Mobile Unified Communications and Collaboration Market by Solutions (Conferencing, Unified Messaging, Voice, Collaboration), & by Deployment Type (Cloud & On-Premise) - Global Forecast to 2019

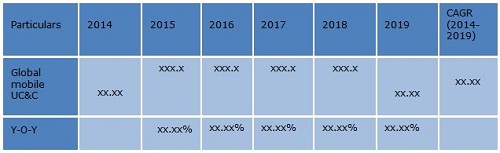

[110 Pages Report] MarketsandMarkets expects the global mobile Unified Communications and Collaboration market to grow from $5.15 billion in 2014 to $17.38 billion by 2019, at a Compound Annual Growth Rate (CAGR) of 27.5% during the forecast period 2014 – 2019.

There has been a significant adoption of Unified Communications and Collaboration (UC&C) among organizations to enhance organizational productivity. The increased demand for mobility and growing BYOD trend among companies has further encouraged businesses to integrate Unified Communication (UC) solutions with employee owned mobile devices. This integration of mobile with unified communications and collaboration solutions has further added to the mobility benefits attached with UC solutions. This coalition of mobility with communication would further leverage the productivity of employees by radically changing the way the workforce communicate and collaborate. Hence, the mobile Unified Communications and Collaboration enables efficient communication and collaboration functioning over cellular network or organizational wireless network.

Furthermore, significant technological developments in the arena of communications such as Web Real-Time Communication (WebRTC), Voice over Internet Protocol (VoIP), Voice over Long Term Evolution (VoLTE), and Session Initiation Protocol (SIP) trunking are enhancing the mobile Unified Communications and Collaboration solutions. The introduction of WebRTC by WC3 (Worldwide Web Consortium) has empowered UC providers to leverage it for offering the users rich communication experience. Additionally, the surfacing of 4G LTE technology has assisted in the use of VoLTE for transmitting voice and video over these LTE networks, thus augmenting the user experience.

In previous years, the legacy of telephony systems, Private Branch Exchange (PBX), and VoIP solutions has helped telecom network operators to have an upper hand in the mobile Unified Communications market. The ongoing technological developments have further introduced mobile clients from mobile UC infrastructure vendors, third-party FMC (Fixed Mobile Convergence), and SIP apps into the market. However, with the emergence of the latest technologies, UC vendors are increasingly developing multiple mobile UC clients and are in turn capturing a higher share in the market. Moreover, the ubiquitous presence of smartphones has further encouraged UC vendors to develop mobile UC apps compatible with prominent smartphone OS.

Presently, the enterprises' consideration for investing in mobile Unified Communications and Collaboration solutions is growing significantly as the benefit attached with it encourages its adoption. In the years to come, this trend is anticipated to continue leveraging mobile UC & C players to offer more innovative solution with HD as a major component for enabling rich user experience.

The report spans the overall structure of mobile Unified Communications market and provides premium insights that can help telecom network operators, third-party application developers, and UC infrastructure providers to identify the need of enterprises and Small and Medium Businesses (SMBs) along with exhibiting the need gaps for cloud service providers, UC vendors, and telecom network operators. The report analyzes the growth rate and penetration of mobile UC & C across all the major regions.

The global mobile Unified Communications market is segmented on the basis of solutions, services, deployment types, user types, industry verticals, and regions. The mobile UC & C solutions are further categorized into conferencing, unified messaging, voice solution, and content and collaboration. The services are segmented as implementation and integration, training and support, consulting, and managed services. Further the deployment type is categorized into cloud and on-premises. The mobile UC & C users are segmented into enterprises and SMBs. In addition, the report classifies the industry verticals as Banking, Financial Services, and Insurance (BFSI), healthcare, public sector, telecom and IT, retail, media and entertainment, transportation and logistics, and others.

The global mobile Unified Communications and Collaboration market is fast gaining traction which is evident from the acquisitions of InMage by Microsoft, Assemblage by Cisco, and uReach Technologies by Genband. Key players such as Cisco Systems, Inc., Avaya Inc., Microsoft Corporation, IBM, Alcatel-Lucent, Unify GmbH & Co. KG, NEC, Genband, Ericsson, and Mitel (Aastra) offer mobile UC & C solutions and services to enterprises and SMBs.

The global mobile Unified Communications and Collaboration market analyzes global adoption trends, future growth potential, key drivers, restraints, opportunities, and best practices in the mobile UC & C market. The report also examines growth potential market sizes and revenue forecasts across different regions as well as user segments.

The report forecasts the market sizes and trends for mobile Unified Communications and Collaboration in the following sub-markets:

On the basis of solution:

- Conferencing

- Unified Messaging

- Voice Solution

- Content and Collaboration

On the basis of service:

- Implementation and Integration

- Training and Support

- Consulting

- Managed Services

On the basis of deployment type:

- Cloud

- On-Premises

On the basis of user type:

- Enterprises

- SMBs

On the basis of industry vertical:

- BFSI

- Healthcare

- Public Sector

- Telecom and IT

- Retail

- Media and Entertainment

- Transportation and Logistics

- Others

On the basis of region:

- North America (NA)

- Europe

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America (LA)

The global mobile Unified Communication and collaboration (UC&C) market is in its emerging stage and is exhibiting rapid growth. Mobile Unified Communications market is expected to grow in the years to come with fast paced adoption among enterprises. Nowadays, enterprises are seeking efficient communication and collaboration among employees on a real-time basis. The constant development in the field of communication has further introduced novel and enhanced UC&C solutions for offering rich communication experience with single unified inbox solution. Additionally, the surging Bring Your Own Device (BYOD) trend among enterprises and enhanced mobile technology has opened newer avenues for real-time business communications and collaboration. The integration of mobile and unified communications technology has further developed the existing communication and collaboration solutions by the addition of mobility and real-time collaboration into it.

The growing need for gaining competitive advantage and the increase in demand for optimized workflows among organizations have significantly added to the rise in adoption of mobile Unified Communications and Collaboration solutions. Furthermore, the increasing multi-purpose usage of smartphones and the emergence of virtual workforce have encouraged enterprises to integrate mobile devices with Unified Communication (UC) solutions. Thus, with the emergence of mobile workforce, the mobile UC & C adoption is rising among enterprises for enabling real-time communication and collaboration of employees.

Technological developments such as Web Real-Time Communication (WebRTC), Voice over Internet Protocol (VoIP), Voice over Long Term Evolution (VoLTE), and Session Initiation Protocol (SIP) trunking have further bridged the gap for interoperability among various platforms. Telecom network providers, UC vendors, third-party service providers, and cloud service providers have been offering augmented mobile UC services and mobile clients to better suit the needs of enterprises and Small and Medium Businesses (SMBs). The significance of mobile Unified Communications and Collaboration is immense among organizations, developing prospects for UC vendors, telecom network operators, cloud service providers, and third-party application developers.

For businesses that are forward looking and have embraced BYOD along with UC&C, the need for effective integration of mobile with UC&C is an imperative growth strategy. Due to increased flexible work patterns, ease of integration, optimized virtual workflows, and real-time communication and collaboration provided by mobile Unified Communications and Collaboration, organizations are rapidly adopting these solutions. However, the mobile UC & C faces challenges such as lack of knowledge, uncertain Return on Investment (RoI), and security apprehensions among SMBs, and hence its adoption is moderate among them. However, the adoption of cloud-based mobile UC & C is expected to be considerable among SMBs due to enhanced security and reduced upfront cost. Even though security apprehensions are prevalent among enterprises, the adoption of mobile UC & C is significant among them as they leverage on their robust IT to sustain security.

Various UC providers such as Cisco, Avaya, and Microsoft are offering innovative mobile Unified Communications and Collaboration solutions and services catering to the needs of both enterprises and SMBs. Further, telecom network operators are offering services to integrate enterprise Local Area Network (LAN) with IP (Internet Protocol) networks to foster unhindered VoIP and other IP-based functions along with network security. Besides this, various mobile device manufacturers are developing smartphones equipped with UC clients that can integrate with enterprise UC and can function over both cellular and enterprise LAN network. In addition to this, third-party app developers create mobile UC client based on SIP. These applications assist businesses whose UC technology does not support native mobile clients, and they facilitate basic functions as compared to UC. Thus, telecom network operators, mobile device manufacturers and third-party app developers are also adding considerable value to the mobile Unified Communications market.

MarketsandMarkets expects the global mobile Unified Communications and Collaboration market to grow from $5.15 billion in 2014 to $17.38 billion by 2019, at a Compound Annual Growth Rate (CAGR) of 27.5% during the forecast period 2014 – 2019. The overall size of the global mobile UC & C market is the summation of the market size of solutions and services.

Global Mobile Unified Communications and Collaboration: Market Size, 2014 – 2019 ($Billion)

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No.- 15)

1.1 Objectives of The Study

1.2 Markets Covered

1.3 Stakeholders

1.4 Market Scope

2 Research Methodology (Page No.- 18)

2.1 Market Size Estimation

2.2 Market Crackdown

2.3 Market Share Estimation

2.3.1 Key Data Taken From Secondary Sources

2.3.2 Key Data from Primary Sources

2.3.3 Assumptions

2.3.3.1 Key Industry Insights

3 Executive Summary (Page No.- 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in Mobile UC&C Market

4.2 Mobile UC&C Market–Top Three Services

4.3 Global Mobile UC&C Solutions Market

4.4 Mobile UC&C Market Potential

4.5 Mobile UC&C User Market (2019)

4.6 Mobile UC&C Regional Market

4.7 Mobile UC&C Solutions Growth Matrix

4.8 Life Cycle Analysis, By Region, 2014

5 Market Overview (Page No.- 36)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 Mobile UC&C Market, By Solution

5.3.2 Mobile UC&C Market, By Service

5.3.3 Mobile UC&C Market, By Deployment Type

5.3.4 Mobile UC&C Market, By User Type

5.3.5 Mobile UC&C Market, By Industry Vertical

5.3.6 Mobile UC&C Market, By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Trend of BYOD and Virtualization Of Workforce

5.4.1.2 Rising Demand for Attaining Competitive Advantage among Businesses

5.4.1.3 Lower Total Cost of Ownership

5.4.1.4 Mounting Demand for Optimized Workflows

5.4.2 Restraints

5.4.2.1 Growing Security Concerns

5.4.2.2 Lack of Interoperability Among Vendor Products

5.4.2.3 Ambiguity In Financial Returns Involved In Adoption Of Mobile UC&C

5.4.3 Opportunities

5.4.3.1 Increasing Social Media Demand for Business Practices

5.4.3.2 Growing Requirements for Robust Security Software

5.4.3.3 Escalating Demand for Managed Services

5.4.3.4 Increasing Demand for Enterprise Agility

5.4.4 Burning Issue

5.4.4.1 Lack of Awareness About Mobile UC&C Solutions

5.5 Enabling Technologies

5.5.1 Webrtc

5.5.2 Volte

5.5.3 Sip Trunking

5.5.4 VOIP

5.6 Standards and Regulations

5.6.1 Sip

5.6.2 H.323

5.6.3 H.264

5.6.4 Vp8

5.6.5 802.11u/802.21

6 Industry Trends (Page No.- 50)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat from New Entrants

6.3.2 Threat from Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Pest Analysis

6.4.1 Political Factors

6.4.2 Economic Factors

6.4.3 Social Factors

6.4.4 Technological Factors

7 Mobile UC&C Market Analysis, By Solution (Page No.- 56)

7.1 Introduction

7.2 Conferencing Market

7.3 Unified Messaging Market

7.4 Voice Solution Market

7.5 Content and Collaboration Market

8 Mobile UC&C Market Analysis, By Service (Page No.- 66)

8.1 Introduction

8.2 Implementation and Integration Market

8.3 Training and Support Market

8.4 Consulting Market

8.5 Managed Services Market

9 Mobile UC&C Market Analysis, By Deployment (Page No.- 76)

9.1 Introduction

9.2 Cloud Market

9.3 On-Premises Market

10 Mobile UC&C Market Analysis, By User (Page No.- 81)

10.1 Introduction

10.2 SMB Market

10.3 Enterprise Market

11 Mobile UC&C Market Analysis, By Industry Vertical (Page No.- 90)

11.1 Introduction

11.2 BFSI Market

11.3 Healthcare Market

11.4 Public Sector Market

11.5 Telecom and It Market

11.6 Retail Market

11.7 Media and Entertainment Market

11.8 Transportation and Logistics Market

11.9 Others Market

12 Geographical Analysis (Page No.- 99)

12.1 Introduction

12.1.1 Mobile UC&C Market, By Region

12.2 North America

12.2.1 Solution Market

12.2.2 Service Market

12.2.3 User Market

12.3 Europe

12.3.1 Solution Market

12.3.2 Service Market

12.3.3 User Market

12.4 Asia-Pacific

12.4.1 Solution Market

12.4.2 Service Market

12.4.3 User Market

12.5 Middle East And Africa

12.5.1 Solution Market

12.5.2 Service Market

12.5.3 User Market

12.6 Latin America

12.6.1 Solution Market

12.6.2 Service Market

12.6.3 User Market

13 Competitive Landscape (Page No.- 113)

13.1 Overview

13.2 Competitive Situation and Trends

13.2.1 New Product Launches

13.2.2 Agreements, Partnerships, Collaborations, and Joint Ventures

13.2.3 Mergers and Acquisitions

13.2.4 VC Funding

14 Company Profiles (Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MNM View)* (Page No.- 122)

14.1 Introduction

14.2 Microsoft Corporation

14.3 Cisco Systems, Inc.

14.4 IBM Corporation

14.5 Alcatel-Lucent

14.6 Avaya, Inc.

14.7 Siemens Ag

14.8 NEC Corporation

14.9 Genband

14.10 Ericsson

14.11 Mitel (Aastra)

*Details On Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MNM View Might Not Be Captured In Case Of Unlisted Companies.

15 Appendix (Page No.- 157)

15.1 Discussion Guide

15.2 Introducing RT: Real-Time Market Intelligence

15.3 Available Customizations

15.4 Related Reports

List of Tables (90 Tables)

Table 1 Global Mobile UC&C Market Size and Growth Rate, 2013-2019 ($Million, Y-O-Y %)

Table 2 Growing BYOD Trend And Virtualization Of Workforce Is Propelling The Growth Of Mobile UC&C Market

Table 3 Growing Security Concern Is Restraining Market Growth

Table 4 Increased Demands For Social Media For Business Practices Are Paving The Enhanced Growth Avenues For UcCVendors

Table 5 Global Mobile UC&C Market Size, By Solutions, 2012-2019 ($Million)

Table 6 Global Mobile UC&C Market Growth, By Solution, 2014 And 2019 (Y-O-Y%)

Table 7 Conferencing Market Size, By User Type, 2012-2019 ($Million)

Table 8 Conferencing Market Growth, By User Type, 2014 And 2019 (Y-O-Y%)

Table 9 Conferencing Market Size, By Region,2012-2019 ($Million)

Table 10 Conferencing Market Growth, By Region, 2014 And 2019 (Y-O-Y%)

Table 11 Unified Messaging Market Size, By User Type, 2012-2019 ($Million)

Table 12 Unified Messaging Market Growth, By User Type, 2014 And 2019 (Y-O-Y%)

Table 13 Unified Messaging Market Size, By Region, 2012-2019 ($Million)

Table 14 Unified Messaging Market Growth, By Region, 2014 And 2019 (Y-O-Y%)

Table 15 Voice Solution Market Size, By User Type, 2012-2019, ($Million)

Table 16 Voice Solution Market Growth, By User Type, 2014 And 2019 (Y-O-Y%)

Table 17 Voice Solution Market Size, By Region,2012-2019 ($Million)

Table 18 Voice Solution Market Growth, By Region, 2014 And 2019 (Y-O-Y%)

Table 19 Content And Collaboration Market Size, By User Type, 2012-2019 ($Million)

Table 20 Content And Collaboration Market Growth, By User Type, 2014 And 2019 (Y-O-Y%)

Table 21 Content And Collaboration Market Size, By Region, 2012-2019 ($Million)

Table 22 Content And Collaboration Market Growth, By Region, 2014 And 2019 (Y-O-Y%)

Table 23 Global Mobile UC&C Market Size, By Service, 2012-2019 ($Million)

Table 24 Global Mobile UC&C Market Growth, By Service, 2014 And 2019 (Y-O-Y%)

Table 25 Implementation And Integration Market Size, By User Type, 2012-2019 ($Million)

Table 26 Implementation And Integration Market Growth, By User Type, 2014 And 2019 (Y-O-Y%)

Table 27 Implementation And Integration Market Size, By Region, 2012-2019 ($Million)

Table 28 Implementation And Integration Market Growth, By Region, 2014 And 2019 (Y-O-Y%)

Table 29 Training And Support Market Size, By User Type, 2012-2019 ($Million)

Table 30 Training And Support Market Growth, By User Type, 2014 And 2019 (Y-O-Y%)

Table 31 Training And Support Market Size, By Region, 2012-2019 ($Million)

Table 32 Training And Support Market Growth, By Region, 2014 And 2019 (Y-O-Y%)

Table 33 Consulting Market Size, By User Type, 2012-2019, ($Million)

Table 34 Consulting Market Growth, By User Type, 2014 And 2019 (Y-O-Y%)

Table 35 Consulting Market Growth, By Region, 2014 And 2019 (Y-O-Y%)

Table 36 Managed Services Market Size, By User Type, 2012-2019 ($Million)

Table 37 Managed Services Market Growth, By User Type, 2014 And 2019 (Y-O-Y%)

Table 38 Managed Services Market Size, By Region, 2012-2019 ($Million)

Table 39 Managed Services Market Growth, By Region, 2014 And 2019 (Y-O-Y%)

Table 40 Global Mobile UC&C Solution Market Size, By Deployment Type, 2012-2019 ($Million)

Table 41 Global Mobile UC&C Solution Market Growth, By Deployment Type, 2014 And 2019 (Y-O-Y%)

Table 42 Cloud Market Size, By User Type, 2012-2019 ($Million)

Table 43 Cloud Market Growth, By User Type, 2014 And 2019 (Y-O-Y%)

Table 44 On-Premises Market Size, By User Type, 2012-2019 ($Million)

Table 45 On-Premises Market Growth, By User Type, 2014 And 2019 (Y-O-Y%)

Table 46 Global Mobile UC&C Market Size, By User Type, 2012-2019 ($Million)

Table 47 Global Mobile UC&C Market Growth, By User Type, 2014 And 2019 (Y-O-Y %)

Table 48 SMB Market Size, By Solution, 2012-2019 ($Million)

Table 49 SMB Market Growth, By Solution, 2014 And 2019 (Y-O-Y%)

Table 50 SMB Mobile UC&C Solution Market Size, By Deployment Type, 2012-2019 ($Million)

Table 51 SMB Mobile UC&C Solution Market Growth, By Deployment Type, (Y-O-Y%)

Table 52 SMB Market Size, By Service, 2012-2019 ($Million)

Table 53 SMB Market Growth, By Service, 2014 And 2019 (Y-O-Y%)

Table 54 Enterprise Market Size, By Solution, 2012-2019 ($Million)

Table 55 Enterprise Market Growth, By Solution, 2014 And 2019 (Y-O-Y%)

Table 56 Enterprise Mobile UC&C Solution Market Size, By Deployment Type, 2012-2019 ($Million)

Table 57 Enterprise Mobile UC&C Solution Market Growth, By Deployment Type, 2014 And 2019 (Y-O-%)

Table 58 Enterprise Market Size, By Service, 2012-2019 ($Million)

Table 59 Enterprise Market Growth, By Service, 2014 And 2019 (Y-O-Y%)

Table 60 Global Mobile UC&C Market Size, By Industry Vertical, 2012-2019 ($Million)

Table 61 Global Mobile UC&C Market Growth, By Industry Vertical, 2014 And 2019 (Y-O-Y%)

Table 62 BFSI Market Size, By Region, 2012-2019 ($Million)

Table 63 Healthcare Market Size, By Region, 2012-2019 ($Million)

Table 64 Public Sector Market Size, By Region, 2012-2019 ($Million)

Table 65 Telecom And It Market Size, By Region, 2012-2019 ($Million)

Table 66 Retail Market Size, By Region, 2012-2019 ($Million)

Table 67 Media and Entertainment Market Size, By Region, 2012-2019 ($Million)

Table 68 Transportation and Logistics Market Size, By Region, 2012-2019 ($Million)

Table 69 Others Market Size, By Region, 2012-2019 ($Million)

Table 70 Global Mobile UC&C Market Size, By Region, 2012-2019 ($Million)

Table 71 Global Mobile UC&C Market Growth, By Region, 2014 And 2019 (Y-O-Y%)

Table 72 NA: Mobile UC&C Market Size, By Solution, 2012-2019 ($Million)

Table 73 NA: Mobile UC&C Market Size, By Service, 2012-2019 ($Million)

Table 74 NA: Mobile UC&C Market Size, By User Type, 2012-2019 ($Million)

Table 75 Europe: Mobile UC&C Market Size, By Solution, 2012-2019 ($Million)

Table 76 Europe: Mobile UC&C Market Size, By Service, 2012-2019 ($Million)

Table 77 Europe: Mobile UC&C Market Size, By User Type, 2012-2019 ($Million)

Table 78 APAC : Mobile UC&C Market Size, By Solution, 2012-2019 ($Million)

Table 79 APAC : Mobile UC&C Market Size, By Service, 2012-2019 ($Million)

Table 80 APAC : Mobile UC&C Market Size, By User Type, 2012-2019 ($Million)

Table 81 MEA: Mobile UC&C Market Size, By Solution, 2012-2019 ($Million)

Table 82 MEA: Mobile UC&C Market Size, By Service, 2012-2019 ($Million)

Table 83 MEA: Mobile UC&C Market Size, By User Type, 2012-2019 ($Million)

Table 84 LA: Mobile UC&C Market Size, By Solution, 2012-2019 ($Million)

Table 85 LA: Mobile UC&C Market Size, By Service, 2012-2019 ($Million)

Table 86 LA: Mobile UC&C Market Size, By User Type, 2012-2019 ($Million)

Table 87 New Product Launches, 2012–2014

Table 88 Agreements, Partnerships, Collaborations, and Joint Ventures, 2013-2014

Table 89 Mergers and Acquisitions, 2012–2014

Table 90 VC Funding, 2010–2014

List of Figures (57 Figures)

Figure 1 Research Methodology

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Breakdown of Primary Interview: By Company Type, Designation, And Region

Figure 5 Mobile UC&C Solutions Snapshot (2014 Vs 2019): Market for Content And Collaboration Solution Is Expected To Become Three Folds In The Next Five Years

Figure 6 Global Mobile UC&C Market, By Region, 2014

Figure 7 Global Mobile UC&C Market Share, 2014

Figure 8 Integration of Consumers Social Applications With Mobile UC&C Acts As An Attractive Market Opportunity In Mobile UC&C Market

Figure 9 Mobile UC&C Market, Managed Services Gaining Highest Traction

Figure 10 Na Holds the Maximum Share In The Mobile UC&C Solutions Market

Figure 11 APAC Market Is Expected To Have The Highest Market Growth Potential For Mobile UC&C In The Years To Come

Figure 12 Enterprise Segment Will Continue To Dominate The Mobile UC&C Market In The Next Five ears

Figure 13 APAC Market To Grow Faster Than Europe And Na

Figure 14 Mobile UC&C Solutions, Growth Matrix

Figure 15 Asia-Pacific Market To Grow Exponentially During The Forecast Period

Figure 16 WebRTC To Play A Crutial Role In The Mobile UC&C Market

Figure 17 Mobile UC&C Market Segmentation: By Solution

Figure 18 Mobile UC&C Market Segmentation: By Service

Figure 19 Mobile UC&C Market Segmentation: By Deployment Type

Figure 20 Mobile UC&C Market Segmentation: By User Type

Figure 21 Mobile UC&C Segmentation: By Industry Vertical

Figure 22 Mobile UC&C Market Segmentation: By Region

Figure 23 Rising BYOD Trend Will Drive The Mobile UC&C Market

Figure 24 Value Chain Analysis (2014): Major Value Is Added By Enterprise

Figure 25 Porter’s Five Forces Analysis (2014): Diverse Set of Players Is Increasing Competition in the Industry

Figure 26 Conferencing and Voice Solution Lead The Solutions Market

Figure 27 Managed Services Are Expected To Grow Rapidly In The Years To Come

Figure 28 SMB Are Expected To Dominate Cloud-Based Mobile UC&C Market

Figure 29 Enterprise Are Expected To Dominate On-Premises-Based Mobile UC&C Market

Figure 30 Enterprise Continue To Dominate Mobile UC&C Market

Figure 31 Cloud To Become Mainstream Among SMB In The Years To Come

Figure 32 On-Premises Adoption among Enterprise To Increase Two Fold In The Years To Come

Figure 33 Telecom and It Continues To Dominate The Mobile UC&C Market

Figure 34 Geographic Snapshots (2014 And 2019): Rapid Growth Markets Are Emerging As New Hotspot

Figure 35 APAC : An Attractive Destination For All Mobile UC&C Solution

Figure 36 North America Market Snapshot: Enterprise To Contribute Maximum To The Market

Figure 37 Asia-Pacific Mobile UC&C Market Snapshot: Conferencing to Gain Popularity Among Users

Figure 38 Companies Adopted Mergers and Acquisitions as The Key Growth Strategy Over The Last Three Years

Figure 39 Cisco and Microsoft Grew At the Fastest Rate between 2009 And 2013

Figure 40 Market Evaluation Framework

Figure 41 Battle for Market Share: Venture Funding Was the Key Strategy

Figure 42 Geographic Revenue Mix of Top 5 Players

Figure 43 Microsoft: Business Overview

Figure 44 Microsoft: SWOT Analysis

Figure 45 Cisco: Business Overview

Figure 46 Cisco: SWOT Analysis

Figure 47 IBM: Business Overview

Figure 48 IBM: SWOT Analysis

Figure 49 Alcatel-Lucent: Business Overview

Figure 50 Alcatel-Lucent: SWOT Analysis

Figure 51 Avaya: Business Overview

Figure 52 Avaya: SWOT Analysis

Figure 53 Siemens: Business Overview

Figure 54 NEC Corporation: Business Overview

Figure 55 Genband: Business Overview

Figure 56 Ericsson: Business Overview

Figure 57 Mitel: Business Overview

Growth opportunities and latent adjacency in Mobile Unified Communications and Collaboration Market