North America Physical Security Market by Component (Systems and Services), System (PACS, Perimeter Intrusion Detection and Prevention Systems, PIAM, PSIM), Service (Managed and Professional), Organization Size, and Vertical - Global Forecast to 2026

North America Physical Security Market Size & Share

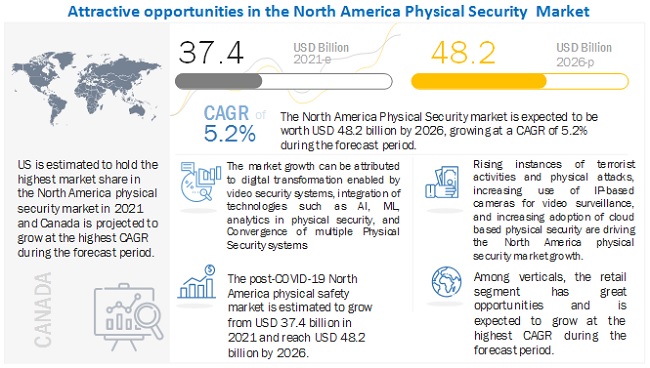

The North America Physical Security Market size was valued at $37.4 billion in 2021 and it is projected to reach $48.2 billion by the end of 2026 at a CAGR of 5.2% during the forecast period. Major driving factors for the North America physical security include rise in security breaches, fraud, and data identity thefts, surge in use of BYOD/ IoT devices, high demand for cloud-based physical security solutions and services, high volume of online transactions, increasing use of IP-based video surveillance camera systems, and stringent government regulations.

Protecting important data, confidential information, networks, software, equipment, facilities, company’s assets, and personnel is what physical security is about. There are two factors by which security can be affected. First attack by nature like a flood, fire, power fluctuation, etc. Though the information will not be misused, it is very hard to retrieve it and may cause permanent loss of data. The second is an attack by the malicious party, which includes terrorism, vandalism, and theft.

To know about the assumptions considered for the study, Request for Free Sample Report

North America Physical Security Market Growth Dynamics

Driver: Increasing use of IP-based cameras for video surveillance

One of the best ways to prevent crimes such as thefts and vandalism in residential and commercial areas is by utilizing advanced North America Physical Security techniques, such as video surveillance. Initially, CCTV cameras were being used to monitor various business assets. With technological advancements in internet and camera hardware, IP cameras and IP network systems are rapidly replacing CCTV cameras. IP cameras offer flexibility, remote access, and better scalability as compared to traditional analog camera-based monitoring systems. IP-based cameras provide a more efficient and flexible North America Physical Security system because of controllable bandwidth, which gives a high resolution. Moreover, the hard drive space can be shared across many systems for recording.

Organizations today are mostly looking for digital solutions in their workplaces because of the various distinctive and unique features that the IP systems provide. There are several reasons contributing for the scenario, ranging from budgetary to technological issues and also distinctive features that have been offered by IP-based systems, such as image resolution, scalability, easy installation procedures, and also the ability to adapt to any future upgrades, such as the integration of video analytics. Moreover, the deployment of IP-based systems is easier than analog systems, due to hardware support, plug in and plug out features, and easy cabling, provided by device manufacturers.

Restraint: Violation of privacy

Any surveillance system in places such as highways, parking lots, parks, transportation modes, retail stores, financial institutions, and offices is often viewed as a violation of privacy and is opposed by various civil liberties groups and activists. There have been concerns about who watches the video and how the video might be used or misused, as people expect their personal information to be used only for legitimate and specific purposes. Governments and private sector organizations should take necessary steps to lower the impact of video surveillance systems on the privacy of people by issuing guidelines. For example, the deployment of California Consumer Protection Act (CCPA) takes violation of privacy very seriously and parties involved are subjected to heavy penalties. With the introduction of such laws regarding privacy, any public or private organization using CCTV to monitor public accessible areas must adhere to the regulatory requirements. The citizens of various North American countries are protesting to the use of video surveillance and facial recognition due to the threat of misuse of their identity. This is working as a restraint for the North America Physical Security market since possible misuse of data can lead to privacy violation.

Opportunity: Integration of technologies such as AI, ML, analytics in Physical Security

Combining AI, ML, and analytics with surveillance offer a wave of unrealized possibilities ranging from predictive crime to real-time identification of an ongoing crime or attack. The security team blends AI-based analytics with surveillance to watch for many possible scenarios. The moment AI identifies any dangerous scenario, it alerts the on-site monitor, the person investigates it, and acts as per the situation. The monitoring operator may issue an audio warning, contact the point person for the business, or call for emergency response. What makes video analytics more powerful than other security solutions is that it's proactive and does help to deter crime and avert damage. For example, IC Realtime launched a product named Ella that combines AI and surveillance. Ella uses AI to analyze what is happening in video feeds, enable the users to search footage to find clips showing specific objects or particulars. Integration of AI, ML and analytics is boosting the surveillance process by analyzing live video without the need for human intervention.

Challenge: Increasing cyber threats to physical security systems

The North America Physical Security equipment that provides safety and security to people and assets are perceived to have a high-level of risk of cyber-attack. Especially video surveillance has been identified as the weakest link in North America Physical Security. According to experts, physical systems from industries such as biomanufacturing, healthcare, agriculture, and food systems throughout the region is facing increasing risks. These cyberattacks on these systems are expected to be exploited to the detriment of national security, economic competitiveness, and societal wellbeing. To prevent such cyber threats to physical systems, steps are being taken towards strengthening the physical systems to eliminate the risks of cyberattacks.

Based on end-user, the retail segment is estimated to grow at the highest CAGR during the forecast period

The COVID-19 outbreak has impacted every possible vertical across the globe, especially high-profile and high-value data verticals such as BFSI, healthcare, retail, and government. With the increasing cyber threat landscape and risk surface, the demand for physical security solutions is also rising in North America. The retail vertical is an early adopter of cutting-edge physical security solutions as they possess highly sensitive personal user data. Retail store outlets are ever-increasingly heading toward the adoption of physical security solutions and services in North America. The retail vertical is largely prone to cyberattacks due to the use of different payment methods, such as MasterCard or Visa. These payment methods capture users’ personal and confidential details, which may consist of phone numbers, email addresses, credit card information, and complete addresses, along with their online behaviors. Regulatory compliances such as PCI-DSS compel retail trade owners to adopt strong physical security measures. Non-compliance with these regulations could lead companies to pay heavy penalties of approximately USD 100,000 every month or USD 500,000 per security incident. Physical security solutions and services also help the retail industry vertical deliver robust security, secure identities, and manage regulatory compliances.

To know about the assumptions considered for the study, download the pdf brochure

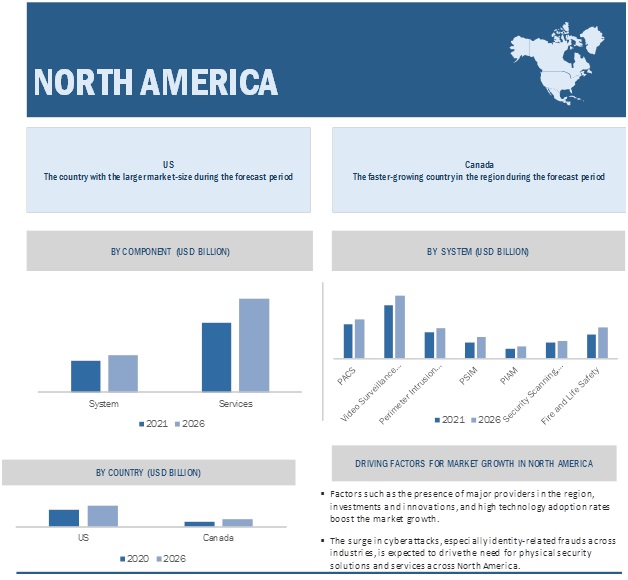

The US is expected to hold the largest market size during the forecast period

The US is estimated to account for the higher market share in the North America physical security market. Early adoption of physical security solutions and the presence of several vendors that provide physical security systems and services is expected to drive market growth in the country. Businesses in this country are increasingly implementing physical security solutions to prevent cyber-attacks, identity thefts, and commercial espionage; and ensure security and privacy of data to facilitate business continuity. The growth of the market in the US can primarily be attributed to the presence of key physical security market vendors, investments and innovations, strict regulatory environment, and high technology adoption rates in the country.

North America Physical Security Companies

This research study outlines the market potential, market dynamics, and key and innovative vendors in the North America physical security market include ADT (US), Cisco (US), Honeywell (US), Johnson Controls (Ireland), TELUS (Canada), Anixter [WESCO] (US), Genetec (Canada), Bosch Building Technologies (Germany), STANLEY Security (US), GardaWorld (Canada), Convergint Technologies (US), Bell Canada (Canada), Paladin Security (Canada), DSC (US), DMP (US), Telsco (Canada), Axis Communication (Sweden), Hanwha Techwin America (US), FLIR Systems (US), Qolsys (US), Chubb Fire & Security (UK), Alarm.com (US), Avigilon (Canada), Tyco (Ireland), ICT (New Zealand), AMAG Technology (US), PTI Security Systems (US), Kantech (US), Feenics (Canada), Brivo (Canada), Exacq Technologies (US), SightLogix (US), Kairos (US), Immix (US), IOTAS (US), Verkada (US), Openpath (US), SmartCone Technologies (Canada), Cloudastructure (US), and Qognify (US).

The study includes an in-depth competitive analysis of these key players in the North America physical security market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2015–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component, Systems, Services, Organization Size, Vertical, and Country. |

|

Geographies covered |

US and Canada |

|

List of Companies in North America Physical Security |

ADT (US), Cisco (US), Honeywell (US), Johnson Controls (Ireland), TELUS (Canada), Anixter [WESCO] (US), Genetec (Canada), Bosch Building Technologies (Germany), STANLEY Security (US), GardaWorld (Canada), Convergint Technologies (US), Bell Canada (Canada), Paladin Security (Canada), DSC (US), DMP (US), Telsco (Canada), Axis Communication (Sweden), Hanwha Techwin America (US), FLIR Systems (US), Qolsys (US), Chubb Fire & Security (UK), Alarm.com (US), Avigilon (Canada), Tyco (Ireland), ICT (New Zealand), AMAG Technology (US), PTI Security Systems (US), Kantech (US), Feenics (Canada), Brivo (Canada), Exacq Technologies (US), SightLogix (US), Kairos (US), Immix (US), IOTAS (US), Verkada (US), Openpath (US), SmartCone Technologies (Canada), Cloudastructure (US), and Qognify (US). |

This research report categorizes the North America Physical Security Market to forecast revenues and analyze trends in each of the following submarkets:

Based on Component:

- Systems

- Services

Based on Systems:

- PACS

- Video Surveillance System

- Perimeter Intrusion Detection and Prevention

- PSIM

- PIAM

- Security Scanning, Imaging, and Metal Detection

- Fire and Life Safety

Based on Services:

- Managed Service

- Professional Service

Based on Organization Size:

- Large Enterprises

- SMEs

Based on the Vertical:

- BFSI

- Government

- Retail

- Transportation

- Residential

- Telecom

- IT and ITES

- Other verticals

Based on the region:

- North America

- United States (US)

- Canada

Recent Developments:

- In February 2021, Honeywell enhanced the capabilities of its MAXPRO Cloud portfolio with the launch of MPA1 and MPA2 access control panels that offer cloud, web-based, or on-premises hosting options to support the needs for SMEs. MPA1 and MPA2 control panels strengthen Honeywell’s MAXPRO Cloud offering by providing users with inexpensive access control functionality and real-time security information.

- In February 2021, Cisco partnered with Openpath, one of the leaders in touchless, modern access control and workplace safety automation. Onepath announced new Video Management System (VMS) partnership integration with Cisco Meraki. Openpath’s access control capabilities will be paired with Cisco Meraki’s industry-leading cloud-based technology, including smart camera intelligence that delivers data and analytics, and provides insights to help users make smarter business decisions.

- In November 2020, Johnson Controls unveiled its Smart Connected Fire Sprinkler Monitoring solution. As a part of Johnson Controls OpenBlue suite of digital solutions, the fire sprinkler monitoring solution will enable preventative maintenance and real-time insights into the health and functioning of the fire sprinkler system.

- In January 2020, ADT introduced ‘Blue by ADT’ DIY Home Security Platform. Blue by ADT is an extensible DIY system that allows customers to customize their smart home security systems with ease. The platform offers several devices with advanced compatibility features, including self-monitoring and 24/7 professional monitoring.

- In October 2019, TELUS acquired ADT Security Services Canada, prominent providers of security and automation solutions in Canada, for approximately CAD 700 million (USD 575 million). The acquisition strengthens TELUS’ capabilities in wireless networks, connected home solutions, security, IoT, smart buildings, smart cities, and smart healthcare services for its Canadian customers.

Frequently Asked Questions (FAQ):

What is the projected market value of the global North America Physical Security market?

The global North America physical security market size is projected to grow from USD 37.4 billion in 2021 to USD 48.2 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 5.2% during the forecast period.

What are the market drivers in the global NORTH AMERICA PHYSICAL SECURITY market?

Major driving factors for the North America physical security market include rise in security breaches, fraud, and data identity thefts, surge in use of BYOD/ IoT devices, high demand for cloud-based physical security solutions and services, high volume of online transactions, increasing use of IP-based video surveillance camera systems, and stringent government regulations.

Which region has the higher market share in the North America Physical Security market?

The US is estimated to hold the highest market share in the North America Physical Security market.

What is the definition of physical security?

Protecting important data, confidential information, networks, software, equipment, facilities, company’s assets, and personnel is what physical security is about. There are two factors by which security can be affected. First attack by nature like a flood, fire, power fluctuation, etc. Though the information will not be misused, it is very hard to retrieve it and may cause permanent loss of data. Second is an attack by the malicious party, which includes terrorism, vandalism, and theft.

Who are the major vendors in the NORTH AMERICA PHYSICAL SECURITY market?

The key and innovative vendors in the North America physical security market include ADT (US), Cisco (US), Honeywell (US), Johnson Controls (Ireland), TELUS (Canada), Anixter [WESCO] (US), Genetec (Canada), Bosch Building Technologies (Germany), STANLEY Security (US), GardaWorld (Canada), Convergint Technologies (US), Bell Canada (Canada), Paladin Security (Canada), DSC (US), DMP (US), Telsco (Canada), Axis Communication (Sweden), Hanwha Techwin America (US), FLIR Systems (US), Qolsys (US), Chubb Fire & Security (UK), Alarm.com (US), Avigilon (Canada), Tyco (Ireland), ICT (New Zealand), AMAG Technology (US), PTI Security Systems (US), Kantech (US), Feenics (Canada), Brivo (Canada), Exacq Technologies (US), SightLogix (US), Kairos (US), Immix (US), IOTAS (US), Verkada (US), Openpath (US), SmartCone Technologies (Canada), Cloudastructure (US), and Qognify (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2014–2020

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 6 NORTH AMERICA PHYSICAL SECURITY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE FROM SYSTEMS/SERVICES OF NORTH AMERICA PHYSICAL SECURITY VENDORS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SYSTEMS AND SERVICES OF NORTH AMERICA PHYSICAL SECURITY VENDORS AND HARDWARE PROVIDERS

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, TOP DOWN (DEMAND SIDE)

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

FIGURE 10 LIMITATIONS OF MARKET

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 11 NORTH AMERICA PHYSICAL SECURITY MARKET 2015–2026

FIGURE 12 MARKET, BY COUNTRY, 2020

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE NORTH AMERICA PHYSICAL SECURITY MARKET

FIGURE 13 RISING INSTANCES OF TERRORIST ACTIVITIES AND PHYSICAL ATTACKS, GROWING USE OF IP-BASED CAMERAS FOR VIDEO SURVEILLANCE, AND INCREASING ADOPTION OF CLOUD-BASED PHYSICAL SECURITY TO FUEL THE GROWTH OF THE MARKET

4.2 MARKET, BY COMPONENT, 2020

FIGURE 14 SERVICES SEGMENT TO HAVE A LARGER MARKET SIZE DURING THE FORECAST PERIOD

4.3 MARKET, BY SYSTEM, 2020

FIGURE 15 PHYSICAL SECURITY INFORMATION MANAGEMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.4 MARKET, BY VERTICAL, 2020

FIGURE 16 RETAIL VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.5 MARKET, MARKET SHARE OF TOP THREE SYSTEMS AND VERTICALS, 2021

FIGURE 17 RETAIL VERTICAL AND PSIM SYSTEMS TO HOLD THE HIGHEST MARKET SHARES IN 2020

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: NORTH AMERICA PHYSICAL SECURITY MARKET

5.2.1 DRIVERS

5.2.1.1 Rising instances of terrorist activities and physical attacks

FIGURE 19 NUMBER OF TERRORIST ATTACKS HAPPENING ANNUALLY IN UNITED STATES FROM 1995–2019

5.2.1.2 Increasing use of IP-based cameras for video surveillance

5.2.1.3 Increasing adoption of cloud-based physical security

5.2.2 RESTRAINTS

5.2.2.1 Violation of privacy

5.2.3 OPPORTUNITIES

5.2.3.1 Digital transformation enabled by video security systems

5.2.3.2 Integration of technologies, such as AI, ML, and analytics, in physical security

5.2.3.3 Convergence of multiple physical security systems

5.2.4 CHALLENGES

5.2.4.1 Increasing cyber threats to physical security systems

5.2.4.2 Integration of logical and physical components of security systems

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

5.4 VALUE CHAIN

FIGURE 20 VALUE CHAIN ANALYSIS: NORTH AMERICA PHYSICAL SECURITY MARKET

5.5 ECOSYSTEM

FIGURE 21 MARKET: ECOSYSTEM

5.6 PRICING MODEL OF NORTH AMERICA PHYSICAL SECURITY PLAYERS 2019–2020

5.7 PHYSICAL SECURITY TECHNOLOGY ANALYSIS

5.7.1 MARKET: TOP TRENDS

5.7.1.1 Integration of AI and analytics with video surveillance

5.7.1.2 Cloud technology and internet of things

5.7.1.3 Contactless biometrics for authentication and access control

5.7.1.4 Innovative physical security solutions to enhance response to COVID-19

5.8 USE CASES

5.9 REVENUE SHIFT – YC/YCC SHIFT FOR NORTH AMERICA PHYSICAL SECURITY MARKET

FIGURE 22 YC/YCC SHIFT: MARKET

5.10 PATENT ANALYSIS

TABLE 3 PHYSICAL SECURITY PATENT ANALYSIS

5.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 PORTERS FIVE FORCES IMPACT ON THE MARKET

FIGURE 23 MARKET: PORTER'S FIVE FORCE ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

6 NORTH AMERICA PHYSICAL SECURITY MARKET, BY COMPONENT (Page No. - 65)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 24 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 5 MARKET SIZE, BY COMPONENT, 2015–2020 (USD BILLION)

TABLE 6 MARKET SIZE, BY COMPONENT, 2020–2026 (USD BILLION)

7 NORTH AMERICA PHYSICAL SECURITY MARKET, BY SYSTEM (Page No. - 68)

7.1 INTRODUCTION

7.1.1 SYSTEMS: MARKET DRIVERS

7.1.2 SYSTEMS: COVID-19 IMPACT

FIGURE 25 VIDEO SURVEILLANCE SYSTEMS ARE EXPECTED TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

7.2 PHYSICAL ACCESS CONTROL SYSTEM

7.2.1 PHYSICAL ACCESS CONTROL SYSTEMS: MARKET DRIVERS

7.2.2 PHYSICAL ACCESS CONTROL SYSTEMS: COVID-19 IMPACT DRIVERS

TABLE 7 PHYSICAL ACCESS CONTROL SYSTEMS: MARKET SIZE, 2015–2020 (USD BILLION)

TABLE 8 PHYSICAL ACCESS CONTROL SYSTEMS: NORTH AMERICA PHYSICAL SECURITY MARKET SIZE, 2020–2026 (USD BILLION)

7.2.3 LOCKS

7.2.3.1 Mechanical locks

7.2.3.2 Electronic locks

TABLE 9 NORTH AMERICA: PHYSICAL ACCESS CONTROL MARKET SIZE, BY ELECTRONIC LOCKS, 2018–2025 (THOUSAND UNITS)

7.2.4 BIOMETRICS

7.2.4.1 Fingerprint recognition

7.2.4.2 Facial recognition

7.2.4.3 Other biometrics

7.2.5 SMART CARDS AND READERS

TABLE 10 NORTH AMERICA : ACCESS CONTROL READER MARKET BY CARD-BASED READERS, 2016–2024 (THOUSAND UNITS)

7.2.6 ACCESS CONTROL SOFTWARE

7.3 VIDEO SURVEILLANCE SYSTEMS

7.3.1 VIDEO SURVEILLANCE SYSTEMS: NORTH AMERICA PHYSICAL SECURITY MARKET DRIVERS

7.3.2 VIDEO SURVEILLANCE SYSTEMS: COVID-19 IMPACT DRIVERS

TABLE 11 VIDEO SURVEILLANCE SYSTEMS: MARKET SIZE, BY SYSTEM, 2015–2020 (USD BILLION)

TABLE 12 VIDEO SURVEILLANCE SYSTEMS: MARKET SIZE, BY SYSTEM,2020–2026 (USD BILLION)

7.3.3 CAMERAS

TABLE 13 NORTH AMERICA: VIDEO SURVEILLANCE SYSTEMS MARKET SIZE, BY CAMERA, 2020–2026 (THOUSAND UNITS)

7.3.3.1 Analog cameras

7.3.3.2 IP cameras

TABLE 14 IP CAMERA VS. ANALOG CAMERA

TABLE 15 NORTH AMERICA CAMERAS MARKET SIZE, BY TYPE, 2017–2025 (THOUSAND UNITS)

7.3.4 RECORDERS

7.3.4.1 Digital video recorders

7.3.4.2 Network video recorders

7.3.5 VIDEO ANALYTICS SOFTWARE

7.3.5.1 Video management software

7.4 PERIMETER INTRUSION DETECTION AND PREVENTION

7.4.1 PERIMETER INTRUSION DETECTION AND PREVENTION: PHYSICAL SECURITY MARKET DRIVERS

7.4.2 PERIMETER INTRUSION DETECTION AND PREVENTION: COVID-19 IMPACT DRIVERS

TABLE 16 PERIMETER INTRUSION DETECTION AND PREVENTION: NORTH AMERICA PHYSICAL SECURITY MARKET SIZE, BY SYSTEM, 2015–2020 (USD BILLION)

TABLE 17 PERIMETER INTRUSION DETECTION AND PREVENTION: MARKET SIZE, BY SYSTEM, 2020–2026 (USD BILLION)

7.5 PHYSICAL SECURITY INFORMATION MANAGEMENT

7.5.1 PHYSICAL SECURITY INFORMATION MANAGEMENT: MARKET DRIVERS

7.5.2 PHYSICAL SECURITY INFORMATION MANAGEMENT: COVID-19 IMPACT DRIVERS

TABLE 18 PHYSICAL SECURITY INFORMATION MANAGEMENT: MARKET SIZE, BY SYSTEM, 2015–2020 (USD BILLION)

TABLE 19 PHYSICAL SECURITY INFORMATION MANAGEMENT: MARKET SIZE, BY SYSTEM, 2020–2026 (USD BILLION)

7.6 PHYSICAL IDENTITY ACCESS MANAGEMENT

7.6.1 PHYSICAL IDENTITY ACCESS MANAGEMENT: PHYSICAL SECURITY MARKET DRIVERS

7.6.2 PHYSICAL IDENTITY ACCESS MANAGEMENT: COVID-19 IMPACT DRIVERS

TABLE 20 PHYSICAL IDENTITY ACCESS MANAGEMENT: NORTH AMERICA PHYSICAL SECURITY MARKET SIZE, BY SYSTEM, 2015–2020 (USD BILLION)

TABLE 21 PHYSICAL IDENTITY ACCESS MANAGEMENT: MARKET SIZE, BY SYSTEM, 2020–2026 (USD BILLION)

7.7 SECURITY SCANNING, IMAGING, AND METAL DETECTION

7.7.1 SECURITY SCANNING, IMAGING, AND METAL DETECTION: MARKET DRIVERS

7.7.2 SECURITY SCANNING, IMAGING, AND METAL DETECTION: COVID-19 IMPACT DRIVERS

TABLE 22 SECURITY SCANNING, IMAGING, AND METAL DETECTION: MARKET SIZE, BY SYSTEM, 2015–2020 (USD BILLION)

TABLE 23 SECURITY SCANNING, IMAGING, AND METAL DETECTION: MARKET SIZE, BY SYSTEM, 2020–2026 (USD BILLION)

7.8 FIRE AND LIFE SAFETY

7.8.1 FIRE AND LIFE SAFETY: NORTH AMERICA PHYSICAL SECURITY MARKET DRIVERS

7.8.2 FIRE AND LIFE SAFETY: COVID-19 IMPACT DRIVERS

TABLE 24 FIRE AND LIFE SAFETY: MARKET SIZE, BY SYSTEM, 2015–2020 (USD BILLION)

TABLE 25 FIRE AND LIFE SAFETY: MARKET SIZE, BY SYSTEM, 2020–2026 (USD BILLION)

8 NORTH AMERICA PHYSICAL SECURITY MARKET, BY SERVICE (Page No. - 88)

8.1 INTRODUCTION

8.1.1 SERVICES: MARKET DRIVERS

8.1.2 SERVICES: COVID-19 IMPACT DRIVERS

8.2 PROFESSIONAL SERVICES

8.2.1 PROFESSIONAL SERVICES: MARKET DRIVERS

8.2.2 PROFESSIONAL SERVICES: COVID-19 IMPACT DRIVERS

TABLE 26 PROFESSIONAL SERVICES: MARKET SIZE, BY SERVICE, 2015–2020 (USD BILLION)

TABLE 27 PROFESSIONAL SERVICES: MARKET SIZE, BY SERVICE, 2020–2026 (USD BILLION)

8.3 MANAGED SERVICES

8.3.1 MANAGED SERVICES: MARKET DRIVERS

8.3.2 MANAGED SERVICES: COVID-19 IMPACT DRIVERS

TABLE 28 MANAGED SERVICES: MARKET SIZE, BY SERVICE, 2015–2020 (USD BILLION)

TABLE 29 MANAGED SERVICES: NORTH AMERICA PHYSICAL SECURITY MARKET SIZE, BY SERVICE, 2020–2026 (USD BILLION)

9 PHYSICAL SECURITY MARKET, BY ORGANIZATION SIZE (Page No. - 93)

9.1 INTRODUCTION

FIGURE 26 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

9.2.1 SMALL AND MEDIUM-SIZED ENTERPRISES: NORTH AMERICA PHYSICAL SECURITY MARKET DRIVERS

9.2.2 SMALL AND MEDIUM-SIZED ENTERPRISES: COVID-19 IMPACT

TABLE 30 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD BILLION)

TABLE 31 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD BILLION)

9.3 LARGE ENTERPRISES

9.3.1 LARGE ENTERPRISES: MARKET DRIVERS

9.3.2 LARGE ENTERPRISES: COVID-19 IMPACT

TABLE 32 LARGE ENTERPRISES: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD BILLION)

TABLE 33 LARGE ENTERPRISES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD BILLION)

10 NORTH AMERICA PHYSICAL SECURITY MARKET, BY VERTICAL (Page No. - 98)

10.1 INTRODUCTION

FIGURE 27 RESIDENTIAL VERTICAL TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

10.2 BANKING, FINANCIAL SERVICES AND INSURANCE

10.2.1 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET DRIVERS

10.2.2 BANKING, FINANCIAL SERVICES AND INSURANCE: COVID-19 IMPACT

TABLE 34 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY VERTICAL, 2015–2020 (USD BILLION)

TABLE 35 BANKING, FINANCIAL SERVICES AND INSURANCE: SIZE, BY VERTICAL, 2020–2026 (USD BILLION)

10.3 GOVERNMENT

10.3.1 GOVERNMENT: NORTH AMERICA PHYSICAL SECURITY MARKET DRIVERS

10.3.2 GOVERNMENT: COVID-19 IMPACT

TABLE 36 GOVERNMENT: MARKET SIZE, BY VERTICAL, 2015–2020 (USD BILLION)

TABLE 37 GOVERNMENT: MARKET SIZE, BY VERTICAL, 2020–2026 (USD BILLION)

10.4 RETAIL

10.4.1 RETAIL: MARKET DRIVERS

10.4.2 RETAIL: COVID-19 IMPACT

TABLE 38 RETAIL: MARKET SIZE, BY VERTICAL, 2015–2020 (USD BILLION)

TABLE 39 RETAIL: MARKET SIZE, BY VERTICAL, 2020–2026 (USD BILLION)

10.5 TRANSPORTATION

10.5.1 TRANSPORTATION: MARKET DRIVERS

10.5.2 TRANSPORTATION: COVID-19 IMPACT DRIVERS

TABLE 40 TRANSPORTATION: MARKET SIZE, BY VERTICAL, 2015–2020 (USD BILLION)

TABLE 41 TRANSPORTATION: MARKET SIZE, BY VERTICAL, 2020–2026 (USD BILLION)

10.6 RESIDENTIAL

10.6.1 RESIDENTIAL: NORTH AMERICA PHYSICAL SECURITY MARKET DRIVERS

10.6.2 RESIDENTIAL: COVID-19 IMPACT DRIVERS

TABLE 42 RESIDENTIAL: MARKET SIZE, BY VERTICAL, 2015–2020 (USD BILLION)

TABLE 43 RESIDENTIAL: MARKET SIZE, BY VERTICAL, 2020–2026 (USD BILLION)

10.7 TELECOM

10.7.1 TELECOM: MARKET DRIVERS

10.7.2 TELECOM: COVID-19 IMPACT DRIVERS

TABLE 44 TELECOM: MARKET SIZE, BY VERTICAL, 2015–2020 (USD BILLION)

TABLE 45 TELECOM: MARKET SIZE, BY VERTICAL, 2020–2026 (USD BILLION)

10.8 INFORMATION TECHNOLOGY ENABLED SERVICES

10.8.1 INFORMATION TECHNOLOGY ENABLED SERVICES: MARKET DRIVERS

10.8.2 INFORMATION TECHNOLOGY ENABLED SERVICES: COVID-19 IMPACT DRIVERS

TABLE 46 INFORMATION TECHNOLOGY ENABLED SERVICES: NORTH AMERICA PHYSICAL SECURITY MARKET SIZE, BY VERTICAL, 2015–2020 (USD BILLION)

TABLE 47 INFORMATION TECHNOLOGY ENABLED SERVICES: MARKET SIZE, BY VERTICAL, 2020–2026 (USD BILLION)

10.9 OTHER VERTICALS

TABLE 48 OTHER VERTICALS: MARKET SIZE, BY VERTICAL, 2015–2020 (USD BILLION)

TABLE 49 OTHER VERTICALS: MARKET SIZE, BY VERTICAL, 2020–2026 (USD BILLION)

11 NORTH AMERICA PHYSICAL SECURITY MARKET, BY COUNTRY (Page No. - 111)

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: PHYSICAL SECURITY MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 28 NORTH AMERICA: MARKET SNAPSHOT

TABLE 50 NORTH AMERICA: PHYSICAL SECURITY MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 51 NORTH AMERICA: PHYSICAL SECURITY MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: PHYSICAL SECURITY MARKET SIZE, BY SYSTEM, 2015–2020 (USD MILLION)

TABLE 53 NORTH AMERICA: PHYSICAL SECURITY MARKET SIZE, BY SYSTEM, 2020–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: PHYSICAL SECURITY MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 55 NORTH AMERICA: PHYSICAL SECURITY MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: PHYSICAL SECURITY MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 57 NORTH AMERICA: PHYSICAL SECURITY MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: PHYSICAL SECURITY MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 59 NORTH AMERICA: PHYSICAL SECURITY MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: PHYSICAL SECURITY MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 61 NORTH AMERICA: PHYSICAL SECURITY MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

11.2.4 UNITED STATES

TABLE 62 UNITED STATES: NORTH AMERICA PHYSICAL SECURITY MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 63 UNITED STATES: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 64 UNITED STATES: MARKET SIZE, BY SYSTEM, 2020–2026 (USD MILLION)

TABLE 66 UNITED STATES: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 67 UNITED STATES: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 68 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 69 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 70 UNITED STATES: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 71 UNITED STATES: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.2.5 CANADA

TABLE 72 CANADA: NORTH AMERICA PHYSICAL SECURITY MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 73 CANADA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 74 CANADA: MARKET SIZE, BY SYSTEM, 2015–2020 (USD MILLION)

TABLE 75 CANADA: MARKET SIZE, BY SYSTEM, 2020–2026 (USD MILLION)

TABLE 76 CANADA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 77 CANADA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 78 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 79 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 80 CANADA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 81 CANADA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 128)

12.1 INTRODUCTION

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 29 NORTH AMERICA PHYSICAL SECURITY: MARKET EVALUATION FRAMEWORK

12.3 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 30 NORTH AMERICA PHYSICAL SECURITY MARKET: REVENUE ANALYSIS

12.4 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

TABLE 82 MARKET: DEGREE OF COMPETITION

12.5 HISTORICAL REVENUE ANALYSIS

FIGURE 31 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

12.6 RIGHT TO WIN

12.7 RANKING OF KEY PLAYERS IN THE MARKET, 20201

FIGURE 32 KEY PLAYERS RANKING, 2021

12.8 COMPANY EVALUATION MATRIX

12.8.1 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

TABLE 83 EVALUATION CRITERIA

12.8.2 STAR

12.8.3 PERVASIVE

12.8.4 EMERGING LEADERS

12.8.5 PARTICIPANTS

FIGURE 33 NORTH AMERICA PHYSICAL SECURITY MARKET COMPANY EVALUATION MATRIX, 2021

12.9 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 34 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MARKET

12.10 BUSINESS STRATEGY EXCELLENCE

FIGURE 35 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MARKET

12.11 STARTUP/SME EVALUATION MATRIX, 2020

12.11.1 PROGRESSIVE COMPANIES

12.11.2 RESPONSIVE COMPANIES

12.11.3 DYNAMIC COMPANIES

12.11.4 STARTING BLOCKS

FIGURE 36 NORTH AMERICA PHYSICAL SECURITY MARKET STARTUP/SME EVALUATION MATRIX, 2021

13 COMPANY PROFILES (Page No. - 140)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business Overview, Products, Solutions & Services, Key Insights, Recent Developments, MnM View)*

13.2.1 ADT

TABLE 84 ADT: BUSINESS OVERVIEW

FIGURE 37 ADT: COMPANY SNAPSHOT

TABLE 85 ADT: SOLUTIONS OFFERED

TABLE 86 ADT: SERVICES OFFERED

TABLE 87 ADT: PRODUCT LAUNCHES

TABLE 88 ADT: DEALS

13.2.2 CISCO

TABLE 89 CISCO: BUSINESS OVERVIEW

FIGURE 38 CISCO: COMPANY SNAPSHOT

TABLE 90 CISCO: SOLUTIONS OFFERED

TABLE 91 CISCO: SERVICES OFFERED

TABLE 92 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 93 CISCO: BUSINESS EXPANSION

TABLE 94 CISCO: DEALS

13.2.3 HONEYWELL

TABLE 95 HONEYWELL: BUSINESS OVERVIEW

FIGURE 39 HONEYWELL: COMPANY SNAPSHOT

TABLE 96 HONEYWELL: SOLUTIONS OFFERED

TABLE 97 HONEYWELL: SERVICES OFFERED

TABLE 98 HONEYWELL: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 99 HONEYWELL: DEALS

13.2.4 JOHNSON CONTROLS

TABLE 100 JOHNSON CONTROLS: BUSINESS OVERVIEW

FIGURE 40 JOHNSON CONTROLS: COMPANY SNAPSHOT

TABLE 101 JOHNSON CONTROLS: SOLUTIONS OFFERED

TABLE 102 JOHNSON CONTROLS: SERVICES OFFERED

TABLE 103 JOHNSON CONTROLS: PRODUCT LAUNCHES

TABLE 104 JOHNSON CONTROLS: BUSINESS EXPANSION

TABLE 105 JOHNSON CONTROLS: DEALS

13.2.5 TELUS

TABLE 106 TELUS: BUSINESS OVERVIEW

FIGURE 41 TELUS: COMPANY SNAPSHOT

TABLE 107 TELUS: SOLUTIONS OFFERED

TABLE 108 TELUS: SERVICES OFFERED

TABLE 109 TELUS: DEALS

13.2.6 ANIXTER (WESCO)

TABLE 110 ANIXTER (WESCO): BUSINESS OVERVIEW

FIGURE 42 ANIXTER: COMPANY SNAPSHOT

TABLE 111 ANIXTER (WESCO): SOLUTIONS OFFERED

TABLE 112 ANIXTER (WESCO): PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 113 ANIXTER (WESCO): BUSINESS EXPANSION

TABLE 114 ANIXTER (WESCO): DEALS

13.2.7 GENETEC

TABLE 115 GENETEC: BUSINESS OVERVIEW

TABLE 116 GENETEC :SOLUTIONS OFFERED

TABLE 117 GENETEC: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 118 GENETEC: DEALS

13.2.8 BOSCH BUILDING TECHNOLOGIES

TABLE 119 BOSCH BUILDING TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 120 BOSCH BUILDING TECHNOLOGIES : SOLUTIONS OFFERED

TABLE 121 BOSCH BUILDING TECHNOLOGIES: SERVICES OFFERED

TABLE 122 BOSCH BUILDING TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 123 BOSCH BUILDING TECHNOLOGIES: DEALS

13.2.9 STANLEY CONVERGENT SECURITY SOLUTIONS

TABLE 124 STANLEY CONVERGENT SECURITY SOLUTIONS: BUSINESS OVERVIEW

TABLE 125 STANLEY CONVERGENT SECURITY SOLUTIONS: SOLUTIONS OFFERED

TABLE 126 STANLEY CONVERGENT SECURITY SOLUTIONS: SERVICES OFFERED

TABLE 127 STANLEY CONVERGENT SECURITY SOLUTIONS: PRODUCT LAUNCHES

TABLE 128 STANLEY CONVERGENT SECURITY SOLUTIONS: DEALS

13.2.10 GARDAWORLD

TABLE 129 GARDAWORLD: BUSINESS OVERVIEW

TABLE 130 GARDAWORLD: SOLUTIONS OFFERED

TABLE 131 GARDAWORLD: SERVICES OFFERED

TABLE 132 GARDAWORLD: DEALS

13.2.11 CONVERGINT TECHNOLOGIES

TABLE 133 CONVERGINT TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 134 CONVERGINT TECHNOLOGIES: SOLUTIONS OFFERED

TABLE 135 CONVERGINT TECHNOLOGIES: DEALS

13.2.12 BELL CANADA ENTERPRISES

13.2.13 PALADIN SECURITY

13.2.14 DSC

13.2.15 DMP

13.2.16 TELSCO

13.2.17 AXIS COMMUNICATIONS

13.2.18 HANWHA TECHWIN AMERICA

13.2.19 FLIR SYSTEMS

13.2.20 QOLSYS

13.2.21 CHUBB FIRE & SECURITY

13.2.22 ALARM.COM

13.2.23 AVIGILON

13.2.24 TYCO

13.2.25 ICT

13.2.26 AMAG TECHNOLOGY

13.2.27 PTI SECURITY SYSTEMS

13.2.28 KANTECH

13.2.29 FEENICS

13.2.30 BRIVO

13.2.31 EXACQ TECHNOLOGIES

13.2.32 SIGHTLOGIX

13.2.33 KAIROS

13.2.34 IMMIX

*Details on Business Overview, Solutions, Products & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

13.3 STARTUP/ SME PROFILES

13.3.1 IOTAS

13.3.2 VERKADA

13.3.3 OPENPATH

13.3.4 SMARTCONE TECHNOLOGY

13.3.5 CLOUDASTRUCTURE

13.3.6 QOGNIFY

14 ADJACENT MARKETS (Page No. - 219)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 CYBERSECURITY

14.3.1 MARKET OVERVIEW

14.3.2 CYBERSECURITY MARKET, BY COMPONENT

TABLE 136 CYBERSECURITY MARKET SIZE, BY COMPONENT, 2016–2023 (USD BILLION)

14.3.2.1 Solutions

TABLE 137 SOLUTIONS: CYBERSECURITY MARKET SIZE, BY REGION, 2016–2023 (USD BILLION)

14.3.2.2 Services

TABLE 138 SERVICES: CYBERSECURITY MARKET SIZE, BY REGION, 2016–2023 (USD BILLION)

14.3.3 CYBERSECURITY MARKET BY TYPE

14.3.3.1 Network security

TABLE 139 NETWORK SECURITY: CYBERSECURITY MARKET SIZE, BY REGION, 2016–2023 (USD BILLION)

14.3.3.2 Endpoint security

TABLE 140 ENDPOINT SECURITY: CYBERSECURITY MARKET SIZE, BY REGION, 2016–2023 (USD BILLION)

14.3.3.3 Application security

TABLE 141 APPLICATION SECURITY: CYBERSECURITY MARKET SIZE, BY REGION, 2016–2023 (USD BILLION)

14.3.3.4 Cloud security

TABLE 142 CLOUD SECURITY: CYBERSECURITY MARKET SIZE, BY REGION, 2016–2023 (USD BILLION)

14.3.4 CYBERSECURITY MARKET, BY DEPLOYMENT

TABLE 143 CYBERSECURITY MARKET SIZE, BY DEPLOYMENT MODE, 2016–2023 (USD BILLION)

14.3.5 CYBERSECURITY MARKET BY ORGANIZATION SIZE

TABLE 144 CYBERSECURITY MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD BILLION)

14.3.6 CYBERSECURITY MARKET, BY INDUSTRY VERTICAL

TABLE 145 CYBERSECURITY MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2023 (USD BILLION)

14.4 IDENTITY AND ACCESS MANAGEMENT

14.4.1 MARKET OVERVIEW

14.4.2 IDENTITY AND ACCESS MANAGEMENT MARKET, BY COMPONENT

TABLE 146 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 147 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

14.4.3 IDENTITY AND ACCESS MANAGEMENT MARKET, BY SOLUTION

TABLE 148 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY SOLUTION, 2014–2019 (USD MILLION)

TABLE 149 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

14.4.4 IDENTITY AND ACCESS MANAGEMENT MARKET, BY DEPLOYMENT TYPE

TABLE 150 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 151 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

14.4.5 IDENTITY AND ACCESS MANAGEMENT MARKET, BY VERTICAL

TABLE 152 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 153 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

14.4.6 GEOGRAPHIC ANALYSIS

TABLE 154 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 155 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

14.5 PERIMETER INTRUSION DETECTION SYSTEM

14.5.1 MARKET OVERVIEW

14.5.2 PERIMETER INTRUSION DETECTION SYSTEMS MARKET, BY COMPONENT

TABLE 156 PERIMETER INTRUSION DETECTION SYSTEMS MARKET SIZE, BY COMPONENT, 2016–2023 (USD MILLION)

14.5.3 PERIMETER INTRUSION DETECTION SYSTEMS MARKET, BY ORGANIZATION SIZE

TABLE 157 PERIMETER INTRUSION DETECTION SYSTEMS MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

14.5.4 PERIMETER INTRUSION DETECTION SYSTEM MARKET, BY DEPLOYMENT TYPE

TABLE 158 PERIMETER INTRUSION DETECTION SYSTEM MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2023 (USD MILLION)

14.5.5 PERIMETER INTRUSION DETECTION SYSTEMS MARKET, BY REGION

14.5.5.1 North America

TABLE 159 NORTH AMERICA: PERIMETER INTRUSION DETECTION SYSTEMS MARKET SIZE, BY COMPONENT, 2016–2023 (USD MILLION)

TABLE 160 NORTH AMERICA: PERIMETER INTRUSION DETECTION SYSTEMS MARKET SIZE, BY SOLUTION, 2016–2023 (USD MILLION)

TABLE 161 NORTH AMERICA: PERIMETER INTRUSION DETECTION SYSTEMS MARKET SIZE, BY SENSOR, 2016–2023 (USD MILLION)

TABLE 162 NORTH AMERICA: PERIMETER INTRUSION DETECTION SYSTEMS MARKET SIZE, BY SERVICE, 2016–2023 (USD MILLION)

TABLE 163 NORTH AMERICA: PERIMETER INTRUSION DETECTION SYSTEM SIZE, BY DEPLOYMENT TYPE, 2016–2023 (USD MILLION)

TABLE 164 NORTH AMERICA: PERIMETER INTRUSION DETECTION SYSTEMS MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

15 APPENDIX (Page No. - 237)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

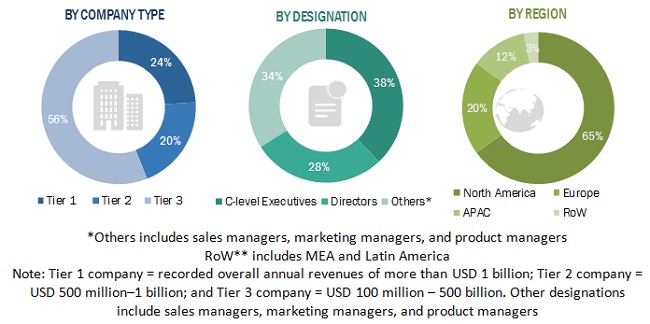

The study involved four major activities in estimating the current size of the North America Physical Security market. Exhaustive secondary research was done to collect information the North America Physical Security market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the size of the market segments and subsegments.

Secondary Research

The market for the companies offering North America physical security systems and services for various verticals is arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolio of major companies in the ecosystem and rating them on the basis of their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases and investor presentations of companies, white papers such as physical security in mission critical systems, A look inside increasing role of IT in physical access control systems, journals such as Journal of Physical Security, Physical and IT security: The Case for Convergence research papers such as a Study on Effectiveness Evaluation for the Physical Protection, and certified publications and articles from recognized authors, directories, and databases. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the North America physical security market.

Following is the breakup of the primary respondent:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the North America Physical Security. These methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at each market segment's exact statistics and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the North America Physical Security by component, systems, services, organization size, vertical, and country from 2021 to 2026, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the market segments' size with respect to two main countries: US and Canada

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall North America Physical Security

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the North America Physical Security

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the North American market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in North America Physical Security Market