Encryption Software Market by Component, Application (Disk Encryption, File/Folder Encryption, Communication Encryption, & Cloud Encryption), Deployment Mode, Organization Size, Vertical & Region - Global Forecast to 2026

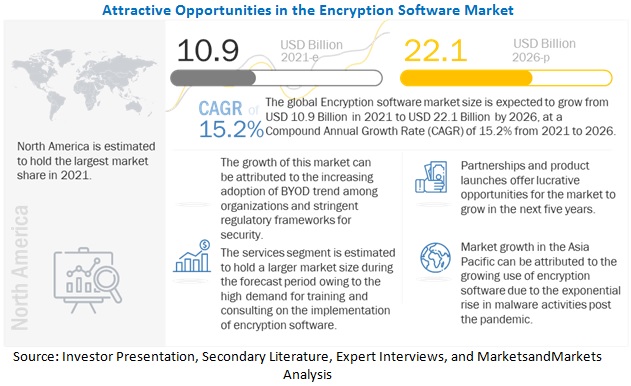

The global Encryption Software Market size was valued at $10.9 billion in 2021 and it is projected to reach $22.1 billion by the end of 2026 at a CAGR of 15.2% during the forecast period. An analysis of market trends is part of the new research report. The latest research study includes conference and webinar materials, patent analysis, important stakeholder information, and pricing analysis. Strict regulatory standards and data privacy compliances; growing concerns about losing critical data; an exponential rise in the adoption of cloud and virtualization technologies; and an increase in data breach incidences are the main drivers of the encryption software industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Encryption Software Market

The adoption of quick digital transformation methods in response to COVID-19 has immediately increased the amount of data stored in the clouds, followed by other challenges like performance, availability, and security that have forced the need for encryption software solutions and services. Organizations' attention on centrally managing several cloud resources has grown because of COVID-19. The significance of data security is rising as a result. During the pandemic, the market for encryption software will expand due to rising BYOD usage and regulatory compliances. Since most businesses continue to use WFH and hybrid work patterns, the demand for encryption software for security assessments is expected to grow even higher for threat intelligence globally.

Encryption Software Market Dynamics

Driver: Stringent regulatory standards and data privacy compliances

Private data protection during transactions, while in transit across networks, and while at rest is a major focus of most standards and compliance regulations in use today. While adhering to data security and privacy regulations, the deployment of appropriate encryption technology aids in strengthening the overall security posture. To assist customers in complying with several data security and data privacy regulations, including PCI-DSS, HIPAA, GDPR, and the California Consumer Privacy Act, encryption software providers offer user access controls and data encryption capabilities (CCPA). Data protection standards like the PCI-DSS and HIPAA, which must be complied with by industry verticals including BFSI, retail, and healthcare, have led to a significant increase in the need for encryption solutions globally.

The innovative GDPR rule oversees data privacy laws in all of Europe. It establishes standards for businesses collecting, maintaining, and using private information about persons within the EU. Organizations are required to pay hefty fines when GDPR regulations are broken. To assist businesses in processing card payments and preventing credit card fraud, the PCI DSS information security standard was developed. As a result, enterprises are compelled by these governmental regulations and regulatory compliances to use encryption software and services.

Restraint: High costs of encryption software solutions

The high cost of deploying encryption software solutions is the main obstacle that businesses encounter when using these solutions. Software encryption solutions assist consumers and businesses in lowering the risk of data loss. With the tremendous data explosion brought on by the adoption of encryption software solutions, firms' overall overhead expenses have climbed dramatically. For instance, depending on the needs, the average monthly fee for an email-encryption solution range between USD 4 to USD 10 per account. The cost of the solution increases in proportion to the size of the encrypted file.

Free online platforms might not have the best skills to protect sensitive data effectively. Due to financial constraints, SMES find the encryption software solution to be an expensive solution. Additionally, the expenditures of timely maintenance and upgrades contribute to the overall rise in an organization's expenses. Low-budget businesses find it expensive to implement these solutions due to the per-user license fees, ongoing maintenance fees, and other associated soft costs like update of the encryption software and technical support for users. Additionally, all encryption solutions must work with current IT systems. All these reasons together prevent the widespread use of encryption software.

Opportunity: Surge in BYOD usage and IoT trends

The threat of data loss among organizations has increased because of the growing trend of BYOD policies at work and the increased penetration of mobile and Iot devices across workplaces. As a result, using encryption software has become crucial for secure data transfer. BYOD usage has led to data loss problems and increased unlawful access to sensitive data, which is driving up demand for encryption software. The market revenue for encryption software is growing because of the increased demand from businesses. As a result of businesses' strong adoption of social media, IoT, and the Internet of Everything (loE), more data is being generated and retrieved via mobile devices. On-premises encryption software adoption has surged because of the rising number of events involving BYOD device thefts and physical intrusions on corporate assets. Data-at-rest is protected from malicious assaults by encryption software. Over the following several years, it is forecasted that this will increase demand for the adoption of both on-premises and cloud-based encryption software.

Challenge: Lack of skilled workforce among enterprises

Spending on IT has increased because of the growing threat to on-site and cloud data. Enterprises were obliged to shift their data to the cloud because their own corporate security teams were unable to protect the data stored on-premises. Lack of encryption understanding could result in mistakes that cost businesses a lot of money. The biggest issue enterprises currently face is a lack of encryption expertise, which limits their capacity to satisfy changing IT security requirements. Businesses must concentrate on staff training and education due to user errors and lack of understanding. Security officers play a crucial role in ensuring that businesses have the finest data protection solutions available and that employees are protected from threats like malware, ransomware, and APTS.

Encryption Software Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Small and Medium enterprises segment to grow at a higher CAGR during the forecast period

SMEs are heavily utilizing encryption software to comply with regulations and reduce fraud risk. The current adoption of BYOD trends, cloud-based services, and mobile technology has increased SMEs' profitability and helped them improve their entire organizational structures. The increased usage of mobile devices has promoted data movement from corporate networks to personal devices like laptops and smartphones, which has increased the amount of fraudulent data, cyberattacks, data loss, and the potential of identity theft. SMES have been compelled by the rising security concerns to concentrate on encryption solutions that can secure and safeguard their data and personal information from hacking and breaches. SMEs are at risk of phishing schemes and ransomware attacks because of the COVID-19 pandemic being widely exploited by APT organizations and criminal actors online. SMES frequently experience problems with a lack of technical know-how and financial resources while using encryption technology.

Budget restrictions aside, SMEs are forced to adopt encryption solutions for data protection due to the significance of protecting corporate information. The loss of data could damage the company's reputation, which would lead to a decline in business and revenue. The limited budget of SMES is taken into consideration when developing the encryption solutions. They can be obtained through the cloud for a fair price. The solutions allow SMES to safeguard their data and corporate information and offer safe, immediate access. Solutions for encryption are anticipated to be widely adopted by SMES worldwide in the upcoming years.

IT and Telecommunications vertical is to grow at the highest CAGR during the forecasted period

The large amount of personal data stored on mobile devices, satellites, and the Internet makes the telecommunications sector a top target for hackers. IT deals with using computers and networking equipment to create, process, store, and safeguard many types of electronic data. Regulations and security concerns it has generated have an impact on how the businesses in the vertical operate. As a result, to deliver services to their clients without interruption, communication service providers have embraced encryption technology.

Cell phone and internet usage have greatly expanded globally during the COVID-19 outbreak. Users may now access their emails and other data on their devices from anywhere owing to the growing popularity of mobile. Additionally, it has raised the risk of cyberattacks. Several services are offered by IT companies via web and mobile applications. Online financial transactions have greatly increased in this sector and are now highly lucrative targets for cybercriminals. To offer risk-free services to their clients, the businesses in this sector are implementing encryption solutions. Additionally, they are employing cloud and mobile technology to provide encrypted services to its clients. Users may now safely save their sensitive information on their mobile devices and access it over the cloud due to the encryption software. In addition to assisting in compliance with rules like AES, PCI DSS, and GDPR, encryption technologies enable telecommunications firms improve their services and give customers safe information.

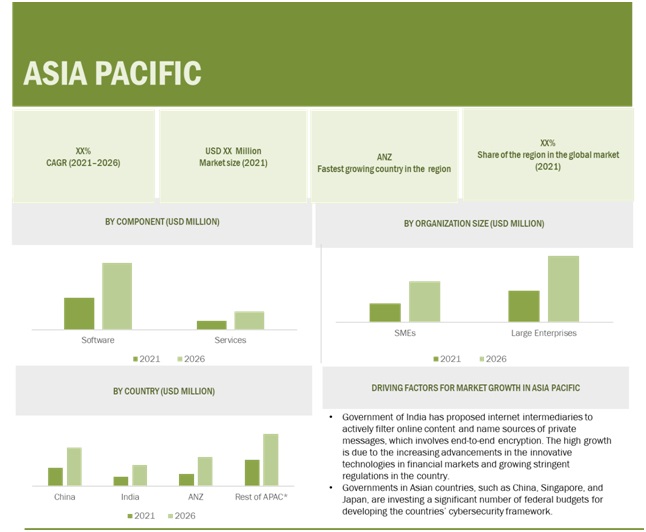

Asia Pacific to grow at the highest CAGR during the forecast period

End-to-end encryption has been advocated by the Indian government as a way for internet intermediaries to actively monitor online content and identify the sources of private messages. To provide effective data security in the cloud, most manufacturers offer application-based software for cloud encryption. The rapid growth is a result of the country's tightening laws and developing innovations in financial markets' innovative technologies.

Asian governments, including those in China, Singapore, and Japan, are spending a sizable portion of their federal budgets to build out their national cybersecurity frameworks. The market is expanding because of these government initiatives, financial backing, and R&D that have contributed to the development of encryption services and products.

In Asia Pacific, the lack of qualified cybersecurity professionals creates a demand for consulting services, which eventually propels the market for encryption software to develop at a considerable CAGR over the forecast period. Several industry participants provide consultancy services to properly deploy encryption software in the area.

Key Market Players

Major vendors in the global Encryption Software market include IBM (US), Microsoft (US), Broadcom (US), Sophos (UK), Thales (France), McAfee (US), Trend Micro (Japan), Dell (US), Check Point (Israel), Micro Focus (UK), PKWare (US), ESET (Slovakia), Boxcryptor (Germany), WinMagic (US), Cryptomathic (Denmark), Bitdefender (Romania), Stormshield (France), Cisco (US), HPE (US), Bitglass (US), Baffle (US), Fortanix (US), Enveil (US), Nord Security (Panama), PreVeil (US).

IBM is a global firm that specializes in computer technology and consulting. It was established in 1911 and has its headquarters in New York, US. The company is divided into five business segments: Global Technology Services, Global Business Services, Software, Systems and Technology, and Global Financing. IBM provides a variety of cybersecurity products, such as endpoint protection, network protection, mainframe security, application security, data security, security intelligence and operations, advanced fraud protection, and cloud and mobile security. Its cybersecurity services include data security services, security intelligence and operations, consulting, secure engineering and application security, and security strategy risk and compliance. The company's products assist users in defending their vital infrastructure from cutting-edge attacks and weaknesses.

IBM offers its solutions to IT and telecom, healthcare, life sciences, government, the automotive, manufacturing, food manufacturing and consumer goods, chemicals and petroleum, electronics, energy and power, media and entertainment, mining, retail, BFS, travel and transportation, and education sectors. The business is present in over 175 nations, including those in North America, Europe, the Asia-Pacific region, the Middle East and Africa, and Latin America.

Scope of the Report:

|

Report Metric |

Details |

|

Market size value in 2021 |

USD 10.9 Billion |

|

Market size value in 2026 |

USD 22.1 Billion |

|

Growth rate |

CAGR of 15.2% |

|

Market Size available for years |

2015-2026 |

|

Base Year Considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast Unit |

Value(USD) |

|

Segments covered |

Encryption software Market: |

|

Geographies covered |

|

|

Companies Covered |

IBM (US), Microsoft (US), Broadcom (US), Sophos (UK), Thales (France), McAfee (US), Trend Micro (Japan), Dell (US), Check Point (Israel), Micro Focus (UK), PKWare (US), ESET (Slovakia), Boxcryptor (Germany), WinMagic (US), Cryptomathic (Denmark), Bitdefender (Romania), Stormshield (France), Cisco (US), HPE (US), Bitglass (US), Baffle (US), Fortanix (US), Enveil (US), Nord Security (Panama), PreVeil (US). |

The research report categorizes the market into the following segments and subsegments:

Encryption software Market, By Component

- Software

- Services

Market By Services

- Professional Services

- Managed Services

Encryption software Market, By Application

- Disc Encryption

- File/Folder Encryption

- Database Encryption

- Communication Encryption

- Cloud Encryption

Market By Deployment Mode

- On Premises

- Cloud

Encryption software Market, By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

Market By Vertical

- Banking, Financial Services, And Insurance

- Aerospace and Defense

- Government and Public Utilities

- IT and Telecommunication

- Healthcare

- Retail

- Other Verticals

Encryption software Market, by Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

Asia Pacific

- China

- India

- ANZ

- Rest of Asia Pacific

-

Middle East and Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In November 2021, Thales introduced CipherTrust Intelligent Protection; which offered an automated workflow to discover, protect and control data using encryption and access controls.

- In March 2021, Sophos Email Advanced Portal Encryption was made available to the customers and partners as an add on on product to Sophos Email Advanced. Portal Encryption enabled senders of emails to deliver an encrypted email onto a web portal securely.

- In December 2020, IBM launched FHE, enabling data to remain encrypted even while being processed or analyzed in the cloud or third-party environments.

Frequently Asked Questions (FAQ):

How big is the global encryption software market?

What is growth rate of the encryption software market?

What are the key trends affecting the global encryption software market?

Who are the key players in encryption software market?

What is the encryption software market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 PERIODIZATION CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2021

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 6 ENCRYPTION SOFTWARE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

FIGURE 7 MARKET: RESEARCH FLOW

2.2 MARKET SIZE ESTIMATION

FIGURE 8 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.2.1 TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

2.2.3 REVENUE ESTIMATES

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE OF SOFTWARE/SERVICES OF ENCRYPTION SOFTWARE VENDORS

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1, SUPPLY-SIDE ANALYSIS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SYSTEMS AND SERVICES OF ENCRYPTION SOFTWARE VENDORS

2.2.4 DEMAND-SIDE ANALYSIS

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, TOP-DOWN (DEMAND SIDE): SHARE OF ENCRYPTION SOFTWARE THROUGH OVERALL INFORMATION TECHNOLOGY INDUSTRY

2.3 COMPANY EVALUATION QUADRANT METHODOLOGY

FIGURE 13 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.4 STARTUPS EVALUATION QUADRANT METHODOLOGY

FIGURE 14 STARTUP EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.5 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 57)

TABLE 3 ENCRYPTION SOFTWARE MARKET AND GROWTH, 2021–2026 (USD MILLION, Y-O-Y GROWTH)

FIGURE 15 GLOBAL MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

FIGURE 16 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2021

FIGURE 17 FASTEST-GROWING SEGMENTS OF MARKET

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 BRIEF OVERVIEW OF MARKET

FIGURE 18 INCREASING USE OF BYOD TREND AND PRESENCE OF REGULATORY COMPLIANCES TO DRIVE GROWTH OF MARKET

4.2 MARKET, BY APPLICATION, 2021

FIGURE 19 DISK ENCRYPTION SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.3 ENCRYPTION SOFTWARE MARKET, BY VERTICAL, 2021

FIGURE 20 BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET INVESTMENT SCENARIO

FIGURE 21 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ENCRYPTION SOFTWARE MARKET

5.2.1 DRIVERS

5.2.1.1 Stringent regulatory standards and data privacy compliances

5.2.1.2 Rising concerns pertaining to critical data loss

5.2.1.2.1 Data at rest

5.2.1.2.2 Data in transit

5.2.1.2.3 Data in use

5.2.1.3 Exponential increase in adopting cloud and virtualization technologies

FIGURE 23 TOP METHODS TO SAFEGUARD DATA STORED IN CLOUD

5.2.1.4 Rising data breach incidents to spur market growth

FIGURE 24 ENCRYPTION CONTROLS VARY AMONG VARIOUS CLOUD PROVIDERS

5.2.2 RESTRAINTS

5.2.2.1 High costs of encryption software solutions

5.2.2.2 Availability of free, open-source, and pirated encryption software

5.2.2.3 Budgetary constraints

5.2.3 OPPORTUNITIES

5.2.3.1 Surge in BYOD and IoT trends

5.2.3.2 Rise in demand for integrated data protection solutions and EaaS among SMEs

5.2.3.3 Increased adoption of encryption software across verticals

TABLE 4 ENCRYPTION SOFTWARE ADOPTION ACROSS VERTICALS

5.2.4 CHALLENGES

5.2.4.1 Complexities in effective management and usage of encryption key

5.2.4.2 Lack of skilled workforce among enterprises

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

FIGURE 25 ENCRYPTION SOFTWARE MARKET: DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

FIGURE 26 MARKET: RESTRAINTS AND CHALLENGES

5.4 ENCRYPTION ECOSYSTEM

FIGURE 27 MARKET: COMPANY ECOSYSTEM

5.4.1 ECOSYSTEM

TABLE 5 MARKET ECOSYSTEM

5.5 VALUE CHAIN ANALYSIS

FIGURE 28 MARKET: VALUE CHAIN

5.6 PATENT ANALYSIS

FIGURE 29 MARKET: PATENT ANALYSIS

TABLE 6 ENCRYPTION PATENTS

5.7 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 7 MARKET: LIST OF CONFERENCES & EVENTS

5.8 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 30 MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.9 AVERAGE SELLING PRICE/PRICING MODEL OF ENCRYPTION SOFTWARE MARKET

TABLE 8 AVERAGE SELLING PRICE MODEL

5.10 TECHNOLOGY ANALYSIS

5.10.1 ARTIFICIAL INTELLIGENCE

5.10.2 BIG DATA ANALYTICS

5.10.3 ZERO TRUST

5.10.4 BLOCKCHAIN

5.11 USE CASES

5.11.1 USE CASE 1: AUTOMOTIVE MANUFACTURER IMPROVED SECURITY AND COMPLIANCE USING THALES CIPHERTRUST

5.11.2 USE CASE 2: FINANCIAL INSTITUTION STREAMLINED DATA PROTECTION WITH THALES CIPHERTRUST

5.11.3 USE CASE 3: OMADA HEALTH SHARED PROTECTED SENSITIVE DATA THROUGH VIRTRU’S ENCRYPTION SOLUTION

5.11.4 USE CASE 4: INSURER CHOSE MICRO FOCUS’ SOLUTION TO COMPLY WITH NATIONAL DATA PRIVACY REGULATIONS

5.11.5 USE CASE 5: INSURANCE COMPANY SECURED CUSTOMER DATA WITH PKWARE’S SOLUTION

5.12 REGULATORY IMPLICATIONS

5.12.1 ADVANCED ENCRYPTION STANDARDS

5.12.2 GENERAL DATA PROTECTION REGULATION

5.12.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.12.4 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.12.5 FEDERAL INFORMATION SECURITY MANAGEMENT ACT

5.12.6 FEDERAL INFORMATION PROCESSING STANDARDS

5.12.7 SARBANES-OXLEY ACT

5.12.8 GRAMM–LEACH–BLILEY ACT

5.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 PORTER’S FIVE FORCES ANALYSIS: ENCRYPTION SOFTWARE MARKET

5.13.1 THREAT FROM NEW ENTRANTS

5.13.2 THREAT FROM SUBSTITUTES

5.13.3 BARGAINING POWER OF SUPPLIERS

5.13.4 BARGAINING POWER OF BUYERS

5.13.5 DEGREE OF COMPETITION

6 ENCRYPTION SOFTWARE MARKET, BY COMPONENT (Page No. - 93)

6.1 INTRODUCTION

FIGURE 31 SERVICES SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

TABLE 10 MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 11 MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 SOFTWARE

6.2.1 SOFTWARE: MARKET DRIVERS

6.2.2 SOFTWARE: COVID-19 IMPACT

TABLE 12 SOFTWARE: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 13 SOFTWARE: MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

6.3.1 SERVICES: MARKET DRIVERS

6.3.2 SERVICES: COVID-19 IMPACT

FIGURE 32 MANAGED SERVICES SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

TABLE 14 MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 15 MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 16 SERVICES: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 17 SERVICES: ENCRYPTION SOFTWARE MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.3 PROFESSIONAL SERVICES

FIGURE 33 SUPPORT AND MAINTENANCE SERVICES SEGMENT TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 18 MARKET, BY PROFESSIONAL SERVICE, 2015–2020 (USD MILLION)

TABLE 19 MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 20 PROFESSIONAL SERVICES: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 21 PROFESSIONAL SERVICES: MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.3.1 Support and maintenance services

TABLE 22 SUPPORT AND MAINTENANCE SERVICES: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 23 SUPPORT AND MAINTENANCE SERVICES: MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.3.2 Training and Education Services

TABLE 24 TRAINING AND EDUCATION SERVICES: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 25 TRAINING AND EDUCATION SERVICES: MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.3.3 Consulting Services

TABLE 26 CONSULTING SERVICES: ENCRYPTION SOFTWARE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 27 CONSULTING SERVICES: MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.4 MANAGED SERVICES

TABLE 28 MANAGED SERVICES: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 29 MANAGED SERVICES: MARKET, BY REGION, 2021–2026 (USD MILLION)

7 ENCRYPTION SOFTWARE MARKET, BY APPLICATION (Page No. - 105)

7.1 INTRODUCTION

FIGURE 34 DISK ENCRYPTION SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 30 MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 31 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

7.2 DISK ENCRYPTION

TABLE 32 COMPANIES V/S THEIR FULL DISK ENCRYPTION SOFTWARE OFFERING

7.2.1 DISK ENCRYPTION: MARKET DRIVERS

7.2.2 DISK ENCRYPTION: COVID-19 IMPACT

TABLE 33 DISK ENCRYPTION: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 34 DISK ENCRYPTION: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3 FILE/FOLDER ENCRYPTION

7.3.1 FILE/FOLDER ENCRYPTION: MARKET DRIVERS

7.3.2 FILE/FOLDER ENCRYPTION: COVID-19 IMPACT

TABLE 35 FULL-DISK ENCRYPTION V/S FILE-BASED ENCRYPTION

TABLE 36 FILE/FOLDER ENCRYPTION: ENCRYPTION SOFTWARE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 37 FILE/FOLDER ENCRYPTION: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.4 DATABASE ENCRYPTION

7.4.1 DATABASE ENCRYPTION: MARKET DRIVERS

7.4.2 DATABASE ENCRYPTION: COVID-19 IMPACT

TABLE 38 DATABASE ENCRYPTION: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 39 DATABASE ENCRYPTION: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.5 COMMUNICATION ENCRYPTION

7.5.1 COMMUNICATION ENCRYPTION: MARKET DRIVERS

7.5.2 COMMUNICATION ENCRYPTION: COVID-19 IMPACT

TABLE 40 COMMUNICATION ENCRYPTION: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 41 COMMUNICATION ENCRYPTION: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.6 CLOUD ENCRYPTION

7.6.1 CLOUD ENCRYPTION: MARKET DRIVERS

7.6.2 CLOUD ENCRYPTION: COVID-19 IMPACT

TABLE 42 CLOUD ENCRYPTION: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 43 CLOUD ENCRYPTION: MARKET, BY REGION, 2021–2026 (USD MILLION)

8 ENCRYPTION SOFTWARE MARKET, BY DEPLOYMENT MODE (Page No. - 116)

8.1 INTRODUCTION

FIGURE 35 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

TABLE 44 MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 45 MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

8.2 ON-PREMISES

TABLE 46 COMPANY AND PRODUCT DESCRIPTION

8.2.1 ON-PREMISES: MARKET DRIVERS

8.2.2 ON-PREMISES: COVID-19 IMPACT

TABLE 47 ON-PREMISES: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 48 ON-PREMISES: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.3 CLOUD

8.3.1 CLOUD: MARKET DRIVERS

8.3.2 CLOUD: COVID-19 IMPACT

TABLE 49 CLOUD: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 50 CLOUD: MARKET, BY REGION, 2021–2026 (USD MILLION)

9 ENCRYPTION SOFTWARE MARKET, BY ORGANIZATION SIZE (Page No. - 122)

9.1 INTRODUCTION

FIGURE 36 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO HOLD HIGHER CAGR DURING FORECAST PERIOD

TABLE 51 MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 52 MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

9.2.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

9.2.2 SMALL AND MEDIUM-SIZED ENTERPRISES: COVID-19 IMPACT

TABLE 53 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 54 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2021–2026 (USD MILLION)

9.3 LARGE ENTERPRISES

9.3.1 LARGE ENTERPRISES: MARKET DRIVERS

9.3.2 LARGE ENTERPRISES: COVID-19 IMPACT

TABLE 55 LARGE ENTERPRISES: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 56 LARGE ENTERPRISES: MARKET, BY REGION, 2021–2026 (USD MILLION)

10 ENCRYPTION SOFTWARE MARKET, BY VERTICAL (Page No. - 127)

10.1 INTRODUCTION

FIGURE 37 IT AND TELECOMMUNICATIONS VERTICAL TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 57 MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 58 MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

10.2.1 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET DRIVERS

10.2.2 BANKING, FINANCIAL SERVICES, AND INSURANCE: COVID-19 IMPACT

TABLE 59 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 60 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.3 AEROSPACE AND DEFENSE

10.3.1 AEROSPACE AND DEFENSE: MARKET DRIVERS

10.3.2 AEROSPACE AND DEFENSE: COVID-19 IMPACT

TABLE 61 AEROSPACE AND DEFENSE: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 62 AEROSPACE AND DEFENSE: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.4 GOVERNMENT AND PUBLIC UTILITIES

10.4.1 GOVERNMENT AND PUBLIC UTILITIES: MARKET DRIVERS

10.4.2 GOVERNMENT AND PUBLIC UTILITIES: COVID-19 IMPACT

TABLE 63 GOVERNMENT AND PUBLIC UTILITIES: ENCRYPTION SOFTWARE MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 64 GOVERNMENT AND PUBLIC UTILITIES: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.5 IT AND TELECOMMUNICATIONS

10.5.1 IT AND TELECOMMUNICATIONS: MARKET DRIVERS

10.5.2 IT AND TELECOMMUNICATIONS: COVID-19 IMPACT

TABLE 65 IT AND TELECOMMUNICATIONS: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 66 IT AND TELECOMMUNICATIONS: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.6 HEALTHCARE

10.6.1 HEALTHCARE: MARKET DRIVERS

10.6.2 HEALTHCARE: COVID-19 IMPACT

TABLE 67 HEALTHCARE: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 68 HEALTHCARE: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.7 RETAIL

10.7.1 RETAIL: MARKET DRIVERS

10.7.2 RETAIL: COVID-19 IMPACT

TABLE 69 RETAIL: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 70 RETAIL: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.8 OTHER VERTICALS

TABLE 71 OTHER VERTICALS: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 72 OTHER VERTICALS: MARKET, BY REGION, 2021–2026 (USD MILLION)

11 ENCRYPTION SOFTWARE MARKET, BY REGION (Page No. - 139)

11.1 INTRODUCTION

FIGURE 38 ASIA PACIFIC TO HAVE LARGEST MARKET DURING FORECAST PERIOD

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

TABLE 73 NORTH AMERICA: ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2015–2020 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.4 UNITED STATES

TABLE 89 UNITED STATES: ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 90 UNITED STATES: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 91 UNITED STATES: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 92 UNITED STATES: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 93 UNITED STATES: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 94 UNITED STATES: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 95 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 96 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 97 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 98 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 99 UNITED STATES: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 100 UNITED STATES: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.2.5 CANADA

TABLE 101 CANADA: ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 102 CANADA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 103 CANADA: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 104 CANADA: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 105 CANADA: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 106 CANADA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 107 CANADA: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 108 CANADA: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 109 CANADA: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 110 CANADA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 111 CANADA: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 112 CANADA: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: ENCRYPTION SOFTWARE MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

11.3.3 EUROPE: REGULATORY LANDSCAPE

TABLE 113 EUROPE: MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2015–2020 (USD MILLION)

TABLE 118 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 121 EUROPE: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 122 EUROPE: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 123 EUROPE: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 124 EUROPE: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 125 EUROPE: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 126 EUROPE: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 127 EUROPE: MARKET, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 128 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

11.3.4 UNITED KINGDOM

TABLE 129 UNITED KINGDOM: ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 130 UNITED KINGDOM: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 131 UNITED KINGDOM: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 132 UNITED KINGDOM: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 133 UNITED KINGDOM: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 134 UNITED KINGDOM: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 135 UNITED KINGDOM: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 136 UNITED KINGDOM: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 137 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 138 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 139 UNITED KINGDOM: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 140 UNITED KINGDOM: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.3.5 GERMANY

TABLE 141 GERMANY: ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 142 GERMANY: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 143 GERMANY: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 144 GERMANY: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 145 GERMANY: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 146 GERMANY: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 147 GERMANY: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 148 GERMANY: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 149 GERMANY: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 150 GERMANY: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 151 GERMANY: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 152 GERMANY: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 153 REST OF EUROPE: ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 154 REST OF EUROPE: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 155 REST OF EUROPE: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 156 REST OF EUROPE: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 157 REST OF EUROPE: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 158 REST OF EUROPE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 159 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 160 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 161 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 162 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 163 REST OF EUROPE: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 164 REST OF EUROPE: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: ENCRYPTION SOFTWARE MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

11.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 165 ASIA PACIFIC: MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 166 ASIA PACIFIC: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 167 ASIA PACIFIC: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 168 ASIA PACIFIC: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 169 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2015–2020 (USD MILLION)

TABLE 170 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 171 ASIA PACIFIC: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 172 ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 173 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 174 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 175 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 176 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 177 ASIA PACIFIC: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 178 ASIA PACIFIC: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 179 ASIA PACIFIC: MARKET, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

11.4.4 CHINA

TABLE 181 CHINA: ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 182 CHINA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 183 CHINA: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 184 CHINA: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 185 CHINA: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 186 CHINA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 187 CHINA: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 188 CHINA: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 189 CHINA: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 190 CHINA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 191 CHINA: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 192 CHINA: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.4.5 INDIA

TABLE 193 INDIA: ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 194 INDIA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 195 INDIA: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 196 INDIA: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 197 INDIA: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 198 INDIA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 199 INDIA: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 200 INDIA: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 201 INDIA: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 202 INDIA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 203 INDIA: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 204 INDIA: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.4.6 AUSTRALIA AND NEW ZEALAND

TABLE 205 AUSTRALIA AND NEW ZEALAND: ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 206 AUSTRALIA AND NEW ZEALAND: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 207 AUSTRALIA AND NEW ZEALAND: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 208 AUSTRALIA AND NEW ZEALAND: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 209 AUSTRALIA AND NEW ZEALAND: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 210 AUSTRALIA AND NEW ZEALAND: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 211 AUSTRALIA AND NEW ZEALAND: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 212 AUSTRALIA AND NEW ZEALAND: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 213 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 214 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 215 AUSTRALIA AND NEW ZEALAND: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 216 AUSTRALIA AND NEW ZEALAND: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

TABLE 217 REST OF ASIA PACIFIC: ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 218 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 219 REST OF ASIA PACIFIC: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 220 REST OF ASIA PACIFIC: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 221 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 222 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 223 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 224 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 225 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 226 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 227 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 228 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

11.5.3 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 229 MIDDLE EAST AND AFRICA: ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 230 MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 231 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 232 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 233 MIDDLE EAST AND AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2015–2020 (USD MILLION)

TABLE 234 MIDDLE EAST AND AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 235 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 236 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 237 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 238 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 239 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 240 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 241 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 242 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 243 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 244 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

11.5.4 MIDDLE EAST

TABLE 245 MIDDLE EAST: ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 246 MIDDLE EAST: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 247 MIDDLE EAST: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 248 MIDDLE EAST: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 249 MIDDLE EAST: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 250 MIDDLE EAST: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 251 MIDDLE EAST: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 252 MIDDLE EAST: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 253 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 254 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 255 MIDDLE EAST: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 256 MIDDLE EAST: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.5.5 AFRICA

TABLE 257 AFRICA: ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 258 AFRICA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 259 AFRICA: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 260 AFRICA: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 261 AFRICA: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 262 AFRICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 263 AFRICA: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 264 AFRICA: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 265 AFRICA: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 266 AFRICA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 267 AFRICA: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 268 AFRICA: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

11.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 269 LATIN AMERICA: ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 270 LATIN AMERICA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 271 LATIN AMERICA: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 272 LATIN AMERICA: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 273 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2015–2020 (USD MILLION)

TABLE 274 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 275 LATIN AMERICA: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 276 LATIN AMERICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 277 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 278 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 279 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 280 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 281 LATIN AMERICA: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 282 LATIN AMERICA: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 283 LATIN AMERICA: MARKET, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 284 LATIN AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

11.6.4 BRAZIL

TABLE 285 BRAZIL: ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 286 BRAZIL: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 287 BRAZIL: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 288 BRAZIL: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 289 BRAZIL: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 290 BRAZIL: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 291 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 292 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 293 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 294 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 295 BRAZIL: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 296 BRAZIL: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.6.5 MEXICO

TABLE 297 MEXICO: ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 298 MEXICO: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 299 MEXICO: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 300 MEXICO: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 301 MEXICO: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 302 MEXICO: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 303 MEXICO: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 304 MEXICO: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 305 MEXICO: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 306 MEXICO: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 307 MEXICO: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 308 MEXICO: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.6.6 REST OF LATIN AMERICA

TABLE 309 REST OF LATIN AMERICA: ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 310 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 311 REST OF LATIN AMERICA: MARKET, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 312 REST OF LATIN AMERICA: MARKET, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 313 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 314 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 315 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 316 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 317 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 318 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 319 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 320 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 229)

12.1 OVERVIEW

12.2 HISTORICAL REVENUE ANALYSIS

FIGURE 41 FIVE-YEAR REVENUE ANALYSIS OF KEY ENCRYPTION SOFTWARE AND SERVICE VENDORS (USD MILLION)

12.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS

FIGURE 42 ENCRYPTION SOFTWARE MARKET: REVENUE ANALYSIS

12.4 MARKET STRUCTURE

TABLE 321 MARKET: DEGREE OF COMPETITION

12.5 RANKING OF KEY PLAYERS

FIGURE 43 RANKING OF KEY MARKET PLAYERS

12.6 RECENT DEVELOPMENTS

TABLE 322 MARKET: PRODUCT LAUNCHES

TABLE 323 MARKET: DEALS

12.7 MARKET EVALUATION FRAMEWORK

FIGURE 44 MARKET EVALUATION FRAMEWORK BETWEEN 2019 AND 2022

12.8 COMPANY EVALUATION QUADRANT

12.8.1 COMPANY EVALUATION QUADRANT DEFINITIONS AND METHODOLOGY

TABLE 324 EVALUATION CRITERIA

12.9 COMPETITIVE BENCHMARKING

12.9.1 COMPANY FOOTPRINT

FIGURE 45 COMPANY FOOTPRINT OF MAJOR PLAYERS IN ENCRYPTION SOFTWARE MARKET

12.10 COMPETITIVE LEADERSHIP MAPPING

12.10.1 STARS

12.10.2 EMERGING LEADERS

12.10.3 PERVASIVE PLAYERS

12.10.4 PARTICIPANTS

FIGURE 46 MARKET, COMPANY EVALUATION QUADRANT

12.11 COMPETITIVE SCENARIO

12.12 STARTUP/SME EVALUATION QUADRANT

12.12.1 PROGRESSIVE COMPANIES

12.12.2 RESPONSIVE COMPANIES

12.12.3 DYNAMIC COMPANIES

12.12.4 STARTING BLOCKS

FIGURE 47 MARKET, STARTUP/SME EVALUATION QUADRANT

12.12.5 COMPETITIVE BENCHMARKING

TABLE 325 MARKET: LIST OF STARTUP/SMES

TABLE 326 ENCRYPTION SOFTWARE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUP/SMES]

13 COMPANY PROFILING (Page No. - 241)

13.1 INTRODUCTION

13.2 MAJOR PLAYERS

(Business Overview, Products, Solutions & Services, Key Insights, Recent Developments, COVID-19 Related Developments, MnM View)*

13.2.1 IBM

TABLE 327 IBM: BUSINESS OVERVIEW

FIGURE 48 IBM: COMPANY SNAPSHOT

TABLE 328 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 329 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 330 IBM: DEALS

13.2.2 MICROSOFT

TABLE 331 MICROSOFT: BUSINESS OVERVIEW

FIGURE 49 MICROSOFT: COMPANY SNAPSHOT

TABLE 332 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 333 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 334 MICROSOFT: DEALS

13.2.3 BROADCOM

TABLE 335 BROADCOM: BUSINESS OVERVIEW

FIGURE 50 BROADCOM: COMPANY SNAPSHOT

TABLE 336 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 337 BROADCOM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 338 BROADCOM: DEALS

13.2.4 SOPHOS

TABLE 339 SOPHOS: BUSINESS OVERVIEW

TABLE 340 SOPHOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 341 SOPHOS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 342 SOPHOS: DEALS

13.2.5 THALES

TABLE 343 THALES: BUSINESS OVERVIEW

FIGURE 51 THALES: COMPANY SNAPSHOT

TABLE 344 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 345 THALES: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 346 THALES: DEALS

13.2.6 MCAFEE

TABLE 347 MCAFEE: BUSINESS OVERVIEW

TABLE 348 MCAFEE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 349 MCAFEE: DEALS

13.2.7 TREND MICRO

TABLE 350 TREND MICRO: BUSINESS OVERVIEW

FIGURE 52 TREND MICRO: COMPANY SNAPSHOT

TABLE 351 TREND MICRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 352 TREND MICRO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 353 TREND MICRO: DEALS

13.2.8 DELL

TABLE 354 DELL: BUSINESS OVERVIEW

TABLE 355 DELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 356 DELL: DEALS

13.2.9 CHECK POINT

TABLE 357 CHECK POINT: BUSINESS OVERVIEW

FIGURE 53 CHECK POINT: COMPANY SNAPSHOT

TABLE 358 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 359 CHECK POINT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 360 CHECK POINT: DEALS

13.2.10 MICRO FOCUS

TABLE 361 MICRO FOCUS: BUSINESS OVERVIEW

FIGURE 54 MICRO FOCUS: COMPANY SNAPSHOT

TABLE 362 MICRO FOCUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 363 MICRO FOCUS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 364 MICRO FOCUS: DEALS

*Details on Business Overview, Products, Solutions & Services, Key Insights, Recent Developments, COVID-19 Related Developments, MnM View might not be captured in case of unlisted companies.

13.3 OTHER PLAYERS

13.3.1 PKWARE

13.3.2 ESET

13.3.3 BOXCRYPTOR

13.3.4 WINMAGIC

13.3.5 CRYPTOMATHIC

13.3.6 BITDEFENDER

13.3.7 STORMSHIELD

13.3.8 CISCO

13.3.9 HPE

13.3.10 BITGLASS

13.4 STARTUP PLAYERS

13.4.1 BAFFLE

13.4.2 FORTANIX

13.4.3 ENVEIL

13.4.4 NORDSECURITY

13.4.5 PREVEIL

14 ADJACENT MARKETS (Page No. - 284)

14.1 INTRODUCTION TO ADJACENT MARKETS

TABLE 365 ADJACENT MARKETS AND FORECASTS

14.2 LIMITATIONS

14.3 EMAIL ENCRYPTION MARKET

TABLE 366 EMAIL ENCRYPTION MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 367 EMAIL ENCRYPTION MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 368 EMAIL ENCRYPTION MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 369 EMAIL ENCRYPTION MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

14.4 CYBERSECURITY MARKET

TABLE 370 CYBERSECURITY MARKET SIZE, BY SOFTWARE, 2015–2020 (USD MILLION)

TABLE 371 CYBERSECURITY MARKET SIZE, BY SOFTWARE, 2020–2026 (USD MILLION)

14.5 MOBILE ENCRYPTION MARKET

14.5.1 MOBILE ENCRYPTION MARKET, BY SOLUTION

TABLE 372 DISK ENCRYPTION: MOBILE ENCRYPTION MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 373 FILE/FOLDER ENCRYPTION: MOBILE ENCRYPTION MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 374 COMMUNICATION ENCRYPTION: MOBILE ENCRYPTION MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 375 CLOUD ENCRYPTION: MOBILE ENCRYPTION MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

14.5.2 MOBILE ENCRYPTION MARKET, BY VERTICAL

TABLE 376 BANKING, FINANCIAL SERVICES, AND INSURANCE: MOBILE ENCRYPTION MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 377 AEROSPACE AND DEFENSE: MOBILE ENCRYPTION MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 378 HEALTHCARE: MOBILE ENCRYPTION MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 379 GOVERNMENT AND PUBLIC SECTOR: MOBILE ENCRYPTION MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 380 TELECOM: MOBILE ENCRYPTION MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 381 RETAIL: MOBILE ENCRYPTION MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 382 OTHERS: MOBILE ENCRYPTION MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

15 APPENDIX (Page No. - 292)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved major activities in estimating the current market size for the Encryption software market. An exhaustive secondary research was done to collect information on the Encryption software industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches like Top-down, bottom-up were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the Encryption software market.

Secondary Research

The market for companies offering encryption software systems and services for various verticals is arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolio of major companies in the ecosystem and rating them based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers, journals, certified publications; and articles from recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, and market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report in the primary research process. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the encryption software market.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the encryption software market. Top-down and bottom-up approaches were used to estimate and validate the size of the global market and estimate the size of various other dependent subsegments. The research methodology used to estimate the market size included the following details: the key players in the market were identified through secondary research, and their revenue contributions in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the encryption software market by component, service, application, deployment mode, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements and new product launches; acquisitions; and partnerships and collaborations, in the encryption software market globally

- To analyze the impact of the COVID-19 outbreak on the growth of the market

Data Encryption Software Market & its impact on Encryption Software Market

The Data Encryption Software Market, on the other hand, specifically refers to the market for software tools that are used to encrypt data at rest, in transit, or in use. Data encryption software is used to protect sensitive data from cyber threats, such as hacking, data theft, and other malicious activities.

The Data Encryption Software Market is a sub-segment of the broader Encryption Software Market. Encryption software is a type of software tool that is used to encrypt data to protect it from unauthorized access. Encryption can be used to protect data in a variety of contexts, such as email, web browsing, file storage, and messaging. Encryption software is used by both individuals and organizations to protect sensitive data from cyber threats.

The Data Encryption Software Market specifically refers to the market for software tools that are used to encrypt data at rest, in transit, or in use. Data encryption software is used to protect sensitive data from cyber threats, such as hacking, data theft, and other malicious activities.

Here are a few ways in which the Data Encryption Software market is expected to impact the Encryption Software market:

The Data Encryption Software Market is expected to have a significant impact on the Encryption Software Market. Data encryption software is used to protect sensitive data from cyber threats, such as hacking, data theft, and other malicious activities, and its adoption has been increasing due to the rising incidents of data breaches and cyber attacks.

The growth of the Data Encryption Software Market is expected to drive the demand for other types of encryption software, such as email encryption software, file encryption software, and disk encryption software, among others. As more companies and individuals adopt data encryption software to protect their sensitive data, the need for other types of encryption software is also expected to increase.

Moreover, the increasing adoption of cloud-based data encryption software solutions is also expected to impact the Encryption Software Market. Cloud-based encryption solutions offer several advantages over traditional on-premise solutions, including lower costs, greater scalability, and easier maintenance. As more companies adopt cloud-based solutions, the demand for cloud-specific encryption software solutions is also expected to increase.

The growth of the Data Encryption Software Market is also expected to lead to the development of more advanced encryption technologies, such as quantum encryption and homomorphic encryption, which can provide even stronger protection for sensitive data.

Futuristic growth use-cases of Data Encryption Software Market

- Quantum Encryption: Quantum encryption is a type of encryption that uses the principles of quantum mechanics to provide unbreakable encryption for sensitive data. This technology is expected to become more widely adopted in the future, and the demand for data encryption software that can support quantum encryption is expected to increase.

- Homomorphic Encryption: Homomorphic encryption is a type of encryption that allows computations to be performed on encrypted data without the need to decrypt it first. This technology has numerous applications in areas such as financial services, healthcare, and government, and the demand for data encryption software that can support homomorphic encryption is expected to increase.

- Cloud-based Encryption: The adoption of cloud-based data encryption software solutions is expected to continue to grow in the future, driven by the benefits of lower costs, greater scalability, and easier maintenance. The demand for data encryption software that can support cloud-based encryption is expected to increase.

- Internet of Things (IoT) Security: As more devices become connected to the internet, the need for encryption to secure data transmitted between these devices is also expected to increase. The demand for data encryption software that can support IoT security is expected to increase.

- Blockchain Security: Blockchain technology is used to secure transactions in cryptocurrencies, and it also has potential applications in other areas, such as supply chain management and voting systems. The demand for data encryption software that can support blockchain security is expected to increase.

Some of the Top players in Data Encryption Software market are Microsoft Corporation, Symantec Corporation, IBM Corporation, Dell EMC, Intel Corporation, Thales Group, McAfee LLC, Check Point Software Technologies Ltd., Sophos Ltd., Trend Micro Incorporated

New business opportunities in the Data Encryption Software market

Here are some of the new business opportunities in the Data Encryption Software market:

- Cloud Encryption: With the increase in cloud adoption, there is a growing need for cloud-based encryption solutions that can protect sensitive data in transit and at rest in cloud environments.

- IoT Security: With the proliferation of IoT devices, there is an increased need for encryption solutions that can secure data generated by these devices, especially in industries like healthcare, manufacturing, and transportation.

- Blockchain Encryption: With the rise of blockchain technology, there is a need for encryption solutions that can secure data and transactions on blockchain networks.

- Quantum Encryption: With the emergence of quantum computing, there is a need for encryption solutions that can protect data from quantum attacks.

- Mobile Encryption: With the increasing use of mobile devices for business purposes, there is a need for encryption solutions that can protect data on mobile devices and prevent data breaches.

- Compliance and Regulations: With the increase in regulations like GDPR and CCPA, there is a need for encryption solutions that can help companies comply with these regulations and avoid penalties.

- Data-Centric Security: With the shift towards data-centric security, there is a need for encryption solutions that can protect data throughout its lifecycle, from creation to destruction.

Industries that are being impacted by the Data Encryption Software Market

Here are some examples of industries that are being impacted by the Data Encryption Software market:

- Healthcare: Healthcare organizations handle a large amount of sensitive patient data that needs to be protected from data breaches. Encryption solutions can help healthcare organizations comply with regulations like HIPAA and protect patient data from cyber threats.

- Finance: The finance industry deals with large amounts of sensitive financial data, including transaction data, customer information, and account information. Encryption solutions can help financial organizations comply with regulations like PCI-DSS and protect financial data from cyber threats.

- Government: Governments handle sensitive information related to national security, law enforcement, and citizen services. Encryption solutions can help governments protect this information from cyber threats and insider attacks.

- Education: Education institutions handle a large amount of sensitive data, including student records, financial aid information, and research data. Encryption solutions can help these institutions comply with regulations like FERPA and protect sensitive data from cyber threats.

- Manufacturing: The manufacturing industry is increasingly using IoT devices and sensors to collect and transmit data. Encryption solutions can help protect this data from cyber threats and ensure the privacy and security of sensitive information.

- Retail: Retail organizations handle a large amount of sensitive customer data, including credit card information and personal information. Encryption solutions can help retail organizations comply with regulations like GDPR and protect customer data from cyber threats.

- Legal: Law firms handle sensitive client data that needs to be protected from cyber threats and insider attacks. Encryption solutions can help law firms comply with regulations like GDPR and protect sensitive client data.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the North America Encryption software market into countries

- Further breakup of the Europe market into countries

- Further breakup of the APAC market into countries

- Further breakup of the Middle East and Africa market into countries

- Further breakup of the Latin America market into countries

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Encryption Software Market