Infrastructure as a Service (IaaS) Market by Solution (Managed Hosting, Storage as a Service, DRaaS, Colocation, Network as a Service, Content Delivery, High Performance Computing as a Service), Deployment Types, End users, verticals, and Region - Global Forecast to 2020

[137 Pages Report] The infrastructure as a service (IaaS) market is expected to grow from USD 15.79 Billion in 2015 to USD 56.05 Billion by 2020, at a CAGR of 29.0%.

The infrastructure as a service (IaaS) market is witnessing tremendous growth and presents many opportunities, making it a lucrative market. The increasing demand for organizations to reduce the IT burden and lower the costs incurred in deploying data centers and hiring skilled resources to manage the IT infrastructures are driving the adoption of IaaS. The major areas of opportunities for IaaS are the increasing demand from the increasing number of SMBs, the need to deploy enterprise level computing capabilities to compete in the market, and the increasing digitalization among the organizations and the economies. Government initiatives to encourage the adoption of the internet and other advanced technologies in their economies are supporting the growth in this market. The infrastructure as a service market has been segmented by solution; deployment type; end user and industry vertical. This study has been done on a global level covering five regions broadly, namely, North Americas, Europe, APAC, MEA, and Latin America. The overall market is expected to grow from USD 15.79 Billion in 2015 to USD 56.05 Billion by 2020, at a CAGR of 29.0%.

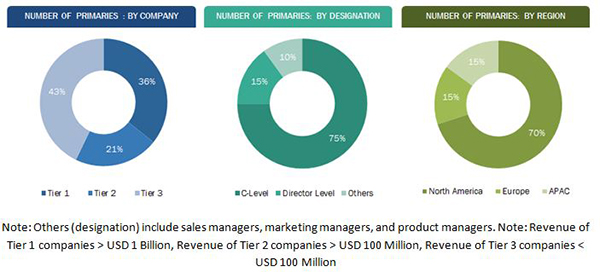

The research methodology used to estimate and forecast the infrastructure as a service market begins with capturing data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global IaaS market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub-segments which are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, Directors, and executives. This data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments.

The breakdown of profiles of primary is depicted in the below figure:

The security analytics ecosystem comprises of security analytics vendors such as AWS, Cisco Systems, IBM, Microsoft, Rackspace, Google, CSC, VMware, and Fujitsu.

Key Target Audience

- Networking Companies

- IaaS Providers

- Data Center Providers

- CSPs

- Internet Service Providers

- Telecom Providers

- Value Added Resellers (VARs)

- Managed Service Providers (MSPs)

- Hosting Vendors

Scope of The Report

The research report segments the infrastructure as a service market to following sub-markets:

By Solution

- Managed hosting

- Disaster Recovery as a Service

- Storage as a Service

- Colocation

- Network management

- Content delivery

- High Performance Computing as a Service

By Deployment Type

- Public cloud

- Private cloud

- Hybrid cloud

By End User

- SMBs

- Enterprises

By Vertical:

- IT & Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Retail and E-commerce

- Government & Defense

- Energy & Utilities

- Manufacturing

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- Middle East and Africa

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America infrastructure as a service market

- Further breakdown of the Europe infrastructure as a service market

- Further breakdown of the APAC infrastructure as a service market

- Further breakdown of the MEA infrastructure as a service market

- Further breakdown of the Latin America infrastructure as a service market

Company Information

- Detailed analysis and profiling of additional market players

The infrastructure as a service (IaaS) market is expected to grow from USD 15.79 Billion in 2015 to USD 56.05 Billion by 2020, at a CAGR of 29.0%. Several factors such as faster implementation, scalability, flexibility, and agility provided by the service; increasing market competition; and increasing demand for reducing investment on IT infrastructures, hardware, and hiring skilled resources are expected to bolster the growth of this market.

Additionally, the adoption of hybrid cloud among organizations is increasing, due to certain limitations of data security and expensive cost in public and private cloud models, respectively. The increase in adoption of hybrid model has played a significant role in enhancing the adoption of solutions in infrastructure as a service (IaaS) market. The other major factors responsible for the upsurge in the adoption of IaaS includeoptimum utilization of computing resources cost effectively; efficient management and security of business data; increasing digitalization; technological advancements; and escalating demand of disaster recovery, storage, and virtualization among numerous industries ranging from IT & telecom, BFSI, healthcare, retail & e-commerce to government and other industries is driving the growth of the infrastructure as a service market tremendously.

Higher adoption rate in SMBs and mobility and BYOD trends among organizations have emerged as new opportunities to drive this market in the future. These technologies are supported by IaaS solutions, allowing users to connect from any location and providing many benefits, such as increased productivity, reduced IT, and operational costs. Some of the leading solutions include managed hosting, STaaS, colocation, and DRaaS.

The IT & telecom industry, along with BFSI and healthcare industries, account for the largest market share in the overall market. Increasing volume of business data in such verticals and concerns related to the security, confidentiality, and management of such a huge volume of critical individual information, financial, and other health related information are some of the major factors resulting in high spending by the verticals in the markets. Other high growth sectors include retail & e-commerce, government, and energy & utilities.

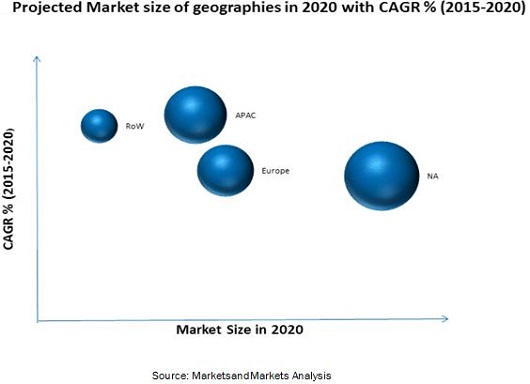

Among regions, North America is projected to have the largest market share and is expected to dominate the infrastructure as a service market from 2015 to 2020. This is backed by the existence of major IaaS vendors in the regions of North America. APAC is expected to showcase the highest growth potential and is projected to grow at a CAGR of 35.8% in IaaS market simultaneously. Increasing digitalization trends, adoption of internet, increasing adoption of smart devices and increasing number of SMBs demanding enterprise level computing capabilities at low cost, are increasing in countries India, China, Brazil, UK, Australia, and others thereby giving rise to the adoption of IaaS in the region.

However, privacy and data protection concerns, high initial investment costs, and other operational challenges are faced by most of the organizations and they struggle to make the optimum use of IaaS and other cloud technologies, which has been significantly hindering the growth of the market. Technological giants such as AWS, Google, IBM, Cisco Systems, CSC, VMware, Rackspace, and Fujitsu, along with some other innovators such as ProfitBrick, Savvis, Mindtree, and others, are providers of leading IaaS solutions. These players have adopted various growth strategies such as new product launches, partnerships, contracts, collaborations, acquisitions, and expansions to expand their global presence and increase their market shares in the global infrastructure as a service market.

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Infrastructure as a Service Market

4.2 IaaS Market: Market Size of the Top Four Components and Regions

4.3 Lifecycle Analysis, By Region

4.4 Enterprises Presents the Best Oppportunity to Be Invested By IaaS Vendors

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Evolution

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 High Penetration of Hybrid Cloud

5.3.1.2 Faster Implementation, Scalability, and Accessibility of the It System

5.3.1.3 Higher Importance to Disaster Recovery for Critical It Systems

5.3.2 Restraints

5.3.2.1 High Cost of Initial Investment

5.3.2.2 Less of Privacy and Data Protection Concern

5.3.3 Opportunities

5.3.3.1 High Adoption Rate in SMBS

5.3.3.2 Mobility and Byod Creating New It Opportunities

5.3.4 Challenges

5.3.4.1 Redesigning the Network for Cloud

5.3.4.2 Strict Rules and Regulations

6 Industry Trends (Page No. - 41)

6.1 Value Chain Analysis

6.2 Strategic Benchmarking

7 Infrastructure as a service Market Analysis, By Solution (Page No. - 43)

7.1 Introduction

7.2 Managed Hosting Services

7.3 Storage as A Service (STaaS)

7.3.1 Storage Area Network (SAN)-Based Storage

7.3.2 Network Attached Storage (NAS)

7.4 Disaster Recovery as A Service (DRaaS)

7.5 Colocation

7.6 Network as A Service (NaaS)

7.7 Content Delivery Services

7.8 High Performance Computing as A Service (HPCaaS)

8 Infrastructure as a service Market Analysis, By End User (Page No. - 55)

8.1 Introduction

8.2 Small and Medium Businesses (SMBS)

8.3 Enterprises

9 Market Analysis, By Deployment Type (Page No. - 60)

9.1 Introduction

9.2 Private Cloud

9.3 Public Cloud

9.4 Hybrid Cloud

10 Infrastructure as a service Market Analysis, By Vertical (Page No. - 64)

10.1 Introduction

10.2 It and Telecom

10.3 Banking, Financial Services, and Insurance (BFSI)

10.4 Healthcare

10.5 Retail and E-Commerce

10.6 Government

10.7 Energy and Utilities

10.8 Media and Entertainment

10.9 Manufacturing

10.10 Others

11 Geographic Analysis (Page No. - 76)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia-Pacific

11.5 Latin America

11.6 Middle East and Africa

12 Competitive Landscape (Page No. - 90)

12.1 Overview

12.1 Competitive Situation and Trends

12.1.1 New Product Launches

12.1.2 Partnerships, Agreements, and Collaborations

12.1.3 Mergers and Acquisitions

13 Company Profile (Page No. - 100)

13.1 Introduction

13.2 Amazon Web Services (AWS)

13.2.1 Business Overview

13.2.2 Products Offered

13.2.3 Recent Developments

13.2.4 MnM View

13.2.4.1 Key Strategies

13.2.4.2 SWOT Analysis

13.3 Microsoft Corporation

13.3.1 Business Overview

13.3.2 Products Offered

13.3.3 Recent Developments

13.3.4 MnM View

13.3.4.1 Key Strategies

13.3.4.2 SWOT Analysis

13.4 International Business Machines (IBM) Corporation

13.4.1 Business Overview

13.4.2 Products Offered

13.4.3 Recent Developments

13.4.4 MnM View

13.4.4.1 Key Strategies

13.4.4.2 SWOT Analysis

13.5 Google

13.5.1 Business Overview

13.5.2 Products Offered

13.5.3 Recent Developments

13.5.4 MnM View

13.5.4.1 Key Strategies

13.5.4.2 SWOT Analysis

13.6 Rackspace Hosting, Inc.

13.6.1 Business Overview

13.6.2 Products Offered

13.6.3 Recent Developments

13.6.4 MnM View

13.6.4.1 Key Strategies

13.6.4.2 SWOT Analysis

13.7 Computer Sciences Corporation (CSC)

13.7.1 Business Overview

13.7.2 Products Offered

13.7.3 Recent Developments

13.8 Vmware

13.8.1 Business Overview

13.8.2 Products Offered

13.8.3 Recent Developments

13.9 Profitbricks

13.9.1 Business Overview

13.9.2 Products Offered

13.9.3 Recent Developments

13.10 Cisco Systems, Inc.

13.10.1 Business Overview

13.10.2 Products Offered

13.10.3 Recent Developments

13.11 Fujitsu

13.11.1 Business Overview

13.11.2 Products Offered

13.11.3 Recent Developments

14 Appendix (Page No. - 131)

14.1 Key Industry Insights

14.2 Introducing RT: Real-Time Market Intelligence

14.3 Available Customizations

14.4 Discussion Guide

14.5 Related Reports

List of Tables (66 Tables)

Table 1 Infrastructure as a Service (IaaS) Market Size and Growth, By Content Type, 20132020 (USD Million, Y-O-Y %)

Table 2 Infrastructure as a Service Market: Analysis of Drivers

Table 3 IaaS Market: Analysis of Restraints

Table 4 Market: Analysis of Opportunities

Table 5 Market: Analysis of Challenges

Table 6 Market Size, By Solution, 20132020 (USD Million)

Table 7 Web Performance Optimization: Market Size, By End User, 20132020 (USD Million)

Table 8 Web Performance Optimization: Market Size, By Region, 20132020 (USD Million)

Table 9 Media Delivery: Infrastructure as a Service Market Size, By End User, 20132020 (USD Million)

Table 10 Media Delivery: Market Size, By Region, 20132020 (USD Million)

Table 11 Cloud Storage and Data Security: Infrastructure as a Service Market Size, By End User, 20132020 (USD Million)

Table 12 Cloud Storage and Data Security: IaaS Market Size, By Region, 20132020 (USD Million)

Table 13 Transparent Caching : Market Size, By End User, 20132020 (USD Million)

Table 14 Transparent Caching: Market Size, By Region, 20132020 (USD Million)

Table 15 Transcoding and DRM : Infrastructure as a Service Market Size, By End User, 20132020 (USD Million)

Table 16 Transcoding and DRM: Market Size, By Region, 20132020 (USD Million)

Table 17 Analytics and Monitoring: Market Size, By End User, 20132020 (USD Million)

Table 18 Analytics and Monitoring: Infrastructure as a Service Market Size, By Region, 20132020 (USD Million)

Table 19 Infrastructure as a Service Market Size, By Service Provider Type, 20152020 (USD Million)

Table 20 Traditional Commercial I-a-a-S: IaaS Market Size, By Region, 20132020 (USD Million)

Table 21 Telco IaaS: Market Size, By Region, 20132020 (USD Million)

Table 22 Cloud IaaS: Market Size, By Region, 20132020 (USD Million)

Table 23 Other IaaS: Market Size, By Region, 20132020 (USD Million)

Table 24 Market Size, By End User, 20152020 (USD Million)

Table 25 SMBS: IaaS Market Size, By Solution, 20132020 (USD Million)

Table 26 SMBS: Infrastructure as a Service Market Size, By Region, 20132020 (USD Million)

Table 27 Enterprises: Market Size, By Solution, 20132020 (USD Million)

Table 28 Enterprises: Market Size, By Region, 20132020 (USD Million)

Table 29 Infrastructure as a Service (IaaS) Market Size, By Vertical, 20132020 (USD Million)

Table 30 Advertising: IaaS Market Size, By Region, 20132020 (USD Million)

Table 31 Advertising: Market Size, By End User, 20132020 (USD Million)

Table 32 Media and Entertainment: Market Size, By Region, 20132020 (USD Million)

Table 33 Media and Entertainment: Market Size, By End User, 20132020 (USD Million)

Table 34 Online Gaming: Market Size, By Region, 20132020 (USD Million)

Table 35 Online Gaming: Market Size, By End User, 20132020 (USD Million)

Table 36 E-Commerce: Infrastructure as a Service Market Market Size, By Region, 20132020 (USD Million)

Table 37 E-Commerce: IaaS Market Size, By End User, 20132020 (USD Million)

Table 38 ISPS: Market Size, By Region, 20132020 (USD Million)

Table 39 ISPS: Market Size, By End User, 20132020 (USD Million)

Table 40 Government: Market Size, By Region, 20132020 (USD Million)

Table 41 Government: Market Size, By End User, 20132020 (USD Million)

Table 42 Healthcare: Infrastructure as a Service Market Size, By Region, 20132020 (USD Million)

Table 43 Healthcare: Market Size, By End User, 20132020 (USD Million)

Table 44 Education: Market Size, By Region, 20132020 (USD Million)

Table 45 Education: Market Size, By End User, 20132020 (USD Million)

Table 46 Others: Market Size, By Region, 20132020 (USD Million)

Table 47 Others: Market Size, By End User, 20132020 (USD Million)

Table 48 Infrastructure as a Service (IaaS) Market Size, By Region, 20132020 (USD Million)

Table 49 North America: Market Size, By Service Provider Type, 20132020 (USD Million)

Table 50 North America: Market Size, By Solution, 20132020 (USD Million)

Table 51 North America: IaaS Market Size, By End User, 20132020 (USD Million)

Table 52 Europe: Market Size, By Service Provider Types, 20132020 (USD Million)

Table 53 Europe: Market Size, By Solution, 20132020 (USD Million)

Table 54 North America: Infrastructure as a Service Market Size, By End User, 20132020 (USD Million)

Table 55 Asia-Pacific: Market Size, By Service Provider Type, 20132020 (USD Million)

Table 56 Asia-Pacific: Market Size, By Solution, 20132020 (USD Million)

Table 57 Asia-Pacific: Market Size, By End User, 20132020 (USD Million)

Table 58 Latin America: Infrastructure as a Service Market Size, By Service Provider Type, 20132020 (USD Million)

Table 59 Latin America: Market Size, By Solution, 20132020 (USD Million)

Table 60 Latin America: Market Size, By End User, 20132020 (USD Million)

Table 61 Middle East and Africa: Market Size, By Service Provider Type, 20132020 (USD Million)

Table 62 Middle East and Africa: Market Size, By Solution, 20132020 (USD Million)

Table 63 Middle East and Africa: Market Size, By End User, 20132020 (USD Million)

Table 64 New Product Launches, 20122015

Table 65 Mergers and Acquisitions, 20122015

Table 66 Agreements, Partnerships, and Collaborations, 20122015

List of Figures (43 Figures)

Figure 1 Infrastructure as a Service Market Segmentation

Figure 2 IaaS Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions of the Research Study

Figure 8 Infrastructure as a Service Market Size, 20152020 (USD Million)

Figure 9 Market Snapshot, By Content Type (2015 vs 2020)

Figure 10 Market Snapshot, By Solution (2015 vs 2020)

Figure 11 Regional Market Snapshot

Figure 12 Lucrative Growth Prospects in the Market

Figure 13 Asia-Pacific is Expected to Soon Enter the High Growth Phase

Figure 14 Enterprises are Expected to Create Huge Market Opportunities in the IaaS Market

Figure 15 Evolution of IaaS

Figure 16 Infrastructure as a Service Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Market: Value Chain Analysis

Figure 18 Strategic Benchmarking: IaaS Market

Figure 19 Media Delivery is Expected to Have the Largest Market Size During the Forecast Period

Figure 20 Traditional Commercial I-A-A-S is Expected to Have the Largest Market Size During the Forecast Period

Figure 21 Enterprises are Expected to Have the Largest Market Size During the Forecast Period

Figure 22 Media and Entertainment is Expected to Be the Dominant Vertical in the Market

Figure 23 Asia-Pacific is Expected to Have the Highest Growth Rate From 2015 to 2020

Figure 24 Asia-Pacific is Expected to Grow at the Highest CAGR From 2015 to 2020

Figure 25 North America Market Snapshot: Increasing Compliance Burden is Driving the IaaS Market

Figure 26 Asia-Pacific Market Snapshot: Increasing Number of SMBS is Driving the Infrastructure as a Service Market

Figure 27 Companies Adopted New Product Launch as the Key Growth Strategy From 2012 to 2015

Figure 28 New Product Launch is the Key Strategy Used By Major Market Players

Figure 29 Akamai Technologies and Ericsson Corporation are the Top Providers of Comprehensive Solutions in the IaaS Market

Figure 30 Battle for Market Share: New Product Launches is the Key Growth Strategy

Figure 31 Geographic Revenue Mix of the Top 5 Market Players

Figure 32 Akamai Technologies: Company Snapshot

Figure 33 Akamai Technologies: SWOT Analysis

Figure 34 Level3 Communications: Company Snapshot

Figure 35 Level 3: SWOT Analysis

Figure 36 Limelight: Company Snapshot

Figure 37 Limelight: SWOT Analysis

Figure 38 Ericsson: Company Snapshot

Figure 39 Ericsson: SWOT Analysis

Figure 40 Internap: Company Snapshot

Figure 41 Internap: SWOT Analysis

Figure 42 Chinacache: Company Snapshot

Figure 43 Tata Communications : Company Snapshot

Growth opportunities and latent adjacency in Infrastructure as a Service (IaaS) Market