Technical Enzymes Market by Type (Amylases, Cellulases, Proteases, and Lipases), Industry (Biofuel, Starch, Textiles & Leather, and Paper & Pulp), Source (Microorganism, Plant, and Animal), Form (Liquid and Dry), and Region - Global Forecast to 2026

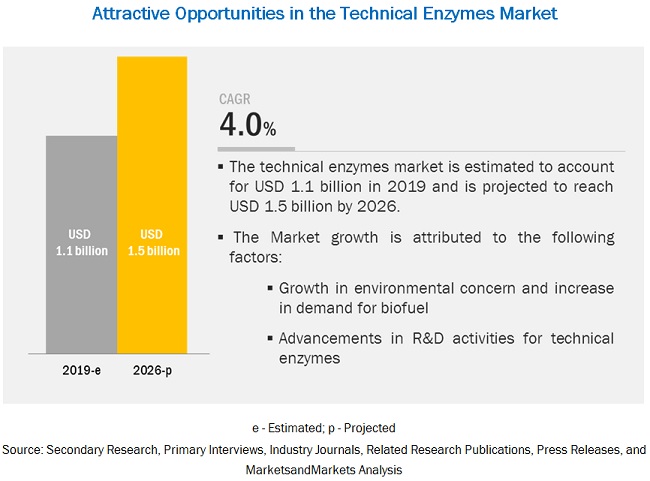

[132 Pages Report] The global technical enzymes market size is projected to grow from USD 1.1 billion in 2019 to USD 1.5 billion by 2026, recording a compound annual growth rate (CAGR) of 4.0% during the forecast period. The increasing trend of environmental concerns in developing countries and advancements of R&D activities for technical enzymes are the major factors that are projected to drive the growth of this market during the forecast period.

The biofuel industry is estimated to account for the largest share in 2019 in the technical enzymes market.

The biofuel industry is estimated to dominate the global market, on the basis of industry, in terms of value, in 2019. Consumer inclination toward an alternative to gasoline for the reduction in harmful auto & industrial emissions has augmented the usage of biofuels in many developed countries. Enzymes have been used for the conversion of biomass into biofuels, as they overcome many drawbacks associated with the use of traditional chemicals as catalysts for biofuel generation. Enzymes are safer substitutes for MTBE (methyl tert-butyl ether), as MTBE is a blending component to oxygenate gasoline and is hazardous to human health.

The starch industry is projected to account for the second-largest share during the forecast period.

The usage of enzymes in starch processing helps them to specifically react with carbohydrate components present in starch to retain moisture more efficiently and increase shelf life. Furthermore, enzymes are able to quickly reduce the viscosity of starch slurries to facilitate further handling and processing. They also play a role in halving the amount of pH chemicals (acidifiers) that are usually used in starch processing, as they help mitigate the pH; this helps in breaking down the large starch molecules into smaller molecules needed for liquefaction of starch.

Amylases have been estimated to dominate the market in 2019.

Amylases are technical enzymes that catalyze the hydrolysis of starch into sugars. As they are one of the main enzymes used in the industry to hydrolyze the starch molecules into polymers composed of glucose units. Amylase breaks down carbohydrates (polysaccharides) into disaccharides and, ultimately, into monosaccharides such as glucose. There are three types—alpha-amylase, beta-amylase, and gamma-amylase; all three types are glucoside hydrolases, which help in the process of starch degradation, by acting on glycosidic bonds to create short-chain sugars. These factors are projected to drive the demand for amylases type of enzymes during the forecast period.

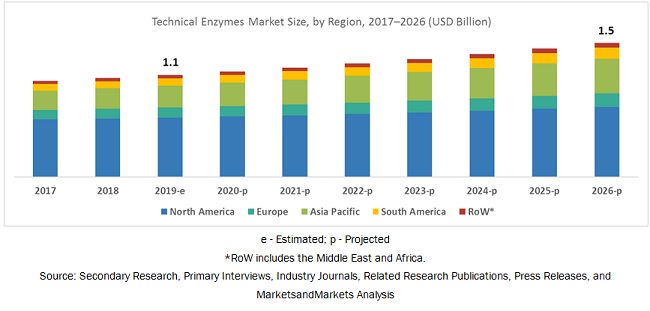

North America is projected to account for the largest share in the technical enzymes market during the forecast period.

The North American market is projected to account for the largest share by 2025, due to various benefits of technical enzymes, as they are an environment-friendly and cost-effective alternative to replace the conventional alkaline or conventional acidic catalysts. Technological advancements have made technical enzymes available for a wide range of applications in biofuel, paper & pulp, textile & leather, starch processing, and other industries, which is estimated to drive the growth in the region. The North American region is estimated to be the largest market for technical enzymes, globally, owing to the development of novel and superior performing products, developed technologies, and global industrialization.

Key Market Players

Key vendors in the global market include BASF (Germany), DuPont (US), Associated British Foods (UK), Novozymes (Denmark), DSM (Netherlands), Dyadic International (US), Advanced Enzymes Technologies (India), Maps Enzymes (India), Epygen Labs (India), Megazyme (Ireland), Aumgene Biosciences (India), Enzymatic Deinking Technologies (US), Tex Biosciences (India), Denykem (UK), MetGen (Finland), and Creative Enzymes (US). These players have a broad industry coverage and high operational and financial strength.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2026 |

|

Forecast units |

Value (USD) and Volume (Ton) |

|

Segments covered |

Industry, Source, Form, Type, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies covered |

BASF (Germany), DuPont (US), Associated British Foods (UK), Novozymes (Denmark), DSM (Netherlands), Dyadic International (US), Advanced Enzymes Technologies (India), Maps Enzymes (India), Epygen Labs (India), Megazyme (Ireland), Aumgene Biosciences (India), Enzymatic Deinking Technologies (US), Tex Biosciences (India), Denykem (UK), MetGen (Finland), Creative Enzymes (US), Sunson Industry Group (China), Transbiodiesel (Israel), Enzyme Supplies (UK), and Enzyme Solutions (US) |

This research report categorizes the technical enzymes market based on industry, type, source, form, and region.

Based on industry, the market has been segmented as follows:

- Biofuel

- Starch processing

- Textiles & leather

- Paper & pulp

- Other industries (cosmetics, wastewater treatment, and oil field & fine chemicals)

Based on form, the market has been segmented as follows:

- Liquid

- Dry

Based on the type, the technical enzymes market has been segmented as follows:

- Amylases

- Cellulases

- Proteases

- Lipases

- Other types (pectinases, xylanases, catalases, laccases, and mannanases)

Based on the region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (South America, Middle East and Africa)

Key questions addressed by the report:

- Who are the major market players in this market?

- What are the regional growth trends and the largest revenue-generating regions for the technical enzymes market?

- What are the key regions and industries that are projected to witness significant growth in the technical enzymes market?

- What are the major industries of technical enzymes that are projected to account for a major revenue share during the forecast period?

- In which major forms are technical enzymes majorly used, and which form is projected to dominate during the forecast period?

- What are the major sources of technical enzymes that are projected to account for a major revenue share during the forecast period?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Regions Covered

1.5 Periodization Considered

1.6 Currency Considered

1.7 Volume Unit Considered

1.8 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.2 Market Size Estimation

2.2.1 Approach One (Based on Industry, By Region)

2.2.2 Approach Two (Based on Global Market)

2.3 Data Triangulation

2.4 Assumptions for the Study

2.5 Limitations of the Study

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 34)

4.1 Overview of this Market

4.2 Major Regional Submarkets

4.3 North America: Technical Enzymes Market, By Key Industry and Country

4.4 Technical Enzymes Market, By Type and Region

4.5 Market, By Industry

4.6 Market, By Form

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth in Environmental Concerns and Increase in Demand for Biofuel

5.2.1.2 Advancements in R&D Activities for Technical Enzymes

5.2.2 Restraints

5.2.2.1 Stringent Regulatory Framework

5.2.3 Opportunities

5.2.3.1 Need for Alternatives to Synthetic Chemicals

5.2.4 Challenges

5.2.4.1 Concerns Over Quality, Safety, and Consumer Perception Toward Enzymes

5.2.4.2 Lack of Transparency in Patent Protection Laws

5.3 Value Chain

5.4 YC & YCC Shift

5.5 Regulations

5.5.1 CLP Legislation

5.5.2 Biocidal Product Regulation (BPR)

6 Technical Enzymes Market, By Type (Page No. - 46)

6.1 Introduction

6.2 Amylases

6.2.1 Amylase Usage has Increased as It is A Boon to the Biofuel & Textile Industry

6.3 Cellulases

6.3.1 Their Complex Nature Allows Wide Industrial Usage

6.4 Proteases

6.4.1 Competent Characteristic to Hydrolyze Proteins has Boosted Its Industrial Use

6.5 Lipases

6.5.1 Commercializing Biofuel Production From Enzymatic Processes has Fueled the Market for Lipases

6.6 Other Types

6.6.1 Functional Benefits in Various Industries Drive the Market for Other Types of Enzymes

7 Technical Enzymes Market, By Industry (Page No. - 54)

7.1 Introduction

7.2 Biofuel

7.2.1 Enzymes as Biological Catalysts in the Production of Biofuel have Been Fueling the Industry

7.3 Starch

7.3.1 Enzymes Functionally Benefit Starch Processing

7.4 Textile & Leather

7.4.1 Less Chemical Discharge in Water and Improvement in Product Quality have Fueled the Usage of Enzymes

7.5 Paper & Pulp

7.5.1 Enzyme Usage Increases the Recycling of Paper in the Industry

7.6 Other Industries

7.6.1 Enzymes Effectively Break Down the Organic Wastes By Mitigating the Usage of Chemicals in Wastewater Treatment

8 Technical Enzymes Market, By Form (Page No. - 61)

8.1 Introduction

8.2 Liquid

8.2.1 Ease of Use in the Biofuel & Textile Industries Boosts the Usage of the Liquid Form

8.3 Dry (Powder & Granular)

8.3.1 Dry Form Enables Better Accuracy of Dosages

9 Technical Enzymes Market, By Source (Page No. - 65)

9.1 Introduction

9.2 Microorganism

9.2.1 Huge Production in Lesser Time Span Boosts the Industrial Usage of Microbial Enzymes

9.3 Plant

9.3.1 Plant-Based Enzymes Boost the Production of Biomass Suitable for Conversion to Biofuels

9.4 Animal

9.4.1 Being Temperature-Sensitive Discourages the Industrial Usage of Animal-Based Enzymes

10 Technical Enzymes Market, By Region (Page No. - 70)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 High Consumption and Production of Biofuel

10.2.2 Canada

10.2.2.1 Technological Advances in Biotechnology and Bio-Sciences

10.2.3 Mexico

10.2.3.1 Government Campaigns to Blend Ethanol With Petrol Will Drive the Market

10.3 Europe

10.3.1 France

10.3.1.1 Investment in Advanced Technologies for Biofuel Production

10.3.2 Germany

10.3.2.1 Growth in Focus on Technical Textiles is Driving the Demand for Technical Enzymes

10.3.3 UK

10.3.3.1 Government Funds to Support Biofuel Production to Reduce Carbon Emission

10.3.4 Netherlands

10.3.4.1 Implementation of the Renewable Energy Directive in the Transportation Sector

10.3.5 Spain

10.3.5.1 Wide Availability of Raw Materials for Biofuel Production

10.3.6 Belgium

10.3.6.1 Development in the Textile Industry in Belgium to Increase the Demand for Technical Enzymes

10.3.7 Rest of Europe

10.3.7.1 Growth in Consumption of Biofuel in Most European Countries

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Shifting of the Key Players’ Manufacturing Operations From Europe and North America to China

10.4.2 India

10.4.2.1 Adoption of Improved Technologies in Starch Processing is Expected to Drive the Market for Technical Enzymes

10.4.3 Australia & New Zealand

10.4.3.1 Government Initiatives and Policies Introducing Ethanol Biofuel Mandates Across the Region

10.4.4 Japan

10.4.4.1 Focus on Expanding Apparel & Home Textile Chemical Businesses

10.4.5 Rest of Asia Pacific

10.4.5.1 Developing Countries in the Asia Pacific Region Present Immense Scope for the Technical Enzymes Industry

10.5 South America

10.5.1 Brazil

10.5.1.1 Advancements in Starch Processing Technology in Brazil

10.5.2 Argentina

10.5.2.1 Growth of the Textile Industry for Domestic Consumption

10.5.3 Rest of South America

10.5.3.1 Expansion of Pulp and Paper Manufacturers

10.6 Rest of the World

10.6.1 Africa

10.6.1.1 Growth in the Potential of the African Biofuel Industry

10.6.2 Middle East

10.6.2.1 Increase in Demand for Ethical and Natural Cosmetic Products

11 Competitive Landscape (Page No. - 111)

11.1 Introduction

11.2 Competitive Leadership Mapping

11.2.1 Visionary Leaders

11.2.2 Dynamic Differentiators

11.2.3 Innovators

11.2.4 Emerging Companies

11.3 Start-Up Microquadrant

11.3.1 Progressive Companies

11.3.2 Starting Blocks

11.3.3 Responsive Companies

11.3.4 Dynamic Companies

11.4 Market Share Analysis

11.5 Competitive Scenario

11.5.1 Expansions

11.5.2 Agreements, Collaborations, and Joint Ventures

11.5.3 New Product Launches

11.5.4 Acquisitions

12 Company Profiles (Page No. - 120)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Right to Win)*

12.1 BASF

12.2 Dupont

12.3 ABF

12.4 Novozymes

12.5 DSM

12.6 Dyadic International

12.7 Advanced Enzymes Technologies

12.8 Maps Enzymes

12.9 Epygen Labs

12.10 Megazyme

12.11 Aumgene Biosciences

12.12 Enzymatic Deinking Technologies

12.13 TEX Biosciences

12.14 Denykem

12.15 Metgen

12.16 Creative Enzymes

12.17 Sunson Industry Group

12.18 Transbiodiesel

12.19 Enzyme Supplies

12.20 Enzyme Solutions

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Right to Win Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 161)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (113 Tables)

Table 1 USD Exchange Rates Considered, 2016–2019

Table 2 Market Snapshot, 2019 vs 2026

Table 3 Major Ethanol Producing Countries/Regions (Million Liter)

Table 4 Technical Enzymes Market Size, By Type, 2017–2026 (USD Million)

Table 5 Market Size for Technical Enzymes, By Type, 2017–2026 (Ton)

Table 6 Technical Amylases Market Size, By Region, 2017–2026 (USD Million)

Table 7 Technical Amylases Market Size, By Region, 2017–2026 (Ton)

Table 8 Technical Cellulases Market Size, By Region, 2017–2026 (USD Million)

Table 9 Technical Cellulases Market Size, By Region, 2017–2026 (Ton)

Table 10 Technical Proteases Market Size, By Region, 2017–2026 (USD Million)

Table 11 Technical Proteases Market Size, By Region, 2017–2026 (Ton)

Table 12 Technical Lipases Market Size, By Region, 2017–2026 (USD Million)

Table 13 Technical Lipases Market Size, By Region, 2017–2026 (Ton)

Table 14 Other Technical Enzyme Types Market Size, By Region, 2017–2026 (USD Million)

Table 15 Other Technical Enzyme Types Market Size, By Region, 2017–2026 (Ton)

Table 16 Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 17 Technical Enzymes Market Size in the Biofuel Industry, By Region, 2017–2026 (USD Million)

Table 18 Market Size in the Starch Industry, By Region, 2017–2026 (USD Million)

Table 19 Market Size in the Textile & Leather Industry, By Region, 2017–2026 (USD Million)

Table 20 Technical Enzymes Market Size in the Paper & Pulp Industry, By Region, 2017–2026 (USD Million)

Table 21 Market Size in Other Industries, By Region, 2017–2026 (USD Million)

Table 22 Market Size for Technical Enzymes, By Form, 2017–2026 (USD Million)

Table 23 Market Size for Liquid Technical Enzymes, By Region, 2017–2026 (USD Million)

Table 24 Market Size for Dry Technical Enzymes, By Region, 2017–2026 (USD Million)

Table 25 Market Size for Technical Enzymes, By Source, 2017–2026 (USD Million)

Table 26 Microorganism-Based Technical Enzymes Market Size, By Region, 2017–2026 (USD Million)

Table 27 Plant-Based Technical Enzymes Market Size, By Region, 2017–2026 (USD Million)

Table 28 Animal-Based Technical Enzymes Market Size, By Region, 2017–2026 (USD Million)

Table 29 Market Size for Technical Enzymes, By Region, 2017–2026 (USD Million)

Table 30 North America: Market Size For Technical Enzymes, By Country, 2017–2026 (USD Million)

Table 31 North America: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 32 North America: Market Size for Technical Enzymes, By Type, 2017–2026 (Ton)

Table 33 North America: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 34 North America: Market Size for the Biofuel Industry, By Country, 2017–2026 (USD Million)

Table 35 North America: Market Size for the Starch Industry, By Country, 2017–2026 (USD Million)

Table 36 North America: Market Size for the Textile & Leather Industry, By Country, 2017–2026 (USD Million)

Table 37 North America: Market Size for the Paper & Pulp Industry, By Country, 2017–2026 (USD Million)

Table 38 North America: Market Size for the Other Industries, By Country, 2017–2026 (USD Million)

Table 39 North America: Market Size For Technical Enzymes, By Source, 2017–2026 (USD Million)

Table 40 North America: Market Size for Technical Enzymes, By Form, 2017–2026 (USD Million)

Table 41 US: Market Size For Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 42 US: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 43 Canada: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 44 Canada: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 45 Mexico: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 46 Mexico: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 47 Europe: Technical Enzymes Market Size, By Country, 2017–2026 (USD Million)

Table 48 Europe: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 49 Europe: Market Size for Technical Enzymes, By Type, 2017–2026 (Ton)

Table 50 Europe: Market Size for Technical Enzymes, By Industry 2017–2026 (USD Million)

Table 51 Europe: Market Size for Technical Enzymes, By Source, 2017–2026 (USD Million)

Table 52 Europe: Market Size for Technical Enzymes, By Form, 2017–2026 (USD Million)

Table 53 France: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 54 France: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 55 Germany: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 56 Germany: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 57 UK: Technical Enzymes Market Size, By Type, 2017–2026 (USD Million)

Table 58 UK: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 59 Netherlands: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 60 Netherlands: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 61 Spain: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 62 Spain: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 63 Belgium: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 64 Belgium: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 65 Rest of Europe: Market Size For Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 66 Rest of Europe: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 67 Asia Pacific: Market Size For Technical Enzymes, By Country/Region, 2017–2026 (USD Million)

Table 68 Asia Pacific: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 69 Asia Pacific: Market Size for Technical Enzymes, By Type, 2017–2026 (Ton)

Table 70 Asia Pacific: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 71 Asia Pacific: Market Size for the Biofuel Industry, By Country/Region, 2017–2026 (USD Million)

Table 72 Asia Pacific: Technical Enzymes Market Size for the Starch Industry, By Country/Region, 2017–2026 (USD Million)

Table 73 Asia Pacific: Market Size for the Textile & Leather Industry, By Country/Region, 2017–2026 (USD Million)

Table 74 Asia Pacific: Market Size for the Paper & Pulp Industry, By Country/Region, 2017–2026 (USD Million)

Table 75 Asia Pacific: Technical Enzymes Market Size for the Other Industries, By Country/Region, 2017–2026 (USD Million)

Table 76 Asia Pacific: Market Size for Technical Enzymes, By Source, 2017–2026 (USD Million)

Table 77 Asia Pacific: Market Size for Technical Enzymes, By Form, 2017–2026 (USD Million)

Table 78 China: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 79 China: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 80 India: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 81 India: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 82 Australia & New Zealand: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 83 Australia & New Zealand: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 84 Japan: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 85 Japan: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 86 Rest of Asia Pacific: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 87 Rest of Asia Pacific: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 88 South America: Market Size For Technical Enzymes, By Country, 2017–2026 (USD Million)

Table 89 South America: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 90 South America: Market Size for Technical Enzymes, By Type, 2017–2026 (Ton)

Table 91 South America: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 92 South America: Market Size for Technical Enzymes, By Source, 2017–2026 (USD Million)

Table 93 South America: Market Size for Technical Enzymes, By Form, 2017–2026 (USD Million)

Table 94 Brazil: Technical Enzymes Market Size, By Type, 2017–2026 (USD Million)

Table 95 Brazil: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 96 Argentina: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 97 Argentina: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 98 Rest of South America: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 99 Rest of South America: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 100 RoW: Market Size For Technical Enzymes, By Region, 2017–2026 (USD Million)

Table 101 RoW: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 102 RoW: Market Size for Technical Enzymes, By Type, 2017–2026 (Ton)

Table 103 RoW: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 104 RoW: Market Size for Technical Enzymes, By Source, 2017–2026 (USD Million)

Table 105 RoW: Market Size for Technical Enzymes, By Form, 2017–2026 (USD Million)

Table 106 Africa: Market Size For Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 107 Africa: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 108 Middle East: Market Size for Technical Enzymes, By Type, 2017–2026 (USD Million)

Table 109 Middle East: Market Size for Technical Enzymes, By Industry, 2017–2026 (USD Million)

Table 110 Expansions, 2017–2019

Table 111 Agreements, Collaborations, and Joint Ventures, 2017–2019

Table 112 New Product Launches, 2017–2019

Table 113 Acquisitions, 2017–2019

List of Figures (39 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Key Data From Primary Sources

Figure 4 Technical Enzymes Market Size, By Type, 2019 vs 2026 (USD Million)

Figure 5 Market Size for Technical Enzymes, By Type, 2019 vs 2026 (KT)

Figure 6 Market Size for Technical Enzymes, By Industry, 2019 vs 2026 (USD Million)

Figure 7 Market Size for Technical Enzymes, By Source, 2019 vs 2026 (USD Million)

Figure 8 Market Size for Technical Enzymes, By Form, 2019 vs 2026 (USD Million)

Figure 9 Market Growth and Share (Value), By Region, 2018

Figure 10 Growing Demand for Biofuel is Expected to Propel the Market for Technical Enzymes

Figure 11 The US Was the Largest Market for Technical Enzymes in 2018

Figure 12 The US Accounted for the Largest Share in the North American Market in 2018

Figure 13 North America is Projected to Dominate the Market for Technical Enzymes

Figure 14 The Biofuel Industry is Projected to Dominate the Global Market During the Forecast Period

Figure 15 North America Dominated Both Forms of Technical Enzymes in 2018

Figure 16 Market Dynamics

Figure 17 Market For Technical Enzymes: Value Chain

Figure 18 YC & YCC Shift for Global Market

Figure 19 Market Share (Value), By Type, 2019 vs 2026

Figure 20 Market Share (Value), By Industry, 2019 vs 2026

Figure 21 Market Share (Value), By Form, 2019 vs 2026

Figure 22 Market Share (Value), By Source, 2019 vs 2026

Figure 23 China to Record the Highest Growth Rate in the Market During the Forecast Period

Figure 24 North America: Market Snapshot

Figure 25 Asia Pacific: Market Snapshot

Figure 26 Technical Enzymes Market: Competitive Leadership Mapping, 2018

Figure 27 Technical Enzymes Start-Up Market: Competitive Leadership Mapping, 2018

Figure 28 BASF: Company Snapshot

Figure 29 BASF: SWOT Analysis

Figure 30 Dupont: Company Snapshot

Figure 31 Dupont: SWOT Analysis

Figure 32 ABF: Company Snapshot

Figure 33 ABF: SWOT Analysis

Figure 34 Novozymes: Company Snapshot

Figure 35 Novozymes: SWOT Analysis

Figure 36 DSM: Company Snapshot

Figure 37 DSM: SWOT Analysis

Figure 38 Dyadic International: Company Snapshot

Figure 39 Advanced Enzymes Technologies: Company Snapshot

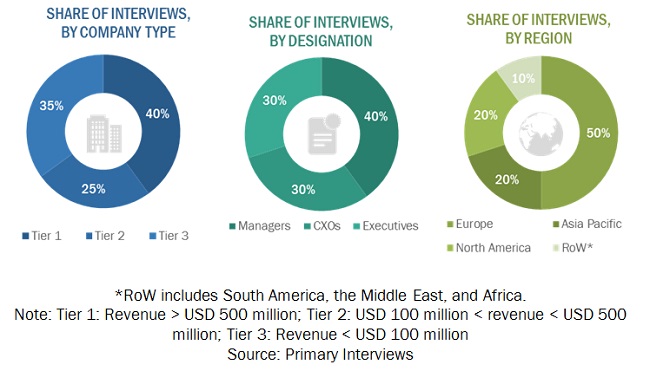

The study involved four major steps in estimating the size of the technical enzymes market. Exhaustive secondary research was done to collect information on the market, as well as the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to, to identify and collect information for this study. These secondary sources included reports from the Food and Agriculture Organization (FAO), World Health Organization (WHO), European Chemicals Agency (ECHA), National Center for Biotechnology Information (NCBI), Renewable Energy Directive (RED), Association of Manufacturers & Formulators of Enzyme Products (AMFEP), and Enzyme Technical Association (ETA). The secondary sources also included annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and databases.

Secondary research was mainly conducted to obtain key information about the industry’s supply chain, the total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The overall technical enzymes market comprises several stakeholders in the supply chain, which include global and regional manufacturers, dealers, distributors, and logistic analysts of industries such as biofuel, starch processing, textiles & leathers, paper & pulp, and other industries (such as cosmetics, wastewater treatment, and oil field & fine chemicals. Primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, regional textile & leather dealers and manufacturers, and biofuel producers, as well as cosmetics & personal care manufacturers. The primary sources from the supply side include producers of biofuel, textile & leather manufacturers, research institutions involved in R&D, and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the technical enzymes market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through extensive secondary research.

- The technical enzymes market size, in terms of value, was determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed to estimate the global technical enzymes market and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- Determining and projecting the size of the technical enzymes market, with respect to industry, source, form, type, and regional markets, over a seven-year period, ranging from 2019 to 2026

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the technical enzymes market

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and products offered across key regions and their impact on the growth of the prominent market players

- Providing insights on key product innovations and investments in the technical enzymes market

Available Customizations

Geographical Analysis

- Further breakdown of the Rest of Europe technical enzymes market, by key country

- Further breakdown of the Rest of Asia Pacific technical enzymes market, by key country

Company Information

- Analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Technical Enzymes Market