Smart Hospitality Market by Offering (Solutions, Services), Solution (Property Management System, Network Management System, Integrated Security Management System), Deployment Mode, End User and Region - Global Forecast to 2027

Smart Hospitality Market - Industry Trends & Forecast

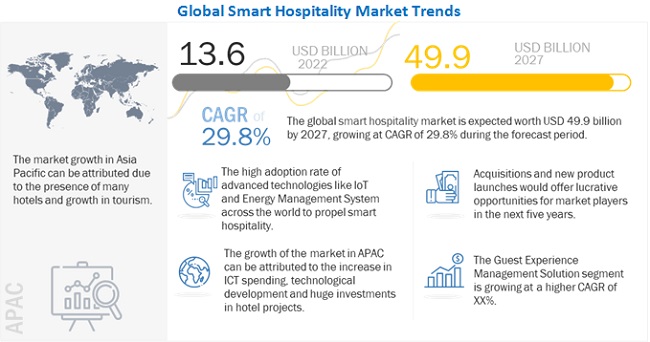

The global Smart Hospitality Market is estimated to be worth USD 13.6 billion in 2022. It is projected to reach USD 49.9 billion by 2027 at a CAGR of 29.8% during the forecast period. The growth in tourism and increased investments in hotel projects to boost the demand of smart hospitality market. Furthermore, the growing demand for guest-oriented, hyperconnected personalization and real-time optimized experience will drive the smart hospitality market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

COVID-19 has impacted the economy badly and forced people to adopt work from home culture. In hospitality industry hotels, resorts, restaurants, spa, casinos are forced people to close their businesses temporarily due to shutdowns imposed by governments. Restrictions on travel and tourism for few months forced hospitality business to shut down their businesses. According to United Nations World Tourism Organization (UNWTO) report in January 2021, international arrivals dropped by 74%. Thus, hospitality industry observed loss of businesses and many hotels, food chain, spa has been closed permanently. According to survey done by to American Hotel and Lodging Association, in November 2020, 71% hotel owners were asking for government support, they were not able to reopen their hotel before 6 months without any support. 47% respondent said they must close their business permanently if they will not receive government assistant such as extension of Main Street Lending Program, second PPP loan, and others.

This situation has reduced the productivity of the industry worldwide. Enterprises were facing challenges such as unavailability of workforce and price shock. After one year of the pandemic, during recovery, the hospitality industry tried to recover from this crisis. The first step of the companies was to adopt automated solutions to digitalize the operations of hotels, spa, resorts, and others to work efficiently with a smaller number of workers. The hospitality industry has responded quickly and collaboratively toward developing new strategies such as use of ultraviolet for surface disinfection, AI-based solutions for cleaning and sanitization, automated check-in, check-out, contactless technologies for payment processing, guest interaction and more to reduce the impact of COVID-19.

Smart Hospitality Market Dynamics

Driver: Growing demand for guest-oriented, hyperconnected personalization and real-time optimized experience will drive the market.

By offering a more personalized travel experience, hoteliers can establish a value-driven, long-term connection with every guest who is far more likely to generate a positive review for the brand. Curating a personalized guest experience not only drives revenue, but it enhances guest loyalty and brand reputation. Emerging smart hospitality solutions open the door to data-backed insights and behaviour, which help hoteliers generate a 360-degree view of each guest, thus enhancing their experience with better customer service. With the help of integrated, digital platforms such as Property Management System (PMS) and Customer Relation Management (CRM), hoteliers can access a dashboard with organized data from all channels, that not only curates a personalized view of each guest but also help to offset operational load. This also lowers the operational costs of the hotels and increase guest return ratio creating a better brand positioning. Hotels now also benefit by providing mobile centric guest experience which enhances the convenience and self-service for the guest. Creating a mobile-centric booking experience, offering keyless entry through a mobile device, text-based communications, mobile concierge etc., hoteliers can curate a more connected and convenient stay for their guests.

Restraint: High implementation, maintenance, and training cost

Smart hospitality solutions consisting of Property Management System (PMS), Guest Experience Management System etc. has high initial cost involved in the installation whether on premises or on-cloud. Since the hospitality industry is recovering from huge financial loss due to pandemic, implementing a smart hospitality solution can be challenge for any hotel due to budget constraints. Majority of hotels who had existing smart hospitality solutions employed in the hotel were expensive to maintain. However, the cost of deployment is usually associated with the complexity of integration, pertaining to a specific application.

Property management systems have a simple pricing structure mostly except for a few additional costs like add-on modules, training costs, access to APIs. A commission percentage on direct additional bookings,maintenance and setup fees,interface fee for third-party connections can also be charged sometimes apart from the monthly pricing structure.

The most popular model for hotem management software is pay-per-room. A higher price per tier is resulted by large number of rooms. Also a one time setup fee can be charged by some solution providers. Tiered models can overlap pay-per-room, though most tier-based models include a room range rather than a specified number that affects pricing. Subscription based tier-based models include a room range and are subscription based. The number of features available in the solution depends upon the price of the solution. More features are available in expensive solutions. Thus, large smart hospitality solutions are not economical for small hospitality organisations.

Opportunity: Evolving 5G to transform the smart hospitality industry

Hotel operators constantly seeking ways to streamline the guest experience with new digital tools and platforms. 5G can enable operators to revolutionize their offerings with cutting edge in-room and cross-facility services.5G has a potential to drive digital transformation in the hotel industry by providing the foundational platform for connecting wireless devices, applications, and people. With 5G technology, hotel operators should be able to deliver more personalized messages to their guests and get a deeper understanding of the guest journey.5G and complementary technologies such as edge computing will enable guests to proactively receive customized travel tips and recommendations based on individual preferences. Augmented reality powered by 5G can enable hotels to go above and beyond the standard experience, especially around guest entertainment. With sensors and video analytics, guests should be able to use augmented wayfinding to navigate large hotel properties prior to booking the stay and while they’re checked in. 5G technology has made possible for cross-cultural inclusivity by supporting real-time language translations. The benefits of 5G networks for security can’t be ignored as they enable superior connectivity between security personnel. Various other uses of 5G in hotel operations include temperature monitoring and lighting control thus promoting sustainable energy consumption. Locating equipments, luggage racks etc. is also supported by 5G due to efficient asset tracking capabilities. Application of robots in completing daily routine tasks is also an important application of 5G.

Challenge: Data security and information sharing threats

Threats of digital data theft and confidential data leaks are a matter of concern for hoteliers globally. Smart hospitality solutions contain personal information and personal preferences of guests. Any data leakage can create a question on the credibility of the hotel brand and have legal consequences. Information sharing across organization always faced several barriers, including intra-organization, inter-organization, technical issues etc. Inter-organization issues such as lack of trust to the new system, exposure of business data to competitors can impede the implementation of smart hospitality big data for the industry. Any concerns from ecosystem members can lower their participating intention on data contribution to the hospitality big data. To eliminate doubts and concerns from individual executives, publicly available data on the cloud should be consolidated, processed, and maintained anonymously so that no organization identity or customers' details can be accessed or recognized by competitors.

By Solution, the Guest Experience Management System segment to have the highest growth rate during the forecast period

The smart hospitality market, by solutions, has been segmented into the Property Management System (PMS), Guest Experience Management System, Point Of Sale (POS) Software, Facility Management System, Network Management System and Integrated Security Management System. By solution, the Guest Experience Management System segment is expected to have the highest growth rate during the forecast period. The need to streamline guest service operations and create a strong brand name will drive the adoption of smart hospitality solutions in the market.

Asia Pacific is expected to have the highest growth rate during the forecast period

Factors such as favorable government efforts and regulations to drive the expansion of the hospitality sector will boost smart hospitality market growth in this area over the next five years. Furthermore, the increased technology innovations, internet infrastructure, expanding IoT applications, and efficient energy use further drive growth in the region's smart hospitality industry. The flourishing tourism industry with a younger hotel infrastructure and the high number of new hotel openings in many Asia-Pacific countries such as Thailand, Malaysia, and Indonesia will drive the market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The report includes the study of key players in market. The major vendors covered in the smart hospitality market include NEC (Japan), Huawei ( China), Schneider Electric (France), Cisco (US), IBM (US), Honeywell (US), Legrand (France), Siemens AG (Germany), Oracle (US), Johnson Controls (Ireland), Samsung (South Korea), Infor (US), Leviton (US), Sabre (US), Springler-Miller Systems (US), Control4 (US), Global Business Solutions (Saudi Arabia), Wisuite (US), Qualsoft Systems (India), Hospitality Network (US), Guestline (UK), Cloudbeds (US), Frontdesk Anywhere (US), Chris Lewis Group (UK), Xie Zhu (China), BuildingIQ (US), Stayntouch (US). These players have adopted various growth strategies, such as partnerships, business expansions, mergers and acquisitions, agreements, and collaborations, new product launches to expand their presence in the smart hospitality market. Partnerships and new product launches have been the most adopted strategies by major players from 2019 to 2022, which helped them innovate their offerings and broaden their customer base.

These players have adopted various strategies to grow in the global offering in smart hospitality market. The study includes an in-depth competitive analysis of these key players in the offering market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 13.6 billion |

|

Revenue forecast for 2027 |

USD 49.9 billion |

|

Growth Rate |

29.8% CAGR |

|

Market size available for years |

2017-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Offering, Solutions, Deployment Mode, End User and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

NEC (Japan), Huawei ( China), Schneider Electric (France), Cisco (US), IBM (US), Honeywell (US), Legrand (France), Siemens AG (Germany), Oracle (US), Johnson Controls (Ireland), Samsung (South Korea), Infor (US), Leviton (US), Sabre (US), Springler-Miller Systems (US), Control4 (US), Gloabal Business Solutions (Saudi Arabia), Wisuite (US), Qualsoft Systems (India), Hospitality Network (US), Guestline (UK), Cloudbeds (US), Frontdesk Anywhere (US), Chris Lewis Group (UK), Xie Zhu (China), BuildingIQ (US), Stayntouch (US) |

This research report categorizes the smart hospitality market to forecast revenues and analyze trends in each of the following subsegments:

By Offering:

-

Solution

- Property Management System

- Guest Experience Management System

- Integrated Security Management

- Facility Management Software

- Network Management Software

- Point Of Sale Software

-

Services

-

Professional Services

- Consulting

- Integration and Deployment

- Support and Maintenance

- Managed Services

-

Professional Services

By Deployment Mode:

- Cloud

- On-premises

By End User:

- Hotel

- Cruise

- Luxury Yatches

- Others

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

Asia Pacific

- China

- Australia

- India

- Rest of Asia Pacific

-

Middle East and Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In May 2022, Oracle and Orient Jakarta collaborated to implement property management system. The solution supported to improve their online presence in the COVID-19 situation and trained staff through Oracle Digital Learning tools remotely due to travel restrictions.

- In January 2022, Johnson Controls acquired FogHorn, developed of Edge AI solutions. This integrating will help to accelerate the healthy buildings movement to develop sustainable, efficient, fully autonomous space.

- In January 2022, Infor and Seven Feathers Casino has partnered to enrich guest service with integrated applications specialized for the industry using Infor’s hospitality solutions.

- In December 2021, Siemens has acquired digital twin software of EcoDomus to expands digital building portfolio which includes cloud-based building operations and its smart building management platform Desigo CC.

- In October 2021, Macdonald and IBM entered partnership to develop automated order tracking app to manage customers order and improve their experience in the restaurant.

Frequently Asked Questions (FAQ):

How is the smart hospitality market expected to grow in the next five years?

According to MarketsandMarkets, the smart hospitality market size is expected to grow from USD 13.6 billion in 2022 to USD 49.9 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 29.8% during the forecast period.

Which region has the largest market share in the smart hospitality market?

Europe is estimated to hold the largest market share in the smart hospitality market in 2022. Europe is one of the leading regions in the smart hospitality market. The relatively robust internet infrastructure, openness to new technology, and presence of a strong domestic cloud provider have all contributed to the growth of the smart hospitality market.

What are the major factors driving smart hospitality market?

The major growth drivers for the smart hospitality market are the growing demand for guest-oriented, hyperconnected personalization and real-time optimized experience.

Who are the major vendors in smart hospitality market?

Major vendors in the smart hospitality market include NEC, Schneider Electric, Cisco, IBM and Huawei .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2020

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

1.7 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 1 SMART HOSPITALITY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 SECONDARY SOURCES

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Breakup of primary profiles

2.1.3.3 List of key primary interview participants

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.3.4 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach for capturing the market share using the bottom-up analysis (demand side)

FIGURE 2 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE SMART HOSPITALITY MARKET

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach for capturing the market share using the top-down analysis (supply side)

FIGURE 4 TOP-DOWN APPROACH

2.3.3 MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

2.3.4 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

2.3.5 GROWTH FORECAST ASSUMPTIONS

TABLE 3 MARKET GROWTH ASSUMPTIONS

2.4 ASSUMPTIONS FOR THE STUDY

2.5 RISK ASSESSMENT

TABLE 4 RISK ASSESSMENT: MARKET

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 7 SMART HOSPITALITY MARKET, 2020-2027

FIGURE 8 LEADING SEGMENTS IN THE MARKET IN 2022

FIGURE 9 MARKET: REGIONAL SNAPSHOT

FIGURE 10 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS DURING 2022–2027

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 BRIEF OVERVIEW OF THE SMART HOSPITALITY MARKET

FIGURE 11 NEED FOR GUEST-ORIENTED, HYPERCONNECTED PERSONALIZATION, AND REAL-TIME OPTIMIZED EXPERIENCE WOULD SIGNIFICANTLY IMPACT THE GROWTH OF THE MARKET

4.2 NORTH AMERICA: MARKET, BY TOP THREE SOLUTIONS

FIGURE 12 PROPERTY MANAGEMENT SYSTEM AND GUEST EXPERIENCE MANAGEMENT SEGMENT TO ACCOUNT FOR LARGE MARKET SHARE IN NORTH AMERICA IN 2022

4.3 EUROPE: MARKET, BY TOP THREE SOLUTIONS

FIGURE 13 PROPERTY MANAGEMENT SYSTEM AND GUEST EXPERIENCE MANAGEMENT SEGMENT TO ACCOUNT FOR LARGE MARKET SHARE IN EUROPE IN 2022

4.4 ASIA PACIFIC: MARKET, BY TOP THREE SOLUTIONS

FIGURE 14 PROPERTY MANAGEMENT SYSTEM AND GUEST EXPERIENCE MANAGEMENT SEGMENT TO ACCOUNT FOR LARGE MARKET SHARES IN ASIA PACIFIC IN 2022

5 MARKET OVERVIEW (Page No. - 50)

5.1 MARKET DYNAMICS

FIGURE 15 SMART HOSPITALITY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Growth in tourism and increased investments in hotel projects

FIGURE 16 NUMBER OF NEW HOTEL PROJECTS UNDER CONSTRUCTION IN VARIOUS REGIONS, 2022

5.1.1.2 Growing demand for guest-oriented, hyperconnected personalized and real-time optimized experience

5.1.1.3 Reduction in operational costs and high revenue growth opportunities

5.1.1.4 High adoption rate of advanced technologies like IoT and Energy Management systems across the world

5.1.2 RESTRAINTS

5.1.2.1 High implementation, maintenance, and training cost

5.1.2.2 Integration complexities over legacy systems and networks

5.1.2.3 Quality and technically sound manpower shortage post COVID-19

FIGURE 17 PERCENTAGE OF WORKFORCE BY PROFESSIONAL QUALIFICATION IN HOSPITALITY AND OTHER INDUSTRIES IN 2022

5.1.3 OPPORTUNITIES

5.1.3.1 Use of smart hospitality to alleviate operational burden and promote safety of employees and customer health

5.1.3.2 Evolving 5G to transform the smart hospitality industry

5.1.3.3 Emerging hotel workspaces concept

5.1.4 CHALLENGES

5.1.4.1 Data security and information sharing threats

5.1.4.2 Integration of real-time streaming analytics capabilities into smart solutions

5.1.4.3 Technology and data fragmentation

5.2 COVID-19 MARKET OUTLOOK FOR SMART HOSPITALITY MARKET

5.2.1 DRIVERS AND OPPORTUNITIES

5.2.2 RESTRAINTS AND CHALLENGES

5.2.3 CUMULATIVE GROWTH ANALYSIS

5.3 PRICING ANALYSIS

TABLE 5 PRICING ANALYSIS

5.4 SUPPLY/VALUE CHAIN ANALYSIS

FIGURE 18 MARKET: VALUE CHAIN ANALYSIS

5.5 ECOSYSTEM

TABLE 6 SMART HOSPITALITY MARKET: ECOSYSTEM

5.6 TECHNOLOGY ANALYSIS

5.6.1 BIG DATA AND ANALYTICS

5.6.2 ARTIFICIAL INTELLIGENCE

5.6.3 BLOCKCHAIN

5.6.4 INTERNET OF THINGS

5.6.5 5G

5.7 PATENT ANALYSIS

FIGURE 19 TOP 10 COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 7 TOP 20 PATENT OWNERS (UNITED STATES)

FIGURE 20 NUMBER OF PATENTS GRANTED IN A YEAR, 2011–2021

5.8 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 8 SMART HOSPITALITY MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.9 REGULATORY LANDSCAPE

5.9.1 BACNET—DATA COMMUNICATION PROTOCOL FOR BUILDING AUTOMATION AND CONTROL NETWORKS

5.9.2 KNX

5.9.3 DIGITAL ADDRESSABLE LIGHTING INTERFACE

5.9.4 MODBUS

5.9.5 CLOUD STANDARD CUSTOMER COUNCIL

5.9.6 COMMUNICATIONS & INFORMATION TECHNOLOGY COMMISSION (CITC)

5.9.7 GENERAL DATA PROTECTION REGULATION

5.9.8 THE INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 27001

5.9.9 CALIFORNIA CONSUMER PRIVACY ACT

5.9.10 PERSONAL DATA PROTECTION ACT

5.10 PORTER’S FIVE FORCES MODEL

TABLE 9 SMART HOSPITALITY MARKET: PORTER’S FIVE FORCES

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 COMPETITIVE RIVALRY

5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN THE BUYING PROCESS

FIGURE 21 INFLUENCE OF STAKEHOLDERS IN THE BUYING PROCESS FOR THE TOP THREE END USERS

TABLE 10 INFLUENCE OF STAKEHOLDERS ON THE BUYING PROCESS FOR THE TOP THREE END USERS

5.11.2 BUYING CRITERIA

FIGURE 22 KEY BUYING CRITERIA FOR THE TOP THREE END USERS

TABLE 11 KEY BUYING CRITERIA FOR THE TOP THREE END USERS

5.12 CASE STUDY ANALYSIS

5.12.1 CASE STUDY 1: HILTON DEPLOYED ECOSTRUXURE SOLUTION TO IMPROVE EFFICIENCY AND GUEST COMFORT

5.12.2 CASE STUDY 2: HYATT DEPLOYED ECOSTRUXURE SOLUTION TO IMPROVE THE GUEST EXPERIENCE

5.12.3 CASE STUDY 3: MERLIN ENTERTAINMENTS SELECTED ORACLE TO INCREASE OCCUPANCY AND HOTEL ATTRACTION

5.12.4 CASE STUDY 4: DEPLOYMENT OF HOSPITALITY SOLUTIONS TO SPEED UP OPERATIONS WITH CLOUD

5.12.5 CASE STUDY 5: DEPLOYMENT OF PROPERTY MANAGEMENT SYSTEM TO MANAGE LODGING INVENTORY

6 SMART HOSPITALITY MARKET, BY OFFERING (Page No. - 79)

6.1 INTRODUCTION

FIGURE 23 SOLUTION SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 12 MARKET, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 13 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

6.1.1 OFFERING: MARKET DRIVERS

6.1.2 OFFERING: COVID-19 IMPACT

6.2 SOLUTIONS

6.2.1 SMART HOSPITALITY SOLUTIONS HELPS SOLVE CRITICAL CHALLENGES FOR HOSPITALITY OPERATIONS AND MANAGEMENT

TABLE 14 SOLUTIONS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 15 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

FIGURE 24 PROFESSIONAL SERVICES TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 16 SMART HOSPITALITY MARKET, BY SERVICES, 2017–2021 (USD MILLION)

TABLE 17 MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 18 SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 19 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

FIGURE 25 INTEGRATION AND DEPLOYMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 20 MARKET, BY PROFESSIONAL SERVICES, 2017–2021 (USD MILLION)

TABLE 21 MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

6.3.1.1 Consulting services

6.3.1.2 Integration and deployment

6.3.1.3 Support and maintenance

6.3.2 MANAGED SERVICES

7 SMART HOSPITALITY MARKET, BY SOLUTION (Page No. - 87)

7.1 INTRODUCTION

FIGURE 26 GUEST EXPERIENCE MANAGEMENT SYSTEM SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 22 MARKET, BY SOLUTIONS, 2017–2021 (USD MILLION)

TABLE 23 MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

7.1.1 SOLUTION: MARKET DRIVERS

7.1.2 SOLUTION: COVID-19 IMPACT

7.2 PROPERTY MANAGEMENT SYSTEM (PMS)

7.2.1 NEED FOR A CENTRALIZED APPLICATION TO PERFORM, SCHEDULE, AND ORGANIZE DAILY OPERATIONS AND TRANSACTIONS

TABLE 24 PROPERTY MANAGEMENT SYSTEM: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 25 PROPERTY MANAGEMENT SYSTEM: SMART HOSPITALITY MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2.1.1 Work force mobility and management

7.2.1.2 Inventory and logistics management

7.2.1.3 Revenue management

7.2.1.4 Centralized reservation management

7.2.1.5 Analytics and reporting system

7.3 GUEST EXPERIENCE MANAGEMENT SYSTEM

TABLE 26 GUEST EXPERIENCE MANAGEMENT SYSTEM: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 27 GUEST EXPERIENCE MANAGEMENT SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 POINT OF SALE (POS) SOFTWARE

7.4.1 NEED TO DELIVER QUICK AND CONVENIENT SERVICE TO CUSTOMERS BY ENHANCING CHECKOUT PROCESS TO DRIVE THE MARKET

TABLE 28 POINT OF SALE (POS) SOFTWARE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 29 POINT OF SALE (POS) SOFTWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 FACILITY MANAGEMENT SYSTEM

7.5.1 NEED TO OPTIMIZE THE USE OF RESOURCES AND MANAGE COST OF AMENITIES TO DRIVE THE MARKET

TABLE 30 FACILITY MANAGEMENT SYSTEM: SMART HOSPITALITY MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 31 FACILITY MANAGEMENT SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5.1.1 Energy management

7.5.1.2 Room automation and control system

7.5.1.3 Safety management

7.6 NETWORK MANAGEMENT SYSTEM

7.6.1 NEED TO MONITOR COMPLEX NETWORK INFRASTRUCTURE TO DRIVE THE MARKET

TABLE 32 NETWORK MANAGEMENT SYSTEM: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 33 NETWORK MANAGEMENT SYSTEM: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.7 INTEGRATED SECURITY MANAGEMENT

7.7.1 NEED TO PROVIDE PROACTIVE AND PREVENTATIVE SECURITY TO DRIVE THE MARKET

TABLE 34 INTEGRATED SECURITY MANAGEMENT: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 35 INTEGRATED SECURITY MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.7.1.1 Video surveillance system

7.7.1.2 Access control system

7.7.1.3 Emergency incident management system

8 SMART HOSPITALITY MARKET, BY DEPLOYMENT MODE (Page No. - 100)

8.1 INTRODUCTION

FIGURE 27 CLOUD SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 36 SMART HOSPITALITY, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 37 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

8.1.1 DEPLOYMENT MODE: MARKET DRIVERS

8.1.2 DEPLOYMENT MODE: COVID-19 IMPACT

8.2 ON-PREMISES

8.2.1 NEED FOR PERSONALIZED SOLUTIONS TO DRIVE THE MARKET

TABLE 38 ON-PREMISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 39 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 CLOUD

8.3.1 GROWING NEED TO SAVE OPERATIONAL EXPENDITURE FUELS THE DEMAND FOR CLOUD-BASED SOLUTIONS

TABLE 40 CLOUD: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 41 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 SMART HOSPITALITY MARKET, BY END USER (Page No. - 105)

9.1 INTRODUCTION

FIGURE 28 SMALL AND MEDIUM ENTERPRISES SEGMENT IS EXPECTED TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 42 MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 43 MARKET, BY END USER, 2022–2027 (USD MILLION)

9.1.1 END USER: MARKET DRIVERS

9.1.2 END USER: COVID-19 IMPACT

9.2 HOTELS

9.2.1 INTRODUCTION

TABLE 44 HOTELS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 HOTELS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2.2 COMMERCIAL

9.2.3 RESORTS AND SPAS

9.2.4 HERITAGE AND BOUTIQUE HOTELS

9.2.5 OTHERS

9.3 CRUISE

TABLE 46 CRUISE: SMART HOSPITALITY MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 47 CRUISE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 LUXURY YACHTS

TABLE 48 LUXURY YACHTS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 49 LUXURY YACHTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 OTHERS

TABLE 50 OTHERS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 51 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 SMART HOSPITALITY MARKET, BY REGION (Page No. - 113)

10.1 INTRODUCTION

10.2 COVID-19 IMPACT ON THE MARKET

FIGURE 29 MARKET: REGIONAL SNAPSHOT (2022)

FIGURE 30 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 52 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 53 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 NORTH AMERICA

10.3.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

TABLE 54 NORTH AMERICA: SMART HOSPITALITY MARKET, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: SMART HOSPITALITY SYSTEM MARKET, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.2 UNITED STATES

10.3.2.1 Leading smart hospitality technology vendors operating across the US to drive the market

TABLE 68 UNITED STATES: SMART HOSPITALITY MARKET, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 69 UNITED STATES: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 70 UNITED STATES: MARKET, BY SOLUTIONS, 2017–2021 (USD MILLION)

TABLE 71 UNITED STATES: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 72 UNITED STATES: MARKET, BY SERVICES, 2017–2021 (USD MILLION)

TABLE 73 UNITED STATES: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 74 UNITED STATES: SMART HOSPITALITY SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2017–2021 (USD MILLION)

TABLE 75 UNITED STATES: MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

TABLE 76 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 77 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 78 UNITED STATES: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 79 UNITED STATES: MARKET, BY END USER, 2022–2027 (USD MILLION)

10.3.3 CANADA

10.3.3.1 Innovation and advancements in hospitality technology to drive the market in Canada

10.4 EUROPE

10.4.1 PESTLE ANALYSIS: EUROPE

TABLE 80 EUROPE: SMART HOSPITALITY MARKET, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY SOLUTIONS, 2017–2021 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY SERVICES, 2017–2021 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 86 EUROPE: SMART HOSPITALITY SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2017–2021 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 90 EUROPE: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 91 EUROPE MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 92 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.2 UNITED KINGDOM

10.4.2.1 Government initiatives supported by collaborations and partnerships to drive the UK market

10.4.3 GERMANY

10.4.3.1 Major investments in travel and tourism sector to drive the German market

TABLE 94 GERMANY: SMART HOSPITALITY MARKET, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 95 GERMANY: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 96 GERMANY: MARKET, BY SOLUTIONS, 2017–2021 (USD MILLION)

TABLE 97 GERMANY: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 98 GERMANY: MARKET, BY SERVICES, 2017–2021 (USD MILLION)

TABLE 99 GERMANY: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 100 GERMANY: SMART HOSPITALITY SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2017–2021 (USD MILLION)

TABLE 101 GERMANY: MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

TABLE 102 GERMANY: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 103 GERMANY: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 104 GERMANY: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 105 GERMANY: MARKET, BY END USER, 2022–2027 (USD MILLION)

10.4.4 REST OF EUROPE

10.5 ASIA PACIFIC

10.5.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 106 ASIA PACIFIC: SMART HOSPITALITY MARKET, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET, BY SOLUTIONS, 2017–2021 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY SERVICES, 2017–2021 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 112 ASIA PACIFIC: SMART HOSPITALITY SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2017–2021 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 117 ASIA PACIFIC MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.2 INDIA

10.5.2.1 Government-enhanced focus on building smart infrastructure for the travel and tourism sector to drive the market

10.5.3 CHINA

10.5.3.1 Rapid development and adoption of new technologies, such as the Internet of Things (IoT) and big data to drive the market in China

TABLE 120 CHINA: SMART HOSPITALITY MARKET, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 121 CHINA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 122 CHINA: MARKET, BY SOLUTIONS, 2017–2021 (USD MILLION)

TABLE 123 CHINA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 124 CHINA: MARKET, BY SERVICES, 2017–2021 (USD MILLION)

TABLE 125 CHINA: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 126 CHINA: SMART HOSPITALITY SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2017–2021 (USD MILLION)

TABLE 127 CHINA: MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

TABLE 128 CHINA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 129 CHINA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 130 CHINA: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 131 CHINA: MARKET, BY END USER, 2022–2027 (USD MILLION)

10.5.4 AUSTRALIA

10.5.4.1 Increasing demand for luxury hotels to drive the market in Australia

10.5.5 REST OF ASIA PACIFIC

10.5.5.1 Need to align with technology to drive the market in the region

10.6 MIDDLE EAST AND AFRICA

10.6.1 PESTLE ANALYSIS: MIDDLE EAST AND AFRICA

TABLE 132 MIDDLE EAST AND AFRICA: SMART HOSPITALITY MARKET, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 133 MIDDLE EAST AND AFRICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 134 MIDDLE EAST AND AFRICA: MARKET, BY SOLUTIONS, 2017–2021 (USD MILLION)

TABLE 135 MIDDLE EAST AND AFRICA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 136 MIDDLE EAST AND AFRICA: MARKET, BY SERVICES, 2017–2021 (USD MILLION)

TABLE 137 MIDDLE EAST AND AFRICA: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 138 MIDDLE EAST AND AFRICA: SMART HOSPITALITY SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2017–2021 (USD MILLION)

TABLE 139 MIDDLE EAST AND AFRICA: MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

TABLE 140 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 141 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 142 MIDDLE EAST AND AFRICA: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 143 MIDDLE EAST AND AFRICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 144 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 145 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.2 MIDDLE EAST

10.6.2.1 Vision 2030 to create huge opportunities for the smart hospitality market in the region

TABLE 146 MIDDLE EAST: MARKET, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 147 MIDDLE EAST: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 148 MIDDLE EAST: MARKET, BY SOLUTIONS, 2017–2021 (USD MILLION)

TABLE 149 MIDDLE EAST: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 150 MIDDLE EAST: MARKET, BY SERVICES, 2017–2021 (USD MILLION)

TABLE 151 MIDDLE EAST: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 152 MIDDLE EAST: SMART HOSPITALITY SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2017–2021 (USD MILLION)

TABLE 153 MIDDLE EAST: MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

TABLE 154 MIDDLE EAST: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 155 MIDDLE EAST: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 156 MIDDLE EAST: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 157 MIDDLE EAST: MARKET, BY END USER, 2022–2027 (USD MILLION)

10.6.3 AFRICA

10.6.3.1 Booming tourism industry supported by investors and major international hospitality brands to drive the market

10.7 LATIN AMERICA

10.7.1 PESTLE ANALYSIS: LATIN AMERICA

TABLE 158 LATIN AMERICA: SMART HOSPITALITY MARKET, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 159 LATIN AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 160 LATIN AMERICA: MARKET, BY SOLUTIONS, 2017–2021 (USD MILLION)

TABLE 161 LATIN AMERICA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 162 LATIN AMERICA: MARKET, BY SERVICES, 2017–2021 (USD MILLION)

TABLE 163 LATIN AMERICA: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 164 LATIN AMERICA: SMART HOSPITALITY SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2017–2021 (USD MILLION)

TABLE 165 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

TABLE 166 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 167 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 168 LATIN AMERICA: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 170 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 171 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.7.2 MEXICO

10.7.2.1 Digital transformation across the country to drive the market

10.7.3 BRAZIL

10.7.3.1 Growing innovation in the country to drive the market

TABLE 172 BRAZIL: SMART HOSPITALITY MARKET, BY OFFERING, 2017–2021 (USD MILLION)

TABLE 173 BRAZIL: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 174 BRAZIL: MARKET, BY SOLUTIONS, 2017–2021 (USD MILLION)

TABLE 175 BRAZIL: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 176 BRAZIL: MARKET, BY SERVICES, 2017–2021 (USD MILLION)

TABLE 177 BRAZIL: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 178 BRAZIL: SMART HOSPITALITY SYSTEM MARKET, BY PROFESSIONAL SERVICES, 2017–2021 (USD MILLION)

TABLE 179 BRAZIL: MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

TABLE 180 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

TABLE 181 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 182 BRAZIL: MARKET, BY END USER, 2017–2021 (USD MILLION)

TABLE 183 BRAZIL: MARKET, BY END USER, 2022–2027 (USD MILLION)

10.7.4 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 164)

11.1 OVERVIEW

11.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 184 OVERVIEW OF STRATEGIES ADOPTED BY KEY HOSPITALITY MARKET VENDORS

11.3 REVENUE ANALYSIS

11.3.1 HISTORICAL REVENUE ANALYSIS

FIGURE 33 REVENUE ANALYSIS OF TOP FIVE LEADING PLAYERS, 2019–2021

11.3.2 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 34 SMART HOSPITALITY MARKET: REVENUE ANALYSIS

11.4 RANKING OF KEY PLAYERS

FIGURE 35 RANKING OF KEY MARKET PLAYERS

11.5 MARKET SHARE ANALYSIS

TABLE 185 MARKET: DEGREE OF COMPETITION

11.6 MARKET EVALUATION FRAMEWORK

FIGURE 36 MARKET EVALUATION FRAMEWORK: EXPANSIONS AND CONSOLIDATIONS IN THE MARKET BETWEEN 2019 AND 2022

11.7 COMPANY EVALUATION QUADRANTS

11.7.1 STARS

11.7.2 EMERGING LEADERS

11.7.3 PERVASIVE PLAYERS

11.7.4 PARTICIPANTS

FIGURE 37 SMART HOSPITALITY MARKET: COMPANY EVALUATION MATRIX, 2022

TABLE 186 COMPANY FOOTPRINT ANALYSIS: MARKET

TABLE 187 COMPANY OFFERING FOOTPRINT: MARKET

TABLE 188 COMPANY FUNCTIONALITY FOOTPRINT

TABLE 189 COMPANY REGION FOOTPRINT

11.8 COMPETITIVE BENCHMARKING

TABLE 190 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 191 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

11.9 STARTUP/SME EVALUATION QUADRANT

11.9.1 PROGRESSIVE COMPANIES

11.9.2 RESPONSIVE COMPANIES

11.9.3 DYNAMIC COMPANIES

11.9.4 STARTING BLOCKS

FIGURE 38 SMART HOSPITALITY MARKET: STARTUP/SME EVALUATION MATRIX

11.10 COMPETITIVE SCENARIO AND TRENDS

11.10.1 NEW PRODUCT LAUNCHES

TABLE 192 MARKET: PRODUCT LAUNCHES, 2019-2022

11.10.2 DEALS

TABLE 193 MARKET: DEALS, 2019–2022

12 COMPANY PROFILES (Page No. - 188)

12.1 MAJOR PLAYERS

(Business Overview, Products, Recent Developments, MnM View)*

12.1.1 NEC CORPORATION

TABLE 194 NEC CORPORATION: BUSINESS OVERVIEW

FIGURE 39 NEC CORPORATION: COMPANY SNAPSHOT

TABLE 195 NEC CORPORATION: PRODUCTS OFFERED

TABLE 196 NEC CORPORATION: PRODUCT LAUNCHES

TABLE 197 NEC CORPORATION: DEALS

12.1.2 HUAWEI

TABLE 198 HUAWEI: BUSINESS OVERVIEW

FIGURE 40 HUAWEI: COMPANY SNAPSHOT

TABLE 199 HUAWEI: PRODUCTS OFFERED

TABLE 200 HUAWEI: PRODUCT LAUNCHES

TABLE 201 HUAWEI: DEALS

12.1.3 SCHNEIDER ELECTRIC

TABLE 202 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 41 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 203 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

TABLE 204 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

TABLE 205 SCHNEIDER ELECTRIC: DEALS

12.1.4 CISCO SYSTEMS

TABLE 206 CISCO: BUSINESS OVERVIEW

FIGURE 42 CISCO: COMPANY SNAPSHOT

TABLE 207 CISCO: PRODUCTS OFFERED

TABLE 208 CISCO: PRODUCT LAUNCHES

TABLE 209 CISCO: DEALS

12.1.5 IBM

TABLE 210 IBM: BUSINESS OVERVIEW

FIGURE 43 IBM: COMPANY SNAPSHOT

TABLE 211 IBM: PRODUCTS OFFERED

TABLE 212 IBM: PRODUCT LAUNCHES

TABLE 213 IBM: DEALS

12.1.6 HONEYWELL

TABLE 214 HONEYWELL: BUSINESS OVERVIEW

FIGURE 44 HONEYWELL: COMPANY SNAPSHOT

TABLE 215 HONEYWELL: PRODUCTS OFFERED

TABLE 216 HONEYWELL: PRODUCT LAUNCHES

TABLE 217 HONEYWELL: DEALS

12.1.7 LEGRAND

TABLE 218 LEGRAND: BUSINESS OVERVIEW

FIGURE 45 LEGRAND: COMPANY SNAPSHOT

TABLE 219 LEGRAND: PRODUCTS OFFERED

TABLE 220 LEGRAND: PRODUCT LAUNCHES

TABLE 221 LEGRAND: DEALS

12.1.8 SIEMENS AG

TABLE 222 SIEMENS AG: BUSINESS OVERVIEW

FIGURE 46 SIEMENS AG: COMPANY SNAPSHOT

TABLE 223 SIEMENS AG: PRODUCTS OFFERED

TABLE 224 SIEMENS AG: PRODUCT LAUNCHES

TABLE 225 SIEMENS AG: DEALS

12.1.9 ORACLE

TABLE 226 ORACLE: BUSINESS OVERVIEW

FIGURE 47 ORACLE: COMPANY SNAPSHOT

TABLE 227 ORACLE: PRODUCTS OFFERED

TABLE 228 ORACLE: PRODUCT LAUNCHES

TABLE 229 ORACLE: DEALS

12.1.10 JOHNSON CONTROLS

TABLE 230 JOHNSON CONTROLS: BUSINESS OVERVIEW

FIGURE 48 JOHNSON CONTROLS: COMPANY SNAPSHOT

TABLE 231 JOHNSON CONTROLS: PRODUCTS OFFERED

TABLE 232 JOHNSON CONTROLS: PRODUCT LAUNCHES

TABLE 233 JOHNSON CONTROLS: DEALS

12.1.11 SAMSUNG

TABLE 234 SAMSUNG ELECTRONICS: BUSINESS OVERVIEW

FIGURE 49 SAMSUNG: COMPANY SNAPSHOT

TABLE 235 SAMSUNG: PRODUCTS OFFERED

TABLE 236 SAMSUNG: PRODUCT LAUNCHES

TABLE 237 SAMSUNG: DEALS

TABLE 238 SAMSUNG: OTHERS

12.1.12 INFOR

TABLE 239 INFOR: BUSINESS OVERVIEW

TABLE 240 INFOR: PRODUCTS OFFERED

TABLE 241 INFOR: PRODUCT LAUNCHES

TABLE 242 INFOR: DEALS

12.1.13 LEVITON

TABLE 243 LEVITON: BUSINESS OVERVIEW

TABLE 244 LEVITON: PRODUCTS OFFERED

TABLE 245 LEVITON: DEALS

12.1.14 SABRE CORPORATION

12.1.15 SPRINGER-MILLER SYSTEMS

12.2 STARTUPS/SMES

12.2.1 CONTROL4

12.2.2 GLOBAL BUSINESS SOLUTIONS CO. LTD

12.2.3 WISUITE

12.2.4 QUALSOFT SYSTEMS PVT LTD

12.2.5 HOSPITALITY NETWORK

12.2.6 GUESTLINE

12.2.7 CLOUDBEDS

12.2.8 FRONTDESK ANYWHERE

12.2.9 CHRIS LEWIS GROUP

12.2.10 XIE ZHU

12.2.11 BUILDINGIQ

12.2.12 STAYNTOUCH

*Details on Business Overview, Products, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKETS (Page No. - 256)

13.1 INTRODUCTION

13.1.1 LIMITATIONS

13.2 IOT IN SMART CITIES MARKET

13.2.1 MARKET DEFINITION

13.2.2 MARKET OVERVIEW

13.2.2.1 IoT in smart cities market, by offering

TABLE 246 IOT IN SMART CITIES MARKET SIZE, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 247 IOT IN SMART CITES MARKET SIZE, BY OFFERING, 2021–2026 (USD BILLION)

13.2.2.2 IoT in smart cities market, by solution

TABLE 248 IOT IN SMART CITIES MARKET SIZE, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 249 IOT IN SMART CITIES MARKET SIZE, BY SOLUTION, 2021–2026 (USD BILLION)

13.2.2.3 IoT in smart cities market, by service

TABLE 250 SERVICES: IOT IN SMART CITIES MARKET SIZE, BY TYPE, 2016–2020 (USD BILLION)

TABLE 251 SERVICES: IOT IN SMART CITIES MARKET SIZE, BY TYPE, 2021–2026 (USD BILLION)

13.2.2.4 IoT in smart cities market, by application

TABLE 252 IOT IN SMART CITIES MARKET SIZE, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 253 IOT IN SMART CITIES MARKET SIZE, BY APPLICATION, 2021–2026 (USD BILLION)

13.2.2.5 IoT in smart cities market, by region

TABLE 254 IOT IN SMART CITIES MARKET, BY REGION, 2016–2020 (USD BILLION)

TABLE 255 IOT IN SMART CITIES MARKET, BY REGION, 2021–2026 (USD BILLION)

TABLE 256 NORTH AMERICA: IOT IN SMART CITIES MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 257 NORTH AMERICA: IOT IN SMART CITIES MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 258 EUROPE: IOT IN SMART CITIES MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 259 EUROPE: IOT IN SMART CITIES MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 260 ASIA PACIFIC: IOT IN SMART CITIES MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 261 ASIA PACIFIC: IOT IN SMART CITIES MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 262 MIDDLE EAST & AFRICA: IOT IN SMART CITIES MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 263 MIDDLE EAST & AFRICA: IOT IN SMART CITIES MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 264 LATIN AMERICA: IOT IN SMART CITIES MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 265 LATIN AMERICA: IOT IN SMART CITIES MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

13.3 SMART BUILDINGS MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.3.2.1 Smart buildings market, by component

TABLE 266 SMART BUILDINGS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 267 SMART BUILDINGS MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

13.3.2.2 Smart building market, by solution

TABLE 268 SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 269 SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

13.3.2.3 Smart buildings market by, building type

TABLE 270 SMART BUILDINGS MARKET SIZE, BY BUILDING TYPE, 2017–2020 (USD MILLION)

TABLE 271 SMART BUILDINGS MARKET SIZE, BY BUILDING TYPE, 2021–2026 (USD MILLION)

13.3.2.4 Smart buildings market, by region

TABLE 272 SMART BUILDINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 273 SMART BUILDINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 274 NORTH AMERICA: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 275 NORTH AMERICA: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 276 EUROPE: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 277 EUROPE: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 278 ASIA PACIFIC: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 279 ASIA PACIFIC: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 280 MIDDLE EAST AND AFRICA: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 281 MIDDLE EAST AND AFRICA: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 282 LATIN AMERICA: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 283 LATIN AMERICA: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

13.4 SMART CITIES PLATFORM MARKET

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

13.4.2.1 Smart cities platform market, by offering

TABLE 284 SMART CITY PLATFORMS MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 285 SMART CITY PLATFORMS MARKET, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 286 SMART CITY PLATFORMS MARKET, BY TYPE, 2016–2020 (USD BILLION)

TABLE 287 SMART CITY PLATFORMS MARKET, BY TYPE, 2021–2026 (USD BILLION)

13.4.2.2 Smart cities platform market, by delivery model

TABLE 288 SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2016–2020 (USD BILLION)

TABLE 289 SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2021–2026 (USD BILLION)

13.4.2.3 Smart cities platforms market, by region

TABLE 290 SMART CITY PLATFORMS MARKET, BY REGION, 2016–2020 (USD BILLION)

TABLE 291 SMART CITY PLATFORMS MARKET, BY REGION, 2021–2026 (USD BILLION)

TABLE 292 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2016–2020 (USD BILLION)

TABLE 293 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2021–2026 (USD BILLION)

TABLE 294 EUROPE: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2016–2020 (USD BILLION)

TABLE 295 EUROPE: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2021–2026 (USD BILLION)

TABLE 296 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2016–2020 (USD BILLION)

TABLE 297 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2021–2026 (USD BILLION)

TABLE 298 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2016–2020 (USD BILLION)

TABLE 299 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2021–2026 (USD BILLION)

TABLE 300 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2016–2020 (USD BILLION)

TABLE 301 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2021–2026 (USD BILLION)

14 APPENDIX (Page No. - 279)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATION

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This research study involved extensive secondary sources, directories, and databases such as Dun and Bradstreet (D&B) Hoovers, and Bloomberg BusinessWeek to identify and collect information useful for a technical, market-oriented, market-oriented, and commercial study of the smart hospitality market. The primary sources were industry experts from the core and related industries and preferred suppliers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information. The following figure shows the market research methodology applied in making this report on the smart hospitality market.

Secondary Research

The market for companies offering smart hospitality for use in different verticals was estimated and projected based on the secondary data made available through paid and unpaid sources and by analyzing their product portfolios in the ecosystem of the smart hospitality market. It also involved rating services of companies based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study on the smart hospitality market. The secondary sources included annual reports, press releases and investor presentations of companies, white papers, journals, certified publications, articles by recognized authors, directories, and databases.

Secondary research was used to obtain key information about the supply chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market and technology-oriented perspectives that were further validated by primary sources.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from smart hospitality solution vendors, system integrators, professional and managed service providers, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the products and services, market breakups, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Strategy Officers (CSOs), and installation teams of the governments/end users who are using smart hospitality solutions were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage of smart hospitality solutions, which will affect the overall smart hospitality market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the smart hospitality market and other dependent submarkets. Key market players were identified through secondary research, and their market share in the targeted regions was determined with the help of primary and secondary research. This entire research methodology included the study of annual and financial presentations of the top market players and interviews with experts for key insights (quantitative and qualitative).

The shares, splits, and breakdowns were determined using secondary sources and verified through primary research. All the possible parameters that affect the smart hospitality market were verified in detail with the help of primary sources and analyzed to obtain quantitative and qualitative data. This data was supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Report Objectives

- To determine and forecast the size of the smart hospitality market based on offerings, service, solutions, deployment type, end users, and region during the forecast period from 2022 to 2027

- To forecast the size of the market segments with respect to five key regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA)

- To provide detailed information related to the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the smart hospitality market

- To analyze each sub-segment for individual growth trends, prospects, and contribution to the total smart hospitality

- To analyze the impact of COVID-19 on the smart hospitality

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the smart hospitality

- To profile key market players comprising top vendors and start-ups; provide comparative analysis based on business overview, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscapes

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Hospitality Market

Interested in market study of Smart Hospitality market

Understanding the dynamics of Smart Hospitality market

Interested in post covid upgrades in the smart hospitality market