Enterprise Key Management Market by Component (Solutions and Services), Deployment Type (Cloud and On-Premises), Organization Size (Small and Medium-Sized Enterprises and Large Enterprises), Application, Vertical, and Region - Global Forecast to 2022

[151 Pages Report] MarketsandMarkets forecasts the global enterprise key management market to grow from USD 933.2 Million in 2017 to USD 2,343.6 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 20.2%.

Request for Customization to get the global Enterprise Key Management market forecasts to 2025

Objectives of the Study:

The main objective of the report is to define, describe, and forecast the global enterprise key management market on the basis of components, deployment types, organization size, applications, verticals, and regions. The report provides detailed information about the major factors influencing the growth of the market: drivers, restraints, opportunities, and industry-specific challenges. The report forecasts the market size with respect to the 5 major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. The report strategically profiles key players and comprehensively analyzes their core competencies. It also tracks and analyzes competitive developments, such as mergers and acquisitions, new product developments, and Research and Development (R&D) activities, in the market.

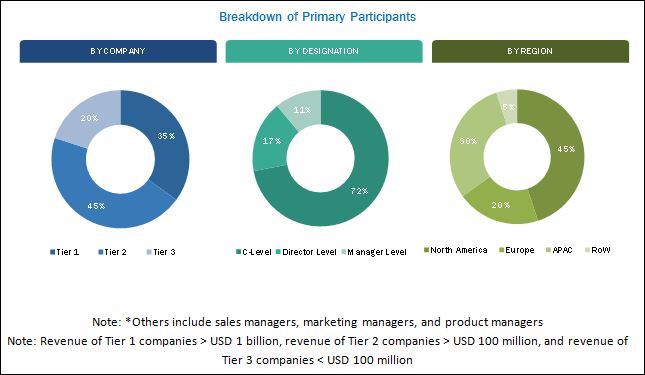

The research methodology used to estimate and forecast the enterprise key management market begins with the collection and analysis of key vendor product offering and business strategy data from secondary sources, such as the World Bank, case studies, press releases, investor presentations, white papers, technology journals, certified publications, articles, directories, and databases. Vendor offerings have also been taken into consideration to determine the market segmentations. The bottom-up procedure was employed to arrive at the total market size from the revenues of the key market software and service providers. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of the primary participants is depsicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Industry Ecosystem

The enterprise key management market includes service and solution providers such as Amazon Web Services, Inc. (US), Gemalto NV (Netherland), Hewlett Packard Enterprise (HPE) Company (US), International Business Machines (IBM) Corporation (US), Oracle Corporation (US), RSA Security LLC (US), Thales e-Security, Inc. (France), and Venafi (US). These Enterprise Key Management Software Vendors are rated and listed by us on the basis of product quality, reliability, and their business strategy. Please visit 360Quadrants to see the vendor listing of Enterprise Key Management Software.

Key Target Audience

- Enterprise users

- Government agencies

- Industrial users

- Key management vendors

- Encryption software Vendors

- Security software Vendors

- System integrators

Scope of the Enterprise Key Management Market Research Report

The research report segments the enterprise key management market into following segments and subsegments:

-

By Component

- Solutions

- Services

- Professional services

- Managed services

-

By deployment type

- On-premises

- Cloud

-

By Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large enterprises

-

By Application

- Disk Encryption

- File/Folder Encryption

- Database Encryption

- Communication Encryption

- Cloud Encryption

-

Enterprise Key Management Market By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Government

- Information Technology (IT) and telecom

- Retail

- Aerospace and defense

- Energy and utilities

- Manufacturing

- Others (transportation, education, and tourism)

-

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the North American enterprise key management market into countries

- Further breakdown of the European market into countries

- Further breakdown of the APAC market into countries

- Further breakdown of the MEA market into countries

- Further breakdown of the Latin American market into countries

Company Information

- Detailed analysis and profiling of additional market players

The enterprise key management market is expected to grow from USD 933.2 Million in 2017 to USD 2,343.6 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 20.2%. Several factors such as increasing data security concerns, requirement to meet compliance regulations, and need to maximize operational efficiency and security are driving the growth of the market. Verticals such as healthcare, manufacturing, retail, Information Technology (IT) and telecom, and aerospace and defense are expected to contribute largely to the market.

The enterprise key management market is segmented by component, deployment type, organization size, application, vertical, and region. The on-premises deployment type is the preferred deployment type, but the cloud-based deployment type is also expected to gain traction during the forecast period. The cloud deployment type is expected to grow at highest CAGR during the forecast period. Cloud-based deployment reduces the total cost of ownership by cutting down the cost associated with installing hardware to support enterprise key management solutions. Cloud-based deployment offers higher agility than on-premises deployment. Enterprises prefer the cloud deployment type as cloud services are available at competitive pricing.

Enterprise key management solutions are estimated to dominate the enterprise key management market in 2017, whereas enterprise key management services are expected to witness the fastest growth during the forecast period. Enterprise key management solutions are gaining popularity as large volumes of data are being generated by organizations, and thereby organizations need to safeguard these data volumes from security risks. Enterprise key management services are vital to ensure the proper implementation and integration of enterprise key management solutions. Enterprise key management service vendors empower organizations to take ownership of enterprise encryption keys by providing exclusive control over keys and providing unalterable audit logs that maintain the usage keys. Moreover, professional and managed services are implemented to manage the security of the key data. This is expected to drive the demand for enterprise key management services.

The Small and Medium-Sized Enterprises (SMEs) segment is expected to grow at a higher CAGR than large enterprises during the forecast period. SMEs hold the personal data of various customers. Enterprises are required to protect customer data from security vulnerabilities. Increasing security awareness and digital transformations have influenced SMEs to adopt cloud-based enterprise key management solutions to manage the entire lifecycle of the keys used to secure data.

Vendors offer enterprise key management solutions and services to help organizations manage cryptographic keys efficiently by monitoring the processes related to the generation, distribution, storage, rotation, revocation, and destruction of keys. Enterprise key management solutions and services are increasingly adopted by various verticals, such as transportation and logistics, aerospace and defense, healthcare and life sciences, consumer goods and retail, manufacturing, and energy and utilities. This is expected to fuel the growth of the enterprise key management market across the globe. The Banking, Financial Services, and Insurance (BFSI) vertical is expected to hold the largest market size during the forecast period. However, the aerospace and defense and healthcare segments are also expected to present prospective opportunities during the forecast period for enterprise key management vendors.

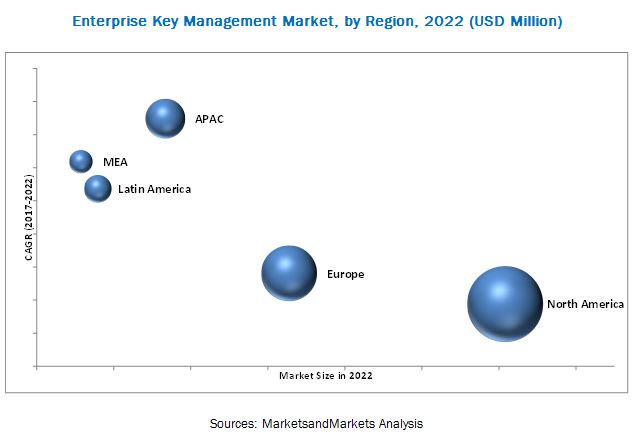

The enterprise key management market has been segmented by region into North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. North America is expected to have the largest market share and is expected to dominate the market during the forecast period due to the presence of many enterprise key management vendors in the region. In the areas of technology adoption and infrastructure, North America is one of the most advanced regions.

Lack of awareness about enterprise key management among enterprises, particularly in the SMEs, is restraining the growth of the global enterprise key management market. This is one of the major identified restraints affecting the global adoption of enterprise key management solutions.

The massive growth in data volume due to the implementation of big data and Internet of Things (IoT) is expected to provide growth opportunities for enterprise key management vendors. There are several established players in the market, such as Amazon Web Services, Inc. (US), Gemalto NV (Netherland), Hewlett Packard Enterprise (HPE) Company (US), International Business Machines (IBM) Corporation (US), Oracle Corporation (US), RSA Security LLC (US), Thales e-Security, Inc. (France), and Venafi (US). These vendors have adopted various organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions to expand their offerings in the enterprise key management market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions and Limitations

2.4 Microquadrant Matrix

2.4.1 Microquadrant Description

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the Enterprise Key Management Market

4.2 Market By Component

4.3 Market By Deployment Type

4.4 Market By Application

4.5 Market By Organization Size

4.6 Market By Vertical and Region

4.7 Lifecycle Analysis, By Region

5 Market Overview and Industry Trends (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Loss of High Profile Data and Compliance Issues

5.2.1.2 Decreased Overall Ownership Cost for Security

5.2.1.3 Maximized Operational Efficiency and Security

5.2.2 Restraints

5.2.2.1 Lack of Awareness and Skilled Workforce

5.2.3 Opportunities

5.2.3.1 Massive Growth of Data With the Rise in IoT and Big Data

5.2.3.2 Increase in Customers Trust With the Growth of Eaas

5.2.3.3 Blockchain Technology Can Bring Disruption Across All Industries

5.2.4 Challenges

5.2.4.1 Complex Database Infrastructure

5.2.4.2 Highly-Complex Network Architecture

5.3 Industry Trends

5.3.1 Innovation Spotlight

6 Enterprise Key Management Market Analysis, By Component (Page No. - 38)

6.1 Introduction

6.2 Solutions

6.3 Services

6.3.1 Professional Services

6.3.1.1 Consulting

6.3.1.2 System Integration

6.3.1.3 Deployment and Support

6.3.2 Managed Services

7 Enterprise Key Management Market Analysis, By Deployment Type (Page No. - 45)

7.1 Introduction

7.2 Cloud

7.3 On-Premises

8 Market Analysis, By Organization Size (Page No. - 49)

8.1 Introduction

8.2 Large Enterprises

8.3 Small and Medium-Sized Enterprises

9 Market Analysis, By Application (Page No. - 53)

9.1 Introduction

9.2 Disk Encryption

9.3 File and Folder Encryption

9.4 Database Encryption

9.5 Communication Encryption

9.6 Cloud Encryption

10 Enterprise Key Management Market Analysis, By Vertical (Page No. - 59)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance (BFSI)

10.3 Healthcare

10.4 Government

10.5 IT and Telecom

10.6 Retail

10.7 Aerospace and Defense

10.8 Energy and Utilities

10.9 Manufacturing

10.10 Others

11 Geographic Analysis (Page No. - 69)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 91)

12.1 Microquadrant Overview

12.1.1 Visionary Leaders

12.1.2 Innovators

12.1.3 Dynamic Differentiator

12.1.4 Emerging Companies

12.2 Competitive Benchmarking

12.2.1 Analysis of Product Portfolio of the Major Players in the Enterprise Key Management Market

12.2.2 Business Strategies Adopted By Major Players in the Market

13 Company Profiles (Page No. - 97)

(Business Overview, Company Scorecard, Product Offerings, Business Strategies, Recent Developments)*

13.1 Amazon Web Services, Inc.

13.2 CA Technologies, Inc.

13.3 Dyadic Security

13.4 Gemalto NV

13.5 Google Inc.

13.6 Hewlett Packard Enterprise

13.7 IBM Corporation

13.8 Oracle Corporation

13.9 Quantum Corporation

13.10 RSA Information Security, Subsidiary of Dell EMC.

13.11 Thales E-Security, Inc.

13.12 Townsend Security

13.13 Venafi

13.14 Winmagic, Inc.

*Details on Business Overview, Company Scorecard, Product Offerings, Business Strategies, Recent Developments might not be captured in case of unlisted companies.

14 Appendix (Page No. - 141)

14.1 Industry Excerpts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (69 Tables)

Table 1 Enterprise Key Management Market Size and Growth, 20152022 (USD Million, Y-O-Y %)

Table 2 Market Size, By Component, 20152022 (USD Million)

Table 3 Solutions: Market Size, By Region, 20152022 (USD Million)

Table 4 Services: Market Size, By Region, 20152022 (USD Million)

Table 5 Services: Market Size, By Type, 20152022 (USD Million)

Table 6 Professional Services Market Size, By Type, 20152022 (USD Million)

Table 7 Consulting: Professional Services Market Size, By Region, 20152022 (USD Million)

Table 8 System Integration: Professional Services Market Size, By Region, 20152022 (USD Million)

Table 9 Deployment and Support: Professional Services Market Size, By Region, 20152022 (USD Million)

Table 10 Managed Services Market Size, By Region, 20152022 (USD Million)

Table 11 Enterprise Key Management Market Size, By Deployment Type, 20152022 (USD Million)

Table 12 Cloud: Market Size, By Region, 20152022 (USD Million)

Table 13 On-Premises: Market Size, By Region, 20152022 (USD Million)

Table 14 Market Size, By Organization Size, 20152022 (USD Million)

Table 15 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 16 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 17 Market Size, By Application, 20152022 (USD Million)

Table 18 Disk Encryption: Market Size, By Region, 20152022 (USD Million)

Table 19 File and Folder Encryption: Market Size, By Region, 20152022 (USD Million)

Table 20 Database Encryption: Market Size, By Region, 20152022 (USD Million)

Table 21 Communication Encryption: Market Size, By Region, 20152022 (USD Million)

Table 22 Cloud Encryption: Market Size, By Region, 20152022 (USD Million)

Table 23 Enterprise Key Management Market Size, By Vertical, 20152022 (USD Million)

Table 24 Banking, Financial Services, and Insurance: Market Size, By Region, 20152022 (USD Million)

Table 25 Healthcare: Market Size, By Region, 20152022 (USD Million)

Table 26 Government: Market Size, By Region, 20152022 (USD Million)

Table 27 IT and Telecom: Market Size, By Region, 20152022 (USD Million)

Table 28 Retail: Market Size, By Region, 20152022 (USD Million)

Table 29 Aerospace and Defense: Market Size, By Region, 20152022 (USD Million)

Table 30 Energy and Utilities: Market Size, By Region, 20152022 (USD Million)

Table 31 Manufacturing: Market Size, By Region, 20152022 (USD Million)

Table 32 Others: Market Size, By Region, 20152022 (USD Million)

Table 33 Enterprise Key Management Market Size, By Region, 20152022 (USD Million)

Table 34 North America: Market Size, By Component, 20152022 (USD Million)

Table 35 North America: Market Size, By Service, 20152022 (USD Million)

Table 36 North America: Market Size, By Professional Service, 20152022 (USD Million)

Table 37 North America: Market Size, By Deployment Type, 20152022 (USD Million)

Table 38 North America: Market Size, By Organization Size, 20152022 (USD Million)

Table 39 North America: Market Size, By Application, 20152022 (USD Million)

Table 40 North America: Market Size, By Vertical, 20152022 (USD Million)

Table 41 Europe: Enterprise Key Management Market Size, By Component, 20152022 (USD Million)

Table 42 Europe: Market Size, By Service, 20152022 (USD Million)

Table 43 Europe: Market Size, By Professional Service, 20152022 (USD Million)

Table 44 Europe: Market Size, By Deployment Type, 20152022 (USD Million)

Table 45 Europe: Market Size, By Organization Size, 20152022 (USD Million)

Table 46 Europe: Market Size, By Application, 20152022 (USD Million)

Table 47 Europe: Market Size, By Vertical, 20152022 (USD Million)

Table 48 Asia Pacific: Market Size, By Component, 20152022 (USD Million)

Table 49 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 50 Asia Pacific: Market Size, By Professional Service, 20152022 (USD Million)

Table 51 Asia Pacific: Market Size, By Deployment Type, 20152022 (USD Million)

Table 52 Asia Pacific: Market Size, By Organization Size, 20152022 (USD Million)

Table 53 Asia Pacific: Market Size, By Application, 20152022 (USD Million)

Table 54 Asia Pacific: Market Size, By Vertical, 20152022 (USD Million)

Table 55 Middle East and Africa: Enterprise Key Management Market Size, By Component, 20152022 (USD Million)

Table 56 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 57 Middle East and Africa: Market Size, By Professional Service, 20152022 (USD Million)

Table 58 Middle East and Africa: Market Size, By Deployment Type, 20152022 (USD Million)

Table 59 Middle East and Africa: Market Size, By Organization Size, 20152022 (USD Million)

Table 60 Middle East and Africa: Market Size, By Application, 20152022 (USD Million)

Table 61 Middle East and Africa: Market Size, By Vertical, 20152022 (USD Million)

Table 62 Latin America: Market Size, By Component, 20152022 (USD Million)

Table 63 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 64 Latin America: Market Size, By Professional Service, 20152022 (USD Million)

Table 65 Latin America: Market Size, By Deployment Type, 20152022 (USD Million)

Table 66 Latin America: Market Size, By Organization Size, 20152022 (USD Million)

Table 67 Latin America: Market Size, By Application, 20152022 (USD Million)

Table 68 Latin America: Market Size, By Vertical, 20152022 (USD Million)

Table 69 Market Ranking for the Enterprise Key Management Market

List of Figures (63 Figures)

Figure 1 Enterprise Key Management Market: Market Segmentation

Figure 2 Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market: Assumptions

Figure 8 Microquadrant Matrix: Criteria Weightage

Figure 9 Microquadrant Matrix

Figure 10 Top 3 Segments for the Market During the Forecast Period

Figure 11 North America is Expected to Hold the Largest Share of the Enterprise Key Management Market in 2017

Figure 12 Need for A Centralized System for Efficiently Managing Encryption Keys is Expected to Drive the Growth of the Market

Figure 13 Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Cloud Deployment Type is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 15 Cloud Encryption Application is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 17 Banking, Financial Services, and Insurance, and North America are Expected to Have the Largest Market Size in 2017

Figure 18 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 19 Enterprise Key Management Market: Drivers, Restraints, Opportunities, and Challenges

Figure 20 Services Segment is Expected to Gain Traction Due to Increase in the Number of Data Breaches

Figure 21 Cloud Segment is Expected to Witness A Higher Growth Rate During the Forecast Period

Figure 22 Small and Medium-Sized Enterprises Segment is Expected to Witness A Higher Adoption of Enterprise Key Management Solutions

Figure 23 Cloud Encryption is Expected to Witness the Highest Adoption of Enterprise Key Management Solutions

Figure 24 Banking, Financial Services, and Insurance Vertical is Expected to Dominate the Enterprise Key Management Market

Figure 25 Asia Pacific is Expected to Witness the Highest Growth Rate Due to the Increasing Adoption of the Encryption Technology

Figure 26 Asia Pacific is Expected to Witness Significant Growth During the Forecast Period

Figure 27 North America: Market Snapshot

Figure 28 Asia Pacific: Market Snapshot

Figure 29 Competitive Leadership Mapping

Figure 30 Amazon Web Services, Inc.: Product Offering Scorecard

Figure 31 Amazon Web Services, Inc.: Business Strategy Scorecard

Figure 32 CA Technologies, Inc.: Company Snapshot

Figure 33 CA Technologies, Inc.: Product Offering Scorecard

Figure 34 CA Technologies, Inc.: Business Strategy Scorecard

Figure 35 Dyadic Security: Product Offering Scorecard

Figure 36 Dyadic Security: Business Strategy Scorecard

Figure 37 Gemalto NV: Company Snapshot

Figure 38 Gemalto NV: Product Offering Scorecard

Figure 39 Gemalto NV: Business Strategy Scorecard

Figure 40 Google Inc.: Company Snapshot

Figure 41 Google, Inc.: Product Offering Scorecard

Figure 42 Google, Inc.: Business Strategy Scorecard

Figure 43 Hewlett Packard Enterprise: Company Snapshot

Figure 44 Hewlett Packard Enterprise: Product Offering Scorecard

Figure 45 Hewlett Packard Enterprise: Business Strategy Scorecard

Figure 46 IBM Corporation: Company Snapshot

Figure 47 IBM Corporation: Product Offering Scorecard

Figure 48 IBM Corporation: Business Strategy Scorecard

Figure 49 Oracle Corporation: Company Snapshot

Figure 50 Oracle Corporation: Product Offering Scorecard

Figure 51 Oracle Corporation: Business Strategy Scorecard

Figure 52 Quantum Corporation: Company Snapshot

Figure 53 Quantum Corporation: Product Offering Scorecard

Figure 54 Quantum Corporation: Business Strategy Scorecard

Figure 55 RSA Information Security: Product Offering Scorecard

Figure 56 RSA Information Security: Business Strategy Scorecard

Figure 57 Thales E-Security: Product Offering Scorecard

Figure 58 Thales E-Security: Business Strategy Scorecard

Figure 59 Townsend Security: Business Strategy Scorecard

Figure 60 Venafi: Product Offering Scorecard

Figure 61 Venafi: Business Strategy Scorecard

Figure 62 Winmagic, Inc.: Product Offering Scorecard

Figure 63 Winmagic, Inc.: Business Strategy Scorecard

Growth opportunities and latent adjacency in Enterprise Key Management Market