Perimeter Intrusion Detection Systems Market by Component (Solutions and Services), Solutions (Sensors & Video Surveillance Systems), Services, Organization Size, Deployment Type, Vertical, and Region - Global Forecast to 2023

[139 Pages Report] The perimeter intrusion detection systems market was valued at USD 9.52 Billion in 2017 and is projected to reach USD 21.75 Billion by 2023, at a CAGR of 15.2% during the forecast period. The base year considered for the study is 2017 and the forecast period is from 2018 to 2023.

Objectives of the study:

- To define, describe, segment, and forecast the perimeter intrusion detection systems market based on component, deployment type, organization size, vertical, and region

- To analyze various macro and microeconomic factors that affect the growth of the market

- To forecast the size of market segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze each submarket with respect to individual growth trends, prospects, and their contribution to the perimeter intrusion detection systems market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To profile key market players and provide comprehensive analysis based on their business overviews, product offerings, regional presence, business strategies, and key financials with the help of in-house statistical tools to understand the competitive landscape of the market

- To track and analyze competitive developments such as mergers & acquisitions, product developments, agreements, partnerships & collaborations, and Research & Development (R&D) activities undertaken by key players in the market

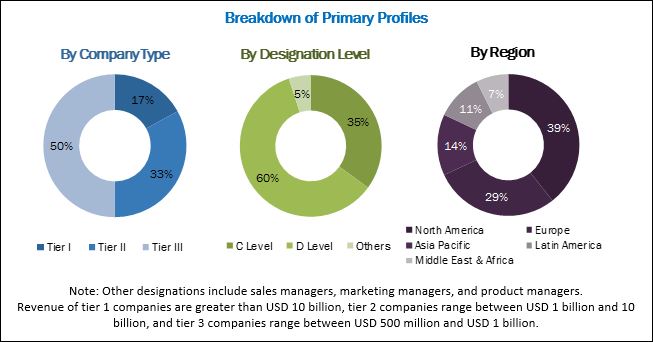

The research methodology used to estimate and forecast the size of the perimeter intrusion detection systems market began with capturing data on key vendor revenues through secondary research. Secondary sources referred for this research study included annual reports, white papers, certified publications, databases, such as Factiva and Bloomberg, press releases, and investor presentations of perimeter intrusion detection systems vendors, as well as articles from recognized industry associations, statistics bureaus, and government publishing sources. Vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall size of the market by estimating revenues of key market players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key individuals, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

The breakdown of profiles of primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The perimeter intrusion detection systems market ecosystem includes key players, such as Honeywell (US), FLIR Systems (US), Johnson Controls (US), Anixter (US), Axis Communications (Sweden), Schneider Electric (France), Senstar Corporation (Canada), RBtec Perimeter Security Systems (US), Southwest Microwave (US), Advanced Perimeter Systems (UK), Fiber SenSys (US), CIAS Elettronica (Italy), UTC Climate, Controls & Security (US), Future Fibre Technologies (Australia), SORHEA (France), DeTekion Security Systems (US), Jacksons Fencing (UK), and Harper Chalice Group (UK).

Key Target Audience For Perimeter Intrusion Detection Systems Market

Government Organizations and Agencies

- Software Application Vendors

- Hardware Vendors

- Investors and Venture Capitalists

- Network and System Integrators

- Security Systems Suppliers

- System Integrators

Scope of the Report

The research report categorizes the market into the following segments and subsegments:

Perimeter Intrusion Detection Systems Market By Component

- Solutions

- Sensors

- Microwave Sensors

- Infrared Sensors

- Fiber-optic Sensors

- Radar Sensors

- Others

- Video Surveillance Systems

- Hardware

- Camera

- Monitor

- Server

- Storage

- Others

- Software

- Video Management Software

- Video Analytics

- Hardware

- Sensors

- Services

- Professional Services

- Managed Services

Perimeter Intrusion Detection Systems Market By Deployment Type

- Open Area

- Fence Mounted

- Buried

Perimeter Intrusion Detection Systems Market By Organization Size

- Large Enterprises

- Small & Medium-sized Enterprises (SMEs)

Perimeter Intrusion Detection Systems Market By Vertical

- Critical Infrastructure

- Military & Defense

- Government

- Transportation

- Industrial

- Correctional Facilities

- Commercial

- Others

Perimeter Intrusion Detection Systems Market By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Available Customizations

Along with the given market data, MarketsandMarkets offers customization as per a companys specific requirements. The following customization options are available for the report:

Geographic Analysis

- Further country-level breakdown of the North America perimeter intrusion detection systems market

- Further country-level breakdown of the Europe market

- Further country-level breakdown of the Asia Pacific market

- Further country-level breakdown of the Middle East & Africa market

- Further country-level breakdown of the Latin America market

Company Information

- Detailed analysis and profiles of additional market players

The perimeter intrusion detection systems market is projected to grow from USD 10.73 Billion in 2018 to USD 21.75 Billion by 2023, at a CAGR of 15.2% during the forecast period. Increasing installations of video surveillance for security systems and rising demand for remote access through the cloud and wireless technology in security systems are key factors contributing to the growth of the market. Government regulations to improve perimeter security and curb infiltration as well as terrorist activities are providing lucrative growth opportunities to vendors of perimeter intrusion detection systems.

The perimeter intrusion detection systems market has been segmented on the basis of component, deployment type, organization size, vertical, and region. Based on component, the market has been segmented into solutions and services. The solutions segment has been further classified into sensors and video surveillance systems. The services segment has been further classified into professional services and managed services. Based on deployment type, the market has been segmented into open area, fence mounted, and buried. Based on organization size, the market has been segmented into large enterprises and Small & Medium-sized Enterprises (SMEs). Based on vertical, the market has been segmented into critical infrastructure, military & defense, government, transportation, industrial, correctional facilities, commercial, and others (educational facilities, townships, and residential apartments). Key regions covered in this report include North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Based on component, the solutions segment is expected to lead the perimeter intrusion detection systems market in 2018. The growth of this segment can be attributed to the rise in demand for integration of visual alarm verification in video surveillance systems and video analytics.

Based on deployment type, the open area segment is expected to lead the market in 2018. Increased terrorist activities and rise in demand for perimeter intrusion detection systems from the transportation sector facilitates the deployment of security solutions in open areas, such as airports and railways.

Based on vertical, the critical infrastructure segment is estimated to account for the largest share of the perimeter intrusion detection systems market in 2018. The use of sensors and video surveillance systems in chemical plants, oil & gas refineries, tank farms, offshore rigs, and well pads; solar farms; mining sites; and conventional and nuclear power stations is expected to drive the growth of the market for critical infrastructure.

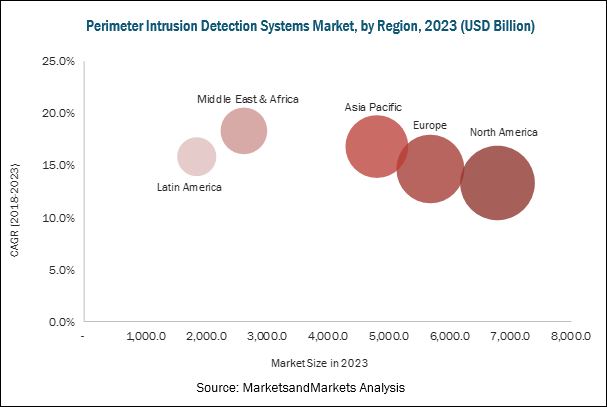

North America is estimated to be the largest market for perimeter intrusion detection systems in 2018. The growth of this market in North America is primarily driven by the presence of key market players such as Honeywell (US), FLIR Systems (US), Johnson Controls (US), Anixter (US), RBtec Perimeter Security Systems (US), Southwest Microwave (US), and Fiber SenSys (US) in this region. The perimeter intrusion detection systems market in the Middle East & Africa is expected to grow at the highest CAGR during the forecast period.

A key restraining factor impacting the growth of the perimeter intrusion detection systems market is rising concerns regarding False Alarm Rates (FAR).

Key players operating in this market include Honeywell (US), FLIR Systems (US), Johnson Controls (US), Anixter (US), Axis Communications (Sweden), Schneider Electric (France), Senstar Corporation (Canada), RBtec Perimeter Security Systems (US), Southwest Microwave (US), Advanced Perimeter Systems (UK), Fiber SenSys (US), CIAS Elettronica (Italy), UTC Climate, Controls & Security (US), Future Fibre Technologies (Australia), SORHEA (France), DeTekion Security Systems (US), Jacksons Fencing (UK), and Harper Chalice Group (UK). These companies are focused on the adoption of various growth strategies, such as new product launches, product enhancements, agreements, partnerships, and collaborations, to strengthen their foothold in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Perimeter Intrusion Detection Systems Market

4.2 North America: Market By Component

4.3 Europe: Market By Solution

4.4 Middle East and Africa: Market By Service

4.5 Asia Pacific: Market By Vertical

4.6 Market By Vertical and Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Installations of Video Surveillance for Security Systems

5.2.1.2 Increasing Demand for Remote Access Through the Cloud and Wireless Technology in Security Systems

5.2.2 Restraints

5.2.2.1 False Alarm Rates

5.2.3 Opportunities

5.2.3.1 Increase in Smart City Initiatives Worldwide

5.2.3.2 Government Regulations to Improve Perimeter Security and Curb Infiltration and Terrorist Activities

5.2.3.3 Evolution of Next-Generation Integrated Systems

5.2.4 Challenges

5.2.4.1 Integration of New Technologies in the Existing Systems

5.2.4.2 High Installation and Maintenance Costs for Small and Medium-Sized Enterprises (SMEs)

5.3 Industry Trends

5.3.1 Introduction

5.3.2 Value Chain Analysis

5.3.2.1 Perimeter Security Solution Vendors

5.3.2.2 System Integrators

5.3.2.3 Service Providers

5.3.2.4 Verticals

5.3.3 Case Studies

5.3.3.1 Case Study 1: Standard Electric, With the Help of Senstar Systems, Installed A Multi-Layer Intrusion Detection Solution

6 Perimeter Intrusion Detection Systems Market, By Component (Page No. - 39)

6.1 Introduction

6.2 Solutions

6.2.1 Sensors

6.2.1.1 Microwave Sensors

6.2.1.2 Infrared Sensors

6.2.1.3 Fiber Optic Sensors

6.2.1.4 Radar Sensors

6.2.1.5 Others

6.2.2 Video Surveillance Systems

6.2.2.1 Hardware

6.2.2.1.1 Cameras

6.2.2.1.2 Monitors

6.2.2.1.3 Servers

6.2.2.1.4 Storage

6.2.2.1.5 Others

6.2.2.2 Software

6.2.2.2.1 Video Management Software

6.2.2.2.2 Video Analytics

6.3 Services

6.3.1 Professional Services

6.3.1.1 Implementation and Integration Services

6.3.1.2 Support and Maintenance Services

6.3.1.3 Consulting Services

6.3.2 Managed Services

7 Perimeter Intrusion Detection Systems Market, By Organization Size (Page No. - 52)

7.1 Introduction

7.2 Small and Medium-Sized Enterprises

7.3 Large Enterprises

8 Perimeter Intrusion Detection Systems Market, By Deployment Type (Page No. - 56)

8.1 Introduction

8.2 Open Area

8.3 Fence-Mounted

8.4 Buried

9 Perimeter Intrusion Detection Systems Market, By Vertical (Page No. - 61)

9.1 Introduction

9.2 Critical Infrastructure

9.3 Military and Defense

9.3.1 Land

9.3.2 Naval

9.3.3 Airborne

9.4 Government

9.5 Transportation

9.6 Industrial

9.7 Correctional Facilities

9.8 Commercial

9.9 Others

10 Perimeter Intrusion Detection Systems Market, By Region (Page No. - 71)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.2 Canada

10.3 Europe

10.3.1 United Kingdom

10.3.2 Germany

10.3.3 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 India

10.4.3 Rest of APAC

10.5 Middle East and Africa

10.5.1 Middle East

10.5.2 Africa

10.6 Latin America

10.6.1 Mexico

10.6.2 Rest of Latin America

11 Competitive Landscape (Page No. - 91)

11.1 Overview

11.2 Competitive Situation and Trends

11.2.1 New Product Launches and Product Enhancements

11.2.2 Agreements, Collaborations, and Partnerships

11.2.3 Acquisitions

11.2.4 Expansions

11.3 Market Ranking of Key Players

12 Company Profiles (Page No. - 97)

12.1 Honeywell

12.1.1 Business Overview

12.1.2 Solutions Offered

12.1.3 Recent Developments

12.1.4 SWOT Analysis

12.1.5 MnM View

12.2 Flir Systems

12.2.1 Business Overview

12.2.2 Products/Solutions Offered

12.2.3 Recent Developments

12.2.4 SWOT Analysis

12.2.5 MnM View

12.3 Johnson Controls

12.3.1 Business Overview

12.3.2 Solutions Offered

12.3.3 Recent Developments

12.3.4 SWOT Analysis

12.3.5 MnM View

12.4 Anixter

12.4.1 Business Overview

12.4.2 Products/Solutions Offered

12.4.3 Recent Developments

12.4.4 SWOT Analysis

12.4.5 MnM View

12.5 Axis Communications

12.5.1 Business Overview

12.5.2 Products/Solutions Offered

12.5.3 Recent Developments

12.5.4 SWOT Analysis

12.5.5 MnM View

12.6 Schneider Electric

12.6.1 Business Overview

12.6.2 Products Offered

12.6.3 Recent Developments

12.7 Senstar

12.7.1 Business Overview

12.7.2 Products Offered

12.7.3 Recent Developments

12.8 Rbtec Perimeter Security Systems

12.8.1 Business Overview

12.8.2 Products/Solutions Offered

12.8.3 Recent Developments

12.9 Southwest Microwave

12.9.1 Business Overview

12.9.2 Products/Solutions Offered

12.9.3 Recent Developments

12.10 Advanced Perimeter Systems

12.10.1 Business Overview

12.10.2 Products Offered

12.10.3 Recent Developments

12.11 Fiber Sensys

12.11.1 Business Overview

12.11.2 Products/Services Offered

12.11.3 Recent Developments

12.12 Cias Elettronica Srl

12.12.1 Business Overview

12.12.2 Products/ Services Offered

12.12.3 Recent Developments

12.13 Utc Climate, Controls & Security

12.13.1 Business Overview

12.13.2 Products/Solutions Offered

12.13.3 Recent Developments

12.14 Future Fibre Technologies

12.14.1 Business Overview

12.14.2 Products/Solutions/Services Offered

12.14.3 Recent Developments

12.15 Sorhea

12.15.1 Business Overview

12.15.2 Products/Solutions/Services Offered

12.16 Detekion Security Systems

12.16.1 Business Overview

12.16.2 Products/Solutions/Services Offered

12.17 Jacksons Fencing

12.17.1 Business Overview

12.17.2 Products/Solutions/Services Offered

12.18 Harper Chalice

12.18.1 Business Overview

12.18.2 Products/Solutions/Services Offered

12.18.3 Recent Developments

12.19 Key Innovators

12.19.1 Sightlogix

12.19.2 Puretech Systems

12.19.3 D-Fence

12.19.4 Heras

12.19.5 Aventura Technologies

12.19.6 Godrej Security Solutions

12.19.7 Detection Technologies

13 Appendix (Page No. - 130)

13.1 Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (73 Tables)

Table 1 Perimeter Intrusion Detection Systems Market Size, By Component, 20162023 (USD Million)

Table 2 Solutions: Market Size, By Type, 20162023 (USD Million)

Table 3 Solutions: Market Size, By Region, 20162023 (USD Million)

Table 4 Sensors: Market Size, By Type, 20162023 (USD Million)

Table 5 Sensors: Market, By Region, 20162023 (USD Million)

Table 6 Microwave Sensors Market Size, By Region, 20162023 (USD Million)

Table 7 Infrared Sensors Market Size, By Region, 20162023 (USD Million)

Table 8 Fiber Optic Sensors Market Size, By Region, 20162023 (USD Million)

Table 9 Radar Sensors Market Size, By Region, 20162023 (USD Million)

Table 10 Others Market, By Region, 20162023 (USD Million)

Table 11 Video Surveillance Systems: Perimeter Intrusion Detection Systems Size, By Region, 20162023 (USD Million)

Table 12 Services: Market Size, By Type, 20162023 (USD Million)

Table 13 Services: Market Size, By Region, 20162023 (USD Million)

Table 14 Professional Services Market Size, By Region, 20162023 (USD Million)

Table 15 Managed Services Market Size, By Region, 20162023 (USD Million)

Table 16 Perimeter Intrusion Detection Systems Market Size, By Organization Size, 20162023 (USD Million)

Table 17 Small and Medium-Sized Enterprises: Market Size, By Region, 20162023 (USD Million)

Table 18 Large Enterprises: Perimeter Intrusion Detection Systems Size, By Region, 20162023 (USD Million)

Table 19 Perimeter Intrusion Detection Systems Market Size, By Deployment Type, 20162023 (USD Million)

Table 20 Open Area: Market Size, By Region, 20162023 (USD Million)

Table 21 Fence-Mounted: Market Size, By Region, 20162023 (USD Million)

Table 22 Buried: Market Size, By Region, 20162023 (USD Million)

Table 23 Perimeter Intrusion Detection Systems Size, By Vertical, 20162023 (USD Million)

Table 24 Critical Infrastructure: Market Size, By Region, 20162023 (USD Million)

Table 25 Military and Defense: Market Size, By Region, 20162023 (USD Million)

Table 26 Government: Market Size, By Region, 20162023 (USD Million)

Table 27 Transportation: Market Size, By Region, 20162023 (USD Million)

Table 28 Industrial: Perimeter Intrusion Detection Systems Size, By Region, 20162023 (USD Million)

Table 29 Correctional Facilities: Market Size, By Region, 20162023 (USD Million)

Table 30 Commercial: Market Size, By Region, 20162023 (USD Million)

Table 31 Others: Market Size, By Region, 20162023 (USD Million)

Table 32 Perimeter Intrusion Detection Systems Market Size, By Region, 2016-2022 (USD Million)

Table 33 North America: Market Size, By Country, 20162023 (USD Million)

Table 34 North America: Perimeter Intrusion Detection Systems Market Size, By Component, 20162023 (USD Million)

Table 35 North America: Market Size, By Solutions, 20162023 (USD Million)

Table 36 North America: Market Size, By Sensors, 20162023 (USD Million)

Table 37 North America: Market Size, By Services, 20162023 (USD Million)

Table 38 North America: Perimeter Intrusion Detection Systems Size, By Deployment Type, 20162023 (USD Million)

Table 39 North America: Market Size, By Vertical, 20162023 (USD Million)

Table 40 Europe: Perimeter Intrusion Detection Systems Market Size, By Country, 20162023 (USD Million)

Table 41 Europe: Market Size, By Component, 20162023 (USD Million)

Table 42 Europe: Market Size, By Solutions, 20162023 (USD Million)

Table 43 Europe: Market Size, By Sensors, 20162023 (USD Million)

Table 44 Europe: Market Size, By Services, 20162023 (USD Million)

Table 45 Europe: Perimeter Intrusion Detection Systems Size, By Deployment Type, 20162023 (USD Million)

Table 46 Europe: Market Size, By Vertical, 20162023 (USD Million)

Table 47 Asia Pacific: Perimeter Intrusion Detection Systems Market Size, By Country, 20162023 (USD Million)

Table 48 Asia Pacific: Market Size, By Component, 20162023 (USD Million)

Table 49 Asia Pacific: Market Size, By Solutions, 20162023 (USD Million)

Table 50 Asia Pacific: Market Size, By Sensors, 20162023 (USD Million)

Table 51 Asia Pacific: Market Size, By Services, 20162023 (USD Million)

Table 52 Asia Pacific: Perimeter Intrusion Detection Systems Size, By Deployment Type, 20162023 (USD Million)

Table 53 Asia Pacific: Market Size, By Vertical, 20162023 (USD Million)

Table 54 Middle East and Africa: Perimeter Intrusion Detection Systems Market Size, By Country, 20162023 (USD Million)

Table 55 Middle East and Africa: Market Size, By Component, 20162023 (USD Million)

Table 56 Middle East and Africa: Market Size, By Solutions, 20162023 (USD Million)

Table 57 Middle East and Africa: Market Size, By Sensors, 20162023 (USD Million)

Table 58 Middle East and Africa: Market Size, By Services, 20162023 (USD Million)

Table 59 Middle East and Africa: Perimeter Intrusion Detection Systems Size, By Deployment Type, 20162023 (USD Million)

Table 60 Middle East and Africa: Market Size, By Vertical, 20162023 (USD Million)

Table 61 Latin America: Perimeter Intrusion Detection Systems Market Size, By Country, 20162023 (USD Million)

Table 62 Latin America: Market Size, By Component, 20162023 (USD Million)

Table 63 Latin America: Market Size, By Solutions, 20162023 (USD Million)

Table 64 Latin America: Market Size, By Sensors, 20162023 (USD Million)

Table 65 Latin America: Market Size, By Services, 20162023 (USD Million)

Table 66 Latin America: Perimeter Intrusion Detection Systems Size, By Deployment Type, 20162023 (USD Million)

Table 67 Latin America: Perimeter Intrusion Detection Systems Market Size, By Vertical, 20162023 (USD Million)

Table 68 Market Evaluation Framework

Table 69 New Product Launches and Product Enhancements, January 2017March 2018

Table 70 Agreements, Collaborations, and Partnerships, May 2016November 2017

Table 71 Acquisitions, April 20162018

Table 72 Expansions, May 2016April 2018

Table 73 Market Ranking of Key Players in the Perimeter Intrusion Detection Systems Market, 2018

List of Figures (38 Figures)

Figure 1 Market Segmentation: Perimeter Intrusion Detection Systems Market

Figure 2 Perimeter Intrusion Detection Systems : Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Perimeter Intrusion Detection Systems Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Perimeter Intrusion Detection Systems Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Perimeter Intrusion Detection Systems Market, By Component, 20182023 (USD Million)

Figure 8 Perimeter Intrusion Detection Systems Market, By Deployment Type, 20182023 (USD Million)

Figure 9 Perimeter Intrusion Detection Systems Market, By Vertical, 2018

Figure 10 Perimeter Intrusion Detection Systems Market, By Region, 20182023 (USD Million)

Figure 11 Middle East and Africa is Expected to Grow at the Highest Rate During the Forecast Period

Figure 12 Increasing Installations of Video Surveillance for Security Systems is Driving the Market Growth

Figure 13 Services Segment is Projected to Grow at A Higher CAGR During the Forecast Period

Figure 14 Video Surveillance Systems Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 15 Managed Services Segment Expected to Grow at A Higher CAGR During the Forecast Period

Figure 16 Military and Defense Vertical is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 17 Critical Infrastructure Segment and the Middle East and African Region are Projected to Grow at the Highest CAGRs During the Forecast Period

Figure 18 Perimeter Intrusion Detection Systems Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Value Chain Analysis

Figure 20 Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 21 Video Surveillance Systems Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 22 Radar Sensors Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Managed Services Segment Expected to Grow at A Higher CAGR During the Forecast Period

Figure 24 Large Enterprises Segment is Estimated to Lead the Perimeter Intrusion Detection Systems Market in 2018

Figure 25 Open Area Deployment Type is Estimated to Grow at the Highest Rate During the Forecast Period

Figure 26 Critical Infrastructure Segment is Estimated to Hold the Highest Market Share in 2018

Figure 27 Latin America is Estimated to Grow at the Highest Rate During the Forecast Period

Figure 28 The Market in Middle East and Africa is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 29 North America: Market Snapshot

Figure 30 Middle East and Africa: Market Snapshot

Figure 31 Companies Adopted New Product Launches as A Key Growth Strategy Between March 2016 and April 2018

Figure 32 Honeywell: Company Snapshot

Figure 33 Flir Systems: Company Snapshot

Figure 34 Johnson Controls: Company Snapshot

Figure 35 Anixter: Company Snapshot

Figure 36 Axis Communications: Company Snapshot

Figure 37 Schneider Electric: Company Snapshot

Figure 38 Future Fibre Technologies: Company Snapshot

Growth opportunities and latent adjacency in Perimeter Intrusion Detection Systems Market