Fruit & Vegetable Processing Enzymes Market by Application (Fruits and Vegetables), Form (Liquid and Powder), Source (Bacteria and Fungi), Type (Amylase, Pectinase, Protease, and Cellulase), Product Type, and Region - Global Forecast to 2022

[170 Pages Report] The fruit & vegetable processing enzymes market, in terms of value, is projected to reach around USD 41.39 Billion by 2022, at a CAGR of 6.7% from 2016 to 2022.

The global market has been segmented on the basis of source, type, application, form, product type, and region.

The years considered for the study are as follows:

- Base year – 2015

- Estimated year – 2016

- Projected year – 2022

- Forecast period – 2016 to 2022

The objectives of the study includes:

- To define, segment, and project the global market for fruit & vegetable processing enzymes

- To understand the structure of the fruit & vegetable processing enzymes market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, industry-specific challenges, and burning issues)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and their contribution to the total market

Research Methodology

This report includes estimation of market sizes for value (USD million) and volume (tons). Both top-down and bottom-up approaches have been used to estimate and validate the size of the fruit & vegetable processing enzymes market and various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research, such as company websites, annual reports, and their market share in their respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

The fruit & vegetable processing enzymes market value chain players are as E. I. du Pont de Nemours and Company (U.S.), Associated British Foods Plc (U.K.), Koninklijke DSM N.V. (The Netherlands), Novozymes A/S (Denmark), and Group Soufflet (France) among others. Maximum value addition of a product in the global fruit & vegetable processing enzymes industry is observed in the stages of product manufacturing. The key companies that offer fruit & vegetable processing enzyme products mainly invest in new product development and production expansion through acquisitions. Companies devise new sales strategies in order to establish their new products in the market. These companies highlight enzyme functionalities and food safety certifications while promoting their food enzyme products. Value addition in the marketing and sales stages varies with key players, addressable markets, manufacturing units, and end consumers.

Target Audience:

- Suppliers

- R&D institutes

- Technology providers

- Enzymes manufacturers/suppliers

- Fruit & vegetable processing enzymes manufacturers/processors

- Intermediary suppliers

- Wholesalers

- Dealers

- Consumers

- End users

- Retailers

Scope of the Report

This research report categorizes the fruit & vegetable processing enzymes market based on source, type, form, application, product type, and region.

Based on Source, the market has been segmented as follows:

- Fungi

- Bacteria

Based on Type, the market has been segmented as follows:

- Amylase

- Pectinase

- Protease

- Cellulase

Based on Form, the market has been segmented as follows:

- Liquid

- Powder

Based on Application, the market has been segmented as follows:

- Fruits

- Vegetables

Based on Product Type, the market has been segmented as follows:

- Juices

- Wine & cider

- Paste & purees

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW (Latin America, and Middle East & Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

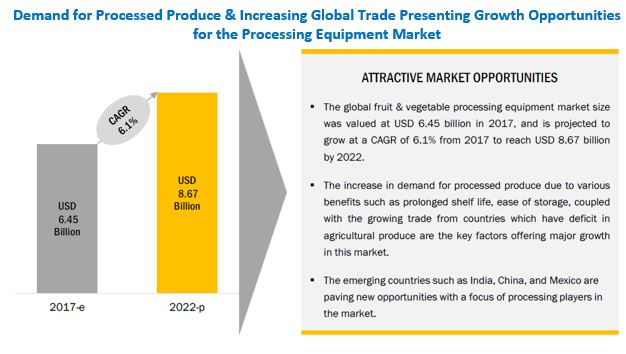

The global fruit & vegetable processing enzymes market has grown steadily in the last few years. The market size is projected to reach USD 41.39 Billion by 2022, at a CAGR of around 6.7% from 2016 to 2022. The high specificity of enzymes in biochemical reactions is the major driving factor of this market.

The global market based on sources has been segmented into bacteria and fungi. This is because bacteria is largely used to increase the shelf-life of fruits & vegetables for a prolonged time. Moreover, bacteria contributes to the easy genetic transformation for enzyme, which has led to the dominance of bacteria compared to other microorganisms in the fruit & vegetable processing enzymes market.

The global market, based on type, has been segmented into amylase, pectinase, protease, and cellulase. The amylase segment accounted for the largest share of the fruit & vegetable processing enzymes market in 2015. Amylases are mainly used in industries, such as food & beverages due to its cost effectiveness, and less time-consuming methods, and therefore the demand is high. Microorganisms are considered as the best source of these enzymes. Alpha-amylase, beta-amylase, and gluco-amylase are the major types of amylases. Out of the three types, á-amylase and gluco-amylase are used in a wider range of products in the food & beverage industry.

In the form segment, the market has been segmented on the basis of liquid and powder. The liquid form accounted for the largest share in 2015. The liquid enzyme is used directly in its liquid form or sprayed and absorbed onto a solid carrier. The liquid formulation of enzyme is supplied as a liquid solution, which is sprayed on the pellets. The growth in this segment is attributed to three major components, such as enzymatic, physical, and microbial stabilities are considered by manufacturers during the production stage which has resulted in the increased demand.

On the basis of product type, the global market is segmented by juices, wine & cider, and paste & purees. The juices segment dominated the market in 2015. The growth of the beverage industry especially in the Asia-Pacific region has led to the increased demand for fruit & vegetable juices, resulting in the demand for enzymes. The enzymes used in the production process of juices break down cell walls in fruits & vegetables and discharge the liquid & sugar contents. Pectinase enzyme is majorly used in the production process and during the cell breakdown, polysaccharides are released, which makes the juice cloudy and reduce the product value. The inclusion of pectinase helps to break insoluble compounds making the juice clearer and sweeter.

The fruit & vegetable processing enzymes market in Asia-Pacific is projected to grow at the highest CAGR during the forecast period. The major driver for the growth of the global market is due to the growth of the food & beverage industry in emerging economies, such as India and China.

Barriers in the brewing industry, such as the traditional brewing practices, and restricted temperature pH operational range are the factors restraining the market.

The fruit & vegetable processing enzymes market is characterized by high competition due to the presence of a number of large- and small-scale firms having low product differentiation. New product launches, acquisitions, and expansions are the key strategies adopted by these players to ensure their growth in the market. The market is dominated by players such as E. I. du Pont de Nemours and Company (U.S.), Associated British Foods Plc (U.K.), Koninklijke DSM N.V. (Netherlands), Novozymes A/S (Denmark), and Group Soufflet (France). Other players in the industry include Advanced Enzymes (India), Jiangsu Boli Bioproducts Co, Ltd (China), Sunson Industry Group (China), Biocatalysts (U.K.), and Amano Enzyme (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Periodization

1.4 Currency

1.5 Units

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 35)

4.1 Opportunities in this Market

4.2 Key Fruit & Vegetable Processing Enzymes Markets

4.3 Life Cycle Analysis: Fruit & Vegetable Processing Enzymes Market, By Region

4.4 Market, By Source

4.5 North America: Fruit & Vegetable Processing Enzymes Market, By Product Type

4.6 Market, By Application

4.7 Market, By Form

4.8 Market, By Type

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Fruit & Vegetable Processing Enzymes Market Segmentation

5.2.1 Type

5.2.2 Application

5.2.3 Product Type

5.2.4 By Source

5.2.5 By Form

5.2.6 Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 High Specificity of Enzymes in Biochemical Reactions

5.3.1.2 Improvement of Quality and Yield of Fruit- & Vegetable-Based Juices and Beverages

5.3.1.3 Growth in Demand for Convenience Foods

5.3.1.4 Rise in Awareness About Healthy and Nutritional Foods

5.3.2 Restraints

5.3.2.1 Restricted Temperature and Ph Operational Range

5.3.2.2 Barriers in the Brewing Industry

5.3.3 Opportunities

5.3.3.1 Emerging Markets in Asia-Pacific and Africa

5.3.4 Challenges

5.3.4.1 Changes in Safety Regulations Regarding Food Enzymes in Europe

6 Industry Trends (Page No. - 50)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Current Regulations for Food Enzymes

7 Fruit & Vegetable Processing Enzymes Market, By Type (Page No. - 52)

7.1 Introduction

7.2 Amylase

7.3 Pectinase

7.4 Protease

7.5 Cellulase

7.6 Other Types

8 Fruit & Vegetable Processing Enzymes Market, By Application (Page No. - 61)

8.1 Introduction

8.2 Fruits

8.2.1 Apples

8.2.2 Oranges

8.2.3 Other Citrus Fruits

8.2.4 Grapes

8.3 Vegetables

8.3.1 Tomatoes

8.3.2 Carrots

8.3.3 Potatoes

9 Fruit & Vegetable Processing Enzymes Market, By Product Type (Page No. - 67)

9.1 Introduction

9.2 Juices

9.3 Wines & Ciders

9.4 Pastes & Purees

9.5 Other Product Types

10 Fruits & Vegetables Processing Enzymes Market, By Source (Page No. - 75)

10.1 Introduction

10.1.1 Bacteria

10.1.2 Fungi

10.1.3 Other Sources

11 Fruit & Vegetable Processing Enzymes Market, By Form (Page No. - 81)

11.1 Introduction

11.2 Liquid

11.3 Powder

11.4 Other Forms

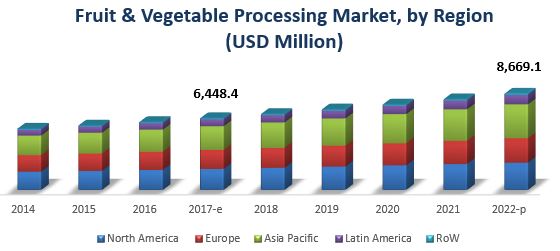

12 Fruit & Vegetable Processing Enzymes Market, By Region (Page No. - 88)

12.1 Introduction

12.2 North America

12.2.1 U.S.

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 Germany

12.3.2 France

12.3.3 U.K.

12.3.4 Italy

12.3.5 Spain

12.3.6 Rest of Europe

12.4 Asia-Pacific

12.4.1 China

12.4.2 Japan

12.4.3 Australia & New Zealand

12.4.4 India

12.4.5 Rest of Asia-Pacific

12.5 Rest of the World (RoW)

13 Competitive Landscape (Page No. - 131)

13.1 Overview

13.2 Competitive Situation & Trends

13.2.1 Expansions

13.2.2 Acquisitions

13.2.3 New Product Launches

13.2.4 Agreements, Partnerships, & Investments

14 Company Profiles (Page No. - 136)

14.1 Introduction

(Business Overview, Products, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

14.2 E. I. Du Pont De Nemours and Company

14.3 Associated British Foods PLC

14.4 Koninklijke DSM N.V.

14.5 Novozymes A/S

14.6 Advanced Enzymes

14.7 Group Soufflet

14.8 Jiangsu Boli Bioproducts Co., Ltd.

14.9 Sunson Industry Group

14.10 Biocatalysts

14.11 Amano Enzyme Inc.

*Details on Business Overview, Products, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

15 Appendix (Page No. - 162)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (127 Tables)

Table 1 GDP Growth of Emerging Countries, 2014–2015

Table 2 Fruit & Vegetable Processing Enzymes Market Size, By Type, 2014–2022 (USD Million)

Table 3 Market Size, By Type, 2014–2022 (Tons)

Table 4 Amylase Market Size, By Region, 2014–2022 (USD Million)

Table 5 Amylase Market Size, By Region, 2014–2022 (Tons)

Table 6 Pectinase Market Size, By Region, 2014–2022 (USD Million)

Table 7 Pectinase Market Size, By Region, 2014–2022 (Tons)

Table 8 Protease Market Size, By Region, 2014–2022 (USD Million)

Table 9 Protease Market Size, By Region, 2014–2022 (Tons)

Table 10 Cellulase Market Size, By Region, 2014–2022 (USD Million)

Table 11 Cellulase Market Size, By Region, 2014–2022 (Tons)

Table 12 Other Types Market Size, By Region, 2014–2022 (USD Million)

Table 13 Other Types Market Size, By Region, 2014–2022 (Tons)

Table 14 Fruit & Vegetable Processing Enzymes Market Size, By Application, 2014–2022 (USD Million)

Table 15 Market Size, By Application, 2014–2022 (Tons)

Table 16 Fruit Processing Enzymes Market Size, By Region, 2014–2022 (USD Million)

Table 17 Fruit Processing Enzymes Market Size, By Region, 2014–2022 (Tons)

Table 18 Vegetable Processing Enzymes Market Size, By Region, 2014–2022 (USD Million)

Table 19 Vegetable Processing Enzymes Market Size, By Region, 2014–2022 (Tons)

Table 20 Fruit & Vegetable Processing Enzymes Market Size, By Product Type, 2014–2022 (USD Million)

Table 21 Market Size, By Product Type, 2014–2022 (Tons)

Table 22 Juices Market Size, By Region, 2014–2022 (USD Million)

Table 23 Juices Market Size, By Region, 2014–2022 (Tons)

Table 24 Wines & Ciders Market Size, By Region, 2014–2022 (USD Million)

Table 25 Wines & Ciders Market Size, By Region, 2014–2022 (Tons)

Table 26 Pastes & Purees Market Size, By Region, 2014–2022 (USD Million)

Table 27 Pastes & Purees Market Size, By Region, 2014–2022 (Tons)

Table 28 Other Product Types Market Size, By Region, 2014–2022 (USD Million)

Table 29 Other Product Types Market Size, By Region, 2014–2022 (Tons)

Table 30 Fruit & Vegetable Processing Enzymes Market Size, By Source, 2014–2022 (USD Million)

Table 31 Market Size, By Source, 2014–2022 (Tons)

Table 32 Bacteria Market Size, By Region, 2014–2022 (USD Million)

Table 33 Bacteria Market Size, By Region, 2014–2022 (Tons)

Table 34 Fungi Market Size, By Region, 2014–2022 (USD Million)

Table 35 Fungi Market Size, By Region, 2014–2022 (Tons)

Table 36 Other Sources Market Size, By Region, 2014–2022 (USD Million)

Table 37 Other Sources Market Size, By Region, 2014–2022 (Tons)

Table 38 Fruit & Vegetable Processing Enzymes Market Size, By Form, 2014–2022 (USD Million)

Table 39 Market Size, By Form, 2014–2022 (Tons)

Table 40 Liquid Market Size, By Region, 2014–2022 (USD Million)

Table 41 Liquid Market Size, By Region, 2014–2022 (Tons)

Table 42 Powder Market Size, By Region, 2014–2022 (USD Million)

Table 43 Powder Market Size, By Region, 2014–2022 (Tons)

Table 44 Other Forms Market Size, By Region, 2014–2022 (USD Million)

Table 45 Other Forms Market Size, By Region, 2014–2022 (Tons)

Table 46 Fruit & Vegetable Processing Enzymes Market Size, By Region, 2014-2022 (USD Million)

Table 47 Market Size, By Region, 2014-2022 (Tons)

Table 48 North America: Fruit & Vegetable Processing Enzymes Market Size, By Country, 2014-2022 (USD Million)

Table 49 North America: Market Size, By Country, 2014-2022 (Tons)

Table 50 North America: Market Size, By Type, 2014-2022 (USD Million)

Table 51 North America: Market Size, By Type, 2014-2022 (Tons)

Table 52 North America: Market Size, By Application, 2014-2022 (USD Million)

Table 53 North America: Market Size, By Application, 2014-2022 (Tons)

Table 54 North America: Market Size, By Form, 2014-2022 (USD Million)

Table 55 North America: Market Size, By Form, 2014-2022 (Tons)

Table 56 North America: Market Size, By Source, 2014-2022 (USD Million)

Table 57 North America: Market Size, By Source, 2014-2022 (Tons)

Table 58 North America: Market Size, By Product Type, 2014-2022 (USD Million)

Table 59 North America: Market Size, By Product Type, 2014-2022 (Tons)

Table 60 U.S.: Market Size for Fruit & Vegetable Processing Enzymes, By Type, 2014-2022 (USD Million)

Table 61 U.S.: Market Size, By Type, 2014-2022 (Tons)

Table 62 Canada: Fruit & Vegetable Processing Enzymes Market Size, By Type, 2014-2022 (USD Million)

Table 63 Canada: Market Size, By Type, 2014-2022 (Tons)

Table 64 Mexico: Market Size for Fruit & Vegetable Processing Enzymes, By Type, 2014-2022 (USD Million)

Table 65 Mexico: Market Size, By Type, 2014-2022 (USD Million)

Table 66 Europe: Fruit & Vegetable Processing Enzymes Market Size, By Country, 2014–2022 (USD Million)

Table 67 Europe: Market Size, By Country, 2014–2022 (Tons)

Table 68 Europe: Market Size, By Type, 2014–2022 (USD Million)

Table 69 Europe: Market Size, By Enzyme Type, 2014–2022 (Tons)

Table 70 Europe: Market Size, By Application, 2014–2022 (USD Million)

Table 71 Europe: Market Size, By Application, 2014–2022 (Tons)

Table 72 Europe: Market Size, By Form, 2014–2022 (USD Million)

Table 73 Europe: Market Size, By Form, 2014–2022 (Tons)

Table 74 Europe: Market Size, By Source, 2014–2022 (USD Million)

Table 75 Europe: Market Size, By Source, 2014–2022 (Tons)

Table 76 Europe: Market Size, By Product Type, 2014–2022 (USD Million)

Table 77 Europe: Market Size, By Product Type, 2014–2022 (Tons)

Table 78 Germany: Fruit & Vegetable Processing Enzymes Market Size, By Type, 2014–2022 (USD Million)

Table 79 Germany: Market Size, By Type, 2014–2022 (Tons)

Table 80 France: Market Size for Fruit & Vegetable Processing Enzymes, By Type, 2014–2022 (USD Million)

Table 81 France: Market Size, By Type, 2014–2022 (Tons)

Table 82 U.K.: Fruit & Vegetable Processing Enzymes Market Size, By Type, 2014–2022 (USD Million)

Table 83 U.K.: Market Size, By Enzyme Type, 2014–2022 (Tons)

Table 84 Italy: Market Size for Fruit & Vegetable Processing Enzymes, By Type, 2014–2022 (USD Million)

Table 85 Italy: Market Size, By Enzyme Type, 2014–2022 (Tons)

Table 86 Spain: Fruit & Vegetable Processing Enzymes Market Size, By Type, 2014–2022 (USD Million)

Table 87 Spain: Market Size, By Type, 2014–2022 (Tons)

Table 88 Spain: Market Size, By Type, 2014–2022 (USD Million)

Table 89 Rest of Europe: Market Size for Fruit & Vegetable Processing Enzymes, By Type, 2014–2022 (Tons)

Table 90 Asia-Pacific: Fruit & Vegetable Processing Enzymes Market Size, By Country, 2014-2022 (USD Million)

Table 91 Asia-Pacific: Market Size, By Country, 2014-2022 (Tons)

Table 92 Asia-Pacific: Market Size, By Type, 2014-2022 (USD Million)

Table 93 Asia-Pacific: Market Size, By Type, 2014-2022 (Tons)

Table 94 Asia-Pacific: Market Size, By Application, 2014-2022 (USD Million)

Table 95 Asia-Pacific: Market Size, By Application, 2014-2022 (Tons)

Table 96 Asia-Pacific: Market Size, By Form, 2014-2022 (USD Million)

Table 97 Asia-Pacific: Market Size, By Form, 2014-2022 (Tons)

Table 98 Asia-Pacific: Market Size, By Source, 2014-2022 (USD Million)

Table 99 Asia-Pacific: Market Size, By Source, 2014-2022 (Tons)

Table 100 Asia-Pacific: Market Size, By Product Type, 2014-2022 (USD Million)

Table 101 Asia-Pacific: Market Size, By Product Type, 2014-2022 (Tons)

Table 102 China: Fruit & Vegetable Processing Enzymes Market Size, By Type, 2014-2022 (USD Million)

Table 103 China: Market Size, By Type, 2014-2022 (Tons)

Table 104 Japan: Market Size, By Type, 2014-2022 (USD Million)

Table 105 Japan: Market Size, By Type, 2014-2022 (Tons)

Table 106 Australia & New Zealand: Fruit & Vegetable Processing Enzymes Market Size, By Type, 2014-2022 (USD Million)

Table 107 Australia & New Zealand: Market Size, By Type, 2014-2022 (Tons)

Table 108 India: Market Size for Fruit & Vegetable Processing Enzymes, By Type, 2014-2022 (USD Million)

Table 109 India: Market Size, By Type, 2014-2022 (Tons)

Table 110 Rest of Asia-Pacific: Fruit & Vegetable Processing Enzymes Market Size, By Type, 2014-2022 (USD Million)

Table 111 Rest of Asia-Pacific: Market Size, By Type, 2014-2022 (Tons)

Table 112 RoW: Market Size for Fruit & Vegetable Processing Enzymes, By Country, 2014–2022 (USD Million)

Table 113 RoW: Market Size, By Country, 2014–2022 (Tons)

Table 114 RoW: Market Size, By Type, 2014–2022 (USD Million)

Table 115 RoW: Market Size, By Type, 2014–2022 (Tons)

Table 116 RoW: Market Size, By Application, 2014–2022 (USD Million)

Table 117 RoW: Market Size, By Application, 2014–2022 (Tons)

Table 118 RoW: Market Size, By Form, 2014–2022 (USD Million)

Table 119 RoW: Market Size, By Formulation, 2014–2022 (Tons)

Table 120 RoW: Market Size, By Source, 2014–2022 (USD Million)

Table 121 RoW: Market Size, By Source, 2014–2022 (Tons)

Table 122 RoW: Market Size, By Product Type, 2014–2022 (USD Million)

Table 123 RoW: Market Size, By Product Type, 2014–2022 (Tons)

Table 124 Expansions, 2011–2016

Table 125 Acquisitions, 2011–2016

Table 126 Product/Service/Technology Launches, 2011–2016

Table 127 Agreements, Partnerships, and Investments, 2011–2016

List of Figures (54 Figures)

Figure 1 Market Segmentation

Figure 2 Fruit & Vegetable Processing Enzymes Market: Research Design

Figure 3 Market: Breakdown of Primary Interviews

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Assumptions of the Research Study

Figure 8 Limitations of the Research Study

Figure 9 Fruit & Vegetable Processing Enzymes Market, By Product Type (2016 vs 2022)

Figure 10 Market Size, By Region, 2016–2022 (USD Million)

Figure 11 Market Size, By Source, 2016–2022 (USD Million)

Figure 12 Market Size, By Type, 2016–2022 (USD Million)

Figure 13 Market Share, By Form and Application, By Value, 2016 (%)

Figure 14 Market Share (Value), By Region, 2016

Figure 15 Rising Demand for Convenience and Nutritional Food Products to Drives the Global Market

Figure 16 Emerging Markets to Drive Global Demand for Fruit & Vegetable Processing Enzymes

Figure 17 Asia-Pacific Poised for Robust Growth, 2016 to 2022

Figure 18 Bacteria Segment is Projected to Record High Growth Between 2016 & 2022

Figure 19 Juices Segment to Account for the Largest Share in North America, 2016

Figure 20 Fruits Segment to Lead the Fruits and Vegetable Processing Market By Application, 2016

Figure 21 Liquid Segment to Account for the Largest Share in this Market, 2016

Figure 22 Amylase is Expected to Be the Largest Segment During the Forecast Period

Figure 23 Fruit & Vegetable Processing Enzymes Market, By Type

Figure 24 Market, By Application

Figure 25 Market, By Product Type

Figure 26 Market, By Source

Figure 27 Market, By Form

Figure 28 Market, By Region

Figure 29 Demand for Convenience Foods and Rising Health Concerns Among Consumers to Drive the Fruit & Vegetable Processing Enzymes Market

Figure 30 Revenue of Quick Service Restaurants in the U.S., 2010—2014 (USD Billion)

Figure 31 Research and Enzyme Development Contributes Maximum Value

Figure 32 Amylases Dominated the Fruit & Vegetable Processing Enzymes Market, By Type, in 2015

Figure 33 Asia-Pacific is Projected to Grow at the Highest Rate in the Amylase Market for Fruit & Vegetable Processing During the Forecast Period

Figure 34 Fruits to Lead the Fruit & Vegetable Processing Enzymes Market During the Forecast Period

Figure 35 Juice Segment is Projected to Dominate the Fruit & Vegetable Processing Enzymes Market Through 2022

Figure 36 Bacteria Segment to Dominate the Global Market During the Forecast Period

Figure 37 Liquid Segment is Projected to Dominate the Fruit & Vegetable Processing Enzymes Market By 2022

Figure 38 North American Market Snapshot

Figure 39 Europe Market: Snapshot

Figure 40 Companies Adopted Expansions and Acquisitions as Key Growth Strategies Between 2011 & 2016

Figure 41 Expansions: Key Strategies, 2011–2016

Figure 42 Number of Developments Between 2013 and 2016

Figure 43 Market Share of Key Players in the Fruit & Vegetable Processing Enzymes Market (2015)

Figure 44 E. I. Du Pont De Nemours and Company: Company Snapshot

Figure 45 E. I. Du Pont De Nemours and Company: SWOT Analysis

Figure 46 Associated British Foods PLC: Company Snapshot

Figure 47 Associated British Foods PLC: SWOT Analysis

Figure 48 Koninklijke DSM N.V.: Company Snapshot

Figure 49 Koninklijke DSM N.V.: SWOT Analysis

Figure 50 Novozymes A/S : Company Snapshot

Figure 51 Novozymes A/S: SWOT Analysis

Figure 52 Advanced Enzymes: Company Snapshot

Figure 53 Advanced Enzymes: SWOT Analysis

Figure 54 Group Soufflet: Company Snapshot

Growth opportunities and latent adjacency in Fruit & Vegetable Processing Enzymes Market