Scale-out NAS Market by Component (Software, Service), Storage Technology (File, Block, Object), Deployment Type, Organization Size (SMES, Large Enterprises), Vertical (BFSI, Government, Healthcare), and Region - Global Forecast to 2022

[125 Pages Report] The scale-out NAS market is estimated to grow from USD 12.58 Billion in 2017 to USD 32.68 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 21.05% during the period 2017–2022. The base year considered for this study is 2016 and the forecast period considered is 2017–2022.

Objectives of the Study:

- To determine and forecast the global market based on component, storage technology, deployment type, organization size, vertical, and region

- To forecast the size of market segments with respect to four main regions, namely, North America, Europe, Asia-Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze each submarket with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile key market players and provide a competitive landscape of the market

- To track and analyze competitive developments, such as mergers & acquisitions, product developments, partnerships & collaborations, and Research & Development (R&D) activities in the market

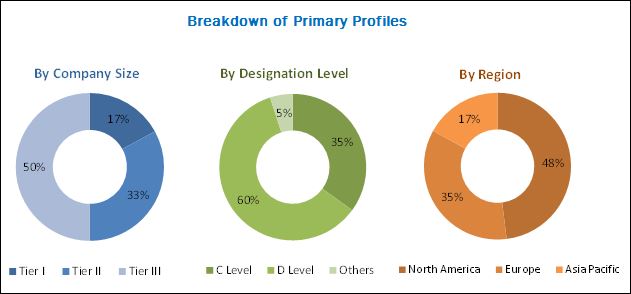

The research methodology used to estimate and forecast the scale-out NAS Market begins with capturing data on key vendor revenues and the market size of individual segments through secondary sources such as Storage Networking Industry Association (SNIA), journals such as Data Center Journal, PowerBuilder Journal, annual reports, white papers, certified publications, press releases, and investor presentations of scale-out NAS solution and service vendors, as well as articles from recognized industry associations, statistics bureaus, and government publishing sources. The vendor offerings are also taken into consideration to determine market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market from the individual segments. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key industry personnel, such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary discussion participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The scale-out NAS market ecosystem includes players such as Dell, Inc. (US), Hewlett Packard Enterprise (US), Nasuni Corporation (US), NetApp, Inc. (US), Hitachi Data Systems Ltd (US), IBM Corporation (US), Panasas, Inc. (US), Pure Storage, Inc. (US), Tintri, Inc. (US), Scality, Inc. (US), Nexenta Systems, Inc. (US), and Quantum Corporation (US) that provide varied scale-out NAS software and services.

Key Target Audience For Scale-out NAS Market

- Scale-out NAS Software Vendors

- Service Providers

- Application Design and Development Service Providers

- System Integrators/Migration Service Providers

- Consultancy Firms/Advisory Firms

- Training and Education Service Providers

- Data Integration Service Providers

- Managed Service Providers

Scope of the Report

The research report categorizes the scale-out NAS market to forecast the revenues and analyze the trends in each of the following subsegments:

By Component

- Software

- High Performance Computing

- Data Management & Integration

- Data Protection

- Big Data

- In-memory Datagrid

- Service

- Professional Services

- System Integration

By Software Technology

- File Storage

- Block Storage

- Object Storage

Scale-out NAS Market Deployment Type

- On-premises

- Cloud

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Vertical

- Banking, Financial Services & Insurance (BFSI)

- Consumer Goods & Retail

- IT & Telecom

- Energy

- Healthcare

- Government

- Manufacturing

- Education & Academics

By Region

- North America

- Europe

- Asia-Pacific (APAC)

- Rest of the World

Available Customizations

With the given market data, MarketsandMarkets offers customization as per the company’s specific requirements. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players

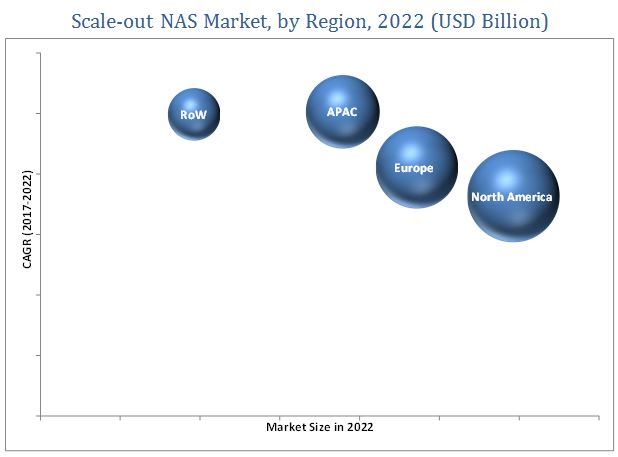

The scale-out NAS market size is projected to grow from USD 12.58 Billion in 2017 to reach USD 32.68 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 21.05% during the forecast period. The major drivers for the upsurge in the market growth include the increasing demand for scale-out NAS applications across enterprises.

The report covers the market analysis by component, storage technology, deployment type, organization size, vertical, and region. The component section is further segmented into software and service. The services subsegment is projected to grow at the highest CAGR during the forecast period owing to the extensive adoption of scale-out NAS software by various enterprises, such as BFSI, government & defense, healthcare, and retail to increase the efficiency of their storage systems. These software help in storage of rich content data files and big data sets, data archiving and backup, disaster recovery, data management & integration, data security, and high-performance computing. These features make data storage more scalable, secure, and easily manageable. The services subsegment is expected to create enough growth opportunities for the scale-out NAS market. Scale-out NAS services have been categorized into professional services and system integration.

The banking, financial services & insurance (BFSI) vertical segment is expected to have the largest market share in 2017 owing to the generation of voluminous data in this vertical which creates the need for highly secured data storage solutions. The scale-out NAS technologies enable advanced data storage techniques which help provide better solutions and services for the BFSI industry. New and improved financial products and services are frequently introduced by the BFSI organizations to enhance their business operations and expand their customer database, which makes the industry a lucrative market for scale-out NAS technology.

The scale-out NAS market is projected to witness significant growth in the Asia-Pacific region during the forecast period due to the increasing adoption of advanced storage technologies and rising amount of data generation. Increasing requirement of cost-effective storage solutions is expected to boost the adoption of scale-out NAS by SMEs and startups in the region.

One of the restraining factors that affects the growth of the market is the lack of technically skilled personnel. The scale-out NAS market vendors profiled in the report include Dell, Inc. (US), Hewlett Packard Enterprise (US), Nasuni Corporation (US), NetApp, Inc. (US), Hitachi Data Systems Ltd (US), IBM Corporation (US), Panasas, Inc. (US), Pure Storage, Inc. (US), Tintri, Inc. (US), Scality, Inc. (US), Nexenta Systems, Inc. (US), and Quantum Corporation (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Microquadrant Methodology

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Scale-out NAS Market

4.2 Market, By Component

4.3 Market, By Software

4.4 Market, By Service

4.5 Market, By Storage Technology

4.6 Market, By Deployment Type

4.7 Market, By Organization Size

4.8 Market, By Top Three Verticals and Regions

4.9 Market, By Region

4.10 Lifecycle Analysis, By Region

5 Market Overview and Industry Trends (Page No. - 33)

5.1 Introduction

5.2 Scale-Up NAS vs Scale-out NAS

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand for Scale-out NAS Applications Across Enterprises

5.3.1.2 High Cost and Downtime of Scale-Up Nas

5.3.1.3 Rising Need for High Throughput Rate, Increased I/O Capacity, and Low Latency With High Computing Parallel Processing

5.3.1.4 Big Data Analytics Propels the Growth of Advanced Parallel Storage Platforms

5.3.2 Restraints

5.3.2.1 Lack of Technically Skilled Personnel

5.3.3 Opportunities

5.3.3.1 Commercialization of Scale-out NAS Solution Anticipated to Drive the Growth of the NAS Market

5.3.3.2 Independent Node Hardware Failures Without Affecting the Whole Cluster Would Eliminate the Downtime Issue

5.3.3.3 Real-Time Data Consistency Would Enhance the Applicability of Scale-out Nas

5.3.4 Challenges

5.3.4.1 Resistant Nature of Storage Administrators to Alter Legacy Systems

5.3.4.2 Parallel Operations Between Storage Competency and Manageability Need Significant Developments

5.4 Industry Trends

6 Scale-out NAS Market, By Component (Page No. - 38)

6.1 Introduction

6.2 Software

6.2.1 High Performance Computing

6.2.2 Data Management & Integration

6.2.3 Data Protection

6.2.4 Big Data

6.2.5 In-Memory Datagrid

6.3 Service

6.3.1 Professional Services

6.3.2 System Integration

7 Scale-out NAS Market, By Storage Technology (Page No. - 46)

7.1 Introduction

7.2 File Storage

7.3 Block Storage

7.4 Object Storage

8 Market, By Deployment Type (Page No. - 50)

8.1 Introduction

8.2 On-Premises

8.3 Cloud

9 Scale-out NAS Market, By Organization Size (Page No. - 54)

9.1 Introduction

9.2 Large Enterprises

9.3 Small & Medium Enterprises (SMES)

10 Market, By Vertical (Page No. - 58)

10.1 Introduction

10.2 Banking, Financial Services & Insurance (BFSI)

10.3 Consumer Goods & Retail

10.4 IT & Telecom

10.5 Energy

10.6 Healthcare

10.7 Government

10.8 Manufacturing

10.9 Education & Academics

11 Scale-out NAS Market, By Region (Page No. - 66)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia-Pacific

11.5 Rest of the World

12 Competitive Landscape (Page No. - 82)

12.1 Microquadrant Overview

12.1.1 Vanguards

12.1.2 Innovators

12.1.3 Dynamic

12.1.4 Emerging

12.2 Product Offering

12.3 Business Strategy

13 Company Profiles (Page No. - 87)

(Business Overview, Product Offerings & Business Strategies, Recent Developments)*

13.1 Dell Inc.

13.2 Hewlett Packard Enterprise

13.3 Nasuni Corporation

13.4 Netapp, Inc.

13.5 Hitachi Data Systems Ltd.

13.6 IBM Corporation

13.7 Panasas, Inc.

13.8 Pure Storage, Inc.

13.9 Tintri, Inc.

13.10 Scality, Inc.

13.11 Nexenta Systems, Inc.

13.12 Quantum Corporation

*Details on Business Overview, Product Offerings & Business Strategies, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Key Innovators (Page No. - 116)

14.1 Stonefly, Inc

14.2 Qumulo, Inc.

15 Appendix (Page No. - 117)

15.1 Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

15.7 Author Details

List of Tables (60 Tables)

Table 1 Scale-out NAS Market Size and Growth, 2015–2022 (USD Billion, Y-O-Y %)

Table 2 Market Size and Growth, By Component, 2015–2022 (USD Billion, Y-O-Y %)

Table 3 Component: Market, By Type, 2015–2022 (USD Billion)

Table 4 Software: Market, By Type, 2015–2022 (USD Billion)

Table 5 High Performance Computing Software: Market, By Region, 2015–2022 (USD Billion)

Table 6 Data Management & Integration Software: Market, By Region, 2015–2022 (USD Billion)

Table 7 Data Protection Software: Market, By Region, 2015–2022 (USD Billion)

Table 8 Big Data Software: Market, By Region, 2015–2022 (USD Billion)

Table 9 In-Memory Datagrid: Market, By Region, 2015–2022 (USD Billion)

Table 10 Professional Services: Scale-out NAS Services Market, By Region, 2017–2022 (USD Billion)

Table 11 System Integration: Market, By Region, 2015–2022 (USD Billion)

Table 12 Storage Technology: Market, By Type, 2015–2022 (USD Billion)

Table 13 File Storage: Market, By Region, 2017–2022 (USD Billion)

Table 14 Block Storage: Market, By Region, 2015–2022 (USD Billion)

Table 15 Object Storage: Market, By Region, 2015–2022 (USD Billion)

Table 16 Scale-out NAS Market Size, By Deployment Type, 2015-2022 (USD Billion)

Table 17 On-Premises: Market Size, By Region, 2015-2022 (USD Billion)

Table 18 Cloud: Market Size, By Region, 2015-2022 (USD Billion)

Table 19 Market Size, By Organization Size, 2015-2022 (USD Billion)

Table 20 Large Enterprises: Market Size, By Region, 2015-2022 (USD Billion)

Table 21 SMES: Market Size, By Region, 2015-2022 (USD Billion)

Table 22 Scale-out NAS Market Size, By Vertical, 2015-2022 (USD Billion)

Table 23 BFSI: Market Size, By Region, 2015-2022 (USD Billion)

Table 24 Consumer Goods & Retail: Market Size, By Region, 2015–2022 (USD Billion)

Table 25 IT & Telecom: Market Size, By Region, 2015-2022 (USD Billion)

Table 26 Energy: Market Size, By Region, 2015-2022 (USD Billion)

Table 27 Healthcare: Market Size, By Region, 2015-2022 (USD Billion)

Table 28 Govenrment: Market Size, By Region, 2015-2022 (USD Billion)

Table 29 Manufacturing: Market Size, By Region, 2015-2022 (USD Billion)

Table 30 Education & Academics: Market Size, By Region, 2015-2022 (USD Billion)

Table 31 Scale-out NAS Market Size, By Region, 2015-2022 (USD Billion)

Table 32 North America: Market Size, By Component, 2015-2022 (USD Billion)

Table 33 North America: Market Size, By Software, 2015-2022 (USD Billion)

Table 34 North America: Market Size, By Service, 2015-2022 (USD Billion)

Table 35 North America: Market Size, By Storage Technology, 2015-2022 (USD Billion)

Table 36 North America: Market Size, By Organization Size, 2015-2022 (USD Billion)

Table 37 North America: Market Size, By Deployment Type, 2015-2022 (USD Billion)

Table 38 North America: Market Size, By Vertical, 2015-2022 (USD Billion)

Table 39 Europe: Market Size, By Component, 2015-2022 (USD Billion)

Table 40 Europe: Market Size, By Software, 2015-2022 (USD Billion)

Table 41 Europe: Market Size, By Service, 2015-2022 (USD Billion)

Table 42 Europe: Market Size, By Storage Technology, 2015-2022 (USD Billion)

Table 43 Europe: Market Size, By Organization Size, 2015-2022 (USD Billion)

Table 44 Europe: Market Size, By Deployment Type, 2015-2022 (USD Billion)

Table 45 Europe: Market Size, By Vertical, 2015-2022 (USD Billion)

Table 46 Asia-Pacific: Scale-out NAS Market Size, By Component, 2015-2022 (USD Billion)

Table 47 Asia-Pacific: Market Size, By Software, 2015-2022 (USD Billion)

Table 48 Asia-Pacific: Market Size, By Service, 2015-2022 (USD Billion)

Table 49 Asia-Pacific: Market Size, By Storage Technology, 2015-2022 (USD Billion)

Table 50 Asia-Pacific: Market Size, By Organization Size, 2015-2022 (USD Billion)

Table 51 Asia-Pacific: Market Size, By Deployment Type, 2015-2022 (USD Billion)

Table 52 Asia-Pacific: Market Size, By Vertical, 2015-2022 (USD Billion)

Table 53 Rest of the World: Market Size, By Component, 2015-2022 (USD Billion)

Table 54 Rest of the World: Market Size, By Software, 2015-2022 (USD Billion)

Table 55 Rest of the World: Market Size, By Service, 2015-2022 (USD Billion)

Table 56 Rest of the World: Market Size, By Storage Technology, 2015-2022 (USD Billion)

Table 57 Rest of the World: Market Size, By Organization Size, 2015-2022 (USD Billion)

Table 58 Rest of the World: Market Size, By Deployment Type, 2015-2022 (USD Billion)

Table 59 Rest of the World: Market Size, By Vertical, 2015-2022 (USD Billion)

Table 60 Market Ranking for the Scale-out NAS Market, 2017

List of Figures (60 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primaries: By Company Type, Designation, and Region

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Microquadrant: Criteria Weightage

Figure 7 Scale-out NAS Market: Assumptions

Figure 8 Global Market Growth Rate, 2015–2022 (USD Billion, Y-O-Y %)

Figure 9 North America is Estimated to Be the Largest Market for Scale-out NAS in 2017

Figure 10 Increasing Number of Rich Content Data Files in Enterprises is Expected to Drive the Market During the Forecast Period

Figure 11 The Service Segment is Projected to Grow at A Higher CAGR During the Forecast Period

Figure 12 The Data Management & Integration Software Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 13 The System Integration Service Segment is Projected to Grow at A Higher CAGR During the Forecast Period

Figure 14 The Object Storage Technology Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 15 The Cloud Segment is Projected to Grow at A Higher CAGR During the Forecast Period

Figure 16 The SMES Segment is Projected to Grow at A Higher CAGR During the Forecast Period

Figure 17 North America is Estimated to Be the Largest Market for Scale-out NAS in 2017

Figure 18 The Asia-Pacific Scale-out NAS Market is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 19 The Market has Growth Opportunities in Asia-Pacific

Figure 20 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 21 The Service Segment is Projected to Grow at A Higher CAGR During the Forecast Period

Figure 22 The Data Management & Integration Software Subsegment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 23 The System Integration Service Subsegment is Projected to Grow at A Higher CAGR During the Forecast Period

Figure 24 The Object Storage Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 25 The Cloud Segment is Projected to Grow at A Higher CAGR During the Forecast Period

Figure 26 The SMES Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 27 The Healthcare Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 28 North America is Estimated to Be the Largest Market for Scale-out NAS During 2017 to 2022

Figure 29 Geographic Snapshot: the Scale-out NAS Market in Asia-Pacific is Estimated to Witness the Highest Growth During Forecast Period

Figure 30 North America Market Snapshot

Figure 31 Microquadrant

Figure 32 Dell, Inc.: Product Offering Scorecard

Figure 33 Dell, Inc.: Business Strategy Scorecard

Figure 34 HPE: Company Snapshot

Figure 35 HPE: Product Offering Scorecard

Figure 36 HPE Company: Business Strategy Scorecard

Figure 37 Nasuni Corporation: Product Offering Scorecard

Figure 38 Nasuni Corporation: Business Strategy Scorecard

Figure 39 NetApp, Inc.: Company Snapshot

Figure 40 NetApp, Inc.: Product Offering Scorecard

Figure 41 NetApp, Inc.: Business Strategy Scorecard

Figure 42 Hitachi Data Systems Ltd.: Product Offering Scorecard

Figure 43 Hitachi Data Systems Ltd.: Business Strategy Scorecard

Figure 44 IBM Corporation: Company Snapshot

Figure 45 IBM Corporation: Product Offering Scorecard

Figure 46 IBM Corporation: Business Strategy Scorecard

Figure 47 Panasas, Inc.: Product Offering Scorecard

Figure 48 Panasas, Inc.: Business Strategy Scorecard

Figure 49 Pure Storage, Inc.: Company Snapshot

Figure 50 Pure Storage, Inc.: Product Offering Scorecard

Figure 51 Pure Storage, Inc.: Business Strategy Scorecard

Figure 52 Tintri, Inc.: Product Offering Scorecard

Figure 53 Tintri, Inc.: Business Strategy Scorecard

Figure 54 Scality, Inc.: Product Offering Scorecard

Figure 55 Scality, Inc.: Business Strategy Scorecard

Figure 56 Nexenta Systems, Inc.: Product Offering Scorecard

Figure 57 Nexenta Systems, Inc.: Business Strategy Scorecard

Figure 58 Quantum Corporation: Company Snapshot

Figure 59 Quantum Corporation: Product Offering Scorecard

Figure 60 Quantum Corporation: Business Strategy Scorecard

Growth opportunities and latent adjacency in Scale-out NAS Market