Mobile Encryption Market by Component (Solution and Services), Application (Disk Encryption, File/Folder Encryption, Communication Encryption, and Cloud Encryption), End-User Type, Deployment Type, Vertical, and Region - Global Forecast to 2022

[143 Pages Report] The mobile encryption market size is expected to grow from USD 761.4 Million in 2017 to USD 2,917.9 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 30.8%. The proliferation of smartphones and tablets across enterprises, need for stringent compliance and regulatory requirements, and increased concerns for data security and privacy issues are some of the factors fueling the growth of the market across the globe. The base year considered for this study is 2016 and the forecast period considered is 20172022.

Objectives of the study:

- To define, describe, and forecast the global mobile encryption market on the basis of components (solutions and services), applications, deployment types, end-user types, verticals, and regions

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To forecast the market size and growth rate of market segments with respect to the five main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders and provide company profiles of the key market players to comprehensively analyze the core competencies and draw a competitive landscape for the market

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and research and development activities in the market

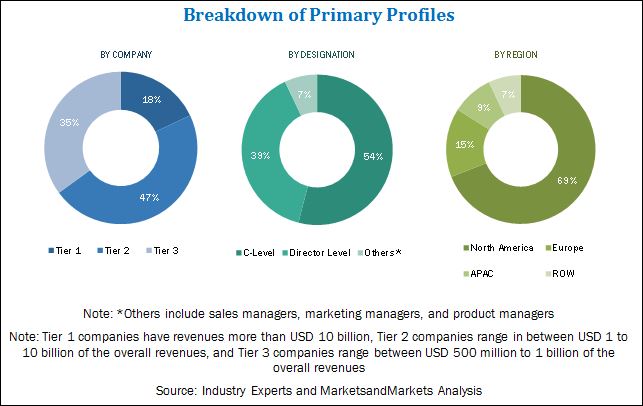

The research methodology used to estimate and forecast the mobile encryption market begins with the capturing of data on the revenues of the key vendors through secondary sources, such as annual reports, press releases, associations such as IEEE Cybersecurity Community, Information Security Research Association (ISRA), and Information Systems Security Association (ISSA), and databases such as Factiva, BusinessWeek, company websites, and news articles. The vendor offerings are also taken into consideration to determine the market segmentations. The bottom-up procedure is employed to arrive at the overall market size of the global market from the revenue of the key market players. After arriving at the overall market size, the total market is split into several segments and subsegments, which are then verified through primary research, by conducting extensive interviews with key individuals, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures are employed to complete the overall market engineering process and arrive at the exact statistics for all segments. The breakdown of the primary profiles is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The mobile encryption ecosystem comprises various mobile encryption solution and service providers, such as Adeya SA (Morges, Switzerland), AlertBoot Data Security (Las Vegas, US), Becrypt, Ltd. (London, UK), BlackBerry Ltd. (Ontario, Canada), CSG, Inc. (Washington, US), Certes Networks, Inc. (Pennsylvania, US), Check Point Software Technologies, Ltd. (Tel Aviv, Israel), DataMotion, Inc. (New Jersey, US), Dell Technologies, Inc. (Texas, US), ESET (Bratislava, Slovakia), Gold Line Group Ltd. (Israel), Hewlett Packard Enterprise (California, US), Huawei Technologies Co. Ltd. (Shenzhen, China), IBM Corporation (New York, US), Intel Corporation (California, US), KoolSpan, Inc. (Maryland, US), MobileIron, Inc. (California, US), Open Whisper Systems (California, US), Proofpoint, Inc. (California, US), SecurStar (Munich, Germany), Silent Circle, LLC (Le Grand-Saconnex, Switzerland), Sophos Ltd. (Abingdon, UK), Symantec Corporation (California, US), T-Systems International GmbH (Frankfurt, Germany),and Zix Corporation (Texas, US). Other stakeholders of the mobile encryption market include mobile security vendors, encryption solution providers, network solution providers, independent software vendors, consulting firms, system integrators, Value-Added Resellers (VARs), and Managed Security Service Providers (MSSPs).

Key Target Audience

- Mobile encryption solution providers

- Mobile security vendors

- Network solution providers

- Encryption solution vendors

- Independent software vendors

- Value-Added Resellers (VARs)

- Information Technology (IT) security agencies

- Managed Security Service Providers (MSSPs)

- System integrators

- Research organizations

- Consulting companies

- Government agencies

The research study answers several questions for the stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing the efforts and investments.

Scope of the Report

The research report categorizes the mobile encryption market to forecast revenues and analyze trends in each of the following submarkets:

By Component

- Solution

- Services

- Professional services

- Support and maintenance

- Training and education

- Consulting

- Managed services

- Professional services

By Application

- Disk encryption

- File/folder encryption

- Communication encryption

- Cloud encryption

By End-User Type

- Small and Medium Enterprises (SMEs)

- Large enterprises

By Deployment Type

- On-premises

- Cloud

By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Aerospace and Defense

- Healthcare

- Government and public sector

- Telecommunications and IT

- Retail

- Others(manufacturing, education, and media and entertainment)

By Region

- North America

- Europe

- MEA

- APAC

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the APAC market into countries contributing 75% of the regional market size

- Further breakdown of the North American market into countries contributing 75% of the regional market size

- Further breakdown of the Latin American market into countries contributing 75% of the regional market size

- Further breakdown of the MEA market into countries contributing 75% of the regional market size

- Further breakdown of the European market into countries contributing 75% of the regional market size

Company Information

- Detailed analysis and profiling of additional market players (Up to 5).

The mobile encryption market is expected to grow from USD 761.4 Million in 2017 to USD 2,917.9 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 30.8%. Proliferation of smartphones and tablets across enterprises,need for stringent compliance and regulatory requirements, and increased concerns for data security and privacy issues have led to the increased demand for mobile encryption solutions.

The mobile encryption market has been segmented based on components (solutions and services), applications, end-user types, deployment types, verticals, and regions. The services segment in components is expected to grow at the highest CAGR during the forecast period, while solutions are projected to have the largest market size in 2017, in the market. Security systems have to be upgraded on a regular basis to counter the newly available threats, attacks, ransomware, and sophisticated cyber criminals. As a result, companies are rapidly outsourcing their network security concerns to specialized service providers known as Managed Security Service Providers (MSSPs). Thus, among the services, managed services are expected to grow at the highest CAGR during the forecast period.

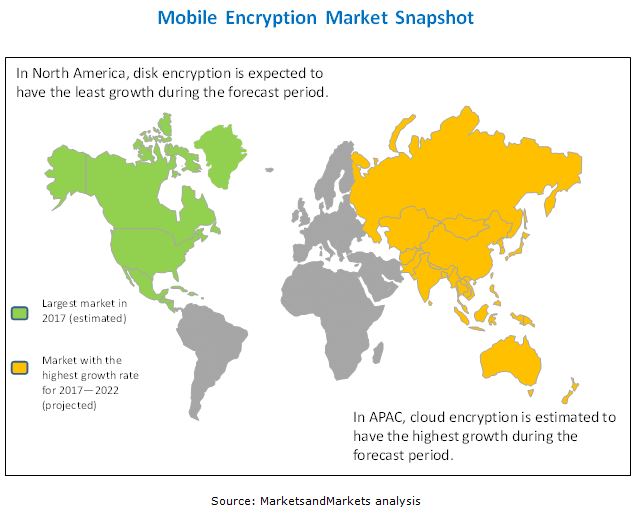

Cloud encryption is expected to grow at the highest CAGR during the forecast period in the applications segment owing to the ongoing expansive adoption of the cloud among companies across the world. Increase in the intensity and volume of cyber-attacks has further amplified data security concerns for organizations that have adopted cloud for data storage. This has encouraged the adoption of cloud encryption to safeguard sensitive information from security breaches and thefts. Disk encryption is estimated to have the largest market size in 2017. The increasing BYOD trend needs adoption of strong encryptions, which can protect confidential data, even if the device is lost or stolen.

The Small and Medium Enterprises (SMEs) segment is expected to grow at the highest CAGR in the mobile encryption market during the forecast period. The medium-sized companies are significantly growing in this market since mobile encryption solutions allow SMEs to protect their data and business information and provide secure real-time access facilities. Moreover, these solutions are available at economical pricings through the cloud.

The cloud deployment type is expected to grow at the highest rate in the market during the forecast period. This type of deployment requires less capital investment, offers high scalability, and is available through subscription-based pricing models, thus, having the fastest growth rate and the largest market share.

North America is expected to have the largest market share in 2017, whereas the Asia Pacific (APAC) region is expected to grow at the highest CAGR from 2017 to 2022, in the market. This is mainly because the organizations in the developed economies of the US and Canada are highly focused toward the early adoption of innovative solutions obtained from research and development in security technologies. The APAC region is expected to be the fastest-growing region in the mobile encryption market. Rising need to defend against advanced cyber-attacks and increasing adoption of cloud-based solutions drive the regional market growth.

The adoption of mobile encryption is increasing in the market owing to the exponential rise in the number of smartphones and tablets. However, increased operational expenditure, budget constraints, and lack of awareness are acting as barriers to the adoption of mobile encryption solutions.

The major vendors in the mobile encryption market include Adeya SA (Morges, Switzerland), AlertBoot Data Security, Inc. (Las Vegas, US), Becrypt, Ltd. (London, UK), BlackBerry Ltd. (Ontario, Canada), CSG, Inc. (Washington, US), Certes Networks, Inc. (Pennsylvania, U.S.), Check Point Software Technologies, Ltd. (Tel Aviv, Israel), DataMotion, Inc. (New Jersey, US), Dell Technologies, Inc. (Texas, US), ESET (Bratislava, Slovakia), Gold Line Group Ltd. (Israel), Hewlett Packard Enterprise (California, US), Huawei Technologies Co. Ltd. (Shenzhen, China), IBM Corporation (New York, US), Intel Corporation (California, US), KoolSpan, Inc. (Maryland, US), MobileIron, Inc. (California, US), Open Whisper Systems (California, US), Proofpoint, Inc. (California, US), SecurStar (Munich, Germany), Silent Circle, LLC (Le Grand-Saconnex, Switzerland), Sophos Ltd. (Abingdon, UK), Symantec Corporation (California, US), T-Systems International GmbH (Frankfurt, Germany), and Zix Corporation (Texas, US). These players have adopted various strategies such as new product development; mergers and acquisitions; partnerships, agreements, contracts, and collaborations; and business expansions to cater to the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.3 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.2.3 Research Assumptions

2.2.4 Research Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the Market

4.2 Market Share of Top 3 Applications and Regions, 2017

4.3 Lifecycle Analysis, By Region

4.4 Market Investment Scenario

4.5 Mobile Encryption Market By Vertical

5 Market Overview and Industry Trends (Page No. - 33)

5.1 Regulatory Implications

5.1.1 Advanced Encryption Standards

5.1.2 Payment Card Industry Data Security Standard

5.1.3 Health Insurance Portability and Accountability Act/Hitech Compliance

5.1.4 Federal Information Processing Standards

5.2 Innovation Spotlight

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Proliferation of Smartphones and Tablets Across Enterprises

5.3.1.2 Need for Stringent Compliance and Regulatory Requirements

5.3.1.3 Increasing Concern for Data Security Issues and Privacy of Data

5.3.2 Restraints

5.3.2.1 Increased Operational Expenditure and Budget Constraints

5.3.2.2 Lack of Awareness and Skilled Workforce

5.3.3 Opportunities

5.3.3.1 Increasing Demand for Cloud-Based Mobile Encryption Solutions

5.3.3.2 Rising Demand for Integrated Solutions

5.3.4 Challenges

5.3.4.1 Encryption Key Management

6 Mobile Encryption Market Analysis By Component (Page No. - 39)

6.1 Introduction

6.2 Solutions

6.3 Services

6.3.1 Professional Services

6.3.1.1 Support and Maintenance

6.3.1.2 Training and Education

6.3.1.3 Consulting

6.3.2 Managed Services

7 Mobile Encryption Market Analysis By Application (Page No. - 49)

7.1 Introduction

7.2 Disk Encryption

7.3 File/Folder Encryption

7.4 Communication Encryption

7.5 Cloud Encryption

8 Mobile Encryption Market Analysis By Deployment Type (Page No. - 55)

8.1 Introduction

8.2 On-Premises

8.3 Cloud

9 Mobile Encryption Market Analysis By End-User Type (Page No. - 59)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.3 Large Enterprises

10 Mobile Encryption Market Analysis By Vertical (Page No. - 63)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.3 Aerospace and Defense

10.4 Healthcare

10.5 Government and Public Sector

10.6 Telecom

10.7 Retail

10.8 Others

11 Geographic Analysis (Page No. - 71)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 89)

12.1 Introduction

12.1.1 Vanguards

12.1.2 Innovators

12.1.3 Dynamic

12.1.4 Emerging

12.2 Competitive Benchmarking

12.2.1 Product Offerings

12.2.2 Business Strategies

13 Company Profiles (Page No. - 93)

(Business Overview, Company Scorecard, Product Offering and Business Strategy, Recent Developments)*

13.1 Introduction

13.2 Blackberry

13.3 Dell

13.4 IBM

13.5 McAfee

13.6 Mobileiron

13.7 Sophos

13.8 Symantec

13.9 Alertboot

13.10 Certes Networks

13.11 Communication Security Group

13.12 Eset

13.13 T-Systems

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 134)

14.1 Key Industry Insights

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (66 Tables)

Table 1 Mobile Encryption Market Size and Growth Rate, 20152022 (USD Million, Y-O-Y %)

Table 2 Market Size, By Component, 20152022 (USD Million)

Table 3 Solutions: Market Size, By Region, 20152022 (USD Million)

Table 4 Services: Market Size, By Region, 20152022 (USD Million)

Table 5 Mobile Encryption Market Size, By Service, 20152022 (USD Million)

Table 6 Professional Services: Market Size, By Region, 20152022 (USD Million)

Table 7 Professional Services: Market Size, By Type, 20152022 (USD Million)

Table 8 Support and Maintenance: Market Size By Region, 20152022 (USD Million)

Table 9 Training and Education: Market Size, By Region, 20152022 (USD Million)

Table 10 Consulting: Market Size, By Region, 20152022 (USD Million)

Table 11 Managed Services: Market Size, By Region, 20152022 (USD Million)

Table 12 Mobile Encryption Market Size, By Application, 20152022 (USD Million)

Table 13 Disk Encryption: Market Size, By Region, 20152022 (USD Million)

Table 14 File/Folder Encryption: Market Size, By Region, 20152022 (USD Million)

Table 15 Communication Encryption: Market Size, By Region, 20152022 (USD Million)

Table 16 Cloud Encryption: Market Size By Region, 20152022 (USD Million)

Table 17 Market Size By Deployment Type, 20152022 (USD Million)

Table 18 On-Premises: Size, By Region, 20152022 (USD Million)

Table 19 Cloud: Market Size, By Region, 20152022 (USD Million)

Table 20 Mobile Encryption Market Size, By End-User Type, 20152022 (USD Million)

Table 21 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 22 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 23 Mobile Encryption Market Size, By Vertical, 20152022 (USD Million)

Table 24 Banking, Financial Services, and Insurance: Market Size, By Region, 20152022 (USD Million)

Table 25 Aerospace and Defense: Market Size By Region, 20152022 (USD Million)

Table 26 Healthcare: Market Size By Region, 20152022 (USD Million)

Table 27 Government and Public Sector: Market Size By Region, 20152022 (USD Million)

Table 28 Telecom: Market Size, By Region, 20152022 (USD Million)

Table 29 Retail: Market Size, By Region, 20152022 (USD Million)

Table 30 Others: Market Size, By Region, 20152022 (USD Million)

Table 31 Market Size By Region, 20152022 (USD Million)

Table 32 North America: Mobile Encryption Market Size, By Component, 20152022 (USD Million)

Table 33 North America: Market Size, By Service, 20152022 (USD Million)

Table 34 North America: Market Size, By Professional Service, 20152022 (USD Million)

Table 35 North America: Market Size, By Application, 20152022 (USD Million)

Table 36 North America: Market Size, By Deployment Type, 20152022 (USD Million)

Table 37 North America: Market Size, By End-User Type, 20152022 (USD Million)

Table 38 North America: Market Size, By Vertical, 20152022 (USD Million)

Table 39 Europe: Mobile Encryption Market Size, By Component, 20152022 (USD Million)

Table 40 Europe: Market Size, By Service, 20152022 (USD Million)

Table 41 Europe: Market Size, By Professional Service, 20152022 (USD Million)

Table 42 Europe: Market Size, By Application, 20152022 (USD Million)

Table 43 Europe: Market Size, By Deployment Type, 20152022 (USD Million)

Table 44 Europe: Market Size, By End-User Type, 20152022 (USD Million)

Table 45 Europe: Market Size, By Vertical, 20152022 (USD Million)

Table 46 Asia Pacific: Mobile Encryption Market Size, By Component, 20152022 (USD Million)

Table 47 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 48 Asia Pacific: Market Size, By Professional Service, 20152022 (USD Million)

Table 49 Asia Pacific: Market Size, By Application, 20152022 (USD Million)

Table 50 Asia Pacific: Market Size, By Deployment Type, 20152022 (USD Million)

Table 51 Asia Pacific: Market Size, By End-User Type, 20152022 (USD Million)

Table 52 Asia Pacific: Market Size, By Vertical, 20152022 (USD Million)

Table 53 Middle East and Africa: Mobile Encryption Market Size, By Component, 20152022 (USD Million)

Table 54 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 55 Middle East and Africa: Market Size, By Professional Service, 20152022 (USD Million)

Table 56 Middle East and Africa: Market Size, By Application, 20152022 (USD Million)

Table 57 Middle East and Africa: Market Size, By Deployment Type, 20152022 (USD Million)

Table 58 Middle East and Africa: Market Size, By End-User Type, 20152022 (USD Million)

Table 59 Middle East and Africa: Market Size, By Vertical, 20152022 (USD Million)

Table 60 Latin America: Mobile Encryption Market Size, By Component, 20152022 (USD Million)

Table 61 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 62 Latin America: Market Size, By Professional Service, 20152022 (USD Million)

Table 63 Latin America: Market Size, By Application, 20152022 (USD Million)

Table 64 Latin America: Market Size, By Deployment Type, 20152022 (USD Million)

Table 65 Latin America: Market Size, By End-User Type, 20152022 (USD Million)

Table 66 Latin America: Market Size, By Vertical, 20152022 (USD Million)

List of Figures (57 Figures)

Figure 1 Global Mobile Encryption Market Segmentation

Figure 2 Regional Scope

Figure 3 Global Mobile Encryption Market: Research Design

Figure 4 Breakdown of Primaries

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Market Size By Component (2017 vs 2022)

Figure 9 Market Size By Service (2017 vs 2022)

Figure 10 North America is Estimated to Hold the Largest Market Share in 2017

Figure 11 Top 3 Revenue Segments of the Mobile Encryption Market

Figure 12 Increasing Adoption of Bring Your Own Device and Need for Stringent Compliance is Expected to Boost the Mobile Encryption Market

Figure 13 Disk Encryption and North America are Expected to Have the Largest Market Shares in 2017

Figure 14 The Mobile Encryption Market has Immense Opportunities for Growth in Asia Pacific

Figure 15 Asia Pacific Would Emerge as the Best Market for Investments in the Next 5 Years

Figure 16 Banking, Financial Services, and Insurance Vertical is Estimated to Have the Largest Market Size in 2017

Figure 17 Mobile Encryption Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Solutions Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 19 Professional Services Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 20 Support and Maintenance Services Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 21 Disk Encryption Segment is Expected to Hold the Largest Market Size During the Forecast Period

Figure 22 Cloud Deployment Type is Expected to Hold the Largest Market Size During the Forecast Period

Figure 23 Large Enterprises Segment is Expected to Hold the Largest Market Size During the Forecast Period

Figure 24 Banking, Financial Services, and Insurance Vertical is Expected to Hold the Largest Market Size During the Forecast Period

Figure 25 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 26 North America Market Snapshot

Figure 27 Asia Pacific: Market Snapshot

Figure 28 Dive Chart

Figure 29 Blackberry: Company Snapshot

Figure 30 Blackberry: Product Offering Scorecard

Figure 31 Blackberry: Business Strategy Scorecard

Figure 32 Dell: Product Offering Scorecard

Figure 33 Dell: Business Strategy Scorecard

Figure 34 IBM: Company Snapshot

Figure 35 IBM: Product Offering Scorecard

Figure 36 IBM: Business Strategy Scorecard

Figure 37 McAfee: Product Offering Scorecard

Figure 38 McAfee: Business Strategy Scorecard

Figure 39 Mobileiron: Company Snapshot

Figure 40 Mobileiron: Product Offering Scorecard

Figure 41 Mobileiron: Business Strategy Scorecard

Figure 42 Sophos: Company Snapshot

Figure 43 Sophos: Product Offering Scorecard

Figure 44 Sophos: Business Strategy Scorecard

Figure 45 Symantec: Company Snapshot

Figure 46 Symantec: Product Offering Scorecard

Figure 47 Symantec: Business Strategy Scorecard

Figure 48 Alertboot: Product Offering Scorecard

Figure 49 Alertboot: Business Strategy Scorecard

Figure 50 Certes Networks: Product Offering Scorecard

Figure 51 Certes Networks: Business Strategy Scorecard

Figure 52 Communication Security Group: Product Offering Scorecard

Figure 53 Communication Security Group: Business Strategy Scorecard

Figure 54 Eset: Product Offering Scorecard

Figure 55 Eset: Business Strategy Scorecard

Figure 56 T-Systems: Product Offering Scorecard

Figure 57 T-Systems: Business Strategy Scorecard

Growth opportunities and latent adjacency in Mobile Encryption Market