Passenger Car Sensors Market by Application (Powertrain/Drivetrain, Exhaust, Interior/Comfort, DAS, & Body Control), by Sensor Type (Pressure, Temperature, Speed, O2/NOx, Position, & Others) & by Geography - Trends & Forecast to 2019

[234 Pages Report] The use of sensors in automotive industry has rapidly increased in the last few decades. This trend is also reflecting on the changing demand pattern in the global passenger car sensors market. The first sensors made for a car were to manage the engine. By 1960’s, it became a widespread practice in passenger cars. The introduction of federal emission norms gave a boost to this market making it quintessential for the Original Equipment Manufacturers (OEMs) to strike a balance between government regulations, manufacturability, and robustness. This required the systems to be equipped with new and precise sensors, such as the Manifold Absolute Pressure (MAP), air fuel ratio sensors, and others. Since then, the sensors used in automobiles have evolved and have catapulted the complexity of vehicle electronics to new heights. Precise measurements and quick data analysis has paved the way for technologies which have helped automotive OEMs cope with the increased pressure from the governments. For Example, the number of sensors used in engine control application has increased from 10 in 1995 to more than 60 in 2013.

The application segment of the passenger car sensors market can be widely categorized under five categories which are power train/drive train, body control, exhaust, interior/comfort, and Advanced Driver Assist Systems (ADAS). Powertrain/drivetrain applications of sensors were the first wave of passenger car sensors. These sensors were widely used in engines, transmissions, and onboard diagnostics. The increased use of these sensors can be attributed to the customers’ demand for these, the requirements of the OEM’s to differentiate their products with different features and conform to government legislations. The second-wave of the sensors market can be considered as the development of sensors in the body control system which includes the application of sensors in the steering, suspensions, braking, and stability. The market for sensors in the area of body control has increased due to factors such as stringent safety regulations, weight reduction, and multiplex compatibility. On the other hand, market for sensors used in interior and comfort systems, and ADAS are mainly driven by the customers demand for comfort, convenience, and safety.

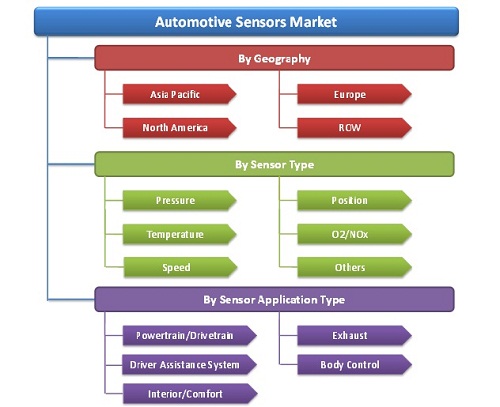

The report segments the global market by geography (Asia-Pacific, Europe, North America, and ROW), by application (powertrain/drivetrain, body control, exhaust, interior/comfort, and Advanced Driver Assist System (ADAS)), and by sensor type (position sensors, pressure sensors, temperature sensors, speed sensors, and NOX /O2 sensors).

The report also features the profiles of key players of passenger car sensors market covering their market share, financial information, products and services and further insight on their recent market developments and strategies.

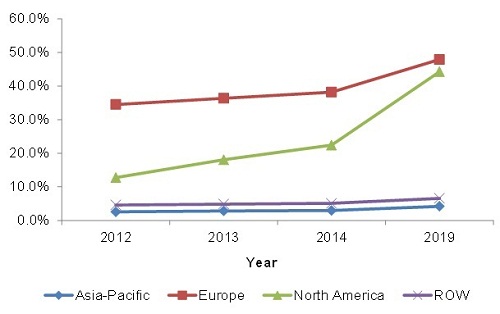

Passenger Car Sensors Market Value, By Region

Passenger Car Sensors Market Segmentation

Passenger car sensors market estimated to reach $146.5 billion by the year 2019.

Considering the driving efficiency, stringent emission norms, safety and comfort factors, passenger car sensors have been an integral part playing a vital role in the vehicle. These advancements include tire pressure monitoring systems, occupant detection, electronic stability control, heating and ventilation air conditioning, advanced driver assistance systems and others. The growing demand has led to the growth of this market which in turn is responsible for technological advancements in this area. Sensors are used from engine to exhaust system of the vehicle. Majorly, sensors are used in Powertrain/Drivetrain, chassis, and body control where they monitor temperature, pressure, voltages/currents, vacuum, and other such parameters.

The growth of the automobile sensor market is directly proportional to the growth of automobile industry. One of the important factors driving the market for passenger car sensors is the growth in the vehicle production where China plays a vital role in producing large number of vehicles. The global vehicle production is expected to grow at a CAGR of 7.5% by 2020, thus stimulating the growth of the passenger car sensors markets. In addition to this, the Government regulations for safety and emissions have also supported the growth of this market. In order to meet the stringent norms and regulations for safety and emissions, the sensor manufacturers are striving hard and coming up with a number of technological advancements in electronic stability control and anti-lock braking systems such as deployment of crash avoidance technology. This technology along with others is expected to be a part of almost all the vehicles in matured markets of the U.S. & Europe by 2020. Owing to the customers demand for safety and comfort, the implementation of new technological concept of Advanced Driver Assist system (ADAS) has aided in boosting the safety and drivability factor by mitigating the effects of a driver’s flaws, where sensors have played an important role. This system also acts as a co-driver system providing real time advice, warnings, and instructions to the drivers in order to abide the traffic safety norms. These wide ranges of advantages offered by ADAS have created a positive impact on the sensor markets and boosted its use in the vehicles.

The key manufacturers of passenger car sensors are identified as Allegro (U. S.), CTS (U. S.), Robert Bosch (Germany), Delphi (U. K.) among others. These companies contribute a major share in automotive sensor market. However, the demand for the products of these companies highly depends on the automotive OEMs, and the automotive technological advancements.

The report covers passenger car sensors market based on geography (Asia-Pacific, Europe, North America, and ROW), sensor type (pressure, temperature, NOX/O2, speed, position, and others), and application type (Powertrain/drivetrain, exhaust, interior/comfort, driver assistance system, and body control).

Passenger Car Sensors Market: Overview

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives Of the Report

1.2 Report Description

1.2.1 Safety/Das Application: Increasing Prefrence By the Buyer

1.3 Glance At Markets Covered

1.3.1 By Region

1.3.1.1 Asia-Pacific

1.3.1.2 Europe

1.3.1.3 North America

1.3.1.4 ROW

1.3.2 By Sensors Type

1.3.2.1 Pressure Sensors

1.3.2.2 Temperature Sensors

1.3.2.3 Position Sensors

1.3.2.4 Speed Sensors

1.3.2.5 Nox/O2 Sensors

1.3.2.6 Das Sensors

1.3.3 By Application Type

1.3.3.1 Powertrain/Drivetrain

1.3.3.2 Exhaust

1.3.3.3 Interior/Comfort

1.3.3.4 Driver Assistance System

1.3.3.5 Body Control System

1.4 Research Methodology

1.4.1 Market Size

1.4.1.1 Methodology

1.4.2 Key Secondary Sources

1.4.3 Key Data Taken From the Primary Sources

1.4.4 Assumptions

1.5 Stakeholders

2 Executive Summary (Page No. - 31)

2.1 Asia Pacific: Leader in Vehicle Production

2.2 Pressure Sensors: Most Popular Sensor

2.3 Driver Assistance Systems Application Segment: Highest Growth Potential

2.4 Adas: Leading Application

3 Premium Insights (Page No. - 35)

3.1 Automotive Sensors Market Segmentation

3.2 Automotive Sensors Market, By Application Segment

3.3 Automotive Sensors Market, By Geography

3.3.1 Pressure Sensors Market

3.3.2 Temperature Sensors Market

3.3.3 Speed Sensors Market

3.3.4 Position Sensors Market

3.3.5 O2/Nox Sensors Market

3.3.6 Other Sensors Market

3.4 Market Share Analysis

4 Market Overview (Page No. - 45)

4.1 Introduction

4.2 Market Dynamics

4.2.1 Drivers

4.2.1.1 Increasing Passenger Car Sales & Production

4.2.1.2 Government Regulation for Safety & Emissions

4.2.1.3 Customer’s Demand for Safety

4.2.2 Restraints

4.2.2.1 Pricing Of Sensor Products

4.2.2.2 Increasing Expectation Of the Oem’s

4.2.2.3 Regulations for Diagnostics & Enhanced Computing Capabilities

4.2.3 Opportunities

4.2.3.1 Low Penetration in the Developing Economy

4.2.3.2 Electrification Of Powertrain

4.3 Burning Issue

4.3.1 Lowered the Driver’s Involvement

4.4 Winning Imperatives

4.4.1 Low-Cost Mems

4.5 Porter’s Five forces Analysis

4.5.1 Bargaining Power Of the Suppliers

4.5.2 Threat Of Substitutes

4.5.3 Threat Of New Entrants

4.5.4 Bargaining Power Of the Buyers

4.5.5 Degree Of Competition

4.6 Value Chain

4.7 Market Share Analysis

4.8 Pestle Analysis

5 Technology Overview (Page No. - 64)

5.1 Technology Roadmap

5.2 Types Of Sensors & their Working

5.2.1 Pressure Sensors

5.2.2 Temperature Sensors

5.2.3 Speed Sensors

5.2.4 Position Sensors

5.2.5 O2 and Nox Sensors

5.2.6 Safety & Comfort Sensors

5.2.7 Other Sensors

5.3 Application Technologies and Their Working

5.3.1 Turbochargers

5.3.2 Automatic Transmission

5.3.3 Airbags

5.3.4 Park Assist

5.3.5 Lane Departure Warning

5.3.6 Adaptive Cruise Control

5.3.7 Drowsiness Sensors

5.3.8 Blind Spot Detection

5.3.9 Tire Pressure Monitoring System

5.3.10 Antilock Braking System

5.3.11 Heating Ventilation & Air Conditioning (HVAC)

5.3.12 Electric Power Steering (EPS)

5.3.13 Diesel Particulate Filter (DPF)

6 Automotive Sensors Market, By Sensor Type (Page No. - 83)

6.1 Introduction

6.2 By Sensor Type

6.2.1 Market Size Estimate

6.2.2 Pressure Sensors

6.2.2.1 By Region

6.2.2.2 By Application

6.2.3 Temperature Sensors

6.2.3.1 By Region

6.2.3.2 By Application

6.2.4 Speed Sensor

6.2.4.1 By Region

6.2.4.2 By Application

6.2.5 Position Sensor

6.2.5.1 By Region

6.2.5.2 By Application

6.2.6 O2 & Nox Sensor

6.2.6.1 By Region

6.2.6.2 By Application

6.2.7 Other Sensor

6.2.7.1 By Region

6.2.7.2 By Application

7 Automotive Sensor Market, By Applications (Page No. - 112)

7.1 Introduction

7.1.1 Automotive Sensors Market, By Application

7.2 Powertrain/Drivetrain System Sensors

7.2.1 By Geography

7.2.2 By Sensor Type

7.3 Exhaust System Sensors

7.3.1 By Geography

7.3.2 By Sensor Type

7.4 Interior/Comfort System Sensor

7.4.1 By Geography

7.4.2 By Sensor Type

7.5 Safety/Das Sensors

7.5.1 By Geography

7.5.2 By Sensor Type

7.6 Body Control Sensors

7.6.1 By Geography

7.6.2 By Sensor Type

8 Automotive Sensors Market, By Geography (Page No. - 135)

8.1 Introduction

8.1.1 By Geography

8.1.1.1 Market Size Estimate

8.1.2 Asia-Pacific

8.1.2.1 By Application

8.1.2.2 By Sensor Type

8.1.3 North America

8.1.3.1 By Application

8.1.3.2 By Sensor Type

8.1.4 Europe

8.1.4.1 By Application

8.1.4.2 By Sensor Type

8.1.5 ROW

8.1.5.1 By Application

8.1.5.2 By Sensor Type

9 Competitive Landscape (Page No. - 155)

9.1 Introduction

9.2 Market Players

9.2.1 Companies’ Relative Market Positions, By Geography

9.3 Key Growth Strategies Of Automotive Sensors Market

10 Company Profiles (Page No. - 167)

(Overview, Financial*, Products & Services, Strategy, and Developments)

10.1 Robert Bosch GMBH

10.2 Continental AG

10.3 Denso Corporation

10.4 Delphi Automotive PLC

10.5 Allegro Microsystems, LLC

10.6 Analog Devices, Inc.

10.7 CTS Corporation

10.8 Elmos Semiconductor AG

10.9 Infineon Technologies AG

10.10 TRW Automotive Holdings Corp.

*Details Might Not Be Captured In Case Of Unlisted Companies.

Annexure (Page No. - 214)

List Of Tables (96 Tables)

Table 1 Research Methodology: Automotive Sensors Market

Table 2 Pestle Analysis: Asia-Pacific

Table 3 Pestle Analysis: Europe

Table 4 Pestle Analysis: North America

Table 5 Automotive Applications Of Pressure Sensors, By System

Table 6 Automotive Applications Of Temperature Sensors, By System

Table 7 Automotive Applications Of Speed Sensors, By System

Table 8 Automotive Applications Of Position Sensors, By System

Table 9 Automotive Applications Of O2 and Nox Sensors, By System

Table 10 Automotive Applications Of Safety & Comfort Sensors, By System

Table 11 Automotive Applications Of Other Sensors, By System

Table 12 Automotive Sensors Market Size, By Sensor Type, 2012-2019 (Million Units)

Table 13 Automotive Sensors Market Size, By Sensor Type, 2012-2019 ($Million)

Table 14 Pressure Sensors Market Size, By Region, 2012-2019 (Million Units)

Table 15 Pressure Sensors Market Size, By Region, 2012-2019 ($Million)

Table 16 Pressure Sensors Market Size, By Application, 2012-2019 (Million Units)

Table 17 Pressure Sensors Market Size, By Application, 2012-2019 ($Million)

Table 18 Temperature Sensors Market Size, By Region, 2012-2019 (Million Units)

Table 19 Temperature Sensors Market Size, By Region, 2012-2019 ($Million)

Table 20 Temperature Sensors Market Size, By Application Type, 2012-2019 (Million Units)

Table 21 Temperature Sensors Market Size, By Application, 2012-2019 ($Million)

Table 22 Speed Sensors Market Size, By Region, 2012-2019 (Million Units)

Table 23 Speed Sensors Market Size, By Region, 2012-2019 ($Million)

Table 24 Speed Sensors Market Size, By Application, 2012-2019 (Million Units)

Table 25 Speed Sensors Market Size, By Application, 2012-2019 ($Million)

Table 26 Position Sensors Market Size, By Region, 2012-2019 (Million Units)

Table 27 Position Sensors Market Size, By Region, 2012-2019 ($Million)

Table 28 Position Sensors Market Size, By Application, 2012-2019 (Million Units)

Table 29 Position Sensors Market Size, By Application, 2012-2019 ($Million)

Table 30 O2/Nox Sensors Market Size, By Region, 2012-2019 (Million Units)

Table 31 O2/Nox Sensors Market Size, By Region, 2012-2019 ($Million)

Table 32 O2/Nox Sensor Market Size, By Application, 2012-2019 (Million Units)

Table 33 O2/Nox Sensors Market Size, By Application, 2012-2019 ($Million)

Table 34 Other Sensors Market Size, By Region, 2012-2019 (Million Units)

Table 35 Other Sensors Market Size, By Region, 2012-2019 ($Million)

Table 36 Other Sensors Market Size, By Application, 2012-2019 (Million Units)

Table 37 Other Sensor Market Size, By Application, 2012-2019 ($Million)

Table 38 Automotive Sensors Market Size, By Appplication, 2012-2019 (Million Units)

Table 39 Automotive Sensors Market Size, By Appplication, 2012-2019 ($Million)

Table 40 Powertrain/Drivetrain Sensors Market Size, By Region, 2012-2019 (Million Units)

Table 41 Powertrain/Drivetrain Sensors: Market Size, By Region, 2012-2019 ($Million)

Table 42 Powertrain/Drivetrain Sensors Market Size, By Type, 2012-2019 (Million Units)

Table 43 Powertrain/Drivetrain Sensors Market Size, By Type, 2012-2019 ($Million)

Table 44 Exhaust Sensors Market Size, By Region, 2012-2019 (Million Units)

Table 45 Exhaust Sensors Market Size, By Region, 2012-2019 ($Million)

Table 46 Exhaust Sensors Market Size, By Type, 2012-2019 (Million Units)

Table 47 Exhaust Sensors Market Size, By Type, 2012-2019 ($Million)

Table 48 Interior/Comfort Sensors Market Size, By Region, 2012-2019 (Million Units)

Table 49 Interior/Comfort Sensors Market Size, By Region, 2012-2019 ($Million)

Table 50 Interior/Comfort Sensors Market Size, By Type, 2012-2019 (Million Units)

Table 51 Interior/Comfort Sensors Market Size, By Type, 2012-2019 ($Million)

Table 52 Safety/Das Sensors Market Size, By Region, 2012-2019 (Million Units)

Table 53 Safety/Das Sensors Market Size, By Region, 2012-2019 ($Million)

Table 54 Safety/Das Sensors Market Size, By Type, 2012-2019 (Million Units)

Table 55 Safety/Das Sensors Market Size, By Type, 2012-2019 ($Million)

Table 56 Body Control Sensors Market Size, By Region, 2012-2019 (Million Units)

Table 57 Body Control Sensors Market Size, By Region, 2012-2019 ($Million)

Table 58 Body Control Sensors Market Size, By Type, 2012-2019 (Million Units)

Table 59 Body Control Sensors Market Size, By Type, 2012-2019 ($Million)

Table 60 Automotive Sensors: Market Size, By Region, 2012–2019 (Million Units)

Table 61 Automotive Sensors: Market Size, By Region, 2012–2019 ($Million)

Table 62 Asia-Pacific: Automotive Sensors Market Size, By Application, 2012-2019 (Million Units)

Table 63 Asia-Pacific: Automotive Sensor Market Size, By Application, 2012-2019 ($Million)

Table 64 Asia-Pacific: Automotive Sensors Market Size, By Sensor Type, 2012-2019 (Million Units)

Table 65 Asia-Pacific: Automotive Sensors Market Size, By Sensor Type, 2012-2019 ($Million)

Table 66 North America: Automotive Sensor Market Size By Application, 2012-2019 (Million Units)

Table 67 North America: Automotive Sensor Market Size, By Application, 2012-2019 ($Million)

Table 68 North America: Automotive Sensors Market Size, By Sensor Type, 2012-2019 (Million Units)

Table 69 North America: Automotive Sensors Market Size, By Sensor Type, 2012-2019 ($Million)

Table 70 Europe: Automotive Sensor Market Size, By Application, 2012-2019 (Million Units)

Table 71 Europe: Automotive Sensor Market Size, By Application, 2012-2019 ($Million)

Table 72 Europe: Automotive Sensors Market Size, By Sensor Type, 2012-2019 (Million Units)

Table 73 Europe: Automotive Sensors Market Size, By Sensor Type, 2012-2019 ($Million)

Table 74 ROW: Automotive Sensors Market Size, By Application, 2012-2019 (Million Units)

Table 75 ROW: Automotive Sensors Market Size, By Application, 2012-2019 ($Million)

Table 76 ROW: Automotive Sensors Market Size, By Sensor Type, 2012-2019 (Million Units)

Table 77 ROW: Automotive Sensors Market Value, By Sensor Type, 2012-2019 ($Million)

Table 78 Key Players in the Automotive Sensors Market

Table 79 Expansions & Other Developments

Table 80 New Product Launches/Product Developments/R&D

Table 81 AGreements, Partnerships, Collaborations, Joint Ventures & Contracts

Table 82 Mergers & Acquisitions

Table 83 Robert Bosch: Products & Services

Table 84 Continental AG: Sensor Segment Product Offerings

Table 85 Denso Corporation: Products & Services

Table 86 Delphi: Products & Their Description

Table 87 Allegro Microsystems, LLC: Product Segments & Products

Table 88 Analog Digital, Inc.: Product Segments & Products

Table 89 CTS Corporation: Products, Their Description & Application Area

Table 90 Elmos Semiconductor AG: Products Segments & Products

Table 91 Infineon Corporation: Product Segments & Products

Table 92 TRW: Products Segments & Products

Table 93 AGreement/Partnership/Collaboration/ Joint Ventures/Contracts

Table 94 Expansion & Other Developments

Table 95 Mergers & Acquisition

Table 96 New Product Launch/Product Development/R&D

List Of Figures (37 Figures)

Figure 1 Automotive Sensors Market Snapshot, 2014

Figure 2 Market Segmentation

Figure 3 Automotive Sensors Market, By Application, 2014 Vs 2019

Figure 4 Automotive Sensors Market, By Geography, 2012-2019

Figure 5 Automotive Pressure Sensors Market, By Geography, 2012-2019

Figure 6 Automotive Temperature Sensors Market, By Geogrpahy, 2012-2019

Figure 7 Automotive Speed Sensors Market, By Geography, 2012-2019

Figure 8 Automotive Position Sensors Market, By Geography, 2012-2019

Figure 9 Automotive O2/Nox Sensors Market, By Geography, 2012-2019

Figure 10 Automotive Other Sensors Market, By Geography, 2012-2019

Figure 11 Automotive Sensors Market: Market Share Analysis

Figure 12 Automotive Sensors Market Drivers: Impact Analysis

Figure 13 Global Passenger Car Production, 2012-2019 (‘000 Units)

Figure 14 Automotive Sensors Market Restraints’ Impact Analysis

Figure 15 Automotive Sensors Market Opportunities’ Impact Analysis

Figure 16 Porter’s Five forces Analysis

Figure 17 Value Chain Analysis

Figure 18 Automotive Sensors Market Share Analysis, 2014

Figure 19 Technology Roadmap: Automotive Sensors

Figure 20 Turbochargers: Penetration Rate (%), By Region, 2012-2019

Figure 21 Transmission: Penetration Rate (%). By Region 2012-2019

Figure 22 Lane Departure Warning: Penetration Rate (%), By Region 2012-2019

Figure 23 Adaptive Cruise Control: Penetration Rate (%), By Region 2012-2019

Figure 24 Drowsiness Sensors: Penetration Rate (%), By Region, 2012-2019

Figure 25 Blind Spot Detection: Penetration Rate (%), By Region, 2012-2019

Figure 26 Tire Pressure Monitoring System: Penetration Rate (%), By Region 2012-2019

Figure 27 HVAC: Penetration Rate (%), By Region 2012-2019

Figure 28 EPS: Penetration Rate (%), By Region 2012-2019

Figure 29 DPF: Penetration Rate (%), By Region 2012-2019

Figure 30 Relative Market Position Of Key Manufacturers

Figure 31 Automotive Sensors Market: Key Growth Strategies, 2010–2014

Figure 32 Automotive Sensors Market, By Key Growth Strategies, 2010–2014

Figure 33 Robert Bosch GMBH: SWOT Analysis

Figure 34 Continental AG: SWOT Analysis

Figure 35 Denso Corp.: SWOT Analysis

Figure 36 Delphi Automotive PLC: SWOT Analysis

Figure 37 Allegro Microsystems: SWOT Analysis

Growth opportunities and latent adjacency in Passenger Car Sensors Market

Rain Sensor, IR sensors and cameras technology, techinical specifications, major players /adoptors and market share.

I kindly ask you for a free sample of this report. Please also indicate your sources (Internet search, company visits, interviews,…), divided by primary and secondary ones. Thank you and Kind Regards

My company is conducting research in Sensata Technologies and is interested in your report. We were wondering if you also have historical data available, both unit data and dollar sales volumes by geography and sensor type. Thank you.

Pressure, Temperature, O2/NOx, Position in the Interior of the car. Exsting sensors in application. Potential new emerging technologies