Automotive Closure Market for EV & ICE by Application (Power- Window, Sunroof, Tailgate, Convertible Roof, Sliding Door, and Side Door), Component (Switch, ECU, Latch, Motor/Actuator, Relay), Type (Manual and Powered), and Region - Global Forecast to 2022

The automotive closure market size is valued at USD 16.42 Billion in 2016 and is projected to grow at a CAGR of 7.75% during the forecast period. The base year considered for the study is 2016 and the forecast period is from 2017 to 2022. Automotive closure market is primarily driven by the rising consumer demand for comfort and luxury features in vehicles. Also, the market is influenced by the increasing concern towards safety/hands-free operations over manual operations. The increasing demand for premium cars across the globe is increasing the number of advanced electronics systems in vehicles.

Objectives of the Report

- To define, segment, and forecast the market (2017–2022), in terms of volume (‘000 units) and value (USD million)

- To define, describe, and project the market, by vehicle type and by application (power window, power sliding door, power side door, power tailgate, power convertible roof, and power sunroof) at country level

- To define, describe, and project the market, by component, by type, and by electric vehicle type, based on regions, namely, Asia Oceania, Europe, North America, and Rest of the World (RoW)

- To provide a detailed analysis of various forces acting in the market (drivers, restraints, opportunities, and challenges)

- To analyze the competitive leadership map for the key players based on their product offerings and business strategies to find the Dynamic Differentiators, Innovators, Visionary Leaders and Emerging Companies (DIVE) in the market

The research methodology used in the report involves primary and secondary sources and follows a bottom-up as well as a top-down approach for data triangulation. The study involves the country-level OEM and model-wise analysis of automotive closure system components. This analysis involves historical trends as well as existing penetrations by country as well as vehicle type. The analysis is projected based on various factors such as growth trends in vehicle production and adoption rate by OEMs. The analysis has been discussed and validated by primary respondents, which include experts from the automotive electronics industry, manufacturers, and suppliers. Secondary sources include associations such as International Organization of Motor Vehicle Manufacturers (OICA), American Association of Motor Vehicle Administrators (AAMVA), Automotive Component Manufacturers Association of India (ACMA), and paid databases and directories such as Factiva and Bloomberg.

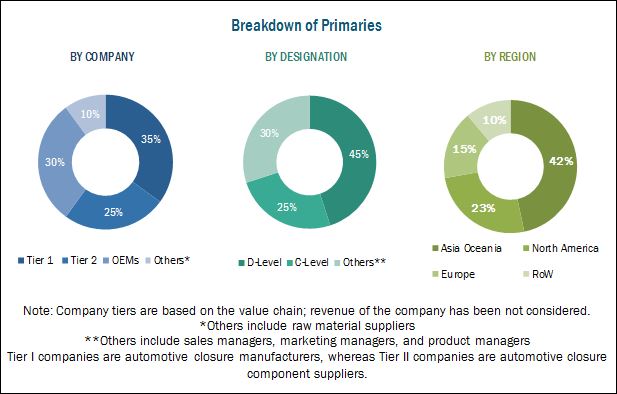

The figure given below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive closure market consists of manufacturers and service providers such as Continental AG (Germany), Magna International Inc. (Canada), Robert Bosch GmbH (Germany), and Aisin Seiki. Co. Ltd (Japan). These systems and technologies are supplied to automotive OEMs such as Volkswagen AG (Germany), General Motors (U.S.), Toyota Motor Corporation (Japan), and others.

Target Audience

- Automotive closure system manufacturers and component suppliers

- Raw material manufacturers of automotive closure system components (suppliers for Tier I)

- Automotive OEMs

- Industry associations and other body control systems manufacturers

- Government’s national and regional environmental regulatory agencies or organizations

- The automobile industry and related end-user industries

Scope of the Report

Market, By Application

Market, By Components

Market for Electric Vehicles, By Vehicle Type

Market, By Type

Market, By Region & Country

-

- Power Window

- Power Tailgate

- Power Sunroof

- Power Convertible Roof

- Power Sliding Door

- Power Side Door

-

Light-Duty Vehicles

- Switch

- ECU (Electronic Control Unit)

- Latch

- Relay

- Motor/ Actuator

- Others

-

Buses

- Switch

- ECU (Electronic Control Unit)

- Latch

- Relay

- Motor/ Actuator

- Others

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Power

- Manual

- Asia-Oceania (China, Japan, South Korea, India, and Others)

- Europe (Germany, France, Italy, UK, and Others)

- North America (US, Mexico, and Canada)

- Rest of the World (Brazil, Russia, and Others)

Available Customizations

Market for Ride Hailing, By Region

Market for Integrated Mobility Solutions, By Region

Market for Future Goods Transport Services, By Region

Market, By Module & Region

Market, By Type

Market, By EV Type & Country

(Countries include China, Japan, South Korea, India, Germany, France, UK, Italy, US, Mexico, Canada, Brazil, and Russia)

The automotive closure market is projected to grow at a CAGR of 7.75% from 2017 to 2022, and the market size is expected to grow from USD 17.43 Billion in 2017 to USD 25.31 Billion by 2022. The key drivers of this market are rising consumer demand for comfort and luxury features in vehicles, increasing complexity of mechanical operations, lightweight design of automotive closure, and demand for quiet and smooth operations. These factors lead to the increased demand for automotive closure applications in vehicles.

Passenger cars are estimated to be the largest segment of the automotive closure market, by vehicle type. The increase in vehicle production and growing demand for luxury vehicles are driving the market for automotive closure in the passenger car segment. One of the major factors for the growth of the market in the passenger car segment is the rising sales of luxury vehicles in Europe and North America. Advanced automotive closure applications such as power sunroof, side door closure system, and power convertible roof are employed in these vehicles or provided as an optional feature. Plug-in Hybrid Electric Vehicles (PHEVs) are projected to lead the market, by electric vehicle type. OEMs and Tier-1 suppliers are working on the development of components and systems that are lighter and more efficient in order to comply with the emission and fuel economy standards by converting several mechanically operated systems such as window, tailgate, and sliding door into powered.

The power sliding door application segment is projected to grow at the highest growth rate in the automotive closure market. The growth is attributed to the increasing growth of minivans in North America and Europe regions. Also, the increasing awareness about safety and security features among consumers is driving the power sliding door market. The latch segment is projected to grow at the fastest rate in the market, by component. New technologies such as hands-free opening doors, LED latches, and collision avoidance closure system had increased the production demand of technically advanced latches in automotive closure applications. Also, the growing demand for highly safe and secure automotive closure systems and the increasing production of automobiles has propelled the growth of the latches in market in near future.

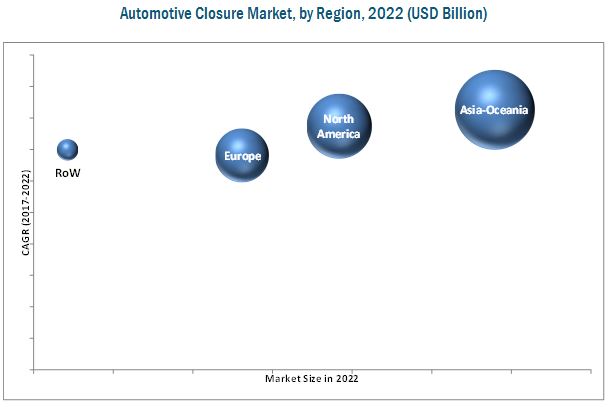

Asia Oceania is estimated to dominate the market for automotive industry, by volume as well as value. Factors such as low production costs, availability of economical labor, lenient emission and safety norms, and government initiatives for FDIs, have transformed the region into manufacturing hub in terms of vehicle production as well as sales. The demand for automotive closure is directly linked to the vehicle production and consumer demand in this region. Several European and American automobile manufacturers have shifted their production plants to developing countries in Asia-Oceania. The Chinese and Indian market is the largest market, is seeing growth in sales and demand for premium vehicles during past few years. All this will lead to growth of market in this region during the forecast period.

A key factor restraining the growth of the automotive closure market is the higher cost of electronic system components. Advanced electronic systems involve high development cost. This means that the companies have to invest heavily in research and development for developing and testing advanced electronic systems. The high costs involved are restraining the adoption of the automotive closure by OEMs. The market is dominated by a few global players. Some of the key manufacturers operating in the market are Continental AG (Germany), Magna International Inc. (Canada), Aisin Seiki Co., Ltd. (Japan), Robert Bosch GmbH (Germany), and Denso Corporation (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

- Power Window

- Power Tailgate

- Power Door

- Manual

- Power

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered in the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Data From Secondary Sources

2.4 Primary Data

2.4.1 Sampling Techniques & Data Collection Methods

2.4.2 Primary Participants

2.5 Factor Analysis

2.5.1 Introduction

2.5.1.1 Increasing Vehicle Electrification Influencing the Automotive Closure Market

2.5.1.2 Flourishing Automotive Industry in Southeast Asia

2.5.2 Supply Side Analysis

2.5.2.1 Demand for Low-Density Materials in Power Closures System in Order to Minimize the Cabin Space

2.6 Market Size Estimation

2.6.1 Bottom-Up Approach

2.6.2 Top-Down Approach

2.7 Data Triangulation

2.8 Assumptions

3 Executive Summary (Page No. - 35)

4 Premium Insights (Page No. - 42)

4.1 Attractive Opportunities in the Automotive Closure Market

4.2 Market, By Region

4.3 Market, By Application

4.4 Manual Closure Market, By Application

4.5 Market for Light-Duty Vehicles, By Component

4.6 Market for Buses, By Component

4.7 Market, By Electric Vehicle Type

4.8 Market, By Type & Vehicle Type

4.9 IC Engine Vehicles Equipped With Automotive Closure, By Country

4.10 Electric Vehicles Equipped With Automotive Closure for Key Countries

5 Automotive Closure Market Overview (Page No. - 51)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Demand for Comfort and Luxury is Driving the Sales of Premium-Segment Vehicles

5.2.1.1.1 Rising Demand for Premium-Segment Vehicles

5.2.1.1.2 Growth in Hybrid Electric Vehicles (HEV) and Plug-In Hybrid Electric Vehicles (PHEV) Sales

5.2.1.2 Increased Focus Toward Safety/Hands-Free Operations

5.2.2 Restraints

5.2.2.1 High Cost of the System

5.2.3 Opportunities

5.2.3.1 Biometric Vehicle Access System

5.2.3.2 Future Mobility Solutions: Autonomous Cars, Integrated Mobility Solutions, & Automated Deliveries

5.2.4 Challenges

5.2.4.1 Fail-Safe Electronics

5.2.4.2 Use of Lightweight Material in Automotive Closure

5.3 Future Technologies

5.3.1 Hands-Free Smart Boot

5.3.2 Soft Door Closure

5.3.3 E-Latch

6 Manual Closure Market, By Application, Vehicle Type & Region (Page No. - 60)

6.1 Introduction

6.2 Manual Closure Market, By Region

6.3 Manual Closure Market, By Application & Vehicle Type

6.3.1 Asia Oceania: Manual Closure Market, By Application & Vehicle Type

6.3.2 Europe: Manual Closure Market, By Application & Vehicle Type

6.3.3 North America: Manual Closure Market, By Application & Vehicle Type

6.3.4 Rest of the World: Manual Closure Market, By Application & Vehicle Type

7 Automotive Closure Market, By Component, Vehicle Type & Region (Page No. - 74)

7.1 Introduction

7.2 Market for Light-Duty Vehicles, By Component & Region

7.2.1 Switch Market for Light-Duty Vehicles, By Region

7.2.2 Electronic Control Unit (ECU) Market for Light Duty Vehicles, By Region

7.2.3 Latch Market for Light-Duty Vehicles, By Region

7.2.4 Motor/Actuator Market for Light Duty Vehicles, By Region

7.2.5 Relay Market for Light-Duty Vehicles, By Region

7.2.6 Other Components Market for Light-Duty Vehicles, By Region

7.3 Market for Buses, By Component & Region

8 Automotive Closure Market for Electric Vehicles, By Application & Vehicle Type (Page No. - 86)

8.1 Introduction

8.2 Market for Electric Vehicles, By Application

8.2.1 Hybrid Electric Vehicle (HEV)

8.2.2 Plug-In Hybrid Electric Vehicle (PHEV)

8.2.3 Battery Electric Vehicle (BEV)

8.3 Power Window Market, By Electric Vehicle Type

8.4 Power Tailgate Market, By Electric Vehicle Type

8.5 Power Sunroof Market, By Electric Vehicle Type

9 Automotive Closure Market, By Application, Vehicle Type & Country (Page No. - 92)

9.1 Introduction

9.2 Market, By Region

9.2.1 Market, By Application & Vehicle Type

9.3 Asia Oceania: Market, By Application, Vehicle Type & Country

9.3.1 Asia Oceania: Market, By Country

9.3.2 Asia Oceania: Market, By Vehicle Type

9.3.3 Asia Oceania: Market, By Application, & Vehicle Type

9.3.3.1 China: Market, By Application & Vehicle Type

9.3.3.2 India: Market, By Application & Vehicle Type

9.3.3.3 Japan: Market, By Application & Vehicle Type

9.3.3.4 South Korea: Market, By Application& Vehicle Type

9.3.3.5 Rest of Asia Oceania: Market, By Application & Vehicle Type

9.4 Europe: Automotive Closure Market, By Application, Vehicle Type & Country

9.4.1 Europe: Market, By Country

9.4.2 Europe: Market, By Vehicle Type

9.4.3 Europe: Market, By Application & Vehicle Type

9.4.3.1 Germany: Market, By Application & Vehicle Type

9.4.3.2 France: Market, By Application & Vehicle Type

9.4.3.3 UK: Market, By Application & Vehicle Type

9.4.3.4 Italy: Market, By Application & Vehicle Type

9.4.3.5 Rest of Europe: Market, By Application & Vehicle Type

9.5 North America: Market, By Application, Vehicle Type & Country

9.5.1 North America: Market, By Country

9.5.2 North America: Market, By Vehicle Type

9.5.3 North America: Market, By Application & Vehicle Type

9.5.3.1 US: Market, By Application & Vehicle Type

9.5.3.2 Canada: Market, By Application & Vehicle Type

9.5.3.3 Mexico: Market, By Application & Vehicle Type

9.6 Rest of the World: Market, By Application, Vehicle Type & Country

9.6.1 Rest of the World: Market, By Country

9.6.2 Rest of the World: Market, By Vehicle Type

9.6.3 Rest of the World: Market, By Application & Vehicle Type

9.6.3.1 Brazil: Market, By Application & Vehicle Type

9.6.3.2 Russia: Market, By Application & Vehicle Type

9.6.3.3 Others: Automotive Closure Market, By Application & Vehicle Type

10 Competitive Landscape (Page No. - 149)

10.1 Introduction

10.1.1 Visionary Leaders

10.1.2 Innovators

10.1.3 Dynamic Differentiators

10.1.4 Emerging Companies

10.2 Automotive Closure Suppliers: Market Ranking

10.3 Competitive Benchmarking

10.3.1 Strength of Product Portfolio for Automotive Closure Market (For All 24 Players)

10.3.2 Business Strategy Excellence for Market (For All 24 Players)

*Top 24 Companies Analyzed for This Study are – Continental AG, Denso Corporation, Delphi Automotive PLC, Magna International Inc., Aisin Seiki Co., Ltd., Johnson Electric, Mitsuba Corporation, Mitsui Kinzoku Act Corporation, U-Shin Ltd., Edscha AG, Omron Corporation, Huf Hulsbeck & Furst GmbH & Co. Kg, Stabilus SA, Hella KGaA Hueck & Co, Kiekert AG, WUHU Motiontec Automotive Co., Ltd, Robert Bosch GmbH, Nidec Corporation, Mabuchi Motor Co., Ltd., Valeo SA, Hi-Lex Corporation, Panasonic Corporation, Visteon Corporation, Acdelco

11 Company Profiles (Page No. - 155)

(Company Overview, Strength of Product Portfolio, Product Offerings, Business Strategy Excellence, Recent Developments)*

11.1 Continental AG

11.2 Denso Corporation

11.3 Magna International Inc.

11.4 Aisin Seiki Co., Ltd.

11.5 Johnson Electric

11.6 Omron Corporation

11.7 Robert Bosch GmbH

11.8 Panasonic Corporation

11.9 Delphi Automotive PLC

11.10 Mitsuba Corporation

11.11 Valeo SA

11.12 Hella KGaA Hueck & Co.

11.13 Visteon Corporation

*Details on Company Overview, Strength of Product Portfolio, Product Offerings, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 197)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.5.1 Automotive Closure Market for Ride Hailing, By Region

12.5.1.1 Asia Oceania

12.5.1.2 Europe

12.5.1.3 North America

12.5.1.4 Rest of the World

12.5.2 Market for Integrated Mobility Solutions, By Region

12.5.2.1 Asia Oceania

12.5.2.2 Europe

12.5.2.3 North America

12.5.2.4 Rest of the World

12.5.3 Market for Future Goods Transport Services, By Region

12.5.3.1 Asia Oceania

12.5.3.2 Europe

12.5.3.3 North America

12.5.3.4 Rest of the World

12.5.4 Market, By Module (Regional Level)

12.5.4.1 Asia Oceania

12.5.4.2 Europe

12.5.4.3 North America

12.5.4.4 Rest of the World

12.5.5 Automotive Closures Market, By Type (Country Level)

12.5.6 Market, By Electric Vehicle Type (Country Level)

12.6 Related Reports

12.7 Author Details

List of Tables (108 Tables)

Table 1 Currency Exchnage Rates (W.R.T. USD)

Table 2 Percentage Mass Reduction With Lightweight Automotive Materials

Table 3 Weight Reduction in Key Models

Table 4 IC Engine Vehicles Equipped With Automotive Closure, By Country

Table 5 Electric Vehicles Equipped With Automotive Closure for Key Countries

Table 6 Change in the Sales of Premium Cars From 2015 to 2016, By Country

Table 7 Luxury Passenger Car Sales By Key Manufacturers in Select Countries, 2015 vs 2016

Table 8 Manual Closure Market Size, By Region, 2015–2022 (‘000 Units)

Table 9 Manual Closure Market Size, By Region, 2015–2022 (USD Million)

Table 10 Manual Closure Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 11 Manual Closure Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 12 Asia Oceania: Manual Closure Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 13 Asia Oceania: Manual Closure Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 14 Europe: Manual Closure Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 15 Europe: Manual Closure Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 16 North America: Manual Closure Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 17 North America: Manual Closure Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 18 Rest of the World: Manual Closure Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 19 Rest of the World: Manual Closure Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 20 Automotive Closure Market Size for Light-Duty Vehicles, By Component, 2015–2022 (‘000 Units)

Table 21 Market Size for Light-Duty Vehicles, By Component, 2015–2022 (USD Million)

Table 22 Market Size for Light-Duty Vehicles, By Region, 2015–2022 (‘000 Units)

Table 23 Market Size for Light-Duty Vehicles, By Region, 2015–2022 (USD Million)

Table 24 Switch Market Size for Light-Duty Vehicles, By Region, 2015–2022 (‘000 Units)

Table 25 Switch Market Size for Light-Duty Vehicles, By Region, 2015–2022 (USD Million)

Table 26 Electronic Control Unit (ECU) Market Size for Light-Duty Vehicles, By Region, 2015–2022 (‘000 Units)

Table 27 Electronic Control Unit (ECU) Market Size for Light-Duty Vehicles, By Region, 2015–2022 (USD Million)

Table 28 Latch Market Size for Light-Duty Vehicles, By Region, 2015–2022 (‘000 Units)

Table 29 Latch Market Size for Light-Duty Vehicles, By Region, 2015–2022 (USD Million)

Table 30 Motor/Actuator Market Size for Light-Duty Vehicles, By Region, 2015–2022 (‘000 Units)

Table 31 Motor/Actuator Market Size for Light-Duty Vehicles, By Region, 2015–2022 (USD Million)

Table 32 Relay Market Size for Light-Duty Vehicles, By Region, 2015–2022 (‘000 Units)

Table 33 Relay Market Size for Light-Duty Vehicles, By Region, 2015–2022 (USD Million)

Table 34 Other Components Market Size for Light-Duty Vehicles, By Region, 2015–2022 (‘000 Units)

Table 35 Other Components Market Size for Light-Duty Vehicles, By Region, 2015–2022 (USD Million)

Table 36 Automotive Closure Market Size for Buses, By Component, 2015–2022 (‘000 Units)

Table 37 Market Size for Buses, By Component, 2015–2022 (USD Million)

Table 38 Market Size for Electric Vehicles, By Vehicle Type, 2015–2022 (‘000 Units)

Table 39 Market Size for Electric Vehicles, By Vehicle Type, 2015–2022 (USD Million)

Table 40 Power Window Market Size, By Electric Vehicle Type, 2015–2022 (‘000 Units)

Table 41 Power Window Market Size, By Electric Vehicle Type, 2015–2022 (USD Million)

Table 42 Power Tailgate Market Size, By Electric Vehicle Type, 2015–2022 (‘000 Units)

Table 43 Power Tailgate Market Size, By Electric Vehicle Type, 2015–2022 (USD Million)

Table 44 Power Sunroof Market Size, By Electric Vehicle Type, 2015–2022 (‘000 Units)

Table 45 Power Sunroof Market Size, By Electric Vehicle Type, 2015–2022 (USD Million)

Table 46 Market Size, By Region, 2015–2022 (‘000 Units)

Table 47 Market Size, By Region, 2015–2022 (USD Million)

Table 48 Market Size, By Vehicle Type, 2015–2022 (‘000 Units)

Table 49 Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 50 Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 51 Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 52 Asia Oceania: Market Size, By Country, 2015–2022 (‘000 Units)

Table 53 Asia Oceania: Market Size, By Country, 2015–2022 (USD Million)

Table 54 Asia Oceania: Market Size, By Vehicle Type, 2015–2022 (‘000 Units)

Table 55 Asia Oceania: Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 56 Asia Oceania: Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 57 Asia Oceania: Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 58 China: Automotive Closure Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 59 China: Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 60 India: Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 61 India: Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 62 Japan: Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 63 Japan: Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 64 South Korea: Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 65 South Korea: Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 66 Rest of Asia Oceania: Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 67 Rest of Asia Oceania: Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 68 Europe: Market Size, By Country, 2015–2022 (‘000 Units)

Table 69 Europe: Market Size, By Country, 2015–2022 (USD Million)

Table 70 Europe: Market Size, By Vehicle Type, 2015–2022 (‘000 Units)

Table 71 Europe: Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 72 Europe: Market Size, By Application & Vehicle Type, 2015-2022 (‘000 Units)

Table 73 Europe: Market Size, By Application & Vehicle Type, 2015-2022 (USD Million)

Table 74 Germany: Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 75 Germany: Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 76 France: Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 77 France: Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 78 UK: Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 79 UK: Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 80 Italy:Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 81 Italy: Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 82 Rest of Europe: Automotive Closure Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 83 Rest of Europe: Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 84 North America: Market Size, By Country, 2015–2022 (‘000 Units)

Table 85 North America: Market Size, By Country, 2015–2022 (USD Million)

Table 86 North America: Market Size, By Vehicle Type, 2015–2022 (‘000 Units)

Table 87 North America: Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 88 North America: Market Size, By Application & Vehicle Type, 2015-2022 (‘000 Units)

Table 89 North America: Market Size, By Application & Vehicle Type, 2015-2022 (USD Million)

Table 90 US: Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 91 US: Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 92 Canada: Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 93 Canada: Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 94 Mexico: Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 95 Mexico: Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 96 Rest of the World: Market Size, By Country, 2015–2022 (‘000 Units)

Table 97 Rest of the World: Market Size, By Country, 2015–2022 (USD Million)

Table 98 Rest of the World: Market Size, By Vehicle Type, 2015–2022 (‘000 Units)

Table 99 Rest of the World: Market Size, By Vehicle Type, 2015–2022 (USD Million)

Table 100 Rest of the World: Market Size, By Application & Vehicle Type, 2015-2022 (‘000 Units)

Table 101 Rest of the World: Market Size, By Application & Vehicle Type, 2015-2022 (USD Million)

Table 102 Brazil: Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 103 Brazil: Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 104 Russia: Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 105 Russia: Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 106 Others: Market Size, By Application & Vehicle Type, 2015–2022 (‘000 Units)

Table 107 Others: Market Size, By Application & Vehicle Type, 2015–2022 (USD Million)

Table 108 Automotive Closure Suppliers: Market Ranking, 2016

List of Figures (45 Figures)

Figure 1 Automotive Closure Market: Research Design

Figure 2 Research Methodology Model

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Increasing Demand for Automotive Closure in Passenger Cars, 2015 vs 2016

Figure 5 Vehicle Production in South East Asian Countries, 2015 vs 2016

Figure 6 Market: Bottom-Up Approach

Figure 7 Market: Top-Down Approach

Figure 8 Market, By Application, 2017 vs 2022 (USD Million)

Figure 9 Market, By Vehicle Type, 2017 vs 2022 (USD Million)

Figure 10 Market, By Country, 2017–2022 (USD Million)

Figure 11 Automotive Closure Manual vs Market, 2017 vs 2022 (USD Million)

Figure 12 Automotive Closure Market, By Electric Vehicle Type, 2017 vs 2022 (USD Million)

Figure 13 Market for Light-Duty Vehicles, By Component, 2017 vs 2022 (USD Million)

Figure 14 Increasing Focus Toward Safety, Security, & Hands-Free Operation to Drive the Market During the Forecast Period

Figure 15 Asia Oceania to Hold the Largest Share in the Market, 2017 vs 2022 (USD Billion)

Figure 16 Power Window Segment to Hold the Largest Market Size in the Market, 2017 vs 2022 (USD Billion)

Figure 17 Side Door Segment to Lead in the Manual Closure Market, 2017 vs 2022 (USD Billion)

Figure 18 Motor/Actuator to Lead the Market, 2017 vs 2022 (USD Million)

Figure 19 Motor/Actuator to Have the Largest Market in the Market, 2017 vs 2022 (USD Million)

Figure 20 Hybrid Electric Vehicle (HEV) Segment to Have the Largest Size in the Market, 2015–2022 (USD Million)

Figure 21 Passenger Car Segment to Have the Largest Market Size in the Market, 2017 vs 2022 (USD Billion)

Figure 22 Market: Market Dynamics

Figure 23 Global HEV & PHEV Sales, 2015 vs 2022 (Units)

Figure 24 Global Number of Motor Vehicle Theft, 2010–2016 (Million)

Figure 25 Increasing Biometric Vehicle Access Applications: an Opportunity for Automotive Closure Manufacturers

Figure 26 Region-Wise Snapshot of the Manual Closure Market, 2017 vs 2022, (Value): Asia Oceania Accounts for the Largest Market Size

Figure 27 Automotive Closure Market, By Component, 2017 vs 2022

Figure 28 Market for Electric Vehicles, By Application, 2017 vs 2022

Figure 29 Market, By Region, 2017 vs 2022 (USD Million)

Figure 30 Asia Oceania: Market Snapshot, 2017

Figure 31 North America: Market Snapshot, 2017

Figure 32 Automotive Closure Suppliers: Competitor Leadership Mapping, 2016

Figure 33 Continental AG: Company Snapshot

Figure 34 Denso Corporation: Company Snapshot

Figure 35 Magna International Inc.: Company Snapshot

Figure 36 Aisin Seiki Co., Ltd.: Company Snapshot

Figure 37 Johnson Electric: Company Snapshot

Figure 38 Omron Corporation: Company Snapshot

Figure 39 Robert Bosch GmbH: Company Snapshot

Figure 40 Panasonic Corporation: Company Snapshot

Figure 41 Delphi Automotive PLC: Company Snapshot

Figure 42 Mitsuba Corporation: Company Snapshot

Figure 43 Valeo SA: Company Snapshot

Figure 44 Hella KGaA Hueck & Co.: Company Snapshot

Figure 45 Visteon Corporation: Company Snapshot

Growth opportunities and latent adjacency in Automotive Closure Market