Mobile Device Management Market by Component (Solutions (Device Management, Application Management, Security Management) and Services), Deployment Mode, Organization Size, Operating System, Vertical and Region - Global Forecast to 2027

Updated on : Nov 17, 2025

Mobile Device Management Market Overview

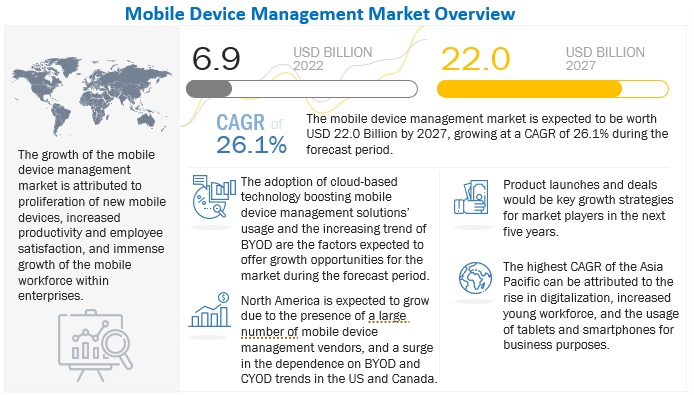

The global mobile device management market size was estimated at USD 6.9 billion in 2022 and is projected to grow at a CAGR of 26.1% from 2022 to 2027. Rapid increase in internet penetration and development of new technologies have been a crucial factor in the growth of the MDM market.

To know about the assumptions considered for the study, Request for Free Sample Report

Mobile Device Management Market Dynamics

Driver: Immense growth of mobile workforce within enterprises

Global business organisations are quickly embracing a number of trends, including organisational mobility and Bring Your Own Device (BYOD). By enabling employees to access company data from any location, at any time, and on any device, BYOD has helped businesses increase the productivity of their workforce. However, because personal devices can be connected to insecure networks, stolen, or misplaced, the likelihood of unauthorised data access and data breaches has increased tremendously as a result of these circumstances. Employees may quickly and securely access company data from their personal devices thanks to MDM solutions. Additionally, it offers increased control over BYOD, CYOD, COPE, and corporate-owned business-only devices (COBO).

Restraint: Compliance with stringent government rules and regulations

The expansion of the mobile device management market is anticipated to be hampered by the existence of strict laws and regulations. The data collection process and record management information are being constrained by laws and regulations such as the Health Insurance Portability and Accountability Act (HIPAA), the International Organization for Standardization (SO) 9001 standard, the Content Management Interoperability Services (CMIS), Electronic Data Logging (ELD), and Federal Information Processing Standard (FPS). Any nation's legislation place a high priority on the security and privacy of its citizens' data, which results in the creation of rules limiting the use of MDM techniques. The General Data Protection Regulations (GDPR) rule is the European Union's (EU) first effort to protect the personally identifiable information (PlI) of its citizens.

Opportunity: Leveraging UEBA into MDM solutions

Business organisations today operate in a volatile environment where cyber threats are more advanced and ubiquitous than ever before due to the exponential growth of enterprise endpoints and data sharing at the edge. Organizations are at danger from cybersecurity and endpoint disruption, which lowers employee productivity and raises IT expenditures. With automatic detection and response capabilities, UEBA is a new class of security solutions that may shield users and endpoints from ongoing surveillance. Additionally, it makes use of cutting-edge analytics tools like machine learning (ML) and deep learning to monitor the activity of mobile devices on corporate networks. By integrating UEBA into MDM, businesses can achieve zero-trust security and frictionless zero-touch productivity. This is the next generation of enterprise cybersecurity.

Challenge: Mobile device management solutions to cater to every business need for consistent end-user experience

MDM solution providers are unable to alter their products to satisfy certain corporate needs. Businesses frequently lament the MDM solution's failure to provide flexibility and agility with multi-user connections. Each business has unique requirements for the security of mobile devices that connect to the corporate network. While integrating MDM into an organization's current security and management controls and workflows, vendors also encounter a number of difficulties. However, the proper MDM solution can improve security and productivity while enabling an IT administrator to manage and keep an eye on systems from a single access point. Accurately understanding what a company needs is quite difficult because every company is unique and has varied business needs.

By Organization size, the SMEs segment to have a higher growth during the forecast period

Businesses with fewer than 1,000 employees are referred to as SMEs. They have a small staff, deal with tight financial budgets, and confront a variety of IT issues. As a result, they are unable to provide their customers with the best services, which makes it tough for them to maintain their revenue. For SMEs, maintaining the IT resources and infrastructure while receiving little support is difficult. If these businesses focused more on IT networks, their attention would divert from their main business operations, and the alignment of those operations would be improper. Therefore, SMEs are quickly implementing MDM solutions in order to provide the finest services to their clients and win over their employees' loyalty. With these solutions, they can manage their mobile devices, which would help organizations mobilize their desk-based operations and focus more on business strategies.

By Vertical, the healthcare segment to dominate the market during the forecast period

A crucial component of the healthcare sector is the safeguarding of patient data. Medical professionals and patients are depending more and more on MDM solutions to access real-time medical information, consult with doctors remotely around the world, and receive expert diagnosis. This further emphasises the requirement to safeguard the security and privacy of patient-related data. For healthcare enterprises, MDM has also become a one-stop shop for ensuring the total protection of patient data. For the management of medical devices, many healthcare IT teams use MDM systems. For healthcare enterprises to provide continuous access to data from many devices, MDM offers security-enabled mobile applications and a multi-device ecosystem.

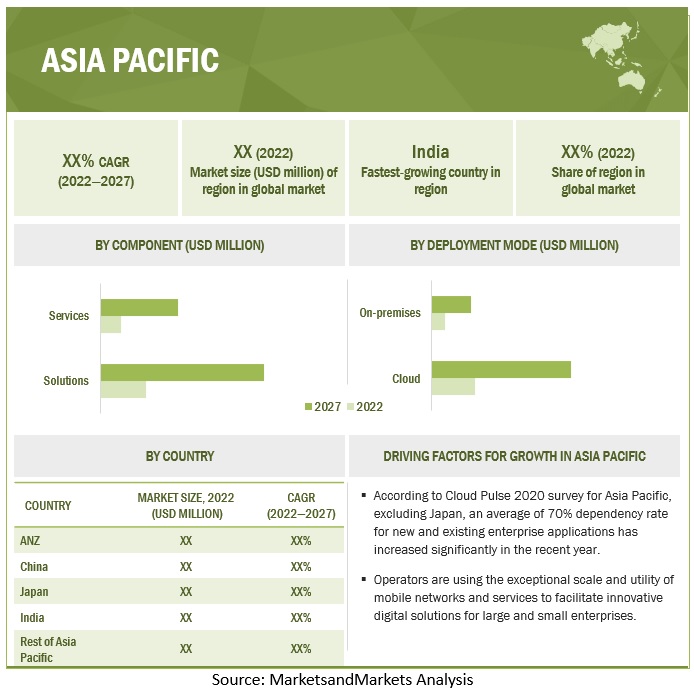

APAC to grow at the highest CAGR during the forecast period

Future growth for the mobile device management market in the Asia Pacific is predicted to be significant. In order to meet the rising demand for securing and protecting critical data, enterprise mobility solutions will need to be adjusted. This is due to the ongoing economic growth, expanding young workforce, and use of tablets and smartphones for business purposes. India is becoming more and more dependent on the BYOD trend as many large and mid-sized companies there have made it possible for staff members to bring their own devices to work. The increase in digitalization has also sparked worries about hacking and dangers to data security. Countries like Japan have intensified their efforts to implement MDM solutions across all industries, assuring the consistency and security of data.

To know about the assumptions considered for the study, download the pdf brochure

Mobile Device Management Market Companies

The report includes the study of key companies in the Mobile device management (MDM) market. The major companies in the market are VMware (US), Microsoft (US), IBM (US), Blackberry (Canada), Citrix (US), Google (US), Cisco (US), Samsung (South Korea), Micro Focus (UK), ZOHO (India), SolarWinds (US), SAP (Germany), Quest Software (US), Ivanti (US), Sophos (US), SOTI (Canada), Jamf (US), Qualys (US), Snow Software (Sweden), Matrix 42 (Germany), Rippling (US), 42Gears (US), ProMobi (India), Baramundi (Germany), Mitsogo Inc (US), Codeproof Technologies (US), AppTec (Switzerland), Addigy (US), Kandji (US). These players have adopted various strategies to grow in the global offering market. The study includes an in-depth competitive analysis of these key players in the offering MDM market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2022 |

$6.9 billion |

|

Revenue forecast in 2027 |

$22.0 billion |

|

Growth Rate |

26.1% CAGR |

|

Market size available for years |

2015-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By component, deployment mode, organization size, operating system, vertical, and region |

|

Regions covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Mobile Device Management Market Use Cases |

|

|

Companies covered |

VMware (US), Microsoft (US), IBM (US), Blackberry (Canada), Citrix (US), Google (US), Cisco (US), Samsung (South Korea), Micro Focus (UK), ZOHO (India), SolarWinds (US), SAP (Germany), Quest Software (US), Ivanti (US), Sophos (US), SOTI (Canada), Jamf (US), Qualys (US), Snow Software (Sweden), Matrix 42 (Germany), Rippling (US), 42Gears (US), ProMobi (India), Baramundi (Germany), Mitsogo Inc (US), Codeproof Technologies (US), AppTec (Switzerland), Addigy (US), Kandji (US). |

This research report categorizes the Mobile device management market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

-

Solution

- Device management

- Application Management

- Security Management

- Other solutions

-

Services

-

Professional services

- Consulting Services

- Implementation Services

- Support Services

- Managed services

-

Professional services

Mobile Device Management Market By Operating System:

- iOS

- Android

- Windows

- MacOS

- Other Operating systems

By Deployment Mode:

- On-Premises

- Cloud

By Organisation Size:

- Small and Medium Enterprises

- Large Enterprises

By Vertical:

- Banking, Financial Services and Insurance

- Telecom

- Retail

- Healthcare

- Education

- Transport and Logistics

- Government and Public Sector

- Manufacturing and Automotive

- Other Verticals

By regions:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Recent Developments:

- In October 2021, VMware was initiated to help customers navigate the multi-cloud era with the launch of VMware Cross-Cloud services. These integrated services will help deliver a faster and smarter path to the cloud for digital businesses, providing customers with the ability to build, run, and better secure apps across any cloud with freedom and flexibility.

- In September 2021, Citrix collaborated with Synopsys to help the company work flexibly, and Synopsys is using Citrix’s digital workspace platform and secure access solutions to overcome the challenges created by distributed IT and work models. These Citrix solutions provide secure and reliable access to resources. Synopsys employees need to work across every work channel, device, and location.

- In September 2021, IBM Watson launched new AI and automation capabilities designed to make it easier for businesses to create enhanced customer service experiences across any channel—phone, web, SMS, and any messaging platform.

- In March 2021, Microsoft and Intel partnership would help small and medium-sized businesses to make use of Windows 10 Pro devices powered by the Intel vPro platform. This can be used in remote or hybrid working models, and these modern devices would help employees stay connected and productive, safeguard against security threats, and manage remote deployments in a fast and flexible manner.

Frequently Asked Questions (FAQ):

What is the projected market value of the global mobile device management market?

What is the estimated growth rate (CAGR) of the global mobile device management market for the next five years?

What does the current study of the mobile device management market consist of?

What are the major revenue pockets in the Mobile device management market currently?

Why SMEs are adopting MDM at a faster rate?

How does Mobile Device Management (MDM) address the unique needs of different industries, such as healthcare or retail?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 MARKET OVERVIEW

-

5.2 MARKET DYNAMICSDRIVERS- Immense growth of mobile workforce within enterprises- Proliferation of new mobile devices- Network access control initiated by mobile device management- Increased productivity and employee satisfaction- Increasing trend of BYODRESTRAINTS- Compliance with stringent government rules and regulations- Security issues with devicesOPPORTUNITIES- 5G to transform importance of mobile devices- Leveraging UEBA into MDM solutions- Adoption of cloud-based technology boosting MDM solutions usageCHALLENGES- Enterprises to face complex mobility challenges due to growing number of mobile devices, platforms, and OS- Mobile device management solutions to cater to every business need for consistent end-user experience

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 TECHNOLOGY ANALYSISINTERNET OF THINGSBIG DATA AND ANALYTICSCLOUD COMPUTING5GARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

-

5.6 PATENT ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.8 KEY CONFERENCES & EVENTS, 2022–2023

-

5.9 REGULATORY LANDSCAPEGENERAL DATA PROTECTION REGULATIONCONTENT MANAGEMENT INTEROPERABILITY SERVICESINTERNATIONAL ORGANIZATION OF STANDARDIZATIONUNDERWIRTERS LABORATORIESFEDERAL INFORMATION SECURITY ACT

-

5.10 PORTER’S FIVE FORCES MODELTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.11 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.12 CASE STUDY ANALYSIS

-

6.1 INTRODUCTIONCOMPONENT: MARKET DRIVERS

-

6.2 SOLUTIONSDEVICE MANAGEMENT- Need to manage field workers’ mobile devices to propel market growthAPPLICATION MANAGEMENT- Need to manage educational apps on air to boost market growthSECURITY MANAGEMENT- Demand for securing patients’ data to drive marketOTHER SOLUTIONS

-

6.3 SERVICESPROFESSIONAL SERVICES- Consulting services- Implementation services- Support servicesMANAGED SERVICES

-

7.1 INTRODUCTIONOPERATING SYSTEM: MARKET DRIVERS

- 7.2 IOS

- 7.3 ANDROID

- 7.4 WINDOWS

- 7.5 MACOS

- 7.6 OTHER OPERATING SYSTEMS

-

8.1 INTRODUCTIONDEPLOYMENT MODE: MARKET DRIVERS

- 8.2 CLOUD

- 8.3 ON-PREMISES

-

9.1 INTRODUCTIONORGANIZATION SIZE: MARKET DRIVERS

- 9.2 LARGE ENTERPRISES

- 9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

-

10.1 INTRODUCTIONVERTICAL: MARKET DRIVERS

- 10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 10.3 TELECOM

- 10.4 RETAIL

- 10.5 HEALTHCARE

- 10.6 EDUCATION

- 10.7 TRANSPORTATION AND LOGISTICS

- 10.8 GOVERNMENT AND PUBLIC SECTOR

- 10.9 MANUFACTURING AND AUTOMOTIVE

- 10.10 OTHER VERTICALS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: PESTLE ANALYSISNORTH AMERICA: MARKET DRIVERSNORTH AMERICA: REGULATIONSNORTH AMERICA: RECESSION IMPACTUS- Increase in time spent on mobile devices to drive marketCANADA- Drastic increase in data breaches due to COVID-19 pandemic to propel market

-

11.3 EUROPEEUROPE: PESTLE ANALYSISEUROPE: MARKET DRIVERSEUROPE: REGULATIONSEUROPE: RECESSION IMPACTUK- Increasing usage of mobile devices for work purposes among employees to boost marketGERMANY- Strict German laws to govern mobile device management marketFRANCE- Initiatives by organizations to make use of mobile phones for businesses to drive marketITALY- Organizations reporting data breaches in 2020 to boost marketREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: PESTLE ANALYSISASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: REGULATIONSASIA PACIFIC: RECESSION IMPACTAUSTRALIA AND NEW ZEALAND- Need to protect data and implement security management solutions to boost marketJAPAN- Penetration of mobile devices and growing concerns for protecting corporate data to propel marketCHINA- Issuing new laws for personal information security to drive marketINDIA- Growing concern of data breaches to propel marketREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: PESTLE ANALYSISMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: REGULATIONSMIDDLE EAST & AFRICA: RECESSION IMPACTKSA- Witnessing several attacks in past to propel marketUAE- High penetration of mobile phones to boost marketSOUTH AFRICA- Government initiatives to protect citizens' data to drive marketQATAR- Rapidly growing smartphone market to boost marketREST OF MIDDLE EAST & AFRICA

-

11.6 LATIN AMERICALATIN AMERICA: PESTLE ANALYSISLATIN AMERICA: MARKET DRIVERSLATIN AMERICA: REGULATIONSLATIN AMERICA: RECESSION IMPACTBRAZIL- Rising focus on employee safety with data protection law to drive marketMEXICO- Growing adoption of telecom and IT services to propel marketREST OF LATIN AMERICA

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 REVENUE ANALYSIS

- 12.4 COMPANY MARKET RANKING ANALYSIS

- 12.5 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

-

12.6 COMPANY EVALUATION QUADRANTSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.7 COMPANY PRODUCT FOOTPRINT ANALYSISVERTICAL FOOTPRINTPRODUCT OFFERING FOOTPRINTREGION FOOTPRINT

- 12.8 COMPETITIVE BENCHMARKING FOR SMES/STARTUPS

-

12.9 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

12.10 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

-

13.1 MAJOR PLAYERSVMWARE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBLACKBERRY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCITRIX- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOOGLE- Business overview- Products/Solutions/Services offered- Recent developmentsCISCO- Business overview- Products/Solutions/Services offered- Recent developmentsSAMSUNG- Business overview- Products/Solutions/Services offered- Recent developmentsMICRO FOCUS- Business overview- Products/Solutions/Services offered- Recent developmentsZOHO- Business overview- Products/Solutions/Services offered- Recent developmentsSOLARWINDSSAPQUEST SOFTWAREIVANTISOPHOSSOTIJAMFQUALYS

-

13.2 SME/STARTUP PLAYERSSNOW SOFTWAREMATRIX42RIPPLING42GEARS MOBILITY SYSTEMSPROMOBI TECHNOLOGIESBARAMUNDI SOFTWAREMITSOGOCODEPROOF TECHNOLOGIESAPPTECADDIGYKANDJI

-

14.1 INTRODUCTIONLIMITATIONS

-

14.2 ENTERPRISE MOBILITY MANAGEMENT MARKET – GLOBAL FORECAST TO 2026MARKET DEFINITIONMARKET OVERVIEW- Enterprise mobility management market, by component- Enterprise mobility management market, by organization size- Enterprise mobility management market, by deployment mode- Enterprise mobility management market, by vertical

-

14.3 ENTERPRISE CONTENT MANAGEMENT MARKET – GLOBAL FORECAST 2026MARKET DEFINITIONMARKET OVERVIEW- Enterprise content management market, by business function- Enterprise content management market, by component- Enterprise content management market, by deployment mode- Enterprise content management market, by vertical

-

14.4 MOBILE SECURITY MARKET - GLOBAL FORECAST 2024MARKET DEFINITIONMARKET OVERVIEW- Mobile security market, by end user- Mobile security market, by operating system- Mobile security market, by enterprise solution

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2023

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 MOBILE DEVICE MANAGEMENT MARKET: ECOSYSTEM

- TABLE 4 TOP TWENTY PATENTS OWNERS (US) IN LAST TEN YEARS

- TABLE 5 AVERAGE SELLING PRICE RANGES OF SUBSCRIPTION-BASED MOBILE DEVICE MANAGEMENT SYSTEMS

- TABLE 6 DETAILED LIST OF CONFERENCES & EVENTS, 2022–2023

- TABLE 7 IMPACT OF PORTER’S FIVE FORCES ON MARKET

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 10 USE CASE 1: IBM PROVIDED SIMPLIFIED SOLUTION TO ISS FOR BETTER SAFEGUARDING MOBILE DEVICES

- TABLE 11 USE CASE 2: BLACKBERRY HELPED CITI ORIENT SECURITIES TO OBTAIN SINGLE VIEW OF ENTIRE MOBILE INFRASTRUCTURE

- TABLE 12 USE CASE 3: MICROSOFT HELPED CADENCE TO ACCELERATE BUSINESS PRODUCTIVITY

- TABLE 13 USE CASE 4: 42GEARS MOBILITY SYSTEMS HELPED ESCOS AUTOMATION GMBH TO INCREASE EFFICIENCY AND PRODUCTIVITY OF TABLETS

- TABLE 14 USE CASE 5: SOTI OFFERED COMPREHENSIVE FEATURES TO ASSIST CARE GROUP IN REDUCING TECHNICAL SUPPORT COSTS

- TABLE 15 MOBILE DEVICE MANAGEMENT MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 16 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 17 COMPONENTS: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 18 COMPONENTS: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 19 SOLUTIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 20 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 21 DEVICE MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 22 DEVICE MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 23 APPLICATION MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 24 APPLICATION MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 25 SECURITY MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 26 SECURITY MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 27 OTHER SOLUTIONS: MOBILE DEVICE MANAGEMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 28 OTHER SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 29 COMPONENTS: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 30 COMPONENTS: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 31 SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 32 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 33 SERVICES: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

- TABLE 34 SERVICES: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 35 PROFESSIONAL SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 36 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 37 CONSULTING SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 38 CONSULTING SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 39 IMPLEMENTATION SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 40 IMPLEMENTATION SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 41 SUPPORT SERVICES: MOBILE DEVICE MANAGEMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 42 SUPPORT SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 43 MANAGED SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 44 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 45 MARKET, BY OPERATING SYSTEM, 2016–2021 (USD MILLION)

- TABLE 46 MOBILE DEVICE MANAGEMENT MARKET, BY OPERATING SYSTEM, 2022–2027 (USD MILLION)

- TABLE 47 IOS: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 48 IOS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 49 ANDROID: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 50 ANDROID: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 51 WINDOWS: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 52 WINDOWS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 53 MACOS: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 54 MACOS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 55 OTHER OPERATING SYSTEMS: MOBILE DEVICE MANAGEMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 56 OTHER OPERATING SYSTEMS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 57 MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 58 MOBILE DEVICE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 59 CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 60 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 61 ON-PREMISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 62 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 63 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 64 MOBILE DEVICE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 65 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 66 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 67 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 68 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 69 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 70 MOBILE DEVICE MANAGEMENT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 71 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 72 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 73 TELECOM: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 74 TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 75 RETAIL: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 76 RETAIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 77 HEALTHCARE: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 78 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 79 EDUCATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 80 EDUCATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 81 TRANSPORTATION AND LOGISTICS: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 82 TRANSPORTATION AND LOGISTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 83 GOVERNMENT AND PUBLIC SECTOR: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 84 GOVERNMENT AND PUBLIC SECTOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 85 MANUFACTURING AND AUTOMOTIVE: MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 86 MANUFACTURING AND AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 87 OTHER VERTICALS: MOBILE DEVICE MANAGEMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 88 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 89 MOBILE DEVICE MANAGEMENT MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 90 MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 92 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 93 NORTH AMERICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 94 NORTH AMERICA: MOBILE DEVICE MANAGEMENT MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 95 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

- TABLE 96 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 97 NORTH AMERICA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 98 NORTH AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 99 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 100 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 101 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 102 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 103 NORTH AMERICA: MARKET, BY OPERATING SYSTEM, 2016–2021 (USD MILLION)

- TABLE 104 NORTH AMERICA: MARKET, BY OPERATING SYSTEM, 2022–2027 (USD MILLION)

- TABLE 105 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 106 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 107 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 108 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 109 US: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 110 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 111 US: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 112 US: MOBILE DEVICE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 113 US: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 114 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 115 CANADA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 116 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 117 CANADA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 118 CANADA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 119 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 120 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 121 EUROPE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 122 EUROPE: MOBILE DEVICE MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 123 EUROPE: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 124 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 125 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

- TABLE 126 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 127 EUROPE: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 128 EUROPE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 129 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 130 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 131 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 132 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 133 EUROPE: MARKET, BY OPERATING SYSTEM, 2016–2021 (USD MILLION)

- TABLE 134 EUROPE: MARKET, BY OPERATING SYSTEM, 2022–2027 (USD MILLION)

- TABLE 135 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 136 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 137 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 138 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 139 UK: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 140 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 141 UK: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 142 UK: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 143 UK: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 144 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 145 GERMANY: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 146 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 147 GERMANY: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 148 GERMANY: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 149 GERMANY: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 150 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 151 FRANCE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 152 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 153 FRANCE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 154 FRANCE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 155 FRANCE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 156 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 157 ITALY: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 158 ITALY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 159 ITALY: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 160 ITALY: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 161 ITALY: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 162 ITALY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 163 REST OF EUROPE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 164 REST OF EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 165 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 166 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 167 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 168 REST OF EUROPE: MOBILE DEVICE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 169 ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 170 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 171 ASIA PACIFIC: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 172 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 173 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

- TABLE 174 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 175 ASIA PACIFIC: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 176 ASIA PACIFIC: MOBILE DEVICE MANAGEMENT MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 177 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 178 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 179 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 180 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 181 ASIA PACIFIC: MARKET, BY OPERATING SYSTEM, 2016–2021 (USD MILLION)

- TABLE 182 ASIA PACIFIC: MARKET, BY OPERATING SYSTEM, 2022–2027 (USD MILLION)

- TABLE 183 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 184 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 185 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 186 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 187 AUSTRALIA AND NEW ZEALAND: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 188 AUSTRALIA AND NEW ZEALAND: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 189 AUSTRALIA AND NEW ZEALAND: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 190 AUSTRALIA AND NEW ZEALAND: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 191 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 192 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 193 JAPAN: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 194 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 195 JAPAN: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 196 JAPAN: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 197 JAPAN: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 198 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 199 CHINA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 200 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 201 CHINA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 202 CHINA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 203 CHINA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 204 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 205 INDIA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 206 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 207 INDIA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 208 INDIA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 209 INDIA: MOBILE DEVICE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 210 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 211 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 213 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 214 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 215 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 216 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: MOBILE DEVICE MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: MARKET, BY OPERATING SYSTEM, 2016–2021 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: MARKET, BY OPERATING SYSTEM, 2022–2027 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 235 KSA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 236 KSA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 237 KSA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 238 KSA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 239 KSA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 240 KSA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 241 UAE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 242 UAE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 243 UAE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 244 UAE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 245 UAE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 246 UAE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 247 SOUTH AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 248 SOUTH AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 249 SOUTH AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 250 SOUTH AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 251 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 252 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 253 QATAR: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 254 QATAR: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 255 QATAR: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 256 QATAR: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 257 QATAR: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 258 QATAR: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 259 REST OF MIDDLE EAST & AFRICA: MOBILE DEVICE MANAGEMENT MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 260 REST OF MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 261 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 262 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 263 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 264 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 265 LATIN AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 266 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 267 LATIN AMERICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 268 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 269 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

- TABLE 270 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 271 LATIN AMERICA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 272 LATIN AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 273 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 274 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 275 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 276 LATIN AMERICA: MOBILE DEVICE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 277 LATIN AMERICA: MARKET, BY OPERATING SYSTEM, 2016–2021 (USD MILLION)

- TABLE 278 LATIN AMERICA: MARKET, BY OPERATING SYSTEM, 2022–2027 (USD MILLION)

- TABLE 279 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 280 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 281 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 282 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 283 BRAZIL: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 284 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 285 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 286 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 287 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 288 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 289 MEXICO: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 290 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 291 MEXICO: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 292 MEXICO: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 293 MEXICO: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 294 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 295 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 296 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 297 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 298 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 299 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 300 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 301 MARKET: DEGREE OF COMPETITION

- TABLE 302 PRODUCT FOOTPRINT WEIGHTAGE

- TABLE 303 COMPANY PRODUCT FOOTPRINT

- TABLE 304 COMPANY VERTICAL FOOTPRINT

- TABLE 305 COMPANY PRODUCT OFFERING FOOTPRINT

- TABLE 306 COMPANY REGION FOOTPRINT

- TABLE 307 MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 308 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- TABLE 309 MARKET: PRODUCT LAUNCHES, 2019–2022

- TABLE 310 MOBILE DEVICE MANAGEMENT MARKET: DEALS, 2019–2022

- TABLE 311 VMWARE: BUSINESS OVERVIEW

- TABLE 312 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 VMWARE: MARKET: PRODUCT LAUNCHES

- TABLE 314 VMWARE: MOBILE DEVICE MANAGEMENT MARKET: DEALS

- TABLE 315 MICROSOFT: BUSINESS OVERVIEW

- TABLE 316 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 MICROSOFT: MOBILE DEVICE MANAGEMENT MARKET: DEALS

- TABLE 318 IBM: BUSINESS OVERVIEW

- TABLE 319 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 IBM: MARKET: PRODUCT LAUNCHES

- TABLE 321 IBM: MOBILE DEVICE MANAGEMENT MARKET: DEALS

- TABLE 322 BLACKBERRY: BUSINESS OVERVIEW

- TABLE 323 BLACKBERRY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 324 BLACKBERRY: MOBILE DEVICE MANAGEMENT MARKET: PRODUCT LAUNCHES

- TABLE 325 BLACKBERRY: MARKET: DEALS

- TABLE 326 CITRIX: BUSINESS OVERVIEW

- TABLE 327 CITRIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 328 CITRIX: MOBILE DEVICE MANAGEMENT MARKET: PRODUCT LAUNCHES

- TABLE 329 CITRIX: MARKET: DEALS

- TABLE 330 GOOGLE: BUSINESS OVERVIEW

- TABLE 331 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 332 GOOGLE: MOBILE DEVICE MANAGEMENT MARKET: PRODUCT LAUNCHES

- TABLE 333 GOOGLE: MARKET: DEALS

- TABLE 334 CISCO: BUSINESS OVERVIEW

- TABLE 335 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 336 CISCO: MOBILE DEVICE MANAGEMENT MARKET: DEALS

- TABLE 337 SAMSUNG: BUSINESS OVERVIEW

- TABLE 338 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 339 SAMSUNG: MARKET: PRODUCT LAUNCHES

- TABLE 340 SAMSUNG: MOBILE DEVICE MANAGEMENT MARKET: DEALS

- TABLE 341 MICRO FOCUS: BUSINESS OVERVIEW

- TABLE 342 MICRO FOCUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 343 MICRO FOCUS: MOBILE DEVICE MANAGEMENT MARKET: PRODUCT LAUNCHES

- TABLE 344 MICRO FOCUS: MARKET: DEALS

- TABLE 345 ZOHO: BUSINESS OVERVIEW

- TABLE 346 ZOHO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 347 ZOHO: MOBILE DEVICE MANAGEMENT MARKET: PRODUCT LAUNCHES

- TABLE 348 EMM MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

- TABLE 349 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

- TABLE 350 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

- TABLE 351 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY VERTICAL, 2020–2026 (USD MILLION)

- TABLE 352 ENTERPRISE CONTENT MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

- TABLE 353 ENTERPRISE CONTENT MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

- TABLE 354 ENTERPRISE CONTENT MANAGEMENT MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

- TABLE 355 ENTERPRISE CONTENT MANAGEMENT MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 356 ENTERPRISE CONTENT MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

- TABLE 357 ENTERPRISE CONTENT MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

- TABLE 358 ENTERPRISE CONTENT MANAGEMENT MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

- TABLE 359 ENTERPRISE CONTENT MANAGEMENT MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 360 MOBILE SECURITY MARKET, BY END USER, 2017–2024 (USD MILLION)

- TABLE 361 MOBILE SECURITY MARKET, BY OPERATING SYSTEM, 2017–2024 (USD MILLION)

- TABLE 362 MOBILE SECURITY MARKET, BY ENTERPRISE SOLUTION, 2017–2024 (USD MILLION)

- FIGURE 1 GLOBAL MOBILE DEVICE MANAGEMENT MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PROFILES OF PRIMARY PARTICIPANTS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 3 TOP-DOWN (DEMAND SIDE): SHARE OF MOBILE DEVICE MANAGEMENT THROUGH OVERALL MOBILE DEVICE MANAGEMENT SPENDING

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY ?APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF MOBILE DEVICE MANAGEMENT MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 2 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF MOBILE DEVICE MANAGEMENT MARKET

- FIGURE 7 MOBILE DEVICE MANAGEMENT MARKET: RECESSION IMPACT, 2016–2027 (USD MILLION)

- FIGURE 8 MOBILE DEVICE MANAGEMENT MARKET, 2020–2027

- FIGURE 9 LARGEST SEGMENTS IN MOBILE DEVICE MANAGEMENT MARKET, 2022

- FIGURE 10 MOBILE DEVICE MANAGEMENT MARKET: REGIONAL ANALYSIS

- FIGURE 11 ASIA PACIFIC TO BE BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

- FIGURE 12 RISING DEMAND FOR MOBILE DEVICE SECURITY TO DRIVE MARKET GROWTH

- FIGURE 13 SOLUTIONS SEGMENT AND US TO ACCOUNT FOR LARGER MARKET SHARES IN NORTH AMERICA IN 2022

- FIGURE 14 SOLUTIONS SEGMENT AND CHINA TO ACCOUNT FOR LARGER MARKET SHARES IN ASIA PACIFIC IN 2022

- FIGURE 15 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MOBILE DEVICE MANAGEMENT MARKET

- FIGURE 17 MARKET: VALUE CHAIN

- FIGURE 18 MOBILE DEVICE MANAGEMENT MARKET: ECOSYSTEM

- FIGURE 19 NUMBER OF PATENTS GRANTED, 2012–2022

- FIGURE 20 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

- FIGURE 21 PORTER’S FIVE FORCES MODEL: MARKET

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 24 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 25 SECURITY MANAGEMENT SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 26 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 27 SUPPORT SERVICES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 28 IOS OPERATING SYSTEM TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 CLOUD DEPLOYMENT MODE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 30 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 31 HEALTHCARE VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO BE FASTEST-GROWING MOBILE DEVICE MANAGEMENT MARKET DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 36 HISTORICAL REVENUE ANALYSIS, 2017–2021

- FIGURE 37 RANKING OF KEY PLAYERS IN MOBILE DEVICE MANAGEMENT MARKET, 2022

- FIGURE 38 MARKET SHARE ANALYSIS OF COMPANIES IN MOBILE DEVICE MANAGEMENT MARKET

- FIGURE 39 MOBILE DEVICE MANAGEMENT MARKET, COMPANY EVALUATION MATRIX, 2022

- FIGURE 40 MOBILE DEVICE MANAGEMENT MARKET, STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 41 VMWARE: COMPANY SNAPSHOT

- FIGURE 42 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 43 IBM: COMPANY SNAPSHOT

- FIGURE 44 BLACKBERRY: COMPANY SNAPSHOT

- FIGURE 45 CITRIX: COMPANY SNAPSHOT

- FIGURE 46 GOOGLE: COMPANY SNAPSHOT

- FIGURE 47 CISCO: COMPANY SNAPSHOT

- FIGURE 48 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 49 MICRO FOCUS: COMPANY SNAPSHOT

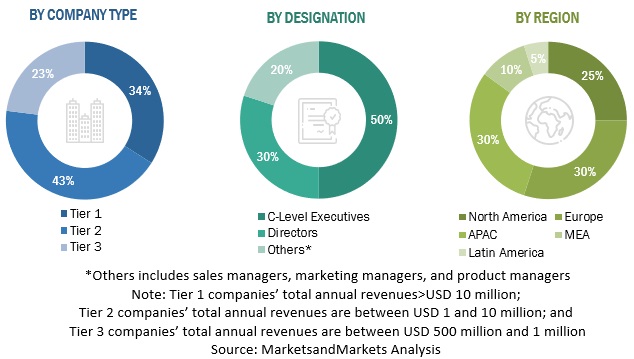

The study involved four major activities in estimating the current size of the Mobile device management market. Exhaustive secondary research was done to collect information on the industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the MDM market.

Secondary Research

In the secondary research process, various secondary sources were referred to, for identifying and collecting information for this study. Secondary sources include annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources. Moreover, journals such as the International Journal of Computer Science, Information Technology, and Security (IJCSITS); Journal of Location Based Services; and associations, such as The International RFID Business Association (RFIDba), Location Based Marketing Association (LBMA), and The International Map Industry Association (IMIA), have also been referred to for consolidating this report.

Secondary research was mainly used to obtain key information about the industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both demand and supply sides were interviewed to obtain qualitative and quantitative information for the global Mobile device management report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), VPs, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations, operating in the global Mobile device management market. After the complete market engineering (which included calculations for market statistics, market breakdown, market size estimation, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the numbers arrived at, through our estimation process. Primary research was also conducted to identify the segmentation types, industry trends, key players, competitive landscape of the global Mobile device management market, and key market dynamics, such as drivers, restraints, opportunities, industry trends, and key player strategies.

To know about the assumptions considered for the study, download the pdf brochure

Mobile Device Management Market Size Estimation

For the estimation and forecasting of the Mobile device management market, many methodologies were used. The first method entails calculating the market's size by adding up the profits that businesses make from the sales of products and services. For crucial insights, this complete process has examined the annual and financial reports of leading market participants and has conducted in-depth interviews with prominent industry figures, including CEOs, VPs, directors, and marketing executives of top businesses. Secondary sources were used to calculate all percentage splits and breakdowns, and primary sources were used to confirm the results. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable.

Report Objectives

- To determine and forecast the global mobile device management market based on components, deployment modes, organization size, operating systems (OS), verticals, and regions from 2022 to 2027, and analyze various macro and microeconomic factors that affect the market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the mobile device management market

- To analyze each subsegment with respect to individual growth trends, prospects, and contribution to the total MDM market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile key market players comprising top vendors and startups; provide comparative analysis based on business overview, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market.

- To analyze the recession impact on the global mobile device management market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Mobile Device Management Tools Market & Its impact on Mobile Device Management Market

The Mobile Device Management Tools market specifically refers to the software applications and tools used by organizations to manage and secure their mobile devices. These tools are a critical component of any MDM strategy and are used to enforce policies, configure settings, monitor usage, and maintain security across an organization's mobile device fleet.

The impact of the MDM Tools market on the MDM Market is significant. The availability of advanced MDM tools has made it easier for organizations to manage their mobile device fleets, enforce policies, configure settings, monitor usage, and maintain security. As a result, businesses have become more efficient and productive, and the adoption of mobile technology has increased.

Additionally, the growth of the MDM Tools market has led to increased competition, which has resulted in the development of more advanced and feature-rich solutions. This has further fueled the growth of the overall MDM market.

Some Futuristic Growth Use-Cases of Mobile Device Management Tools Market

- Internet of Things (IoT) Device Management: As the number of IoT devices in the workplace continues to grow, MDM tools will be required to manage and secure these devices. MDM solutions that can manage and monitor IoT devices alongside traditional mobile devices are expected to see strong growth.

- Artificial Intelligence (AI) and Machine Learning (ML) Integration: MDM tools that incorporate AI and ML capabilities are expected to become more common, allowing for more efficient and proactive device management and security. For example, AI-powered security solutions can identify and respond to potential security threats in real time.

- Wearable Device Management: The growing popularity of wearable devices in the workplace, such as smartwatches and fitness trackers, will require MDM tools to manage and secure these devices. MDM solutions that can integrate wearable devices into their management and security processes will be in high demand.

- Cloud-Based Management: MDM tools that are cloud-based are expected to see strong growth, as they offer greater flexibility and scalability. Cloud-based MDM solutions can be accessed from anywhere and can easily scale up or down as an organization's needs change.

- Integration with Enterprise Mobility Management (EMM) and Unified Endpoint Management (UEM): MDM tools that can integrate with EMM and UEM solutions are expected to become more common. This will allow for more comprehensive management of all endpoints, including mobile devices, desktops, and IoT devices.

Top Players in Mobile Device Management Tools Market

- IBM Corporation

- Microsoft Corporation

- BlackBerry Limited

- Citrix Systems, Inc.

- VMware, Inc.

- MobileIron, Inc.

- Cisco Systems, Inc.

- SAP SE

- Sophos Ltd.

- Ivanti, Inc.

In addition to these established players, there are also many emerging MDM Tools vendors and startups that are bringing new innovations to the market, such as cloud-based MDM solutions, AI-powered security, and integration with other endpoint management solutions.

Industries Getting Impacted in the future by Mobile Device Management Tools Market

- Manufacturing: With the increasing use of mobile devices in manufacturing, MDM tools will be required to manage and secure these devices. MDM solutions can provide remote access to factory floors and enable real-time collaboration, leading to improved efficiency and productivity.

- Retail: The use of mobile devices is becoming increasingly common in the retail industry, both for employees and customers. MDM tools can help retailers manage and secure their mobile devices, while also improving the customer experience by enabling mobile payments, personalized offers, and more.

- Transportation: Mobile devices are used extensively in the transportation industry, from GPS tracking to fleet management. MDM tools can help transportation companies manage and secure their mobile devices, while also improving communication and collaboration between drivers, dispatchers, and other stakeholders.

- Hospitality: The hospitality industry relies heavily on mobile devices, from mobile check-in and payment to in-room entertainment systems. MDM tools can help hotels and resorts manage and secure their mobile devices, while also providing guests with a seamless and personalized experience.

- Energy and Utilities: The energy and utilities industry uses mobile devices to manage field operations, monitor equipment, and communicate with customers. MDM tools can help companies in this industry manage and secure their mobile devices, while also improving efficiency and reducing downtime.

New Business Opportunities in Mobile Device Management Tools Market

- Cloud-based MDM solutions: With the increasing adoption of cloud computing, there is a growing demand for cloud-based MDM solutions that can offer scalability, flexibility, and cost-effectiveness. Companies that can offer cloud-based MDM solutions, either as a software-as-a-service (SaaS) or platform-as-a-service (PaaS) model, are well-positioned to capitalize on this trend.

- AI-powered security: As mobile devices become more sophisticated, the threats to mobile security are also increasing. Companies that can offer AI-powered security solutions for mobile devices, such as machine learning algorithms and predictive analytics, are likely to find new business opportunities in the MDM Tools market.

- Integration with other endpoint management solutions: Many companies are looking for integrated solutions that can manage all their endpoints, including mobile devices, laptops, and IoT devices. Companies that can offer MDM solutions that integrate with other endpoint management solutions, such as unified endpoint management (UEM) platforms, are likely to find new business opportunities in this area.

- Industry-specific MDM solutions: As mobile devices become more specialized for specific industries, such as healthcare or finance, there is a growing need for industry-specific MDM solutions that can meet the unique needs of these industries. Companies that can offer MDM solutions tailored to specific industries are likely to find new business opportunities in this area.

- Consulting and professional services: As the MDM Tools market becomes more complex, many companies are looking for consulting and professional services to help them navigate the landscape and implement effective MDM solutions. Companies that can offer consulting and professional services, such as needs assessments, implementation planning, and ongoing support, are likely to find new business opportunities in this area.

Hypothetic Challenges of Mobile Device Management Tools Business in the Future

- Security threats: With the increasing use of mobile devices for work purposes, the security risks associated with these devices are also increasing. MDM solutions need to be able to keep up with new security threats, but this can be a daunting task. Companies that can offer innovative security solutions that stay ahead of the latest threats are likely to be more successful in this market.

- Platform fragmentation: The proliferation of mobile device platforms and operating systems can be a challenge for MDM solutions. Companies that can offer MDM solutions that are compatible with a wide range of platforms, including iOS, Android, and Windows, are likely to have a competitive advantage.

- User experience: As mobile devices become more integrated into our daily lives, the user experience of MDM solutions is becoming increasingly important. Companies that can offer MDM solutions that strike a balance between security and usability, and that are easy for employees to use, are likely to have a competitive advantage.

- Data privacy: With the increasing use of mobile devices for work purposes, there is a growing concern about data privacy. Companies that can offer MDM solutions that respect employee privacy and that are compliant with data protection regulations are likely to be more successful in this market.

- Cost: The cost of MDM solutions can be a barrier to adoption for some companies, particularly for smaller businesses or those with limited budgets. Companies that can offer cost-effective MDM solutions, either through subscription-based models or other pricing strategies, are likely to be more successful in this market.

- Integration with other technologies: Many companies are looking for integrated solutions that can manage all their endpoints, including mobile devices, laptops, and IoT devices. Companies that can offer MDM solutions that integrate with other endpoint management solutions, such as unified endpoint management (UEM) platforms, are likely to have a competitive advantage.

Speak to our Analyst today to know more about the "Mobile Device Management Tools Market".

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mobile Device Management Market