Mobile BPM Market by Solution, Service (Maintenance & Support, Integration & Design, Consulting, and Others), End User (SMBs and Enterprises), Vertical, Deployment Model (Public, Private, Hybrid), and Region - Global Forecast to 2020

[152 Pages Report] The mobile BPM market is expected to grow from USD 1.18 Billion in 2015 to USD 3.26 Billion by 2020, at a CAGR of 22.5% from 2015 to 2020.

Mobile technologies provide real-time access to business process management (BPM) processes from remote locations. By extending existing processes to mobile workforces, enterprises can significantly improve business responsiveness, increase productivity, and improve processing times. The current trend in the market is the increasing acceptance of technologies such as cloud computing, business analytics, social media platforms, and process automation software. These technologies contribute to cost reduction and more efficient operations, by restructuring the systems background, thereby regulating the technological environment on a unified, centralized platform. The report aims at estimating the market size and future growth potential of the market across different segments, such as solution, service, deployment model, end user, vertical, and region. Companies are adopting mobile BPM solutions to gain competitive advantage and distinguish themselves from other market players by focusing on their core competencies. The need for cost-effective business processes is driving the overall growth of the mobile BPM market

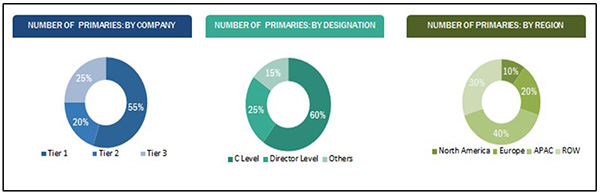

The research methodology used to estimate and forecast the market starts with capturing data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global mobile BPM market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key personnel, such as CEOs, VPs, directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of this market. The breakdown of profiles of primaries is depicted in the figure given below:

The mobile BPM ecosystem comprises mobile BPM processes and solution vendors such as IBM, Oracle, Software AG, Pegasystems, Appian, and Fujitsu, among others. They provide mobile BPM services and solutions to end users in order to cater to their specific business requirements.

Target Audience

- Mobile BPM Solution Providers

- End Users/Consumers/Enterprise Users

- Government Organizations

- Consultants/Advisory Firms

- System Integrators and Resellers

- Training and Education Service Providers

- Support and Maintenance Service Providers

Scope of the Report

The research report segments the mobile BPM market into the following segments:

By Solution:

- Automation

- Process Modeling & Design

- Integration

- Content & Document Management

- Monitoring & Optimization

- Others

By Service:

- Maintenance & Support

- Integration & Deployment

- Consulting

- Others

By Deployment Model:

- Public Cloud

- Private Cloud

- Hybrid Cloud

By End User:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Vertical:

- BFSI

- Telecom & IT

- Consumer Goods & Retail

- Manufacturing

- Government & Defense

- Automotive

- Healthcare

- Transportation & Logistics

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- Middle East and Africa

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America market

- Further breakdown of the Europe mobile market

- Further breakdown of the Asia-Pacific market

- Further breakdown of the Middle East & Africa market

- Further breakdown of the Latin America market

Company Information

- Detailed analysis and profiling of additional market players

Customer Interested in this report can also view

Business Process Management Market by Solution, by Service, by Deployment Type (Cloud, On-Premises), by Organization Size (SMES, Enterprises), by Business Function, by Industry Vertical, by Region (NA, Europe, APAC, MEA, LA) - Global Forecast to 2021Mobile BPM, a subset of business process management, is a specially designed information system that permits customers, business partners, and staffs to interact more efficiently and productively. It helps organizations to operate business processes via mobile devices, thus improving the turn-around-time as well as operational performance. Mobile BPM solutions help to deal with major issues such as redundancy in systems processes, and absence of transparency and flexibility in processes. A large number of organizations use mobile BPM solutions to automate operations, make better decisions, exploit opportunities, and respond to changes in the mobile BPM market. Certain mobile BPM apps offer the advantage of location-based services to dynamically modify a business process based on the current context.

The global mobile BPM market is projected to grow from USD 1.18 Billion in 2015 to USD 3.26 Billion by 2020, at a CAGR of 22.5% from 2015 to 2020. Cost efficiency and return on investment (ROI) from mobile BPM suites is driving the growth of the market in the next five years. Improving cost efficiency is not only related to reducing expenditure but also includes devising strategic investment plans in order improve material savings. Currently, several organizations are recognizing the significance of effective implementation of mobile BPM solutions to achieve efficiency. As organizations seek to manage and measure the business value of every process, mobile BPM provides a powerful collaborative platform to enhance their operational efficiency. It also provides organizations with varied benefits, such as automation, optimization, solution development, regulatory compliance, and advanced workflow solutions.

On the basis of vertical, the mobile BPM market is segmented into BFSI, automation, manufacturing, consumer goods & retail, healthcare, government & defense, IT & telecom, and transportation & logistics, among others. In 2015, the BFSI segment contributed the largest share in the market, followed by the government & defense segment.

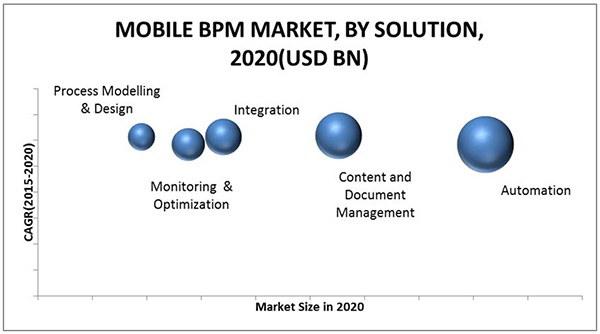

This market is further segmented on the basis of solution into process modeling & design, integration, content & document management, monitoring & optimization, and automation, among others. Among them, the automation solution segment accounted for the largest share in the mobile BPM market. Automation helps businesses automate various business-related processes, such as billing and order processing, among others. The solutions covered under this segment include workflow automation, lifecycle automation, compliance and business rules management system, and service-oriented architecture (SOA). Thus, complex mobile business processes and functions such as data handling are achieved through the implementation of varied automation solutions.

On the basis of region, the mobile BPM market is classified into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. In North America, organizations are shifting to digital businesses and are becoming more customer-centric. Similarly, in Europe and Asia-Pacific regions, enterprises are redesigning and modernizing process with an aim of improving business process efficiencies. Mobile BPM suites and solutions represent ways of automating business processes, hence its adoption in technology-inclined areas is very high.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Year Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities

4.2 Mobile BPM Market Automation Solution, By Region

4.3 Global Market

4.4 Top Vertical, By Region

4.5 Lifecycle Analysis, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 By Solution

5.3.2 By Service

5.3.3 By End User

5.3.4 By Deployment Model

5.3.5 By Vertical

5.3.6 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increased Need for Business Agility

5.4.1.2 Cost Efficiency and Roi From Mobile BPM Suites

5.4.1.3 Efficiency in Compliance Control

5.4.2 Restraints

5.4.2.1 Employee Resistance to Mobile BPM

5.4.2.2 Misconception About Mobile BPM Solutions Among End Users

5.4.3 Opportunities

5.4.3.1 Growth in the Amount of Data and Increasing Complexities of Business Processes

5.4.3.2 Increased Adoption of Cloud

5.4.3.3 Increased Focus on Mobile Technologies

5.4.4 Challenges

5.4.4.1 Integration of New and Existing Technology

5.4.4.2 Management of Cultural Changes

6 Industry Trends (Page No. - 44)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.4 Porters Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

7 Global Mobile BPM Market Analysis, By End User (Page No. - 49)

7.1 Introduction

7.2 Enterprises

7.3 Small and Medium Enterprises (SMES)

8 Global Mobile BPM Market Analysis, By Solution (Page No. - 52)

8.1 Introduction

8.2 Automation

8.3 Content & Document Management

8.4 Integration

8.5 Monitoring & Optimization

8.6 Process Modeling & Design

8.7 Others

9 Global Mobile BPM Market Analysis, By Deployment (Page No. - 64)

9.1 Introduction

9.2 Hybrid Cloud

9.3 Public Cloud

9.4 Private Cloud

10 Global Mobile BPM Market Analysis, By Services (Page No. - 71)

10.1 Introduction

10.2 Maintenance & Support

10.3 Integration & Design

10.4 Consulting

10.5 Others

11 Global Mobile BPM Market Analysis, By Vertical (Page No. - 79)

11.1 Introduction

11.2 Banking Financial Services and Insurance (BFSI)

11.3 Government & Defense

11.4 IT & Telecom

11.5 Consumer Good & Retail

11.6 Manufacturing

11.7 Automotive

11.8 Healthcare

11.9 Transportation & Logistics

11.10 Others

12 Geographic Analysis (Page No. - 95)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia-Pacific

12.5 Middle East and Africa

12.6 Latin America

13 Competitive Landscape (Page No. - 107)

13.1 Overview

13.2 Competitive Situation and Trends

13.3 Competitive Situation and Trends

13.4 Mergers and Acquisitions

13.5 New Product Launches

13.6 Partnerships, Agreements, Joint Ventures, and Collaborations

13.7 Expansions

14 Company Profiles (Page No. - 113)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

14.1 Introduction

14.2 IBM

14.3 Fujitsu

14.4 Oracle

14.5 Opentext Corporation

14.6 Software AG

14.7 Appian

14.8 Pegasystems Inc.

14.9 EMC Corporation

14.10 Hyland Software, Inc.

14.11 Tibco Software

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Key Innovators (Page No. - 144)

15.1 Bizagi

15.1.1 Business Overview

15.1.2 Push for Mobile BPM

15.2 Pnmsoft

15.2.1 Business Overview

15.2.2 Push for Mobile BPM

15.3 Newgen

15.3.1 Business Overview

15.3.2 Push for Mobile BPM

16 Appendix (Page No. - 146)

16.1 Discussion Guide

16.2 Introducing RT: Real Time Market Intelligence

16.3 Available Customizations

16.4 Related Reports

List of Tables (67 Tables)

Table 1 Global Mobile BPM Market Size and Growth, 20132020 (USD Million)

Table 2 Global Market Size, By End Users, 20132020 (USD Million)

Table 3 Enterprises: Market Size, By Services, 20132020 (USD Million)

Table 4 SMES Market Size, By Services, 20132020 (USD Million)

Table 5 Global Market Size, By Solution, 20132020 (USD Million)

Table 6 Automation: Market Size, By Region, 20132020 (USD Million)

Table 7 Automation: Market Size, By End User, 20132020 (USD Million)

Table 8 Content & Document Management: Market Size, By Region, 20132020 (USD Million)

Table 9 Content & Document Management: Market Size, By End User, 20132020 (USD Million)

Table 10 Integration: Market Size, By Region, 20132020 (USD Million)

Table 11 Integration: Market Size, By End User, 20132020 (USD Million)

Table 12 Monitoring & Optimization: Market Size, By Region, 20132020 (USD Million)

Table 13 Monitoring & Optimization: Market Size, By End User, 20132020 (USD Million)

Table 14 Process Modeling & Design: Mobile BPM Market Size, By Region, 20132020 (USD Million)

Table 15 Process Modeling & Design: Market Size, By End User, 20132020 (USD Million)

Table 16 Others: Market Size, By Region, 20132020 (USD Million)

Table 17 Others: Market Size, By End User, 20132020 (USD Million)

Table 18 Global Market Size, By Deployment, 20132020 (USD Million)

Table 19 Hybrid Cloud: Market Size, By Region, 20132020 (USD Million)

Table 20 Hybrid Cloud: Market Size, By End User, 20132020 (USD Million)

Table 21 Public Cloud: Market Size, By Region, 20132020 (USD Million)

Table 22 Public Cloud: Market Size, By End User, 20132020 (USD Million)

Table 23 Private Cloud: Market Size, By Region, 20132020 (USD Million)

Table 24 Private Cloud: Market Size, By End User, 20132020 (USD Million)

Table 25 Market Size, By Services , 20132020 (USD Million)

Table 26 Maintenance & Support: Mobile BPM Market Size, By Region, 20132020 (USD Million)

Table 27 Maintenance & Support: Market Size, By Solution, 20132020 (USD Million)

Table 28 Integration & Design: Market Size, By Region, 20132020 (USD Million)

Table 29 Integration & Design: Market Size, By Solution, 20132020 (USD Million)

Table 30 Consulting Services: Market Size, By Region, 20132020 (USD Million)

Table 31 Consulting Services: Market Size, By Solution, 20132020 (USD Million)

Table 32 Other Services: Market Size, By Region, 20132020 (USD Million)

Table 33 Other Services: Mobile BPM Market Size, By Solution, 20132020 (USD Million)

Table 34 Global Market Size, By Vertical, 20132020 (USD Million)

Table 35 BFSI: Market Size, By Region, 20132020 (USD Million)

Table 36 BFSI: Market Size, By Solution, 20132020 (USD Million)

Table 37 Government & Defense: Market Size, By Region, 20132020 (USD Million)

Table 38 Government & Defense: Market Size, By Solution, 20132020 (USD Million)

Table 39 IT & Telecom: Market Size, By Region, 20132020 (USD Million)

Table 40 IT & Telecom: Market Size, By Solution, 20132020 (USD Million)

Table 41 Consumer Good & Retail: Mobile BPM Market Size, By Region, 20132020 (USD Million)

Table 42 Consumer Good & Retail: Market Size, By Solution, 20132020 (USD Million)

Table 43 Manufacturing: Market Size, By Region, 20132020 (USD Million)

Table 44 Manufacturing: Market Size, By Solution, 20132020 (USD Million)

Table 45 Automotive: Market Size, By Region, 20132020 (USD Million)

Table 46 Automotive: Market Size, By Solution, 20132020 (USD Million)

Table 47 Healthcare: Market Size, By Region, 20132020 (USD Million)

Table 48 Healthcare: Market Size, By Solution, 20132020 (USD Million)

Table 49 Transportation & Logistics : Market Size, By Region, 20132020 (USD Million)

Table 50 Transportation & Logistics : Market Size, By Solution, 20132020 (USD Million)

Table 51 Others : Mobile BPM Market Size, By Regions, 20132020 (USD Million)

Table 52 Others : Market Size, By Solution, 20132020 (USD Million)

Table 53 Market Size, By Region, 20132020 (USD Million)

Table 54 North America : Market Size, By Solution, 20132020 (USD Million)

Table 55 North America : Market Size, By Services, 20132020 (USD Million)

Table 56 Europe : Market Size, By Solution, 20132020 (USD Million)

Table 57 Europe : Market Size, By Services, 20132020 (USD Million)

Table 58 Asia-Pacific : Market Size, By Solution, 20132020 (USD Million)

Table 59 Europe : Market Size, By Services, 20132020 (USD Million)

Table 60 Middle East & Africa : Market Size, By Solution, 20132020 (USD Million)

Table 61 Middle East & Africa : Market Size, By Services, 20132020 (USD Million)

Table 62 Latin America : Market Size, By Solution, 20132020 (USD Million)

Table 63 Latin America: Mobile BPM Market Size, By Services, 20132020 (USD Million)

Table 64 Mergers and Acquisitions, 20112014

Table 65 New Product Launches, 20112014

Table 66 Partnerships, Agreements, Joint Ventures, and Collaborations,20122014

Table 67 Expansion, 2014

List of Figures (75 Figures)

Figure 1 Research Design

Figure 2 Market Size Estimation Methodology: Bottom Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Breakdown Data Triangulation Approach

Figure 5 Mobile BPM Market Size, Regional Snapshot: North America Expected to Account for the Largest Market Share Throughout the Forecast Period

Figure 6 Market Size, Vertical Snapshot: the IT & Telecom Segment Expected to Grow at the Highest CAGR During the Forecast Period

Figure 7 Market Size, Solution Snapshot: Automation Expected to Contribute the Largest Market Share

Figure 8 Market Size, Services Snapshot: Maintenance & Support Expected to Account for the Largest Market Share

Figure 9 Market Size, End Users Snapshot: Enterprises Expected to Account for the Largest Market Share

Figure 10 Global Market: North America Expected to Account for the Largest Market Share in 2015

Figure 11 Need for Business Agility and Cost Efficiency Expected to Drive the Market

Figure 12 North America Expected to Dominate the Market in Automation During the Forecast Period

Figure 13 Consulting and Hybrid Cloud Among are the Dominant Segment in the Market

Figure 14 BFSI Vertical of the Market Expected to Witness Highest Growth in Asia-Pacific

Figure 15 Regional Lifecycle the Mobile BPM Market in Latin America is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Market Segmentation: By Solution

Figure 17 Market Segmentation: By Service

Figure 18 Market Segmentation: By End User

Figure 19 Market Segmentation: By Deployment Model

Figure 20 Market Segmentation: By Vertical

Figure 21 Market Segmentation: By Region

Figure 22 Global Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 Value Chain Analysis: Mobile BPM Market

Figure 24 Supply Chain Analysis

Figure 25 Global Market: Porters Five Forces Analysis

Figure 26 Enterprises are Expected to Dominate the Market Throughout the Forecast Period

Figure 27 Content & Document Management Solutions Expected to Be the FastestGrowing Segment

Figure 28 Market in Automation Expected to Grow at the Highest CAGR in Asia-Pacific

Figure 29 The Content & Document Management Market Expected to Grow at the Highest CAGR in Latin America

Figure 30 The Integration Market Expected to Witness Highest CAGR in the Latin American Region

Figure 31 The Monitoring & Optimization Market Expected to Witness the Highest Growth in Latin America

Figure 32 The Process Modeling & Design Market is Expected to Witness Highest CAGR in Latin America

Figure 33 The Other Solutions Market is Expected to Show Highest CAGR Growth Rate in Latin America

Figure 34 Hybrid Cloud Expected to Lead the Mobile BPM Market

Figure 35 Mobile BPM on Hybrid Cloud Expected to Register Highest Growth in Europe

Figure 36 Mobile BPM on Public Cloud Expected to Register Highest Growth in Europe

Figure 37 Mobile BPM on Private Cloud Expected to Register Highest Growth in Latin America

Figure 38 The Maintenance & Support Segment Projected to Lead the Mobile BPM Market

Figure 39 Mobile BPM for Maintenance & Support is Expected to Register Highest Growth in Latin America

Figure 40 Mobile BPM for Integration & Design Expected to Register Highest Growth in Latin America

Figure 41 Mobile BPM for Consulting Services Expected to Register Highest Growth in Latin America

Figure 42 Others Expected to Register Highest Growth in Asia-Pacific

Figure 43 BFSI Vertical is Expected to Dominate the Market During the Forecast Period

Figure 44 BFSI Vertical Estimated to Witness Highest Growth in Asia-Pacific

Figure 45 Government & Defense Vertical Estimated to Witness Highest Growth in Latin America

Figure 46 IT & Telecom Vertical Estimated to Witness Highest Growth in Latin America Region

Figure 47 Consumer Good & Retail Vertical Estimated to Witness Highest Growth in Latin America

Figure 48 Mobile BPM Market in North America Expected to Show Highest Growth in the Manufacturing Vertical

Figure 49 Automotive Vertical Estimated to Witness the Highest Growth in Latin America

Figure 50 Healthcare Vertical Estimated to Witness the Highest Growth in Asia-Pacific

Figure 51 Transportation & Logistics Vertical Estimated to Witness the Highest Growth in the Middle East & Africa Region

Figure 52 Other Verticals Estimated to Witness the Highest Growth in North America

Figure 53 Latin America is Expected to Witness the Highest Growth in the Market

Figure 54 North America Market: Snapshot

Figure 55 Europe Mobile BPM Market: Snapshot

Figure 56 Asia-Pacific Market: Snapshot

Figure 57 Middle East and Africa Market: Snapshot

Figure 58 Latin America Market: Snapshot

Figure 59 Companies Adopted Mergers and Acquisitions as the Key Growth Strategy to Expand Their Presence in the Market

Figure 60 Market Evaluation Framework

Figure 61 Battle for Market Share: Mergers and Acquisition has Been the Key Strategy

Figure 62 Geographic Revenue Mix of Top 4 Market Players: Reference

Figure 63 IBM: Company Snapshot

Figure 64 IBM: SWOT Analysis

Figure 65 Fujitsu: Company Snapshot

Figure 66 Fujitsu: SWOT Analysis

Figure 67 Oracle: Company Snapshot

Figure 68 Oracle: SWOT Analysis

Figure 69 Opentext Corporation: Company Snapshot

Figure 70 Opentext: SWOT Analysis

Figure 71 Software AG: Company Snapshot

Figure 72 Software AG, Inc.: SWOT Analysis

Figure 73 Pegasystems Inc.: Company Snapshot

Figure 74 EMC: Company Snapshot

Figure 75 Tibco Software: Company Snapshot

Growth opportunities and latent adjacency in Mobile BPM Market