Plant-Based Leather Market by Product Type (Pineapple Leather, Cactus Leather, Mushroom Leather, Apple Leather), Application (Fashion (Clothing, Accessories, and Footwear, Automotive Interior, Home) and Region - Global Forecast to 2027

Plant-based Leather Market Insights

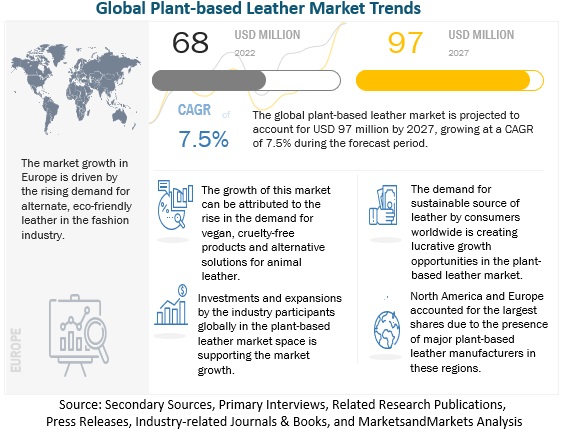

The global Plant-Based Leather Market is valued at USD 68 million in 2022 and is projected to reach a value of USD 97 million by 2027 at a CAGR (Compound Annual Growth Rate) of 7.5% over the forecast period. Plant-based leather market is a popular alternative to genuine leather and is often produced from polyurethane.

The leather business is one of the most polluting industries, producing tons of solid and liquid waste. A UN study found that following the slaughterhouse phase of the leather supply chain, each square meter of leather releases about 17 kg of carbon dioxide equivalent (CO2e). As consumers become more aware of the environmental and ethical implications of their purchases, the demand for plant-based leather products is increasing. Plant-based leather can be made from a variety of materials, including mushrooms, cork, and pineapple fibers, offering a range of textures and colors. Perturbed by the burning issues of climate change and animal welfare, consumers are now looking for alternatives to animal leather that are ethical, environmentally beneficial, and animal-free. The industry stakeholders are taking a step toward practicing sustainable business by adopting plant-based leather causing the market to expand rapidly.

To know about the assumptions considered for the study, Request for Free Sample Report

Plant-based Leather Market Growth Insights

Drivers: Increasing demand for vegan and cruelty-free products

Environmental concerns such as global warming, climate change, and depletion of natural resources are influencing the youth, causing a change in their attitude and behavior. Adopting vegetarianism is one such behavior change. Young people who are key actors in combating climate change are demanding the replacement of animal-derived products with plant-based items which are sustainable, vegan, biodegradable, ethical, and eco-friendly. The surging demand for eco-friendly products is encouraging manufacturers to substitute traditional animal leather with plant-based leather, which is driving the expansion of the market.

Harmful effects of leather on the environment and humans are promoting the adoption of plant-based leather

The production of animal leather involves the emission of countless chemicals, which pollute soil, air, and water bodies and cause severe health effects. The European Commission states that every year, the European footwear sector manufactures about 1,000 million pairs of footwear, with leather constituting 70% of the upper material. According to estimates, this procedure produces 100,000 tons of waste leather, most disposed of by incineration or landfilling. Consumers and manufacturers across all industries are gradually adopting plant-based leather, which exhibits similar textural properties as conventional leather by utilizing minimal water and energy and producing much less waste and carbon footprint. A 2019 study stated that one metric ton of raw cowhide provides just 20% completed leather products and more than 60% solid and liquid waste, including the potentially carcinogenic heavy metal chromium. Plant-based leather produces much less carbon footprint, uses only agro-waste as raw materials, generates less waste, and does not use harmful chemicals, augmenting its rapid market growth. These are the drivers of plant-based leather market.

Restraints: Higher cost of plant-based leather

Plant-based leather requires enough investment for the R&D of the product and for receiving certifications from various organizations, such as USDA, PETA, and REACH, which consequently increases the overall price of the products. The increased cost of plant-based leather is anticipated to act as a restraint in the growth of the market.

Opportunities: Scope for continuous R&D

There is always room for continuous R&D considering the recent advancements in science and innovations, suggesting that more variations of plant-based leather could be expected to be seen in the market, driving its rapid expansion. In April 2021, Natural Fiber Welding and Richemont entered a technological collaboration that helped both businesses continue improving sustainability and material science together.

Challenges: Concerns over quality and consumer perception toward plant-based leather

Consumers are skeptical about the quality, texture, and appearance of plant-based leather and are questioning its capability to compete with real leather as it is developed by recycling agro-waste. Consumer perception is anticipated to be a challenge in expanding the plant-based leather market. According to a survey conducted in the UK by the oldest vegan organization in the world, The Vegan Society, only 34% of consumers consider vegan leather as ethical, although the UK is the fastest-growing market for plant-based leather in Europe. Factors like these are challenging the growth of plant-based leather globally.

Plant-based Leather Market by Product Type Insights

Mushroom leather led the market in 2021, and the market is projected to grow with a CAGR of 7.7% during the forecast period (2022–2027)

Mushroom leather had a share of 26.6% in the plant based leather market in 2021, the largest among all product types and the market is anticipitated to grow with a CAGR of 7.7% between 2022 and 2027. The dominance is attributed to the increased application of mushroom leather in the fashion and automotive industry to meet the demand of vegan and cruelty-free products and also to the collaborations between mushroom leather companies and internationally recognized fashion and automotive brands. MIRUM which is a premium mushroom leather developed by Natural Fiber Welding (US) made its premium watch strap debut with IWC and Gisele Bündchen in July 2022. The collaboration signified the launch of MiraTexTM straps created using MIRUM by IWC Schaffhausen, the Swiss luxury watchmaker alongside Gisele Bündchen, the company's new Environmental & Community Projects Advisor.

Plant-based Leather Market by Application Insights

The fashion accessories market is anticipated to grow at a CAGR of 7.6% between 2022-2027.

Fashion accessories is the fastest growing market having the maximum share in value 35.4% in 2021 and is projected to grow at a CAGR of 7.6% by 2027. Consumers are now turning to vegan and cruelty-free products due to the growing trend of sustainable fashion. Many end-product manufacturers are using plant-based leather to create a variety of accessories, notably handbags, belts and watch straps. American brand Hozen manufactures sustainable handbags using Piñatex pineapple leather. Indian brand Aulive offers a range of designer handbags and wallets made with pineapple leather while another Indian origin brand, Studio BEEJ incorporates cork leather to make a statement with their stylish handbags.

Plant-Based Leather Market by Regional Insights

To know about the assumptions considered for the study, download the pdf brochure

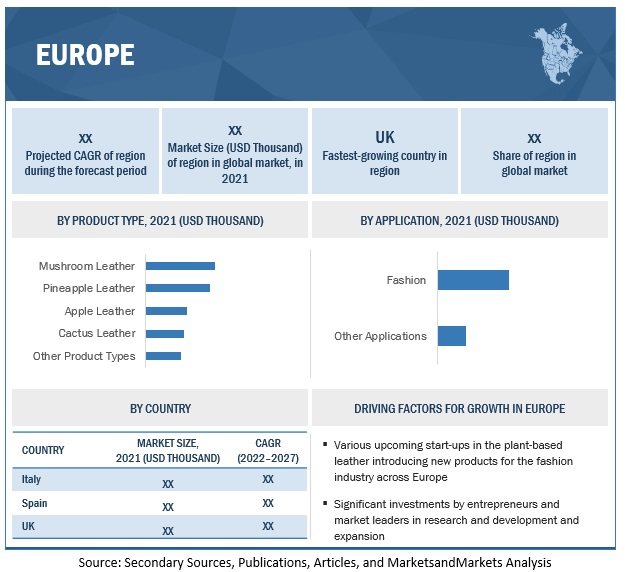

Europe dominated the market in 2021, and the market is projected to grow with a CAGR of 7.47% during the forecast period (2022–2027)

According to the CBI Ministry of Foreign Affairs, in 2020, Europe is a strong market for leather fashion accessories with a total import value of USD 8.6 billion and an average growth of 7.5%. Sustainability is a crucial part of trends and strategies in the European apparel sector, as European consumers have an increased concern about the environment. Various measures are being adopted by producers to solve the problem, including climate neutrality, material recycling and upcycling, sustainable and alternative resources, chemical management, more sustainable production practices, and animal friendliness. Plant-based leather, which is completely sustainable and has a low environmental impact, has been implemented by manufacturers in the region after considering all the issues. Products made of plant leather are in growing demand due to rising customer preference for eco-friendly materials. The regional fashion businesses use the leftovers from the harvest of pineapple, apple, and other fruits to make plant-based leather later used to make clothing, accessories, footwear, and other items. A few of the plant-based leather companies in Europe include Will’s Vegan (UK), Pinatex (Spain), Veja (France), Clarino (Philippines), Viridis (Italy), Mabel (Italy), and Volkswagen (Germany).

Top Key Players in Plant-Based Leather Industry

The key players in the plant-based leather market include Ananas Anam (UK), DESSERTO (Mexico), NUPELLE (Taiwan), Natural Fiber Welding, Inc. (US), and PEEL Lab (Japan).

Scope of the Report

|

Report Metric |

Details |

|

Market Valuation in 2022 |

USD 68 Million |

|

Revenue Forecast in 2027 |

UD $97 Million |

|

Surge rate |

CAGR of 7.5% |

|

Regions covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies studied |

|

Target Audience

- Plant-based leather manufacturers

- Plant-based leather raw material suppliers and manufacturers

- Plant-based leather material importers and exporters

- Plant-based leather material traders and distributors

- Government organizations, research organizations, and consulting firms

- Farmers producing and harvesting the fruits and vegetables

- Food processing companies involved in juice making

- Agencies involved in providing certifications and licenses such as REACH, PETA, USDA, and European Vegetarian Union.

- Commercial Research & Development (R&D) institutions and financial institutions

- Academicians and research organizations

- End users

Plant-based Leather Market Report Segmentation

This research report categorizes the plant-based leather market, based on product type, application, and region.

By Product Type

- Pineapple Leather

- Cactus Leather

- Mushroom Leather

- Apple Leather

- Other Product Types

By Application

-

Fashion

- Clothing

- Accessories

- Footwear

-

Other Applications

- Automotive interiors

- Home and other interior décor

By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Recent Developments

- In April 2022, Natural Fiber Welding, Inc. received funding of USD85 million from BMW if Ventures, Ralph Lauren Corporation, Advantage Capital, and Central Illinois Angels, which helped the company scale its production.

- In November 2021, DESSERTO partnered with Adidas and launched a new line of boxing gloves, Titlt 350, using DESSERTO cactus leather.

- In July 2021, Ananas Anam and DOLE Sunshine Company entered a collaboration, allowing Ananas Anam to utilize the pineapple waste produced by DOLE for leather production. As a result, the collaboration helped Dole to make the most of the waste.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the plant-based leather market?

Europe has the largest share of about 40.4% of the overall plant-based leather market in 2021 and is projected to sustain its leading position by 2027.

What is the forecasted size of the global plant-based leather market?

The global plant-based leather market is projected to reach USD 97 million by 2027 growing at a CAGR of 7.5% from 2022 to 2027.

Which are the major plant-based leather product types considered in the study, and which segments are projected to have promising growth rates in the future?

All the major product types include pineapple leather, mushroom leather, cactus leather, and apple leather. Mushroom and pineapple leather are the most widely used product types.

Which are the key players in the market, and how intense is the competition?

The key players in the plant-based leather market include Ananas Anam (UK), DESSERTO (Mexico), NUPELLE (Taiwan), Natural Fiber Welding, Inc. (US), and PEEL Lab (Japan), and all of them are growing at a fast pace.

What kind of information is provided in the competitive landscape section?

For the list of players mentioned above, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, and MnM view to elaborate analyst view on the company. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 PLANT-BASED LEATHER: MARKET SEGMENTATION

TABLE 1 INCLUSIONS AND EXCLUSIONS

1.3.1 REGIONAL SEGMENTATION

FIGURE 2 PLANT-BASED LEATHER: REGIONAL SEGMENTATION

1.4 YEARS CONSIDERED

FIGURE 3 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES CONSIDERED

1.6 UNITS CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 4 PLANT-BASED LEATHER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

FIGURE 5 KEY DATA FROM SECONDARY SOURCES

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

TABLE 3 PRIMARY INTERVIEWS WITH EXPERTS

2.1.2.2 List of key primary interview participants

TABLE 4 LIST OF KEY PRIMARY INTERVIEW PARTICIPANTS

2.1.2.3 Key industry insights

FIGURE 6 KEY INDUSTRY INSIGHTS

2.1.2.4 Breakdown of primary interviews

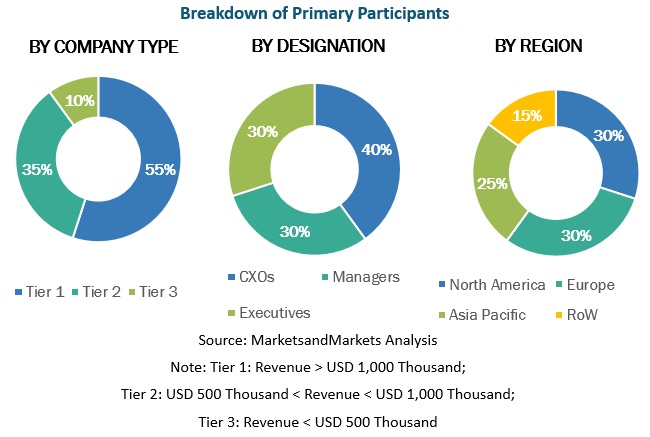

FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.5 Primary sources

FIGURE 8 PRIMARY SOURCES

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH 1

FIGURE 10 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH 2

2.2.2 TOP-DOWN APPROACH

FIGURE 11 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 12 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

FIGURE 13 ASSUMPTIONS CONSIDERED IN THE MARKET

2.5 LIMITATIONS

FIGURE 14 LIMITATION AND RISK ASSESSMENT OF STUDY

3 EXECUTIVE SUMMARY (Page No. - 42)

TABLE 5 PLANT-BASED LEATHER MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 15 MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022 VS. 2027 (USD THOUSAND)

FIGURE 16 MARKET FOR PLANT-BASED LEATHER SIZE, BY APPLICATION, 2022 VS. 2027 (USD THOUSAND)

FIGURE 17 MARKET FOR PLANT-BASED LEATHER SHARE, BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MARKET

FIGURE 18 INVESTMENTS IN DEVELOPING LEATHER FROM INNOVATIVE PLANT MATERIALS TO DRIVE MARKET FOR PLANT-BASED LEATHER

4.2 MARKET: GROWTH RATE OF MAJOR REGIONAL SUBMARKETS

FIGURE 19 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4.3 EUROPE: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE & COUNTRY

FIGURE 20 ITALY TO ACCOUNT FOR LARGEST SHARE OF EUROPEAN MARKET IN 2022

4.4 MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE

FIGURE 21 MUSHROOM LEATHER TO DOMINATE THE MARKET IN 2022

4.5 MARKET FOR PLANT-BASED LEATHER, BY APPLICATION

FIGURE 22 FASHION SEGMENT TO DOMINATE THE MARKET IN 2022

4.6 MARKET FOR PLANT-BASED LEATHER, BY FASHION APPLICATION

FIGURE 23 ACCESSORIES SEGMENT TO CONTINUE TO DOMINATE MARKET FOR FASHION APPLICATION SEGMENT DURING FORECAST PERIOD

4.7 MARKET FOR PLANT-BASED LEATHER, BY OTHER APPLICATION

FIGURE 24 AUTOMOTIVE INTERIOR SEGMENT TO HOLD LARGER SIZE OF THE MARKET IN 2027

4.8 MARKET FOR PLANT-BASED LEATHER, BY REGION

FIGURE 25 EUROPE TO CONTINUE TO DOMINATE THE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 26 MARKET DYNAMICS: PLANT-BASED LEATHER MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for vegan and cruelty-free products

5.2.1.2 Harmful effects of conventional leather on environment and humans

5.2.2 RESTRAINTS

5.2.2.1 High cost of plant-based leather and price-conscious consumers from emerging economies

5.2.2.2 Lack of operational scalability of plant-based leather industry

5.2.3 OPPORTUNITIES

5.2.3.1 Scope for continuous research and development

5.2.4 CHALLENGES

5.2.4.1 Concerns over quality and consumer perception toward plant-based leather

6 INDUSTRY TRENDS (Page No. - 56)

6.1 INTRODUCTION

6.2 TRENDS IMPACTING CUSTOMER BUSINESS

6.3 PRICING ANALYSIS

6.3.1 AVERAGE SELLING PRICE OF PLANT-BASED LEATHER OFFERED BY KEY PLAYERS, BY PRODUCT TYPE

TABLE 6 AVERAGE SELLING PRICE OF PLANT-BASED LEATHER OFFERED BY KEY PLAYERS, BY PRODUCT TYPE (USD/SQ. METER)

6.3.2 AVERAGE SELLING PRICE TREND, BY REGION

TABLE 7 AVERAGE SELLING PRICE OF PLANT-BASED LEATHER, BY REGION (USD/SQ. METER)

6.4 VALUE CHAIN

6.4.1 RESEARCH AND PRODUCT DEVELOPMENT

6.4.2 RAW MATERIAL SOURCING

6.4.3 PRODUCTION & PROCESSING

6.4.4 CERTIFICATIONS/REGULATORY BODIES

6.4.5 MARKETING & SALES

FIGURE 27 VALUE CHAIN ANALYSIS OF THE MARKET

6.5 ECOSYSTEM/MARKET MAP

TABLE 8 PLANT-BASED LEATHER MARKET: ECOSYSTEM

FIGURE 28 PLANT-BASED LEATHER ECOSYSTEM MAP

6.6 TECHNOLOGY ANALYSIS

6.7 TARIFF AND REGULATORY LANDSCAPE

6.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.7.2 NORTH AMERICA

6.7.2.1 US

6.7.3 EUROPE

6.7.4 ASIA PACIFIC

6.7.4.1 India

6.8 PATENT ANALYSIS

TABLE 10 LIST OF IMPORTANT PATENTS FOR PLANT-BASED LEATHER, 2020–2021

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 11 MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 29 MARKET FOR PLANT-BASED LEATHER: PORTER’S FIVE FORCES ANALYSIS

6.9.1 THREAT OF NEW ENTRANTS

6.9.2 THREAT OF SUBSTITUTES

6.9.3 BARGAINING POWER OF SUPPLIERS

6.9.4 BARGAINING POWER OF BUYERS

6.9.5 INTENSITY OF COMPETITIVE RIVALRY

6.10 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 12 MARKET FOR PLANT-BASED LEATHER: DETAILED LIST OF CONFERENCES AND EVENTS, 2022–2023

6.11 KEY STAKEHOLDERS AND BUYING CRITERIA

6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PLANT-BASED LEATHER FOR VARIOUS APPLICATIONS

TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PLANT-BASED LEATHER

6.12 BUYING CRITERIA

FIGURE 31 KEY BUYING CRITERIA FOR VARIOUS APPLICATIONS

TABLE 14 KEY BUYING CRITERIA FOR TOP APPLICATIONS

7 MARKET, BY PRODUCT TYPE (Page No. - 70)

7.1 INTRODUCTION

FIGURE 32 PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2022 VS. 2027 (USD THOUSAND)

TABLE 15 MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 16 MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 17 MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (THOUSAND SQUARE METER)

TABLE 18 MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (THOUSAND SQUARE METER)

7.2 PINEAPPLE LEATHER

7.2.1 SUSTAINABILITY AND MULTIFUNCTIONALITY OF PINEAPPLE LEATHER TO INCREASE ITS ADOPTION IN FASHION AND AUTOMOTIVE INDUSTRIES

TABLE 19 PINEAPPLE LEATHER: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 20 PINEAPPLE LEATHER: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2022–2027 (USD THOUSAND)

7.3 CACTUS LEATHER

7.3.1 LIMITED ENVIRONMENTAL IMPACT AND MULTIFUNCTIONALITY OF CACTUS LEATHER TO DRIVE MARKET

TABLE 21 CACTUS LEATHER: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 22 CACTUS LEATHER: PLANT-BASED LEATHER, BY REGION, 2022–2027 (USD THOUSAND)

7.4 MUSHROOM LEATHER

7.4.1 BIODEGRADABLE NATURE AND INCREASED APPLICATIONS IN FASHION INDUSTRY TO BOOST MARKET GROWTH

TABLE 23 MUSHROOM LEATHER: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 24 MUSHROOM LEATHER: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

7.5 APPLE LEATHER

7.5.1 INCREASING APPLICATIONS OF APPLE LEATHER FOR SHOES AND ACCESSORIES TO DRIVE MARKET

TABLE 25 APPLE LEATHER: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 26 APPLE LEATHER: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2022–2027 (USD THOUSAND)

7.6 OTHER PRODUCTS

TABLE 27 OTHER PRODUCTS: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 28 OTHER PRODUCTS: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2022–2027 (USD THOUSAND)

8 PLANT-BASED LEATHER MARKET, BY APPLICATION (Page No. - 79)

8.1 INTRODUCTION

FIGURE 33 FASHION SEGMENT IS PROJECTED TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

TABLE 29 MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 30 MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 31 FASHION: MARKET FOR PLANT-BASED LEATHER, BY FASHION TYPE, 2019–2021 (USD THOUSAND)

TABLE 32 FASHION: MARKET FOR PLANT-BASED LEATHER, FASHION TYPE, 2022–2027 (USD THOUSAND)

TABLE 33 OTHERS: MARKET FOR PLANT-BASED LEATHER, TYPE, 2019–2021 (USD THOUSAND)

TABLE 34 OTHERS: MARKET FOR PLANT-BASED LEATHER, TYPE, 2022–2027 (USD THOUSAND)

8.2 FASHION

TABLE 35 FASHION: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 36 FASHION: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2022–2027 (USD THOUSAND)

8.2.1 CLOTHING

8.2.1.1 Young consumers shifting from conventional leather products to sustainable alternatives

TABLE 37 CLOTHING: MARKET, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 38 CLOTHING: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2022–2027 (USD THOUSAND)

8.2.2 ACCESSORIES

8.2.2.1 Increased demand for cruelty-free fashion materials

TABLE 39 ACCESSORIES: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 40 ACCESSORIES: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2022–2027 (USD THOUSAND)

8.2.3 FOOTWEAR

8.2.3.1 International shoe brands moving toward plant-based leather

TABLE 41 FOOTWEAR: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 42 FOOTWEAR: MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8.3 OTHERS

TABLE 43 OTHERS: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 44 OTHERS: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2022–2027 (USD THOUSAND)

8.3.1 AUTOMOTIVE INTERIORS

8.3.1.1 Luxurious car brands replacing animal leather with plant leather

TABLE 45 AUTOMOTIVE INTERIORS: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 46 AUTOMOTIVE INTERIORS: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2022–2027 (USD THOUSAND)

8.3.2 HOME AND OTHER INTERIOR DECOR

8.3.2.1 Vegan population generating increased demand for plant-based home decor accessories

TABLE 47 HOME AND OTHER INTERIOR DECOR: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 48 HOME AND OTHER INTERIOR DECOR: PLANT-BASED LEATHER MARKET, BY REGION, 2022–2027 (USD THOUSAND)

9 GEOGRAPHIC ANALYSIS (Page No. - 89)

9.1 INTRODUCTION

FIGURE 34 MARKET SHARE, BY KEY COUNTRY, 2021

TABLE 49 MARKET FOR PLANT-BASED LEATHER, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 50 MARKET FOR PLANT-BASED LEATHER, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 51 MARKET FOR PLANT-BASED LEATHER, BY REGION, 2019–2021 (THOUSAND SQUARE METER)

TABLE 52 MARKET FOR PLANT-BASED LEATHER, BY REGION, 2022–2027 (THOUSAND SQUARE METER)

9.2 NORTH AMERICA

TABLE 53 NORTH AMERICA: MARKET FOR PLANT-BASED LEATHER, BY COUNTRY, 2019–2021 (USD THOUSAND)

TABLE 54 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 55 NORTH AMERICA: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 56 NORTH AMERICA: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 57 NORTH AMERICA: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (THOUSAND SQUARE METER)

TABLE 58 NORTH AMERICA: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (THOUSAND SQUARE METER)

TABLE 59 NORTH AMERICA: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 60 NORTH AMERICA: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 61 NORTH AMERICA: MARKET FOR PLANT-BASED LEATHER, BY FASHION TYPE, 2019–2021 (USD THOUSAND)

TABLE 62 NORTH AMERICA: MARKET FOR PLANT-BASED LEATHER, BY FASHION TYPE, 2022–2027 (USD THOUSAND)

TABLE 63 NORTH AMERICA: MARKET FOR PLANT-BASED LEATHER, BY OTHER APPLICATION TYPE, 2019–2021 (USD THOUSAND)

TABLE 64 NORTH AMERICA: MARKET, BY OTHER APPLICATION TYPE, 2022–2027 (USD THOUSAND)

9.2.1 US

9.2.1.1 Investments in new technologies and shift toward environmentally sustainable products

TABLE 65 US: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 66 US: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 67 US: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 68 US: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 69 US: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 70 US: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 71 US: PLANT-BASED LEATHER MARKET, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 72 US: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2022–2027 (USD THOUSAND)

9.2.2 CANADA

9.2.2.1 New upcoming brands introducing plant-based leather products to fulfill rising consumer demand

TABLE 73 CANADA: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 74 CANADA: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 75 CANADA: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 76 CANADA: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 77 CANADA: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 78 CANADA: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 79 CANADA: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 80 CANADA: MARKET, BY OTHERS, 2022–2027 (USD THOUSAND)

9.2.3 MEXICO

9.2.3.1 Collaborations between plant-based leather manufacturing and end-product manufacturing companies

TABLE 81 MEXICO: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 82 MEXICO: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 83 MEXICO: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 84 MEXICO: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 85 MEXICO: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 86 MEXICO: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 87 MEXICO: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 88 MEXICO: MARKET, BY OTHERS, 2022–2027 (USD THOUSAND)

9.3 EUROPE

FIGURE 35 EUROPE: MARKET SNAPSHOT

TABLE 89 EUROPE: PLANT-BASED LEATHER MARKET, BY COUNTRY, 2019–2021 (USD THOUSAND)

TABLE 90 EUROPE: MARKET FOR PLANT-BASED LEATHER, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 91 EUROPE: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 92 EUROPE: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 93 EUROPE: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (THOUSAND SQUARE METER)

TABLE 94 EUROPE: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (THOUSAND SQUARE METER)

TABLE 95 EUROPE: MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 96 EUROPE: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 97 EUROPE: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 98 EUROPE: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 99 EUROPE: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 100 EUROPE: MARKET, BY OTHERS, 2022–2027 (USD THOUSAND)

9.3.1 GERMANY

9.3.1.1 Introduction of new sources of raw materials for plant-based leather becoming primary focus of fashion experts

TABLE 101 GERMANY: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 102 GERMANY: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 103 GERMANY: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 104 GERMANY: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 105 GERMANY: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 106 GERMANY: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 107 GERMANY: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 108 GERMANY: MARKET, BY OTHERS, 2022–2027 (USD THOUSAND)

9.3.2 ITALY

9.3.2.1 Presence of key luxury fashion brands and their rising acceptance of vegan and sustainable fashion accelerating industry growth

TABLE 109 ITALY: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 110 ITALY: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 111 ITALY: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 112 ITALY: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 113 ITALY: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 114 ITALY: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 115 ITALY: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 116 ITALY: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2022–2027 (USD THOUSAND)

9.3.3 SPAIN

9.3.3.1 Various end-product manufacturing companies introducing products with plant-based leather for multiple applications

TABLE 117 SPAIN: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 118 SPAIN: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 119 SPAIN: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 120 SPAIN: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 121 SPAIN: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 122 SPAIN: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 123 SPAIN: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 124 SPAIN: MARKET, BY OTHERS, 2022–2027 (USD THOUSAND)

9.3.4 UK

9.3.4.1 Growing presence of consumers willing to pay premium prices for clean and sustainable products

TABLE 125 UK: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 126 UK: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 127 UK: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 128 UK: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 129 UK: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 130 UK: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 131 UK: MARKET, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 132 UK: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2022–2027 (USD THOUSAND)

9.3.5 FRANCE

9.3.5.1 New product launches by various start-ups to boost market for plant-based leather

TABLE 133 FRANCE: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 134 FRANCE: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 135 FRANCE: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 136 FRANCE: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 137 FRANCE: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 138 FRANCE: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 139 FRANCE: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 140 FRANCE: MARKET FOR PLANT-BASED LEATHER SIZE, BY OTHERS, 2022–2027 (USD THOUSAND)

9.3.6 SWITZERLAND

9.3.6.1 Investments in new product development to create lucrative opportunities in market

TABLE 141 SWITZERLAND: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 142 SWITZERLAND: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 143 SWITZERLAND: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 144 SWITZERLAND: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 145 SWITZERLAND: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 146 SWITZERLAND: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 147 SWITZERLAND: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 148 SWITZERLAND: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2022–2027 (USD THOUSAND)

9.3.7 REST OF EUROPE

TABLE 149 REST OF EUROPE: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 150 REST OF EUROPE: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 151 REST OF EUROPE: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 152 REST OF EUROPE: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 153 REST OF EUROPE: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 154 REST OF EUROPE: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 155 REST OF EUROPE: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 156 REST OF EUROPE: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2022–2027 (USD THOUSAND)

9.4 ASIA PACIFIC

TABLE 157 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2021 (USD THOUSAND)

TABLE 158 ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY COUNTRY, 2022–2027 (USD THOUSAND)

TABLE 159 ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 160 ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 161 ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (THOUSAND SQUARE METER)

TABLE 162 ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (THOUSAND SQUARE METER)

TABLE 163 ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 164 ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 165 ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 166 ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 167 ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 168 ASIA PACIFIC: MARKET, BY OTHERS, 2022–2027 (USD THOUSAND)

9.4.1 CHINA

9.4.1.1 Increased demand for leather goods

TABLE 169 CHINA: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 170 CHINA: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 171 CHINA: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 172 CHINA: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 173 CHINA: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 174 CHINA: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 175 CHINA: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 176 CHINA: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2022–2027 (USD THOUSAND)

9.4.2 INDIA

9.4.2.1 Environmental consciousness among consumers and growing vegetarianism

TABLE 177 INDIA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 178 INDIA: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 179 INDIA: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 180 INDIA: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 181 INDIA: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 182 INDIA: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 183 INDIA: MARKET, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 184 INDIA: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2022–2027 (USD THOUSAND)

9.4.3 JAPAN

9.4.3.1 Increased demand for natural products, strong R&D, and abundant raw materials

TABLE 185 JAPAN: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 186 JAPAN: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 187 JAPAN: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 188 JAPAN: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 189 JAPAN: MARKET, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 190 JAPAN: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 191 JAPAN: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 192 JAPAN: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2022–2027 (USD THOUSAND)

9.4.4 SOUTH KOREA

9.4.4.1 Application of plant-based leather in automobiles

TABLE 193 SOUTH KOREA: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 194 SOUTH KOREA: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 195 SOUTH KOREA: MARKET, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 196 SOUTH KOREA: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 197 SOUTH KOREA: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 198 SOUTH KOREA: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 199 SOUTH KOREA: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 200 SOUTH KOREA: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2022–2027 (USD THOUSAND)

9.4.5 INDONESIA

9.4.5.1 Plant-based leather using fermentation technique

TABLE 201 INDONESIA: PLANT-BASED LEATHER MARKET, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 202 INDONESIA: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 203 INDONESIA: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 204 INDONESIA: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 205 INDONESIA: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 206 INDONESIA: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 207 INDONESIA: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 208 INDONESIA: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2022–2027 (USD THOUSAND)

9.4.6 THAILAND

9.4.6.1 Teak leather emerging as popular plant-based leather

TABLE 209 THAILAND: MARKET, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 210 THAILAND: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 211 THAILAND: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 212 THAILAND: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 213 THAILAND: MARKET, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 214 THAILAND: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 215 THAILAND: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 216 THAILAND: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2022–2027 (USD THOUSAND)

9.4.7 AUSTRALIA & NEW ZEALAND

9.4.7.1 Kangaroo leather being gradually replaced with plant-based leather due to ethical concerns

TABLE 217 AUSTRALIA & NEW ZEALAND: MARKET, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 218 AUSTRALIA & NEW ZEALAND: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 219 AUSTRALIA & NEW ZEALAND: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 220 AUSTRALIA & NEW ZEALAND: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 221 AUSTRALIA & NEW ZEALAND: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 222 AUSTRALIA & NEW ZEALAND: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 223 AUSTRALIA & NEW ZEALAND: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 224 AUSTRALIA & NEW ZEALAND: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022–2027 (USD THOUSAND)

9.4.8 REST OF ASIA PACIFIC

TABLE 225 REST OF ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 226 REST OF ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 227 REST OF ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 228 REST OF ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 229 REST OF ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 230 REST OF ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 231 REST OF ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 232 REST OF ASIA PACIFIC: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2022–2027 (USD THOUSAND)

9.5 ROW

TABLE 233 ROW: MARKET, BY REGION, 2019–2021 (USD THOUSAND)

TABLE 234 ROW: MARKET FOR PLANT-BASED LEATHER, BY REGION, 2022–2027 (USD THOUSAND)

TABLE 235 ROW: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 236 ROW: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 237 ROW: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2019–2021 (THOUSAND SQUARE METER)

TABLE 238 ROW: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (THOUSAND SQUARE METER)

TABLE 239 ROW: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 240 ROW: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 241 ROW: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 242 ROW: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 243 ROW: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 244 ROW: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2022–2027 (USD THOUSAND)

9.5.1 SOUTH AMERICA

9.5.1.1 Large amount of pineapple and cactus harvest waste

TABLE 245 SOUTH AMERICA: MARKET, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 246 SOUTH AMERICA: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 247 SOUTH AMERICA: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 248 SOUTH AMERICA: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 249 SOUTH AMERICA: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 250 SOUTH AMERICA: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 251 SOUTH AMERICA: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 252 SOUTH AMERICA: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2022–2027 (USD THOUSAND)

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 Local brands shifting from animal leather to plant-based leather due to sustainability concerns

TABLE 253 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT TYPE, 2019–2021 (USD THOUSAND)

TABLE 254 MIDDLE EAST & AFRICA: MARKET FOR PLANT-BASED LEATHER, BY PRODUCT TYPE, 2022–2027 (USD THOUSAND)

TABLE 255 MIDDLE EAST & AFRICA: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2019–2021 (USD THOUSAND)

TABLE 256 MIDDLE EAST & AFRICA: MARKET FOR PLANT-BASED LEATHER, BY APPLICATION, 2022–2027 (USD THOUSAND)

TABLE 257 MIDDLE EAST & AFRICA: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2019–2021 (USD THOUSAND)

TABLE 258 MIDDLE EAST & AFRICA: MARKET FOR PLANT-BASED LEATHER, BY FASHION, 2022–2027 (USD THOUSAND)

TABLE 259 MIDDLE EAST & AFRICA: MARKET FOR PLANT-BASED LEATHER, BY OTHERS, 2019–2021 (USD THOUSAND)

TABLE 260 MIDDLE EAST & AFRICA: PLANT-BASED LEATHER MARKET, BY OTHERS, 2022–2027 (USD THOUSAND)

10 COMPETITIVE LANDSCAPE (Page No. - 159)

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 36 MARKET EVALUATION FRAMEWORK, 2019–2022

10.3 MARKET SHARE ANALYSIS

TABLE 261 MARKET SHARE ANALYSIS, 2021

10.4 COMPANY EVALUATION QUADRANT: DEFINITIONS AND METHODOLOGY

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 PARTICIPANTS

FIGURE 37 MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

10.4.5 COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 262 COMPANY FOOTPRINT, BY PRODUCT TYPE

TABLE 263 COMPANY FOOTPRINT, BY APPLICATION

TABLE 264 COMPANY FOOTPRINT, BY REGION

TABLE 265 OVERALL COMPANY FOOTPRINT

10.5 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

10.5.1 PRODUCT LAUNCHES

TABLE 266 MARKET: NEW PRODUCT LAUNCHES, 2019–2022

10.5.2 DEALS

TABLE 267 MARKET: DEALS, 2019–2022

10.5.3 OTHER DEVELOPMENTS

TABLE 268 MARKET: OTHER DEVELOPMENTS, 2019–2022

11 COMPANY PROFILES (Page No. - 174)

(Business overview, Products offered, Recent developments & MnM View)*

11.1 ANANAS ANAM

TABLE 269 ANANAS ANAM: BUSINESS OVERVIEW

TABLE 270 ANANAS ANAM: PRODUCTS OFFERED

TABLE 271 ANANAS ANAM: PRODUCT LAUNCHES

TABLE 272 ANANAS ANAM: DEALS

TABLE 273 ANANAS ANAM: OTHERS

11.2 MALAI ECO

TABLE 274 MALAI ECO: BUSINESS OVERVIEW

TABLE 275 MALAI ECO: PRODUCTS OFFERED

11.3 BIOLEATHER

TABLE 276 BIOLEATHER: BUSINESS OVERVIEW

TABLE 277 BIOLEATHER: PRODUCTS OFFERED

TABLE 278 BIOLEATHER: OTHERS

11.4 FRUITLEATHER ROTTERDAM

TABLE 279 FRUITLEATHER ROTTERDAM: BUSINESS OVERVIEW

TABLE 280 FRUITLEATHER ROTTERDAM: PRODUCTS OFFERED

11.5 BZ LEATHER

TABLE 281 BZ LEATHER: BUSINESS OVERVIEW

TABLE 282 BZ LEATHER: PRODUCTS OFFERED

11.6 NATURAL FIBER WELDING, INC.

TABLE 283 NATURAL FIBER WELDING, INC.: BUSINESS OVERVIEW

TABLE 284 NATURAL FIBER WELDING, INC.: PRODUCTS OFFERED

TABLE 285 NATURAL FIBER WELDING, INC.: DEALS

TABLE 286 NATURAL FIBER WELDING, INC.: OTHERS

11.7 NUPELLE

TABLE 287 NUPELLE: BUSINESS OVERVIEW

TABLE 288 NUPELLE: PRODUCTS OFFERED

TABLE 289 NUPELLE: PRODUCT LAUNCHES

TABLE 290 NUPELLE: DEALS

11.8 NOVA MILAN

TABLE 291 NOVA MILAN: PLANT-BASED LEATHER MARKET BUSINESS OVERVIEW

TABLE 292 NOVA MILAN: PRODUCTS OFFERED

11.9 ECOVATIVE LLC.

TABLE 293 ECOVATIVE LLC.: BUSINESS OVERVIEW

TABLE 294 ECOVATIVE LLC.: PRODUCTS OFFERED

TABLE 295 ECOVATIVE LLC.: DEALS

11.10 MABEL SRL

TABLE 296 MABEL SRL.: BUSINESS OVERVIEW

TABLE 297 MABEL SRL: PRODUCTS OFFERED

TABLE 298 MABEL SRL: DEALS

11.11 MYCOWORKS

TABLE 299 MYCOWORKS.: BUSINESS OVERVIEW

TABLE 300 MYCOWORKS: PRODUCTS OFFERED

11.12 PANGAIA GRADO ZERO SRL

TABLE 301 PANGAIA GRADO ZERO SRL: BUSINESS OVERVIEW

TABLE 302 PANGAIA GRADO ZERO SRL: PRODUCTS OFFERED

11.13 DESSERTO

TABLE 303 DESSERTO: BUSINESS OVERVIEW

TABLE 304 DESSERTO: PRODUCTS OFFERED

TABLE 305 DESSERTO: DEALS

TABLE 306 DESSERTO: OTHERS

11.14 PEEL LAB

TABLE 307 PEEL LAB: BUSINESS OVERVIEW

TABLE 308 PEEL LAB: PRODUCTS OFFERED

11.15 BEYOND LEATHER MATERIALS

TABLE 309 BEYOND LEATHER MATERIALS: BUSINESS OVERVIEW

TABLE 310 BEYOND LEATHER MATERIALS: PRODUCTS OFFERED

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

12 ADJACENT AND RELATED MARKETS (Page No. - 209)

12.1 INTRODUCTION

TABLE 311 ADJACENT MARKETS TO PLANT-BASED LEATHER MARKET

12.2 LIMITATIONS

12.3 BIO-BASED LEATHER MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.3.3 BIO-BASED LEATHER MARKET, BY SOURCE

TABLE 312 BIO-BASED LEATHER MARKET, BY SOURCE, 2016–2019 (USD THOUSAND)

TABLE 313 BIO-BASED LEATHER MARKET, BY SOURCE, 2020–2026 (USD THOUSAND)

TABLE 314 BIO-BASED LEATHER MARKET, BY SOURCE, 2016–2019 (THOUSAND SQ. METER)

TABLE 315 BIO-BASED LEATHER MARKET, BY SOURCE, 2020–2026 (THOUSAND SQ. METER)

12.3.4 BIO-BASED LEATHER MARKET, BY REGION

TABLE 316 BIO-BASED LEATHER MARKET SIZE, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 317 BIO-BASED LEATHER MARKET SIZE, BY REGION, 2020–2026 (USD THOUSAND)

TABLE 318 BIO-BASED LEATHER MARKET SIZE, BY REGION, 2016–2019 (THOUSAND SQ. METER)

TABLE 319 BIO-BASED LEATHER MARKET SIZE, BY REGION, 2020–2026 (THOUSAND SQ. METER)

12.4 SYNTHETIC LEATHER (ARTIFICIAL LEATHER) MARKET

12.4.1 MARKET DEFINITION

12.4.2 MARKET OVERVIEW

12.4.3 SYNTHETIC LEATHER MARKET, BY TYPE

TABLE 320 SYNTHETIC LEATHER MARKET SIZE, BY TYPE, 2016–2019 (MILLION SQ. METER)

TABLE 321 SYNTHETIC LEATHER MARKET SIZE, BY TYPE, 2020–2025 (MILLION SQ. METER)

TABLE 322 SYNTHETIC LEATHER MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 323 SYNTHETIC LEATHER MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

12.4.4 SYNTHETIC LEATHER MARKET, BY REGION

TABLE 324 SYNTHETIC LEATHER MARKET SIZE, BY REGION, 2016–2019 (MILLION SQ. METER)

TABLE 325 SYNTHETIC LEATHER MARKET SIZE, BY REGION, 2020–2025 (MILLION SQ. METER)

TABLE 326 SYNTHETIC LEATHER MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 327 SYNTHETIC LEATHER MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

13 APPENDIX (Page No. - 218)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the plant-based leather market. In-depth interviews were conducted with various primary respondents—such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information and assess prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases and investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold and silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the plant-based leather market.

To know about the assumptions considered for the study, download the pdf brochure

Report Objectives

- To define, segment, and project the global market size for plant-based leather market based on product type, application, and region ranging from 2022 to 2027

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete value chain and the influence of all key stakeholders, such as manufacturers, suppliers, and end users

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- Analyzing the micro markets with respect to individual growth trends, prospects, and their contribution to the total market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given plant-based leather market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe into Poland, Portugal, and Sweden

- Further breakdown of the Rest of Asia Pacific into Bangladesh, Vietnam, and Taiwan

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Plant-Based Leather Market