Organic Rice Protein Market by Type (Isolates, Concentrates, Others), Application (Bakery & Confectionery, Meat analogues & Extenders, Sports & Energy Nutrition, Dairy Alternatives, Beverages, Others), Form, & by Region - Global Trends & Forecasts to 2021

[131 Pages Report] The organic rice protein market is expected to grow from USD 35.34 million in 2015 to USD 96.54 million by 2021, at a CAGR of 18.3% from 2016 to 2021. Increased demand for dietary protein, clean label, gluten-free, non-GMO, and hypoallergenic products has led to the growth of the organic rice protein market. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

Market Dynamics:

Drivers

- Increasing demand for organic rice proteins due to their functional properties

- Organic rice proteins are a potential alternative to animal and other plant proteins

- Increasing popularity of organic rice proteins due to higher protein composition

Restraints

- Organic rice protein market is still at the development stage

- Low consumer awareness about rice proteins

Opportunities

- Organic rice proteins can meet the needs of consumers looking for non-allergen, lactose-free, and gluten-free sources of protein.

Challenges

- Competition from other plant proteins existing in the market

Multi-functionality drives the global organic rice protein market

Organic rice proteins have applications in sports & energy nutrition, beverages, dairy alternatives,and bakery & confectionery. Organic rice protein ingredients are being used in many product categories such as bars, powdered shakes, soups, pasta, ready-to-drink beverages, cereals, and sweet and savory snacks. They possess a diversified set of functions that enable them to be used in a variety of applications. These include emulsification, texturing, gelling, and foaming. Organic rice protein manufacturers are exploring different functionalities of rice proteins in food and non-food applications to attract a new customer base.

To know about the assumptions considered for the study, Request for Free Sample Report

The following are the major objectives of the study:

- To describe and forecast the organic rice protein market, in terms of type, form, application, function, and brand

- To project the organic rice protein market size, in terms of value & volume, with respect to type, form, and application.

- To describe and forecast the organic rice protein market, in terms of value, by region—Asia Pacific (APAC), Europe, North America, and the Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets, with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of organic rice proteins

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the organic rice protein ecosystem

- To strategically profile key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the organic rice protein market

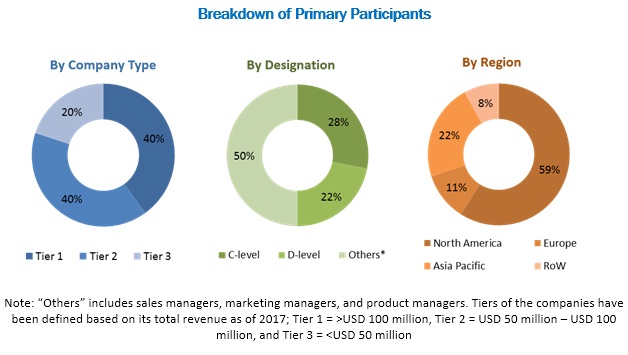

During this research study, major players operating in the organic rice protein market in various regions have been identified; and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Both the top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Key players considered in the analysis of the organic rice protein market are Axiom Foods (US); AIDP, Inc. (US); RiceBran Technologies (US); Shaanxi Fuheng (FH) Biotechnology Co. Ltd. (China); and Shafi Gluco-Chem (Pvt.) Ltd. (Pakistan); Golden Grain Group Limited (China); Ribus, Inc. (US); Top Health Ingredients, Inc. (Canada); Green Labs, LLC (US); and Bioway (Xi’an) Organic Ingredients Co. Ltd. (China).

Major Market Developments:

In February 2016, RiceBran Technologies (US) signed an agreement with Narula Group of Companies (Thailand), a leading manufacturer of organic rice. According to the agreement, RIBT would gain distribution rights for organic rice bran and organic jasmine rice bran products manufactured by Narula Group. The company would be able to distribute the products worldwide, except South East Asia, Germany, and the U.K. RIBT would be able to market additional products and gain the advantage of the growing organic rice product market trend.

Target Audience

- Rice producers and suppliers

- Organic rice protein manufacturers

- Government bodies and research organizations

- Intermediary suppliers

- Regulatory bodies

- Manufacturers/suppliers of food & beverage products

- Manufacturers/suppliers of infant nutrition products

- Manufacturers/suppliers of nutritional products.

Report Scope

By Type

- Rice protein isolates

- Rice protein concentrates

- Others (hydrolysates and ion exchange)

By Application:

- Sports & energy nutrition drinks

- Beverages

- Dairy alternatives

- Bakery & confectionery

- Meat analogues & extenders

- Others (soups, sauces, salad dressings, spices, pasta, frozen fruits, breakfast foods, flavor enhancements & savory flavors, infant formula)

By Form:

- Dry

- Liquid

By Geography

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Critical questions which the report answers:

- What are the new application areas which the caramel ingredients companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per client-specific requirements. The available customization options are as follows:

Geographic Analysis

- Further country-wise breakdown of the market in APAC, based on application

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The overall organic rice protein market is expected to grow from USD 35.34 million in 2015 to USD 96.54 million by 2021, at a CAGR of 18.3%. The increasing demand for dietary protein, clean label, gluten-free, non-GMO, and hypoallergenic products are the key factors driving the growth of this market.

The organic rice protein market has been segmented, on the basis of type, into rice protein concentrates, rice protein isolates, and others. The market for concentrates is expected to grow at the highest CAGR between 2016 and 2021. Among both the types, organic rice protein isolates are commonly used in the food & beverage industry, as it is derived from plant products and hence is preferred by lactose-intolerant consumers.

The organic rice protein market has been segmented, on the basis of form, into dry and liquid. The market for the dry form is expected to grow at the highest CAGR between 2016 and 2021. Among both the forms, dry form is commonly used in the food & beverage industry, owing to the health benefits it offers. Its hypoallergenic property makes it a preferred choice of consumers with allergies.

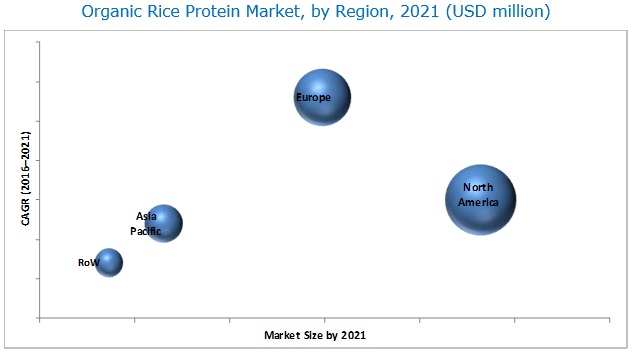

The organic rice protein market in Europe is expected to grow at the highest CAGR during the forecast period. Europe is the fastest-growing market for organic rice protein. Eastern Europe is expected to offer high growth prospects in the coming years, owing to the economic growth and increased demand for processed foods with high nutritional value compared to Western Europe. As a result, Europe holds a significant share of the overall organic rice protein market.

Organic rice protein applications in sports & energy nutrition, beverages, bakery & confectionery, dairy alternatives, and meat analogues & extendersdrive the growth of the organic rice protein market

Sports & energy nutrition

Application of organic rice proteins in sports & energy nutrition is attributed to their high amino acid profile and branched chain amino acids (BCAAs), which are essential for athletes and bodybuilders for muscle recovery. The key reason for the application of organic rice proteins in sports & energy nutrition is weight management. Organic rice proteins administer increased lean body mass, skeletal muscle hypertrophy, power, and strength similar to whey protein. This application segment has potential scope in the near future, with increasing application of organic rice proteins as a nutrition enhancer in common food products.

Beverages

The amino acid profile of organic rice proteins allows them to be used as a supplement in various beverage products. The soluble fibers present in organic rice proteins have similar functional gelling properties as those present in gel fiber. This functional property of organic rice proteins improves mouthfeel and helps in stabilizing smoothies and shakes. Water solubility is one of the key functional properties of organic rice proteins, and hence, they are widely used in beverage applications. Attributes such as clean flavor characteristics, exceptional solubility, and nutritional value make organic rice proteins ideal for use in a variety of beverage applications such as shakes, smoothies, fortified waters, alternative dairy products, and powdered beverage mixes. Moreover, compared to other plant-based proteins, organic rice proteins are hypoallergenic and more environmentally sustainable. Hence, the application of organic rice proteins in beverage applications is considered safe.

Bakery & confectionery

Organic rice proteins are used as an alternative to eggs in snacks & bakery items since it has similar properties. Both organic rice proteins and egg proteins have similar emulsion characteristics. Research and quality tests have demonstrated that organic rice protein isolates and concentrates can perform functions similar to eggs in cookies, cakes, muffins, pasta, and waffles.

Meat analogues & extenders

Organic rice proteins are hypoallergenic, gluten-free, and are vegan; hence they find application in meat analogues & extenders. Organic rice proteins are derived from organic rice through an extrusion process, which changes the structure of the protein to more or less fiber. This fibrous property and texture generated in proteins after rehydration makes them a preferred option to be used as meat analogues & extenders.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for organic rice proteins?

The major restraining factor in the organic rice protein market is low consumer awareness. Health-conscious consumers are well aware of the benefits of a protein-based diet. They are also aware of protein sources such as whey, soy, and pea. Other sources such as rice, canola, and potato are still not popular among consumers.

Key players in the market include Axiom Foods, Inc. (US); AIDP, Inc. (US); RiceBran Technologies (US); Shaanxi Fuheng (FH) Biotechnology Co. Ltd. (China); and Golden Grain Group Limited (China). Other players include Shafi Gluco-Chem (Pvt.) Ltd. (Pakistan); Ribus, Inc. (US); Top Health Ingredients, Inc. (Canada); Green Labs, LLC (US); and Bioway (Xi’an) Organic Ingredients Co. Ltd. (China). These players are increasingly undertaking new product launches, expansions, acquisitions, and agreements to penetrate the market further.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Brown Rice Protein

1.4 Study of Scope

1.4.1 Years Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries By Company Type, Designation & Region

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increase in Demand of Plant Proteins

2.2.2.2 Increase in Applications of Organic Rice Protein

2.2.3 Supply-Side Analysis

2.2.3.1 Cost Effective Production of Plant Protein

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Market Share Estimation

2.6 Research Assumptions & Limitations

2.6.1 Assumptions

2.6.2 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Marketing Opportunities in the Organic Rice Protein Market

4.2 Organic Rice Protein Market Size, By Application

4.3 North American Organic Rice Protein Market, By Type

4.4 U.K. to Grow at the Highest CAGR in the Organic Rice Protein Market, 2016–2021

4.5 Organic Rice Protein Market Life Cycle Analysis, By Region

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand for Organic Rice Protein Due To Its Functional Properties

5.3.1.2 Organic Rice Protein Helps Manufacturers With the Product Label Regulations

5.3.1.3 Organic Rice Protein is A Potential Alternative to Animal and Other Plant Proteins

5.3.1.4 Increasing Popularity of Organic Rice Protein Due to Higher Protein Composition

5.3.2 Restraints

5.3.2.1 Organic Rice Protein Still at Development Stage

5.3.2.2 Low Consumer Awareness About Rice Proteins

5.3.3 Opportunities

5.3.3.1 Organic Rice Protein Can Meet the Needs of Consumers Looking for Non-Allergen, Lactose-Free, and Gluten-Free Source of Protein

5.3.4 Challenges

5.3.4.1 Competition From Other Plant Proteins Existing in the Market

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.4 Industry Trends

6.5 Porter’s Five Forces Analysis

6.5.1 Threat of New Entrants

6.5.2 Threat of Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

7 Market For Organic Rice Protein, By Type (Page No. - 53)

7.1 Introduction

7.2 Rice Protein Concentrates

7.3 Rice Protein Isolates

7.4 Other Rice Protein Types

8 Market For Organic Rice Protein, By Form (Page No. - 59)

8.1 Introduction

8.2 Dry Form

8.3 Liquid Form

9 Market For Organic Rice Protein, By Application (Page No. - 63)

9.1 Introduction

9.2 Sports & Energy Nutrition

9.3 Beverages

9.4 Bakery & Confectionery

9.5 Meat Analogues & Extenders

9.6 Dairy Alternatives

9.7 Other Applications

10 Market For Organic Rice Protein, By Function (Page No. - 71)

10.1 Introduction

10.1.1 Definition: Functional Properties of Proteins

10.2 Emulsifying

10.3 Texturing

10.4 Gelling

10.5 Foaming

11 Market For Organic Rice Protein, By Brand (Page No. - 74)

11.1 Introduction

11.2 Proryza

11.3 Oryzatein

11.4 Gabiotein

11.5 Nu-Rice

12 Market For Organic Rice Protein, By Region (Page No. - 76)

12.1 Introduction

12.2 North America

12.2.1 U.S.

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 France

12.3.2 Germany

12.3.3 U.K.

12.3.4 Italy

12.3.5 Rest of Europe

12.4 Asia-Pacific

12.4.1 China

12.4.2 Japan

12.4.3 Australia

12.4.4 Rest of Asia-Pacific

12.5 RoW

12.5.1 Brazil

12.5.2 Others

13 Competitive Landscape (Page No. - 102)

13.1 Overview

13.2 Market Share Analysis of the Organic Rice Protein Market

13.3 Competitive Situations & Trends

14 Company Profiles (Page No. - 106)

14.1 Introduction

(Business overview, Products offered, Recent developments, MNM view, SWOT analysis)*

14.2 Axiom Foods, Inc.

14.3 AIDP, Inc.

14.4 RiceBran Technologies

14.5 Shaanxi Fuheng (FH) Biotechnology Co., Ltd

14.6 Shafi Gluco-Chem (Pvt.) Ltd.

14.7 Bioway (Xi'an) Organic Ingredients Co., Ltd.

14.8 Golden Grain Group Limited

14.9 Ribus, Inc.

14.10 The Green Labs LLC

14.11 Top Health Ingredients Inc.

*Business overview, Products offered, Recent developments, MNM view, SWOT analysis might not be captured in case of unlisted companies.

15 Appendix (Page No. - 124)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real-Time Intelligenece

15.5 Available Customizations

15.6 Related Reports

List of Tables (58 Tables)

Table 1 Amino Acid Profiles of Brown Rice Protein

Table 2 Plant Protein Production vs. Animal Protein Production

Table 3 Organic Rice Protein Market Size, By Type, 2014–2021 (USD Thousand)

Table 4 Organic Rice Protein Market Size, By Type, 2014–2021 (Tons)

Table 5 Organic Rice Protein Concentrates Market Size, By Region, 2014–2021 (USD Thousand)

Table 6 Organic Rice Protein Isolates Market Size, By Region, 2014–2021 (USD Thousand)

Table 7 Organic Other Rice Protein Types Market Size, By Region, 2014–2021 (USD Thousand)

Table 8 Organic Rice Protein Market Size, By Form, 2014-2021 (USD Thousand)

Table 9 Organic Rice Protein Market Size, By Form, 2014-2021 (Tons)

Table 10 Dry Form: By Market Size, By Region, 2014-2021 (USD Thousand)

Table 11 Liquid Form: By Market Size, By Region, 2014-2021 (USD Thousand)

Table 12 Organic Rice Protein Market Size, By Application, 2014–2021 (USD Thousand)

Table 13 Organic Rice Protein in Sports & Energy Nutrition Market Size, By Region, 2014–2021 (USD Thousand)

Table 14 Organic Rice Protein in Beverages Market Size, By Region, 2014–2021 (USD Thousand)

Table 15 Organic Rice Protein in Bakery & Confectionery Market Size, By Region, 2014–2021 (USD Thousand)

Table 16 Organic Rice Protein in Meat Analogues & Extenders Market Size, By Region, 2014–2021 (USD Thousand)

Table 17 Organic Rice Protein in Dairy Alternatives Market Size, By Region, 2014–2021 (USD Thousand)

Table 18 Organic Rice Protein in Other Applications Market Size, By Region, 2014–2021 (USD Thousand)

Table 19 Organic Rice Protein Market Size, By Region, 2014-2021 (USD Thousand)

Table 20 Organic Rice Protein Market Size, By Region, 2014-2021 (Tons)

Table 21 North America: Organic Rice Protein Market Size, By Application, 2014-2021 (USD Thousand)

Table 22 North America: By Market Size, By Form, 2014-2021 (USD Thousand)

Table 23 North America: By Market Size, By Type, 2014-2021 (USD Thousand)

Table 24 North America: Organic Rice Protein Isolates Market Size, By Country, 2014-2021 (USD Thousand)

Table 25 North America: Organic Rice Protein Concentrates Market Size, By Country, 2014-2021 (USD Thousand)

Table 26 North America: Other Organic Rice Protein Market Size, By Country, 2014-2021 (USD Thousand)

Table 27 U.S.: By Market Size, By Type, 2014-2021 (USD Thousand)

Table 28 Canada: By Market Size, By Type, 2014-2021 (USD Thousand)

Table 29 Mexico: By Market Size, By Type, 2014-2021 (USD Thousand)

Table 30 Europe: By Market Size, By Application, 2014-2021 (USD Thousand)

Table 31 Europe: By Market Size, By Form, 2014-2021 (USD Thousand)

Table 32 Europe: By Market Size, By Type, 2014-2021 (USD Thousand)

Table 33 Europe: Organic Rice Protein Isolates Market Size, By Country, 2014-2021 (USD Thousand)

Table 34 Europe: Organic Rice Protein Concentrates Market Size, By Country, 2014-2021 (USD Thousand)

Table 35 Europe: Other Organic Rice Protein Market Size, By Country, 2014-2021 (USD Thousand)

Table 36 France: By Market Size, By Type, 2014-2021 (USD Thousand)

Table 37 Germany: By Market Size, By Type, 2014-2021 (USD Thousand)

Table 38 U.K.: By Market Size, By Type, 2014-2021 (USD Thousand)

Table 39 Italy: By Market Size, By Type, 2014-2021 (USD Thousand)

Table 40 Rest of Europe: Organic Rice Protein Market Size, By Type, 2014-2021 (USD Thousand)

Table 41 Asia-Pacific: By Market Size, By Application, 2014-2021 (USD Thousand)

Table 42 Asia-Pacific: Organic Rice Protein Market Size, By Form, 2014-2021 (USD Thousand)

Table 43 Asia-Pacific: By Market Size, By Type, 2014-2021 (USD Thousand)

Table 44 Asia-Pacific: Organic Rice Protein Isolates Market Size, By Country, 2014-2021 (USD Thousand)

Table 45 Asia-Pacific: Organic Rice Protein Concentrates Market Size, By Country, 2014-2021 (USD Thousand)

Table 46 Asia-Pacific: Organic Rice Protein Others Market Size, By Country, 2014-2021 (USD Thousand)

Table 47 China: By Market Size, By Type, 2014-2021 (USD Thousand)

Table 48 Japan: By Market Size, By Type, 2014-2021 (USD Thousand)

Table 49 Australia: Organic Rice Protein Market Size, By Type, 2014-2021 (USD Thousand)

Table 50 Rest of Asia-Pacific: Organic Rice Protein Market Size, By Type, 2014-2021 (USD Thousand)

Table 51 RoW: By Market Size, By Application, 2014-2021 (USD Thousand)

Table 52 RoW: By Market Size, By Form, 2014-2021 (USD Thousand)

Table 53 RoW: By Market Size, By Type, 2014-2021 (USD Thousand)

Table 54 RoW: Organic Rice Protein Isolates Market Size, By Country, 2014-2021 (USD Thousand)

Table 55 RoW: Organic Rice Protein Concentrates Market Size, By Country, 2014-2021 (USD Thousand)

Table 56 RoW: Other Organic Rice Protein Market Size, By Country, 2014-2021 (USD Thousand)

Table 57 Brazil: Organic Rice Protein Market Size, By Type, 2014-2021 (USD Thousand)

Table 58 Others in RoW: By Market Size, By Type, (USD Thousand)

List of Figures (45 Figures)

Figure 1 Brown Rice Protein has the Highest Biological Value

Figure 2 Organic Rice Protein Market Segmentation

Figure 3 Organic Rice Protein: Research Methodology

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Organic Rice Protein Market Snapshot, 2016 & 2021

Figure 8 Organic Rice Protein Market Size, By Type 2016 & 2021

Figure 9 Sports & Energy Nutrition: Most Attractive Application of Organic Rice Protein for Investment in the Next Five Years

Figure 10 Europe Projected To Register High Growth Rate, 2016–2021

Figure 11 Organic Rice Protein Market Size, By Region, 2016–2021 (USD Thousand)

Figure 12 Organic Rice Protein Market Size, By Application, 2016–2021

Figure 13 Isolates Accounted for the Largest Share in the North American Organic Rice Protein Market in 2016

Figure 14 By Market Size, By Region, 2016 & 2021 (USD Thousand)

Figure 15 By Market Growth Rate, By Country, 2016–2021

Figure 16 Organic Rice Protein Market in Europe is Experiencing High Growth

Figure 17 By Market Segmentation

Figure 18 Rising Demand for From Food & Beverage Industry is the Key Driver of the Market

Figure 19 Plant Protein Ingredients Market Share (Value), 2012

Figure 20 Value Chain Analysis: Major Value is Added During Manufacturing and Assembly

Figure 21 Manufacturers Play A Vital Role in the Supply Chain

Figure 22 Increase in Demand for Wellness Products is the Leading Trend Among Key Players

Figure 23 Porter’s Five Forces Analysis: Involvement of Established Players in R&D is Increasing the Competition in the Industry

Figure 24 Organic Rice Protein Concentrates Market Size, By Region, 2016 & 2021 (USD Thousand)

Figure 25 Organic Rice Protein Isolates Market Size, By Region, 2016 & 2021 (USD Thousand)

Figure 26 Organic Other Rice Protein Types Market Size, By Region, 2016 & 2021 (USD Thousand)

Figure 27 Dry Form Market Size, By Region, 2016 vs. 2021 (USD Thousand)

Figure 28 Liquid Form Market Size, By Region, 2016 vs. 2021 (USD Thousand)

Figure 29 Sports & Energy Drinks is Projected To Be the Fastest Growing Segment in the Market From 2016 To 2021

Figure 30 Percentage of Digestibility of Protein

Figure 31 Geographic Snapshot: New Hotspots Emerging in Asia-Pacific, By Growth Rate (2016–2021)

Figure 32 North America is Estimated To Dominate the Organic Rice Protein Market in 2016 (Tons)

Figure 33 North American Organic Rice Protein Market Snapshot: U.S. is Projected To Be the Leader Between 2016 & 2021

Figure 34 Sports & Energy Nutrition Application is Estimated To Dominate the Organic Rice Protein Market in 2016 (USD Thousand)

Figure 35 European Organic Rice Protein Market Snapshot: High Sales & Demand in Mature Market

Figure 36 Europe: Isolates Segment is Estimated To Dominate the Market in 2016 (USD’ 000)

Figure 37 Asia-Pacific Organic Rice Protein Market Snapshot: China is the Most Lucrative Market

Figure 38 Asia-Pacific: China is Estimated To Dominate the Organic Rice Protein Isolates Market in 2016, (USD Thousand)

Figure 39 Companies Adopted Certifications as the Key Growth Strategy, 2009–2016

Figure 40 Organic Rice Protein Market Share, By Key Player, 2015

Figure 41 Axiom Foods: SWOT Analysis

Figure 42 AIDP, Inc.: SWOT Analysis

Figure 43 RiceBran Technologies: SWOT Analysis

Figure 44 Shaanxi Fuheng (FH) Biotechnology Co., Ltd: SWOT Analysis

Figure 45 Shafi Gluco-Chem (Pvt.) Ltd: SWOT Analysis

Growth opportunities and latent adjacency in Organic Rice Protein Market