Automotive Carbon Thermoplastic Market by Resin Type (PA, PEEK, PPS, PC, PP), Application (Exterior, Interior, Chassis, Powertrain & UTH), and Region (North America, Europe, APAC, Latin America, MEA) - Global Forecast to 2028

Updated on : April 23, 2024

Automotive Carbon Thermoplastic Market

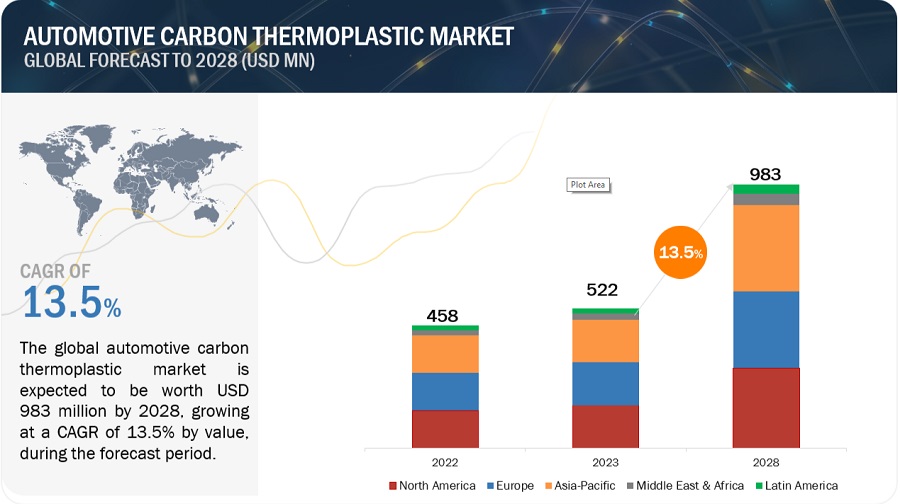

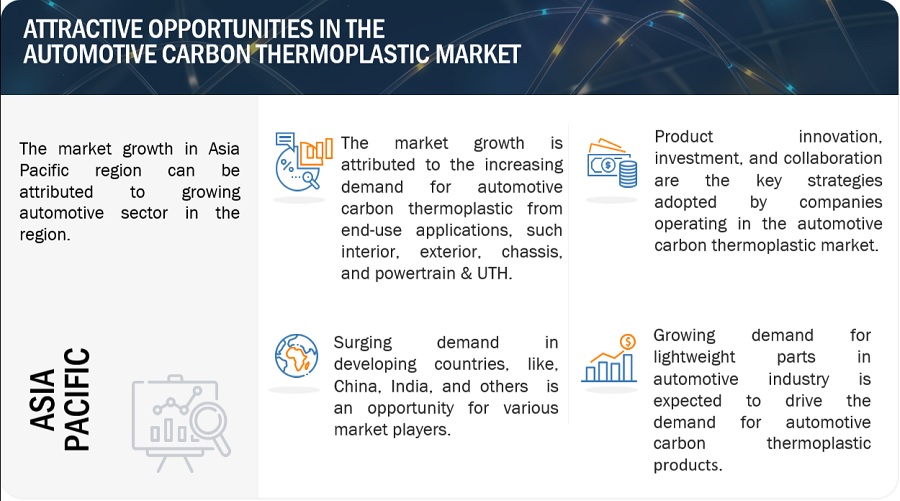

The global automotive carbon thermoplastic market was valued at USD 522 million in 2023 and is projected to reach USD 983 million by 2028, growing at 13.5% cagr from 2023 to 2028. The automotive sector is under constant pressure to reduce carbon emissions and bring down fuel consumption by reducing the weight of vehicles. At the same time the improvement in the safety is essential. This is in turn driving the electric drive technology, lower weight of automobiles, multi material or hybrid cars, as well as stricter environmental legislation, and related traffic regulations. The thermoset composites have already been in use widely for many years in the construction of racing cars and luxury sports cars. The processing capacity of thermoset composites has not yet achieved the industrial production speeds required in the automobile industry, which is characterized by high volumes. For larger volumes of cars, automated production processes are a must. For instance, the time required to make a component should be a maximum of about one minute only. This is achievable with the use of thermoplastic composites.

Attractive Opportunities in Automotive Carbon Thermoplastic Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Carbon Thermoplastic Market Dynamics

Driver: OEMs looking for a complete solution from suppliers

CFRTP composites have enjoyed considerable success in Formula 1 motorsport car production. This has created a highly fragmented and technology-rich support industry. Over the next five years, CFRTP composite usage will cascade from the high-end sports and luxury segments into mainstream premium vehicles as OEMs aim to deliver fuel-efficient cars through weight reduction across their portfolios. Not all incumbent suppliers, however, will be able to translate their motorsport experience into these higher-volume segments. The lack of experience using composites in the mainstream applications such as aerospace and wind energy will drive OEMs towards suppliers, who can provide a complete solution to help navigate through the adoption cycle. Small companies wishing to prosper in this segment should look to provide an increasing proportion of the composites value chain. Reducing manufacturing costs and cycle times will offer the greatest potential to grow the business in the medium term.

Restraint: No major breakthrough from research and technical side

Huge investments are made and various laboratories are being set up in order to develop new technologies for production of low-cost carbon fiber. Oak Ridge National Laboratory (ORNL) leads the research work done for carbon fiber. The Automobile OEMs have made huge investments for mass use of carbon fiber composites in the automotive industry. Attempts are being made to modify the value chain of carbon composites but nothing concrete has been achieved in this regard so far.

Opportunity: Growth opportunity in high volume production of structural automotive components

Composites are becoming a core strategic material for automotive OEMs for structural (hood, roof, doors, fenders, deck-lid, front-end, seats, powertrain) as well as non-structural (dashboard, under the hood components) components. Higher volume usage to date has been hindered by high material costs, long production cycles, and lack of automation. But the scenario is expected to change in the near future with decreased cost of carbon fiber and automated processes with low cycle time for large volume production of automotive components.

Challenge: Capital-intensive and complex manufacturing process of carbon fibers

Carbon fiber manufacturing is highly capital-intensive and requires significant investments. New technologies must be developed to produce low-cost carbon fiber to commercialize the end products. Production and development projects are being undertaken to reduce the manufacturing costs of carbon fiber products through advanced technologies and process solutions. According to some industry experts, the production process of carbon fiber is complex and lengthy compared to the other alternative products. Developing low-cost and simpler technologies for the commercial production of low-cost thermoplastic composites is a major challenge for governments, research laboratories, and carbon fiber producers globally.

Automotive Carbon Thermoplastic Market Ecosystem

Based on the application, the interior segment is estimated to account for the second-largest automotive carbon thermoplastic market share during the forecast period.

CFRP composites have been embraced by luxury car manufacturers for seat backs, headliners, package trays, dashboards, and other interior parts. Technology for implementing CFRP composites into interior trim continues to be developed by Tier I and Tier II automotive suppliers, typically in partnership with producers of carbon fibers. Car interior trim laminate in sports and luxury automobiles today is a natural offshoot of CFRP material with the impressive strength to weight ratio. Consoles, knobs, steering wheels, and door sills are other popular carbon fiber car interior items.

Based on resin type, the PA resin is anticipated to register highest CAGR in automotive carbon thermoplastic market.

PA is a strong competitor for the polymeric matrix of the carbon fiber reinforced thermoplastic composites due to its low dielectric constant, low cost, chemical inertness, high mechanical strength, good dimensional stability, and heat resistance to 2400C. CF/PA composites can be used in automobile air intake manifolds which were once made of metal. Substituting metal in the manifolds with nylon reduces the weight of the part by up to 60%, cuts system costs through parts integration, and contributes to higher fuel efficiency.

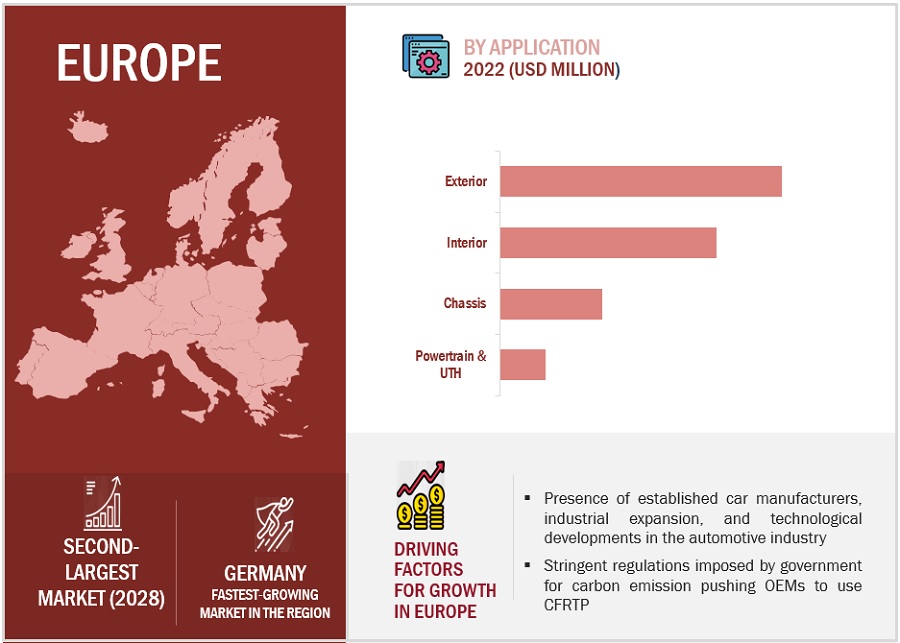

Europe to hold the second-largest market share during the forecast period.

Europe is the second-largest market for automotive carbon thermoplastics. Major factors driving the growth of the market in the region are the presence of established automobile manufacturers, industrial expansion, and technological developments in the automotive industry. The European automotive industry is one of the major industries in the region and is stronger than other regions due to the presence of established automakers. The European Union Commission has enforced to increase the EU’s GHG reduction target for 2030 from a 40% cut in CO2 emission to 50 or 55%. The increasing fuel efficiency requirement has forced the use of automotive carbon thermoplastic composites in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The automotive carbon thermoplastic market is dominated by a few globally established players. BASF SE (Germany), Solvay (Belgium), Avient Corporation (US), Celanese Corporation (US), Toray Industries, Inc. (Japan), Teijin Limited (Japan), Mitsubishi Chemical Group Corporation (Japan), SGL Carbon (Germany), Asahi Kasei Corporation (Japan), CompLam Material Co., Ltd. (Taiwan), Ensinger (Germany), and Jiangsu QIYI Technology Co., Ltd. (China), among others, are the main producers in the global market.

These companies are attempting to establish themselves in the automotive carbon thermoplastic market by employing a range of inorganic and organic approaches. A thorough competitive analysis of these major automotive carbon thermoplastic market participants is included in the research, along with information on their company profiles, most recent advancements, and important market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments Covered |

By Resin Type, By Application, By Region |

|

Geographies covered |

Europe, North America, Asia Pacific, Latin America, Middle East, and Africa |

|

Companies covered |

BASF SE (Germany), Solvay (Belgium), Avient Corporation (US), Celanese Corporation (US), Toray Industries, Inc. (Japan), Teijin Limited (Japan), Mitsubishi Chemical Group Corporation (Japan), SGL Carbon (Germany), Asahi Kasei Corporation (Japan), CompLam Material Co., Ltd. (Taiwan), Ensinger (Germany), and Jiangsu QIYI Technology Co., Ltd. (China). |

The study categorizes the automotive carbon thermoplastic market based on Resin Type, Application, and Region.

By Resin Type

- PA

- PEEK

- PPS

- PC

- PP

- Others

By Application:

- Exterior

- Interior

- Chassis

- Powertrain & UTH

By Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Recent Developments

- In October 2023, Toray Industries, Inc., announced that it had decided to expand French subsidiary Toray Carbon Fibers Europe S.A.’s production facilities for regular tow medium- and high-modulus carbon fibers. This move will increase the annual capacity at the plant in Abidos (South-West France) from 5,000 metric tons annually to 6,000 metric tons. Also, this advancement will boost the production of automotive carbon fiber thermoplastic products. The production is expected to start in 2025.

- In June 2023, BASF and Avient collaborated to offer colored grades of Ultrason high-performance polymers to the global market. The collaboration will give customers in different industries a distinctive benefit by providing comprehensive technical support from the base polymer to the final-colored product.

- In May 2023, Celanese announced its intent to initiate a three-year plan to expand engineered materials compounding capacities at the company’s facilities in Asia, including the locations of Nanjing, China; Suzhou, China; and Silvassa, India.

- In March 2023, Solvay and Airborne received funding for a composite alternative to metal battery enclosures. Solvay’s collaboration with Airborne, a technology leader in advanced composites manufacturing using automation and digitalization, received letters of support from Jaguar Land Rover and Vertical Aerospace. They see great potential in the design of more compact and lightweight enclosures for high-energy batteries in future electric cars and aircraft and are interested in the sustainability aspect of this project, which aims to reuse composite waste.

- In February 2023, Toray Industries, Inc. developed a rapid integrated molding technology for carbon fiber-reinforced plastic mobility components. This material sandwiches a light, porous carbon fiber-reinforced foam core prepreg skin, offering outstanding mechanical properties.

Frequently Asked Questions (FAQ):

Which are the major companies in the automotive carbon thermoplastic market? What are their major strategies to strengthen their market presence?

Some of the key players in the automotive carbon thermoplastic market are BASF SE (Germany), Solvay (Belgium), Avient Corporation (US), Celanese Corporation (US), Toray Industries, Inc. (Japan), Teijin Limited (Japan), Mitsubishi Chemical Group Corporation (Japan), SGL Carbon (Germany), Asahi Kasei Corporation (Japan), CompLam Material Co., Ltd. (Taiwan), Ensinger (Germany), and Jiangsu QIYI Technology Co., Ltd. (China).

What are the drivers and opportunities for the automotive carbon thermoplastic market?

Increase in demand for fuel efficient vehicles is driving the market. Emission regulations are forcing OEM’s attention toward carbon fiber composites anticipated to accelerate market expansion globally.

Which region is expected to hold the highest market share?

North America, Asia Pacific, and Europe’s automotive carbon thermoplastic market has been experiencing growth and significant industry demand.

What is the total CAGR expected to be recorded for the automotive carbon thermoplastic market during 2023-2028?

The CAGR is expected to record a CAGR of 13.5% from 2023-2028.

How is the automotive carbon thermoplastic market aligned?

The market is growing at a significant pace. The market is a potential market, and many manufacturers are planning business strategies to expand their existing business. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increase in demand for fuel-efficient vehicles to reduce carbon emissions and GHGs- Reduced weight and parts consolidation- Joint ventures of OEMs and carbon fiber suppliersRESTRAINTS- High cost of carbon fiber- Stiff competition from thermoset compositesOPPORTUNITIES- Emission regulations encouraging OEMs to shift focus to carbon fiber composites- Reduced cycle time of manufacturing process- OEMs looking for complete solution from suppliers- High-volume production of structural automotive componentsCHALLENGES- Need for low-cost technologies- Production of low-cost carbon fiber- Recyclability of composite components

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATIONAVERAGE SELLING PRICE TREND, BY REGION

-

5.6 TRADE DATA ANALYSISEXPORT SCENARIO OF CARBON FIBERIMPORT SCENARIO OF CARBON FIBER

-

5.7 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.8 TECHNOLOGY ANALYSIS

- 5.9 SUPPLY CHAIN ANALYSIS

- 5.10 VALUE CHAIN ANALYSIS

- 5.11 CASE STUDY ANALYSIS

- 5.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.13 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS RELATED TO AUTOMOTIVE CARBON THERMOPLASTIC MARKET

-

5.14 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISANALYSIS OF TOP APPLICANTSLIST OF PATENTS BY EQUISTAR CHEMICALS LPLIST OF PATENTS BY TEIJIN LIMITEDLIST OF PATENTS BY FAURECIA INNENRAUM SYSTEME GMBH

- 5.15 KEY CONFERENCES AND EVENTS

- 6.1 INTRODUCTION

-

6.2 POLYAMIDE (PA)LOW DIELECTRIC CONSTANT OF PA TO DRIVE GROWTHPOLYAMIDE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION

-

6.3 POLYETHER ETHER KETONE (PEEK)ABILITY TO PRODUCE COMPLEX SHAPES TO DRIVE GROWTHPOLYETHER ETHER KETONE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION

-

6.4 POLYPHENYLENE SULFIDE (PPS)CHEMICAL RESISTANCE AND HIGH THERMAL PERFORMANCE OF PPS TO DRIVE GROWTHPOLYPHENYLENE SULFIDE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION

-

6.5 POLYCARBONATE (PC)EXCELLENT TOUGHNESS, THERMAL STABILITY, AND GOOD DIMENSIONAL STABILITY TO DRIVE GROWTHPOLYCARBONATE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION

-

6.6 POLYPROPYLENE (PP)ABILITY TO OFFER COST-EFFECTIVE SOLUTIONS FOR INTERIOR AND EXTERIOR APPLICATIONS TO DRIVE GROWTHPOLYPROPYLENE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION

-

6.7 OTHERSOTHER RESINS: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION

- 7.1 INTRODUCTION

-

7.2 EXTERIORASIA PACIFIC TO BE LEADING MARKET IN THIS SEGMENTAUTOMOTIVE CARBON THERMOPLASTIC MARKET IN EXTERIOR APPLICATION, BY REGION

-

7.3 INTERIORASIA PACIFIC TO BE FASTEST-GROWING MARKET IN THIS SEGMENTAUTOMOTIVE CARBON THERMOPLASTIC MARKET IN INTERIOR APPLICATION, BY REGION

-

7.4 CHASSISGROWING USE OF CFRTP COMPOSITES BY HIGH-END SPORTS AND LUXURY CAR MANUFACTURERS IN DEVELOPED ECONOMIES TO DRIVE GROWTHAUTOMOTIVE CARBON THERMOPLASTIC MARKET IN CHASSIS APPLICATION, BY REGION

-

7.5 POWERTRAIN & UNDER THE HOOD (UTH)STRICT EMISSION CONTROL NORMS AND STANDARDS TO DRIVE GROWTHAUTOMOTIVE CARBON THERMOPLASTIC MARKET IN POWERTRAIN & UTH APPLICATION, BY REGION

-

8.1 INTRODUCTIONAUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION

-

8.2 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICANORTH AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPENORTH AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATIONNORTH AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY- US- Canada

-

8.3 EUROPEIMPACT OF RECESSION ON EUROPEEUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPEEUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATIONEUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY- Germany- France- UK- Spain- Italy- Rest of Europe

-

8.4 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPEASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATIONASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY- China- Japan- South Korea- India- Rest of Asia Pacific

-

8.5 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPEMIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATIONMIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRYGCC COUNTRIES- UAE- Saudi Arabia- Rest of GCC CountriesSOUTH AFRICA- Rising demand for fuel-efficient automobiles to drive growth- South Africa: Automotive carbon thermoplastic market, by applicationREST OF MIDDLE EAST & AFRICA- Rest of Middle East & Africa: Automotive carbon thermoplastic market, by application

-

8.6 LATIN AMERICAIMPACT OF RECESSION ON LATIN AMERICALATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPELATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATIONLATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY- Brazil- Mexico- Rest of Latin America

- 9.1 INTRODUCTION

- 9.2 KEY PLAYERS’ STRATEGIES/RIGHT TO WIN

- 9.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

- 9.4 MARKET SHARE ANALYSIS

-

9.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

9.6 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

-

9.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

10.1 KEY PLAYERSSOLVAY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTORAY INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTEIJIN LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSGL CARBON- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMITSUBISHI CHEMICAL GROUP CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAVIENT CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCELANESE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewASAHI KASEI CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOMPLAM MATERIAL CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewENSINGER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJIANGSU QIYI TECHNOLOGY CO., LTD.- Business overview- Products/Solutions/Services offered- MnM view

-

10.2 OTHER PLAYERSQINGDAO CIMC COMPOSITES CO., LTD.XIAMEN LFT COMPOSITE PLASTIC CO., LTD.OKUTANI LTD.CTECH-LLCFIBRTECLINGOL CORPORATIONSHANGHAI WANHOO CARBON FIBER INDUSTRY CO., LTD.GPM COMPOSITE TECHNOLOGY (KUNSHAN) CO., LTD.HEBEI CHAOKE IMPORT & EXPORT CO., LTD.SUZHOU TOPO NEW MATERIAL CO., LTD.HEBEI BENJINXIN INDUSTRIAL CO., LTD.JIANGSU AIMI TECH CO., LTD.KINGFA SCIENCE AND TECHNOLOGY CO., LTD.

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 EUROPEAN UNION: CO2 EMISSION STANDARDS FOR NEW PASSENGER CARS (G/KM)

- TABLE 2 AUTOMOTIVE CARBON THERMOPLASTIC MARKET: IMPACT OF PORTER’S FIVE FORCES

- TABLE 3 AUTOMOTIVE CARBON THERMOPLASTIC MARKET: ROLE COMPANIES IN ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION (USD/KG)

- TABLE 5 AVERAGE SELLING PRICE OF AUTOMOTIVE CARBON THERMOPLASTIC, BY REGION

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 7 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 CURRENT STANDARD CODES FOR AUTOMOTIVE COMPOSITES

- TABLE 13 AUTOMOTIVE CARBON FIBER THERMOPLASTIC MARKET: GLOBAL PATENTS

- TABLE 14 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 15 LIST OF CONFERENCES & EVENTS RELATED TO AUTOMOTIVE CARBON THERMOPLASTIC AND RELATED MARKETS, 2023–2024

- TABLE 16 AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 17 AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 18 AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 19 AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 20 POLYAMIDE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 21 POLYAMIDE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 22 POLYAMIDE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 23 POLYAMIDE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 POLYETHER ETHER KETONE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 25 POLYETHER ETHER KETONE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 POLYETHER ETHER KETONE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 27 POLYETHER ETHER KETONE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 POLYPHENYLENE SULFIDE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 29 POLYPHENYLENE SULFIDE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 POLYPHENYLENE SULFIDE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 31 POLYPHENYLENE SULFIDE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 POLYCARBONATE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 33 POLYCARBONATE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 POLYCARBONATE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 35 POLYCARBONATE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 POLYPROPYLENE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 37 POLYPROPYLENE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 POLYPROPYLENE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 39 POLYPROPYLENE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 OTHER RESINS: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 41 OTHER RESINS: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 OTHER RESINS: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 43 OTHER RESINS: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 45 AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 46 AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 47 AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 48 AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN EXTERIOR APPLICATION, BY REGION, 2018–2022 (KILOTON)

- TABLE 49 AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN EXTERIOR APPLICATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN EXTERIOR APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 51 AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN EXTERIOR APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN INTERIOR APPLICATION, BY REGION, 2018–2022 (KILOTON)

- TABLE 53 AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN INTERIOR APPLICATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN INTERIOR APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 55 AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN INTERIOR APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN CHASSIS APPLICATION, BY REGION, 2018–2022 (KILOTON)

- TABLE 57 AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN CHASSIS APPLICATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN CHASSIS APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 59 AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN CHASSIS APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN POWERTRAIN & UTH APPLICATION, BY REGION, 2018–2022 (KILOTON)

- TABLE 61 AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN POWERTRAIN & UTH APPLICATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 62 AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN POWERTRAIN & UTH APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 63 AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN POWERTRAIN & UTH APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 65 AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 66 AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 67 AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 69 NORTH AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 71 NORTH AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 73 NORTH AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 75 NORTH AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 77 NORTH AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 79 NORTH AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 80 US: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 81 US: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 82 US: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 83 US: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 84 CANADA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 85 CANADA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 86 CANADA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 87 CANADA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 89 EUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 90 EUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 91 EUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 93 EUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 94 EUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 95 EUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 97 EUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 98 EUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 99 EUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 100 GERMANY: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 101 GERMANY: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 102 GERMANY: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 103 GERMANY: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 104 FRANCE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 105 FRANCE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 106 FRANCE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 107 FRANCE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 108 UK: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 109 UK: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 110 UK: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 111 UK: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 112 SPAIN: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 113 SPAIN: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 114 SPAIN: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 115 SPAIN: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 116 ITALY: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 117 ITALY: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 118 ITALY: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 119 ITALY: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 120 REST OF EUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 121 REST OF EUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 122 REST OF EUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 123 REST OF EUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 125 ASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 127 ASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 129 ASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 130 ASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 131 ASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 133 ASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 135 ASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 136 CHINA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 137 CHINA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 138 CHINA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 139 CHINA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 140 JAPAN: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 141 JAPAN: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 142 JAPAN: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 143 JAPAN: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 144 SOUTH KOREA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 145 SOUTH KOREA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 146 SOUTH KOREA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 147 SOUTH KOREA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 148 INDIA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 149 INDIA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 150 INDIA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 151 INDIA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 153 REST OF ASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 155 REST OF ASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 157 MIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 159 MIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 161 MIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 163 MIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 165 MIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 167 MIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 168 UAE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 169 UAE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 170 UAE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 171 UAE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 172 SAUDI ARABIA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 173 SAUDI ARABIA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 174 SAUDI ARABIA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 175 SAUDI ARABIA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 176 REST OF GCC COUNTRIES: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 177 REST OF GCC COUNTRIES: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 178 REST OF GCC COUNTRIES: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 179 REST OF GCC COUNTRIES: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 180 SOUTH AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 181 SOUTH AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 182 SOUTH AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 183 SOUTH AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 185 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 186 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 187 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 188 LATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2018–2022 (KILOTON)

- TABLE 189 LATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2018–2022 (USD MILLION)

- TABLE 190 LATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 191 LATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 192 LATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 193 LATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 194 LATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 195 LATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 196 LATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 197 LATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 198 LATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 199 LATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 200 BRAZIL: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 201 BRAZIL: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 202 BRAZIL: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 203 BRAZIL: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 204 MEXICO: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 205 MEXICO: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 206 MEXICO: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 207 MEXICO: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 208 REST OF LATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 209 REST OF LATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 210 REST OF LATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 211 REST OF LATIN AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 212 STRATEGIES ADOPTED BY AUTOMOTIVE CARBON THERMOPLASTIC MANUFACTURERS

- TABLE 213 DEGREE OF COMPETITION

- TABLE 214 COMPANY PRODUCT FOOTPRINT

- TABLE 215 COMPANY APPLICATION FOOTPRINT

- TABLE 216 COMPANY RESIN TYPE FOOTPRINT

- TABLE 217 COMPANY REGION FOOTPRINT

- TABLE 218 AUTOMOTIVE CARBON THERMOPLASTIC MARKET: LIST OF KEY START-UPS/SMES

- TABLE 219 AUTOMOTIVE CARBON THERMOPLASTIC MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 220 PRODUCT LAUNCHES, 2018–2023

- TABLE 221 DEALS, 2018–2023

- TABLE 222 OTHER DEVELOPMENTS, 2018–2023

- TABLE 223 SOLVAY: COMPANY OVERVIEW

- TABLE 224 SOLVAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 SOLVAY: DEALS

- TABLE 226 SOLVAY: OTHER DEVELOPMENTS

- TABLE 227 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 228 TORAY INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 230 TORAY INDUSTRIES, INC.: DEALS

- TABLE 231 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

- TABLE 232 TEIJIN LIMITED: COMPANY OVERVIEW

- TABLE 233 TEIJIN LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 TEIJIN LIMITED: DEALS

- TABLE 235 TEIJIN LIMITED: OTHER DEVELOPMENTS

- TABLE 236 SGL CARBON: COMPANY OVERVIEW

- TABLE 237 SGL CARBON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 SGL CARBON: DEALS

- TABLE 239 SGL CARBON: OTHER DEVELOPMENTS

- TABLE 240 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 241 MITSUBISHI CHEMICAL GROUP CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 242 MITSUBISHI CHEMICAL GROUP CORPORATION: DEALS

- TABLE 243 BASF SE: COMPANY OVERVIEW

- TABLE 244 BASF SE: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 245 BASF SE: DEALS

- TABLE 246 BASF SE: OTHER DEVELOPMENTS

- TABLE 247 AVIENT CORPORATION: COMPANY OVERVIEW

- TABLE 248 AVIENT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 AVIENT CORPORATION: PRODUCT LAUNCHES

- TABLE 250 AVIENT CORPORATION: OTHER DEVELOPMENTS

- TABLE 251 CELANESE CORPORATION: COMPANY OVERVIEW

- TABLE 252 CELANESE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 CELANESE CORPORATION: DEALS

- TABLE 254 CELANESE CORPORATION: OTHER DEVELOPMENTS

- TABLE 255 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- TABLE 256 ASAHI KASEI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 ASAHI KASEI CORPORATION: DEALS

- TABLE 258 COMPLAM MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 259 COMPLAM MATERIAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 ENSINGER: COMPANY OVERVIEW

- TABLE 261 ENSINGER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 ENSINGER: DEALS

- TABLE 263 JIANGSU QIYI TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 264 JIANGSU QIYI TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 265 QINGDAO CIMC COMPOSITES CO., LTD.: COMPANY OVERVIEW

- TABLE 266 XIAMEN LFT COMPOSITE PLASTIC CO., LTD.: COMPANY OVERVIEW

- TABLE 267 OKUTANI LTD.: COMPANY OVERVIEW

- TABLE 268 CTECH-LLC: COMPANY OVERVIEW

- TABLE 269 FIBRTEC: COMPANY OVERVIEW

- TABLE 270 LINGOL CORPORATION: COMPANY OVERVIEW

- TABLE 271 SHANGHAI WANHOO CARBON FIBER INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 272 GPM COMPOSITE TECHNOLOGY (KUNSHAN) CO., LTD.: COMPANY OVERVIEW

- TABLE 273 HEBEI CHAOKE IMPORT & EXPORT CO., LTD.: COMPANY OVERVIEW

- TABLE 274 SUZHOU TOPO NEW MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 275 HEBEI BENJINXIN INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 276 JIANGSU AIMI TECH CO., LTD.: COMPANY OVERVIEW

- TABLE 277 KINGFA SCIENCE AND TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- FIGURE 1 AUTOMOTIVE CARBON THERMOPLASTIC MARKET SEGMENTATION

- FIGURE 2 AUTOMOTIVE CARBON THERMOPLASTIC MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 AUTOMOTIVE CARBON THERMOPLASTIC MARKET: DATA TRIANGULATION

- FIGURE 6 MAJOR FACTORS RESPONSIBLE FOR GLOBAL RECESSION AND THEIR IMPACT ON AUTOMOTIVE CARBON THERMOPLASTIC MARKET

- FIGURE 7 PEEK RESIN TYPE LED AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN 2022

- FIGURE 8 EXTERIOR APPLICATION SEGMENT LED AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN 2022

- FIGURE 9 NORTH AMERICA LED AUTOMOTIVE CARBON THERMOPLASTIC MARKET IN 2022

- FIGURE 10 INCREASING ADOPTION OF CFRTP TO DRIVE AUTOMOTIVE CARBON THERMOPLASTIC MARKET BETWEEN 2023 AND 2028

- FIGURE 11 EXTERIOR APPLICATION AND ASIA PACIFIC REGION LED MARKET IN 2022

- FIGURE 12 PA SEGMENT LED MARKET IN 2022

- FIGURE 13 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AUTOMOTIVE CARBON THERMOPLASTIC MARKET

- FIGURE 15 PORTER’S FIVE FORCES ANALYSIS OF AUTOMOTIVE CARBON FIBER THERMOPLASTIC MARKET

- FIGURE 16 AUTOMOTIVE CARBON THERMOPLASTIC MARKET MAP

- FIGURE 17 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION (USD/KG)

- FIGURE 18 EXPORT OF CARBON FIBER, BY KEY COUNTRY, 2018−2022 (TONS)

- FIGURE 19 IMPORT OF CARBON FIBER, BY KEY COUNTRY, 2018−2022 (TONS)

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 21 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 22 CFRP MANUFACTURING STEPS: FROM CRUDE OIL TO CFRP PRODUCTS

- FIGURE 23 AUTOMOTIVE CARBON THERMOPLASTIC MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 AUTOMOTIVE CARBON THERMOPLASTIC MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 CO2 EMISSIONS, BY SECTOR (2022)

- FIGURE 26 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 27 GLOBAL PATENT PUBLICATION TREND ANALYSIS: LAST 10 YEARS

- FIGURE 28 AUTOMOTIVE CARBON THERMOPLASTIC MARKET: LEGAL STATUS OF PATENTS

- FIGURE 29 GLOBAL JURISDICTION ANALYSIS

- FIGURE 30 EQUISTAR CHEMICALS LP HAS HIGHEST NUMBER OF PATENTS

- FIGURE 31 PEEK TO BE LARGEST RESIN TYPE OF AUTOMOTIVE CARBON THERMOPLASTICS DURING FORECAST PERIOD

- FIGURE 32 CFRTP COMPOSITES: APPLICATIONS IN AUTOMOTIVE SECTOR

- FIGURE 33 EXTERIOR SEGMENT TO BE LARGEST APPLICATION OF AUTOMOTIVE CARBON THERMOPLASTICS DURING FORECAST PERIOD

- FIGURE 34 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: AUTOMOTIVE CARBON THERMOPLASTIC MARKET SNAPSHOT

- FIGURE 36 EUROPE: AUTOMOTIVE CARBON THERMOPLASTIC MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: AUTOMOTIVE CARBON THERMOPLASTIC MARKET SNAPSHOT

- FIGURE 38 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

- FIGURE 39 SHARES OF TOP COMPANIES IN AUTOMOTIVE CARBON THERMOPLASTIC MARKET

- FIGURE 40 AUTOMOTIVE CARBON THERMOPLASTIC MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 41 AUTOMOTIVE CARBON THERMOPLASTIC MARKET: START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 42 SOLVAY: COMPANY SNAPSHOT

- FIGURE 43 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 44 TEIJIN LIMITED: COMPANY SNAPSHOT

- FIGURE 45 SGL CARBON: COMPANY SNAPSHOT

- FIGURE 46 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 BASF SE: COMPANY SNAPSHOT

- FIGURE 48 AVIENT CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 CELANESE CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

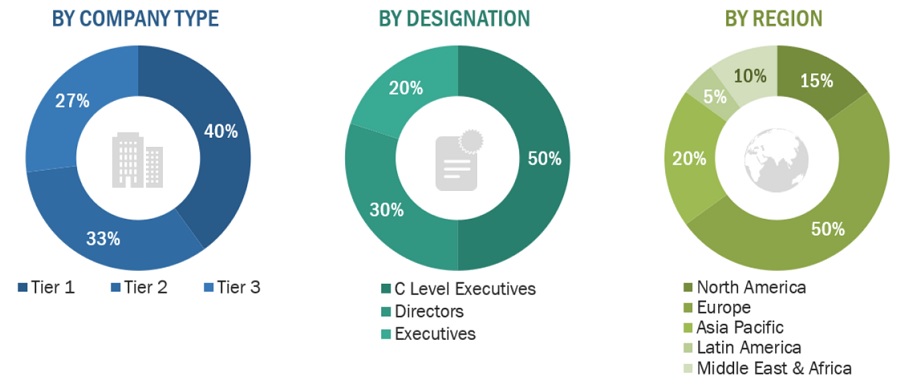

The study involves two major activities in estimating the current market size for the automotive carbon thermoplastic market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering automotive carbon thermoplastic products and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the automotive carbon thermoplastic market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the automotive carbon thermoplastic market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from automotive carbon thermoplastic industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to resin type, product type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using CFRTP products were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of CFRTP products and future outlook of their business which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

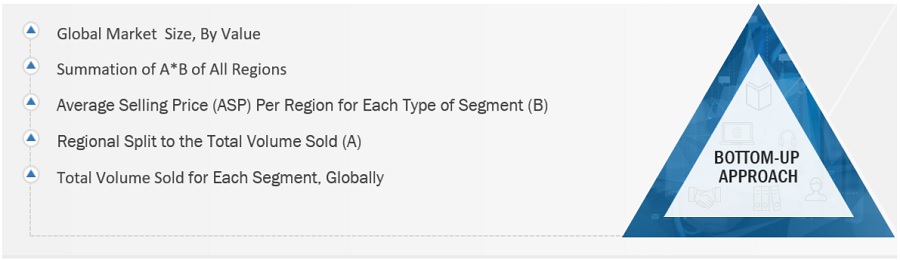

The research methodology used to estimate the size of the automotive carbon thermoplastic market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in automotive carbon thermoplastic products in different applications at a regional level. Such procurements provide information on the demand aspects of the automotive carbon thermoplastic industry for each application. For each application, all possible segments of the automotive carbon thermoplastic market were integrated and mapped.

Automotive Carbon Thermoplastic Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Carbon Thermoplastic Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Carbon fiber and carbon fiber reinforced plastics (CFRP) have been incorporated in high-performance applications for several decades, but relatively at a higher cost compared to conventional materials, such as steel and aluminum. The higher cost and limited supply have constrained their use in automotive applications, but they are expected to be extensively used in the near future. CFRTP composites are looked upon as the future material for automotive applications due to their various properties, such as mass-weight-reduction, high strength, high stiffness, and corrosion resistance.

Key Stakeholders

- Automotive Carbon Thermoplastic Manufacturers

- Raw Materials Suppliers

- Distributors and Suppliers

- End-use Industries

- Industry Associations

- R&D Institutions

- Environment Support Agencies

Report Objectives

- To define, describe, and forecast the automotive carbon thermoplastic market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global automotive carbon thermoplastic market by resin type, application, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, and analyze the significant region-specific trends

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape.

- To strategically profile the key market players and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the automotive carbon thermoplastic market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Growth opportunities and latent adjacency in Automotive Carbon Thermoplastic Market