARGEST SIDELITE AUTOMOTIVE GLAZING MARKET

9.4 BACKLITE

9.4.1 STRENGTH PROVIDED BY POLYCARBONATE IN BACKLITE IS ESTIMATED TO DRIVE MARKET FOR BACKLITE POLYCARBONATE

9.5 REAR QUARTER GLASS

9.5.1 INCREASING DEMAND FOR PREMIUM SUV IN ASIA OCEANIA REGION IS ESTIMATED TO DRIVE THE POLYCARBONATE REAR QUARTER GLASS MARKET

9.6 SUNROOF

9.6.1 INCREASING DEMAND FOR CONVENIENCE AND LIGHTWEIGHTING IN PREMIUM VEHICLE HAS POSITIVE INFLUENCE ON SUNROOF POLYCARBONATE MARKET

9.7 FRONT LIGHTING

9.7.1 REGULATION ON DRL HAS INCREASED DEMAND FOR LIGHTING COVERS WHICH HAS POSITIVE IMPACT ON FRONT LIGHTING SEGMENT OF POLYCARBONATE GLAZING MARKET

9.8 REAR LIGHTING

9.8.1 THE INSTALLATION OF POLYCARBONATE IN LIGHTING APPLICATION HAS INCREASED GLOBALLY DUE TO THE ABILITY OF POLYCARBONATE TO ADAPT TO ANY COMPLEX DESIGN USING INJECTION MOLDING

10 AUTOMOTIVE GLAZING MARKET, BY VEHICLE TYPE

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS CONSIDERED FOR THE CHAPTER

10.1.3 INDUSTRY INSIGHTS

10.2 PASSENGER CAR

10.2.1 RISING DEMAND FOR AESTHETIC FEATURES AND ADVANCED SAFETY SYSTEMS IS EXPECTED TO HAVE MAJOR INFLUENCE ON THE PASSENGER CAR SEGMENT OF THE AUTOMOTIVE GLAZING MARKET

10.3 LIGHT COMMERCIAL VEHICLE (LCV)

10.3.1 NORTH AMERICA IS EXPECTED TO BE THE LARGEST MARKET FOR AUTOMOTIVE GLAZING IN LCVS

10.4 TRUCK

10.4.1 WEIGHT REDUCTION WILL HAVE LOW IMPACT ON AUTOMOTIVE GLAZING MARKET FOR TRUCKS

10.5 BUS

10.5.1 POLYCARBONATE GLAZING RESULTS IN AN APPROXIMATE 300 LB WEIGHT REDUCTION PER 40 FT. BUS

11 AUTOMOTIVE GLAZING MARKET, BY ELECTRIC VEHICLE

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS CONSIDERED FOR THE CHAPTER

11.1.3 INDUSTRY INSIGHTS

11.2 BATTERY ELECTRIC VEHICLE (BEV)

11.2.1 OWING TO HIGH SALES OF BEV'S IN CHINA, ASIA OCEANIA TO BE THE LARGEST GLAZING MARKET FOR BEV'S

11.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

11.3.1 INCREASING DEMAND FOR SUNROOF AND REAR QUARTER GLASS IS ESTIMATED TO DRIVE THE MARKET FOR AUTOMOTIVE GLAZING

11.4 FUEL CELL ELECTRIC VEHICLE (FCEV)

11.4.1 INCREASE IN THE USAGE OF POLYCARBONATE DUE TO MOLDABLE PROPERTY EXPECTED TO INFLUENCE THE FCEV GLAZING MARKET

12 AUTOMOTIVE GLAZING MARKET, BY REGION

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS

12.1.3 INDUSTRY INSIGHTS

12.2 ASIA OCEANIA

12.2.1 CHINA

12.2.1.1 China accounts for the largest share in the automotive glazing market owing to the largest vehicle production in the country

12.2.2 INDIA

12.2.2.1 The passenger car segment is estimated to drive the Indian polycarbonate glazing market

12.2.3 JAPAN

12.2.3.1 The bus segment is estimated to register the second fastest growth rate owing to increasing urbanization

12.2.4 SOUTH KOREA

12.2.4.1 The LCV segment is expected to account for the second largest share in the polycarbonate glazing market

12.2.5 REST OF ASIA OCEANIA

12.2.5.1 The passenger car segment accounts for the largest share in the Rest of Asia Oceania glazing market

12.3 EUROPE

12.3.1 FRANCE

12.3.1.1 France is expected to be one of the early adopters of polycarbonate glazing

12.3.2 GERMANY

12.3.2.1 Germany is estimated to account for the largest market share in the European polycarbonate glazing market

12.3.3 ITALY

12.3.3.1 The bus segment of the Italian polycarbonate glazing market is estimated to grow at the highest CAGR

12.3.4 SPAIN

12.3.4.1 The passenger car segment in Spain is estimated to account for the largest market share

12.3.5 RUSSIA

12.3.5.1 Increasing penetration of Sunroof in passenger cars to drive the Russian market

12.3.6 UK

12.3.6.1 Fuel efficiency mandates and increasing sales of premium cars and SUVs to drive the UK market

12.3.7 REST OF EUROPE

12.3.7.1 Increasing vehicle production to drive the glazing market for Rest of Europe

12.4 NORTH AMERICA

12.4.1 CANADA

12.4.1.1 LCV polycarbonate glazing market is estimated to account for the largest market in Canada

12.4.2 MEXICO

12.4.2.1 Mexico is estimated to be the second largest polycarbonate glazing market in the North American region

12.4.3 US

12.4.3.1 High Sales of SUVs, Pickup trucks and Premium sedans to drive the US glazing market

12.5 ROW

12.5.1 BRAZIL

12.5.1.1 Lighting (exterior) application in all vehicle types is estimated to drive the Brazilian market

12.5.2 SOUTH AFRICA

12.5.2.1 Cost of polycarbonate glazing is estimated to restrict the growth rate of the South African automotive glazing market

12.5.3 ROW OTHERS

12.5.3.1 The passenger car segment is estimated to account for the largest market share in the RoW others market

13 ADJACENT MARKETS

13.1 ADJACENT & RELATED MARKETS

13.1.1 INTRODUCTION

13.2 LIMITATIONS

13.3 AUTOMOTIVE GLAZING MARKET BY POLYCARBONATE ECOSYSTEM & INTERCONNECTED MARKETS

13.4 AUTOMOTIVE DIFFERENTIAL MARKET

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

13.4.3 AUTOMOTIVE GLASS MARKET, BY REGION

13.5 AUTOMOTIVE LIGHTING MARKET

13.5.1 MARKET DEFINITION

13.5.2 INCLUSIONS & EXCLUSIONS

13.5.3 MARKET OVERVIEW

13.5.4 AUTOMOTIVE LIGHTING MARKET

13.6 AUTOMOTIVE WINDSHIELD MARKET

13.6.1 MARKET DEFINITION

13.6.2 MARKET OVERVIEW

13.6.3 AUTOMOTIVE WINDSHIELD MARKET

13.7 POWER SUNROOF MARKET

13.7.1 MARKET DEFINITION

13.7.2 MARKET OVERVIEW

13.7.3 POWER SUNROOF MARKET

14 COMPETITIVE LANDSCAPE

14.1 MARKET EVALUATION FRAMEWORK

14.2 OVERVIEW

14.3 MARKET SHARE, 2019

14.4 MARKET RANKING ANALYSIS

14.5 MARKET EVALUATION FRAMEWORK: REVENUE ANALYSIS OF TOP FIVE PLAYERS

14.6 COMPETITIVE SCENARIO

14.6.1 NEW PRODUCT DEVELOPMENTS

14.6.2 SUPPLY CONTRACT

14.6.3 EXPANSIONS

14.6.4 JOINT VENTURE

14.7 COMPETITIVE LEADERSHIP MAPPING

14.7.1 STARS

14.7.2 EMERGING LEADERS

14.7.3 PERVASIVES

14.7.4 EMERGING COMPANIES

14.8 STRENGTH OF PRODUCT PORTFOLIO: GLAZING AND POLYCARBONATE MANUFACTURERS

14.9 BUSINESS STRATEGY EXCELLENCE: GLAZING AND POLYCARBONATE MANUFACTURERS

15 COMPANY PROFILES

15.1 COVESTRO AG

15.1.1 BUSINESS OVERVIEW

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENTS

15.1.4 SWOT ANALYSIS

15.1.5 RIGHT TO WIN

15.1.6 MNM VIEW

15.2 SABIC

15.2.1 BUSINESS OVERVIEW

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENTS

15.2.4 SWOT ANALYSIS

15.2.5 RIGHT TO WIN

15.2.6 MNM VIEW

15.3 WEBASTO GROUP

15.3.1 BUSINESS OVERVIEW

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENTS

15.3.4 SWOT ANALYSIS

15.3.5 RIGHT TO WIN

15.3.6 MNM VIEW

15.4 IDEMITSU KOSAN

15.4.1 BUSINESS OVERVIEW

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.4.4 SWOT ANALYSIS

15.4.5 RIGHT TO WIN

15.4.6 MNM VIEW

15.5 TEIJIN

15.5.1 BUSINESS OVERVIEW

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.5.4 SWOT ANALYSIS

15.5.5 RIGHT TO WIN

15.5.6 MNM VIEW

15.6 TRINSEO

15.6.1 BUSINESS OVERVIEW

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.6.4 SWOT ANALYSIS

15.6.5 MNM VIEW

15.7 FREEGLASS

15.7.1 BUSINESS OVERVIEW

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.7.4 SWOT ANALYSIS

15.7.5 MNM VIEW

15.8 MITSUBISHI ENGINEERING PLASTICS

15.8.1 BUSINESS OVERVIEW

15.8.2 PRODUCT PORTFOLIO

15.9 CHI MEI CORPORATION

15.9.1 BUSINESS OVERVIEW

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 KRD SICHERHEITSTECHNIK

15.10.1 BUSINESS OVERVIEW

15.10.2 PRODUCT PORTFOLIO

15.11 ADDITIONAL COMPANY PROFILES

15.11.1 AGC

15.11.2 CENTRAL GLASS

15.11.3 XINYI GLASS

15.11.4 GUARDIAN INDUSTRIES

15.11.5 NIPPON SHEET GLASS

15.11.6 FUYAO GLASS INDUSTRY

15.11.7 SAINT-GOBAIN

15.11.8 SUMITOMO CORPORATION

15.11.9 EVONIK

15.11.10 CORNING INCORPORATED

15.11.11 SISECAM GROUP

15.11.12 SHENZHEN BENSON AUTOMOBILE GLASS CO. LTD

15.11.13 ARKEMA SA

15.11.14 SINOGRACE CHEMICAL CO., LTD

15.11.15 MITSUI CHEMICALS AMERICA

15.12 LONG LIST OF COMPANIES (ANNEXURE)

15.12.1 CELANESE CORPORATION

15.12.2 HUNTSMAN

15.12.3 LG CHEM

15.12.4 RTP COMPANY

15.12.5 A. SCHULMAN

15.12.6 SPARTECH

15.12.7 SUMITOMO BAKELITE

15.12.8 TECHMER PM

15.12.9 PEERLESS PLASTICS & COATINGS

15.12.10 DOTT.GALLINA S.R.L

15.12.11 PEARL NANO

15.12.12 NANOTECH COATINGS

15.12.13 PITTSBURGH PLATE GLASS INDUSTRIES

15.12.14 HUATE BONDING MATERIAL

16 APPENDIX

16.1 INSIGHTS OF INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.4.1 ELECTRIC VEHICLE GLAZING MARKET, BY APPLICATION

16.4.1.1 Asia Oceania

16.4.1.1.1 Windscreen

16.4.1.1.2 Sidelite

16.4.1.1.3 Backlite

16.4.1.1.4 Sunroof

16.4.1.1.5 Rear Quarter Glass

16.4.1.1.6 Front Lighting

16.4.1.1.7 Rear Lighting

16.4.1.2 Europe

16.4.1.2.1 Windscreen

16.4.1.2.2 Sidelite

16.4.1.2.3 Backlite

16.4.1.2.4 Sunroof

16.4.1.2.5 Rear Quarter Glass

16.4.1.2.6 Front Lighting

16.4.1.2.7 Rear Lighting

16.4.1.3 North America

16.4.1.3.1 Windscreen

16.4.1.3.2 Sidelite

16.4.1.3.3 Backlite

16.4.1.3.4 Sunroof

16.4.1.3.5 Rear Quarter Glass

16.4.1.3.6 Front Lighting

16.4.1.3.7 Rear Lighting

16.4.1.4 RoW

16.4.1.4.1 Windscreen

16.4.1.4.2 Sidelite

16.4.1.4.3 Backlite

16.4.1.4.4 Sunroof

16.4.1.4.5 Rear Quarter Glass

16.4.1.4.6 Front Lighting

16.4.1.4.7 Rear Lighting

16.4.2 OFF HIGHWAY VEHICLE GLAZING MARKET, BY EQUIPMENT TYPE

16.4.2.1 Asia Oceania

16.4.2.1.1 Backhoe Loader

16.4.2.1.2 Wheeled Loader

16.4.2.1.3 Skid-steer Loader

16.4.2.1.4 Mini Excavator

16.4.2.1.5 Crawler Excavator

16.4.2.1.6 100HP -250 HP Agricultural Tractor

16.4.2.1.7 250 HP and Above Agricultural Tractor

16.4.2.2 Europe

16.4.2.2.1 Backhoe Loader

16.4.2.2.2 Wheeled Loader

16.4.2.2.3 Skid-steer Loader

16.4.2.2.4 Mini Excavator

16.4.2.2.5 Crawler Excavator

16.4.2.2.6 100 HP -250 HP Agricultural Tractor

16.4.2.2.7 250 HP and Above Agricultural Tractor

16.4.2.3 North America

16.4.2.3.1 Backhoe Loader

16.4.2.3.2 Wheeled Loader

16.4.2.3.3 Skid-steer Loader

16.4.2.3.4 Mini Excavator

16.4.2.3.5 Crawler Excavator

16.4.2.3.6 100 HP -250 HP Agricultural Tractor

16.4.2.3.7 250 HP and Above Agricultural Tractor

16.4.2.4 RoW

16.4.2.4.1 Backhoe Loader

16.4.2.4.2 Wheeled Loader

16.4.2.4.3 Skid-steer Loader

16.4.2.4.4 Mini Excavator

16.4.2.4.5 Crawler Excavator

16.4.2.4.6 100 HP -250 HP Agricultural Tractor

16.4.2.4.7 250 HP and Above Agricultural Tractor

16.4.3 ADDITIONAL COMPANY INFORMATION

16.4.3.1 Celanese Corporation

16.4.3.2 Huntsman Corporation

16.4.3.3 LG Chem

16.4.3.4 RTP Company

16.4.3.5 A. Schulman

16.4.3.6 Spartech

16.4.3.7 Sumitomo Bakelite

16.4.3.8 Techmer PM

16.4.3.9 Peerless Plastics & Coatings

16.4.3.10 Dott.Gallina S.R.L

16.4.3.11 Pearl Nano

16.4.3.12 NanoTech Coatings

16.4.3.13 Pittsburgh Plate Glass Industries

16.4.3.14 Huate Bonding Material

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

LIST OF TABLES (198 Tables)

TABLE 1 INCLUSIONS & EXCLUSIONS FOR THE AUTOMOTIVE GLAZING MARKET

TABLE 2 CURRENCY EXCHANGE RATES (W.R.T. USD)

TABLE 3 OVERVIEW OF EMISSION & FUEL ECONOMY REGULATION SPECIFICATIONS FOR PASSENGER CARS

TABLE 4 BLIND SPOT DETECTION: BY REGION, 2017-2025 ('000 UNITS)

TABLE 5 WEIGHT REDUCTION GOALS FOR LIGHT DUTY VEHICLES

TABLE 6 TRACTOR GLAZINGMARKET: IMPACT OF MARKET DYNAMICS

TABLE 7 POLYCARBONATE MANUFACTURERS EXPECTED TO WITNESS HIGH GROWTH IN REVENUE OWING TO HIGH DEMAND FOR LIGHTWEIGHTING

TABLE 8 POLYCARBONATE GLAZING MARKET SIZE, PENETRATION ANALYSIS

TABLE 9 EUROPE: LOSS IN VEHICLE PRODUCTION DUE TO PLANT SHUTDOWNS, BY COUNTRY, (UNITS)

TABLE 10 AUTOMOTIVE PRODUCTION: PRE- VS. POST-COVID-19 SCENARIO, 2017-2025 ('000 UNITS)

TABLE 11 MARKET BY POLYCARBONATE (REALISTIC SCENARIO), BY REGION, 2017-2025 (USD MILLION)

TABLE 12 MARKET BY POLYCARBONATE (LOW IMPACT SCENARIO), BY REGION, 2017-2025 (USD MILLION)

TABLE 13 MARKET BY POLYCARBONATE (HIGH IMPACT SCENARIO), BY REGION, 2017-2025 (MILLION USD)

TABLE 14 MARKET, BY OFF-HIGHWAY VEHICLE, 2016-2019 ('000 SQUARE METER)

TABLE 15 MARKET, BY OFF-HIGHWAY VEHICLE, 2016-2019 (USD MILLION)

TABLE 16 MARKET, BY OFF-HIGHWAY VEHICLE, 2020-2025 ('000 SQUARE METER)

TABLE 17 MARKET, BY OFF-HIGHWAY VEHICLE, 2020-2025 (USD MILLION)

TABLE 18 CONSTRUCTION EQUIPMENT: OFF-HIGHWAY GLAZING MARKET, BY REGION, 2016-2019 ('000 SQUARE METER)

TABLE 19 CONSTRUCTION EQUIPMENT: OFF-HIGHWAY GLAZING MARKET, BY REGION, 2016-2019 (USD MILLION)

TABLE 20 CONSTRUCTION EQUIPMENT: OFF-HIGHWAY GLAZING MARKET, BY REGION, 2020-2025 ('000 SQUARE METER)

TABLE 21 CONSTRUCTION EQUIPMENT: OFF-HIGHWAY GLAZING MARKET, BY REGION, 2020-2025 (USD MILLION)

TABLE 22 AGRICULTURAL TRACTORS: OFF-HIGHWAY GLAZING MARKET, BY REGION, 2016-2019 ('000 SQUARE METER)

TABLE 23 AGRICULTURAL TRACTORS: OFF-HIGHWAY GLAZING MARKET, BY REGION, 2016-2019 (USD MILLION)

TABLE 24 AGRICULTURAL TRACTORS: OFF-HIGHWAY GLAZING MARKET, BY REGION, 2020-2025 ('000 SQUARE METER)

TABLE 25 AGRICULTURAL TRACTORS: OFF-HIGHWAY GLAZING MARKET, BY REGION, 2020-2025 (USD MILLION)

TABLE 26 AUTOMOTIVE GLAZING MARKET, BY APPLICATION, 2016-2019 ('000 SQUARE METER)

TABLE 27 MARKET, BY APPLICATION, 2016-2019 (USD THOUSAND)

TABLE 28 MARKET, BY APPLICATION, 2020-2025 ('000 SQUARE METER)

TABLE 29 MARKET, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 30 WINDSCREEN: MARKET, BY REGION, 2020-2025 ('000 SQUARE METER)

TABLE 31 WINDSCREEN: MARKET, BY REGION, 2020-2025 (USD MILLION)

TABLE 32 SIDELITE: MARKET, BY REGION, 2016-2019 ('000 SQUARE METER)

TABLE 33 SIDELITE: MARKET, BY REGION, 2016-2019 (USD MILLION)

TABLE 34 SIDELITE: MARKET, BY REGION, 2020-2025 ('000 SQUARE METER)

TABLE 35 SIDELITE: MARKET, BY REGION, 2020-2025 (USD MILLION)

TABLE 36 BACKLITE: MARKET, BY REGION, 2016-2019 ('000 SQUARE METER)

TABLE 37 BACKLITE: MARKET, BY REGION, 2016-2019 (USD MILLION)

TABLE 38 BACKLITE: MARKET, BY REGION, 2020-2025 ('000 SQUARE METER)

TABLE 39 BACKLITE: MARKET, BY REGION, 2020-2025 (USD MILLION)

TABLE 40 REAR QUARTER GLASS: AUTOMOTIVE GLAZING MARKET, BY REGION, 2016-2019 ('000 SQUARE METER)

TABLE 41 REAR QUARTER GLASS: MARKET, BY REGION, 2016-2019 (USD MILLION)

TABLE 42 REAR QUARTER GLASS: MARKET, BY REGION, 2020-2025 ('000 SQUARE METER)

TABLE 43 REAR QUARTER GLASS: MARKET, BY REGION, 2020-2025 (USD MILLION)

TABLE 44 SUNROOF: MARKET, BY REGION, 2016-2019 ('000 SQUARE METER)

TABLE 45 SUNROOF: MARKET, BY REGION, 2016-2019 (USD MILLION)

TABLE 46 SUNROOF: MARKET, BY REGION, 2020-2025 ('000 SQUARE METER)

TABLE 47 SUNROOF: MARKET, BY REGION, 2020-2025 (USD MILLION)

TABLE 48 FRONT LIGHTING: MARKET, BY REGION, 2016-2019 ('000 SQUARE METER)

TABLE 49 FRONT LIGHTING: MARKET, BY REGION, 2016-2019 (USD MILLION)

TABLE 50 FRONT LIGHTING: MARKET, BY REGION, 2020-2025 ('000 SQUARE METER)

TABLE 51 FRONT LIGHTING: MARKET, BY REGION, 2020-2025 (USD MILLION)

TABLE 52 REAR LIGHTING: MARKET, BY REGION, 2016-2019 ('000 SQUARE METER)

TABLE 53 REAR LIGHTING: MARKET, BY REGION, 2016-2019 (USD MILLION)

TABLE 54 REAR LIGHTING: MARKET, BY REGION, 2020-2025 ('000 SQUARE METER)

TABLE 55 REAR LIGHTING: MARKET, BY REGION, 2020-2025 (USD MILLION)

TABLE 56 AUTOMOTIVE GLAZING MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 57 MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 58 MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 59 MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 60 PASSENGER CAR: MARKET, BY REGION, 2016-2019 ('000 SQUARE METER)

TABLE 61 PASSENGER CAR: MARKET, BY REGION, 2016-2019 (USD MILLION)

TABLE 62 PASSENGER CAR: MARKET, BY REGION, 2020-2025 ('000 SQUARE METER)

TABLE 63 PASSENGER CAR: MARKET, BY REGION, 2020-2025 (USD MILLION)

TABLE 64 LCV: CAR GLAZING MARKET, BY REGION, 2016-2019 ('000 SQUARE METER)

TABLE 65 LCV: AUTOMOTIVE GLAZING MARKET, BY REGION, 2016-2019 (USD MILLION)

TABLE 66 LCV: MARKET, BY REGION, 2020-2025 ('000 SQUARE METER)

TABLE 67 LCV: MARKET, BY REGION, 2020-2025 (USD MILLION)

TABLE 68 TRUCK: MARKET, BY REGION, 2016-2019 ('000 SQUARE METER)

TABLE 69 TRUCK: MARKET, BY REGION, 2016-2019 (USD MILLION)

TABLE 70 TRUCK: MARKET, BY REGION, 2020-2025 ('000 SQUARE METER)

TABLE 71 TRUCK: MARKET, BY REGION, 2020-2025 (USD MILLION)

TABLE 72 BUS: AUTOMOTIVE BUS GLAZING MARKET, BY REGION, 2016-2019 ('000 SQUARE METER)

TABLE 73 BUS: MARKET, BY REGION, 2016-2019 (USD MILLION)

TABLE 74 BUS: MARKET, BY REGION, 2020-2025 ('000 SQUARE METER)

TABLE 75 BUS: MARKET, BY REGION, 020-2025 (USD MILLION)

TABLE 76 AUTOMOTIVE GLAZING MARKET, BY ELECTRIC VEHICLE, 2016-2019 (SQUARE METER)

TABLE 77 MARKET, BY ELECTRIC VEHICLE, 2016-2019 (USD THOUSAND)

TABLE 78 MARKET, BY ELECTRIC VEHICLE, 2020-2025 (SQUARE METER)

TABLE 79 MARKET, BY ELECTRIC VEHICLE, 2020-2025 (USD THOUSAND)

TABLE 80 BEV: MARKET, BY REGION, 2016-2019 (SQUARE METER)

TABLE 81 BEV: MARKET, BY REGION, 2016-2019 (USD THOUSAND)

TABLE 82 BEV: MARKET, BY REGION, 2020-2025 (SQUARE METER)

TABLE 83 BEV: MARKET, BY REGION, 2020-2025 (USD THOUSAND)

TABLE 84 PHEV: AUTOMOTIVE GLAZING MARKET, BY REGION, 2016-2019 (SQUARE METER)

TABLE 85 PHEV: MARKET, BY REGION, 2016-2019 (USD THOUSAND)

TABLE 86 PHEV: MARKET, BY REGION, 2020-2025 (SQUARE METER)

TABLE 87 PHEV: MARKET, BY REGION, 2020-2025 (USD THOUSAND)

TABLE 88 FCEV: MARKET, BY REGION, 2016-2019 (SQUARE METER)

TABLE 89 FCEV: MARKET, BY REGION, 2016-2019 (USD THOUSAND)

TABLE 90 FCEV: MARKET, BY REGION, 2020-2025 (SQUARE METER)

TABLE 91 FCEV: MARKET, BY REGION, 2020-2025 (USD THOUSAND)

TABLE 92 AUTOMOTIVE GLAZING MARKET, BY REGION, 2016-2019 ('000 SQUARE METER)

TABLE 93 MARKET, BY REGION, 2016-2019 (USD MILLION)

TABLE 94 MARKET, BY REGION, 2020-2025 ('000 SQUARE METER)

TABLE 95 MARKET, BY REGION, 2020-2025 (USD MILLION)

TABLE 96 ASIA OCEANIA: MARKET, BY COUNTRY, 2016-2019 ('000 SQUARE METER)

TABLE 97 ASIA OCEANIA: MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 98 ASIA OCEANIA: MARKET, BY COUNTRY, 2020-2025 ('000 SQUARE METER)

TABLE 99 ASIA OCEANIA: MARKET, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 100 CHINA: AUTOMOTIVE GLAZING MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 101 CHINA: MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 102 CHINA: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 103 CHINA: MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 104 INDIA: MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 105 INDIA: MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 106 INDIA: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 107 INDIA: MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 108 JAPAN: AUTOMOTIVE GLAZING MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 109 JAPAN: MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 110 JAPAN: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 111 JAPAN: MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 112 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 113 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 114 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 115 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 116 REST OF ASIA OCEANIA: AUTOMOTIVE GLAZING MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 117 REST OF ASIA OCEANIA: MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 118 REST OF ASIA OCEANIA: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 119 REST OF ASIA OCEANIA: MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY COUNTRY, 2016-2019 ('000 SQUARE METER)

TABLE 121 EUROPE: MARKET, BY COUNTRY, 2016-2019(USD MILLION)

TABLE 122 EUROPE: MARKET, BY COUNTRY, 2020-2025 ('000 SQUARE METER)

TABLE 123 EUROPE: MARKET, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 124 FRANCE: MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 125 FRANCE: MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 126 FRANCE: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 127 FRANCE: MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 128 GERMANY: MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 129 GERMANY: MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 130 GERMANY: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 131 GERMANY: MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 132 ITALY AUTOMOTIVE GLAZING MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 133 ITALY MARKET, BY VEHICLE TYPE, 2016-2019 USD MILLION)

TABLE 134 ITALY: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 135 ITALY: MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 136 SPAIN: MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 137 SPAIN: MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 138 SPAIN: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 139 SPAIN: MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 140 RUSSIA: MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 141 RUSSIA: MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 142 RUSSIA: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 143 RUSSIA: MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 144 UK: AUTOMOTIVE GLAZING MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 145 UK: MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 146 UK: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 147 UK: MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 148 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 149 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 150 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 151 REST OF EUROPE: MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 152 NORTH AMERICA: MARKET, BY COUNTRY, 2016-2019 ('000 SQUARE METER)

TABLE 153 NORTH AMERICA: MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 154 NORTH AMERICA: MARKET, BY COUNTRY, 2020-2025 ('000 SQUARE METER)

TABLE 155 NORTH AMERICA: MARKET, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 156 CANADA: AUTOMOTIVE GLAZING MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 157 CANADA: MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 158 CANADA: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 159 CANADA: MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 160 MEXICO: MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 161 MEXICO: MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 162 MEXICO: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 163 MEXICO: MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 164 US: AUTOMOTIVE GLAZING MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 165 US: MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 166 US: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 167 US: MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 168 ROW: MARKET, BY COUNTRY, 2016-2019 ('000 SQUARE METER)

TABLE 169 ROW: MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 170 ROW: MARKET, BY COUNTRY, 2020-2025 ('000 SQUARE METER)

TABLE 171 ROW: MARKET, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 172 BRAZIL: AUTOMOTIVE GLAZING MARKET, BY VEHICLE TYPE, 2016-2019 (000 SQUARE METER)

TABLE 173 BRAZIL: MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 174 BRAZIL: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 175 BRAZIL: MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 176 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 177 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 178 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 179 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 180 REST OF ROW: MARKET, BY VEHICLE TYPE, 2016-2019 ('000 SQUARE METER)

TABLE 181 REST OF ROW: MARKET, BY VEHICLE TYPE, 2016-2019 (USD MILLION)

TABLE 182 REST OF ROW: MARKET, BY VEHICLE TYPE, 2020-2025 ('000 SQUARE METER)

TABLE 183 REST OF ROW: AUTOMOTIVE GLAZING MARKET, BY VEHICLE TYPE, 2020-2025 (USD MILLION)

TABLE 184 ADJACENT MARKET REPORTS FOR AUTOMOTIVE GLAZING

TABLE 185 AUTOMOTIVE GLASS MARKET, BY REGION, 2015-2025 ('000 SQUARE METERS)

TABLE 186 AUTOMOTIVE GLASS MARKET, BY REGION, 2015-2025 (USD MILLION)

TABLE 187 AUTOMOTIVE LIGHTING MARKET, BY REGION, 2017-2019 (MILLION UNITS)

TABLE 188 AUTOMOTIVE LIGHTING MARKET, BY REGION, 2017-2019 (USD MILLION)

TABLE 189 AUTOMOTIVE LIGHTING MARKET, BY REGION, 2020-2025 (MILLION UNITS)

TABLE 190 AUTOMOTIVE LIGHTING MARKET, BY REGION, 2020-2025 (USD MILLION)

TABLE 191 AUTOMOTIVE WINDSHIELD GLAZING MARKET, BY REGION, 2015-2025 ('000 UNITS)

TABLE 192 AUTOMOTIVE WINDSHIELD MARKET, BY REGION, 2015-2025 (USD MILLION)

TABLE 193 POWER SUNROOF MARKET, BY REGION, 2015-2025 ('000 UNITS)

TABLE 194 POWER SUNROOF MARKET, BY REGION, 2015-2025 (USD MILLION)

TABLE 198 JOINT VENTURE, 2016-2019

LIST OF FIGURES (63 Figures)

FIGURE 1 AUTOMOTIVE GLAZING MARKET: MARKET SEGMENTATION

FIGURE 2 RESEARCH DESIGN: MARKET

FIGURE 3 RESEARCH METHODOLOGY MODEL

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 5 MARKET FOR ON HIGHWAY VEHICLE: BOTTOM-UP APPROACH

FIGURE 6 MARKET FOR ELECTRIC VEHICLE: BOTTOM-UP APPROACH

FIGURE 7 MARKET FOR OFF-HIGHWAY VEHICLE: BOTTOM-UP APPROACH

FIGURE 8 DATA TRIANGULATION

FIGURE 9 PRE- & POST-COVID-19 SCENARIO: AUTOMOTIVE GLAZING MARKET, 2016-2025 (USD BILLION)

FIGURE 10 MARKET SHARE, 2020 (USD MILLION)

FIGURE 11 MARKET, BY REGION, 2020 VS. 2025 (USD MILLION)

FIGURE 12 INCREASING FOCUS ON DEVELOPMENT OF LIGHTWEIGHT VEHICLES AND INCREASING DEMAND FOR POLYCARBONATE IN PASSENGER CARS TO DRIVE THE AUTOMOTIVE GLAZING MARKET DURING THE FORECAST PERIOD

FIGURE 13 ADOPTION OF POLYCARBONATE IN AUTOMOTIVE LIGHTING APPLICATION PROJECTED TO DRIVE DEMAND FOR GLAZING IN FRONT AND REAR LIGHTING, 2020 VS. 2025 (USD MILLION)

FIGURE 14 STRINGENT EMISSION NORMS DRIVING DEMAND IN THE BEV SEGMENT MARKET, 2020 VS. 2025 (USD THOUSAND)

FIGURE 15 CONSTRUCTION EQUIPMENT TO LEAD THE POLYCARBONATE GLAZING MARKET DUE TO INCREASE IN THE ADOPTION OF POLYCARBONATE GLAZING IN OFF HIGHWAY VEHICLES

FIGURE 16 PASSENGER CAR SEGMENT PROJECTED TO DOMINATE THE MARKET, 2020 VS. 2025 (USD MILLION)

FIGURE 17 CHINA PROJECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE IN THE AUTOMOTIVE GLAZING MARKET BY 2025 (USD MILLION)

FIGURE 18 ASIA OCEANIA PROJECTED TO BE THE LARGEST MARKET, 2020 VS. 2025 (USD MILLION)

FIGURE 19 AUTOMOTIVE GLAZING: MARKET DYNAMICS

FIGURE 20 PRODUCTION OF PASSENGER CARS WITH SUNROOFS, BY REGION

FIGURE 21 PRICING TRENDS IN SELECT COUNTRIES FOR POLYCARBONATES IN 2018

FIGURE 22 POLYCARBONATE MANUFACTURERS AND ESTABLISHED AUTOMOTIVE GLAZING MANUFACTURERS EXPECTED TO WITNESS HIGH LEVEL OF COMPETITION

FIGURE 23 PRICING ANALYSIS: AUTOMOTIVE GLAZING MARKET

FIGURE 24 AUTOMOTIVE HUD MARKET, BY REGION 2022 VS. 2025 (USD MILLION)

FIGURE 25 VALUE CHAIN ANALYSIS: MARKET

FIGURE 26 AUTOMOTIVE PRODUCTION: PRE- VS. POST-COVID-19 SCENARIO, 2017-2025 ('000 UNITS)

FIGURE 27 MARKET BY POLYCARBONATE SCENARIO, 2017-2025 (USD MILLION)

FIGURE 28 MARKET, BY OFF-HIGHWAY VEHICLE, 2020 VS. 2025 (USD MILLION)

FIGURE 29 MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 30 MARKET, BY VEHICLE TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 31 MARKET, BY ELECTRIC VEHICLE, 2020 VS. 2025 (USD THOUSAND)

FIGURE 32 MARKET: ASIA OCEANIA ACCOUNTS FOR THE LARGEST MARKET SHARE, BY VALUE, 2020 VS. 2025 (USD MILLION)

FIGURE 33 ASIA OCEANIA: AUTOMOTIVE GLAZING MARKET SNAPSHOT

FIGURE 34 EUROPE: MARKET SNAPSHOT

FIGURE 35 NORTH AMERICA: US IS PROJECTED TO BE THE LARGEST MARKET, 2020 VS. 2025 (USD MILLION)

FIGURE 36 ROW: BRAZIL IS PROJECTED TO BE THE LARGEST MARKET,

FIGURE 37 AUTOMOTIVE GLAZING MARKET BY POLYCARBONATE ECOSYSTEM & INTERCONNECTED MARKETS

FIGURE 38 AUTOMOTIVE GLASS MARKET, BY REGION (MILLION USD)

FIGURE 39 AUTOMOTIVE LIGHTING MARKET, BY REGION, 2020 VS. 2025 (USD MILLION)

FIGURE 40 AUTOMOTIVE WINDSHIELD MARKET, BY REGION, 2017 VS. 2025 (USD MILLION)

FIGURE 41 POWER SUNROOF MARKET, BY REGION, 2017 VS. 2025 (USD MILLION)

FIGURE 42 MARKET EVALUATION FRAMEWORK

FIGURE 43 MARKET SHARE ANALYSIS, 2019

FIGURE 44 AUTOMOTIVE GLAZING MARKET RANKING ANALYSIS

FIGURE 45 TOP FIVE PLAYERS DOMINATED THE MARKET DURING THE LAST THREE YEARS

FIGURE 46 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE MARKET, 2015-2019

FIGURE 47 COMPETITIVE LEADERSHIP MAPPING: AUTOMOTIVE POLYCARBONATE GLAZING MANUFACTURERS

FIGURE 48 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MARKET

FIGURE 49 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE AUTOMOTIVE GLAZING MARKET

FIGURE 50 COVESTRO: COMPANY SNAPSHOT

FIGURE 51 COVESTRO: SWOT ANALYSIS

FIGURE 52 SABIC: COMPANY SNAPSHOT

FIGURE 53 SABIC: SWOT ANALYSIS

FIGURE 54 WEBASTO: COMPANY SNAPSHOT

FIGURE 55 WEBASTO: SWOT ANALYSIS

FIGURE 56 IDEMITSU KOSAN: COMPANY SNAPSHOT

FIGURE 57 IDEMITSU KOSAN: SWOT ANALYSIS

FIGURE 58 TEIJIN: COMPANY SNAPSHOT

FIGURE 59 TEIJIN: SWOT ANALYSIS

FIGURE 60 TRINSEO: COMPANY SNAPSHOT

FIGURE 61 TRINSEO: SWOT ANALYSIS

FIGURE 62 FREEGLASS: SWOT ANALYSIS

FIGURE 63 CHI MEI CORPORATION: COMPANY SNAPSHOT

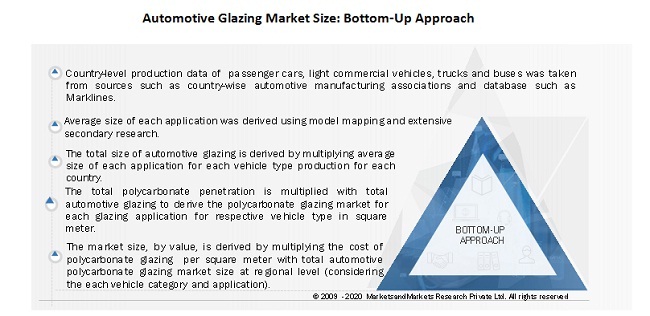

The study involves key activities to estimate the current size for the automotive glazing market. The first step defines the scope of the research study, which includes application type, vehicle type, EV type, off-highway type, and regions to be considered in the study along with the assumptions and limitations to derive the market numbers. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. The bottom-up approach has been used for market estimation and calculating the size of the automotive glazing market

Secondary Research

The secondary sources referred for this research study include company annual reports/presentations, press releases, industry association publications such as International Organization of Motor Vehicle Manufacturers (OICA), Canada Automobile Association (CAA), Europe Automobile Manufacturers Association (EAMA), investor presentations, and annual reports of key market players. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

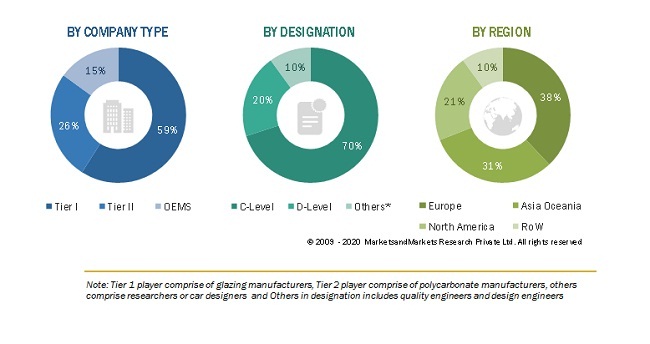

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the automotive glazing market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (OEMs) and supply-side (polycarbonate and glazing manufacturers) across major regions, namely, North America, Europe, Asia Oceania, and the Rest of the World. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interactions with industry participants, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The below figure shows the break-up of the profile of industry experts who participated in primary discussions

FIGURE 1 breakdown of primary interviews

To know about the assumptions considered for the study, download the pdf brochure

Note: Tier 1 player comprise of glazing manufacturers, Tier 2 player comprise of polycarbonate manufacturers, others comprise researchers or car designers and Others in designation includes quality engineers and design engineers

Market Size Estimation

The bottom-up approach has been used to estimate and validate the size of the automotive glazing market.

- In this approach, the vehicle production statistics for each vehicle type have been considered at a country and regional level.

- Market analysis based on industry experts and OEMs has been considered to understand overall automotive vehicle production forecasts on the post-COVID scenario.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various segments used in the automotive industry.

- Several primary interviews have been conducted with key opinion leaders related to the automotive glazing market development, including key OEMs and Tier I

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Automotive Glazing Market Size: Bottom-Up Approach

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The data was triangulated by studying various factors and trends from both the demand and supply sides in the polycarbonate glazing market.

Report Objectives

- To define and segment the automotive (polycarbonate) glazing market sizing and forecast (2016–2025) in terms of volume (thousand square meters) and value (USD Million)

- To segment the market for polycarbonate glazing and forecast the market size, by value and volume, based on application (windscreen, sidelite, backlite, sunroof, front lighting, rear lighting, and rear quarter glass)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) in the automotive glazing market

- To segment the market for polycarbonate glazing and forecast the market size, by value and volume, based on electric and hybrid vehicle type (BEV, PHEV, and FCEV)

- To segment the market for polycarbonate glazing and forecast the market size, by value and volume, based on off-highway vehicle type (agricultural tractors and construction equipment)

- To segment the market for polycarbonate glazing and forecast the market size, by value and volume, based on region (Asia Oceania, North America, Europe, and the Rest of the World)

- To understand the future market potential for polycarbonate glazing in advanced polycarbonate applications (head-up display, large windscreens, sun control, switchable glazing, and hydrophobic glazing)

- To segment the market for polycarbonate glazing and forecast the market size, by value and volume, based on vehicle type (passenger car, light commercial vehicle, bus, and truck)

- To provide detailed information about industry trends in the polycarbonate glazing market, which would include porters five forces, technology overview, and revenue impact.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive leadership mapping for market players

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To provide an analysis of the recent developments, alliances, joint ventures, and mergers & acquisitions in the polycarbonate glazing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

-

ELECTRIC & HYBRID VEHICLE GLAZING MARKET, BY APPLICATION

-

Asia Oceania

- Windscreen

- Sidelite

- Backlite

- Sunroof

- Rear quarter glass

- Front lighting

- Rear lighting

-

Europe

- Windscreen

- Sidelite

- Backlite

- Sunroof

- Rear quarter glass

- Front lighting

- Rear lighting

-

Asia Oceania

-

North America

- Windscreen

- Sidelite

- Backlite

- Sunroof

- Rear quarter glass

- Front lighting

- Rear lighting

-

RoW

- Windscreen

- Sidelite

- Backlite

- Sunroof

- Rear quarter glass

- Front lighting

- Rear lighting

-

OFF-HIGHWAY VEHICLE GLAZING MARKET, BY EQUIPMENT TYPE

- Construction equipment, by vehicle Type

- Agricultural tractors, by power output

DETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 3)

Growth opportunities and latent adjacency in Automotive Glazing Market