Automotive Rain Sensor Market by Region (APAC, Europe, North America & Rest of the World), and by Vehicle Type (PC, LCV & HCV) - Trends and Forecast to 2020

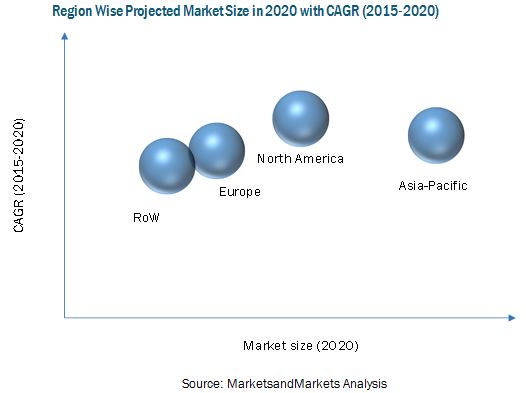

[119 Pages Report] The automotive rain sensor market is driven by increased demand for comfort features and driver safety in automobiles. The automotive rain sensor market, in terms of value, is projected to grow at a CAGR of 6.05% from 2015 to 2020, to reach a market size of USD 4.15 Billion by 2020.

The global market is driven by increased vehicle electrification. The adoption of advanced electrical systems in automotive has fueled the demand for sensors. The sensors form an important part of the automotive system as it provides the necessary data and helps the system deliver optimum output. The study segments the automotive rain sensor market on the basis of vehicle type and region.

Europe is estimated to be the largest market for automotive rain sensors. In Europe, Germany is estimated to be one of the largest markets for automotive rain sensors in 2015. The higher production of luxury cars and high technological capabilities is a peculiar characteristic of the European region. The consumer’s prefer high performance vehicles which is major reason for the growth of automotive rain sensor market.

The research methodology used in the report involves various secondary sources including paid databases and directories. Experts from related industries and suppliers have been interviewed to understand the future trends of the automotive rain sensor market. The bottom-up approach has been used to estimate the market size, in which country-wise vehicle production statistics has been taken into account for each vehicle type.

In order to arrive at the market size, in terms of volume, for automotive rain sensors, the number of sensors that go into each vehicle category has been identified and multiplied by vehicle production numbers to get the country-level rain sensor volume. This country-wise market size, in terms of volume, of rain sensors for each vehicle type is then multiplied with the country-wise average OE price (AOP) of rain sensors required for the wiper application. This results in the country-wise market size, in terms of value. The summation of the country-wise market gives the regional market and further summation of the regional market provides the global automotive rain sensor market.

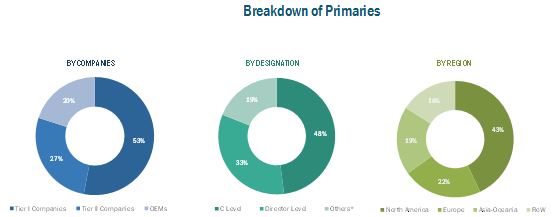

Figure below shows the break-up of profile of industry experts who participated in primary discussions.

Industry Ecosystem

Some of the key industry players which comprise the ecosystem of automotive rain sensor market are given below:

- OEM’s (Original Equipment Manufacturers) : General Motors Company, Ford Motor Company, Toyota Motor Corporation, Volkswagen AG, Daimler AG, BMW Group, PSA Peugeot Citroën & Others

- Automotive Rain Sensor Suppliers: Denso Corporation (Japan), HELLA KGaA Hueck & Co. (Germany), ZF TRW (U.S.), Robert Bosch GmBH (Germany), and Hamamatsu Photonics K.K. (Japan) among others

The automotive rain sensor ecosystems consists of manufacturers such as Denso Corporation (Japan), HELLA KGaA Hueck & Co. (Germany), ZF TRW (U.S.), Robert Bosch GmBH (Germany), automotive original equipment manufacturers (OEM) such as Toyota Motor Corporation (Japan), Volkswagen AG (Germany) & Ford Motor Company (U.S.), research institutes such as The Automotive Research Association of India (ARAI), European automotive research partners association (EARPA), & The United States Council for Automotive Research (USCAR) and regional automobile associations such as China Association of Automobile Manufacturers (CAAM), Japan Automobile Manufacturers Association (JAMA), & European Automobile Manufacturers Association (ACEA), among others.

Target Audience

- Raw material suppliers of the materials

- Original Equipment Manufacturers (OEMs)

- Dealers

- Distributors of automotive rain sensors

- Industry Associations

- Private Equity Firms

Scope Of The Report

This report segments the automotive rain sensor market as follows:

- By Vehicle Type (Passenger Car, LCV, and HCV)

- By Region (North America, Asia-Pacific , Europe, and RoW)

- Automotive wiper blade market, by region

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

- Automotive Wiper Blade Market, by type

- Company Profile For Automotive Wiper Blade Market

- Automotive Rain Sensor Aftermarket

The automotive rain sensor market, in terms of value, is projected to grow at a CAGR of 6.05% from 2015 to 2020, to reach a market size of USD 4.15 Billion by 2020. This growth can be attributed to factors such as the increasing demand for better comfort features, increasing awareness regarding driver safety, and technological advances.

Europe is estimated to occupy the largest share in the automotive rain sensor market in 2015. The passenger car segment is estimated to dominate the market in 2015, followed by Light Commercial Vehicles (LCV). The increasing demand for comfort and safety creates promising growth opportunities for rain sensing wiper systems, which use automotive rain sensors, and would consequently boost the demand for the same. Automotive rain sensors have no direct substitutes which is a positive for the manufacturers. The market is dominated by manufacturers who possess advanced technological capabilities.

Initially, the rain sensor used in rain sensing wiper system was an optional feature only offered in luxury cars. However, with advancements in technology, this feature has become a standard feature for luxury cars while becoming an optional feature in other car segments. Thus, the market for automotive rain sensors is expected to grow in all passenger car segments. The increased use of rain sensors in commercial vehicles will also boost the market at the global level. The North American market has high growth potential as it is one of the largest luxury car markets. The sales statistics of vehicles show promising growth potential, particularly driven by pick-up truck sales and SUVs, which dominate the market. Thus, the LCV segment is also expected to grow in the near future.

The different types of vehicles considered in the study are passenger cars, light commercial vehicles, and heavy commercial vehicles and the regions considered under the study are Asia-Pacific, North America, Europe, and RoW.

Average unit price has played an important role in the growth of the market. The prices have seen a downward trend, making it possible for the OEMs to incorporate rain sensor across all variants of the various vehicles. However, now the sensor is integrated with various other features including the Rain/Light sensor, which will impact average unit price. The automotive rain sensor market is dominated by a few globally established suppliers such as Denso Corporation (Japan), HELLA KGaA Hueck & Co. (Germany), ZF TRW (U.S.), Robert Bosch GmBH (Germany), and Hamamatsu Photonics K.K. (Japan) among others. Robert Bosch GmBH (Germany) is currently the market leader and has adopted new product development and expansion as key strategies to gain traction in the market.

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Limitation

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Sampling Techniques & Data Collection Methods

2.1.2.2 Primary Participants

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand Side Analysis

2.2.2.1 Impact of Gdp on Commercial Vehicle Sales

2.2.2.2 Infrastructure: Roadways

2.2.2.3 Vehicle Production Increasing in Developing Countries

2.2.3 Supply Side Analysis

2.2.3.1 Technological Advancements

2.2.3.2 Influence of Other Factors

2.3 Market Estimation

2.3.1 Bottom-Up Approach

2.3.2 Data Triangulation

2.3.3 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in this Market

4.2 Automotive Rain Sensor Market Share & CAGR, By Region (2015, 2015-2020)

4.3 Europe Automotive Rain Sensors Market, By Country (2015 vs. 2020)

4.4 Automotive Rain Sensor Market, By Vehicle Type (2015 vs. 2020)

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Overview of Automotive Wiper Blade Market

5.3 Market Segmentation

5.3.1 Automotive Rain Sensor Market

5.3.1.1 Automotive Rain Sensor Market, By Vehicle Type

5.3.1.2 Market, By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Vehicle Electrification

5.4.2 Restraints

5.4.2.1 Increasing Cost of Overall Vehicle

5.4.3 Opportunities

5.4.3.1 Increasing Demand for Better Comfort Features

5.4.4 Challenges

5.4.4.1 Manufacturing Sensors at Low Cost

5.5 Value Chain

5.6 Porter’s Five Forces Analysis

5.6.1 Threat of New Entrants

5.6.2 Threat of Substitutes

5.6.3 Bargaining Power of Suppliers

5.6.4 Bargaining Power of Buyers

5.6.5 Intensity of Competitive Rivalry

6 Automotive Rain Sensor Market, By Vehicle Type (Page No. - 48)

6.1 Introduction

6.2 Passenger Car

6.3 LCV

6.4 HCV

7 Automotive Rain Sensor Market, By Region (Page No. - 55)

7.1 Introduction

7.1.1 Asia-Pacific

7.1.1.1 China

7.1.1.2 Japan

7.1.1.3 South Korea

7.1.1.4 India

7.1.1.5 Rest of APAC

7.1.2 Europe

7.1.2.1 Germany

7.1.2.2 France

7.1.2.3 U.K.

7.1.2.4 Rest of Europe

7.1.3 North America

7.1.3.1 U.S.

7.1.3.2 Mexico

7.1.3.3 Canada

7.1.4 RoW

7.1.4.1 Brazil

7.1.4.2 Russia

7.1.4.3 Others

7.2 Pest Analysis

7.2.1 Asia-Pacific

7.2.1.1 Political Factors

7.2.1.2 Economic Factors

7.2.1.3 Social Factors

7.2.1.4 Technological Factors

7.2.2 Europe

7.2.2.1 Political Factors

7.2.2.2 Economic Factors

7.2.2.3 Social Factors

7.2.2.4 Technological Factors

7.2.3 North America

7.2.3.1 Political Factors

7.2.3.2 Economic Factors

7.2.3.3 Social Factors

7.2.3.4 Technological Factors

7.2.4 RoW

7.2.4.1 Political Factors

7.2.4.2 Economic Factors

7.2.4.3 Social Factors

7.2.4.4 Technological Factors

8 Competitive Landscape (Page No. - 82)

8.1 Key Market Player Ranking: Automotive Rain Sensor Market

8.2 Competitive Situation &Trends

8.3 Expansions

8.4 Agreements/Joint Ventures/Supply Contracts/Partnerships

8.5 Mergers & Acquisition

8.6 New Product Launches/Development

9 Company Profiles (Page No. - 91)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

9.1 Introduction

9.2 Hella KGAA Hueck & Co

9.3 Denso Corporation

9.4 Robert Bosch GmbH

9.5 Valeo SA

9.6 ZF TRW

9.7 Mitsubishi Motors Corporation

9.8 Vishay Intertechnology Inc

9.9 Hamamatsu Photonics K.K.

9.10 Melexis Microelectronic Systems

9.11 The Kostal Group

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

10 Appendix (Page No. - 116)

10.1 Insights From Key Industry Experts

10.2 Discussion Guide

10.3 Introducing RT: Real Time Market Intelligence

10.4 Available Customizations

10.4.1 Regional Analysis

10.4.2 Company Information

10.5 Related Reports

List of Tables (64 Tables)

Table 1 Automotive Rain Sensor & Wiper Blade Market, By Product2013-2020 (Million Units)

Table 2 Automotive Rain Sensor & Wiper Blade Market, By Product2013-2020 (USD Million)

Table 3 Automotive Wiper Blade Market, By Region 2013-2020 (Million Units)

Table 4 Automotive Wiper Blade Market, By Region 2013-2020 (USD Million)

Table 5 Asia-Pacific: Automotive Wiper Blade Market, By Country2013-2020 (Million Units)

Table 6 Asia-Pacific: Automotive Wiper Blade Market, By Country2013-2020 (USD Million)

Table 7 Europe: Automotive Wiper Blade Market, By Country2013-2020 (Million Units)

Table 8 Europe: Automotive Wiper Blade Market, By Country2013-2020 (USD Million)

Table 9 North America: Automotive Wiper Blade Market, By Country2013-2020 (Million Units)

Table 10 North America: Automotive Wiper Blade Market, By Country2013-2020 (USD Million)

Table 11 RoW: Automotive Wiper Blade Market, By Country2013-2020 (Million Units)

Table 12 RoW: Automotive Wiper Blade Market, By Country2013-2020 (USD Million)

Table 13 Automotive Rain Sensor Market, By Vehicle Type 2013-2020 (‘000 Units)

Table 14 Market, By Vehicle Type 2013-2020 (USD Million)

Table 15 Passenger Car: Automotive Rain Sensor Market Size, By Region,2013-2020 (‘000 Units)

Table 16 Passenger Car: Market Size, By Region,2013-2020 (USD Million)

Table 17 LCV: Automotive Rain Sensor Market Size, By Region,2013-2020 (‘000 Units)

Table 18 LCV: Market Size, By Region,2013-2020 (USD Million)

Table 19 HCV: Automotive Rain Sensor Market Size, By Region,2013-2020 (‘000 Units)

Table 20 HCV: Market Size, By Region,2013-2020 (USD Million)

Table 21 Automotive Rain Sensor Market, By Geography,2013-2020 (Million Units)

Table 22 Market, By Geography, 2013-2020 (USD Million)

Table 23 Asia-Pacific: Automotive Rain Sensor Market, By Geography

Table 24 Asia-Pacific: Market, By Geography,2013-2020 (USD Million)

Table 25 China: Automotive Rain Sensor Market, By Vehicle Type,2013-2020 ('000 Units)

Table 26 China: Market, By Vehicle Type,2013-2020 (USD Million)

Table 27 Japan: Automotive Rain Sensor Market, By Vehicle Type,2013-2020 ('000 Units)

Table 28 Japan: Market, By Vehicle Type,2013-2020 (USD Million)

Table 29 South Korea: Automotive Rain Sensor Market, By Vehicle Type,2013-2020 ('000 Units)

Table 30 South Korea: Market, By Vehicle Type,2013-2020 (USD Million)

Table 31 India: Automotive Rain Sensor Market, By Vehicle Type,2013-2020 ('000 Units)

Table 32 India: Market, By Vehicle Type,2013-2020 (USD Million)

Table 33 Rest of APAC: Automotive Rain Sensor Market, By Vehicle Type,2013-2020 ('000 Units)

Table 34 Rest of APAC: Market, By Vehicle Type,2013-2020 (USD Million)

Table 35 Europe: Automotive Rain Sensor Market, By Geography,2013-2020 ('000 Units)

Table 36 Europe: Market, By Geography,2013-2020 (USD Million)

Table 37 Germany: Automotive Rain Sensor Market, By Vehicle Type,2013-2020 ('000 Units)

Table 38 Germany: Market, By Vehicle Type,2013-2020 (USD Million)

Table 39 France: Automotive Rain Sensor Market, By Vehicle Type,2013-2020 ('000 Units)

Table 40 France: Market, By Vehicle Type,2013-2020 (USD Million)

Table 41 U.K.: Automotive Rain Sensor Market, By Vehicle Type,2013-2020 ('000 Units)

Table 42 U.K.: Market, By Vehicle Type,2013-2020 (USD Million)

Table 43 Rest of Europe: Automotive Rain Sensor Market, By Vehicle Type,2013-2020 ('000 Units)

Table 44 Rest of Europe: Market, By Vehicle Type,2013-2020 (USD Million)

Table 45 North America: Automotive Rain Sensor Market, By Geography,2013-2020 ('000 Units)

Table 46 North America: Market, By Geography,2013-2020 (USD Million)

Table 47 U.S.: Automotive Rain Sensor Market, By Vehicle Type,2013-2020 ('000 Units)

Table 48 U.S.: Market, By Vehicle Type,2013-2020 (USD Million)

Table 49 Mexico: Automotive Rain Sensor Market, By Vehicle Type,2013-2020 ('000 Units)

Table 50 Mexico: Market, By Vehicle Type,2013-2020 (USD Million)

Table 51 Canada: Automotive Rain Sensor Market, By Vehicle Type,2013-2020 ('000 Units)

Table 52 Canada: Market, By Vehicle Type,2013-2020 (USD Million)

Table 53 RoW: Automotive Rain Sensor Market, By Geography,2013-2020 ('000 Units)

Table 54 RoW: Market, By Geography,2013-2020 (USD Million)

Table 55 Brazil: Automotive Rain Sensor Market, By Vehicle Type,2013-2020 ('000 Units)

Table 56 Brazil: Market, By Vehicle Type,2013-2020 (USD Million)

Table 57 Russia: Automotive Rain Sensor Market, By Vehicle Type,2013-2020 ('000 Units)

Table 58 Russia: Market, By Vehicle Type,2013-2020 (USD Million)

Table 59 Others: Automotive Rain Sensor Market, By Vehicle Type,2013-2020 ('000 Units)

Table 60 Others: Market, By Vehicle Type,2013-2020 (USD Million)

Table 61 Expansions, 2010-2015

Table 62 Agreements/Joint Ventures/Supply Contracts/Partnerships,2010–2015

Table 63 Mergers & Acquisition, 2010-2015

Table 64 New Product Launches/Development, 2010-2015

List of Figures (49 Figures)

Figure 1 Research Design

Figure 2 Research Methodology Model

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation,& Region

Figure 4 Gross Domestic Product vs. Commercial Vehicle Production 2012& 2013

Figure 5 Road Network vs. Total Vehicle Sales 2012 & 2013

Figure 6 Vehicle Production, 2009 & 2014

Figure 7 Industry Specific Micro and Macro Factor Analysis

Figure 8 Market Size Estimation Methodology: Bottom-Up Approach

Figure 9 Data Triangulation

Figure 10 Europe Automotive Rain Sensor Market to Account for the Largest Market Share, By Value, 2020 (USD Million)

Figure 11 Automotive Rain Sensor By Vehicle Type, 2015 vs. 2020

Figure 12 France Rain Sensor Market has the Highest CAGR in the European Region From 2015-2020 in Terms of Value

Figure 13 Increasing Consumer Preference for Comfort Features is Expected to Drive Market Growth During the Forecast Period

Figure 14 North America is Projected to Have the Fastest CAGR During the Forecast Period

Figure 15 Germany is Estimated to Dominate the Automotive Rain Sensors Market Owing to Higher Production of Luxury Cars During the Forecast Period

Figure 16 Passenger Car Rain Sensor Market is Projected to Have the Largest Market Share During the Forecast Period

Figure 17 Increasing Vehicle Production to Drive the Market for Automotive Rain Sensor Market

Figure 18 Vehicle Electrification Market, By Technology (2014–2019)

Figure 19 Automotive Sensors Market, By Region 2015 & 2020

Figure 20 Value Chain Analysis: Major Value is Added During the Manufacturing and Assembly Phases

Figure 21 Porter’s Five Force Analysis (2015): Automotive Rain Sensor Market

Figure 22 Passenger Car Segment is Projected to Have the Largest Share Throughout the Forecast Period (2015 –2020)

Figure 23 Automotive Rain Sensors Market Size 2015-2020

Figure 24 China is Expected to Be the Fastest Growing Country in the Automotive Rain Sensor Market During the Forecast Period (2015-2020)

Figure 25 China is Expected to Lead the Asia-Pacific Automotive Rain Sensor Market in 2015

Figure 26 France has the Fastest Growth Rate in the European Region From 2015-2020

Figure 27 U.S. Captures the Major Market Share of Automotive Rain Sensor Market

Figure 28 Brazil is Projected to Have the Largest Share in the RoW Region By 2020

Figure 29 Companies Have Adopted Expansions as the Key Growth Strategy Over 2010-2015

Figure 30 Automotive Rain Sensor Market, 2014

Figure 31 Market Evaluation Framework: Expansions has Fuelled the Demand for Automotive Rain Sensor Market

Figure 32 Valeo SA Grew at the Fastest Rate Between 2010 and 2014

Figure 33 Battle for Market Share: Expansion Was the Key Strategy

Figure 34 Region-Wise Revenue Mix of Five Market Players

Figure 35 Hella KGAA Hueck & Co: Company Snapshot

Figure 36 Hella KGAA Hueck & Co: SWOT Analysis

Figure 37 Denso Corporation: Company Snapshot

Figure 38 Denso Corporation: SWOT Analysis

Figure 39 Robert Bosch GmbH: Company Snapshot

Figure 40 Robert Bosch GmbH: SWOT Analysis

Figure 41 Valeo SA: Company Snapshot

Figure 42 Valeo SA: SWOT Analysis

Figure 43 ZF TRW: Company Snapshot

Figure 44 ZF TRW: SWOT Analysis

Figure 45 Mitsubishi Motors Corporation: Company Snapshot

Figure 46 Vishay Intertechnology, Inc: Company Snapshot

Figure 47 Hamamatsu Photonics K.K.: Company Snapshot

Figure 48 Melexis Microelectronic Systems: Company Snapshot

Figure 49 The Kostal Group: Company Snapshot

Growth opportunities and latent adjacency in Automotive Rain Sensor Market