Mobile Cloud Market by Application (Gaming, Entertainment, Utilities, Education, Productivity, Business & Finance, Social Networking, Healthcare, Travel & Navigation), & By User (Enterprise User, Consumer) - Worldwide Market Forecast and Analysis (2014 - 2019)

In the recent years, there has been a considerable growth in the mobile and cloud technologies. Mobile communications have radically altered the business functionalities all over the globe. At the same time, cloud computing has also transformed the way of delivering services and maintenance of IT infrastructure. The need for high computational power and growing usage of connected mobile devices has fostered the convergence of mobile and cloud technology and has further led to the evolution of mobile cloud market solutions. This convergence would further enhance the mobility value and would fundamentally modify the work methodologies of workforce in business operations.

The significant technological development in the area of mobile and cloud has been the emergence of various technologies such as OneAPI, 4G LTE, Cloudlets, HTML5, Hypervisor, and CSS3 to overcome the difficulties of interoperability, and has further enhanced the adoption of the solutions offered by the mobile cloud market. Additionally, the emergence of cloud-based mobile apps has also leveraged mobile cloud adoptions with the provision of instantaneous personalized user experience regardless of the time and place, even in the memory constrained mobile devices.

The constant rise in BYOD trend among enterprises and significant shift to the cloud has further leveraged the mobile cloud as real mobility can be experienced with the help of cloud, when desired information is accessed on real-time basis to help provide customers with a rich experience. The other features such as scalability, ease of integration, reliability, and data synchronization add to the benefits of mobile cloud adoption.

There has been an ongoing development in the field of mobile cloud, which is paving a way for other smart mobile technologies such as wearable technologies that will continue to exploit the cloud technology. These developments will help in enhancing the value of mobility and faster workability, not only for enterprises but also for consumers. This report covers the overall structure of the market and provides definite actions that can help enterprises and application developers recognize the needs of consumers and organizations, and also exhibit the opportunities for the cloud service providers, personal cloud providers, and telecom network operators.

The global market of mobile cloud is fast gaining traction which is evident from the acquisitions of LiveLOOK by Oracle, Capptain by Microsoft, and Cloudant by IBM. Key players such as Amazon Web Service (AWS), Google, Inc., Microsoft Corporation, Apple, Inc., Salesforce.com, Rackspace, Inc., EMC (VMware), IBM, Oracle, and Akamai Technolgies Inc., offer services to enterprises and consumers.

The global market of mobile cloud has been segmented on the basis of cloud-based applications, users, and regions. This report analyzes global adoption trends, future growth potential, key drivers, restraints, opportunities, and best practices in the market. The report also examines growth potential market sizes and revenue forecasts across different regions as well as user segment.

The report forecasts the market sizes and trends for mobile cloud in the following sub-markets:

On the basis of applications:

- Gaming

- Entertainment

- Utilities

- Education

- Productivity

- Business and finance

- Social networking

- Healthcare

- Travel and navigation

- Others

On the basis of users:

- Enterprises

- Consumers

On the basis of regions:

- North America (NA)

- Europe

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America (LA)

The global mobile cloud market is in its evolutionary stage and is exhibiting rapid growth. The global market is expected to grow in the years to come with fast-paced adoption among enterprises. Nowadays, enterprises and consumers are seeking more mobility to remain connected on real-time basis. The continuous development in the field of mobile has improved business communication by providing connectivity to organizational information on the go. The cloud technology has opened better ways of service delivery and IT usage providing scalability and data synchronization to businesses. The amalgamation of cloud and mobile has further enhanced the term mobility as it provides instantaneous information.

The cloud-based apps are increasingly being used as they shift computational tasks on cloud that enhances the functioning of limited memory mobile devices. The growing multi-purpose usage of Smartphones and improved Internet speed has further encouraged consumers to use cloud-based apps. With the emergence of mobile workforce, enterprises are increasingly adopting mobile cloud, to provide real-time information to employees and enable business continuity, so as to provide an enhanced rich user experience to its customers.

The technological development such as One API, Hypervisor, HTML5, and CSS3 has further bridged the gap for overall interoperability of mobile cloud. Telecom network providers and personal cloud providers have been comprehensively offering extensive amount of cloud services to better serve the rising needs of enterprises and consumers. The usability of mobile cloud market technology is immense among enterprises creating a wide prospect for application developers and cloud service providers.

The adoption of mobile cloud is an imperative growth strategy for businesses that are looking forward to enhance their enterprise mobility. Considering the flexibility, scalability, ease of integration, and data synchronization provided by mobile cloud, users are rapidly adopting it. However, the cloud technology among consumers at times faces the challenges such as lack of awareness, and hence its adoption among consumers is moderate. Besides this, consumers are mostly inclined to adopt free mobile cloud-based apps. In spite of data security still being a major concern, enterprises are significantly the major adopters of mobile cloud technology. Various cloud service provider such as Microsoft, Amazon Web Services, and Google offer cloud services catering to both consumers and enterprises. Further, the personal cloud provider and white-label cloud provider are also adding a significant value to the market.

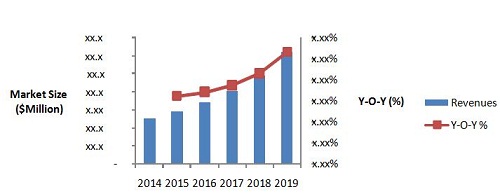

MarketsandMarkets forecasts the global mobile cloud market to grow from $9.43 billion in 2014 to $46.90 billion by 2019, at a CAGR of 37.8% during the forecast period 2014-2019.

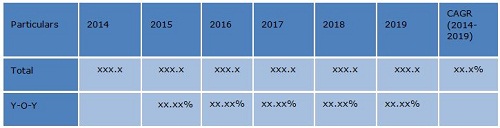

Mobile Cloud: Market Size, 20142019 ($Million)

Source: MarketsandMarkets Analysis

Mobile Cloud: Market Size and Growth Rate, 2014-2019 ($Million, Y-O-Y %)

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Market Scope

2 Research Methodology (Page No. - 17)

2.1 Description of the Mobile Cloud Demand Model

2.2 Market Size Estimation

2.3 Market Crackdown

2.4 Market Share Estimation

2.4.1 Key Data Taken From Secondary Sources

2.4.2 Key Data From Primary Sources

2.4.2.1 Key Industry Insights

2.4.3 Assumptions

3 Mobile Cloud Market Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Opportunities in the Market

4.2 Top Three Applications

4.3 Global Mobile Cloud-Based Applications Market

4.4 Market Potential

4.5 Mobile Cloud User Market (2019)

4.6 Mobile Cloud Regional Market

4.7 Mobile Cloud-Based Applications Growth Matrix

4.8 Life Cycle Analysis, By Geography

5 Mobile Cloud Market Overview (Page No. - 31)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 Market By Application

5.3.2 Market By User Type

5.3.3 Market By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Manifold Usage of the Smartphone

5.4.1.2 Enhanced Network Connectivity

5.4.1.3 Evolving Needs for Centralized Data Management

5.4.1.4 Rising Use of HTML5 Technology

5.4.2 Restraints

5.4.2.1 Prevalence of Data Security Apprehensions

5.4.2.2 Lack of Awareness About Network Connectivity

5.4.2.3 Multi-Platform Os Are Hindering the Mobility Management

5.4.3 Opportuities

5.4.3.1 Bridging the Connectivity and Accessibility Gap

5.4.3.2 Enhancing Flexibility Provision in Enterprises

5.4.3.3 Mounting Prospects for Mobile APP Sellers

5.4.3.4 Beginning of A New Workflow Pattern

5.4.4 Burning Issue

5.4.4.1 Rising Indispensible Requirement to Transit to the Cloud

5.5 Enabling Technologies

5.5.1 HTML5

5.5.2 Cascading Style Sheet (CSS)

5.5.3 Oneapi

5.5.4 4g Lte

5.5.5 Hypervisor

5.5.6 Cloudlets

5.5.7 Web 4.0

5.6 Smartphone

5.6.1 Shipment and forecast By Operating System

5.7 Tablets

5.7.1 Shipment and forecast By Operating System

5.8 Smartphone APP Store Facts

5.9 Global Mobile Cloud Subscribers

5.10 Mobile Cloud Storage APPs

5.10.1 Google Drive

5.10.2 Dropbox

5.10.3 Box

5.10.4 Sugarsync

5.10.5 Onedrive

5.10.6 Idrivesync

5.10.7 Carbonite

5.10.8 Mozy

5.11 Mobile Cloud Services

5.11.1 Traditional Vs Unique

5.11.2 Service Type

5.11.2.1 Business Process Services (BPS)

5.11.2.2 Information Services

5.11.2.3 Application Services

5.11.2.4 Application Infrastructure Services

5.11.2.5 System Infrastructure Services

5.11.2.6 Mobile Platform Services

5.12 Personal Cloud Provider Perspective

5.12.1 Personal Cloud Market

5.12.2 Personal Cloud Services

5.12.3 Pricing and Subscription

5.13 Telecom Network Operator Cloud

6 Mobile Cloud Market: Industry Trends (Page No. - 58)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five forces Analysis

6.3.1 Threat From New Entrants

6.3.2 Threat From Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Pest Analysis

6.4.1 Political Factors

6.4.2 Economic Factors

6.4.3 Social Factors

6.4.4 Technological Factors

7 Mobile Cloud Market By Application (Page No. - 65)

7.1 Introduction

7.2 Gaming APP Market

7.3 Entertainment APP Market

7.4 Utilities APP Market

7.5 Education APP Market

7.6 Productivity APP Market

7.7 Business and Finance APP Market

7.8 Social Networking APP Market

7.9 Healthcare APP Market

7.10 Travel and Navigation APP Market

7.11 Other APP Market

8 Mobile Cloud Market By User Type (Page No. - 84)

8.1 Introduction

8.2 Enterprise User Market

8.3 Consumer Market

9 Geographic Analysis (Page No. - 89)

9.1 Introduction

9.1.1 Market By Region

9.2 North America

9.2.1 Application Market

9.2.2 User Market

9.3 Europe

9.3.1 Application Market

9.3.2 User Market

9.4 Asia-Pacific

9.4.1 Application Market

9.4.2 User Market

9.5 Middle East and Africa

9.5.1 Application Market

9.5.2 User Market

9.6 Latin America

9.6.1 Application Market

9.6.2 User Market

10 Competitive Landscape (Page No. - 103)

10.1 Overview

10.2 Competitive Situation and Trends

10.2.1 Venture Funding

10.2.2 Mergers and Acqusitions

10.2.3 New Product Launches

10.2.4 Partnerships and Collaborations

10.3 End-User Landscape

10.3.1 End-User Analysis

10.3.2 End-User Mobile APP Spending

11 Company Profiles (Page No. - 114)

11.1 Introduction

11.2 Amazon Web Services

11.3 Microsoft Corporation

11.4 Google, Inc.

11.5 Salesforce.Com

11.6 Apple, Inc.

11.7 Rackspace, Inc.

11.8 EMC

11.9 IBM

11.10 Oracle

11.11 Akamai Technologies, Inc.

12 Appendix (Page No. - 148)

12.1 Discussion Guide

12.2 Introducing RT: Real-Time Market Intelligence

12.3 Available Customizations

12.4 Related Reports

List of Tables (74 Tables)

Table 1 Manifold Usage of the Smartphone is Propelling the Growth of Market

Table 2 Data Security Apprehensions is Restraining Market Growth

Table 3 Newer Workflow Patterns Are Paving the Enhanced Growth Avenues for APP Developers

Table 4 Personal Cloud Market, By Region, 20142019 ($Billion)

Table 5 White-Label Cloud Market, By Region, 20132019 ($Billion)

Table 6 Mobile Cloud Market, By Application, 20132019 ($Million)

Table 7 Market Growth, By Application Category, Y-O-Y (%)

Table 8 Gaming Application Market, By User Type, 20132019 ($Million)

Table 9 Gaming Application Market Growth, By User Type, Y-O-Y (%)

Table 10 Gaming Application Market, By Region, 20132019 ($Million)

Table 11 Gaming Application Market Growth, By Region, Y-O-Y (%)

Table 12 Entertainment Application Market, By User Type , 20132019 ($Million)

Table 13 Entertainment Application Market Growth, By User Type, Y-O-Y (%)

Table 14 Entertainment Application Market, By Region, 20132019 ($Million)

Table 15 Entertainment Application Market Growth, By Region, Y-O-Y (%)

Table 16 Utilities Application Market, By User Type, 20132019 ($Million)

Table 17 Utilities Application Market Growth, By User Type, Y-O-Y (%)

Table 18 Utilities Application Market, By Region, 20132019 ($Million)

Table 19 Utilities Application Market Growth, By Region, Y-O-Y (%)

Table 20 Education Application Market, By User Type, 20132019 ($Million)

Table 21 Education Application Market Growth, By User Type, Y-O-Y (%)

Table 22 Education Application Market, By Region, 20132019 ($Million)

Table 23 Education Application Market Growth, By Region, Y-O-Y (%)

Table 24 Productivity Application Market, By User Type, 20132019 ($Million)

Table 25 Productivity Application Market Growth, By User Type, Y-O-Y (%)

Table 26 Productivity Application Market, By Region, 20132019 ($Million)

Table 27 Productivity Application Market Growth, By Region, Y-O-Y (%)

Table 28 Business and Finance Application Market, By User Type, 20132019 ($Million)

Table 29 Business and Finance Application Market Growth, By User Type, Y-O-Y (%)

Table 30 Business and Finance Application Market, By Region, 20132019 ($Million)

Table 31 Business and Finance Application Market, By Region, Y-O-Y (%)

Table 32 Social Networking Application Market, By User Type, 20132019 ($Million)

Table 33 Social Networking Application Market, By User Type, Y-O-Y (%)

Table 34 Social Networking Application Market, By Region, 20132019 ($Million)

Table 35 Social Networking Application Market Growth, By Region, Y-O-Y (%)

Table 36 Healthcare Application Market, By User Type, 20132019 ($Million)

Table 37 Healthcare Application Market Growth, By User Type, Y-O-Y (%)

Table 38 Healthcare Application Market, By Region, 20132019 ($Million)

Table 39 Healthcare Application Market Growth, By Region, Y-O-Y (%)

Table 40 Travel and Navigation Application Market, By User Type, 20132019 ($Million)

Table 41 Travel and Navigation Application Market Growth, By User Type, Y-O-Y (%)

Table 42 Travel and Navigation Application Market, By Region, 20132019 ($Million)

Table 43 Travel and Navigation Application Market Growth, By Region, Y-O-Y (%)

Table 44 Others Application Market, By User Type, 20132019 ($Million)

Table 45 Others Application Market Growth, By User Type, Y-O-Y (%)

Table 46 Others Application Market, By Region, 20132019 ($Million)

Table 47 Others Application Market Growth, By Region, Y-O-Y (%)

Table 48 Mobile Cloud Market, By User Type, 20132019 ($Million)

Table 49 Mobile Cloud Market Growth, By User Type, Y-O-Y (%)

Table 50 Enterprise User Market, By Application, 20132019 ($Million)

Table 51 Enterprise User Market, By Region, 20132019 ($Million)

Table 52 Consumer Market, By Application, 20132019 ($Million)

Table 53 Consumer Market, By Region, 20132019 ($Million)

Table 54 Mobile Cloud Market, By Region, 20132019 ($Million)

Table 55 Mobile Cloud Market Growth, By Region, Y-O-Y (%)

Table 56 North America, Market, By Application, 20132019 ($Million)

Table 57 North America, Market, By User Type, 20132019 ($Million)

Table 58 North America, Market Growth, By User Type, Y-O-Y (%)

Table 59 Europe, Mobile Cloud Market, By Application, 20132019 ($Million)

Table 60 Europe, Market, By User Type, 20132019 ($Million)

Table 61 Europe, Market Growth, By User Type, Y-O-Y (%)

Table 62 APAC, Market, By Application, 20132019 ($Million)

Table 63 APAC, Market, By User Type, 20132019 ($Million)

Table 64 APAC, Market Growth, By User Type, Y-O-Y (%)

Table 65 MEA, Mobile Cloud Market, By Application, 20132019 ($Million)

Table 66 MEA, Mobile Cloud Market, By User Type, 20132019 ($Million)

Table 67 MEA, Market Growth, By User Type, Y-O-Y (%)

Table 68 LA, Market, By Application, 20132019 ($Million)

Table 69 LA, Market, By User Type, 20132019 ($Million)

Table 70 LA, Market Growth, By User Type, Y-O-Y (%)

Table 71 Venture Funding, 20112014

Table 72 Mergers and Acqusitions, 20112014

Table 73 New Launches, 20112014

Table 74 Partnerships and Collaborations, 20112014

List of Figures (54 Figures)

Figure 1 Research Methodology

Figure 2 Mobile Cloud Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Mobile Cloud Market Size Estimation Methodology: top-Down Approach

Figure 4 Mobile Cloud-Based Application Snapshot (2014 Vs 2019):

Figure 5 Global Mobile Cloud Market, By Region, 2014

Figure 6 Global Market Share, 2014

Figure 7 Attractive Opportunities in the Market

Figure 8 Mobile Cloud: Market, Gaming APP Gaining Highest Traction

Figure 9 Europe Holds the Maximum Share in the Mobile Cloud-Based APPlications Market

Figure 10 Asia-Pacific Market is Expected to Have the Highest Market Growth Potential for Mobile Cloud in the Years to Come

Figure 11 Enterprise User Segment Will Continue to Dominate the Market in the Next Five Years

Figure 12 Asia-Pacific Market to Grow Faster Than Europe and North America

Figure 13 Mobile Cloud-Based APP, Growth Matrix

Figure 14 Regional Life Cycle

Figure 15 HTML5 to Play A Crucial Role in the Market

Figure 16 Mobile Cloud Market Segmentation: By APPlication

Figure 17 Market Segmentation: By User Type

Figure 18 Mobile Cloud Market Segmentation: By Region

Figure 19 Rising Use of HTML5 Technology Will Drive the Market

Figure 20 Smartphone Shipment and forecast By Operating System

Figure 21 Tablets Shipment and forecast By Operating System

Figure 22 Total APP Download By Smartphone Type

Figure 23 APP Store Revenue By Smartphone Type (2013)

Figure 24 Average Number of APPs Downloaded Per Smartphone

Figure 25 Percentage of APP User Who Paid Less Than $1

Figure 26 Average Price Per APP

Figure 27 Global Mobile Cloud Subscribers

Figure 28 Value Chain Analysis (2014): Major Value is Added By Enterprise User and Consumer

Figure 29 Porters Five forces Analysis (2014): Low Capital Requirement is increasing Competition in the Industry

Figure 30 Geographic Snapshot (2014 & 2019): Rapid Growth Markets Are Emerging As New Hot Spots

Figure 31 APAC: An Attractive Destination for All Application Category

Figure 32 Europe Market Snapshot - Gaming APPs Expected to Contribute Maximum to the Market Value in 2014

Figure 33 Asia-Pacific Market Snapshot - Productivity APPs Expected to Gain Popularity Among Enterprise User By 2019

Figure 34 Companies Adopted Mergers and Acquisitions As the Key Growth Strategy Over the Last Three Years

Figure 35 Apple and Amazon Grew At Fastest Rate Between 2009 and 2013

Figure 36 Market Evolution Framework: Significant Number of Venture Capital Fundings Has Fueled Growth and Innovation In 2013

Figure 37 Battle for Market Share: Venture Funding Was the Key Strategy

Figure 38 Global Spending on Mobile APPs

Figure 39 Geographic Revenue Mix of Top 5 Market Players

Figure 40 Amazon Web Services: Business Overview

Figure 41 Amazon Web Services: SWOT Analysis

Figure 42 Microsoft Corporation: Business Overview

Figure 43 Microsoft Corporation: SWOT Analysis

Figure 44 Google, Inc.: Business Overview

Figure 45 Google, Inc.: SWOT Analysis

Figure 46 Salesforce.Com: Business Overview

Figure 47 Salesforce.Com: SWOT Analysis

Figure 48 Apple, Inc.: Business Overview

Figure 49 Apple, Inc.: SWOT Analysis

Figure 50 Rackspace, Inc.: Business Overview

Figure 51 EMC: Business Overview

Figure 52 IBM: Business Overview

Figure 53 Oracle: Business Overview

Figure 54 Akamai Technologies, Inc.: Business Overview

Growth opportunities and latent adjacency in Mobile Cloud Market