Polyphenylene Sulfide Market by Application (Automotive, Electrical & Electronics, Filter Bags, Aerospace, Industrial, Coatings, and Others) and by Region (Asia-Pacific, North America, Europe, and Row) - Global Forecast to 2020

[121 Pages Report] The global Polyphenylene Sulfide (PPS) market size is estimated to reach USD 1,574.7 Million by 2020 at a CAGR of 9.6% between 2015 and 2020. The report segments the polyphenylene sulfide market by application into automotive, electrical & electronics, filter bags, aerospace, industrial, coatings, and others, and by region into Asia-Pacific, North America, Europe, and RoW. Base year considered for the study is 2014, while the forecast period is between 2015 and 2020.

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global market and to estimate the sizes of various other dependent submarkets in the overall polyphenylene sulfide market. The research study involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government and private websites to identify and collect information useful for the technical, market-oriented, and commercial study of the global PPS market.

The value chain of polyphenylene sulfide market starts with the sourcing of basic raw materials, manufacturing, compounding, and used for various end-use applications. Raw material suppliers are the para-dichlorobenzene and sodium sulfide or sodium hydrogen sulfide manufacturers and suppliers. Various companies, such as DIC Corp., Kureha Corp., Toray Industries, Fortron Industries LLC (joint venture of Kureha Corp. and Celeanse Corp.), Tosoh Corp. manufacture PPS resins. PPS resins should be reinforced by compounding with glass fiber, mineral reinforcements, or any other engineering plastic/polymer, as these are brittle. Companies have integrated facilities for in-house compounding, but there are also a few companies that have only compounding facilities. Development of newer technology shall also be an opportunity for the PPS market. SK. Chemicals has developed a new manufacturing process that is halogen-free and eco-friendly. Initz Co. Ltd, a joint venture between SK Chemicals and Teijin Ltd., uses this patented manufacturing process.

Key Target Audience:

- Raw material suppliers

- PPS resin manufacturers

- PPS compounders

- Traders, distributors, and PPS suppliers

- Government and regional agencies and research organizations

- Investment research firms

Scope of the Report:

This research report categorizes the global polyphenylene sulfide market on the basis of application and region.

On the basis of application:

- Automotive

- Electrical & electronics

- Industrial

- Filter bags

- Aerospace

- Coatings

- Other applications (sterilizable medical, dental, and laboratory equipment, hair dryer grills, and components)

On the basis of region:

- North America

- Europe

- Asia-Pacific

- RoW

The polyphenylene sulfide market is further analyzed for the key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Geographic Analysis:

- Country-level analysis of the PPS market by application.

Company Information:

- Detailed analysis and profiling of additional market players.

The global Polyphenylene Sulfide (PPS) market is estimated to reach USD 1,574.7 Million by 2020, registering a CAGR of 9.6% between 2015 and 2020. The polyphenylene sulfide market is driven by increasing demand for PPS in emerging markets and high demand from the automotive, electrical & electronics and filter bag application segments. PPS has unique properties, such as high temperature resistance, chemical resistance, flame retardancy, good electrical properties, and high dimensional stability, for which it is widely used in harsh fire-prone chemical environments.

PPS is used in various applications, such as automotive, electrical & electronics, filter bags, aerospace, industrial, coatings, and others. In 2014, the automotive segment accounted for the largest market share, in terms of volume, followed by filter bags and electrical & electronics. PPS is used in the automotive industry for manufacturing under-the-hood components, including engines and auto body parts operating under high temperature and pressure environments. PPS is resistant to fuel and transmission & brake fluids at high temperatures. Automotive components such as fuel system parts, induction systems, coolant systems, lighting components, and electrical & electronic components are made from PPS. Increasing industrialization in emerging countries of Asia-Pacific is driving the polyphenylene sulfide market in automotive application. North America accounted for the second largest market share in the automotive application segment in 2014.

PPS is used for manufacturing filter and filter bags used in coal-fired powered fire stations and dust chamber filters in incinerators. PPS can withstand both acidic environment and high temperature in coal-fired power plants. They are also cheaper than other fibers such as PTFE, aramid, and polyamides. Moreover, PPS filter bags have service life of three years in comparison to six months for glass fiber. This helps power plants significantly reduce operating costs along with downtime for maintenance activities. The filter bags application segment is projected to witness the highest CAGR between 2015 and 2020, in terms of value, closely followed by the aerospace application. With stringent regulations levied for particulate matter emissions from power plants, the need for PPS filter bags has increased, which have higher efficiencies. Also, the filter bag replacement market shall drive the filter bags application segment.

Improving economies coupled with increased demand from the automotive, electrical & electronics, and filter bags application boost the market in Asia-Pacific. The region accounts for a major share in the polyphenylene sulfide market and is the largest producer of PPS globally. China is the largest market for PPS, but depends on imports for meeting its demand. Key market players are expanding their reach in the country by installing compounding plants. The local players are also projected to expand their manufacturing capacities owing to increasing demand for PPS.

Japan is the largest producer of PPS resins worldwide with the presence of manufacturing sites of major industry players in the country. Japan and the U.S. have majority of the PPS resins manufacturing plants. These countries have been manufacturing more than their demand, thus creating an oversupply in the market. Currently, the Japanese companies are expanding their production capacities and reach in China with new capacities. DIC Corp. is set to have a new compounding facility in China, which is the largest market for PPS globally. With the available global capacity, industry players have been operating at low operating rates providing future expansion opportunities, depending on the growing demand. Hence, with further expansions in China, the overcapacity of PPS may create demand-supply gap, thus restricting growth of the global polyphenylene sulfide market.

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Polyphenylene Sulfide Market Scope

1.2.1 Market Definition

1.3 Markets Covered

1.3.1 Years Considered for the Study

1.3.2 Currency

1.3.3 Package Size

1.3.4 Limitations

1.4 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

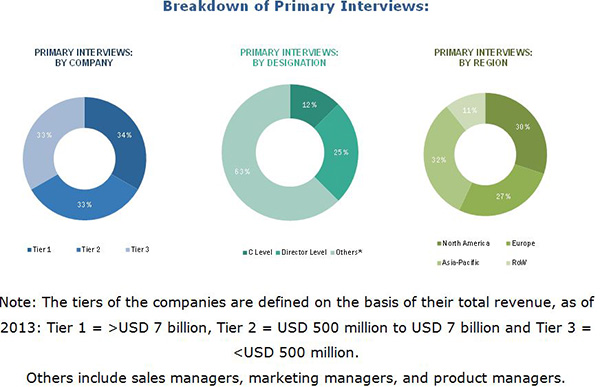

2.1.2.3 Breakdown of Primary Interviews

2.2 Polyphenylene Sulfide Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities for PPS

4.2 Industry Life Cycle Analysis of PPS in Different Regions

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Polyphenylene Sulfide Market Segmentation

5.2.1 By Application

5.2.2 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growth in Electric and Hybrid Vehicles Market

5.3.1.2 Increasing Consumption in Filter and Filter Bag Applications

5.3.1.3 Replacement of Conventional Materials

5.3.2 Restraints

5.3.2.1 Capacity Build and Oversupply

5.3.3 Opportunities

5.3.3.1 New Product Developments

5.3.4 Challenges

5.3.4.1 Halogen-Free, Ecofriendly, and Low-Emission PPS

6 Industry Trends (Page No. - 38)

6.1 Introduction

6.2 Value-Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Threat of New Entrants

6.3.3 Threat of Substitutes

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Rivalry

6.4 Production Capacities

7 Polyphenylene Sulfide Market, By Application (Page No. - 44)

7.1 Introduction

7.2 Automotive

7.3 Electrical & Electronics

7.4 Industrial

7.5 Filter Bags

7.6 Aerospace

7.7 Coatings

7.8 Other Applications

8 Polyphenylene Sulfide Market, By Region (Page No. - 59)

8.1 Introduction

8.2 North America

8.2.1 U.S.

8.2.2 Rest of North America

8.3 Europe

8.3.1 Germany

8.3.2 U.K.

8.3.3 Italy

8.3.4 France

8.3.5 Rest of Europe

8.4 Asia-Pacific

8.4.1 China

8.4.2 Japan

8.4.3 India

8.4.4 South Korea

8.4.5 Rest of Asia-Pacific

8.5 RoW

8.5.1 South America

8.5.2 Middle East & Africa

9 Competitive Landscape (Page No. - 91)

9.1 Overview

9.2 Competitive Situation and Trends

9.3 Expansions: Most Popular Growth Strategy Between 2011 and 2015

9.3.1 Expansions, 2011-2015

9.3.2 New Product Development

9.3.3 Joint Ventures/Acquisitions

9.3.4 Agreements

10 Company Profiles (Page No. - 96)

(Overview, Financial*, Products & Services, Strategy, and Developments)

10.1 Introduction

10.2 Solvay SA

10.3 Tosoh Corporation

10.4 DIC Corporation

10.5 Toray Industries Inc.

10.6 Kureha Corporation

10.7 Fortron Industries LLC

10.8 Initz Co. Ltd.

10.9 China Lumena New Materials Corporation

10.10 Zhejiang Nhu Special Materials Co. Ltd.

10.11 Lion Idemitsu Composites Co. Ltd.

*Details Might Not Be Captured in Case of Unlisted Companies

11 Appendix (Page No. - 117)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Introducing RT: Real Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

List of Tables (71 Tables)

Table 1 Polyphenylene Sulfide Market, By Application

Table 2 Particulate Matter Emission Standards

Table 3 Polyphenylene Sulfide Installed Capacity, Kiloton

Table 4 Polyphenylene Sulfide Market Size, By Application, 2013-2020 (Ton)

Table 5 PPS Market Size, By Application, 2013-2020 (USD Million)

Table 6 Market Size in Automotive, By Region, 2013-2020 (Ton)

Table 7 PPS Market Size in Automotive, By Region, 2013-2020 (USD Million)

Table 8 Polyphenylene Sulfide Market Size in Electrical & Electronics, By Region, 2013-2020 (Ton)

Table 9 PPS Market Size in Electrical & Electronics, By Region, 2013-2020 (USD Million)

Table 10 Polyphenylene Sulfide Market Size in Industrial, By Region, 2013-2020 (Ton)

Table 11 Polyphenylene Sulfide Market Size in Industrial, By Region, 2013-2020 (USD Million)

Table 12 Polyphenylene Sulfide Market Size in Filter Bags, By Region, 2013-2020 (Ton)

Table 13 Polyphenylene Sulfide Market Size in Filter Bags, By Region, 2013-2020 (USD Million)

Table 14 Polyphenylene Sulfide Market Size in Aerospace, By Region, 2013-2020 (Ton)

Table 15 PPS Market Size in Aerospace, By Region, 2013-2020 (USD Million)

Table 16 Polyphenylene Sulfide Market Size in Coatings, By Region, 2013-2020 (Ton)

Table 17 Polyphenylene Sulfide Market Size in Coatings, By Region, 2013-2020 (USD Million)

Table 18 Polyphenylene Sulfide Market Size in Other Applications By Region, 2013-2020 (Ton)

Table 19 Polyphenylene Sulfide Market Size in Other Applications, By Region, 2013-2020 (USD Million)

Table 20 Polyphenylene Sulfide Market Size, By Region, 2013-2020 (Ton)

Table 21 PPS Market Size, By Region, 2013-2020 (USD Million)

Table 22 Polyphenylene Sulfide Market Size, By Application, 2013-2020 (Ton)

Table 23 Polyphenylene Sulfide Market Size, By Application, 2013-2020 (USD Million)

Table 24 North America: Polyphenylene Sulfide Market Size, By Country, 2013-2020 (Ton)

Table 25 North America: Polyphenylene Sulfide Market Size, By Country, 2013-2020 (USD Million)

Table 26 North America: Polyphenylene Sulfide Market Size, By Application, 2013-2020 (Ton)

Table 27 North America: Polyphenylene Sulfide Market Size, By Application, 2013-2020 (USD Million)

Table 28 U.S.: Polyphenylene Sulfide Market Size, By Application, 2013-2020 (Ton)

Table 29 U.S.: PPS Market Size, By Application, 2013-2020 (USD Million)

Table 30 Rest of North America: Polyphenylene Sulfide Market Size, By Application, 2013-2020 (Ton)

Table 31 Rest of North America: Polyphenylene Sulfide Market Size, By Application, 2013-2020 (USD Million)

Table 32 Europe: Polyphenylene Sulfide Market Size, By Country, 2013-2020 (Ton)

Table 33 Europe: Polyphenylene Sulfide Market Size, By Country, 2013-2020 (USD Million)

Table 34 Europe: Polyphenylene Sulfide Market Size, By Application, 2013-2020 (Ton)

Table 35 Europe: Polyphenylene Sulfide Market Size, By Application, 2013-2020 (USD Million)

Table 36 Germany: Polyphenylene Sulfide Market Size, By Application, 2013-2020 (Ton)

Table 37 Germany: Polyphenylene Sulfide Market Size, By Application, 2013-2020 (USD Million)

Table 38 U.K.: Polyphenylene Sulfide Market Size, By Application, 2013-2020 (Ton)

Table 39 U.K.: Polyphenylene Sulfide Market Size, By Application, 2013-2020 (USD Million)

Table 40 Italy: Polyphenylene Sulfide Market Size, By Application, 2013-2020 (Ton)

Table 41 Italy: Polyphenylene Sulfide Market Size, By Application, 2013-2020 (USD Million)

Table 42 France: PPS Market Size, By Application, 2013-2020 (Ton)

Table 43 France: Polyphenylene Sulfide Market Size, By Application, 2013-2020 (USD Million)

Table 44 Rest of Europe: Polyphenylene Sulfide Market Size, By Application, 2013-2020 (Ton)

Table 45 Rest of Europe: Polyphenylene Sulfide Market Size, By Application, 2013-2020 (USD Million)

Table 46 Asia-Pacific: Polyphenylene Sulfide Market Size, By Country, 2013-2020 (Ton)

Table 47 Asia-Pacific: Polyphenylene Sulfide Market Size, By Country, 2013-2020 (USD Million)

Table 48 Asia-Pacific: PPS Market Size, By Application, 2013-2020 (Ton)

Table 49 Asia-Pacific: Polyphenylene Sulfide Market Size, By Application, 2013-2020 (USD Million)

Table 50 China: Market Size, By Application, 2013-2020 (Ton)

Table 51 China: Market Size, By Application, 2013-2020 (USD Million)

Table 52 Japan: Market Size, By Application, 2013-2020 (Ton)

Table 53 Japan: Market Size, By Application, 2013-2020 (USD Million)

Table 54 India: Market Size, By Application, 2013-2020 (Ton)

Table 55 India: Market Size, By Application, 2013-2020 (USD Million)

Table 56 South Korea: Market Size, By Application, 2013-2020 (Ton)

Table 57 South Korea: Market Size, By Application, 2013-2020 (USD Million)

Table 58 Rest of Asia-Pacific: Market Size, By Application, 2013-2020 (Ton)

Table 59 Rest of Asia-Pacific: Market Size, By Application, 2013-2020 (USD Million)

Table 60 RoW: Polyphenylene Sulfide Market Size, 2013-2020 (Ton)

Table 61 RoW: Market Size, 2013-2020 (USD Million)

Table 62 RoW: Market Size, By Application, 2013-2020 (Ton)

Table 63 RoW: Market Size, By Application, 2013-2020 (USD Million)

Table 64 South America: Market Size, By Application, 2013-2020 (Ton)

Table 65 South America: Market Size, By Application, 2013-2020 (USD Million)

Table 66 Middle East & Africa: Market Size, By Application, 2013-2020 (Ton)

Table 67 Middle East & Africa: Market Size, By Application, 2013-2020 (USD Million)

Table 68 Expansions, 2011–2015

Table 69 New Product Development, 2011–2015

Table 70 Joint Venture/Acquisitions, 2011-2015

Table 71 Agreements, 2011-2015

List of Figures (48 Figures)

Figure 1 Polyphenylene Sulfide Market Segmentation: By Application and Region

Figure 2 PPS Market: Research Methodology

Figure 3 Breakdown of Primary Interviews

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation: Polyphenylene Sulfide Market

Figure 7 Automotive Projected to Be the Dominant Application of PPS Between 2015 and 2020

Figure 8 Asia-Pacific Projected to Dominant the PPS Market Between 2015 and 2020

Figure 9 Asia-Pacific Led the Polyphenylene Sulfide Market in 2014

Figure 10 PPS Market Size, 2015 vs 2020 (USD Million)

Figure 11 China to Be the Largest Market for PPS and Filter Bags to Be the Largest Application in the Asia-Pacific, 2015–2020

Figure 12 Asia-Pacific Projected to Dominate the Global PPS Market, 2015–2020

Figure 13 PPS Market: Life Cycle Analysis

Figure 14 Polyphenylene Sulfide Market, By Region

Figure 15 Polyphenylene Sulfide Market Dynamics

Figure 16 Portfolio of Engineering Plastics

Figure 17 Polyphenylene Sulfide Market: Value-Chain Analysis

Figure 18 Porter’s Five Forces Analysis

Figure 19 Automotive Sector to Be the Largest Application Segment of PPS, 2015-2020 (Ton)

Figure 20 Aerospace Sector Projected to Be the Fastest-Growing Application for PPS Between 2015 and 2020

Figure 21 Asia-Pacific Dominates the PPS Demand in Automotive

Figure 22 Asia-Pacific to Drive the Polyphenylene Sulfide Market in Electrical & Electronics Segment Between 2015 and 2020

Figure 23 Asia-Pacific to Witness Highest CAGR in the PPS Market in Industrial Segment, Between 2015 and 2020

Figure 24 Asia-Pacific Projected to Be the Fastest-Growing Market for PPS in Filter Bags Application (2015-2020)

Figure 25 Asia-Pacific Projected to Dominate the PPS Market in Aerospace Segment, Between 2015 and 2020

Figure 26 Asia-Pacific Projected to Dominate the PPS in Coatings Segment, Between 2015 and 2020

Figure 27 Asia-Pacific Projected to Witness Highest Growth in Polyphenylene Sulfide Market, in Other Applications, Between 2015 and 2020 (Ton)

Figure 28 Regional Snapshot – Rapid Growth Markets are Emerging As New Hotspots

Figure 29 Asia-Pacific to Account for the Major Share of Growth: 2015-2020

Figure 30 North American Market Snapshot: Consumption of PPS Projected to Increase Between 2015–2020

Figure 31 U.S. Accounts for the Major Share of North American PPS Market

Figure 32 European Market Snapshot: Polyphenylene Sulfide Market in Automotive, Electrical & Electronics and Filter Bags Segments, 2014

Figure 33 Automotive to Account for A Major Share of PPS in Asia-Pacific

Figure 34 Asia-Pacific Snapshot: China Dominates PPS Market in Asia-Pacific

Figure 35 China Accounts for Biggest Share of the PPS Market in Asia-Pacific

Figure 36 Companies Adopted Capacity Expansion As the Key Growth Strategy Between 2011 and 2015

Figure 37 Market Evaluation Framework–Expansions Fueled Growth in Between 2013 and 2015

Figure 38 Regional Revenue Mix of Top Market Players

Figure 39 Solvay SA: Company Snapshot

Figure 40 Solvay SA.: SWOT Analysis

Figure 41 Tosoh Corporation: Company Snapshot

Figure 42 Tosoh Corporation.: SWOT Analysis

Figure 43 DIC Corporation: Company Snapshot

Figure 44 DIC Corporation: SWOT Analysis

Figure 45 Toray Industries Inc.: Company Snapshot

Figure 46 Toray Industries Inc.: SWOT Analysis

Figure 47 Kureha Corporation: Company Snapshot

Figure 48 Kureha Corporation.: SWOT Analysis

Growth opportunities and latent adjacency in Polyphenylene Sulfide Market