Physical Identity and Access Management Market by Component, Service, Organization Size, Vertical (BFSI, IT and ITeS, Telecom, Energy and Utilities, Transportation, Healthcare, Government and Defense, and Education), and Region - Global Forecast to 2025

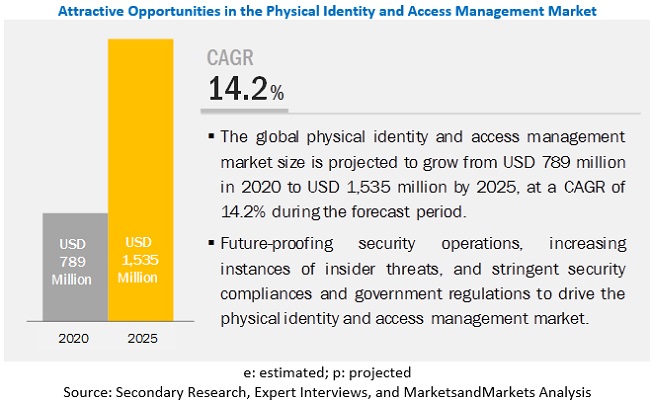

[159 Pages Report] The global physical identity and access management market size is projected to grow from USD 789 million in 2020 to USD 1,535 million by 2025, at a Compound Annual Growth Rate (CAGR) of 14.2% during the forecast period. Factors such as future-proofing security operations and compliance with stringent security and government regulations are expected to enhance the use of physical identity and access management software across the globe.

By vertical, the government and defense segment to grow at the highest CAGR during the forecast period

The government and defense vertical requires physical identity and access management solutions on a large-scale due to the voluminous information produced across these organizations. Physical identity and access management software helps the government and defense vertical secure their infrastructure and users from identity risks with reduced costs. The increasing complexities in networks and increasing instances of insider threats and cyberattacks are fueling the adoption of physical identity and access management solutions among governments across the globe.

By service, the maintenance and support services segment to grow at the highest CAGR during the forecast period

Maintenance services include providing upgradations for the physical identity and access management software and services and providing assistance for resolving issues in software. The support services offered in the physical identity and access management include real-time monitoring of access control systems, scheduled backup of data, and provision of security advisory and consulting services. Support and maintenance services are important to enhance and extend the life of applications. The demand for support and maintenance services is increasing with the deployment of physical identity and access management software and solutions.

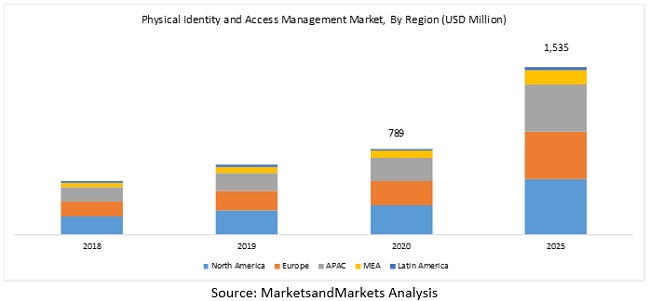

By region, North America to account for the highest market share during the forecast period

North America has the presence of several prominent market players delivering advanced solutions to all the end users in the regions. Owing to their strong economies, the US and Canada are expected to be major contributors to the growth of the physical identity and access management market. Apart from this factor, the geographical presence, strategic investments, partnerships, and significant Research and Development (R&D) activities are contributing to the hefty deployments of physical identity and access management solutions. Key pure play vendors, such as AWS, IBM, HID Global, and AlertEnterprise offer enhanced physical identity and access management softwares to cater to the needs of customers. Such factors are expected to fuel the growth of the global physical identity and access management market in North America.

Physical Identity and Access Management Companies:

The vendors covered in the market report include HID Global (US), AlertEnterprise (US), IDCUBE (India), Micro Focus (UK), Okta (US), Access Security Corporation (US), Gemalto (Netherlands), IBM (US), Oracle (US), AWS (US), Avatier (US), Wallix Group (France), Atos (France), Identiv (US), Nexus Group (Sweden), Alfrednet (Bucharest), Wipro (India), One Identity (US), Sequr (US), E&M Technologies (US), and WSO2 (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) Million |

|

Segments covered |

Component, Service, Organization Size, Vertical, And Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

List of Companies in Physical Identity and Access Management |

HID Global (US), AlertEnterprise (US), IDCUBE (India), Micro Focus (UK), Okta (US), Access Security Corporation (US), Gemalto (Netherlands), IBM (US), Oracle (US), AWS (US), Avatier (US), Wallix Group (France), Atos (France), Identiv (US), Nexus Group (Sweden), Alfrednet (Bucharest), Wipro (India), One Identity (US), Sequr (US), E&M Technologies (US), and WSO2 (US) |

This research report categorizes the physical identity and access management market to forecast revenues and analyze trends in each of the following submarkets:

Based on component:

- Software

- Services

Based on services:

- Consulting

- Implementation and Integration

- Maintenance and Support

Based on organization size:

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

Based on verticals:

- IT and ITeS

- Telecom

- Government and Defense

- BFSI

- Healthcare

- Energy and Utilities

- Transportation

- Education

- Others (retail, manufacturing, and logistics)

Based on the region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe (Spain, the Netherlands, and Italy)

-

APAC

- China

- Japan

- India

- Rest of APAC (South Korea, Australia, and Singapore)

-

MEA

- Middle East

- Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America (Venezuela and Argentina)

Recent Developments

- In January 2020, Micro Focus launched the Voltage SmartCipher. Voltage SmartCipher is flexible, transparent, and centralizes policy-driven controls for IT security administrators, balancing protection, and insights regardless of data complexity or location.

- In October 2019, HID Global entered into an agreement to acquire LUX-Ident.

- In September 2019, AlertEnterprise integrated its Enterprise Guardian application with the SAP SuccessFactors Human Capital Management (HCM) suite. This integration delivers secure access for company workspaces, including automated batch access management.

- In April 2019, Okta launched a product named Okta Access Gateway. The new product would enable customers to access on-premises applications, easily with the help of the Okta Identity Cloud.

- In August 2019, Gemalto collaborated with the Thailand government to deploy identity verification solutions with innovative ePassports.

Key questions addressed by the report

- What are the opportunities in the global physical identity and access management market?

- What is the competitive landscape in the market?

- What are the restraining factors that will impact the market?

- How have global physical identity and access management solutions evolved from traditional interactive solutions?

- What are the dynamics of the global physical identity and access management market?

Frequently Asked Questions (FAQ):

What is Physical Identity Access Management?

Physical Identity and Access Management is a software which integrates physical access control systems and badging with various business applications, such as HR and IT. Physical identity and access management manages the identification, access and authentication of employees, on-premise visitors, contractors, and partners to the organizations infrastructure. The software simplifies control of all physical identities across an organization to ensure each identity has the right access, to the right areas, for the right amount of time. The software includes physical security application, such as badge management, visitor management, physical asset management, and access control systems.

What are the top trends in Physical Identity Access Management market?

Trends that are impacting Physical Identity and Access Management market includes:

- Future proofing security operations

- Stringent security compliances and government regulations

- Increased adoption of physical access control systems

- Increasing need of business intelligence

What is the Physical Identity Access Management market size?

The global Physical Identity and Access Management market size is expected to grow from USD 789 million in 2020 to USD 1,535 million by 2025, at a Compound Annual Growth Rate (CAGR) of 14.2% during the forecast period. Major growth drivers for the market include several advantages such as the increasing insider threats and future proofing of the security operations.

Which are the leading vendors operating in this market?

Some of the prominent players in the Physical Identity and Access Management market include The vendors covered in the market report include HID Global, Alert Enterprise, IDCUBE, Micro Focus, Okta, Access Security Corporation, Gemalto, IBM, Oracle, AWS, Avatier, Wallix Group, Atos, Identiv, Nexus Group, Alfrednet, Wipro, One identity, Sequr, E&M Technologies, and WSO2.

Which are the major Physical Identity Access Management verticals?

Some of the major verticals that deploy Physical Identity and Access Management are Government and Defense, Banking, Financial Services and Insurance (BFSI), IT and ITeS, Telecom, Retail and eCommerce, Education, Healthcare, and Transportation.

The government and defense vertical is to grow at the highest CAGR during the forecast period. The government and defense vertical requires physical identity and access management solutions at a large-scale due to the voluminous information produced in these organizations. Physical identity and access management software helps the government and defense industry vertical secure their infrastructure and users from identity risks with reduced costs. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency Considered

1.5 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.2 Breakup and Data Triangulation

2.2.1 Secondary Data

2.2.1.1 Vendor Selection and Evaluation

2.2.1.2 Geographic Analysis

2.2.2 Primary Data

2.2.2.1 Key Industry Insights

2.3 Market Size Estimation

2.3.1 Revenue Estimates

2.4 Physical Identity and Access Management Market Size Estimation

2.4.1 Top-Down Approach

2.4.2 Bottom-Up Approach

2.5 Competitive Leadership Mapping Methodology

2.6 Research Assumptions and Limitations

2.6.1 Assumptions for the Study

2.6.2 Limitations of the Study

3 Executive Summary (Page No. - 36)

4 Premium Insights (Page No. - 40)

4.1 Attractive Market Opportunities in the Physical Identity and Access Management Market

4.2 Market, Market Share of Top 3 End Users and Regions, 2020

4.3 Market, By Service, 2020–2025

4.4 Market: Top 5 Verticals, 2020–2025

5 Market Overview and Industry Trends (Page No. - 42)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Future-Proofing Security Operations

5.2.1.2 Stringent Security Compliances and Government Regulations

5.2.2 Restraints

5.2.2.1 Lack of Awareness About Advanced Security Solutions Among End Users

5.2.3 Opportunities

5.2.3.1 Increased Adoption of Physical Access Control Systems

5.2.3.2 Increasing Need for Business Intelligence

5.2.4 Challenges

5.2.4.1 Remote Identity Proofing With the Public

5.2.4.2 Security Breaches Due to Internal Vulnerabilities

5.2.4.3 Lack of Skilled Security Analysts

5.3 Use Cases

5.3.1 Use Case: Healthcare

5.3.2 Use Case: Defense

5.3.3 Use Case: Education

5.3.4 Use Case: Transportation and Logistics

5.3.5 Use Case: Manufacturing

5.4 Regulatory Implications

5.4.1 Introduction

5.4.2 Payment Card Industry Data Security Standard

5.4.3 Health Insurance Portability and Accountability Act

5.4.4 Federal Information Security Management Act

5.4.5 Gramm-Leach-Bliley Act

5.4.6 Sarbanes-Oxley Act

6 Physical Identity and Access Management Market, By Component (Page No. - 50)

6.1 Introduction

6.2 Software

6.2.1 Software: Market Drivers

6.3 Services

7 Physical Identity and Access Management Market, By Service (Page No. - 54)

7.1 Introduction

7.2 Consulting

7.2.1 Consulting: Market Drivers

7.3 Implementation and Integration

7.3.1 Implementing and Integration: Market Drivers

7.4 Maintenance and Support

7.4.1 Maintenance and Support: Market Drivers

8 Physical Identity and Access Management Market, By Organization Size (Page No. - 59)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.2.1 Small and Medium-Sized Enterprises: Market Drivers

8.3 Large Enterprises

8.3.1 Large Enterprises: Market Drivers

9 Physical Identity and Access Management Market, By Vertical (Page No. - 63)

9.1 Introduction

9.2 Government and Defense

9.2.1 Government and Defense: Market Drivers

9.3 Energy and Utilities

9.3.1 Energy and Utilities: Market Drivers

9.4 Information Technology and IT-Enabled Services

9.4.1 Information Technology and IT-Enabled Services: Market Drivers

9.5 Telecom

9.5.1 Telecom: Market Drivers

9.6 Banking, Financial Services and Insurance

9.6.1 Banking, Financial Services and Insurance: Market Drivers

9.7 Healthcare

9.7.1 Healthcare: Market Drivers

9.8 Education

9.8.1 Education: Market Drivers

9.9 Transportation

9.9.1 Transportation: Market Drivers

9.10 Others

10 Physical Identity and Access Management Market, By Region (Page No. - 74)

10.1 Introduction

10.2 North America

10.2.1 North America: Market Drivers

10.2.2 United States

10.2.3 Canada

10.3 Europe

10.3.1 Europe: Market Drivers

10.3.2 United Kingdom

10.3.3 Germany

10.3.4 France

10.3.5 Rest of Europe

10.4 Asia Pacific

10.4.1 Asia Pacific: Market Drivers

10.4.2 China

10.4.3 Japan

10.4.4 India

10.4.5 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 Middle East and Africa: Market Drivers

10.5.2 Middle East

10.5.3 Africa

10.6 Latin America

10.6.1 Latin America: Market Drivers

10.6.2 Brazil

10.6.3 Mexico

10.6.4 Rest of Latin America

11 Competitive Landscape (Page No. - 122)

11.1 Competitive Leadership Mapping

11.1.1 Visionary Leaders

11.1.2 Innovators

11.1.3 Dynamic Differentiators

11.1.4 Emerging Companies

12 Company Profiles (Page No. - 124)

12.1 Introduction

12.2 HID Global (Quantum Secure)

(Business Overview, Software Offered, Recent Developments, and SWOT Analysis)*

12.3 AlertEnterprise

12.4 IDCUBE Identification Systems

12.5 Micro Focus

12.6 OKTa

12.7 Access Security Corporation

12.8 Gemalto

12.9 IBM

12.10 Oracle

12.11 AWS

12.12 Avatier

12.13 Wallix Group

12.14 Atos

12.15 Identiv

12.16 Nexus Group (Integid GmbH)

12.17 Alfrednet

12.18 Wipro

12.19 One Identity

12.20 Sequr

12.21 E&M Technologies

12.22 WSO2

*Details on Business Overview, Software Offered, Recent Developments, and SWOT Analysis Might Not be Captured in Case of Unlisted Companies.

12.23 Right to Win

13 Appendix (Page No. - 153)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (114 Tables)

Table 1 United States Dollar Exchange Rate, 2016–2019

Table 2 Physical Identity and Access Management Market Ecosystem: Vendor Selection and Evaluation Criteria

Table 3 Revenue Share Estimates for Selected Vendors

Table 4 Market Size and Growth, 2018–2025 (USD Million, CAGR {%})

Table 5 Use Case: Healthcare

Table 6 Use Case: Defense

Table 7 Use Case: Education

Table 8 Use Case: Transportation and Logistics

Table 9 Use Case: Manufacturing

Table 10 Market Size, By Component, 2018–2025 (USD Million)

Table 11 Software: Market Size, By Region, 2018–2025 (USD Million)

Table 12 Services: Market Size, By Region, 2018–2025 (USD Million)

Table 13 Market Size, By Service, 2018–2025 (USD Million)

Table 14 Consulting: Market Size, By Region, 2018–2025 (USD Million)

Table 15 Implementation and Integration: Market Size, By Region, 2018–2025 (USD Million)

Table 16 Maintenance and Support: Market Size, By Region, 2018–2025 (USD Million)

Table 17 Market Size, By Organization Size, 2018–2025 (USD Million)

Table 18 Small and Medium-Sized Enterprises: Market Size, By Region, 2018–2025 (USD Million)

Table 19 Large Enterprises: Market Size, By Region, 2018–2025 (USD Million)

Table 20 Physical Identity and Access Management Market Size, By Vertical, 2018–2025 (USD Million)

Table 21 Government and Defense: Market Size, By Region, 2018–2025 (USD Million)

Table 22 Energy and Utilities: Market Size, By Region, 2018–2025 (USD Million)

Table 23 Information Technology and IT-Enabled Services: Market Size, By Region, 2018–2025 (USD Million)

Table 24 Telecom: Market Size, By Region, 2018–2025 (USD Million)

Table 25 Banking, Financial Services and Insurance: Market Size, By Region, 2018–2025 (USD Million)

Table 26 Healthcare: Market Size, By Region, 2018–2025 (USD Million)

Table 27 Education: Market Size, By Region, 2018–2025 (USD Million)

Table 28 Transportation: Market Size, By Region, 2018–2025 (USD Million)

Table 29 Others: Market Size, By Region, 2018–2025 (USD Million)

Table 30 Physical Identity and Access Management Market Size, By Region, 2018–2025 (USD Million)

Table 31 North America: Market Size, By Component, 2018–2025 (USD Million)

Table 32 North America: Market Size, By Service, 2018–2025 (USD Million)

Table 33 North America: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 34 North America: Market Size, By Vertical, 2018–2025 (USD Million)

Table 35 North America: Market Size, By Country, 2018–2025 (USD Million)

Table 36 United States: Market Size, By Component, 2018–2025 (USD Million)

Table 37 United States: Market Size, By Service, 2018–2025 (USD Million)

Table 38 United States: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 39 United States: Market Size, By Vertical, 2018–2025 (USD Million)

Table 40 Canada: Market Size, By Component, 2018–2025 (USD Million)

Table 41 Canada: Market Size, By Service, 2018–2025 (USD Million)

Table 42 Canada: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 43 Canada: Market Size, By Vertical, 2018–2025 (USD Million)

Table 44 Europe: Market Size, By Component, 2018–2025 (USD Million)

Table 45 Europe: Physical Identity and Access Management Market Size, By Service, 2018–2025 (USD Million)

Table 46 Europe: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 47 Europe: Market Size, By Vertical, 2018–2025 (USD Million)

Table 48 Europe: Market Size, By Country, 2018–2025 (USD Million)

Table 49 United Kingdom: Market Size, By Component, 2018–2025 (USD Million)

Table 50 United Kingdom: Market Size, By Service, 2018–2025 (USD Million)

Table 51 United Kingdom: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 52 United Kingdom: Market Size, By Vertical, 2018–2025 (USD Million)

Table 53 Germany: Market Size, By Component, 2018–2025 (USD Million)

Table 54 Germany: Market Size, By Service, 2018–2025 (USD Million)

Table 55 Germany: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 56 Germany: Market Size, By Vertical, 2018–2025 (USD Million)

Table 57 France: Market Size, By Component, 2018–2025 (USD Million)

Table 58 France: Market Size, By Service, 2018–2025 (USD Million)

Table 59 France: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 60 France: Physical Identity and Access Management Market Size, By Vertical, 2018–2025 (USD Million)

Table 61 Rest of Europe: Market Size, By Component, 2018–2025 (USD Million)

Table 62 Rest of Europe: Market Size, By Service, 2018–2025 (USD Million)

Table 63 Rest of Europe: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 64 Rest of Europe: Market Size, By Vertical, 2018–2025 (USD Million)

Table 65 Asia Pacific: Market Size, By Component, 2018–2025 (USD Million)

Table 66 Asia Pacific: Market Size, By Service, 2018–2025 (USD Million)

Table 67 Asia Pacific: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 68 Asia Pacific: Market Size, By Vertical, 2018–2025 (USD Million)

Table 69 Asia Pacific: Physical Identity and Access Management Market Size, By Country, 2018–2025 (USD Million)

Table 70 China: Market Size, By Component, 2018–2025 (USD Million)

Table 71 China: Market Size, By Service, 2018–2025 (USD Million)

Table 72 China: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 73 China: Market Size, By Vertical, 2018–2025 (USD Million)

Table 74 Japan: Market Size, By Component, 2018–2025 (USD Million)

Table 75 Japan: Market Size, By Service, 2018–2025 (USD Million)

Table 76 Japan: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 77 Japan: Market Size, By Vertical, 2018–2025 (USD Million)

Table 78 India: Physical Identity and Access Management Market Size, By Component, 2018–2025 (USD Million)

Table 79 India: Market Size, By Service, 2018–2025 (USD Million)

Table 80 India: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 81 India: Market Size, By Vertical, 2018–2025 (USD Million)

Table 82 Rest of Asia Pacific: gement Market Size, By Component, 2018–2025 (USD Million)

Table 83 Rest of Asia Pacific: Market Size, By Service, 2018–2025 (USD Million)

Table 84 Rest of Asia Pacific: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 85 Rest of Asia Pacific: Market Size, By Vertical, 2018–2025 (USD Million)

Table 86 Middle East and Africa: Market Size, By Component, 2018–2025 (USD Million)

Table 87 Middle East and Africa: Market Size, By Service, 2018–2025 (USD Million)

Table 88 Middle East and Africa: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 89 Middle East and Africa: Physical Identity and Access Management Market Size, By Vertical, 2018–2025 (USD Million)

Table 90 Middle East: Market Size, By Component, 2018–2025 (USD Million)

Table 91 Middle East: Market Size, By Service, 2018–2025 (USD Million)

Table 92 Middle East: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 93 Middle East: Market Size, By Vertical, 2018–2025 (USD Million)

Table 94 Africa: Market Size, By Component, 2018–2025 (USD Million)

Table 95 Africa: Market Size, By Service, 2018–2025 (USD Million)

Table 96 Africa: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 97 Africa: Market Size, By Vertical, 2018–2025 (USD Million)

Table 98 Latin America: Market Size, By Component, 2018–2025 (USD Million)

Table 99 Latin America: Market Size, By Service, 2018–2025 (USD Million)

Table 100 Latin America: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 101 Latin America: Market Size, By Vertical, 2018–2025 (USD Million)

Table 102 Latin America: Physical Identity and Access Management Market Size, By Country, 2018–2025 (USD Million)

Table 103 Brazil: Market Size, By Component, 2018–2025 (USD Million)

Table 104 Brazil: Market Size, By Service, 2018–2025 (USD Million)

Table 105 Brazil: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 106 Brazil: Market Size, By Vertical, 2018–2025 (USD Million)

Table 107 Mexico: Market Size, By Component, 2018–2025 (USD Million)

Table 108 Mexico: Market Size, By Service, 2018–2025 (USD Million)

Table 109 Mexico: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 110 Mexico: Market Size, By Vertical, 2018–2025 (USD Million)

Table 111 Rest of Latin America: Market Size, By Component, 2018–2025 (USD Million)

Table 112 Rest of Latin America: Market Size, By Service, 2018–2025 (USD Million)

Table 113 Rest of Latin America: Market Size, By Organization Size, 2018–2025 (USD Million)

Table 114 Rest of Latin America: Market Size, By Vertical, 2018–2025 (USD Million)

List of Figures (33 Figures)

Figure 1 Physical Identity and Access Management Market: Research Design

Figure 2 Sample Secondary Data: Geographic Analysis

Figure 3 Market Size Estimation Methodology: Approach 1

Figure 4 Market: Top-Down and Bottom-Up Approaches

Figure 5 Market Size Estimation Methodology: Revenue Generation From Physical Identity and Access Management Software and Services Vendors

Figure 6 Market Size Estimation Methodology: Illustrative Example of AWS (2018)

Figure 7 Competitive Leadership Mapping: Criteria Weightage

Figure 8 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 9 North America to Hold the Highest Market Share in 2020

Figure 10 Fastest-Growing Segments of the Market

Figure 11 Increasing Incidents of Insider Threats to Drive the Adoption of Physical Identity and Access Management Software and Services

Figure 12 Banking, Financial Services and Insurance Vertical and North America to Hold the Highest Market Shares in 2020

Figure 13 Maintenance and Support Segment to Hold the Highest Market Share During the Forecast Period

Figure 14 Banking, Financial Services and Insurance Segment to Hold the Highest Market Share in 2020

Figure 15 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Software Segment to Account for a Larger Market Size During the Forecast Period

Figure 17 Maintenance and Support Segment to Account for the Largest Market Size During the Forecast Period

Figure 18 Small and Medium-Sized Enterprises Segment to Record a Higher CAGR During Forecast Period

Figure 19 Banking, Financial Services and Insurance Vertical to Dominate the Market During the Forecast Period

Figure 20 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 21 North America: Market Snapshot

Figure 22 Asia Pacific: Market Snapshot

Figure 23 Physical Identity and Access Management Market (Global), Competitive Leadership Mapping, 2020

Figure 24 HID Global (Quantum Secure): SWOT Analysis

Figure 25 AlertEnterprise: SWOT Analysis

Figure 26 IDCUBE Identification Systems: SWOT Analysis

Figure 27 Micro Focus: Company Snapshot

Figure 28 Micro Focus: SWOT Analysis

Figure 29 Okta: Company Snapshot

Figure 30 Gemalto: Company Snapshot

Figure 31 IBM: Company Snapshot

Figure 32 Oracle: Company Snapshot

Figure 33 AWS: Company Snapshot

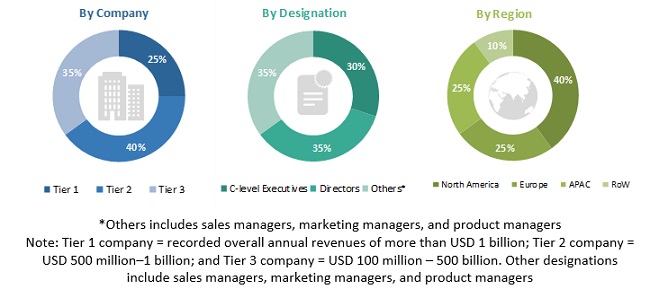

The study involved four major activities to estimate the current size of the physical identity and access management market. An exhaustive secondary research was done to collect information on the physical identity and access management market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the size of the segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet have been referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, certified publications, such as International Journal of Engineering and Advanced Technology (IJEAT), Association of Information Technology Professionals (AITF), Information Security Forum (ISF) and Journal of Internet Security and Applications (JISA) and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The physical identity and access management market comprises several stakeholders, physical identity and access management specialists, physical identity and access management solution providers, business analysts, business intelligence tools, enterprise users, telecommunication providers, technology consultants, and System Integrators (SIs). The demand side of the market consists of Information Technology (IT) and IT-Enabled Services (ITeS), Banking, Financial Services and Insurance (BFSI), telecom, government and defense, transportation, healthcare, education, and others. The supply side includes physical identity and access management software providers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakup of the primary respondent

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the physical identity and access management market. These methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global physical identity and access management market by component, service, organization size, vertical, and region from 2020 to 2025, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the physical identity and access management market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the European market, which includes the rest of Europe countries, such as the Netherlands, Spain, and Italy

- Further breakup of the APAC market includes South Korea, Australia, and Singapore

- Further breakup of the Latin America market, comprising Venezuela and Argentina

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Physical Identity and Access Management Market