High Temperature Thermoplastics Market by End-use Industry (Transportation, Electrical & Electronics, Industrial, Medical), Resin Type (High Temperature FPs, HPPA, PPS, SP, LCP, AKP, PI), Temperature Range, and Region - Global Forecast to 2022

[150 Pages Report] High Temperature Thermoplastics Market size was USD 13.28 Billion in 2016 and is estimated to reach USD 21.70 Billion by 2022, at a CAGR of 8.57% during the forecast period. The HTTs market is driven by the increasing use of fluoropolymers and aromatic ketone polymers due to its superior thermal conductivity property. The report includes an analysis of the HTTs market by region, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- Base Year 2016

- Estimated Year 2017

- Projected Year 2022

- Forecast Period 2017-2022

2016 has been considered as the base year for company profiles. Whenever information was unavailable for the base year, the years prior to it have been considered.

Objectives of the Study

- To define, describe, and forecast the HTTs market on the basis of resin type, end-use industry, and region

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the market segmentation and to project the HTTs market by temperature range, by end-use industry, and by resin type in different regions, namely, North America, Europe, Asia Pacific, South America, and Middle East & Africa

- To analyze the significant region-specific trends

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze recent market developments and competitive strategies, such as agreements, collaborations, joint ventures, mergers & acquisitions, and new product developments

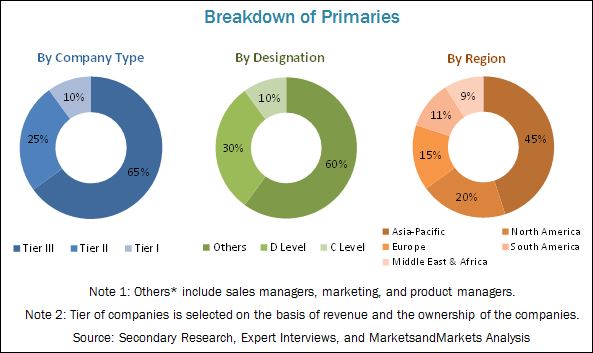

Different secondary sources such as Hoovers, Bloomberg, Chemical Weekly, Factiva, Commonwealth Scientific and Industrial Research Organization (CSIRO), Securities And Exchange Commission (SEC), American National Standards Institute (ANSI), Organization for Economic Co-operation and Development (OECD), and other government and private websites, directories, and databases were referred to identify and collect information useful for a technical, market-oriented, and commercial study of the global HTTs market. Primary sources, which include experts from related industries, have been interviewed to verify and collect critical information as well as to assess the prospects of the market. The top-down approach has been implemented to validate the market size, in terms of value and volume. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study.

To know about the assumptions considered for the study, download the pdf brochure

Some of the major players in the HTTs market are Solvay (Belgium), BASF (Germany), Evonik Industries (Germany), DowDuPont (US), Celanese Corporation (US), and Arkema (Japan).

Key Target Audience:

- Manufacturers of HTTs

- Traders, Distributors, and Suppliers of HTTs

- Regional Manufacturers Associations and General Performance Plastics Associations

- Government and Regional Agencies and Research Organizations

- Investment Research Firms

Scope of the Report:

This research report categorizes the HTTs market on the basis of resin type, end-use industry, and region.

High Temperature Thermoplastics Market, On the Basis of End-use Industry

- Transportation

- Electrical & Electronics

- Industrial

- Medical

- Others

High Temperature Thermoplastics Market, On the Basis of Temperature Range

- HTTs (Range 302˚F-449.6˚F)

- Extreme Temperature Thermoplastics (Range >449.6˚F)

High Temperature Thermoplastics Market, On the Basis of Resin Type

- High Temperature Fluoropolymers (High Temperature FPs)

- High Performance Polyamide (HPPA)

- Polyphenylene Sulfide (PPS)

- Sulfone Polymers (SP)

- Liquid Crystal Polymers (LCP)

- Aromatic Ketone Polymers (AKP)

- Poly-imide (PI)

High Temperature Thermoplastics Market, On the Basis of Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North American HTTs market

- Further breakdown of the European HTTs market

- Further breakdown of the Asia Pacific HTTs market

- Further breakdown of the Middle East & Africa HTTs market

- Further breakdown of the South America HTTs market

Company Information

- Detailed analysis and profiling of additional market players

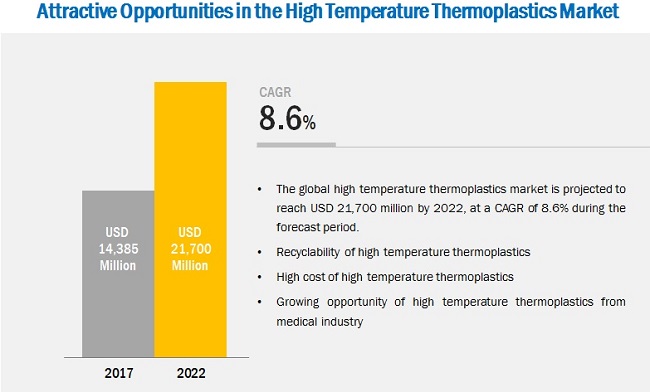

The global market for High Temperature Thermoplastics (HTTs) is estimated at USD 14.38 Billion in 2017 and is projected to reach USD 21.70 Billion by 2022, at a CAGR of 8.57% between 2017 and 2022. The market has witnessed significant growth in the recent years, and this growth is projected to persist in the coming years. HTTs, due to their characteristic properties such as high thermal stability, greater chemical resistance, high dielectric strength, low shrinkage, and greater design flexibility, are used in a wide range of end-use industries such as transportation, medical, electrical & electronics, industrial, and others.

Different types of HTTs are also included in the report. The main types are fluoropolymers, high performance polyamides, polyphenylene sulfide, sulfone polymers, liquid crystal polymers, aromatic ketone polymers, and poly-imide. The fluoropolymers segment accounted for the largest market share in 2016 due to their suitability in several application areas. The sulfone polymers segment is expected to be the fastest-growing type segment due to their increasing acceptance in various end-use industries such as electrical & electronics and industrial.

High temperature thermoplastics are used in various end-use industries such as transportation, medical, electrical & electronics, industrial, and others. These are the main end-use industries considered in the report. In 2016, the transportation end-use industry accounted for the largest market share, in terms of volume, followed by electrical & electronics, industrial, medical and others. The medical end-use industry segment is estimated to register the highest CAGR between 2017 and 2022 among all the end-use industries considered.

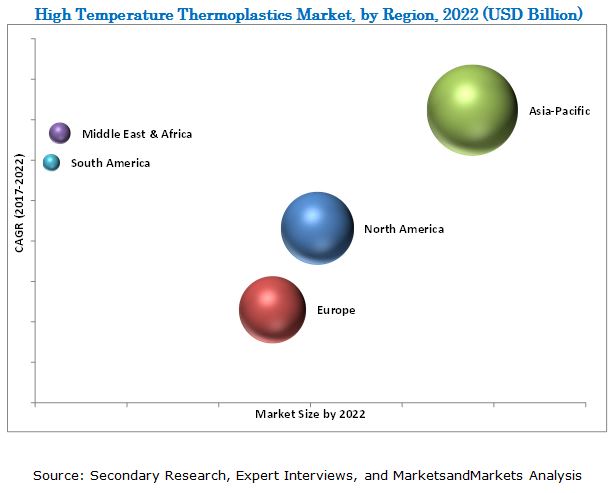

North America, Europe, Asia Pacific, Middle East & Africa, and South America are the main regions considered in the report. Asia Pacific is dominant in the HTTs market. The rising demand for HTTs in this region is mainly driven by their increased use in transportation, electrical & electronics, and medical industries. North America is the second-largest consumer and manufacturer of HTTs, globally. The market in this region is mainly driven by the growing opportunities from electrical & electronics and medical industries. Transportation and electrical & electronics are the top 2 end-use industries contributing to the growing demand for HTTs globally. The Middle East & Africa is the second fastest-growing region after Asia Pacific due to the growing electrical & electronics industry in the region.

Though the HTTs market is growing at a significant rate, few factors, such as the high price of raw materials, shift of end-use markets from the developed countries to developing countries, and rising cost of production may hinder the growth of the market, globally.

Companies such as Solvay (Belgium), BASF (Germany), Evonik Industries (Germany), DowDuPont (US), Celanese Corporation (US), and Arkema (Japan) are the leading players in the global HTTs market. These companies are expected to account for a significant market share in the near future. Entering into related industries and targeting new markets will enable the HTTs manufacturers to overcome the effects of volatile economy, leading to diversified business portfolio and increase in revenue. Other major manufacturers of HTTs are SABIC (Saudi Arabia), Toray (Japan), Royal DSM (Netherlands), and Victrex (UK).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 High Temperature Thermoplastics Market: Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Significant Opportunities in the High Temperature Thermoplastics Market, 20172022

4.2 High Temperature Thermoplastics Market, By Resin

4.3 High Temperature Thermoplastics Market, By End-Use Industry, and Region

4.4 High Temperature Thermoplastics Market Size, By Temperature Range

4.5 High Temperature Thermoplastics Market Growth, By Country

4.6 High Temperature Thermoplastics Market Size, By End-Use Industry

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Recyclability

5.2.1.2 Increasing Demand From Transportation Industry

5.2.2 Restraints

5.2.2.1 High Cost of High Temperature Thermoplastics

5.2.2.2 Competition From Alternative Materials

5.2.3 Opportunities

5.2.3.1 Superior Properties of High Temperature Thermoplastics

5.2.3.2 Collaborative Research With Component Manufacturers and End Users

5.2.4 Challenges

5.2.4.1 Difficulty in Processing

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Macroeconomic Overview and Key Trends (Page No. - 42)

6.1 Introduction

6.2 Trends and Forecast of GDP

6.3 Trends of Automotive Industry

6.4 Trends of Aerospace Industry

6.5 Trends of the Construction Industry

7 High Temperature Thermoplastics Market, By Resin (Page No. - 48)

7.1 Introduction

7.2 High Temperature Fluoropolymers

7.2.1 Polytetrafluoroethylene (PTFE)

7.2.2 Fluorinated Ethylene Propylene (FEP)

7.2.3 Fluoroelastomers

7.2.4 Other High Temperature Fluoropolymers

7.3 High Performance Polyamide

7.3.1 Polyamide 11 (PA 11)

7.3.2 Polyamide 12 (PA 12)

7.3.3 Polyamide 9t (PA 9t)

7.3.4 Polyamide 46 (PA 46)

7.3.5 Polyphthalamide(PPA)

7.3.6 Polyacrylamide (PARA)

7.4 Polyphenylene Sulfide

7.5 Sulfone Polymers

7.5.1 Poly Sulfone

7.5.2 Polyether Sulfone (PES)

7.5.3 Polyphenylsulfone

7.6 Liquid Crystal Polymers

7.7 Aromatic Ketone Polymers

7.7.1 Polyether Ether Ketone (PEEK)

7.7.2 Polyether Ketone (PEK)

7.7.3 Polyetherketoneketone (PEKK)

7.8 Polyimides (PI)

7.8.1 Polyether-Imide (PEI)

7.8.2 Polyamide-Imide (PAI)

7.8.3 Polyester-Imide

8 High Temperature Thermoplastics Market, By Temperature Range (Page No. - 64)

8.1 Introduction

8.1.1 High Temperature Thermoplastics (Range- 302˚f-449.6˚f)

8.1.2 Extreme Temperature Thermoplastics (Range- >449.6˚f)

9 High Temperature Thermoplastics Market, By End-Use Industry (Page No. - 68)

9.1 Introduction

9.2 Transportation

9.2.1 Automotive

9.2.2 Aerospace

9.3 Electrical & Electronics

9.3.1 Telecommunication

9.3.2 Semiconductors

9.3.3 Electronic Components

9.3.4 Display

9.3.5 Defense Electronics

9.4 Industrial

9.4.1 Oil & Gas

9.4.2 Chemical Processing

9.4.3 Power Plant

9.4.4 Water Treatment

9.5 Medical

9.5.1 Pharmaceutical & Biotechnology

9.5.2 Surgical Equipment

9.5.3 Diagnostic

9.5.4 Therapeutic System

9.5.5 Dental

9.6 Others

9.6.1 Defense

9.6.2 Building & Construction

9.6.3 Consumer Goods

10 High Temperature Thermoplastics Market, By Region (Page No. - 79)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 U.K.

10.3.4 Italy

10.3.5 Spain

10.3.6 Russia

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 South Korea

10.4.4 India

10.4.5 Indonesia

10.4.6 Thailand

10.4.7 Malaysia

10.5 Middle East & Africa

10.5.1 South Africa

10.5.2 Saudi Arabia

10.6 South America

10.6.1 Brazil

11 Competitive Landscape (Page No. - 107)

11.1 Introduction

11.2 Competitive Leadership Mapping, 2016

11.2.1 Visionary Leaders

11.2.2 Innovators

11.2.3 Dynamic Differentiators

11.2.4 Emerging Companies

11.3 Competitive Benchmarking

11.3.1 Strength of Product Portfolio (25 Players)

11.3.2 Business Strategy Excellence (25 Players)

11.4 Market Ranking of Top-5 Players in the High Temperature Thermoplastics Market

12 Company Profiles (Page No. - 112)

(Business Overview, Products Offered, Scorecard of Product Offering, Scorecard of Business Strategy, and New Product Launch)

12.1 Solvay

12.2 Dowdupont

12.3 Celanese Corporation

12.4 BASF

12.5 Arkema S.A.

12.6 Royal Dsm

12.7 Sabic

12.8 Victrex

12.9 Evonik Industries

12.10 Toray Industries Inc.

12.11 Other Companies

12.11.1 Polyone Corporation

12.11.2 Freudenberg

12.11.3 Quadrant Plastics

12.11.4 Sumitomo Chemicals

12.11.5 DIC Corporation

12.11.6 Nytef Plastics

12.11.7 GSF Plastics Corporation

12.11.8 Dyneon Fluoropolymers

12.11.9 Ensigner

12.11.10 RTP Company

12.11.11 Lehmann & Voss & Co.

12.11.12 Asahi Kasei

12.11.13 Hycomp LLC

12.11.14 Drake Plastics

12.11.15 Akro Plastic

*Details Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 143)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (68 Tables)

Table 1 High Temperature Thermoplastic Market Size, 20152022

Table 2 Trends and Forecast of GDP, USD Billion (20162022)

Table 3 Automotive Production, Million Units (2011-2016)

Table 4 Number of New Airplane Deliveries, By Region (2016)

Table 5 Contribution of Construction Industry to GDP, By Region, USD Billion (2014-2021)

Table 6 High Temperature Thermoplastic Market Size, By Resin, 20152022 (USD Million)

Table 7 High Temperature Thermoplastic Market Size, By Resin, 20152022 (Kiloton)

Table 8 High Temperature Fluoropolymers Market Size, By Region, 20152022 (USD Million)

Table 9 By Market Size, By Region, 20152022 (Kiloton)

Table 10 High Performance Polyamide Market Size, By Region, 20152022 (USD Million)

Table 11 By Market Size, By Region, 20152022 (Kiloton)

Table 12 Polyphenylene Sulfide Market Size, By Region, 20152022 (USD Million)

Table 13 Polyphenylene Sulfide Market Size, By Region, 20152022 (Kiloton)

Table 14 Sulfone Polymers Market Size, By Region, 20152022 (USD Million)

Table 15 Sulfone Polymers Market Size, By Region, 20152022 (Kiloton)

Table 16 Liquid Crystal Polymers Market Size, By Region, 20152022 (USD Million)

Table 17 Liquid Crystal Polymers Market Size, By Region, 20152022 (Kiloton)

Table 18 Aromatic Ketone Polymers Market Size, By Region, 20152022 (USD Million)

Table 19 Aromatic Ketone Polymers Market Size, By Region, 20152022 (Kiloton)

Table 20 Polyimides Market Size, By Region, 20152022 (USD Million)

Table 21 Polyimides Market Size, By Region, 20152022 (Kiloton)

Table 22 High Temperature Thermoplastic Market Size, By Temperature Range, 20152022 (USD Million)

Table 23 High Temperature Thermoplastic Market Size, By Temperature Range, 20152022 (Kiloton)

Table 24 High Temperature Thermoplastic Market Size, By End-Use Industry, 20152022 (USD Million)

Table 25 High Temperature Thermoplastic Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 26 High Temperature Thermoplastic Market Size in Transportation, By Region, 20152022 (USD Million)

Table 27 High Temperature Thermoplastic Market Size in Transportation, By Region, 20152022 (Kiloton)

Table 28 High Temperature Thermoplastic Market Size in Electrical & Electronics, By Region, 20152022 (USD Million)

Table 29 High Temperature Thermoplastic Market Size in Electrical & Electronics, By Region, 20152022 (Kiloton)

Table 30 High Temperature Thermoplastic Market Size in Industrial, By Region, 20152022 (USD Million)

Table 31 High Temperature Thermoplastic Market Size in Industrial, By Region, 20152022 (Kiloton)

Table 32 High Temperature Thermoplastic Market Size in Medical, By Region, 20152022 (USD Million)

Table 33 High Temperature Thermoplastic Market Size in Medical, By Region, 20152022 (Kiloton)

Table 34 High Temperature Thermoplastic Market Size in Other End-Use Industries, By Region, 20152022 (USD Million)

Table 35 High Temperature Thermoplastic Market Size in Other End-Use Industries, By Region, 20152022 (Kiloton)

Table 36 High Temperature Thermoplastic Market Size, By Region, 20152022 (USD Million)

Table 37 High Temperature Thermoplastic Market Size, By Region, 20152022 (Kiloton)

Table 38 North America: High Temperature Thermoplastic Market Size, By Country, 20152022 (USD Million)

Table 39 North America: High Temperature Thermoplastic Market Size, By Country, 20152022 (Kiloton)

Table 40 North America: High Temperature Thermoplastic Market Size, By Resin, 20152022 (USD Million)

Table 41 North America: High Temperature Thermoplastic Market Size, By Resin, 20152022 (Kiloton)

Table 42 North America: High Temperature Thermoplastic Market Size, By End-Use Industry, 20152022 (USD Million)

Table 43 North America: High Temperature Thermoplastic Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 44 Europe: By Market Size, By Country, 20152022 (USD Million)

Table 45 Europe: By Market Size, By Country, 20152022 (Kiloton)

Table 46 Europe: By Market Size, By Resin, 20152022 (USD Million)

Table 47 Europe: By Market Size, By Resin, 20152022 (Kiloton)

Table 48 Europe: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 49 Europe: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 50 Asia-Pacific: By Market Size, By Country, 20152022 (USD Million)

Table 51 Asia-Pacific: By Market Size, By Country, 20152022 (Kiloton)

Table 52 Asia-Pacific: By Market Size, By Resin, 20152022 (USD Million)

Table 53 Asia-Pacific: By Market Size, By Resin, 20152022 (Kiloton)

Table 54 Asia-Pacific: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 55 Asia-Pacific: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 56 Middle East & Africa: By Market Size, By Country, 20152022 (USD Million)

Table 57 Middle East & Africa: By Market Size, By Country, 20152022 (Kiloton)

Table 58 Middle East & Africa: By Market Size, By Resin, 20152022 (USD Million)

Table 59 Middle East & Africa: By Market Size, By Resin, 20152022 (Kiloton)

Table 60 Middle East & Africa: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 61 Middle East & Africa: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 62 South America: By Market Size, By Country, 20152022 (USD Million)

Table 63 South America: By Market Size, By Country, 20152022 (Kiloton)

Table 64 South America: By Market Size, By Resin, 20152022 (USD Million)

Table 65 South America: By Market Size, By Resin, 20152022 (Kiloton)

Table 66 South America: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 67 South America: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 68 Market Ranking of Top-5 Players, 2016

List of Figures (47 Figures)

Figure 1 High Temperature Thermoplastics Market: Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Aromatic Ketone Polymer to Account for the Largest Share in the Htts Market Between 2017 and 2022

Figure 5 Transportation to Lead the High Temperature Thermoplastics Market Between 2017 and 2022

Figure 6 China to Lead the High Temperature Thermoplastics Market Between 2017 and 2022

Figure 7 302F449.6 F Range of High Temperature Thermoplastics to Lead the Market Between 2017 and 2022

Figure 8 Asia-Pacific to Lead the High Temperature Thermoplastics Market Between 2017 and 2022

Figure 9 Attractive Opportunities in the High Temperature Thermoplastics Market, 20172022

Figure 10 Aromatic Ketone Polymer to Be the Fastest-Growing Resin in the High Temperature Thermoplastics Market, 2017-2022

Figure 11 Transportation Industry to Drive the High Temperature Thermoplastics Market, 2017-2022

Figure 12 High Temperature Thermoplastics to Account for the Largest Market Share (Volume), 20172022

Figure 13 India Recorded the Fastest Growth in the High Temperature Thermoplastics Market in 2016

Figure 14 Transportation to Account for the Largest Market Share, 20172022

Figure 15 Factors Governing the High Temperature Thermoplastics Market

Figure 16 Porters Five Forces Analysis: High Temperature Thermoplastics Market

Figure 17 Trends and Forecast of GDP, USD Billion (20162022)

Figure 18 Automotive Production in Key Countries, Million Units (2015 vs 2016)

Figure 19 New Airplane Deliveries, By Region, 20162035

Figure 20 Construction Industry in Asia-Pacific to Contribute the Maximum to the GDP, Between 2016 and 2021

Figure 21 High Temperature Fluoropolymers to Lead High Temperature Thermoplastics Market Between 2017 and 2022

Figure 22 Asia-Pacific to Lead High Temperature Fluoropolymers Segment Between 2017 and 2022

Figure 23 Asia-Pacific is Expected to Dominate the High Temperature Thermoplastics Market in High Performance Polyamide Segment Between 2017 and 2022

Figure 24 Asia-Pacific is the Largest High Temperature Thermoplastics Market in Polyphenylene Sulfide Segment Between 2017 and 2022

Figure 25 Asia-Pacific is the Fastest-Growing High Temperature Thermoplastics Market in Sulfone Polymers Segment Between 2017 and 2022

Figure 26 302F449.6F Range of High Temperature Thermoplastics to Lead the Market

Figure 27 Transportation Industry to Lead High Temperature Thermoplastics Market, 20172022

Figure 28 Asia-Pacific to Be Fastest-Growing High Temperature Thermoplastics Market in Transportation End-Use Industry, Between 2017 and 2022

Figure 29 Asia-Pacific to Lead High Temperature Thermoplastics Market in Electrical & Electronics End-Use Industry, 20172022

Figure 30 Asia-Pacific to Lead High Temperature Thermoplastics Market in Industrial End-Use Industry, 20172022

Figure 31 India to Register the Highest CAGR in High Temperature Thermoplastics Market, in Terms of Value, Between 2017 and 2022

Figure 32 North America High Temperature Thermoplastics Market Snapshot: U.S. is the Most Lucrative Market

Figure 33 Europe High Temperature Thermoplastics Market Snapshot: Italy is the Fastest-Growing Market

Figure 34 China is the Largest Market of High Temperature Thermoplastics in Asia-Pacific

Figure 35 Industrial to Be Largest End-Use Industry in the Middle East & Africa High Temperature Thermoplastics Market Between 2017 and 2022

Figure 36 Medical to Be Fastest-Growing End-Use Industry of High Temperature Thermoplastics in South America, Between 2017 and 2022

Figure 37 By Market: Competitive Leadership Mapping, 2016

Figure 38 Solvay: Company Snapshot

Figure 39 Dowdupont: Company Snapshot

Figure 40 Celanese Corporation: Company Snapshot

Figure 41 BASF: Company Snapshot

Figure 42 Arkema: Company Snapshot

Figure 43 Royal DSM: Company Snapshot

Figure 44 Sabic: Company Snapshot

Figure 45 Victrex: Company Snapshot

Figure 46 Evonik Industries: Company Snapshot

Figure 47 Toray Industries: Company Snapshot

Growth opportunities and latent adjacency in High Temperature Thermoplastics Market