Organic Pea Protein Market by Type (Isolates, Concentrates, Textured), Application (Nutritional supplements, Beverages, Meat extenders & analogs, Snacks & bakery products, and others), Form (Dry, Liquid), & by Region - Global Trends & Forecast to 2021

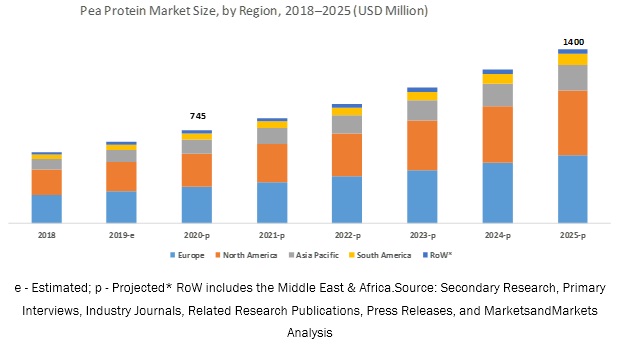

[126 Pages Report] The organic pea protein market was valued at USD 9.40 billion in 2015 and is projected to grow at a CAGR of 12.0% from 2016, to reach a value of 18.49 billion by 2021. The market is majorly driven by the wellness trends such as weight management, protein fortification in food & beverages, cost-competitiveness of plant proteins, regulations for sourcing, processing, packaging, and labeling of food & beverages, genetically modified strains for soy protein, and growing vegetarian and vegan population. Organic pea proteins are being used in many applications such as meat extenders & analogs, snacks & bakery products, nutritional supplements, beverages and many other applications. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

Market Dynamics

Drivers

- Increasing demand for organic products

- Government’s support for organic farming

- Risisng vegan population

- High Niutritional profile of pea

Restraints

- Low consumer awareness

- High cost of organic pea protein

Opportunities

- Consumer preferences towards organic food

- Tapping the emerging markets

Challenges

- Non-certified organic food sector

Growing demand for concentrate type of organic pea protein in food & beverages industry to drive the global market

Organic pea protein concentrate is obtained by separating the protein fraction of organic pea seeds from the starch and fiber fraction. Organic pea protein concentrates are less refined than isolates. They generally contain 70% to 85% protein. They are extracted from organic peas by both dry and wet milling processes. A dry milling process, in combination with air classification, is used to obtain protein concentrates that have lesser protein and more starch content as compared to protein isolates. Concentrates are used as ingredients to enhance texture and volume in varied food & beverage products. Latest application of organic pea protein concentrates can be found in healthy, protein-fortified or gluten-free snacks, baked goods, cereals, pastas, beverages, and some other food products.

The following are the major objectives of the study.

- To describe and forecast the organic pea protein market, in terms of value, by type, form, function and application

- To describe and forecast the market, in terms of volume, by type

- To describe and forecast the organic pea protein market, in terms of value, by region–Asia Pacific (APAC), Europe, North America, and Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of organic pea protein

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the organic pea protein ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the organic pea protein market

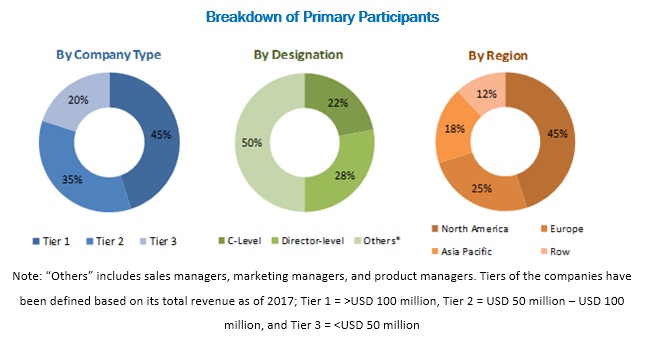

During this research study, major players operating in the organic pea protein market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale; and post-sales services.The key players in the report include Axiom Foods, Inc. (U.S.), The Scoular Company (U.S.), AIDP, Inc. (U.S.), World Food Processing, L.L.C (U.S.), and Shaanxi Fuheng Biotechnology Co., Ltd (China). Other players include Farbest Brands (U.S.), The Green Labs LLC (U.S.), Phyto-Therapy Pty. Ltd. (Australia), Bioway (Xi'an) Organic Ingredients Co., Ltd. (China), and Zelang Group (China).

Major Market Developments

- In 2016, World Food Processing expanded the capacity of its USA pea protein manufacturing plant. This will enable the company to meet the growing demand of clean label, allergen-friendly, non-GMO, and organic ingredients

- In 2015, World Food Processing launched its protein brand PURISPea. It is primarily manufactured in U.S., which provides the company with a strategic advantage.

- In 2014, Axiom launched organic pea protein, which gives a competitive edge to the company.

Target Audience:

- Organic pea protein manufacturers

- Intermediary suppliers

- Food & beverages manufacturers

- Food ingredient manufacturers

- Research institutes and organizations

Report Scope

By Form

- Dry

- Liquid

By Type

- Isolates

- Concentrates

- Textured

By Application:

- Meat extenders & analogs

- Snacks & bakery products

- Nutritional supplements

- Beverages

- Other applications

By Function

- Texturing

- Emulsification

- Gelation

- Stabilization

- Others

By Geography

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Critical questions which the report answers

- What are new application areas which the organic pea protein companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Further country-wise breakdown of the market in APAC based on application

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The organic pea protein market was valued at USD 9.40 billion in 2015 and is projected to grow at a CAGR of 12.0% from 2016, to reach a value of 18.49 billion by 2021. The growth of the market is driven by the rising demand for organic food products, increasing vegan population, and high nutritional profile of peas. Increasing government support for organic farming is also driving the market for organic pea protein.

Organic pea protein is most widely used in nutritional supplements, beverages, meat extenders & analogues, snacks & bakery products, and others such as baby foods, soups, and pastas. The factors influencing the plant protein market growth include health and wellness trends such as weight management, protein fortification in food & beverages, cost-competitiveness of plant proteins, regulations for sourcing, processing, packaging, and labeling of food & beverages, genetically modified strains for soy protein, and growing vegetarian and vegan population.

The market has been segmented, on the basis of type, Isolates, concentrates and textured. The market for concentrates is expected to grow at the highest CAGR between 2016 and 2021.

Concentrates are widely used as ingredients to enhance texture and volume in varied food & beverage products. Latest application of organic pea protein concentrates can be found in healthy, protein-fortified or gluten-free snacks, baked goods, cereals, pastas, beverages, and some other food products.

The organic pea protein market in Europe is expected to grow at the highest CAGR during the forecast period. Europe is the fastest-growing market for organic pea proteins. Major food & beverage manufacturers in Europe have begun to concentrate more on ‘health & wellness’ by introducing products prepared with plant protein ingredients. The rising vegan population in Europe is a key driver for increased consumption of organic pea protein. Organic pea protein is non-allergic, which is ideal for consumers suffering from lactose and gluten intolerance. It is also non-genetically modified (GMO), which is a requirement of the strict rules and regulations implemented in Europe. The growing demand for condition-specific nutrition and weight management is driving the European organic pea protein market. Moreover, based on key countries in the organic food market, Italy is one of the major players in Europe, due to a favorable climate, agronomic conditions, and good access to all major export markets. Italian consumers are health-conscious; hence they prefer healthier and safer foods. Apart from this, the increasing availability of organic foods in supermarkets drives the Italian organic food market.

Organic pea protein applications in nutritional supplements, to drive the growth of organic pea protein market

Nutritional Supplements

Nutritional supplement is projected to be the largest and fastest growing segment by application, during the forecast period. The application of organic pea protein as a nutritional supplement is attributed to their high amino acid profile. The key parameter of organic pea protein application in nutritional supplements is weight management products. The market in North America dominates the nutritional supplements market with the U.S. as a major consumer of products containing organic pea proteins as nutritional supplements. The nutritional supplements segment has potential scope in the near future, with the increasing application of organic pea protein as a nutrition enhancer in common food products.

Beverages

Beverages is projected to be the second largest segment during the forecast period. Health-conscious consumers have become more aware of the benefits of including organic protein in their diet. This has especially increased the application of organic milk and plant-based proteins. However, with the cases of intolerance and allergies due to milk, the food & beverages manufacturers demand alternatives that are allergen-free. Organic pea proteins are free from allergens as well as any genetic modification. Furthermore, the taste of different organic protein ingredients also plays an important part in their application. Hence, the application of organic pea proteins in food applications is preferred due its neutral taste.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for organic pea proteins?

The high cost of organic pea proteins is a major factor restraining the growth of the market. Pea proteins is usually higher because of higher labor inputs and variety of enterprises owing to which economies of scale is difficult to achieve. Handling of organic pea protein in small amounts after harvesting results in higher prices due to compulsory separation of organic pea protein from conventional plant protein. The marketing & distribution network for organic pea protein is comparatively less efficient and costs increase due to the small sizes or volumes.

The key players in the report include Axiom Foods, Inc. (US), The Scoular Company (US), AIDP, Inc. (US), World Food Processing, L.L.C (US), and Shaanxi Fuheng Biotechnology Co., Ltd (China). Other players include Farbest Brands (US), The Green Labs LLC (US), Phyto-Therapy Pty. Ltd. (Australia), Bioway (Xi'an) Organic Ingredients Co., Ltd. (China), and Zelang Group (China).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Units

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key data from primary sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Overview of the Parent Industry

2.2.3 Demand-Side Analysis

2.2.3.1 Growth in Global Food & Beverage Industry

2.2.3.1.1 Emerging Applications of Plant Proteins in Food & Beverages Sector

2.2.3.2 Increase in Demand for Organic Food

2.2.4 Supply-Side Analysis

2.2.4.1 Regulatory Compliances for Organic Pea Protein Manufacturers

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Market Share Estimation

2.6 Research Assumptions

2.7 Limitations

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Market

4.2 Isolates: Largest Type Segment for Organic Pea Protein Market

4.3 U.S.: Largest Organic Isolates Pea Protein Market

4.4 Organic Pea Protein Concentrates Market Growth, By Country, 2016–2021

4.5 Organic Pea Protein Market, By Application (USD Thousand)

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Organic Pea Protein Market, By Type

5.2.2 Market, By Form

5.2.3 Market, By Application

5.2.4 Market, By Brand

5.2.5 Organic Pea Protein Market, By Function

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand for Organic Products

5.3.1.2 Government Support for Organic Farming

5.3.1.3 Rising Vegan Population

5.3.1.4 High Nutritional Profile of Pea

5.3.2 Restraints

5.3.2.1 Low Consumer Awareness

5.3.2.2 Expensive Organic Protein

5.3.3 Opportunities

5.3.3.1 Consumer Preference Towards Organic Food

5.3.3.2 Tapping the Emerging Markets

5.3.4 Challenges

5.3.4.1 Non-Certified Organic Food Sector

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.4 Porter’s Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

7 Market for Organic Pea Protein, By Type (Page No. - 50)

7.1 Introduction

7.2 Isolates

7.3 Concentrates

7.4 Textured

8 Market for Organic Pea Protein, By Form (Page No. - 56)

8.1 Introduction

8.2 Dry

8.3 Liquid

9 Market for Organic Pea Protein, By Application (Page No. - 60)

9.1 Introduction

9.2 Meat Extenders & Analogs

9.3 Snacks & Bakery Products

9.4 Nutritional Supplements

9.5 Beverages

9.6 Other Applications

10 Market for Organic Pea Protein, By Function (Page No. - 67)

10.1 Introduction

10.2 Texturing

10.3 Emulsification

10.4 Gelation

10.5 Stabilization

10.6 Others

11 Market for Organic Pea Protein, By Brand (Page No. - 69)

11.1 Introduction

11.2 Veg-O-Tein Protein

11.3 Purispea Protein

11.4 Peasipro

11.5 Phyto-Therapy

12 Market for Organic Pea Protein, By Region (Page No. - 71)

12.1 Introduction

12.2 North America

12.2.1 U.S.

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 U.K.

12.3.2 Germany

12.3.3 France

12.3.4 Italy

12.3.5 Rest of Europe

12.4 Asia-Pacific

12.4.1 China

12.4.2 Australia

12.4.3 Japan

12.4.4 Rest of Asia-Pacific

12.5 Rest of the World

13 Regulatory Framework (Page No. - 97)

13.1 Introduction

13.2 North America

13.3 Europe

13.4 Asia-Pacific

13.5 Rest of the World (RoW)

13.6 Clinical Trials on Human Consumption of Pea Protein

14 Competitive Landscape (Page No. - 100)

14.1 Overview

14.2 Competitive Situation & Trends

15 Company Profiles (Page No. - 103)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

15.1 Introduction

15.2 Axiom Foods, Inc.

15.3 The Scoular Company

15.4 World Food Processing, L.L.C

15.5 AIDP, Incorporated

15.6 Shaanxi Fuheng (Fh) Biotechnology Co., Ltd

15.7 Farbest Brands

15.8 The Green Labs LLC

15.9 Phyto-Therapy Pty Ltd

15.10 Bioway (Xian) Organic Ingredients Co., Ltd.

15.11 Zelang Group

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 119)

16.1 Discussion Guide

16.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.3 Introducing RT: Real-Time Market Intelligence

16.4 Available Customizations

16.5 Related Reports

List of Tables (64 Tables)

Table 1 Market Size, By Type, 2014-2021 (USD Thousand)

Table 2 Market Size, By Type, 2014-2021 (Tons)

Table 3 Amino Acid Profile for Organic Pea Protein Isolates

Table 4 Isolates: Market Size for Organic Pea Protein, By Region,2014-2021 (USD Thousand)

Table 5 Amino Acid Profile for Organic Pea Protein Concentrates

Table 6 Concentrates: Organic Pea Protein Market Size, By Region,2014-2021 (USD Thousand)

Table 7 Textured: Market Size for Organic Pea Protein, By Region,2014-2021 (USD Thousand)

Table 8 Organic Pea Protein Market Size, By Form, 2014–2021 (USD Thousand)

Table 9 Dry Organic Pea Protein Market Size, By Region,2014–2021 (USD Thousand)

Table 10 Liquid Organic Pea Protein Market Size, By Region,2014–2021 (USD Thousand)

Table 11 Organic Pea Protein Market Size, By Application,2014–2021 (USD Thousand)

Table 12 Meat Extenders & Analogs: Organic Pea Protein Market Size, By Region, 2014–2021 (USD Thousand)

Table 13 Snacks & Bakery Products: Market Size for Organic Pea Protein, By Region, 2014–2021 (USD Thousand)

Table 14 Nutritional Supplements: Organic Pea Protein Market Size, By Region, 2014–2021 (USD Thousand)

Table 15 Beverages: Market Size for Organic Pea Protein, By Region,2014–2021 (USD Thousand)

Table 16 Other Applications: Organic Pea Protein Market Size, By Region,2014–2021 (USD Thousand)

Table 17 Functional Properties Performed By Organic Pea Protein in Food Products

Table 18 Market Size for Organic Pea Protein, By Region, 2014–2021 (USD Thousand)

Table 19 Market Size, By Region, 2014–2021 (Tons)

Table 20 North America: Organic Pea Protein Market Size, By Country,2014–2021 (USD Thousand)

Table 21 North America: Market Size, By Type,2014-2021 (USD Thousand)

Table 22 North America: Market Size, By Type,2014-2021 (Tons)

Table 23 North America: Organic Pea Protein Isolates Market Size, By Country, 2014-2021 (USD Thousand)

Table 24 North America: Organic Pea Protein Concentrates Market Size,By Country, 2014-2021 (USD Thousand)

Table 25 North America: Organic Textured Pea Protein Market Size, By Country, 2014-2021 (USD Thousand)

Table 26 North America: Organic Pea Protein Market Size, By Application,2014-2021 (USD Thousand)

Table 27 North America: Market Size, By Form,2014-2021 (USD Thousand)

Table 28 U.S.: Market Size for Organic Pea Protein, By Type, 2014-2021 (USD Thousand)

Table 29 Canada: Organic Pea Protein Market Size, By Type,2014-2021 (USD Thousand)

Table 30 Mexico: Market Size for Organic Pea Protein, By Type, 2014-2021 (Tons)

Table 31 Europe: Pea Protein Market Size Size, By Country,2014–2021 (USD Thousand)

Table 32 Europe: Organic Pea Protein Market Size, By Type,2014-2021 (USD Thousand)

Table 33 Europe: Market Size, By Type, 2014-2021 (Tons)

Table 34 Europe: Organic Pea Protein Isolates Market Size, By Country,2014–2021 (USD Thousand)

Table 35 Europe: Organic Pea Protein Concentrates Market Size, By Country, 2014–2021 (USD Thousand)

Table 36 Europe: Organic Textured Pea Protein Market Size, By Country,2014–2021 (USD Thousand)

Table 37 Europe: Market Size for Organic Pea Protein, By Application,2014-2021 (USD Thousand)

Table 38 Europe: Market Size, By Form,2014-2021 (USD Thousand)

Table 39 U.K.: Organic Pea Protein Market Size, By Type, 2014-2021 (USD Thousand)

Table 40 Germany: Market Size for Organic Pea Protein, By Type,2014-2021 (USD Thousand)

Table 41 France: Organic Pea Protein Market Size, By Type,2014-2021 (USD Thousand)

Table 42 Italy: Market Size for Organic Pea Protein, By Type, 2014-2021 (USD Thousand)

Table 43 Rest of Europe: Organic Pea Protein Market Size, By Type,2014-2021 (USD Thousand)

Table 44 Asia-Pacific: Market Size for Organic Pea Protein, By Country,2014–2021 (USD Thousand)

Table 45 Asia-Pacific: Market Size, By Type,2014-2021 (USD Thousand)

Table 46 Asia-Pacific: Market Size, By Type, 2014-2021 (Tons)

Table 47 Asia-Pacific: Organic Pea Protein Isolates Market Size, By Country,2014–2021 (USD Thousand)

Table 48 Asia-Pacific: Organic Pea Protein Concentrates Market Size, By Country, 2014–2021 (USD Thousand)

Table 49 Asia-Pacific: Organic Textured Pea Protein Market Size, By Country, 2014–2021 (USD Thousand)

Table 50 Asia-Pacific: Organic Pea Protein Market Size, By Application,2014-2021 (USD Thousand)

Table 51 Asia-Pacific: Market Size, By Form,2014-2021 (USD Thousand)

Table 52 China: Market Size for Organic Pea Protein, By Type,2014-2021 (USD Thousand)

Table 53 Australia: Organic Pea Protein Market Size, By Type,2014-2021 (USD Thousand)

Table 54 Japan: Market Size for Organic Pea Protein, By Type,2014-2021 (USD Thousand)

Table 55 Rest of Asia-Pacific: Organic Pea Protein Market Size, By Type,2014-2021 (USD Thousand)

Table 56 RoW: Market Size for Organic Pea Protein, By Country,2014–2021 (USD Thousand)

Table 57 RoW: Market Size, By Type, 2014-2021 (USD Thousand)

Table 58 RoW: Market Size, By Type, 2014-2021 (Tons)

Table 59 RoW: Organic Pea Protein Isolates Market Size, By Country,2014–2021 (USD Thousand)

Table 60 RoW: Organic Pea Protein Concentrates Market Size, By Country,2014–2021 (USD Thousand)

Table 61 RoW: Textured Organic Pea Protein Market Size, By Country,2014–2021 (USD Thousand)

Table 62 RoW: Organic Pea Protein Market Size, By Application,2014-2021 (USD Thousand)

Table 63 RoW: Market Size, By Form,2014-2021 (USD Thousand)

Table 64 Organic Governmental Standards in Select Countries in Asia-Pacific Region

List of Figures (46 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Impact of Key Factors Influencing the Parent Industry

Figure 4 RTE and Snacks & Savory Products Segments Collectively Accounted for the Largest Market Share in the Food Sector, 2013 (USD Million)

Figure 5 Organic Food Sales in U.S., 2003-2013

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation Methodology

Figure 9 Assumptions of the Research Study

Figure 10 Limitations of the Research Study

Figure 11 Organic Pea Protein Market Snapshot (2016 vs. 2021): Isolates Segment is Projected to Grow Rapidly During Forecast Period

Figure 12 Market Snapshot (2016 vs. 2021): Nutritional Supplements Segment is Projected to Grow Rapidly During Forecast Period

Figure 13 Market Size, By Region (USD Thousand)

Figure 14 Market Share (Value), By Region, 2015

Figure 15 Emerging Markets With Promising Growth Potential,2016–2021 (USD Million)

Figure 16 Concentrates Segment to Grow at the Highest CAGR From 2016 to 2021

Figure 17 Isolates Accounted for Largest Share in the Organic Pea Protein Market, 2015 (USD Thousand)

Figure 18 U.K. to Grow at Highest CAGR in Organic Concentrates Market,2016–2021

Figure 19 Nutritional Supplements to Dominate & Show Strong Growth Opportunities in the Next Five Years

Figure 20 Organic Pea Protein Market is Projected to Experience Strong Growth in the North America Region

Figure 21 Market Segmentation, By Type

Figure 22 Market Segmentation, By Form

Figure 23 Market Segmentation, By Application

Figure 24 Market Segmentation, By Brands

Figure 25 Market Segmentation, By Function

Figure 26 Rising Demand for Organic Food Driving the Growth of the Market

Figure 27 Research & Development and Raw Material Sourcing of Organic Pea Protein Contribute the Most to the Overall Value

Figure 28 Food Manufacturers Play A Vital Role in the Supply Chain for Organic Pea Protein Products

Figure 29 Porter’s Five Forces Analysis

Figure 30 Isolates Segment is Estimated to Dominate the Market in 2016

Figure 31 North America is Estimated to Dominate the Nutritional Supplements Segment in 2016

Figure 32 Dry Segment is Estimated to Dominate the Market Terms of Value in 2016

Figure 33 North America is Estimated to Dominate the Dry Segment of Market in 2016

Figure 34 Nutritional Supplements Segment is Estimated to Dominate the Market in 2016

Figure 35 North America is Estimated to Dominate the Nutritional Supplements Segment in 2016

Figure 36 North American Organic Pea Protein Market Snapshot

Figure 37 European Organic Pea Protein Market Snapshot

Figure 38 Asia-Pacific Organic Pea Protein Market Snapshot

Figure 39 Key Companies Preferred New Product Launches and Partnerships From 2010 to 2016

Figure 40 Market Share, By Key Player, 2015

Figure 41 Geographical Revenue Mix of Top Five Market Players

Figure 42 Axiom Foods, Inc.: SWOT Analysis

Figure 43 The Scoular Company: SWOT Analysis

Figure 44 World Food Processing, L.L.C: SWOT Analysis

Figure 45 AIDP, Incorporated: SWOT Analysis

Figure 46 Shaanxi Fuheng (FH) Biotechnology Co., Ltd: SWOT Analysis

Growth opportunities and latent adjacency in Organic Pea Protein Market