Pectin Market by Type (HM Pectin, LM Pectin), Raw Material (Citrus fruits, Apples, Sugar beet), Function, Application (Food & beverages, Pharmaceutical & Personal Care Products, Industrial Applications), and Region - Global Forecast to 2025

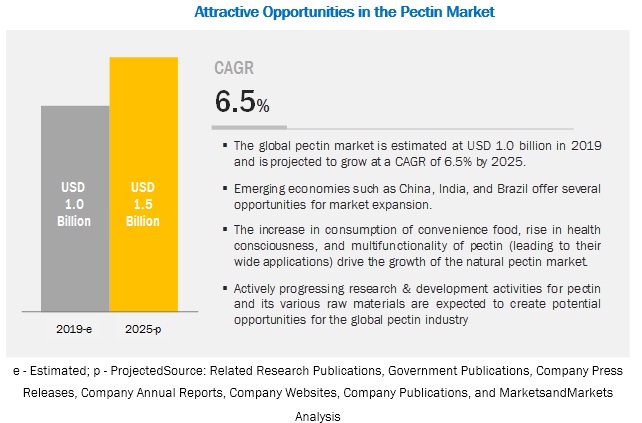

[181 Pages Report] The pectin market size is estimated to account for a value of USD 1.0 billion in 2019 and is projected to grow at a CAGR of 6.5% from 2019, to reach a value of USD 1.5 billion by 2025. The increasing consumption of convenience food, rise in health consciousness, and multifunctionality of pectin (leading to their wide applications) drive the growth of the pectin industry.

By type, the HM pectin segment is projected to dominate the pectin market during the forecast period.

HM pectin is the most common type of pectin and is labeled as either rapid-set or slow-set. The gel strength of HM pectin remains high due to the increase in the degree of methylation; however, any further increase in the degree of methylation, i.e., more than 70%, leads to a decrease in its gel strength. HM pectins are widely used in the production of jams and jellies, as they are used for thickening the product.

By raw material, the citrus fruits segment is projected to dominate the pectin market during the forecast period.

The demand for citrus fruits from the pharmaceutical & personal care industries has drastically increased over the last decade. Citrus fruits contain active phytochemicals that can protect health, and in addition to this, they also abundantly provide vitamin C, folic acid, and potassium. Sugar beet pectin extracts show a potential role as an emulsifier apart from a gelling agent, due to which it becomes a viable substitute for gum Arabic, as less quantity is required to activate the oil-water interface.

By application, the food & beverages segment is projected to dominate the pectin market during the forecast period.

The food & beverages segment dominates the pectin market due to the high demand for the use of natural and organic products for producing jams, jellies and spreads, bakery & confectionery and increasing applications in sauces, spreads, & dressings, and meat products. The demand for pectin also remains high in the pharmaceutical and personal care product sectors due to the increasing application of pectin to treat diarrheal diseases and various other diseases such as gastrointestinal diseases.

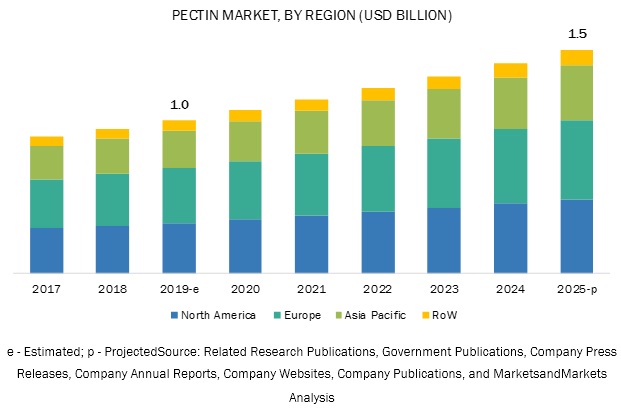

The increasing demand for pectin in Europe and Asia Pacific is driving the growth of the pectin market.

The European and Asia Pacific countries are witnessing increasing demand for pectin mainly in the food & beverages industries. Europe accounted for the largest share of the global pectin market due to the high demand for convenience foods & functional dairy products and increasing consumption of jam & jellies and baked goods.

Asia Pacific is likely to be the fastest-growing region in the global pectin industry. The growth in the market is driven by the growing demand for convenience foods, functional dairy products, and baked goods, coupled with the changing consumer lifestyle in the region.

Key Market Players

Key players in this market include DowDupont (US), Cargill, Incorporated (US), Ingredion Incorporated (US), CP Kelco (US) and Koninklijke DSM N.V. (Netherlands). Major players in this market are focusing on increasing their presence through new product launch, expansions & investments, mergers & acquisitions, partnerships, collaborations, and agreements. These companies have a strong presence in North America and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2017-2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2025 |

|

Forecast units |

Value (USD Million) and Volume (KT) |

|

Segments covered |

Type, Raw Material, Application, Function, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, RoW |

|

Companies covered |

DowDupont (US), Cargill, Incorporated (US), Ingredion Incorporated (US), CP Kelco (US), Tate & Lyle PLC (UK), Koninklijke DSM N.V. (Netherlands), Naturex (France), Lucid Colloids Ltd (India), Silvateam S.p.A (Italy), Compañía Española de Algas Marinas S.A (CEAMSA) (Spain), Herbstreith & Fox Corporate Group (Germany), Yantai Andre Pectin Co. Ltd. (China), B&V Srl (Italy) |

This research report categorizes the pectin market based on type, raw material, application, function, and region.

Based on type, the pectin market has been segmented as follows:

- HM Pectin

- LM Pectin

Based on raw material, the pectin market has been segmented as follows:

- Citrus fruits

- Apple

- Sugar beet

- Others*

*Others includes sunflower, pears, guavas, quince, plums, and berries.

Based on application, the pectin market has been segmented as follows:

-

Food & beverages

- Jams, jellies, and spreads

- Dairy products

- Beverages

- Bakery & confectionery

- Others*

*Others include meat & poultry products, sauces & dressing, baby food, and prepared foods.

- Pharmaceutical & personal care products

- Industrial applications

Based on function, the pectin market has been segmented as follows:

- Gelling Agents

- Thickener

- Stabilizer

- Fat replacer

- Others*

*Others include coating materials, emulsifier, and moisture-binding agents.

Based on the region, the pectin market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Rest of World (RoW)*

*Rest of the World (RoW) includes South America and the Middle East & Africa.

Recent Developments:

- In May 2019, DowDuPont’s specialty products division combined its two-business division's nutrition & health and industrial biosciences, to form DuPont nutrition & biosciences business unit. Both the business divisions are known for their innovations and strong scientific approach. This merger would accelerate the growth and innovation that would provide healthy, safe, innovative, and sustainable solutions for customers across the industries.

- In March 2019, CP Kelco announced plans to expand its pectin production facility by 10% in its Latin America, Brazil facility. This expansion would help the company to fulfill the pectin demand in the market.

- In March 2019, DSM increased its shareholding in Yantai Andre Pectin Co. Ltd. (China), from 29% to 75%. This would help DSM to expand its pectin market in Asia.

- In November 2018, CP Kelco expanded its low methyl ester (LM) pectin production capacity by approximately 15% in Denmark facility.

- In October 2018, CP Kelco introduced GENU Explorer Pectin ND-200 for dairy dessert application.

- In October 2018, Compañia Española de Algas Marinas (CEAMSA) and Palmer Holland (US) formed a commercial partnership to distribute hydrocolloids, such as pectin, carrageenan, fiber, alginate, and refined locust bean gum to the US market. This helped the company expand its horizon in the US for pectin products.

- In August 2018, Cargill planned to invest USD 150 million in South America to construct HM pectin production facility in Brazil. This would help the company to meet the growing market demand for pectins.

- In August 2018, Brenntag North America Inc. (US), part of Brenntag Group, collaborated with Silvateam S.P.A. to distribute its pectin in the US and Canada. This would help the company to expand its presence and promote its specialty pectin in the North American region.

- In April 2018, CP Kelco, along with Azelis (Belgium), announced a distribution partnership. Through the partnership, Azelis would offer CP Kelco’s products, such as carrageenan, pectin, gellan gum, and xanthan gum for food industries in Indonesia.

- In February 2018, DowDupont’s nutrition & health business unit introduced new GRINDSTED Pectin Prime 541 for reduced sugar fruit spreads. It is designed to increase flexibility and has improved tolerance to heat and can work in a various range of fruit types and sugar levels.

Key questions addressed by the report:

- What are the new application areas for the pectin market that companies are exploring?

- Who are some of the key players operating in the pectin market and how intense is the competition?

- What kind of competitors and stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

- How are the current R&D activities and M&A’s in the pectin market projected to create a disrupting environment in the coming years?

- What will be the level of impact of new product launches on the revenues of stakeholders, due to the benefits offered by pectin market, such as increasing revenue, environmental regulatory compliance, and sustainable profits for the suppliers?

Frequently Asked Questions (FAQ):

What are major drivers for the market growth of pectin globally?

The major drivers that is contributing to the growth of the market globally are:

- Rise in the consumption of premium food & beverage products

- Multi-functionality of pectin leading to demand from newer applications

- Growing need for pharmaceuticals

Are all the global patents for pectin market covered in this report?

What all raw materials have you covered for the Pectin Market?

"Following raw materials are covered:

- Citrus

- Apple

- Sugarbeat

Others including sunflower and tamarind"

Can you provide in-depth competitive analysis for companies in Europe region?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Unit Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

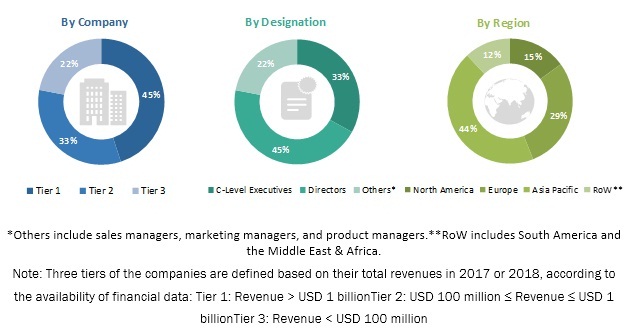

2.1.2.1 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Market

4.2 Market For Pectin, By Region, 2019 vs. 2025

4.3 Market For Pectin, By Raw Material, 2019 vs. 2025

4.4 Market For Pectin, By Type, 2019 vs. 2025

4.5 Europe: Market For Pectin, By Application & Country

4.6 Pectin Market Share, By Food & Beverage, 2019 vs. 2025

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rise in the Consumption of Premium Food & Beverage Products

5.2.1.2 Multi-Functionality of Pectins Leading to Demand From Newer Applications

5.2.1.3 Growing Need for Pharmaceuticals

5.2.2 Restraints

5.2.2.1 Stringent Regulations and Need for Quality Standards

5.2.2.2 Fluctuating Prices of Pectin and Its Products

5.2.3 Opportunities

5.2.3.1 Emerging Markets Illustrating Great Potential for Pectin

5.2.3.2 Increase in Investments in Research & Development

5.2.4 Challenges

5.2.4.1 Development of Pectin Substitutes

5.2.4.2 Unclear Labeling Leading to Ambiguity and Uncertainty

6 Industry Trends (Page No. - 44)

6.1 Introduction

6.2 Supply Chain

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of Substitute

6.3.2 Threat of New Entrants

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Rivalry Among Existing Competitors

6.4 Patent List

7 Pectin Market: Regulations (Page No. - 50)

7.1 Introduction

7.2 Codex Alimentarius

7.3 North America

7.3.1 US Food and Drug Administration (21CFR 184.1588)

7.3.2 Canada

7.4 European Commission

7.5 Asia Pacific

7.5.1 India

7.5.2 Japan

7.5.3 Malaysia

7.6 RoW

8 Pectin Market, By Function (Page No. - 59)

8.1 Introduction

8.2 Thickner

8.2.1 as A Thickening Agent, Pectin Finds Application in Confectionery Products, Dairy Products, and Jam & Jelly and Sauces & Dressings

8.3 Stabiliser

8.3.1 Pectin Acts as A Stabilizer in Various Food & Beverage Applications Such as Dairy Products, Beverages, and Desserts

8.4 Gelling Agent

8.4.1 Increasing Applications of Jams, Jelly, Confectionery Products, and Bakery Products is A Key Factor That is Projected to Drive the Market Growth

8.5 Fat Replacer

8.5.1 Due to the Increasing Health Awareness, Consumers Prefer Spending on Low-Fat Products in their Routine Diet

8.6 Others

8.6.1 Increasing Innovation in Edible Films and Packaging is Projected to Drive the Market for Pectin

9 Pectin Market, By Raw Material (Page No. - 62)

9.1 Introduction

9.2 Citrus Fruit

9.2.1 Rise in the Production of Citrus Fruits Increasing Opportunities for Pectin Manufacturers

9.3 Apple

9.3.1 Rise in the Production of Apple Pomace Expected to Boost the Demand for Pectin in Asian Countries

9.4 Sugar Beet

9.4.1 Rise in the Production of Sugar Beet in the European Region Boosting the Pectin Market

9.5 Others

9.5.1 Rise in the Production of Sunflower in Ukraine and Russia Boosting the Demand for Pectin

10 Pectin Market, By Type (Page No. - 74)

10.1 Introduction

10.2 HM Pectin

10.2.1 High Degree of Methylation, Up to Nearly 70%, Increases the Gel Strength of Jams and Jellies

10.3 LM Pectin

10.3.1 Calcium is A Key Ingredient Used in the Formation of Gels

11 Pectin Market, By Region (Page No. - 83)

11.1 Introduction

11.2 Food & Beverages

11.2.1 Jams, Jellies, & Spreads

11.2.1.1 The Rise in Demand for Jams, Jellies, and Spreads in European Countries is Driving the Pectin Market

11.2.2 Bakery & Confectionery

11.2.2.1 The Use of Pectin Enhances the Color, Texture, and Shelf Life of Bakery & Confectionery Products

11.2.3 Beverages

11.2.3.1 Growth in Demand for Natural & Organic Ingredients and Functional Foods is the Driving Factor for the Beverages Segment

11.2.4 Dairy Products

11.2.4.1 Technical Advancements in the Manufacturing of Pectin Products are Driving the Dairy Products Segment

11.2.5 Other Food & Beverages

11.2.5.1 Increase in Consumer Awareness Regarding Health and Wellness is A Driving Factor for Pectin

11.3 Pharmaceuticals & Personal Care Products

11.3.1 The Rise in Demand From the Pharmaceutical Industry Will Boost the Demand for Pectin

11.4 Industrial Applications

11.4.1 The Growth in Livestock and Feed Consumption is Expected to Drive the Demand for Pectin

12 Pectin Market, By Region (Page No. - 98)

12.1 Introduction

12.2 North America

12.2.1 US

12.2.1.1 Favorable Price Support Systems and Increasing Preference for Natural and Clean Label Products Among Consumers in the Country is Projected to Drive the Growth of the Pectin Market in the US

12.2.2 Canada

12.2.2.1 High Domestic Demand for Healthy and Organic Food is Projected to Drive the Demand for Pectins in the Food and Beverage Industry

12.2.3 Mexico

12.2.3.1 Increasing Preference for Healthy Diets and Busy Lifestyles of Consumers Have Driven the Demand for Pectins in the Production of Convenience Food Products

12.3 Europe

12.3.1 Germany

12.3.1.1 The Rise in Demand From the Food & Beverage Industry is Expected to Drive the Pectin Market, Owing to Its Multi-Functionality

12.3.2 UK

12.3.2.1 Due to the Busy Lifestyles of Consumers, the Demand for Convenience and Ready-To-Eat Foods is Increasing in the Country

12.3.3 France

12.3.3.1 The Rise in Health Awareness Among Consumers is Driving the Pectin Market

12.3.4 Spain

12.3.4.1 The Rise in Awareness About the Use of Natural Ingredients in Personal Care Products Will Boost the Demand for Fruits as Natural Ingredients in the Country

12.3.5 Russia

12.3.5.1 Growth in Consumption of Apple Juice in Russia Will Drive Fruit Juice Production, Which Will Indirectly Boost the Pectin Market

12.3.6 Rest of Europe

12.3.6.1 The Increased Use of Pectins in Food & Beverage Applications is Propelling the Market Growth

12.4 Asia Pacific

12.4.1 China

12.4.1.1 Changing Lifestyles of Consumers and the Increasing Preference for Convenience & Processed Food to Contribute to the Market Growth

12.4.2 India

12.4.2.1 High Demand for Plant-Based Ingredients in the Country is Driving the Market for Pectin

12.4.3 Japan

12.4.3.1 The Demand for Pectins Produced in the Country Remains High Due to Its Increasing Import Prices

12.4.4 Australia & New Zealand

12.4.4.1 The Demand for Plant-Based Products is Increasing in the Cosmetics Industry, Which Contributes to the Market Growth

12.4.5 Rest of Asia Pacific

12.4.5.1 The Use of Pectins Offered at Lower Prices to Support the Production of Citrus Fruit in the South Korean Countries

12.5 Rest of the World (RoW)

12.5.1 South America

12.5.1.1 The Per Capita Income in South America has Been Increasing, Due to Which the Demand for Pectin in Food Processing Applications in This Region is Growing

12.5.2 The Middle East & Africa

12.5.2.1 The Increase in Regional Economic Cooperation and the Intra-African Trade are Key Drivers of the Growth of the African Food Processing Industry

13 Competitive Landscape (Page No. - 129)

13.1 Overview

13.2 Competitive Leadership Mapping (Overall Market)

13.2.1 Terminology/Nomenclature

13.2.1.1 Visionary Leaders

13.2.1.2 Innovators

13.2.1.3 Dynamic Differentiators

13.2.1.4 Emerging Companies

13.3 Strength of Product Portfolio

13.4 Business Strategy Excellence

13.5 Ranking of Key Players, 2018

13.6 Competitive Scenario

13.6.1 New Product Launches

13.6.2 Expansions & Investments

13.6.3 Mergers & Acquisitions

13.6.4 Agreements, Collaborations, and Partnerships

14 Company Profiles (Page No. - 139)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 DowDupont

14.2 Cargill, Incorporated

14.3 Ingredion Incorporated

14.4 CP Kelco

14.5 Koninklijke DSM N.V.

14.6 Tate & Lyle Plc

14.7 Naturex

14.8 Lucid Colloids Ltd

14.9 Silvateam S.P.A

14.10 Compañía Española De Algas Marinas S.A (CEAMSA)

14.11 Herbstreith & Fox Corporate Group

14.12 Yantai Andre Pectin Co. Ltd.

14.13 B&V SRL

14.14 Krishna Pectins Pvt. Ltd.

14.15 Pacific Pectin Inc.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 172)

15.1 Discussion Guide

15.2 Available Customizations

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Related Reports

15.5 Author Details

List of Tables (87 Tables)

Table 1 USD Exchange Rates Considered, 2014–2018

Table 2 Applications and Functions of Pectins

Table 3 Top Five Gdp Per Capita (PPP) for Emerging Economies in Asia Pacific, 2013

Table 4 Pectin Content in Raw Materials (% of the Dry Form)

Table 5 Pectin Market Size, By Raw Material, 2017–2025 (Kt)

Table 6 Pectin Market Size, By Raw Material, 2017–2025 (USD Million)

Table 7 Citrus Fruit Market Size, By Region, 2017–2025 (Kt)

Table 8 Citrus Fruit Market Size, By Region, 2017–2025 (USD Million)

Table 9 Apple Market Size, By Region, 2017–2025 (Tons)

Table 10 Apple Market Size, By Region, 2017–2025 (USD Million)

Table 11 Sugar Beet Market Size, By Region, 2017–2025 (Tons)

Table 12 Sugar Beet Market Size, By Region, 2017–2025 (USD Million)

Table 13 Pectin Market Size for Others, By Region, 2017–2025 (Tons)

Table 14 Pectin Market Size for Others, By Region, 2017–2025 (USD Million)

Table 15 Pectin Market Size, By Type, 2017–2025 (Kt)

Table 16 Pectin Market Size, By Type, 2017–2025 (USD Million)

Table 17 Categories of HM Pectins

Table 18 HM Pectin Market Size, By Region, 2017–2025 (Kt)

Table 19 HM Pectin Market Size, By Region, 2017–2025 (USD Million)

Table 20 LM Pectin Market Size, By Region, 2017–2025 (Kt)

Table 21 LM Pectin Market Size, By Region, 2017–2025 (USD Million)

Table 22 Pectin Market Size, By Application, 2017–2025 (Kt)

Table 23 Pectin Market Size, By Application, 2017–2025 (USD Million)

Table 24 Pectin Market Size in Food & Beverages, By Subapplication, 2017–2025 (Kt)

Table 25 Pectin Market Size in Food & Beverages, By Subapplication, 2017–2025 (USD Million)

Table 26 Pectin Market Size in Food & Beverages, By Region, 2017–2025 (Kt)

Table 27 Pectin Market Size in Food & Beverages, By Region, 2017–2025 (USD Million)

Table 28 Pectin Market Size in Jams, Jellies, & Spreads, By Region, 2017–2025 (Kt)

Table 29 Pectin Market Size in Jams, Jellies, & Spreads, By Region, 2017–2025 (USD Million)

Table 30 Pectin Market Size in Bakery & Confectionery, By Region, 2017–2025 (Tons)

Table 31 Pectin Market Size in Bakery & Confectionery, By Region, 2017–2025 (USD Million)

Table 32 Pectin Market Size in Beverages, By Region, 2017–2025 (Tons)

Table 33 Pectin Market Size in Beverages, By Region, 2017–2025 (USD Million)

Table 34 Pectin Market Size in Dairy Products, By Region, 2017–2025 (Tons)

Table 35 Pectin Market Size in Dairy Products, By Region, 2017–2025 (USD Million)

Table 36 Pectin Market Size in Other Food & Beverages, By Region, 2017–2025 (Tons)

Table 37 Pectin Market Size in Other Food & Beverages, By Region, 2017–2025 (USD Million)

Table 38 Pectin Market Size in Pharmaceuticals & Personal Care Products, By Region, 2017–2025 (Tons)

Table 39 Pectin Market Size in Pharmaceuticals & Personal Care Products, By Region, 2017–2025 (USD Million)

Table 40 Pectin Market Size in Industrial Applications, By Region, 2017–2025 (Tons)

Table 41 Pectin Market Size in Industrial Applications, By Region, 2017–2025 (USD Million)

Table 42 Global Pectin Market Size, By Region, 2017–2025 (Kt)

Table 43 Global Pectin Market Size, By Region, 2017–2025 (USD Million)

Table 44 North America: Pectin Market Size, By Country, 2017–2025 (Kt)

Table 45 North America: By Market Size, By Country, 2017–2025 (USD Million)

Table 46 North America: By Market Size, By Type, 2017–2025 (Kt)

Table 47 North America: By Market Size, By Type, 2017–2025 (USD Million)

Table 48 North America: By Market Size, By Raw Material, 2017–2025 (Tons)

Table 49 North America: By Market Size, By Raw Material, 2017–2025 (USD Million)

Table 50 North America: By Market Size, By Application, 2017–2025 (Kt)

Table 51 North America: By Market Size, By Application, 2017–2025 (USD Million)

Table 52 North America: By Market Size, By Food & Beverage Application, 2017–2025 (Tons)

Table 53 North America: By Market Size, By Food & Beverage Application, 2017–2025 (USD Million)

Table 54 Europe: By Market Size, By Country, 2017–2025 (Tons)

Table 55 Europe: By Market Size, By Country, 2017–2025 (USD Million)

Table 56 Europe: By Market Size, By Type, 2017–2025 (Kt)

Table 57 Europe: By Market Size, By Type, 2017–2025 (USD Million)

Table 58 Europe: By Market Size, By Raw Material, 2017–2025 (Tons)

Table 59 Europe: By Market Size, By Raw Material, 2017–2025 (USD Million)

Table 60 Europe: By Market Size, By Application, 2017–2025 (Tons)

Table 61 Europe: By Market Size, By Application, 2017–2025 (USD Million)

Table 62 Europe: By Market Size in Food & Beverages, By Subapplication, 2017–2025 (Tons)

Table 63 Europe: By Market Size in Food & Beverages, By Subapplication, 2017–2025 (USD Million)

Table 64 Asia Pacific: Pectin Market Size, By Country, 2017–2025 (Kt)

Table 65 Asia Pacific: By Market Size, By Country, 2017–2025 (USD Million)

Table 66 Asia Pacific: By Market Size, By Raw Material, 2017–2025 (Tons)

Table 67 Asia Pacific: By Market Size, By Raw Material, 2017–2025 (USD Million)

Table 68 Asia Pacific: By Market Size, By Type, 2017–2025 (Kt)

Table 69 Asia Pacific: By Market Size, By Type, 2017–2025 (USD Million)

Table 70 Asia Pacific: By Market Size, By Application, 2017–2025 (Tons)

Table 71 Asia Pacific: By Market Size, By Application, 2017–2025 (USD Million)

Table 72 Asia Pacific: By Market Size, By Food & Beverages Application, 2017–2025 (Tons)

Table 73 Asia Pacific: By Market Size, By Food & Beverages Application, 2017–2025 (USD Million)

Table 74 RoW: Pectin Market Size, By Country, 2017–2025 (Kt)

Table 75 RoW: By Size, By Country, 2017–2025 (USD Million)

Table 76 RoW: By Size, By Raw Material, 2017–2025 (Tons)

Table 77 RoW: By Size, By Raw Material, 2017–2025 (USD Million)

Table 78 RoW: By Size, By Type, 2017–2025 (Kt)

Table 79 RoW: By Size, By Type, 2017–2025 (USD Million)

Table 80 RoW: By Size, By Application, 2017–2025 (Tons)

Table 81 RoW: By Size, By Application, 2017–2025 (USD Million)

Table 82 RoW: By Size, By Food & Beverages Application, 2017–2025 (Tons)

Table 83 RoW: By Size, By Food & Beverages Application, 2017–2025 (USD Million)

Table 84 New Product Launches

Table 85 Expansions & Investments

Table 86 Mergers & Acquisitions

Table 87 Agreements, Collaborations, and Partnerships

List of Figures (56 Figures)

Figure 1 Pectin Market Segmentation

Figure 2 Regional Segmentation

Figure 3 Pectin Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Citrus Fruits Segment, By Raw Material, to Dominate the Market Throughout 2025

Figure 9 HM Pectin Segment, By Type, to Dominate the Market During the Forecast Period

Figure 10 Food & Beverages, By Application, to Dominate the Market Through the Forecast Period

Figure 11 Asia Pacific to Be the Fastest-Growing Region in the Market During the Forecast Period

Figure 12 Pectin is an Emerging Market With Promising Growth Potential

Figure 13 Europe to Dominate the Pectin Market From 2019 to 2025

Figure 14 Pectin From Citrus Fruits is Projected to Be the Largest Segment From 2019 to 2025

Figure 15 The HM Pectin Segment is Projected to Account for A Larger Share in the Market From 2019 to 2025

Figure 16 The Food & Beverages Segment, By Application, Accounted for the Largest Share of the European Pectin Market

Figure 17 Jam, Jelly & Spreads Segment Estimated to Dominate the Food & Beverage Pectin Market in 2019

Figure 18 US, China, and India Projected to Grow at Higher CAGRs During the Forecast Period (By Value)

Figure 19 Pectin Market: Drivers, Restraints, Opportunities, and Challenges

Figure 20 Product Development and Distribution Phase Play A Vital Role in the Value Addition of the Supply Chain for Pectin

Figure 21 Porter’s Five Forces Analysis: Development and Launch of New Products Have Intensified Industrial Rivalry in the Pectin Market

Figure 22 Pectin Market, By Raw Material, 2019 vs. 2025 (Kt)

Figure 23 Pectin Market, By Raw Material, 2019 vs. 2025 (USD Million)

Figure 24 Citrus Fruit: Pectin Market, By Region, 2019 vs. 2025 (Kt)

Figure 25 Citrus Fruit: Pectin Market, By Region, 2019 vs. 2025 (USD Million)

Figure 26 Global Citrus Fruit Production, 2011–2015 (Thousand Tons)

Figure 27 Global Apple Production, 2011–2017 (Thousand Tons)

Figure 28 Global Sugar Beet Production, 2011–2017

Figure 29 Pectin Market Size, By Type, 2019 vs. 2025 (Kt)

Figure 30 Pectin Market Size, By Type, 2019 vs. 2025 (USD Million)

Figure 31 HM Pectin Market Size, By Region, 2019 vs. 2025 (Kt)

Figure 32 HM Pectin Market Size, By Region, 2019 vs. 2025 (USD Million)

Figure 33 Pectin Manufacturing Process

Figure 34 Pectin Market Size, By Application, 2019 vs. 2025 (Kt)

Figure 35 Pectin Market Size, By Application, 2019 vs. 2025 (USD Million)

Figure 36 Pectin Market Size in Food & Beverages, By Region, 2019 vs. 2025 (Kt)

Figure 37 Pectin Market Size in Food & Beverages, By Region, 2019 vs. 2025 (USD Million)

Figure 38 Geographic Snapshot (2018): Markets in the Asia Pacific Region are Emerging as New Hotspots

Figure 39 North America: Pectin Market Snapshot, 2018

Figure 40 Europe: Pectin Market Snapshot, 2018

Figure 41 Asia Pacific: Pectin Market Snapshot, 2018

Figure 42 Key Developments of the Leading Players in the Market, 2014-2019

Figure 43 Global Pectin Market Competitive Leadership Mapping, 2018

Figure 44 Cargill, Incorporated Led the Market In, 2018

Figure 45 Market Evaluation Framework, 2016–2018

Figure 46 Dowdupont: Company Snapshot

Figure 47 Dowdupont: SWOT Analysis

Figure 48 Cargill, Incorporated.: Company Snapshot

Figure 49 Cargill, Incorporated: SWOT Analysis

Figure 50 Ingredion Incorporated: Company Snapshot

Figure 51 Ingredion Incorporated: SWOT Analysis

Figure 52 CP Kelco: SWOT Analysis

Figure 53 Koninklijke DSM N.V.: Company Snapshot

Figure 54 Koninklijke DSM N.V: SWOT Analysis

Figure 55 Tate & Lyle Plc: Company Snapshot

Figure 56 Naturex: Company Snapshot

The study involves four major activities to estimate the current market size of the pectin market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as FAOSTAT, FAO, Government websites, Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The pectin market comprises several stakeholders such as manufacturers, importers and exporters, traders, distributors and suppliers of pectin, and government & research organizations. The demand-side of this market is characterized by the rising demand for pectin from the food & beverage industry, pharmaceutical, and personal care industries, researchers, importers/exporters, and distributors. The supply-side is characterized by the supply of pectin from various suppliers in the market and by the presence of key providers of pectin. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the pectin market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, was determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary respondents

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the pectin market.

Report Objectives

- To define, segment, and project the global market size of the pectin market

- To understand the pectin market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by the players across the key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, collaborations, and agreements

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe pectin market into the Netherlands, Denmark, Belgium, Switzerland, Ireland, and Italy

- Further breakdown of the Rest of Asia Pacific pectin market into Indonesia, Thailand, Vietnam, Singapore Malaysia, and South Korea

- Further breakdown of the RoW pectin market into South America and the Middle East & Africa.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Pectin Market

What are the major driving factors for the growth of the pectin market, other than its growing usage in various application industries? Can a separate chapter be provided for the major substitutes available in the market for pectin?