Top 10 Plastics Market by Type (Polyethylene, Polypropylene, Expanded Polystyrene, Polyethylene Terephthalate, Polyvinyl Chloride), Application (Automotive, Building & Construction, Packaging, Electronics & Consumer, Textile) - Global Forecast to 2021

[151 Slides Report] The global Top 10 Plastics Market was valued at USD 413.19 Billion in 2015 and is projected to reach USD 586.24 Billion by 2021, at a CAGR of 6.84% from 2016 to 2021. The market size was 252.9 Million tons in 2015 and is projected to reach 332.4 Million tons by 2021, at a CAGR of 4.68% from 2016 to 2021. In this study, 2015 has been considered as the base year and 2021 the projected year, with the forecast period from 2016 to 2021.

Objectives of the study:

- To segment the global market of top 10 plastics by type, application, and region

- To estimate and forecast the global top 10 plastics market by region, namely, North America, Asia-Pacific, Europe, and RoW, which includes South America and Middle East & Africa

- To estimate and forecast the market size of top 10 plastics, in terms of value (USD billion) and volume (million tons), at global and regional-levels

- To identify and analyze the key growth drivers, restraints, opportunities, and challenges influencing the global top 10 plastics market

- To strategically identify and profile the key market players and analyze their core competencies in each type and application of the global top 10 plastics market

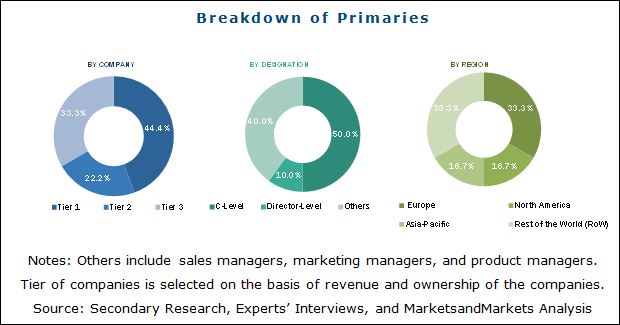

Secondary sources, such as company websites, encyclopedia, directories, and databases such as Hoovers, Bloomberg, Businessweek, Factiva, and OneSource, have been used to identify and collect information useful for this extensive commercial study of the global top 10 plastics market. The primary sources, including experts from related industries, have been interviewed to verify and collect critical information and assess the future prospects of the market. Top-down and bottom-up approaches have been implemented to validate the market size in terms of value. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study.

To know about the assumptions considered for the study, download the pdf brochure

The top 10 plastics market has a diversified and established ecosystem of its upstream players, such as the raw material suppliers; and downstream stakeholders, such as manufacturers, vendors, end-users, and government organizations.

This study answers several questions for the stakeholders, primarily which market segments they should focus upon during the next two to five years to prioritize their efforts and investments. These stakeholders include top 10 plastics manufacturers, such as The Dow Chemical Company (U.S.), Borealis AG (Austria), ExxonMobil Chemical Company, Inc. (U.S.), Ach Foam Technologies (U.S.), Vinnolit GmbH & Co. KG (Germany), E. I. du Pont de Nemours and Company (U.S.), Polyplastics Co., Ltd. (Japan), Solvay SA (Belgium), SABIC (Saudi Arabia), and Huntsman Corporation (U.S.).

Key Target Audience:

- Regional Manufacturers’ Associations and General Top 10 Plastics Associations

- Raw Material Manufacturers

- Traders, Distributors, and Suppliers of Top 10 Plastics

- Government and Regional Agencies and Research Organizations

Scope of the Report:

This research report categorizes the global top 10 plastics market based on type, application, and region, and forecasts the revenue growth and provides an analysis of trends in each of the submarkets.

On the Basis of Type:

- Polyethylene

- Polypropylene

- Polystyrene

- Polyethylene Terephthalate

- Polyvinyl chloride

- Polycarbonate

- Acrylonitrile Butadiene Styrene

- Polyoxymethylene

- Polyamide

- Polyurethane

Each type is further described in detail in the report with value forecasts until 2021.

On the Basis of Application:

- Automotive & Transportation

- Building & Construction

- Electronics & Consumer Goods

- Packaging

- Textiles

- Others (injection & blow molding, and so on)

Each application segment is further described in detail in the report, with value forecasts until 2021.

On the Basis of Region:

- Asia-Pacific

- North America

- Europe

- RoW (South America, Middle East & Africa)

Available Customizations: The following customization options are available for the report:

- Company Information

Analysis and profiles of additional global as well as regional market players (up to three)

The global top 10 plastics market is projected to reach USD 586.24 Billion by 2021, at a CAGR of 6.84% from 2016 to 2021. The market size is projected to reach 332.4 Million tons by 2021, at a CAGR of 4.68%. Growth in key end-use industries, such as automotive, building & construction, packaging, electrical & electronics, and construction; and the substitution of metal-based products with various plastic materials are the key factors driving the global top 10 plastics market.

Polyethylene (PE) was the largest type segment of the top 10 plastics market in 2015, owing to the extensive use of PE in applications, such as packaging, construction, electrical, electronics, automotive, and so on. Its cost-effective nature, ability to be easily remolded according to requirements, and flexibility makes its large scale utilization possible in the packaging bottles, polyethylene tubing, and polyethylene sheets.

Packaging is estimated to be the largest application segment of market. Industrial growth and infrastructure development, along with the rapidly growing demand for articles that employ plastic packaging, offer lucrative opportunities for the packaging segment to flourish. Manufacturing of plastic containers and films that are used in the packaging of food, beverages, pharmaceuticals, and personal care products further contributes to making packaging the largest application segment of the global top 10 plastics market.

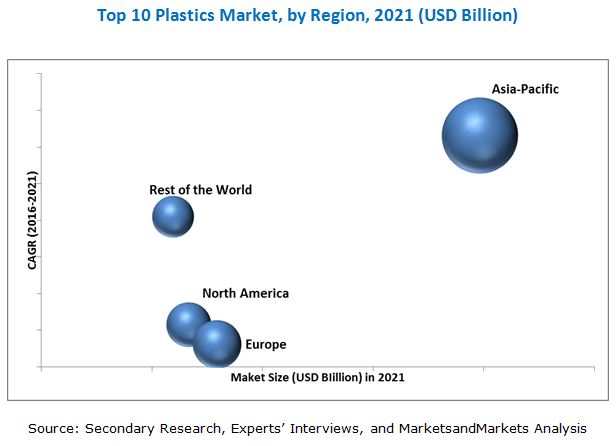

The Asia-Pacific region led the global top 10 plastics market, in terms of both value and volume, in 2015. The growing construction sector, increasing R&D activities initiated by major players, easy availability of raw materials, and urbanization are among the key growth drivers for the top 10 plastics market in this region.

Although the global top 10 plastics market is growing rapidly, a few factors restrain its growth. Apprehensions regarding the disposal of plastic waste and fluctuation in crude oil prices are some of the factors restraining and challenging the growth of the global top 10 plastics market.

The Dow Chemical Company (U.S.), ExxonMobil Chemical Company, Inc. (U.S.), and SABIC (Saudi Arabia) have led the global top 10 plastics market in the last five years. Diverse product portfolios, strategically positioned R&D centers, adoption of various development strategies, and technological advancements are some of the factors that helped strengthen the market position of these companies in the global top 10 plastics market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Content

1 Introduction

1.1 Market Introduction

1.2 Objectives of the Study

1.3 Market Segmentation

2 Research Methodology

2.1 Introduction

2.2 Market Size

2.2.1 Secondary Data

2.3 Market Volume

2.4 Key Data From Secondary Sources

2.5 Key Data From Primary Sources

2.6 Market Approach

2.6.1 Bottom-up Approach

2.6.2 Top-down Approach

2.7 Data Triangulation

2.8 Assumptions

2.9 Key Industry Insights

3 Executive Summary

3.1 Global Top 10 Plastics Market , By Type

3.2 Global Top 10 Plastics Market, By Application

3.3 Global Top 10 Plastics Market, By Region

4 Premium Insights

4.1 Attractive Market Opportunities

Top 3 Segments of Global Top 10 Plastics Market 2015

4.2 Global Top 10 Plastics Market , By Application

4.3 Lifecycle Analysis

5 Market Overview

5.1 Market Dynamics

6 Industry Trends

6.1 Supply Chain Analysis

7 Top 10 Plastics Market, By Type

7.1 Global Top 10 Plastics Market, By Type, 2016 & 2021 (USD Billion)

7.2 Global Top 10 Plastics Market, By Type, 2016 & 2021 (Million Tons

7.3 Global Top 10 Plastics Market - Polyethylene

7.4 Global Top 10 Plastics Market - Polypropylene

7.5 Global Top 10 Plastics Market – Expanded Polystyrene

7.6 Global Top 10 Plastics Market – Polyethylene Trerphthalate

7.7 Global Top 10 Plastics Market – Polycarbonate

7.8 Global Top 10 Plastics Market – Acrylonitrile Butadiene Styrene

7.9 Global Top 10 Plastics Market –Polyamide

7.10 Global Top 10 Plastics Market –Polyoxymethylene

7.11 Global Top 10 Plastics Market –Polyurethane

7.12 Global Top 10 Plastics Market – Polyvinyl Chloride

8 Global Top 10 Plastic Market, By Application

8.1 Introduction

8.2 Global Top 10 Plastic Market, By Application

9 Top 10 Plastics Market , By Region

9.1 Global Top 10 Plastics Market, Asia-Pacific

9.2 Global Top 10 Plastics Market, North America

9.3 Global Top 10 Plastics Market, Europe

9.4 Global Top 10 Plastics Market, Rest of the World

10 Company Profiles

10.1 The DOW Chemical Company

10.2 Borealis AG

10.3 Ach Foam Technologies

10.4 Vinnolit GmbH & Co. Kg

10.5 E. I. Du Pont De Nemours and Company

10.6 Exxonmobil Chemical

10.7 Polyplastics Co., Ltd

10.8 Solvay SA

10.9 Sabic

10.10 Huntsman Corporation

11 Appendix

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Available Customizations

11.4 Marketsandmarkets Knowledge Store

11.5 Marketsandmarkets Knowledge Store: Snapshot

11.6 Introducing RT: Real Time Market Intelligence

11.7 Related Reports

11.8 Authors Details

List of Tables (34 Tables)

Table 1 Polyethylene Plastics Market, 2014-2021

Table 2 Polypropylene Plastics Market, 2014-2021

Table 3 Expanded Polystyrene Plastics Market, 2014-2021

Table 4 Polyethylene Terephthalate Plastics Market, 2014-2021

Table 5 Polyvinyl Chloride Plastics Market, 2014-2021

Table 6 Polycarbonate Plastics Market, 2014-2021

Table 7 Acrylonitile Butadiene Stryrene Plastics Market, 2014-2021

Table 8 Polyamide Plastics Market, 2014-2021

Table 9 Polyoxymethylene Plastics Market, 2014-2021

Table 10 Polyurethane Plastics Market, 2014-2021

Table 11 Polyethylene, By Application, 2014-2021 (USD Billion)

Table 12 Polyethylene, By Application, 2014-2021 (Million Tons)

Table 13 Polypropylene, By Application, 2014-2021 (USD Billion)

Table 14 Polypropylene, By Application, 2014-2021 (Million Tons)

Table 15 Expanded Polystyrene , By Application, 2014-2021 (USD Billion )

Table 16 Expanded Polystyrene, By Application, 2014-2021 (Million Tons)

Table 17 Polyethylene Terephthalate , By Application, 2014-2021 (USD Billion )

Table 18 Polyethylene Terephthalate, By Application, 2014-2021 (Million Tons)

Table 19 Polyvinyl Chloride, By Application, 2014-2021 (USD Billion )

Table 20 Polyvinyl Chloride, By Application, 2014-2021 (Million Tons)

Table 21 Polycarbonates, By Application, 2014-2021 (USD Billion)

Table 22 Polycarbonates, By Application, 2014-2021 (Million Tons)

Table 23 Polyamide, By Application, 2014-2021 (USD Billion )

Table 24 Polyamide, By Application, 2014-2021 (Million Tons)

Table 25 Polyoxymethylene, By Application, 2014-2021 (USD Billion )

Table 26 Polyoxymethylene , By Application, 2014-2021 (Million Tons)

Table 27 Polyurethane, By Application, 2014-2021 (USD Billion )

Table 28 Polyurethane, By Application, 2014-2021 (Million Tons)

Table 29 Acrylonitile Butadiene Stryrene, By Application, 2014-2021 (USD Billion )

Table 30 Acrylonitile Butadiene Stryrene , By Application, 2014-2021 (Million Tons

Table 31 Global Top 10 Plastics Market, Asia-Pacific Market, 2014-2021

Table 32 Global Top 10 Plastics Market, North America Market, 2014-2021

Table 32 Global Top 10 Plastics Market, Europe Market, 2014-2021

Table 34 Global Top 10 Plastics Market, Rest of The World Market, 2014-2021

List of Figures (17 Figures)

Figure 1 Global Top 10 Plastic Market: Segmentation & Coverage

Figure 2 Research Methodology

Figure 3 Global Top 10 Plastics Market, 2016 & 2021 (USD Billion)

Figure 4 Global Top 10 Plastics Market, 2016 & 2021 (Million Tons)

Figure 5 Global Top 10 Plastics Market, By Type, 2015 (%)

Figure 6 Global Top 10 Plastics Market, By Application, 2015 (%)

Figure 7 Global Top 10 Plastics Market, By Application, By Value & By Volume, 2015

Figure 8 Polyethylene Plastics Market, By Region, 2014-2021, USD Billion

Figure 9 Polypropylene Plastics Market, By Region, 2014-2021, USD Billion

Figure 10 Expanded Polystyrene Plastics Market, By Region, 2014-2021, USD Billion

Figure 11 Polyethylene Terephthalate, By Region, 2014-2021, USD Billion

Figure 12 Polyvinyl Chloride Market, By Region, 2014-2021, USD Billion

Figure 13 Polycarbonate Market, By Region, 2014-2021, USD Billion

Figure 14 Acrylonitile Butadiene Stryrene Market, By Region, 2014-2021, USD Billion

Figure 15 Polyamide Plastics Market, By Region, 2014-2021, USD Billion

Figure 16 Polyoxymethylene Plastics Market, By Region, 2014-2021, USD Billion

Figure 17 Polyurethane Plastics Market, By Region, 2014-2021, USD Billion

Growth opportunities and latent adjacency in Top 10 Plastics Market