Soluble Dietary Fibers Market by Source (Fruits & Vegetables, Nuts & Seeds, and Cereals & Grains), Type (Inulin, Polydextrose, Pectin, and Beta-glucan), Application (Functional Foods & Beverages, Pharmaceuticals), and Region - Global Forecast to 2022

[130 Pages Report] The soluble dietary fibers market was valued at USD 1.52 billion in 2016. It is projected to grow at a CAGR of 13.4% from 2017, to reach USD 3.23 billion by 2022. The objectives of the study are to define, segment, and measure the size of the market with respect to type, application, source, and region.

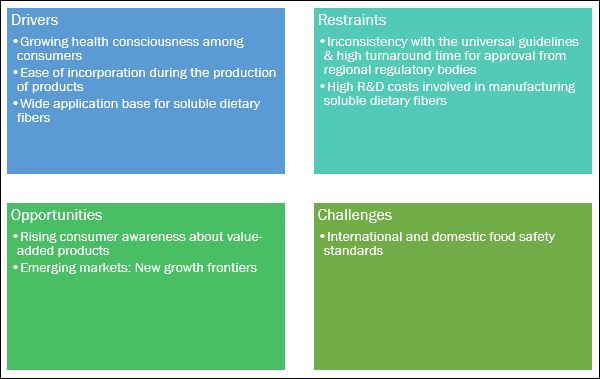

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

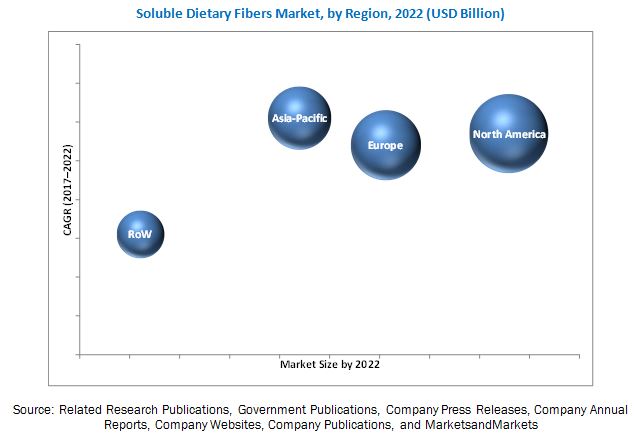

- To project the size of the soluble dietary fibers market in terms of value and volume, with respect to four regions (along with their respective key countries), namely, North America, Europe, Asia-Pacific, and RoW (Rest of the World)

-

To analyze competitive developments:

- New product launches

- Acquisitions

- Expansions

- Agreements, joint ventures, and partnerships

- To strategically profile the key players and comprehensively analyze their product portfolio and core competencies

The years and periodization considered for the study are as follows:

- Base year: 2016

- Beginning of the projection period: 2017

- End of the projection period: 2022

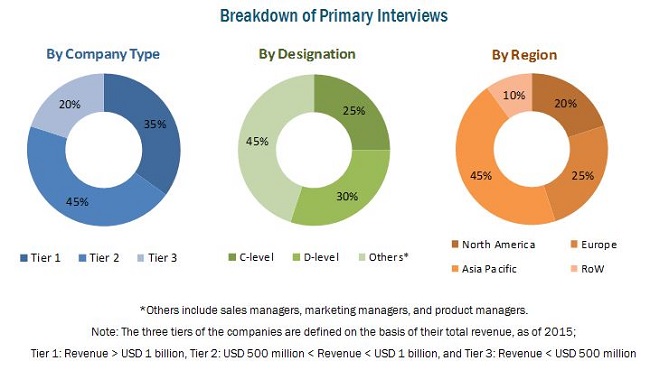

This report includes estimations of the market size in terms of value (USD million). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global soluble dietary fibers market and to estimate the size of various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research; some of the sources are press releases, annual reports, and financial journals, and paid databases such as Factiva and Bloomberg. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. The figure below shows the breakdown of profiles of industry experts that participated in the primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

The various contributors involved in the value chain of soluble dietary fibers market include manufacturers, suppliers, distributors, importers, and exporters. The key players in this market include Cargill (US), Ingredion Incorporated (US), Archer Daniels Midland Company (US), DowDuPont (US), Südzucker AG (Germany), Kerry Group plc (Ireland), Tate & Lyle PLC (UK), Frutarom Industries Ltd. (Israel), Royal Cosun U.A. (Netherlands), Nexira (France), Tereos (France), and Roquette Frères S.A. (France).

Target Audience

- Soluble dietary fiber manufacturers, suppliers, and formulators

- Soluble dietary fiber traders, suppliers, and distributors

- Professional soluble dietary fiber providers, associations, and industry bodies

- Research and development organizations

- Government authorities and agencies related to public health, environment, and agriculture

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Scope of the report

On the basis of type, the soluble dietary fibers market has been segmented as follows:

- Inulin

- Polydextrose

- Pectin

- Beta-glucan

- Others (corn, acacia, oligosaccharides, galactomannan, fructo-oligosaccharides, and oligofructose fibers)

On the basis of application, the soluble dietary fibers market has been segmented as follows:

- Functional foods & beverages

- Pharmaceuticals

- Animal feed

- Others (bakery, confectionery, processed foods, and personal care products)

On the basis of source, the soluble dietary fibers market has been segmented as follows:

- Fruits & vegetables

- Cereals & grains

- Nuts & seeds

On the basis of region, the soluble dietary fibers market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Segment Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

- Detailed analysis at volume level can also be provided

Geographic Analysis

- Further breakdown of the Rest of Europe soluble dietary fibers market into Italy, Spain, the Netherlands, Finland, Denmark, Norway, Belgium, and Russia

- Further breakdown of the Rest of Asia-Pacific market into Indonesia, South Korea, Malaysia, Singapore, and Vietnam

- Further breakdown of the Rest of the World soluble dietary fibers market, including countries in Africa, and the Middle East.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Rising number of health-conscious consumers and adoption of healthy diets to propel market growth for Soluble Dietary Fibers through to 2023

Soluble dietary fibers are polysaccharides that function as prebiotic agents and regulate the balance of the gut microflora. These dietary fibers have hypocholesterolemic properties, which help in reducing and controlling the cholesterol and glucose levels in the blood. These fibers are predominantly found and extracted from fruits & vegetables, nuts, and cereals, such as oats.

The global soluble dietary fibers market is projected to reach USD 3,231.0 million by 2022, at a CAGR of 13.4% from 2017. The growth of the market is driven by an increasing number of health-conscious consumers, and ease of incorporation in production has increased its application base. Other key drivers include changing lifestyle, higher disposable income, and increasing demand for fiber supplements.

High R&D costs for manufacturing soluble dietary fibers to remain a major restraint for the market growth

Substantial investments in the R&D activities, laboratories, research equipment, and hiring trained professionals have inhibited the growth of the soluble dietary fibers market. Key companies, such as Cargill (U.S.), E.I. du Pont de Nemours and Company (U.S.), Ingredion Incorporation (U.S.), and Royal Cosun U.A. (Netherlands) are focusing on building a strong R&D base to gain a competitive advantage, which is difficult for the small players and new entrants. It is observed that, in 2016, some of the leading food & beverage manufacturers invested 1%–3% of their revenue in R&D activities. For instance, Cargill has set up Cargill ONE innovation center in China, which focuses on producing innovative products to cater to the changing demands of Chinese customers in December 2016. Also, DuPont Nutrition & Health expanded its R&D facilities by setting up an innovation application center in India in March 2015.

Price, quality, convenience, year-round availability, high shelf life, variety, nutritional concerns, safety, and hygiene are encouraging customers to spend on health & nutrition products. Consumers want time-saving and hassle-free products that are nutritious and healthy, owing to which there is a huge scope for value-added products. As the value-added products complement well with functional food, they witness significant demand among the younger and middle-aged population. Dietary fiber products offer these health-enriching and nutrition-dense properties, due to which the demand for these products continues to remain high. Soluble dietary fibers market is expected to grow at a significant pace due to the increasing number of research studies about new applications, thereby helping manufacturers to develop new value-added products specific to the requirements of various sectors. Furthermore, the nutrition-dense properties of soluble dietary fibers and their ready availability make them ideal for food, feed, and dietary applications. Due to these factors, the value-added nutrition products have huge market potential for these fibers.

Market Dynamics

Leading food & beverage manufacturers are developing innovative products to include soluble dietary fibers as ingredients in their products to meet consumer demand for healthy products

Functional food & beverages: Growing health consciousness among consumers as well as consumer willingness to spend on healthy products drives the sales of functional food & beverages market

Functional food can be described as food or ingredients that may provide health benefits and prevent diseases. Soluble dietary fibers are considered as functional foods due to the health benefits provided by them. Fiber ingredients are increasingly used to provide excellent dissolution and taste characteristics and they also blend easily with a variety of functional food & beverages. Commercially, health-promoting soluble fibers are being manufactured from a variety of sources. For instance, Frutarom Industries Ltd. (Israel) has developed galactomannan fiber from fenugreek seeds as a functional food product, which provides multiple benefits, such as balancing blood sugar levels, weight management, and prevention of indigestion. Consumption of functional food & beverages by health-conscious consumers is increasing the demand for soluble dietary fibers.

Feed

Soluble dietary fibers are increasingly being manufactured in the feed industry, owing to its health-promoting properties, such as regulation of intestinal immunity, lowering the number of pathogenic bacteria, and balancing of intestinal microflora. Commercially, highly soluble dietary fiber is available as feed in two forms, namely, powder and liquid. These products are a rich source of fiber and energy for animals and help in maintaining optimum health and performance. As the consumption of the feed-soluble fiber-enriched food to animals aids in the growth of useful bacteria in their large intestines, the demand for these fibers continues to remain high in the global market.

Pharmaceuticals

Increasing awareness about health and nutrition-dense products has a driven the demand for soluble dietary fibers in the pharmaceuticals sector. The global soluble dietary fibers market is witnessing the development of a wide range of applications of soluble dietary fibers on account of the strong research base to benefit the human health. Soluble dietary fibers are available in the form of supplements and nutraceuticals in the market. The main consumers of these supplements include the obese, cardiac, and diabetic patients.

Others

Other applications of soluble dietary fibers include bakery, confectionery, processed foods, and personal care products. Commercially, soluble fiber is increasingly incorporated in the bakery and processed foods, such as fiber-enriched bread and biscuits to enhance both, nutritional and functional benefits. Soluble fibers, when used in confectionery products, such as jellies and candies, provide the products with a stable structure and chewy texture.

Key Questions

- The soluble dietary fiber market is going through the demand-supply gap; when will this scenario ease out?

- The market for soluble dietary fibers is projected to account for the highest growth rate in the next five years. With functional food & beverages gaining more traction in the global market, will the suppliers continue to explore new avenues for soluble dietary fibers? What could be the adjacencies?

- Most suppliers have adopted marketing strategies, such as expansions, as could be seen from the recent developments. Where will it take the industry in the mid to long-term?

- What will be the prominent revenue-generating pockets for the market in the next five years?

The soluble dietary fibers market is projected to grow at a CAGR of 13.4% from 2017, to reach a projected value of USD 3.23 billion by 2022. The growth of this market can be attributed to the growth of convenience food sector, favorable functional properties of soluble dietary fibers, and the growth in usage and applications of soluble dietary fibers in the functional foods & beverages industry. Further, increase in R&D activities on various types of soluble dietary fibers such as inulin, beta glucan, and pectin has increased the overall product offering range as well.

The soluble dietary fibers market is governed by different regulatory bodies, which vary regionally. Thus, the inconsistency on universal guidelines and high turnaround time for approval from regional regulatory bodies act as restraints for the market.

The inulin segment, on the basis of type, accounted for the largest market share in 2016, due to its multiple health benefits. Inulin is extensively used as a food additive to enhance flavor and acts as a replacer of fats & sugar in various food applications such as bakery, frozen dairy desserts, and confectionery products. The fruits & vegetables segment, on the basis of source, accounted for the largest market share in 2016, owing to its higher soluble dietary fiber content in a wide variety of fruits & vegetables.

Extensive sources for soluble dietary fiber, ranging from fruits & vegetables, cereal grains to seeds are available for human and animal consumption. Among them, fruits & vegetables dominated the soluble dietary fibers market. Soluble dietary fiber such as inulin and fructooligosaccharide (FOS) found in some vegetables helps in maintaining the function of the intestines. Fruits such as apples and pears have a high content of the soluble dietary fiber, pectin. Thus, due to the various health benefits of soluble dietary fiber drives the demand.

The application of soluble dietary fibers is estimated to be the largest in the functional foods & beverages sector due to the growing application of soluble dietary fibers to obtain varied functional properties in food products such as confectioneries, beverages, and processed foods.

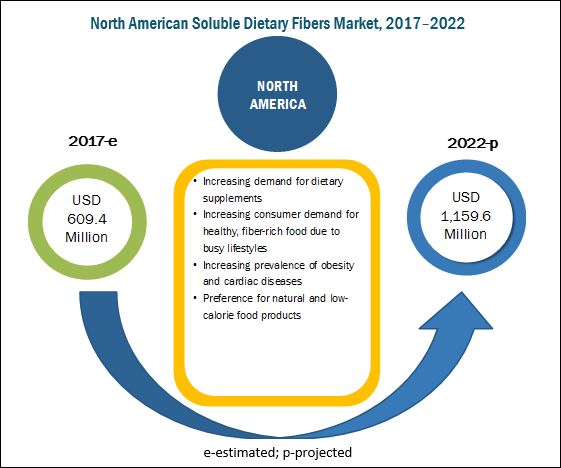

North America accounted for the largest market share in 2016, due to the increase in consumer demand for healthy fibrous food. Asia-Pacific is projected to be the fastest-growing region from 2017 to 2022, due to its large untapped market, growing food sector, and low production costs. The food & beverage market in the Asia-Pacific region is currently undergoing a dramatic transformation in response to rapid urbanization, diet diversification, and the liberalization of foreign direct investment in the food sector.

North America and Europe are estimated to be the dominant regions in the soluble dietary fibers market. The factors that influence the growth in these regions include high demand for functional food & beverage products, the presence of major players in these regions, and awareness about the benefits of using soluble dietary fibers. The market growth in developing countries is expected to be primarily driven by the changes in consumption patterns, public nutritional health & wellbeing measures, use of new sources for manufacturing soluble fiber, easy availability of raw materials, and product innovations.

The market is dominated by key players such as include Cargill (US), Ingredion Incorporated (US), Archer Daniels Midland Company (US), DowDuPont (US), and Südzucker AG (Germany). Other players include Kerry Group plc (Ireland), Tate & Lyle PLC (UK), Frutarom Industries Ltd. (Israel), Royal Cosun U.A. (Netherlands), Nexira (France), Tereos (France), and Roquette Frères S.A. (France). The key players have adopted strategic developments such as new product launches, acquisitions, joint ventures, expansions, partnerships, and agreements in order to explore the market in new geographies.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Periodization Considered

1.4 Currency

1.5 Unit

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in this Market

4.2 Inulin: Leading Type Segment of Soluble Dietary Fibers

4.3 Asia-Pacific: Fastest-Growing Market

4.4 Soluble Dietary Fibers Market, By Country

4.5 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Health Consciousness Among Consumers

5.2.1.2 Ease of Incorporation has Increased Application Base for Soluble Dietary Fibers

5.2.2 Restraints

5.2.2.1 Inconsistency on Universal Guidelines & High Turnaround Time for Approval From Regional Regulatory Bodies

5.2.2.2 High R&D Costs Involved in Manufacturing Soluble Dietary Fibers

5.2.3 Opportunities

5.2.3.1 Rising Consumer Awareness About Value-Added Products

5.2.3.2 Emerging Markets: New Growth Frontiers

5.2.4 Challenges

5.2.4.1 International and Domestic Food Safety Standards

5.3 Value Chain

6 Soluble Dietary Fibers Market, By Type (Page No. - 37)

6.1 Introduction

6.2 Inulin

6.3 Pectin

6.4 Polydextrose

6.5 Beta-Glucan

6.6 Others

7 Soluble Dietary Fibers Market, By Source (Page No. - 42)

7.1 Introduction

7.2 Cereals & Grains

7.2.1 Oats

7.2.2 Barley

7.3 Nuts & Seeds

7.4 Fruits & Vegetables

7.4.1 Apple

7.4.2 Banana

7.4.3 Grapefruit & Pear

7.4.4 Carrot & Potato

7.4.5 Legumes

8 Soluble Dietary Fibers Market, By Application (Page No. - 47)

8.1 Introduction

8.2 Functional Food & Beverages

8.3 Animal Feed

8.4 Pharmaceuticals

8.5 Other Applications

9 Soluble Dietary Fibers Market, By Region (Page No. - 52)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 France

9.3.2 Germany

9.3.3 U.K.

9.3.4 Rest of Europe

9.4 Asia-Pacific

9.4.1 Japan

9.4.2 Australia

9.4.3 China

9.4.4 India

9.4.5 Rest of Asia-Pacific

9.5 Rest of the World (RoW)

9.5.1 Brazil

9.5.2 Others in RoW

10 Competitive Landscape (Page No. - 83)

10.1 Introduction

10.2 Vendor Dive Overview

10.2.1 Vanguard

10.2.2 Innovator

10.2.3 Dynamic

10.2.4 Emerging

10.3 Competitive Benchmarking

10.3.1 Product Offering Scorecard (For All 25 Companies)

10.3.2 Business Strategy Scorecard (For All 25 Companies)

*Top 25 Companies Analyzed for This Study are – Cargill (U.S.), Archer Daniels Midland (U.S.), E.I. Du Pont De Nemours and Company (U.S.), Südzucker AG (Germany), Ingredion Incorporated (U.S.), Roquette Frères S.A.(France), Tate & Lyle PLC (U.K.), Kerry Group PLC (Ireland), Tereos (France), Royal Cosun U.A.(Netherlands), Frutarom Industries Ltd. (Israel), Nexira (France), Pmv Nutrients Products Pvt. Ltd. (India), Cj Cheiljedang (South Korea), Fuji Nihon Seito Corporation (Japan), Cosucra Groupe Warcoing S.A. (Belgium), the Tierra Group (U.S.), Novagreen Inc. (Canada), Mengzhou Tailijie Co. Ltd. (China), Baolingbao Biology Co. Ltd. (China), Nutricia Advanced Medical Nutrition (U.S.), Fiberstar Inc. (U.S.), Naturex (France), Best Ground International S.A. De C.V. (Mexico), Unipektin Ingredients AG (Switzerland)

11 Company Profiles (Page No. - 88)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

11.1 Cargill

11.2 Archer Daniels Midland Company

11.3 E. I. Du Pont De Nemours and Company

11.4 Südzucker AG Company

11.5 Ingredion Incorporated

11.6 Roquette Frères S.A.

11.7 Tate & Lyle PLC

11.8 Frutarom Industries Ltd

11.9 Royal Cosun U.A.

11.10 Nexira

11.11 Kerry Group PLC

11.12 Tereos

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 124)

12.1 Discussion Guide

12.2 Key Industry Insights

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Author Details

List of Tables (61 Tables)

Table 1 Soluble Dietary Fibers Market Size, By Type, 2015-2022 (USD Million)

Table 2 Inulin Market Size, By Region, 2015-2022 (USD Million)

Table 3 Pectin Market Size, By Region, 2015-2022 (USD Million)

Table 4 Polydextrose Market Size, By Region, 2015-2022 (USD Million)

Table 5 Beta-Glucan Market Size, By Region, 2015-2022 (USD Million)

Table 6 Other Types Market Size, By Region, 2015-2022 (USD Million)

Table 7 Soluble Dietary Fibers Market Size, By Source, 2015-2022 (USD Million)

Table 8 Cereals & Grains Market Size, By Region, 2015-2022 (USD Million)

Table 9 Nuts & Seeds Market Size, By Region, 2015-2022 (USD Million)

Table 10 Fruits & Vegetables Market Size, By Region, 2015-2022 (USD Million)

Table 11 Market Size, By Application, 2015–2022 (USD Million)

Table 12 Soluble Dietary Fibers Market Size in Functional Food & Beverages, By Region, 2015–2022 (USD Million)

Table 13 Market Size in Animal Feed, By Region, 2015–2022 (USD Million)

Table 14 Market Size in Pharmaceuticals, By Region, 2015–2022 (USD Million)

Table 15 Market Size in Other Applications, By Region, 2015–2022 (USD Million)

Table 16 Soluble Dietary Fibers Market Size, By Region, 2015–2022 (USD Million)

Table 17 Market Size, By Region, 2015–2022 (KT)

Table 18 North America: Market Size, By Country, 2015–2022 (USD Million)

Table 19 North America: Soluble Dietary Fibers Market Size, By Source, 2015–2022 (USD Million)

Table 20 North America: Market Size, By Application, 2015–2022 (USD Million)

Table 21 North America: Market Size, By Type, 2015–2022 (USD Million)

Table 22 U.S.: Market Size, By Source, 2015–2022 (USD Million)

Table 23 U.S.: Market Size, By Application, 2015–2022 (USD Million)

Table 24 Canada: Market Size, By Source, 2015–2022 (USD Million)

Table 25 Canada: Market Size, By Application, 2015–2022 (USD Million)

Table 26 Mexico: Market Size, By Source, 2015–2022 (USD Million)

Table 27 Mexico: Market Size, By Application, 2015–2022 (USD Million)

Table 28 Europe: Soluble Dietary Fibers Market Size, By Country, 2015–2022 (USD Million)

Table 29 Europe: Market Size, By Source, 2015–2022 (USD Million)

Table 30 Europe: Market Size, By Application, 2015–2022 (USD Million)

Table 31 Europe: Market Size, By Type, 2015–2022 (USD Million)

Table 32 France: Market Size, By Source, 2015–2022 (USD Million)

Table 33 France: Market Size, By Application, 2015–2022 (USD Million)

Table 34 Germany: Soluble Dietary Fibers Market Size, By Source, 2015–2022 (USD Million)

Table 35 Germany: Market Size, By Application, 2015–2022 (USD Million)

Table 36 U.K.: Market Size, By Source, 2015–2022 (USD Million)

Table 37 U.K.: Market Size, By Application, 2015–2022 (USD Million)

Table 38 Rest of Europe: Market Size, By Source, 2015–2022 (USD Million)

Table 39 Rest of Europe: Market Size, By Application, 2015–2022 (USD Million)

Table 40 Asia-Pacific: Soluble Dietary Fibers Market Size, By Country, 2015–2022 (USD Million)

Table 41 Asia-Pacific: Market Size, By Source, 2015–2022 (USD Million)

Table 42 Asia-Pacific: Market Size, By Application, 2015–2022 (USD Million)

Table 43 Asia-Pacific: Market Size, By Type, 2015–2022 (USD Million)

Table 44 Japan: Market Size, By Source, 2015–2022 (USD Million)

Table 45 Japan: Market Size, By Application, 2015–2022 (USD Million)

Table 46 Australia: Market Size, By Source, 2015–2022 (USD Million)

Table 47 Australia: Market Size, By Application, 2015–2022 (USD Million)

Table 48 China: Market Size, By Source, 2015–2022 (USD Million)

Table 49 China: Market Size, By Application, 2015–2022 (USD Million)

Table 50 India: Market Size, By Source, 2015–2022 (USD Million)

Table 51 India: Market Size, By Application, 2015–2022 (USD Million)

Table 52 Rest of Asia-Pacific: Soluble Dietary Fibers Market Size, By Source, 2015–2022 (USD Million)

Table 53 Rest of Asia-Pacific: Market Size, By Application, 2015–2022 (USD Million)

Table 54 RoW: Market Size, By Country, 2015–2022 (USD Million)

Table 55 RoW: Market Size, By Source, 2015–2022 (USD Million)

Table 56 RoW: Market Size, By Application, 2015–2022 (USD Million)

Table 57 RoW: Market Size, By Type, 2015–2022 (USD Million)

Table 58 Brazil: Market Size, By Source, 2015–2022 (USD Million)

Table 59 Brazil: Market Size, By Application, 2015–2022 (USD Million)

Table 60 Others in RoW: Market Size, By Source, 2015–2022 (USD Million)

Table 61 Others in RoW: Soluble Dietary Fibers Market Size, By Application, 2015–2022 (USD Million)

List of Figures (36 Figures)

Figure 1 Market Segmentation

Figure 2 Regional Scope

Figure 3 Soluble Dietary Fibers Market: Research Design

Figure 4 Market: Breakdown of Primary Interviews

Figure 5 Soluble Dietary Fibers Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 North America Dominated the Soluble Dietary Fibers Market in 2016

Figure 9 Asia-Pacific to Grow at the Highest Rate During the Forecast Period

Figure 10 Increased Demand for Functional Food & Beverage Products to Drive the Market for Soluble Dietary Fibers

Figure 11 Soluble Dietary Fibers Market Snapshot, By Source, 2017 vs 2022 (USD Million)

Figure 12 Inulin to Capture the Largest Share in the Soluble Dietary Fibers Market

Figure 13 Emerging Markets With Promising Growth Potential, 2017–2022

Figure 14 Inulin Was the Leading Type of Soluble Dietary Fiber Across Regions in 2016

Figure 15 Functional Food & Beverages Segment Accounted for Largest Share in the Asia-Pacific Market, 2016 (USD Million)

Figure 16 China to Grow at the Highest CAGR in the Market, 2017–2022

Figure 17 Soluble Dietary Fibers Market is Projected to Experience Strong Growth in the Asia-Pacific Region

Figure 18 Soluble Dietary Fibers: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Value Chain Analysis of the Market (2016): A Major Contribution is Witnessed From Processing

Figure 20 Geographic Snapshot (2017–2022): Rapidly Growing Markets are Emerging as New Hotspots

Figure 21 U.S. Recorded the Largest Market for Soluble Dietary Fibers in North America

Figure 22 France Was the Largest Market for Soluble Dietary Fibers in Europe in 2016

Figure 23 Japan Dominated the Market for Soluble Dietary Fibers in the Asia-Pacific Region in 2016

Figure 24 Dive Chart

Figure 25 Dive Vendor Comparison: Criteria Weightage

Figure 26 Cargill: Company Snapshot

Figure 27 Archer Daniels Midland Company: Company Snapshot

Figure 28 Dupont: Company Snapshot

Figure 29 Südzucker AG Company: Company Snapshot

Figure 30 Ingredion Incorporated: Company Snapshot

Figure 31 Roquette Frères S.A.: Company Snapshot

Figure 32 Tate & Lyle PLC: Company Snapshot

Figure 33 Frutarom Industries Ltd: Company Snapshot

Figure 34 Royal Cosun U.A.: Company Snapshot

Figure 35 Kerry Group PLC: Company Snapshot

Figure 36 Tereos: Company Snapshot

Growth opportunities and latent adjacency in Soluble Dietary Fibers Market